Modern technologies have shifted how users make payments across shops, online platforms, and other places. Plastic cards and E-wallets have replaced cash, which helps the economy to become cashless.

With the help of E-wallets, users don’t have to carry around cash across all places.

The growing trend of utilizing E-wallets across different places has facilitated a greater opportunity for anyone to profit from this industry by developing their app and monetizing them in various ways.

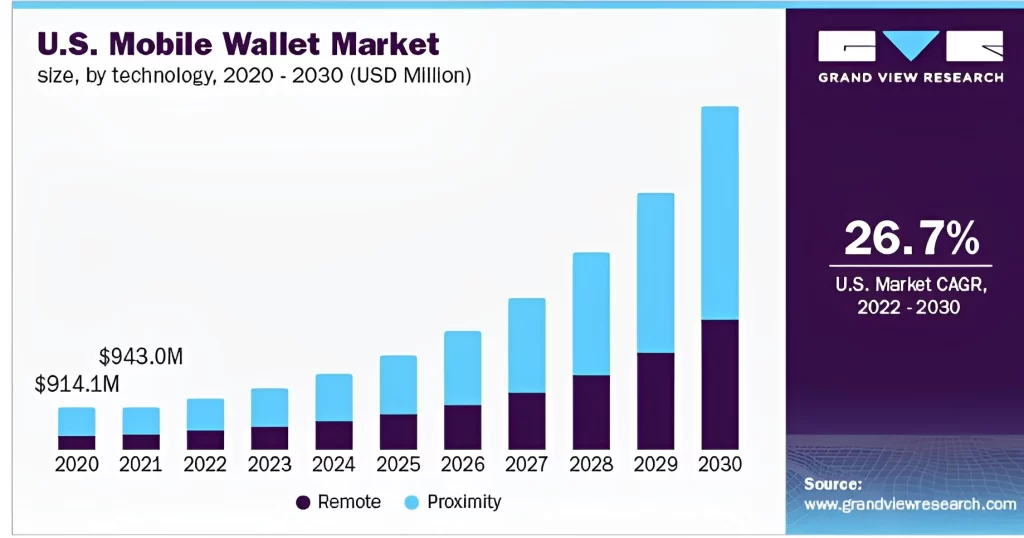

The above market stats indicate the right opportunity to tap into this market with e-wallet app development.

In this blog, explore the development steps, must-have features, and the working of the e-wallet app to create your app starting from scratch.

What Is eWallet Mobile App?

E-wallets are mobile applications that allow users to manage, store and transact funds electronically.

The e-wallet applications act as a virtual version of a physical wallet that offers a convenient way to make digital payments, store payment information, and manage financial transactions.

Users can access e-wallets through smartphones, computers, tablets, or other devices. Users can link their credit cards, bank account details, or other payment methods to e-wallets.

The user can add funds to their e-wallet accounts and can use them for various purposes such as online purchases, bill payments, fund transfers, etc.

How Does The eWallet Mobile App Work?

Here are the step-by-step ways about how the mobile wallet app works:

1. User Registration

Users can download and install the e-wallet app and register with their personal information, such as contact details, e-mail address, name, and other required information.

During the onboarding process, users can set passwords or use biometric authentication to access an additional layer of security.

2. Account Creation

After registration, the user account will be stored on the app’s servers. Users can link their accounts with their mobile devices and bank accounts for online payments.

3. Funding the Wallet

The applications enable users to fund their wallets and inking them to their bank accounts or credit/debit cards. The application can also use third-party payment gateways to process the transactions of its users.

4. Security Measures

The eWallet applications offer various security measures such as tokenization, encryption, and multi-factor authorization to secure user data and transactions from unauthorized access.

5. Wallet Balance

The application provides users with information regarding their wallet balance with real-time updates on each transaction.

6. Transaction Authorization

The application can provide necessary details to its users, such as transaction amount, recipient’s information, security PIN, and biometric authorization for simplifying the payment processes on the platform.

