- What is the Venmo app?

- The Rise of Venmo: A Social Payments Trailblazer

- Features of the Venmo app

- Top 10 Venmo Alternatives & Competitors

- Steps to Take for Venmo-Like Payment App Development

- Tech stack used for the development of an app like Venmo

- How do payment apps like Venmo make money?

- Market overview of payment app

- Challenges faced by payment app

- The future of payment apps

- All set to be the next Venmo-like payment app?

- FAQ

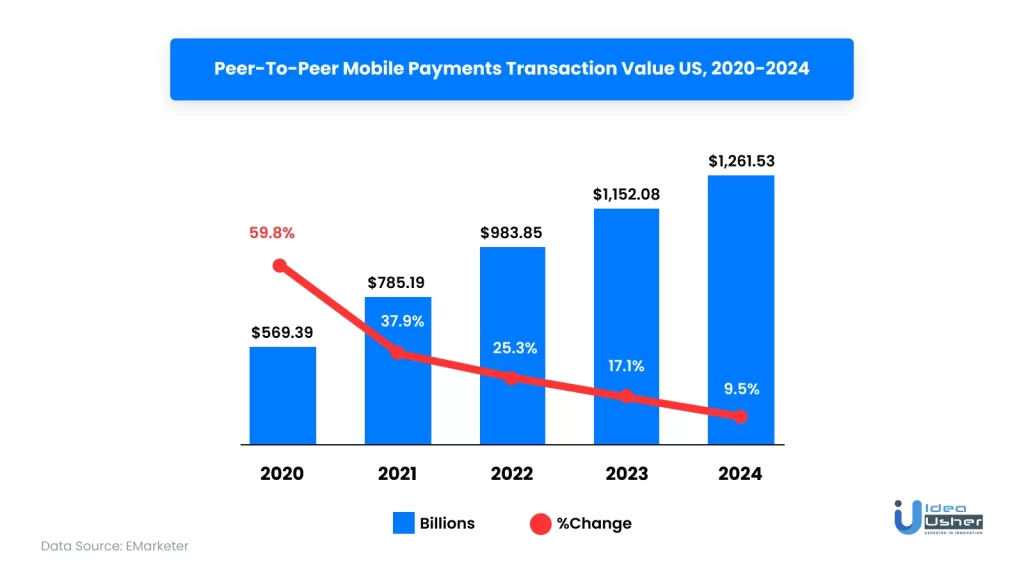

Do you want to start a new business? You can learn about the development process of payment apps like Venmo and begin your journey to success. Payment apps have eliminated the need to carry cash and you can make small to big-scale purchases in one click. This digital convenience of making online payments is expanding as you can see in the data below:

| Over two billion people used mobile payments in 2021, according to the report by Business of apps. |

| The P2P payment market is expected to reach $9,097.06 Billion by 2030. Growing at a CAGR of 17.3% (2021-2030) |

Overall, payment apps bring ample opportunities for SMEs and startups, so indeed, it’s an ideal field to work in. Read this article to learn everything about P2P payment app development.

- What is the Venmo app?

- The Rise of Venmo: A Social Payments Trailblazer

- Features of the Venmo app

- Top 10 Venmo Alternatives & Competitors

- Steps to Take for Venmo-Like Payment App Development

- Tech stack used for the development of an app like Venmo

- How do payment apps like Venmo make money?

- Market overview of payment app

- Challenges faced by payment app

- The future of payment apps

- All set to be the next Venmo-like payment app?

- FAQ

What is the Venmo app?

Venmo is one of the most popular and successful money transfer applications, which is owned by Paypal. There are many services like Uber and online products that you may purchase with Venmo.

When Venmo first appeared in 2009, a huge number of users adopted it as their preferred method of payment because of the features it provided. Millennials were the ones who made up the majority of the app’s user base. The app gained enough notoriety within five months of its release to be acquired by Braintree for $26.2 million, a PayPal subsidiary.

Venmo was initially intended to function as a peer-to-peer (P2P) payment application, fusing the idea of a payment wallet app with that of a social network. Currently, the app enables safe, cashless transactions with businesses and friends. In the app, a user’s account is directly linked with their credit card or bank account for one-tap transactions.

- The feature of Venmo allows users to view all of their transactions in a continuous stream, in addition to searching and adding friends.

- The app shows all the transactions with emoticons.

