We are breaking all the doors towards a digital future, and developing technology is our biggest weapon. Every service is digitized and easy to use these days, whether it is watching the news, playing games, streaming movies, ordering food, or making a payment. Technology has literally changed the way we do everything. Similarly, our transactions have become way easier and convenient through digital platforms. Keep reading this insight by Idea Usher experts for a brief dive into how to create a mobile payment app.

Undoubtedly, mobile payment app development is one of the essential evolving technologies and is in demand all over the world. People are now accepting the importance of digital payments, during these testing times of the COVID19 pandemic. Apart from all the easiness, convenience, and flexibility offered by mobile payment apps, these digital platforms help us to do contactless payments.

What can a Mobile Payments app do?

Mobile payment apps have multiple use cases:

- paying a shopkeeper/merchant or landlord on an installment basis

- booking and paying for a cab service

- configuring a borrowing limit for peers/ kids, hence allowing them to spend a certain amount, a fixed number of times for a preset duration of time.

- sending and receiving a P2P transfer (borrowing) request

- fulfilling a transfer (borrowing) request from a peer

- splitting a restaurant/utility bill with peers

- sending a gift as a money transfer to loved ones

- transferring remittances to the family from abroad;

- paying for online utilities, recharges, internet services, bills, and more such services.

What to consider while developing the best mobile payments app?

Mobile payments app development offers a wide variety of features that make the user’s transactions easier. However, there are a number of factors that need to be considered before developing a mobile payments app. The target audience, planned scalability of the app, accessibility, relevant features and another bunch of aspects contribute to the decision-making for mobile payments app development.

-

Feature Requirements

A considerable number of functionalities and features can be incorporated while solving how to create a mobile payment app. Therefore, developers should be very selective in indulging features into the app as the success probability is directly related. User demands, expectations, and relative market position are some voids to check while developing a mobile payments app.

-

Security

Security planning is a crucial module while laying the foundation of a mobile payments app. The trust and expectations shown by users for an app shouldn’t be taken for granted. As the users have their precious information like card details stored in a payment app, efficient security should be the priority for the development team.

Here’s how app developers can optimize their security for mobile payments app:

- App Security: App should offer exclusive security lock functionality, with biometric verification and facial recognition. Further, these front filters can assist the users to secure the app. Therefore, if the phone is in an unknown’s hand or it’s stolen, the app security can’t be compromised instantly.

- Two-factor authentication: It will help eliminate frauds, significant hacks, and ultimately critical data and money can be saved. If just with passwords, it ends up being a lot easier for the hackers to break into the system. Additionally, when password logic is combined with another unique authentication backend, it is a lot harder to break into the system.

- Instant notifications: The app users should be notified at the same time when a transaction succeeds, or balance is debited from or credited to their bank account.

- Follow the regulations: Developers should always keep an eye on PCI DSS regulatory protocols (those keep updating).

Additionally, no consumer would ever risk their financial credentials via a mobile payments app. Money being almost the highest priority for everyone in life, developers should continuously ensure the security and safety of mobile payments apps.

-

Digital invoices

This is another critical prerequisite for the layout of a payment app. Customers demand assurance once payment is done successfully or even if it fails. Hence, an invoice should be generated after each digital transaction.

-

Bonus and reward points

Cashbacks, offers, bonuses, and rewards are immensely liked by users, hence creating a buzz for the mobile payments app. The rewards feature should be designed to assist customers in claiming their cashback/rewards whenever they wish to.

-

Solutions for multi-currency processing

Once you serve users multi-currency processing, your app is already way ahead of other mobile payments apps and you can expand your business globally.

-

Security solution of payment processing

Certified authentication, Encryption, and Digital signature constitute a set of security solutions of payment processing for mobile payments apps.