7. Transaction Processing

The application securely processes transactions by verifying various details, such as checking users’ wallet balances, verifying transaction details, and confirming transactions on both the receiver and sender sides.

8. Transaction Confirdevices

After the successful transaction, the app confirms the transactions from both sides, along with recording necessary details such as transaction ID, time, date, amount, and any other required details.

9. Transaction Types

The eWallet facilities various transactions on its platforms, including bill payments, merchant payments, peer-to-peer transactions, and online/offline purchases.

10. Security Audits

The platform performs multiple security audits on its app. The app ensures and offers up-to-date and effective information for safeguarding user data and transactions.

11. Error Handling

For unsuccessful online payments, the e-wallet applications handle multiple transaction failures, such as incorrect transaction details, insufficient funds, or connectivity issues.

The platform provides appropriate error messages to the users for citing as a reason for unsuccessful payments.

Steps To Develop eWallet Mobile App

The E-Wallet application development consists of multiple steps that depend on the specific purpose of each project.

Therefore partnering with a reliable app development company is a great way to ensure the success of the development of your E-wallet app.

However, the general steps to create your E-wallet app are as follows.

Step 1: Define App Features

Implement the required feature to the e-wallet app, such as login, user registration, wallet creation, money transfer, etc. to enable app users to make payments.

It would be best to explore top e-wallet applications to get more ideas about features and functionalities you can implement in your app. Also, consider building MVP of your ewallet app during its initial launch to limit app development time and budget.

Step 2: Choose the Platform

Selecting the appropriate platform is crucial to determine the scalability of your app. Consider popular platforms such as iOS & Android to publish your app.

Step 3: Design UI/UX

The process involves designing parts such as UI/UX for your app. The app developers will start prototyping, wireframing, and designing the app’s parts, such as screens, buttons, icons, navigation flow, etc.

Step 4: Backend Development

The app developers will start the backend part of your app to make it fully functional by developing and implementing all the required features and integrating with external payment gateways and banking systems.

The selection of appropriate technology for the backend development is crucial to make your app fully functional such as Node JS, Django, or Ruby on Rails.

Step 5: Frontend Development

The front-end development will involve integrating the back-end part into the UI part of your app. Consider selecting appropriate development technologies such as Swift or Kotlin for native app development or React Native or Flutter for cross-app development.

Also check: Native vs cross-app development.

Step 6: Payment Gateway Integration

Consider integrating popular third-party payment gateways such as Stripe, Braintree, and PayPal to enable users to manage their credit and debit cards and send or receive payments.

Step 7: Security Implementation

A robust security measure is crucial to gain user trust and make their data safe on your platform.

Consider incorporating security standards such as data encryption for securing sensitive information and complying with industry standards such as PCI-DSS (Payment Card Industry Data Security Standard.).

Step 8: Testing and QA

The testing will involve identifying and resolving errors, bugs, or other usability issues. Multiple methods will be included, such as performance testing, functional testing, and security testing.

Step 9: Deployment

In this stage, your app will be ready to launch.

You can consider deploying your app to the respective app stores, such as Google Play or Apple App Store, along with following their app publishing guidelines to avoid any challenges and issues during the app launch.

Step 10: Maintenance and Updates

Developing and integrating new features and functionalities into your app is a way to enhance the platform experience for your app users.

Alongside integrating new features and functionalities, continuously monitoring and maintaining your app is crucial to identify any issues and fix them as soon as possible.

Therefore, app maintenance and its upgradation with new features are crucial to enhance the platform experience even further.

Top 5 E-Wallets Mobile Apps

Here are the top mobile wallet apps that are dominating the e-wallet industry.

