Imagine having access to some of your income before payday. That could enable you to pay your expenses on time. Getting ahead, however, may be challenging due to the high costs associated with the conventional methods of early paycheck access. However, apps like Earnin give you the option to withdraw a portion of your salary early without taking out a high-interest payday loan.

For users who wish to borrow money, apps like Earnin provide a cash advance. Instant transfers are an option if you want to get cash advances. Most cash lending applications provide easy access to additional available funds.

What is Earnin?

By giving individuals access to the resources they need to improve their financial situation, this new fintech is overturning the sector.

You can get a percentage of your upcoming salary early with Earnin. You may receive an advance of up to $100, depending on your salary.

As soon as you get paid, you’ll repay Earnin. You can avoid bank fees that can significantly reduce your budget if you have the opportunity to access a modest advance.

The best thing is that Earnin is giving away these tools without charge. You are not obligated to leave a tip if you cannot afford to do so, even if it is an optional function.

How Do Apps Like Earnin Work?

Earnin is among the top companies offering rapid personal loans for short-term financial setbacks. Borrowers can use this app to get payment.

- You require a working, valid bank account, a consistent monthly income, and a mobile phone to use Earnin’s credit builder loans.

- Cash advance apps like Earnin enable each application to obtain additional funding to cover emergency requirements and costs. These apps also engage with the community to support applicants.

- To utilize this money advance app, you must connect your bank account and provide employment information to assist management in verifying your pay schedule.

- The next step is to input your income into this credit advance app. It can be easily done by sending your electronic timesheet, utilizing the Automagic Earnings feature that automatically adds your money.

Apps like Earnin are a less expensive alternative to traditional payday loans.

However, as a cash advance cannot replace an emergency reserve, it should also be utilized carefully. Having an emergency reserve large enough to pay for major expenses is crucial.

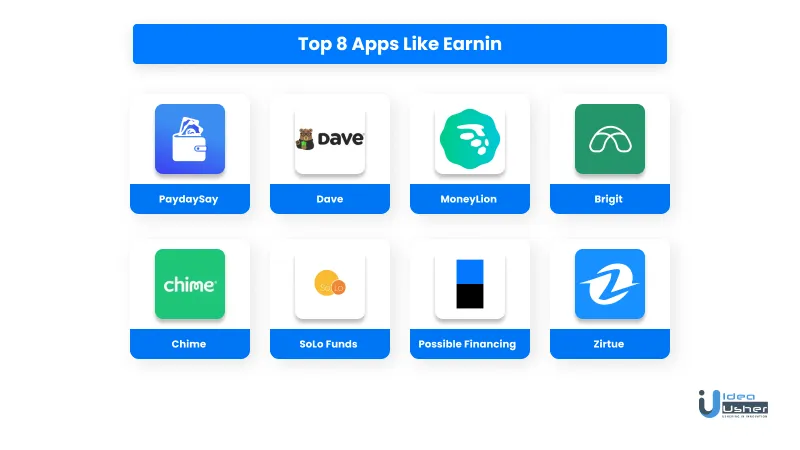

Top 8 Apps Like Earnin

When you require cash to deal with a financial emergency, check out the following apps like Earnin. So let’s get started:

1. PaydaySay

The top service provider, PayDaySay, provides instant access to short-term loans with the potential for subsequent borrowing.

Do you want free access to funds? From 5.99 to 35.99 % is the APR (annual percentage rate) range. Although it is one of the most flexible options, this platform doesn’t offer loan decisions because it isn’t a direct lender.

This is one of the alternatives to credit card cash-back incentives that might help you manage your finances better. It provides customers who require same-day funding with a range of loan alternatives.

Let’s learn a few benefits:

- Offers extra cash for a short period

- Mobile banking app that is convenient

- Offers flexible interest rates

- Get direct access to more funds

- Quick credit

| App | PaydaySay |

| Price | Free |

| Ratings | 4.5 |

2. Dave

The Dave app provides a well-organized procedure for obtaining a payday loan. You may apply for a significant portion of your previously earned monthly income.

The Dave app’s free version is more than sufficient for paying for paper checks and obtaining extra money without interest. This app does not require your credit score, allowing people with terrible credit to apply.

What is the charge or interest rate? The monthly fee for using this loan-based app is just $1. Hourly workers are also eligible to apply here and repay the loan on their subsequent payday.

Let’s focus on the benefits mentioned below:

- Alternative financing options

- Pay for different needs and expenses

- With no interest fees

- Adaptive repayment terms

| App | Dave |

| Price | Free |

| Ratings | 4.8 |

A good substitute for payday lending choices is the MoneyLion app. For your immediate requirements, direct deposit enables you to get a personal loan with just one source of funding.