- Users may use the Trust function of the app to set up automated payments for recurrent expenses like utilities.

- The UI/UX of the app offers aesthetic visuals, is simple to use, cost-free (all fees are invoiced to the benefiting firms), and is an entertaining platform to use.

According to a Nerdwallet survey, 94% of millennials use mobile payment apps, compared to 87% of Gen Zers, 88% of Gen Xers, and 65% of baby boomers.

The Rise of Venmo: A Social Payments Trailblazer

In 2009, the landscape of mobile payments shifted dramatically with the introduction of Venmo. This innovative app quickly gained traction, particularly among Millennials, and revolutionized the way people send and receive money. Within a mere five months, Venmo’s popularity skyrocketed, leading to its acquisition by Braintree, a prominent payment processor under the PayPal umbrella, for a staggering $26.2 million.

Venmo’s ingenious concept merged the functionality of a peer-to-peer (p2p) payment app with the engaging features of a social network. It transformed the way people approached money transfers, allowing users to make secure and cashless transactions not just with friends, but also with nearby businesses. Linking a bank account or credit card to the app facilitated seamless transactions. Users could effortlessly search for and connect with friends, while a continuous feed displayed all transactions, complete with fun emoticons, adding a social layer to financial interactions.

Venmo’s intuitive interface, coupled with its free-of-charge nature (transaction fees are borne by businesses), made it an instant favorite. The app also introduced the innovative “Trust” feature, enabling users to automate payments for recurring bills, further streamlining financial management. Venmo’s unique combination of user-friendliness, social engagement, and cost-effectiveness solidified its position as a true pioneer in the realm of social payments.

Features of the Venmo app

1. User account

Including a user account component in your app will allow users to update their financial information, such as bank account and credit card information, enter personal information, select a currency, etc.

2. Real-time payments

Instant payments should be available to users. You need to have a handy real-time payment method. This functionality eases the payment of a bill or a friend.

3. Bank accounts and credit cards integration

User reliance on built-in digital wallets shouldn’t be encouraged by your app. They ought to be allowed to use their debit/credit cards to make direct bank-to-bank payments.

4. PIN code authentication

When it comes to online payment apps, security is of the highest significance. You should incorporate a two-factor authentication mechanism into your app to make it safe. Because of this, a user account can remain safe even while a mobile device is locked.

5. Online purchases

Several online companies and Venmo have collaborated for a combined venture, which allows users to use their payment app to make purchases on external websites. An equivalent in-app functionality can be created to speed up and simplify consumers’ internet buying experiences.

6. Request payment

Users may stay updated and communicate with other Venmo users using the in-app messaging and notification features; additionally, they can also ask other app users for money.

7. Cryptocurrency exchange

In the current fintech business, cryptocurrency is a popular selling factor. To draw more users to your app, you might provide a Bitcoin or any other cryptocurrency trading option.

8. App wallet money transfer

This function makes the P2P payment software more user-friendly. Users can transfer funds between each other’s digital wallets or from their app accounts to banks and vice versa.

9. Transaction tracking

Users may use this feature to keep track of their payments and maintain a history of their financial transactions. Additionally, you may configure an emailing tool to update users on the status of their transactions.

10. Chatbot assistant

While utilizing your app, your consumers could want immediate assistance. A chatbot, or virtual assistant, may swiftly respond to user inquiries.

11. Notification alerts

When a payment is made or if their in-app digital wallet changes, users are immediately notified via a feature that notifies them of these events.

12. Share purchase

Applications like Venmo give this interesting choice, where friends can divide costs using their payment app with the use of a shared payment option.

Bonus: Standout feature

There are many payment applications accessible nowadays, so in order to stand out and draw in more users, your app should provide special features. In its app, Venmo offers a useful social feed integration tool. It allows users to make updates on their “payment activities,” which are subsequently published to their “friends feed.”

When it appeared in 2009, features like these were well-received by consumers. The app earned many younger users and was bought by PayPal company Braintree for $26.2 million.

Think of anything your target user market would be interested in and include it in your app to attain comparable market success. The bottom line is that you should utilize a business strategy that is compatible with your target market to encourage them to use your mobile payment app.

