Neobanks have ruled the world with their numerous advantages. Here are the top neobanking apps that have proved a hit in the US. These applications have given tough competition to the banking industry in the US. Knowing about the details of these payment applications – their pros and cons can help businesses in getting a clear idea of the competitive market.

Can you imagine a virtual banking system today? Well! The answer would be YES. But if the same question was asked a decade ago, people might not even think of it. So, basically, the Neobanks have revolutionized the banking industry.

What is a Neobank?

Neobank is a kind of digital banking system which has no physical branches. The only mode of operation for a Neobank is online banking. Neobanks have proved a super hit because of their advantages over traditional banks.

They offer a range of services with proper categorization of expenditures and revenue. Also, their customer care services are far more efficient than the traditional banks. Due to their numerous benefits over traditional banks, Neobanks have been the choice of millions of users. Top features of Neobanks include:

- Enhanced Customer Experience

- International Transfers and a Nationwide ATM Network

- Open Technical Infrastructure

- Customer-Centric Design

Here are some concepts of Neo Banking for your better understanding:

1. Digital-Only Convenience

Neobanks are all about being digital. They don’t have regular bank branches that you can visit. Everything, from opening an account to transferring money, is done through their mobile apps or websites. It’s banking at your fingertips.

2. Customer-Focused Experience

The aim of neobanks is to make your online banking experience super easy and smooth. They design user-friendly apps and make sure their customer service is quick and efficient. It’s not just about transactions; it’s about making your whole financial journey hassle-free.

3. Variety of Services

Neobanks don’t just stick to the basics. While they do offer regular services like checking and savings accounts, many also provide credit cards and loans. They tailor their services to meet your specific financial needs.

4. Working with Traditional Banks

Because of certain rules, neobanks often team up with traditional banks to offer their services. This way, they can follow the rules but still bring you the benefits of digital banking. It’s a partnership that combines the best of both worlds.

5. Specific Audience

Neobanks have their sights set on particular groups, especially people who are comfortable managing money online. They often target millennials and those who are tech-savvy. It’s about providing banking that suits the way you live and handle your finances.

6. Different Types of Neobanks

There’s not just one type of neobank. Some work closely with traditional banks for the technical stuff, and others are like the digital side of bigger banks. It’s a diverse landscape catering to different needs.

For detailed information read: Know How to Build an App for a Neobank – The Evolution of Future Banking

Key Features That Distinguish Neobanks From Traditional Banks

Neobanks and traditional banks emerge as distinctive players, each shaping the financial experience in unique ways. Here are the key features that set neobanks apart from their traditional counterparts.

1. Digital DNA and Physical Presence

- Neobanks (Fintech Pioneers)

Entirely digital entities, neobanks harness fintech to provide seamless banking services exclusively through mobile apps or desktop interfaces. Strikingly, neobanks defy the traditional brick-and-mortar model, boasting zero physical branches. Their virtual existence enhances accessibility and convenience for tech-savvy consumers.

- Traditional Banks (Legacy Giants)

Rooted in tradition, traditional banks maintain a physical footprint with branches and ATMs, catering to a diverse clientele who prefer in-person interactions. The conventional model includes a tangible network of branches, symbolizing stability and a long-established presence in the financial sector.

2. Regulatory Landscape and Operational Models

- Neobanks (Innovative Approach)

Many neobanks chart a unique course by operating without direct charters from state or federal regulators, leveraging partnerships with established chartered banks. This collaborative model allows neobanks to navigate regulatory complexities while focusing on their core strengths in digital innovation.

- Traditional Banks (Regulatory Compliance)

Traditional banks adhere to stringent state and federal regulations, often operating as standalone entities with direct charters. Regulatory compliance is hereby important for traditional banks, ensuring consumer protection and financial stability.

3. Customer-Centric Digital Experiences

- Neobanks (Tech-Driven Excellence)

Fueled by a digital-first moral code, neobanks excels in delivering superior online experiences, resonating particularly well with younger or tech-savvy consumers. Intuitive interfaces, real-time transaction updates, and personalized financial insights characterize the immersive digital journeys offered by neobanks.

