- What is an ETF?

- What is Blockchain Technology?

- Why should you invest in Blockchain technology?

- How does Blockchain technology ETFs grant you access to the crypto world?

- There are primarily 4 top blockchain ETFs, and they are listed and compared below:

- How can you access the crypto world using blockchain technology ETFs?

- Conclusion:

- Frequently Asked Questions:

Suppose you have been thinking about investing in the crypto market but are unsure which coin to pick. Then blockchain technology ETFs are the best option for you.

- What is an ETF?

- What is Blockchain Technology?

- Why should you invest in Blockchain technology?

- How does Blockchain technology ETFs grant you access to the crypto world?

- There are primarily 4 top blockchain ETFs, and they are listed and compared below:

- How can you access the crypto world using blockchain technology ETFs?

- Conclusion:

- Frequently Asked Questions:

What is an ETF?

Exchange-traded funds (ETFs) are a way to pool the investor’s money in a basket that invests in stocks, bonds, Crypto, or other asset classes.

In exchange, investors receive an interest in the fund. SEC-registered investment advisers professionally manage most ETFs.

So, becoming an early investor in the ETFs might yield a much higher return in the future than you might expect.

What is Blockchain Technology?

Blockchain is a database that records data and distributes it over a network of devices.

Another advantage of blockchain is that the records are immutable, which means the records are permanent.

In short, it is a super-secured method of recording data, which is impossible to falsify.

The most common use of blockchain technology has been to keep a record of transactions. Blockchain has given rise to various cryptocurrencies like Bitcoin, Ethereum, Cardano, etc.

In the case of Crypto, blockchain is used to store data in a decentralized way so that no single person/ institute has control over it. But, there are so many more cryptocurrencies that are currently in the market right now.

That’s where an ETF can help you invest in blockchain technology. Yet, Blockchain technology ETFs and Cryptocurrency ETFs are not the same things.

Why should you invest in Blockchain technology?

Blockchain technology is going to be used everywhere—everything from healthcare to supply chain management.

And being an early investor can fetch you lucrative in the future.

The blockchain technology underlying crypto is considered a revolution for a large number of industries.

From healthcare to supply chain management, everything will be influenced by the use of Blockchain.

By cutting intermediaries, distributed ledgers can enable new types of economic activity that were not possible before.

Crypto as a whole is also considered a stable store of value, like gold. This crypto property makes it appealing to investors worried about risks like hyperinflation, bank failures, etc.

Unlike fiat currencies, most of the cryptocurrencies have a limited supply, which makes them inflation-proof.

Let us look at how Blockchain can influence industries:

1. Healthcare:

A patient’s medical records can be written into the Blockchain and be secured using a private key.

This will allow records to be held permanently and would be only accessible to the concerned person.

2. Supply Chain Management:

The food industry is already using blockchain technology to track the origins of its materials.

This allows the company to verify the authenticity of their products and also avoid the distribution of fake products.

3. Smart Contracts:

Smart contacts are snippets of code that carry out a specific outcome based on the terms and conditions provided.

Say, if a man does not pay his power bill for 15 days after the due date has elapsed. The smart contract will shut off the power to his address.

As soon as the man clears the bill, the blockchain will restore power to the address.

4. Voting:

Voting can be held in a more effective manner using blockchain and it can assist in ending voter fraud.

This model is already tested and ready to use, as proven in the West Virginia elections, 2018.

There are many such uses of blockchain in many other industries as well. NFTs are another good use of blockchain technology.

How does Blockchain technology ETFs grant you access to the crypto world?

Now that you know what blockchain technology and ETFs are, it’s time for you to understand BLCN ETFs. Blockchain-based ETFs are a way to invest in a basket of blockchain-based companies.

The companies in the basket have business operations in blockchain technology or invest in the same. The blockchain ETFs aims at tracking the stocks of companies working with blockchain.