Top 10 Venmo Alternatives & Competitors

Compared to Venmo, user feedback of the competitors are as follows:

| Competitors | Slower to reach ROI | Easier to set up | Better at support | More expensive | Easier to do business with | Easier to admin |

| Amazon Pay | no | yes | yes | – | – | – |

| Stripe Payments | no | yes | – | no | – | – |

| Square Payments | – | – | – | no | yes | yes |

| GoCardless | no | yes | – | – | yes | – |

| FreshBooks | no | yes | – | no | – | – |

| Birdeye | no | – | – | no | yes | – |

| Thryv | no | – | – | no | yes | – |

| WePay | no | yes | – | no | – | – |

| Synder | no | – | – | no | yes | – |

| HoneyBook | no | – | – | no | yes | – |

Source: g2.com

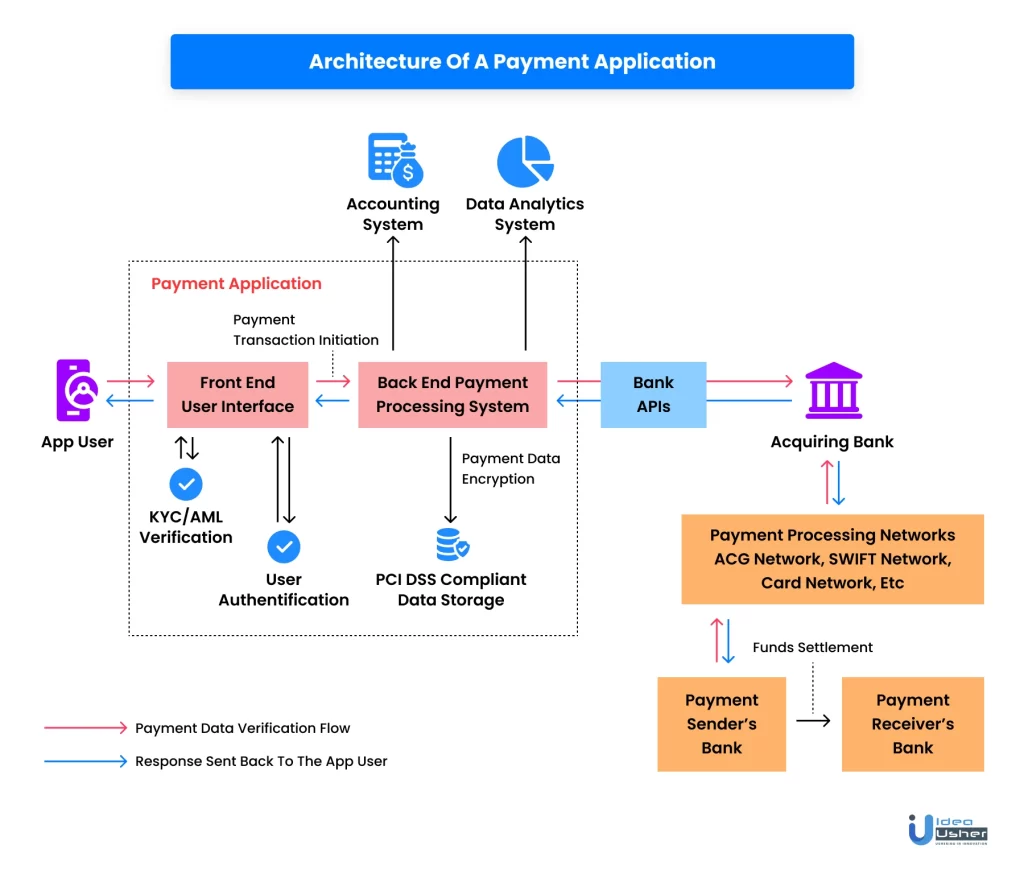

Steps to Take for Venmo-Like Payment App Development

It takes planning, execution, and improvisation the develop of a payment app. Here’s how to accomplish it.

1. Outline the specifications for your application

Create a specification plan for your payment app as a first step. Develop your app concept so you can specify the project requirements. You may use market research to determine which features are in demand and which ones are not worth your attention.

Specify all the functional and technical requirements for your payment application by obtaining needs from consumers and stakeholders. You will be prepared for the following stage once you have documented these in the form of a specifications list.

2. Specify your development infra

For data storage, data processing, networking, etc., you will need the infrastructure and tools to deploy and manage your server-side code and client-side application. A dependable choice is to invest in a cloud-based mobile backend as a service.