- Traditional Banks (Established Relationships)

While embracing digital channels, traditional banks may not match the seamless online experiences of neobanks. However, they often emphasize established relationships and personalized in-branch services.

4. Service Offerings and Financial Focus

- Neobanks (Streamlined Focus)

Neobanks prioritize fundamental services like checking and savings accounts, tailoring their offerings for simplicity and efficiency. Credit extensions here are typically limited or absent, reflecting a streamlined approach focused on essential banking needs.

- Traditional Banks (Diverse Portfolio)

Offering a comprehensive suite of financial services, traditional banks go beyond basic accounts to provide mortgages, loans, and various financial products. The expansive portfolio caters to diverse financial needs, making traditional banks one-stop destinations for a wide array of services.

5. Economic Considerations and Fee Structures

- Neobanks (Digital Cost Efficiency)

Capitalizing on digital operating models, neobanks often offer competitive interest rates on deposits, waive minimum balance requirements, and eliminate conventional banking fees like overdraft charges. The absence of physical infrastructure contributes to cost efficiency, allowing neobanks to pass on benefits to their customers.

- Traditional Banks (Established Overheads)

Traditional banks, burdened by the costs of physical infrastructure and extensive regulatory compliance, may have higher operational overheads. Consequently, conventional banks may maintain traditional fee structures, including charges for overdrafts and ATM usage.

6. Targeted Audience Engagement

- Neobanks (Niche Appeal)

Unlike the broad appeal of traditional banks, neobanks often target specific demographic segments. This includes a focus on younger consumers or individuals seeking to build their credit. The customized offerings and marketing strategies of Newbanks align with the unique needs and preferences of niche audiences, fostering a sense of community.

- Traditional Banks (Mass Appeal)

Traditional banks traditionally cater to a broad spectrum of consumers, irrespective of age or technological inclination. The mass appeal of traditional banks positions them as inclusive financial institutions, accommodating the diverse requirements of a wide-ranging clientele.

| Differentiation | Neobanks | Traditional Banks |

| Digital Presence | Entirely digital with mobile apps and desktop interfaces. No physical branches. | Physical presence with branches and ATMs, emphasizing stability. |

| Regulatory Approach | Operate without direct charters, often through partnerships. Focus on digital innovation. | Adhere to strict state and federal regulations as standalone entities. |

| Customer Experience | Digital-first, excelling in online experiences for tech-savvy consumers. | Embraces digital but may lack seamless online experiences. Emphasizes in-person services. |

| Services Offered | Prioritizes basics like checking and savings. Limited credit extensions for simplicity. | Comprehensive services, including mortgages and loans. One-stop for diverse financial needs. |

| Economic Efficiency | Digital cost efficiency, competitive rates, and waived fees. No physical infrastructure costs. | Higher operational overheads due to physical presence. Maintains traditional fee structures. |

| Audience Targeting | Niche appeal, targeting younger consumers or those building credit. | Mass appeal, catering to a broad consumer base. |

For detailed information read: Know How to Build an App for a Neobank – The Evolution of Future Banking

Growth of the Neobanking Industry

Source: Grand View Research

| Market Size Value (2022) | USD 66.82 billion |

| The revenue forecast in 2030 | USD 2,048.53 billion |

| The base year of estimation | 2021 |

| Growth Rate (from 2022 to 2030) | CAGR of 53.4% |

The global neobanking market, with a valuation of USD 66.82 billion in 2022, anticipates robust growth at a Compound Annual Growth Rate (CAGR) of 54.8% from 2023 to 2030. This trajectory is driven by an increasing customer preference for banking convenience on a global scale.

In alignment with these projections, an alternate report forecasts the transaction value within the Neobanking market to reach US$4.74 trillion by the end of 2023. This value is positioned for an annual growth rate (CAGR 2023-2027) of 18.16%, culminating in a projected total of US$9.24 trillion by 2027.

Significantly, the average transaction value per user in the Neobanking market is estimated at US$19.76 thousand in 2023. A global perspective underscores the United States as the leader in transaction value, expected to reach US$1,426.00 billion in 2023.