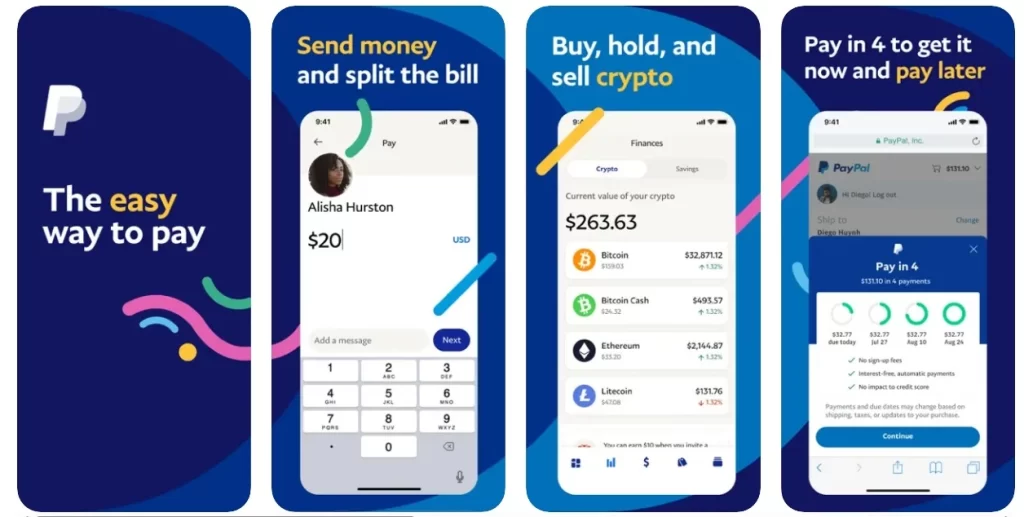

1. Paypal

The platform is one of the oldest digital wallets where users can make payments and transfer money. The PayPal is available for both Android and Apple devices. Moreover, the platform enables customers to link their digital wallets, including Apple Pay.

- Founded in: 1998

- Developed by:Max Levchin, Peter Thiel, and Luke Nosek

- Available on Android & iOS

- App Downloads: 100M

- App Ratings: 4.2

- Headquarters: San Jose, California, United States

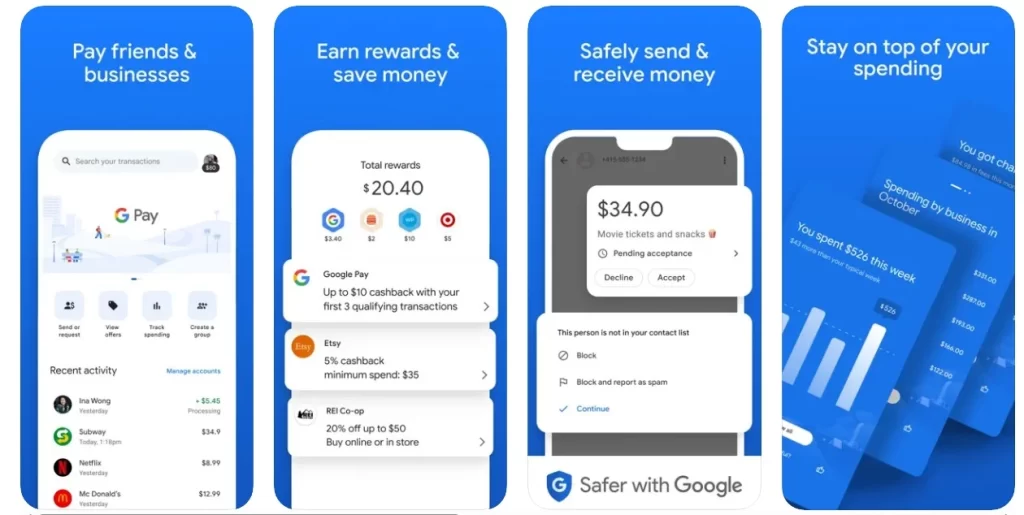

2. Google Pay

Google Pay has gained its users’ trust as the platform securely protects financial information about its users, such as their credit card, debit card, bank account, or PayPal account.

Moreover, the platform offers loyalty rewards to improve engagement on their platform. Users can access Google Pay from many devices, including computers, by using the e-mail address of the account holders.