The MBaaS will provide your developers with the following:

- A file management system,

- APIs to handle backend data,

- Hosting for your server code, and

- Secure communication between app users and servers

- Relief from maintaining the backend infrastructure, including hardware and OS updates.

- Ample time to focus on creating the application.

A prominent example of a mobile backend as a service is AWS Amplify. Your developers will be able to efficiently create and manage scalable apps using this. The AWS-powered mobile backend seamlessly integrates into Android and iOS front-ends.

IBM Mobile Foundation and Microsoft Azure Mobile Apps are some other MBaaS options. These mBaaS providers also offer APIs to integrate with other app development frameworks, SDKs, and databases efficiently.

API integration

Your mobile payment app will require a variety of third-party functionality, such as payment gateways, ID verification, etc. You will need API integration specialists in your development team to do this. They must be skilled in APIs such as:

- Synapse API for assistance with payment card issuance and compliance management,

- Dwolla API for assistance with activity management and connection with the US financial system,

- Stripe API for assistance with payment gateways,

- REST APIs for push alerts, transaction history, billing, and other features of payment apps, etc.

Since the REST API tech stack is the most widely used API architecture, your engineers should also be adept at developing APIs utilizing it.

3. Prepare for the payment app security

The majority of app hackers and online threats target mobile wallet apps. App security that is impenetrable has to be offered by your app developers. For the purpose of creating secure payment apps that are in complete compliance with PCI DSS, your developers should be an experts in this field. The security of users’ private data is ensured through PCI-compliant software.

To ensure app security, your development team should be able to include the following:

- Security elements like unique ID/OTP (one-time password), biometric authorization, etc.

- Defense against common cyberattacks like phishing and denial-of-service attacks.

- Use of SDKs like Firebase and Twilio to develop a secure payment app experience. These systems only permit the exchange of encrypted data between user apps.

Regulatory compliance for the payment app

To create a mobile app that complies with financial rules, your development team should have a thorough grasp of those requirements. Your developer has to be informed of the essential regulatory authorities and rules since they change according to different geographical regions around the globe.

This is one reason why it’s important to hire an app development firm that has prior expertise working on projects for the market you’re creating a product.

Below are a couple of examples of authorities where you need to resolve legal issues by region:

| USA | Depends on the state |

| The UK | Financial Conduct Authority, Prudential Regulation Authority |

| European Union | Directive (EU) 2015/2366 + GDPR compliant, ESMA (European Securities and Markets Authority) |

| Korea | FinTech Center under the Financial Services Commission (FSC) |

| Australia | Innovation Hub by the Australian Securities and Investments Commission (ASIC) |

| China | FinTech Committee under the People’s Bank of China (PBOC) |

4. Select a development methodology

Determine the methods your team will use for the development of Venmo-like payment apps. However, we recommend the Agile methodology as it is the best strategy for creating mobile payment apps.

Agile development focuses on the following:

- Iterative development.

- It is used to manage app development among small cross-functional teams.

- It helps build motivation and dedication among teammates as everyone is assigned daily tasks for the collective result.

- This methodology helps in ensuring maximum productivity.