The Neobanking market is also prepared for an increase in users, reaching an estimated 376.90 million users by 2027. With a user penetration rate of 3.3% in 2023, projections suggest a rise to 4.7% by 2027.

Top 10 USA Neobanking Apps – Pros And Cons

Neobanking applications aim at offering financial services better than traditional banks. Here is a list of the top neobanking apps that are available in the USA.

1. Chime

Chime is a fintech (financial technology) offering fee-free mobile banking services. It partners with The Bancorp Bank and Stride Bank for FDIC-insured checking services and debit credit card procurement. Chime earns most of its revenue from the interchange model, charging merchants whenever a customer incurs an expenditure. It enables users to get paid two days early and provides credit-builder services. Moreover, users have access to around 60,000 ATMs for free. As of 2023, Chime has over 21.6+ million users and an estimated revenue of $3.16 billion. The app has been downloaded over 10 million times, boasting a rating of 4.5. The platform remains free.

PROS

- Chime has become the most downloaded application, with around 21.6 million+ users in the past two years. The reason behind its popularity is said to be the personalized notifications, alerts, tutorials, user interface, pricing, and payments.

- Chime offers two-factor authentication to stay in control of the funds. The transaction alerts are instant, with daily balance updates. It also enables car blocking in a single tap in case of apprehension.

- There are no direct deposit fees, monthly fees, maintenance fees, overdraft fees, foreign transaction fees, or minimum balance fees (with SpotMe). It also enables quick money transfers to friends, family, and relatives with no transfer fees.

CONS

- No face-to-face support causes issues among users.

- Not every service is fee-free. Standard ATM withdrawal charges and third-party cash deposit fees apply.

- Many users complain about device compatibility.

- High charges on overseas card usage and no multi-currency option.