Based on various factors like investments and expenses in R&D activities, corporate results, and innovations. There is a specific blockchain score allotted to every company stock in the domain.

This score grows based on the company’s contribution to the ecosystem. The top 50 to 100 such companies with the highest blockchain scores are eligible to be listed in this index.

Research has shown that over 20+ years, an ETF or an Index fund outperforms an active investor 90% of the time.

ETFs increase your upside while reducing risk significantly. So, in a market as high risk as crypto, your risk would be in check as well.

Blockchain ETFs have two benefits:

- Pooled investments in baskets of stocks.

- Real-time trading with datasheets crack-by-crack price changes like that of stocks.

Blockchain ETFs Vs. Bitcoin ETF.

Blockchain ETFs track the stock prices of companies that have invested in blockchain technology in their fund or are blockchain-grounded.

Since blockchain is a technology, it isn’t associated to a specific company or product.

A bitcoin ETF is one that tracks the price of the bitcoin. This permits investors to buy into the ETF without the process of trading in bitcoin itself.

The top 4 blockchain technology ETFs that can give you access to the crypto world are listed in this blog post.

Now that we’ve determined that investing in blockchain ETFs is the stylish system of investing in blockchain technology companies, we can now enlist which are the best of the business.

There are primarily 4 top blockchain ETFs, and they are listed and compared below:

1. KOIN:

Index factors are picked grounded on their personal sentiment score rankings. They are limited to limit overconcentration to a certain order and weighted inversely.

2. LEGR:

LEGR offers global exposure to enterprises with varying degrees of investment in blockchain technology.

Colorful types of public information are used in this assessment, including periodic reports, press releases, assiduity reports, and news outlets.

In reference to this exploration, enterprises are grouped into three baskets of blockchain investment.

- Active Enablers,

- Active Druggies, and

- Active Explorers.

The index is rebalanced semi-annually.

3. BLCN:

BLCN is one of the first finances to concentrate on blockchain technology. The fund tracks an indicator of global companies committed to blockchain technology.

Although not an active fund, the indicator commission has wide discretion in opting for companies.

The main parameter used to estimate a company is the position of material coffers it has committed to R&D, supporting and expanding the relinquishment of blockchain technology.

The indicator is reconstituted and rebalanced semi-annually. And it tracks the performance of the Indxx Blockchain Index.

4. BLOK:

BLOK aims to seek total return by investing in companies developing or using “transformational data participating technology inflation-proofs”, substantially fastening on blockchain technology.

The fund classifies eligible companies into two groups.

- Core – with 70 weight, are enterprises that decide direct profit from developing or profitably planting data participating technologies, and

- Secondary – having the remaining 30 of the portfolio are those that have partnered with or invested in similar enterprises.

The fund’s active director may elect companies from any country or assiduity.

So, which one to pick? W,e’ve compared all four of the ETFs grounded on four different parcels.

- Means Under Operation (AUM)

- Average Volume

- Expenditure Rate and

- 1- Time Returns.

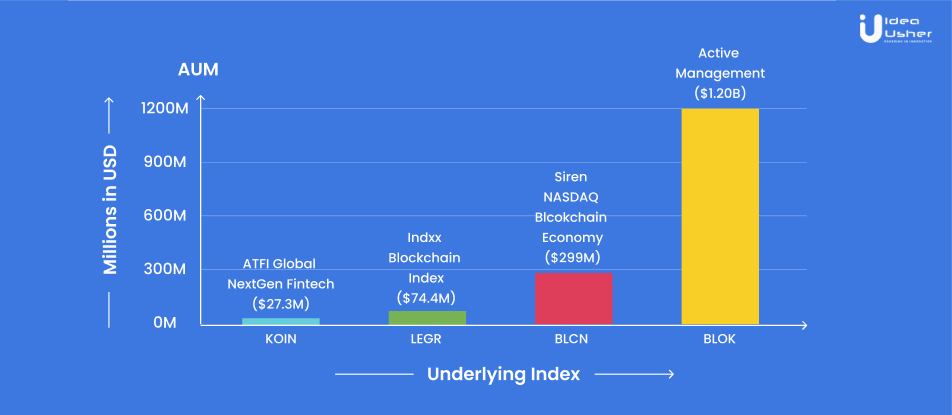

1. Assets Under Management (AUM):

Assets Under Management or AUM refers to the total market value of the assets that a fund manages at a given moment in time.