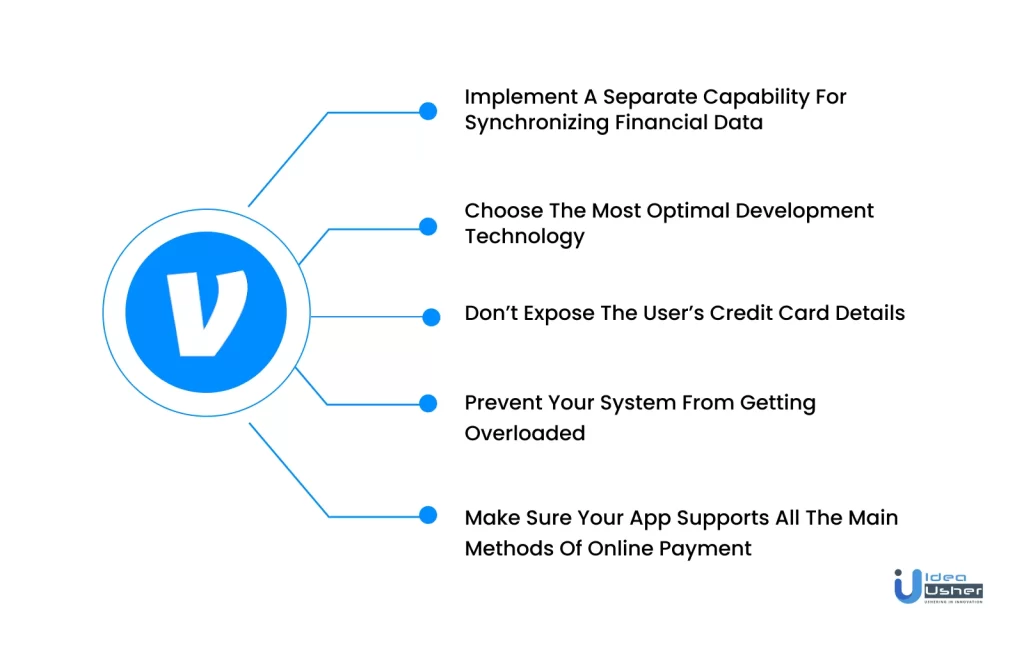

5. Select the development technology

The market is brimming with different technologies, each of which has unique qualities. Some of these are cross-platform, hybrid, and native app development technologies. Take a glance at these:

| Hybrid applications | Compatible with various OS like iOS and Android | Saves time and costs as its tools work on the strategy of ‘single-code-for-all.’ | Technologies: React Native, Xamarin, Adobe PhoneGap, and Ionic. |

| Native applications | Coded with specific app programming language | Fast and possess a high-reliability level | Technologies: Swift, Java, C++, PHP, PhoneGap, and HTML5. |

| Cross-platform applications | Compatible with different operating systems | The development process is lower than the native | Technologies: Flutter, Ionic, React Native, Xamarin, and Node. |

6. Design the interface and front-end layout for the payment app

The way a user interacts with your mobile app is influenced by its design. It is ultimately one of the crucial factors that will determine whether or not your app is successful. Your developers should have the necessary skills to create an engaging and user-friendly interface, including theme, typography, component positioning, etc.

Developers that have a strong understanding of user experience (UX) will be more likely to design apps with amazing user interfaces that improve the user experience.

7. Develop a minimum viable product for your payment app like Venmo

Building and releasing a Minimum Viable Product to the user market first is always recommended. Your app’s time-to-market will be shorter with an MVP. Your app is more likely to miss out on prospects for market expansion and fail the longer it takes to launch.

You must first choose whether you want to build an iOS or an Android application. In order to immediately access a large market of mobile consumers, you can design a hybrid app that targets both OS. Apart from that, there are a few things that can be considered before the actual development process, which include:

7.1. Ensure that your application is compatible with all popular online payment methods:

- In-store payments

- Network-wide peer-to-peer transactions

- Online eCommerce payments

7.2. You might incorporate the following functions into your payment wallet app:

- Using a payment plan to pay a business

- Paying for taxi service (including discount calculation)

- Sending and receiving a request for a loan among friends

- Posting a comment and a borrowing request to contact, etc.

7.3. Refrain from disclosing the user’s credit card information:

- To ensure user safety and security, incorporate a mobile payment gateway.

- Make it a priority to follow Venmo’s simple and safe app architecture while creating your own P2P payment app.

- Users of your payment app will use their phones to pay at locations; make sure that your app doesn’t reveal their card information throughout a transaction.

- Create your app so that it only sends protected code to provide a high degree of security.

- Incorporate the usage of fingerprint identification even for transactions.

7.4. Venmo and other payment applications follow the steps below to stay on top of security issues:

- Data encryption

- 2-factor authentication

- Compliance with PCI-DSS and other standards

7.5. Avoid overloading your system:

- Even if the number of users for your app doesn’t expand as quickly as Venmo’s, you can still anticipate a sizable and steady growth.

- The potential for growth in this industry sector should not be taken for granted.

- To prevent overloading, build a cluster solution that will allow the capacity of your system to grow in proportion to its growing number of users.

7.6. Add a separate feature for syncing financial data:

- A series of events start upon a transaction in your payment system.

- The system then updates any amounts that have been affected by the transaction and that it is intended to track.

- This results in hundreds of recalculations per second for a system with many users, which might cause it to malfunction.

- Advice: Don’t attempt to have your whole system chase every single transaction that takes place, as the chances of success with this strategy are quite low.

- Instead, implement a feature that would change all impacted amounts across your system at predetermined times. Following that, peer-to-peer data synchronization in payment apps can be managed.