| Founder | CEO Chris Britt CTO Ryan King |

| USP | Chime is not just a bank but a financial technology company |

| Price | Free |

| Downloads | 2.16 M+ |

| Ratings | 4.5 |

| Platform Fees | Free |

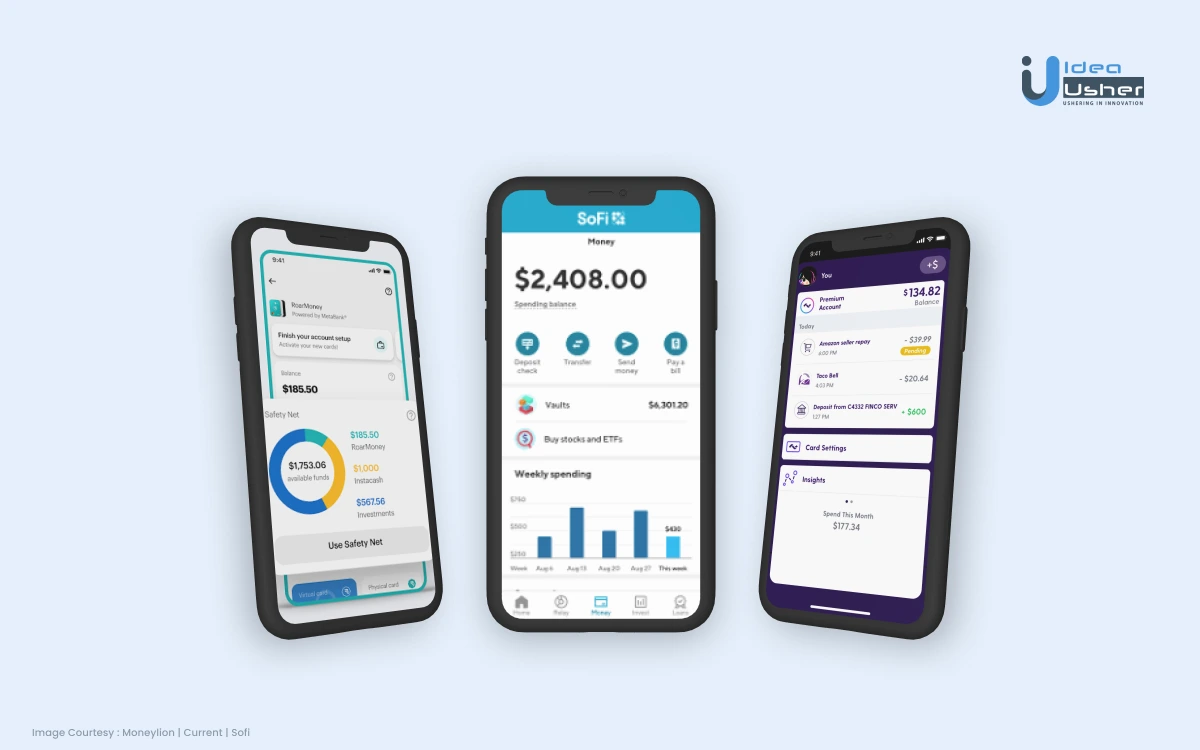

2. Current

Current is a fintech company aimed at making spending, saving, and money management better. Its banking partner is a member of FDIC- Choice Financial Group.

Current offers premium and basic account benefits to users of all ages. Users can set their children’s accounts and monitor their expenses, budgets, etc. Other features include high saving interests, early paychecks, rewards like cash-backs and points, instant gas hold removal, privacy controls, etc.

PROS

- Current enables parents to build money management capabilities and independence at early stages. It offers backend supervision, so the child doesn’t feel controlled.

- There are no monthly fees and no minimum balance for a basic online checking account.

- It enables cash deposits via 60,000+ stores across the States.

- Shopping at participating stores can generate rewards.

- Easy finance tracking makes money management seamless.

- Features that generate positive user sentiment include notifications, alerts, user interface, stability, and tutorial.

CONS

- Premium services cost highly. It is $4.99 for the current premium, and adding teen accounts is $36 per teen. Therefore, more than one kid’s account management can become pricey.

- Customer support is lacking due to no physical confrontation. Also, the documentation and verification process may become complex and overwhelming.

| Founder | Stuart Sopps |

| USP | Mobile banking is better with Current |

| Price | Free |

| Downloads | 3.4 M+ |

| Ratings | 4.6 |

| Platform Fees | Basic service: Free, Current premium: $4.99, Child account: $36 per year per account |

3. Varo

Varo is the first all-digital bank offering a comprehensive range of financial services. These include bank account management in one place, tracking spending, credit building, high-yielding saving accounts, access to a cash advance when qualified, and many other helpful features.

It differentiated itself from competitors by applying for a banking license to develop into a full-fledged bank. It created the financial services platform internally.

PROS

- Varo saves users’ money by eliminating monthly checking and saving account fees, overdraft fees (if eligible), in-network ATM fees (available in Walgreens, CVS, and 55000+ all-point stores), foreign transaction fees, debit card replacement fees, and transfer fees.

- Being eligible for Varo Advance enables you to get $100 as an advance. Up to $20, it has no fees, but more than that can attract $3-$5.

- It offers an impressive savings rate with a minimum annual percentage yield of 0.50% to 3%.

- Users can qualify for up to 5.00% APY on deposits up to $5,000, with an APY of 3.00% on amounts exceeding that.

CONS

- Varo does not let users deposit money directly into the savings account. Therefore, while making cash deposits to checking accounts, users have to bear fees charged by third parties.

- Paper checks are not allowed.

| Founder | Colin Walsh and Kolya Klymenko |

| USP | With Varo, nothing stops the customers from going ahead |

| Price | Free |

| Downloads | 3.8 M |

| Ratings | 4.7 |

| Platform Fees | Free ACH, Cash App charges 1.5% for instant transfers. |

4. Dave

Dave aims to become your banking buddy with breakthrough financial tools to improve your economic health and no fees. It helps avoid overdrafting and offers real value and solid strategies to boost the credit score.

Dave alerts you when your checking account goes red. It offers analytical budgeting and cash management features. Users can avail of loans and repay them as auto-debit when the paycheck arrives or at any earlier date. However, qualifying for loans and advances requires having a steady income flow and other requirements.

PROS

- Dave is suitable for individuals who keep over drafting. The interest-free model saves money on overdraft or non-sufficient funds fees.

- By paying the rent and utilities on time, users can build and improve their credit scores.