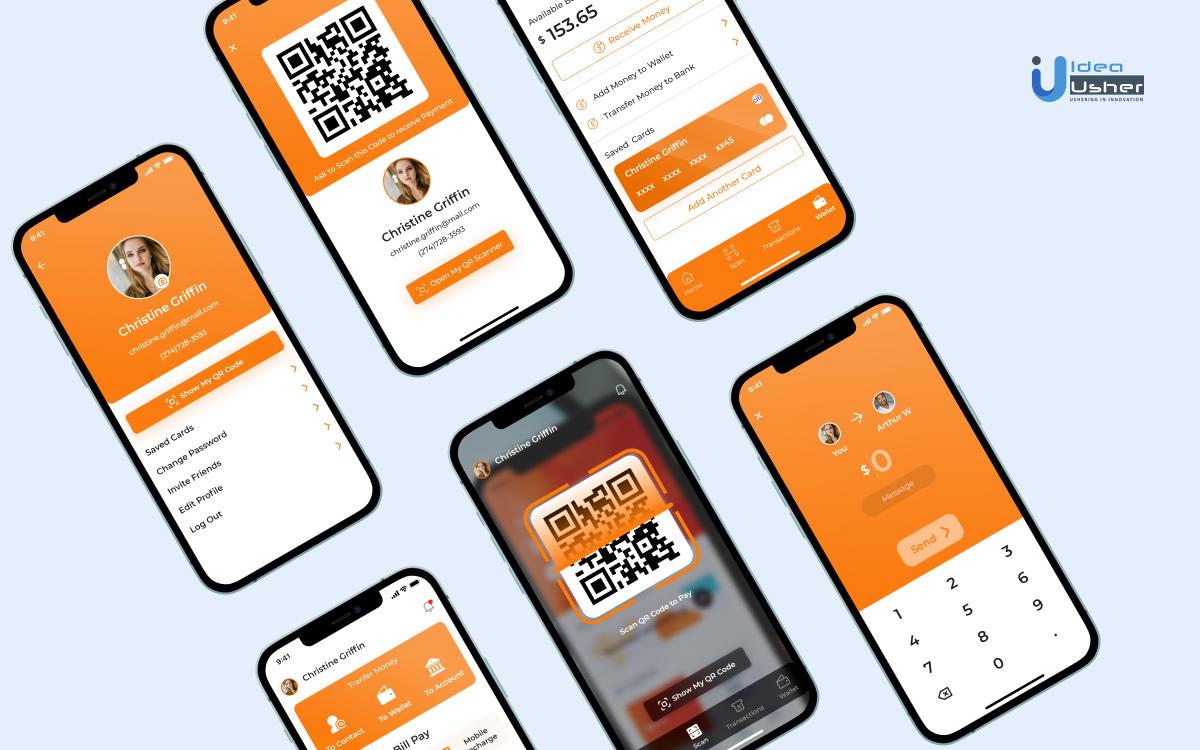

Mobile Payments App features

-

User-panel features

- SignUp/ User registration

The first-time users should be able to sign in using the required information. The registered users should be allowed to log in to the app using the created credentials.

- Account Integration

Users can add as many bank accounts for making transactions using the payments app.

- Add money to Wallet

Serve users with extended ease of paying by including a digital wallet into your app.

- Balance Enquiry

Check your balance in your app wallet as well as in your bank accounts.

- Pay Bills

Pay for your mobile, broadband, fuel connection, electricity and various other bills through a single platform.

- Transaction History

Download your account statement within the app in an organized and efficient way.

- Funds Transfer

Transfer money, perform secure, effortless transactions with your contacts. Moreover, you can send money to anyone having the payments app through their phone number.

-

Merchant-panel features

- Merchant registration

Merchants can sign up on the platform and get verified using their business license.

- Unique QR Code

Every merchant gets a unique QR code, using which users can scan and pay for goods or services.

- EMI

Merchants have the power to allow their users to pay as per an easy monthly installments (EMI) plan.

- Promotional Offers

Business owners can customize their offers/rewards for users so that they will be able to engage more, sell more, and their business grows.

- Push Notifications

Merchants should receive instant notifications for each successful transaction.

-

Admin Panel

- User Management

Clients can be managed in an effective and smooth way.

- Live Insights

Real-time updates and analytical data presentation to improve insight efficiency and to focus on growth.

- Offers

Admin can arrange offers and rewards for app users.

- Manage Merchants

Admin has the power to handle all the merchants from a single platform.

- Revenue Management

Each of the revenue streams should ideally be manageable via a single platform.

How to create a mobile payment app: key development steps

1. Choose the type of mobile payments app

Priorly, you have to choose the type of mobile payment app you want to create. As per statistics and research, standalone and banking app platforms are the topmost in demand. So you have these choices:

- Standalone: Also known as universal mobile apps, allow users to perform all transactions using any bank accounts and payment methods.

- Bank centric: Specifically made by a certain bank, and hence operable using only bank accounts from the app providing bank.

- Social Media centric

- Foreign Exchange

Prioritize mobile platform

You should do this if your budget is limited. Initially, you can start with one mobile platform – iOS or Android. Further, a bit later you can order the development of another app version for the other platform.

2. Features planning

Excluding MVP features a mobile payments app can also include bonus functionalities that can make it unique. Moreover, everything relies on your requirements. Some of the most important features for every mobile payments app are:

- Signup/Login

- Passcode/ fingerprint authentication

- Notifications

- Unique ID and OTP verification

- Digital wallet

- Sending bills and invoices

- Sending and receiving money

- Transaction history

- Messaging

3. Fix the security and legal issues

- This step is a vital one in a fintech business.