8. Test your payment application

Your payment application must be released without bugs in order to secure a successful market launch. Your app’s developers should ensure it satisfies all functional criteria and operates according to your established standards.

In the event of a poor user experience, users can quickly submit a negative review on an app store. This is something you should stay away from at all costs. Developers may conduct tests using a variety of testing tools to find errors and defects in their code.

- For Android apps: run tests on platforms like Espresso

- For iOS developers: run tests on testing tools like XCTest

- You can use different automated testing tools, like Appium, Test IO, etc., (helps in effective quality assurance)

- Through features like exploratory testing, parallel testing, etc., testing frameworks enable developers to execute automated tests.

- Developers can use cloud-based mobile app testing solutions like Kobiton because of the flexibility they bring to the execution of manual and automated tests.

You must ensure, after carrying out a thorough QA, your mobile app complies with industry standards and is prepared to boost brand recognition by operating flawlessly and offering a first-rate user experience.

Tech stack used for the development of an app like Venmo

| For Android | Java, Android Studio/Eclipse [Tool] |

| For iOS | Swift/Obj C, Apple XCode/Intellij Appcode [Tool] |

| Digital wallet | Rest APIs |

| Notifications | Chrome notifications, Rest APIs, Amazon SNS, APNS, and Firebase cloud messaging. |

| Sending and receiving money | Dwolla, ACH |

| Unique ID and OTP verification | Bamboo invoice, Rest of APIs |

| Biometric authentication | Optical fingerprint, Capacitive sensors |

| Sending bills and invoices | 3rd party SDKs like Firebase, Twilio, Nexmo, Digimiles |

| Backend | Laravel |

| Admin Panel | Javascript, Laravel Nova |

| Payment Gateway | Stripe, Paypal, Braintree, Mastercard |

| Geolocation | Google map API |

| Server | AWS |

How do payment apps like Venmo make money?

Venmo may generate income in a variety of ways, and it does it often to maintain its high-profit level. The following are some methods you may include in your Venmo-like application:

1. Credit card payment charges

When paying with a credit card as opposed to a debit card, Venmo levies a 3% transaction fee. By including this monetization approach in your P2P payment wallet software, you will not only receive consistent revenue but will also be able to minimize any damages that may result from a failed credit card payment.

2. Merchant charges

Venmo makes a significant amount of money from its merchant partners. This is another reason the company is attempting to increase the number of users that conduct business on the platform. The concept behind this scheme is that Venmo will retain a percentage of the transaction fees, around 2.9%.

3. Faster money transfer charges

For those who want to use the quick peer-to-peer money transfer feature, Venmo levies a flat fee from all app users. Venmo typically takes two to three days to send money to a user’s bank account, but when the user chooses to pay extra to speed up the P2P money transfers, the transfer time is significantly shortened.

4. Cash a check

Venmo introduced a brand-new service called Cash a Check in January 2021, where users may cash checks and have the funds delivered to a Venmo account. Eligible clients may use the Venmo app to take a photo of the check and email it for approval. This peer-to-peer money transfer system puts the funds into the user’s account if they are authorized. In return for this authentication service, Venmo charges 1%. Cashing out must be at least $5.

5. Cashback Program

Venmo provides customers with a cashback incentive feature at particular businesses, similar to the majority of other debit cards. The customer’s account receives a percentage of the total purchase price through these cashback schemes. In exchange for suggesting that the consumer, the partner, then pays a commission to this peer-to-peer money transfer app.