- It analyzes the spending pattern to create a budget and alerts if users miss an expense.

- Dave offers job opportunities and ways to earn extra money.

- It generates positive user sentiment via notifications, alerts, signup, login, user interface, and tutorial.

- It offers a $500 cash advance with no late fees and no interest.

CONS

- Inflexible cash advance feature with users not able to change the payback date and a small-cap of $75 on a standard account.

- It charges a monthly membership fee of $1.

- The cash management account does not offer APY and charges low-monthly fees.

| Founder | Jason Wilk |

| USP | Dave helps improve your financial health with the breakthrough financial tools |

| Price | Paid |

| Downloads | 10 M+ |

| Ratings | 4.4 |

| Platform Fees | Membership fee of $1 monthly, optional express free between $1.99 to $5.99 to receive funds faster (within 8 hours instead of 1-3 days), optional tips up to 20% of the amount borrowed |

5. Albert

Albert is a saving, budgeting, investing, and banking solution. It offers enriching features like direct deposits, debit cards, early paychecks, and advances.

It offers a comprehensive view of users’ financial picture via pie charts, budgeting tools, etc. Their experts guide your investments in the right direction. Subscribing to the paid version gives access to unlimited human financial advice. It encourages savings by transferring a particular amount automatically to the savings account.

PROS

- Albert app is rich in features that help manage finances. It partners with various companies to lower the bills, prevent late fees, and notify overspending. Access to direct deposits is quicker than traditional banking.

- Money management tools make saving, investing, and budgeting seamless and efficient.

- No inactivity or monthly fees get charged.

- Early paychecks help plan expenses accordingly.

- Cashbacks and other rewards are available using debit cards and the app for money transfers.

- Financial health scores and expert advice let users stay on top of their finances and goals.

CONS

- The interest in savings is pretty low than other applications.

- Not having a mobile check deposit feature creates a mess as users have to transfer money from a different account.

- More than one saving transaction requires Genius access.

- It does not have a desktop version.

| Founder | Yinon Ravid and Andrzej Baraniak |

| USP | Powerful technology to automate finances |

| Price | Free |

| Downloads | 5 M+ |

| Ratings | 4.1 |

| Platform Fees | No fees except Genius subscription is of $8 per month |

6. Moneylion

Moneylion is a personal finance company providing users with finance, mobile banking, cash advancing, investing, and more features. The account minimizes service fees and offers a viable alternative to a traditional checking account.

It provides instacash, automatic spare change investing, credit builder plus, and investment advisory services.

PROS

- There is no overdraft, insufficient funds, or foreign transaction fees

- Access to 55000+ fee-free ATMs nationwide

- It offers loans without much inquiry

- Cryptocurrency features and prizes are available

- An integrated financial service platform

- Investment portfolios are customizable

CONS

- It only offers loans of small amounts, which may not be as valuable.

- There is no dedicated financial planner or advisor

- Paper checks are not useful

| Founder | Chee Mun Foong, Diwakar Choubey, Pratyush Tiwari, Adam Green |

| USP | Most powerful financial membership |

| Price | Free |

| Downloads | 1 M+ |

| Ratings | 4.4 |

| Platform Fees | Monthly maintenance fee $1, $3/month (accounts valued over $5,000), $5/month (accounts valued over $25,000). |

7. Aspiration

Aspiration is a cash management app that lets users save, invest, and bank with a conscience. It helps them make ethical choices with their money without opening traditional savings and checking accounts. They can use it to Spend and Save for routine transactions.

PROS

- Users have a ‘Pay what is fair’ policy for the basic Aspiration Save and Spend account, even if it is $0.

- The Aspiration Plus account offers up to 1% Annual Percentage Yield on balances up to $10,000. More than $10,000 attracts 0.10 % interest.

- Users can earn cashback using an Aspiration debit card by shopping with partners in conscience coalition with the company. The amount is between 3% to 10%.

- It claims that deposits do not fund fossil fuel production or exploration. However, the techniques applied are not mentioned on their website.

- There are no hidden or overdraft fees.

CONS

- It requires a minimum of $10 for deposits.

- It does not support cash deposits.