3. MoneyLion

MoneyLion provides payroll debit cards without a monthly cost, though the reasons for getting money may differ.

With the help of the financial goods offered by this app, monthly costs, and other spending habits, may be covered.

Let’s learn a few benefits mentioned below:

- Less expensive than an overdraft fee

- Aids in credit creation

- Obtain between $25 and $250

- 14-day payment extension potential

- No interest rate

| App | MoneyLion |

| Price | Free |

| Ratings | 4.7 |

4. Brigit

To acquire a payday loan using the Brigit app, you must have an active bank account.

Throughout the pay period, Brigit permits certain direct deposits. You’ve chosen the right app if you want to avoid paying excessive interest rates and instead receive lesser costs. With Brigit, customers may receive funding in as little as eight hours for a maximum payment of $250.

Benefits:

- Payday loans

- Pay for financial needs

- Credit score Is Accepted

- Provides bill alerts to help you make on-time payments

- No interest paid

| App | Brigit |

| Price | Free |

| Ratings | 4.8 |

5. Chime

While traditional banks charge between $1 and $3 per transaction, a monthly membership to Chime’s ATM network allows you to access payment immediately with low or no monthly fees.

Individual investors from this online-only budgeting tool lack tax records and do not run credit checks on their customers. You may apply here even if your credit score is less.

One might be able to get effective alternative financing through the Chime app to pay for prescribed drugs and unforeseen expenses.

The following are the benefits of the Chime app:

- Zero overdraft charges

- Low or no monthly fees

- Finance additional fees for any purchases

- More Than 60,000 Free ATMs for Flex pay

- Maximum advance per pay cycle: $2,000

| App | Chime |

| Price | Free |

| Ratings | 4.8 |

6. SoLo Funds

The SoLo Funds aim to assist customers in bettering their monthly budgets by providing more funds while also providing investors with a unique opportunity. However, this program is not meant to make a lot of money.

There is no cost to apply; however, a checking account should be there. The maximum advance amount varies across investors. While the program indicates future expenses, new investors may see where their money is going.

There is no membership fee or any costs. Tips range from 3% to 10% of the loan amount. It also provides cash advances and fraudulent activity. Your net income and capacity to accept direct payments will determine the maximum advance.

Below mentioned are the benefits of SoLo Funds:

- Provides opportunities for investment

- Loan application transparency

- Reduced subscription costs

- Fixed-price credit monitoring

| App | SoLo Funds |

| Price | Free |

| Ratings | 3.9 |

7. Zirtue

This app facilitates peer-to-peer lending. There is no monthly fee for utilizing this app, and you can borrow extra financial assistance from friends and family until your working hours rise and your earning potential increases.

If you’re careful with the loan, you won’t accrue any more debt. It has a 5% interest rate, which is very reasonable for this loan choice. Zirtue can assist you if you are in a situation where you cannot wait until your next payment.

Some of the benefits of Zirtue are mentioned below:

- A short-term loan from family or friends

- No monthly fees

- More funds till the next paycheck are signed by the employer

| App | Zirtue |

| Price | Free |

| Ratings | 4.4 |

8. PayActiv

Another cash advance app that allows employees to access earned income before getting a paycheck is PayActiv. In addition, PayActiv offers its consumers financial counseling in which it instructs them on many techniques for wise money management.

A feature of PayActiv lets you pay bills and find discounts on prescription drugs. In addition, it provides a debit card that enables instant cash withdrawals. However, moving cash may incur a $5 cost.

| App | PayActiv |

| Price | Free |

| Ratings | 4+ |

Conclusion

Without delay or the need to apply for secured or unsecured personal loans, the money-borrowing apps can assist you in meeting your immediate needs. Since you’re probably not prepared for financial emergencies, each new financial commitment can make you anxious.

You’ll agree that apps like Earnin are essential for keeping your life afloat if you depend on one paycheck after another.

With the high trend and popularity of these apps, individuals can now maximize and discover new business opportunities.

If you wish to have apps like Earnin, choose Idea Usher. This company’s mobile app development services offer business advantages, and design is not only the primary focus but also customer experience.

Get ready to create something big and new with Idea Usher

Email: [email protected]

Phone Numbers: (+91) 946 340 7140, (+91) 859 140 7140, and (+1) 732 962 4560

FAQs

Do Apps Like Earnin Work With Paypal?

For people who lack access to a savings account or an emergency fund, there are many apps that provide installment loans. These apps work with PayPal and accept applications from people with any credit score, but you won’t be able to get a credit builder loan through them.

Is Moneylion Like Earnin?

A similar app called MoneyLion requires your checking account for direct deposits. It can lend money for a variety of purposes and merely asks for a tip in return. Since they don’t demand membership fees or monthly fees, no-interest cash advances are well-liked by consumers.

Nikhil Jassal