- Founded in: 2013

- Developed by: Google

- Available on: Android & iOS

- App Downloads: 500M+

- App Ratings: 4.0

- Headquarters: Mountain View, California, United States

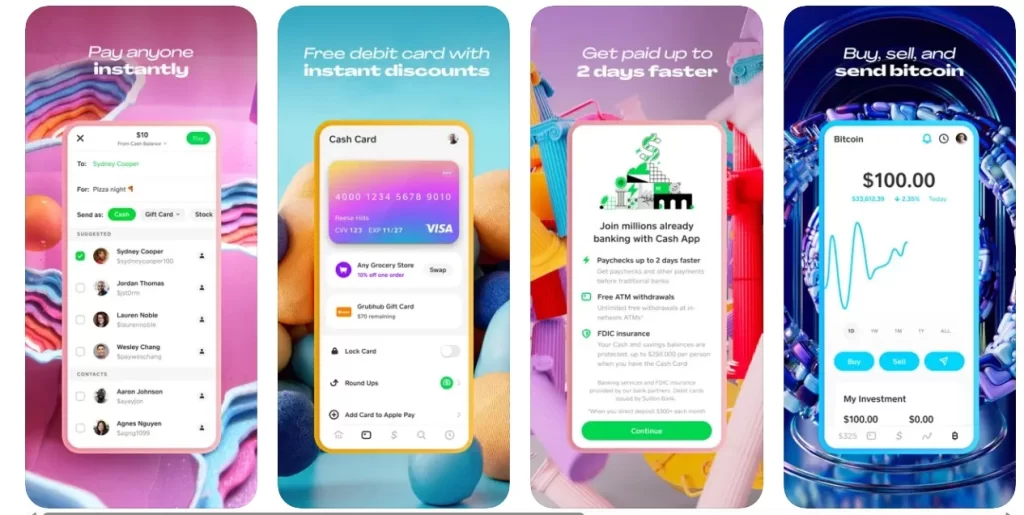

3. Cash App

The platform stores users’ information by converting data into tokens that can only access with a user’s fingerprint. The Cash app enables users to keep coupons, loyalty cards, membership cards, tickets, and paychecks directly in the app.

- Founded in: 2013

- Developed by: Bob Lee

- Available on: Android & iOS

- App Downloads: 50M+

- App Ratings: 4.6

- Headquarters: San Francisco, California, United States

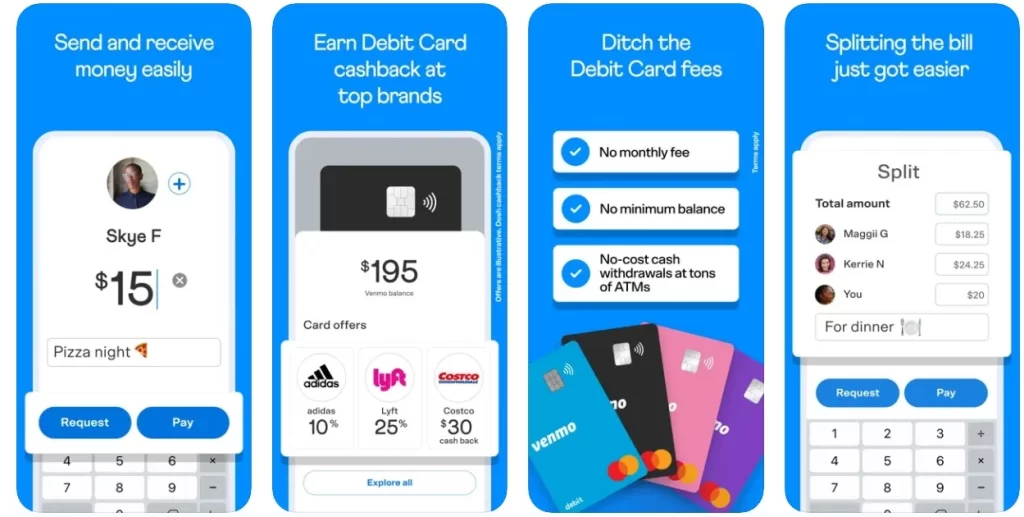

4. Venmo

Another popular platform that enables their users to shop online and allows them to pay via scanning QR codes. The users can use this platform across a wide range of popular shops and outlets such as Euber Eats, Starbucks, Amazon, etc.