- Higher savings interest requires incurring expense on Aspiration plus of $5.99 per month.

| Founder | Joe Sanberg |

| USP | It provides brokerage services and securities products |

| Price | Free |

| Downloads | 1 M+ |

| Ratings | 4.1 |

| Platform Fees | Optional to pay what you think is fair; Aspiration Plus comes at a $0 to 7.99 monthly fee |

8. Sofi

Sofi- short for social finance began as a personal loan and student loan refinancing company. Today, it is a one-stop shop for all the financial services- save, spend, earn, borrow, and invest.

Sofi checking and saving accounts can earn interest rates up to 1% APY. It enables crypto trading, stock investing, ETF, retirement funds, etc., with no commission or minimum amount. Sofi loan with no hidden costs encourages savings. There are complementary analytics and budgeting tools to check financial health.

PROS

- There is no minimum requirement to start investing or opening a deposit account.

- There are no maintenance or overdraft fees.

- In-network ATMs are accessible free of cost nationwide.

- Value-adding features like comprehensive financial view, loan, savings, investment, etc., are available.

- High-yielding savings account from 0.25% to 1% APY.

CONS

- Cash deposits are not allowed with the app

- Transaction limitations restrict functioning

- There are no options for business banking

| Founder | Ian Brady, James Finnigan, Dan Macklin, Mike Cagney |

| USP | An easier way to control finances |

| Price | Free |

| Downloads | 1 M+ |

| Ratings | 4.3 |

| Platform Fees | Free |

9. Acorns

Acorns help grow money by investing in your future and retirement plans. It invests money in recurring ETFs backed by experts. Moreover, investment accounts for kids and custom rewards for families are available.

The checking account and a metal debit card allow early paycheck and a portion invested automatically. It offers rewards, job opportunities, and financial literacy through educational content.

PROS

- It promotes savings by investing spare change automatically.

- Cashback is available with selected retailers.

- Educational content is available, which differentiates it from other Neobank apps.

- No minimum amount to open accounts

- It offers automatic rebalancing of the portfolio to adjust to market fluctuations and other affecting factors.

- Easy to use and navigate interface

CONS

- Too high tiered-fee structure on small account balances

- No human advisors or tax-loss harvesting

- Fees paid to access the checking account

| Founder | Jeffrey James Cruttenden and Walter Wemple Cruttenden |

| USP | Specializes in micro-investing |

| Price | Paid |

| Downloads | 10 M+ |

| Ratings | 4.6 |

| Platform Fees | $3 per month personal and $5 for family |

10. Go2Bank

Go2Bank enables users to manage their finances and build their credit with a mobile banking app and debit card enriched with features. Its value and convenience lie in direct deposits with no fees, a vast ATM network, overdraft protection, early paycheck, better credit scores, fraud alerts, etc.

PROS

- It offers 1% APY across all saving vaults.

- Dividing saving goals up to 5 accounts

- Seamless cash deposits and withdrawals with vast ATM and retail network

- Not many inquiries in the credit check

- Cashback and rewards on purchases

CONS

- A monthly fee of $5 gets charged if deposit requirements are not met

- High saving interest rate is only for the first $5000

- Customer service options are limited

- No paper check privileges are available

- Transfer from Go2Banks to an external bank account is not allowed

| Founder | Scott Moran |

| USP | Better manage your money and build your credit |

| Price | Free |

| Downloads | 1 M+ |

| Ratings | 4.5 |

| Platform Fees | Monthly $5 fee waived with a direct deposit account. |

Here is the summarized table for the Neobanking app mentioned above:

| Neobank | Key Features | Downloads | Platform Fees | USP |

| Chime | No-fee checking with Bancorp Bank and Stride Bank partnerships, 21.6M users (2023), No minimum balance, monthly, maintenance, or overdraft fees. | 21.6M | None | Low-fee banking alternative. |

| Current | Digital platform, 3.4M users (2023), $4.99/mo premium fee. | 3.4M | $4.99/mo | Best for families, expedited direct deposit, fee-free overdraft. |

| Varo | New peer-to-peer service Varo to Anyone, 3.8M users (2023). | 3.8M | Free ACH, Cash App charges 1.5% for instant transfers. | First federally chartered digital bank, innovative peer-to-peer service. |