So, the more the AUM, the better it is. Let’s look at the AUMs of the 4 ETFs we listed.

Assets under management – bar graph comparing the four ETFs.

From this chart, you get a clear idea of the AUM of the four ETFs; we can see BLOK has the highest AUMs in market capitalization, with about 1.2 Billion USD.

For perspective, BLOK’s AUM is almost 3 times all the other AUMs put together.

KOIN is the smallest ETF with only 27.7 Million USD worth of assets under management. LEGR is the second smallest with 74.4 Million USD worth of AUM.

BLCN on the other hand, is an excellent alternate to BLOK with almost assets worth almost 300 Million USD. It is worth noting that the no. of holdings for BLCN is 72, whereas BLOK is just 50.

KOIN and LEGR have about 45 and 100 holdings, respectively, compared to the other ETFs.

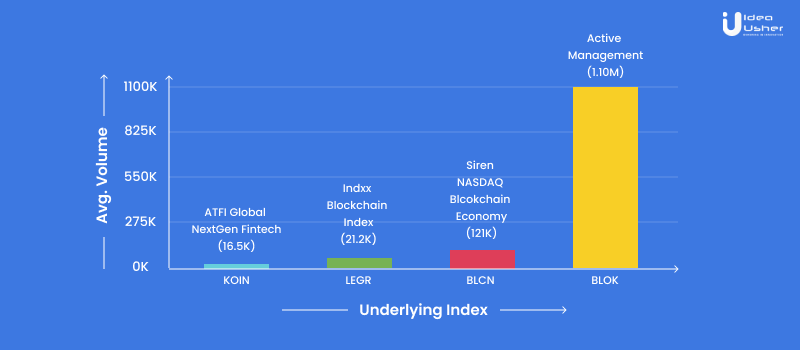

2. Average Volume:

The average volume is the average number of shares that trade on a single trading day. The higher the volume, the better.

The average volume determines how quickly you can liquidate your ETFs and cash out on them if needed.

Average Volume – bar graph comparing the four ETFs.

It is clear from the chart that BLOK is the hands-down winner of this category, with an average volume of 1.10 Million per day.

Other ETFs don’t come even close to it, with KOIN at 16.5K, LEGR at 21.2K, and BLCN at 121K.

So, BLOK so far is a clear choice and uncontested leader when it comes to investing in blockchain technology ETFs and getting the investor’s access to the crypto world.

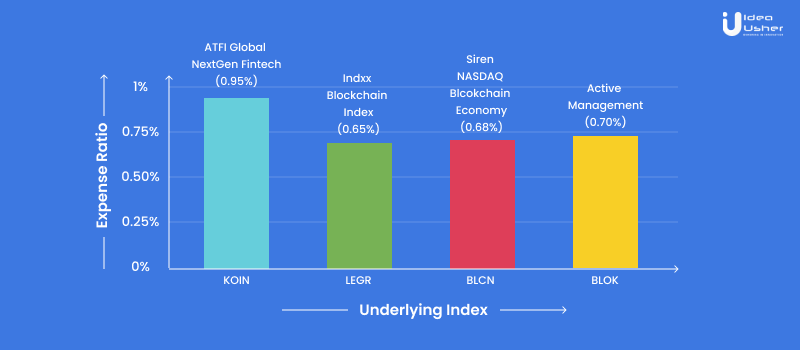

3. Expense Ratio:

The expense ratio is the cost of buying an ETF or mutual fund.