Moreover, the user can buy cryptos, split bills, and can receive debit card cashback for top brands.

Here’s a guide to build your payment app like Venmo.

- Founded in: 2009

- Developed by: Andrew Kortina

- Available on: Android & iOS

- App Downloads: 10M+

- App Ratings: 4.2

- Headquarters: New York, United States

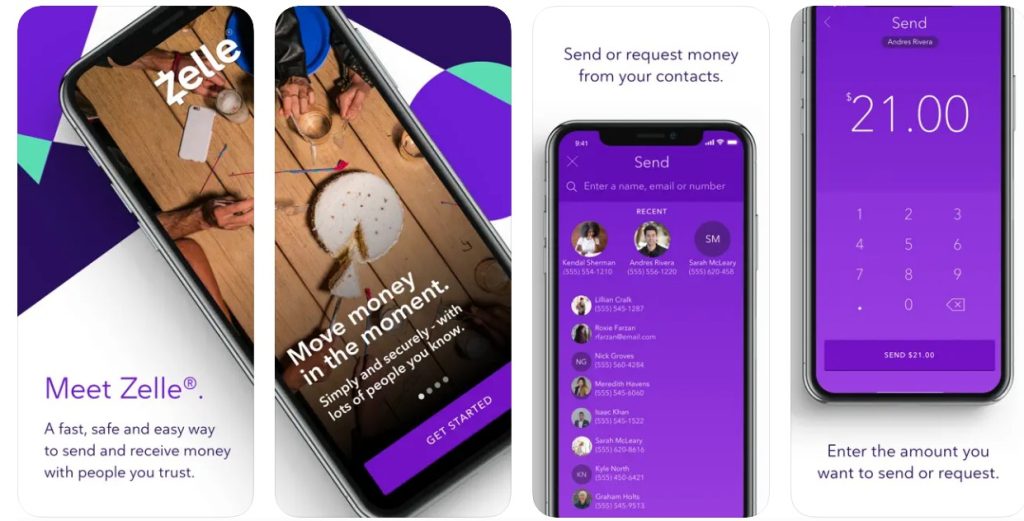

5. Zelle

The platform enables quick payments, where recipients don’t have to wait to receive payments. The users can make Zelle payments by setting them directly on the bank account’s site.

However, both the sender and receiver need a Zelle account, and the platform doesn’t allow their users to get money back after sending. Therefore, users must correctly confirm the receiver’s credentials before sending money.

- Founded in: 2009

- Developed by: Chad Thies

- Available on: Android & iOS

- App Downloads: 10M+

- App Ratings: 4.2

- Headquarters: New York, United States

Must-Have Features Of Mobile Wallet Apps

Here are the following features necessary to be included in your E-wallet mobile app.

1. Push Notification

The feature will enable users to receive notifications regarding the completion of payment processing and any other relevant and important information.

Also, you can promote products and services of your partner brands among your app users with the help of push notifications.

2. Better Management of Personal Expenses

The feature offers a history tab allowing users to access all their past transactions to understand how much money they have spent. The personal expense feature will help users to better manage their expenses by making informed decisions based on their expenses.

3. Loyalty Programs

Improve your app engagement by introducing a customer loyalty program to your e-wallet app. The loyalty program can take any form, like collecting and spending loyalty points in the future or offering scratch cards on each transaction.

4. CRM System

Help your users get assistance at any point by implementing CRM (Customer relationship management) feature in your app.

CRM feature is the best way to handle complex queries of your app users, such as payment getting stuck in the middle of the transaction or not being able to log into your E-wallet platform or any other type of queries.