| Dave | Unique checking for all, Extra Cash feature, data not available. | 10M+ | $1/month | Extra Cash for small borrowings, no late fees or interest. |

| Albert | Micro-investing, robo-advisors, checking, investment options. | 5M+ | $8/month | Diverse financial services, details not specified. |

| Moneylion | Digital-first traditional banking, details not available. | 1M+ | $1/month$3/month (accounts valued over $5,000), $5/month (accounts valued over $25,000). | Financial services, à la carte subscription model. |

| Aspiration | Socially conscious neobank, details not available. | 1M+ | $0 to $7.99/mo | Eco-friendly banking, donation commitment. |

| Sofi | Digital platform, details not available. | 1M+ | None | Checking, high-yield savings, secured credit card, wide ATM access. |

| Acorns | Unified banking solution, details not available. | 10M+ | $3 to $9/mo | Micro-investing, top robo-advisors. |

| Go2Bank | Mobile banking, credit features, details not available. | 1M+ | $5/mo (waived with qualifying direct deposit) | Checking, high-yield savings, secured credit card, ATM access. |

Key Consideration For Selecting Ideal Neobank App

Selecting the ideal neobank app involves a detailed evaluation of various criteria to ensure a seamless and secure banking experience. Consider the following factors when ranking and choosing a neobanking app:

1. Intuitive User Interface (UI) & User Experience (UX)

An important aspect of the assessment is the design and user-friendliness of the app. Optimal neobank apps feature a clean, intuitive interface that simplifies navigation and facilitates smooth transactions. A user-friendly design enhances overall satisfaction and ease of use.

2. Features

The breadth and quality of services offered by the app hold substantial importance. Look for neobank apps that provide a spectrum of services, including checking and savings accounts, international transfers, access to a nationwide ATM network, and more. Distinguishing neobanks may offer unique features such as early paycheck access and automatic savings tools, adding significant value.

3. Security Measures

A reliable neobank app should implement robust security measures to safeguard user data and funds. This may involve the incorporation of two-factor authentication, encryption protocols, and other advanced security features, ensuring a secure banking environment.

4. User Feedback and Reviews

Customer reviews are invaluable in gauging the performance and reliability of neobank apps. Feedback provides insights into the quality of customer service, overall user satisfaction, and the app’s reliability. Prioritize apps with positive reviews and a strong track record in meeting user expectations.

5. Transparent Pricing and Efficient Payments

Assess the cost of using the neobank app and the efficiency of its payment processing. Some neobanks differentiate themselves by offering fee-free services, presenting a considerable advantage. Transparent pricing structures contribute to a more informed decision-making process for users.

6. Customer-Centric Design

Neobanks often emphasize a customer-centric approach, striving to provide personalized experiences. Look for apps that offer features such as personalized notifications, alerts, and tutorials. A neobank app that tailors its services to individual user preferences enhances the overall banking journey.

7. Popularity Indicators

Consider the popularity of the neobank app, as indicated by the number of downloads. An app with a higher number of downloads may signify widespread user acceptance and trust. While not the sole criterion, popularity indicators can provide insights into the app’s market presence.

Future Trends In Neobanking

Neobanking is propelled by several key trends that promise to reshape the entire experience. Understanding these trends is crucial for those seeking insights into the future of digital banking:

1. Rapid Adoption of Digital Solutions

A trend shaping the future of neobanking is the accelerated adoption of digital solutions. Users are increasingly gravitating towards seamless digital banking experiences, embracing mobile banking, and opting for online account opening. This shift reflects a broader movement towards a more technologically integrated and user-friendly financial ecosystem.

2. Expansion into Diverse Markets

Neobanks are strategically diversifying their portfolios by venturing into new markets, particularly in areas like SME lending and investment services. Collaborative efforts with traditional financial institutions to offer white-label banking services signify a trend toward forging symbiotic relationships. This strategic expansion enhances the scope of services offered by neobanks, catering to a more comprehensive array of financial needs.