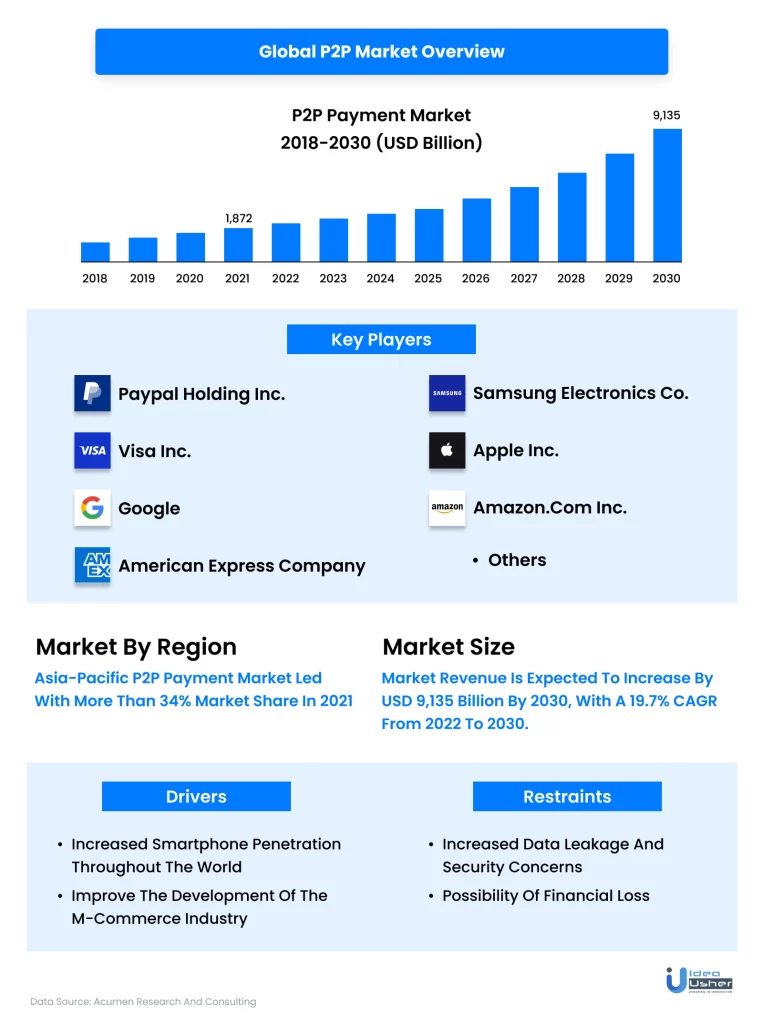

Market overview of payment app

| By 2030, the worldwide P2P market is expected to reach $9,097.06 billion, according to Allied Market Research. |

| The amount of payments made via applications like Venmo has increased by 44% year over year, according to Business of Apps. |

| According to Statista, in the US, 23% of customers prefer to use a mobile payment app. |

| In North America, digital and mobile wallets account for 29.3% of all eCommerce transaction value, as per the report published by Statista. |

| Since the Covid-19 epidemic, 79% of worldwide customers have used cashless payment methods using NFC POS terminals, and this contactless payments trend is anticipated to continue in the future, according to data by Fortune Business Insight. |

| As per the acumen research and consulting, with a 19.7% CAGR from 2022 to 2030, the global P2P payment industry is predicted to generate USD 9,135 billion in sales by that time. |

| With more than 34% of the global P2P payment market, Asia-Pacific was in first place in 2021. |

| The remote sector accounted for over 55% of all market share for payment types. |

| With more than 400 million active account users worldwide in 2021, PayPal Holdings Inc. |

| In 2020, 19.7% of Canadians and 30.6% of Americans, respectively, will utilize P2P mobile payments, according to the survey. |

Challenges faced by payment app

Businesses are moving towards the convenience of digital payments, but there are some obstacles that yet need to be sorted out to determine the development of a payment app like Venmo. The majority of the issues are not technical; however, some are.

1. Currency conversion

The transactions in payment applications should be speedy and seamless throughout the app development. Providers of P2P payment services must find a solution for the difficulty of real-time currency conversion. As there are almost 180 nations utilizing the payment app, it can be challenging to keep things on track at a time.

2. Security

The question “How to develop a secure payment app?” must be the proper driving force behind app development. Whether it is a P2P payment app like Venmo or any other, security is a major concern. Since the payment app has confidential data in abundance, it is crucial to have a secure data management system. The right motivation for app development must be ‘How to build a secure payment app?’

3. Slow Change in Mindset

The public’s perception of digital payments is difficult to alter. Lack of public confidence is the non-technical difficulty that all P2P payment service providers deal with. Due to a lack of confidence in digital technology, people are still at ease utilizing traditional payment methods.

4. Case of Dispute

The possibility of a dispute is one of the main factors undermining consumers’ trust in online payment applications. For example,

- When a sender transfers money to a certain account, it ends up in another account.

- The money was withdrawn from the sender’s account, but the intended recipient did not get it.

How will such conflict situations be resolved? A suitable resolution to disagreements like these has not yet been found.

The future of payment apps

We’ve already addressed the predicted payment app statistics for the upcoming years. However, what can a person anticipate from the market as a whole?