5. Real-Time Analytics

Real-time analytics will help users get information on all transactions made in a day or at a particular time. The dashboard allows admins to understand the real-time analytics of the app.

6. Online Bills and Recharges

Gone are the days when users needed to reach the electricity board address to make payments for electricity consumed by them in a month.

Many wallet apps allow users to pay their bills for electricity, gas, broadband plans, etc. You can implement the same feature to your app to help users to make payments without needing to leave the comfort of their homes.

7. Virtual Card

Offering virtual Debit/Credit cards to your users is a great way to attract more audience to your platform. Almost all users carry their smartphones more than their physical cards to each place, so they can utilize their virtual debit credit cards when needed across shopping centers or other sites.

8. eCommerce Integration

Integrating e-commerce functionality into your app will help you to partner with other brands and promote their products and services to your platform.

By offering different discounts and offers, you can make a great revenue stream by taking commissions from the sales of each product and service via your e-wallet app.

9. Social Login and Signup

The user can join the E-wallet platform by enabling the app to access their social media credentials, such as name and e-mail address, for quick onboarding.

Enabling users to create their accounts with their social media details helps them save time by avoiding entering all their basic details repeatedly.

10. QR Code Readers

A crucial function of the e-wallet app can help users to make payments by scanning the QR code.

Most shops and merchants use QR codes to receive customer payments. This feature simplifies payment processing as users don’t need to enter the mobile numbers of the receiver manually.

11. Chatbot Support

Automate handling the basic customer queries by enabling chatbot functionality to your app. Moreover, chatbot integration will help your users learn more about your platform by answering their basic questions about your app’s features and functionalities.

Tech Stack To Develop An E-Wallet Mobile App

The recommended technical stack to build your E-wallet mobile app is as follows.

- SMS, Voice, and Phone Verification: Nexmo

- Front-End: Angular, Javascript, HTML5, and CSS

- Payment: Braintree, PayPal, PayUMoney, and Stripe

- Database: HBase, MongoDB, Cassandra, and MailChimp Integrations

- Push Notifications: Push.IO, Twilio, Amazon SNS, Urban Airship

- Cloud Environment: Google Cloud, Salesforce, Azure and AWS

- Email Management: Mandrill

- Data Management: Datastax

- QR Code Scanning: ZBar Code reader

- Real time Analytics: Big Data, Hadoop, Spark, and Apache

Conclusion

Due to the security, convenience, and ease of use, the e-wallet app development has revolutionized how users handle financial transactions and manage their money.

The e-wallet apps facilitate users with a wide range of features such as bill payments, mobile payments, expense tracking, fund transfer, etc.

Moreover, e-wallets eliminate the need for physical wallets to make transactions or carry cash, simplifying their payment processing experience.

Anyone seeking to profit from this ongoing opportunity should consult a reliable app development company to create their e-wallet app.

Therefore, it becomes essential to partner with a company that can help you, from market research to publishing your audiobook app to your preferred platform.

Partner with Idea Usher, a leading mobile app development company with over decades of experience creating mobile apps across different industries. Our team has excelled in converting ideas into applications.

We understand the importance of creating an e-wallet app that stands out. Therefore our team works closely with our clients to know their requirements and design an app tailored to them.

So, if you’re seeking an organization to help you develop an e-wallet app, look no further than IdeaUsher.

FAQ

Q. How do I create an eWallet app?

A. You can follow the given steps to create your e-wallet app: define app features, choose an app publishing platform, introduce loyalty programs, design the UI/UX part, build and integrate app features, maintain and upgrade your app.

Q. What is the market analysis of e-wallets?

A. The market for mobile wallets was valued at $943 million in 2021 and is projected to increase at a CAGR of 26.2% from 2022 to 2030.

Q. Which is the best online wallet app?

A. PayPal, Google Pay, Venmo, Zelle, and Cash App are some of the best online wallet apps.

Gaurav Patil