3. Influence of Regulatory Changes

Noteworthy developments in regulatory frameworks, particularly in established markets like Europe, the US, and the UK, are fostering an environment conducive to neobanking growth. Regulatory changes are becoming favorable, opening up opportunities for neobanks to innovate and operate more flexibly within the financial sector. This evolution is pivotal in shaping the regulatory landscape and facilitating the continued growth of neobanking.

4. Targeting of Niche Segments

Evolving beyond broad-market approaches, emerging players in the neobanking space are shifting focus towards ultra-niche segments. Tailoring services for specific demographics, such as artisans and teenagers, exemplifies a trend toward personalized banking experiences. This niche targeting allows neobanks to craft specialized solutions, meeting the unique financial needs of distinct customer segments.

Additionally, there are several technologies that can enhance the capabilities of neobanks:

5. Smart Assistance through AI and ML

Neobanks are embracing the power of Artificial Intelligence (AI) and Machine Learning (ML) to refine and personalize your banking encounters. These technologies work intelligently behind the scenes, offering tailored suggestions and ensuring seamless operations while maintaining the utmost security.

6. Robust Financial Guidance from Robo-Advisors

The introduction of robo-advisors brings a new era of automated financial planning. These advisors, devoid of excessive human intervention, provide cost-effective financial advice, guiding users in managing their finances effectively.

7. Enhanced Security via Biometric Authentication

Neobanks are improving security measures by incorporating biometric authentication methods, such as fingerprint scanning and facial recognition. These measures not only fortify account security but also contribute to a user-friendly and trustworthy banking experience.

8. Blockchain Integration and Cryptocurrency Exploration

The adoption of blockchain technology contributes to heightened security and transparency within neobanking. Simultaneously, neobanks are delving into the realm of cryptocurrencies, offering novel avenues for managing and growing assets securely.

9. Collaboration through Open Banking and API Integrations

Neobanks are building collaboration through open banking and establishing partnerships with third-party developers through API integrations. This cooperative approach leads to the development of innovative features and services, enriching the overall banking experience.

10. Efficient Transactions with Digital Wallets and Expedited Payments

Neobanks are simplifying transactional processes with the integration of digital wallets, providing users with a convenient means of managing their finances. Concurrently, advancements in payment technologies are ensuring faster and more efficient processing for swift financial transactions.

11. Prompt Financial Solutions via Advanced Algorithms

Neobanks are utilizing advanced algorithms to expedite financial solutions, such as instant loans and credits. These algorithms, grounded in advanced mathematical principles, facilitate quick and responsive assistance, addressing users’ financial needs promptly.

Build Your Own Neobanking Apps

Making an application is not an easy task. It requires a lot of brainstorming and innovative ideas to make an application that would stand out from the crowd. To make the application development process easier and more convenient, you need experienced developers. Idea Usher is one of the best application development companies which can provide you with all your requirements.

The experts at Idea Usher can help you develop an application from scratch. You can create mind-blowing features for your app with the help of experienced developers. This would make your application a great hit in the market.

Final Words

The above-mentioned list of top neobanking apps has brought a revolution to the banking industry. They might have given you a fair idea of the competition that is already there in the market. Now if you want to create an app that could fight this competition, you need some creative ideas. To get out-of-the-box application development ideas, you should visit Idea Usher.

For more information and a detailed understanding of the application development process, you can contact them at.

E-mail: [email protected]

Phone Numbers : (+91)9463407140, (+91)8591407140, and (+1)7329624560

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQ‘s

Here are some interesting FAQs on top neobanking apps

Q. What is The Estimated Time To Develop A Neobanking App?

A. Depending upon its features and functionalities, the time taken to develop a neobanking app usually ranges between 45 days to 90 days.

Q. How Can Someone Start a Neobank?

A. The steps to start a neobank include:

- Define Your Target Audience and Value Proposition

- Create a Fundamental Basis for a Neobank

- Build Strong Cornerstones – Backend Infrastructure and Frontend Development

- Maintain Neobank Security and Compliance

- Testing

- Deployment

- Marketing

Q. What Are Open Banking Initiatives?

A. Open banking aims to create better financial services options for consumers by giving more stakeholders access to finance.