Undoubtedly, the advent of cryptocurrency will be interesting. By distributing the record over thousands of devices worldwide, blockchain technology is preventing total control of any one entity over the transactions and eliminating corruption and mistakes in the transaction process. Together, technologies like blockchain, big data, and AI can contribute to building a payment app that acknowledges and approves the legitimacy of each transaction performed using sophisticated algorithms.

There will undoubtedly be greater competition in the payment app sector. Every day, new applications emerge, challenging existing businesses to step up their game and perform better than before. Who knows, your app may end up becoming one of the most successful ones.

All set to be the next Venmo-like payment app?

Apps for peer-to-peer payments are revolutionizing how we do transactions. And such money transfer app development has a bright future ahead of it! Investing in the development of payment apps like Venmo can be profitable for your business in the financial sector. People have been switching from cash to digital payments as they are gradually gaining trust in these apps.

Do you still have questions about how to make a money transfer app or how much it would cost to develop a peer-to-peer app similar to Venmo? Our expert team at Idea Usher will walk you through the process of developing a fintech app.

So let’s talk!

Contact Idea Usher at [email protected]

Or reach out at: (+1)732 962 4560, (+91)859 140 7140

FAQ

Q. What steps should I take to develop an online payment app?

To start your business path, you must first prepare yourself financially and mentally. The next step is to speak with a reputable FinTech app development firm, which can assist you with the ideation, planning, design, development, and implementation of your app.

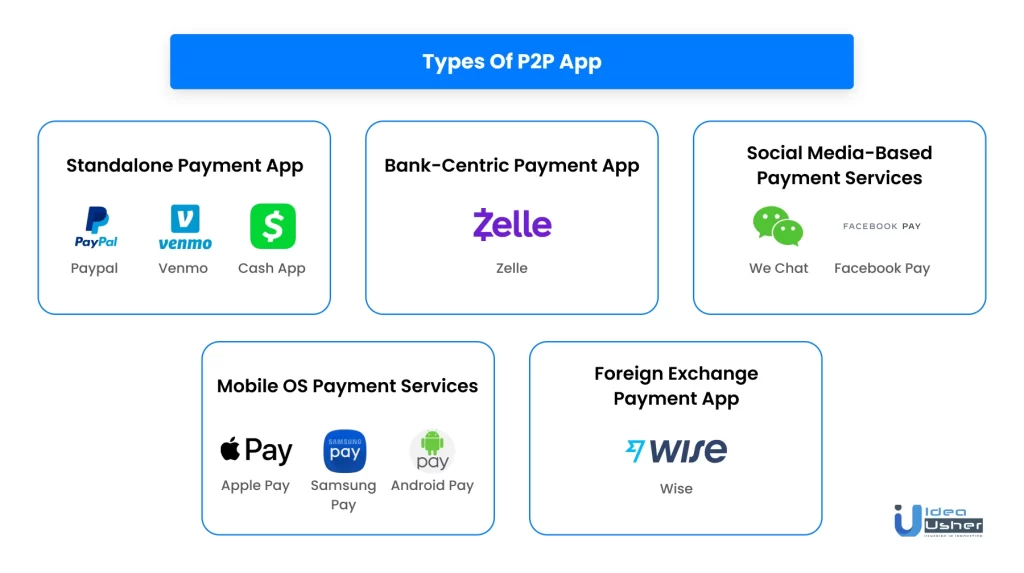

Q. What are various mobile payment app platforms there?

Standalone services like PayPal, Bank-Centric platforms like Zelle, Social Media-Centric platforms like Google Pay, and For Mobile OS systems like Samsung Pay are examples of different types of mobile payment platforms.

Q. How can my payment app make money?

Your mobile payment app may be made profitable by running in-app adverts, charging intermediate transfer fees, an annual fee to access premium app features, and a similar monetization model.

Q. How can a low-cost money transfer app be developed?

Consider outsourcing to software development firms that offer a full product development cycle, including design, deployment, and support, to save development expenses for your mobile payment app. You won’t need to search for additional partners if you do it this way.

Q. Which technology stack is ideal for P2P apps?

Only the most up-to-date technology should be used while developing p2p payment apps. MEAN, and Python-Django is excellent choices for web apps. If you decide to build iOS apps, choose Objective-C and Swift. Java and Kotlin are the best programming languages for Android. Reach out to us if you have any more questions, and we will assist you!

Rebecca Lal