- All the security issues need to be addressed to secure the app and make it trustworthy for users.

- Additionally, a mobile payments app being a fintech service, has certain legalities indulged in it.

- Every country has its own regulatory laws for mobile payments apps.

- Unless you satisfy these rules and regulations, it is illegal to launch and start the operations of your app in the market.

4. Choose the tech stack

Although selecting the correct tech stack depends on the app’s type (native/web/hybrid). Now since an ideal payment app is a native app, the developers can utilize the mentioned tech stack.

- iOS Dev – Swift/Obj C, Apple XCode/Intellij Appcode [Tool]

- Android Dev– Java, Android Studio/Eclipse [Tool]

- For Notifications – Rest APIs, Amazon SNS, Chrome notifications, APNS, and Firebase cloud messaging

- Unique ID and OTP verification – Bamboo invoice, Rest APIs

- Digital wallet – Rest APIs

- Sending bills and invoices: 3rd party SDKs like:Firebase, Twilio, Nexmo, Digimiles

- Sending and receiving money – Dwolla, ACH

- Biometric authentication – Optical fingerprint, Capacitive sensors

5. Pick the nature of the payments app

Mainly, there are 3 kinds of apps: Native, Hybrid, and Web apps.

- Native app: A native app is a smartphone application boundedly designed and deployed for a mobile operating system. One of the examples is Facebook. The app is identical on Android and iOS, however if you put up a brief look, you’ll notice the differences.

- Web Apps: These are server-deployed apps/sites accessible in a browser via the internet across any platform.

- Hybrid: These are ultimately web apps covered in a fancy native design. For example: Gmail, it certainly catches the interface of the in-use operating system. Unlike Native apps, they are not designed distinguishably for each.

6. Choose the revenue model

Ever imagined:

How does Paypal make money?

What is the revenue generation strategy for a mobile payment app?

We now move on to find answers to some really interesting questions

A revenue model tells how your business creates, delivers and captures wealth and value

At the end of the day, it’s nothing but revenue that ignites the rocket towards further development. An optimal revenue model guarantees lucrative annual profit and efficient capital flow. As we all know, without the business model, innovation, brainstorming, and efforts would hold no value.

Primarily, a couple of revenue models exist for mobile payments apps. Out of these two, a business may choose one or both depending upon their strategies:

A. Freemium business model

The most basic revenue-generating strategy is the freemium model, in which you basically charge people depending upon the features you provide. For example, in the case of a payments app, native features will be free and the features like that of foreign currency exchange or overseas cash transfer will only be available to the premium (paying) clients.

B. In-app advertising

Advertisements are the easiest way to generate app revenue these days. Many online businesses will be more than happy to advertise their products/services on a popular mobile payments app.

Mobile Payments app user interface

Development Stages

For Mobile Wallet Development

- Framing the business requirements

- Brainstorming and analyzing based on requirements

- Preparing an action plan

- Constructing an architecture design

- Designing the graphics and UI

- Coding the app

- Integrating third-party tools

- Quality assurance and testing

- Launching the app

- Marketing

Read More: Why Coronavirus has made Digital Transactions necessary?

How can Idea Usher help you in Mobile Payments app Development?

Without any doubt, digitization has started blooming to its full potential. Everything including payments is slowly shifting to the state of being entirely digital. We will very soon see a day where no one will carry cash and the world will be full of contactless payments. Mobile payments app development will contribute majorly towards a digital future.

Now if you are someone with a vision to build and scale, and you are searching for answers to how to create a mobile payment app you are at the right and beneficial place. Idea Usher is a leading app and software development organization that designs and develops web and mobile-based innovative solutions exclusively for you. Contact us now for a quote.

From design to development, we always have your back! Our expert team of developers will guide you throughout your journey to launching a mobile payments app. From design to reality, and further- marketing, we will always cater to all your needs and requirements and hence help you to serve your users with the best in segment apps and services.

Wrapping Up

We strongly hope that you liked this insight on how to create a mobile payment app. To conclude, brainstorming and developing an online payment app like PayPal is a lengthy process that requires deep expertise. However, with the latest innovations in the development and tech world, it is surely becoming one of the most demanded app development niches.

Ultimately, investing in creating a mobile payments app solution is potentially a million-dollar ROI game. All you need is a professional team of designers, developers, project managers, and brilliant marketers – you can get all of these here at Idea Usher, contact us now at [email protected].