Suppose you want to buy $100 worth of funds, then the ETF with the expense ratio of 0.5% would keep about 50 cents from the $100 you invested only about $99.5 will be actually invested.

Expense Ratios range from 0.5% to 1.5% where the 0.5% to 0.75% category is Good, 0.8% to 1% is high and 1% to 1.5% is extremely high.

Now, let’s compare the expense ratio of the different ETFs on this list.

Expense Ratio – bar graph comparing the four ETFs.

From the graph you can see that all the expense ratios are pretty close, with LEGR being the cheapest, KOIN being the most expensive,, and BLCN and BLOK pretty close to each other.

If I were given a choice, I would still go for BLOK because it has won the two other categories and still lies in the good expense ratio range of 0.5% to 0.75%.

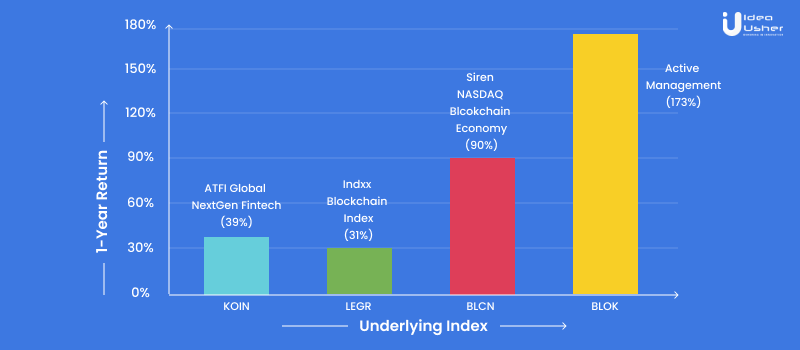

4. 1-Year returns:

The 1-Year returns are one of the key factors in choosing your ETF.

1-year returns – bar graph comparing the four ETFs.

From the chart, It can be easily inferred that BLOK again has won this category too with a 1-Year return of 173%. And BLCN came second with the 1-Year return of 90%.

KOIN and LEGR have the lowest returns of 39% and 31% respectively which in itself are also not bad numbers.

How can you access the crypto world using blockchain technology ETFs?

Investments and Growth Graphics

So, now that you have picked your ETF and have decided to buy it, only one bitcoin ETF is available in the US, the ProShare’s Bitcoin Strategy ETF ($BITO).

But, if you want to buy BLOK or some other blockchain technology ETF, you would need to open a brokerage account with Robinhood, Stash, Fidelity, or Charles Schwab. This will give you access to the crypto world via blockchain ETFs.

These brokers can give you access to blockchain ETFs. After opening the account, , which search the ticker name and place a market order with the desired amount.

You can also set up an automatic blockchain ETF investment plan with your broker if you want to keep investing in blockchain ETFs regularly.

Conclusion:

Blockchain technology is a revolution in the technology business and it is changing and redefining how things are done.

It is going to be incorporated in every sector and industry sooner or later. So investing in it early on while minimizing the risk is the way to go.

And ETFs are the best solution for the same. The ETFs we have discussed in this blog are all based on facts and datasheets.

We hope that this blog post has cleared any doubts you might have had about investing in blockchain technology ETFs and helped you access the crypto world. If you are looking for trusted and reliable blockchain developers. We at Idea Usher are here to help you out.

Frequently Asked Questions:

-

-

-

Is GBTC an ETF?

-

Yes, Grayscale Bitcoin Trust (GBTC) lands on the same day as the ProShares Bitcoin Strategy ETF (BITO) debuts, becoming the first exchange-traded fund in the U.S. investing in futures on the digital asset.

-

-

-

-

How can I invest in blockchain technology safely?

-

A safer way to invest in cryptos and blockchain technology companies is through exchange-traded funds

-

-

-

-

Where can I buy bitcoin/ crypto directly?

-

You can buy crypto directly from crypto exchange platforms like Binance, Coinbase, etc.

-

Ronit Banerjee