- What is Neobank?

- Overview of the Neobank Market

- Top 10 examples of Neo Banks That Have Succeeded

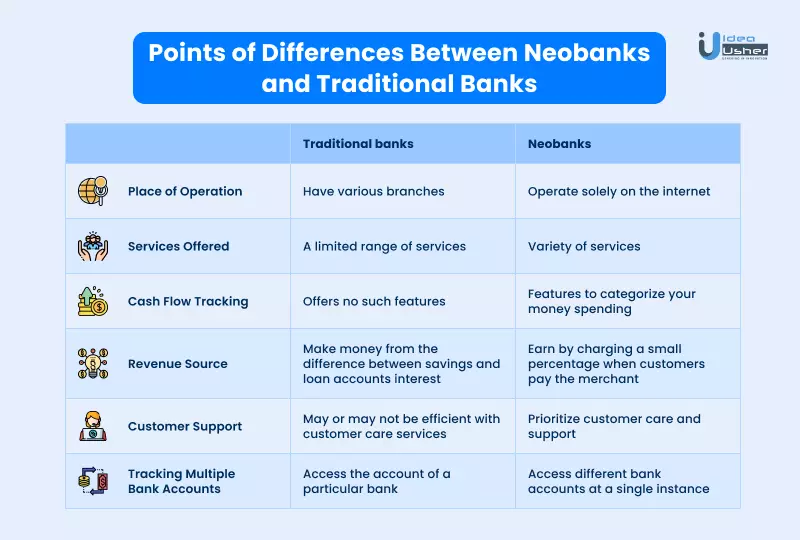

- Differences Between Neobanks and Traditional Banks

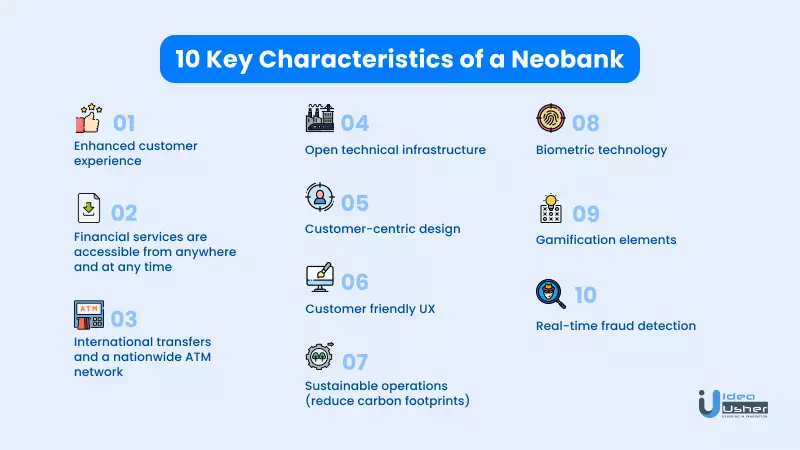

- 10 Key Characteristics of a Neobank

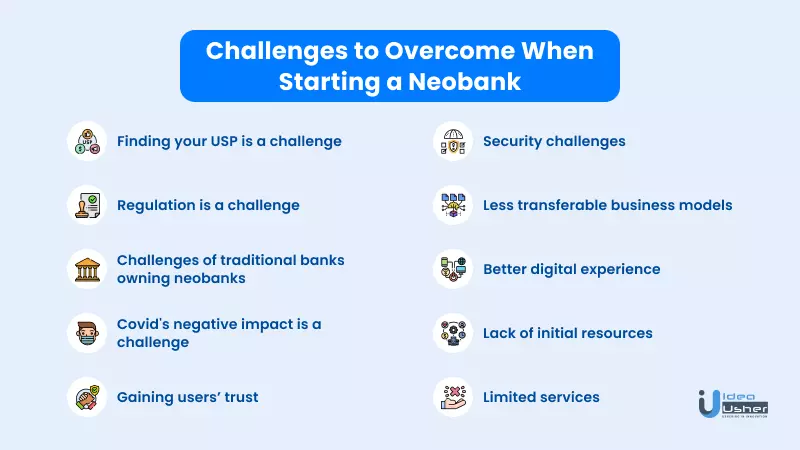

- Challenges to Overcome When Starting a Neobank

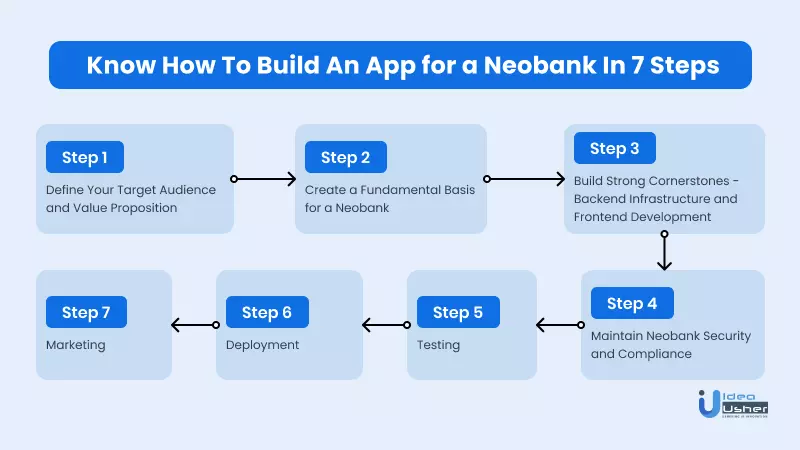

- Know How To Build An App for a Neobank In 7 Steps

- Build Your Own Neobanking Apps With Idea Usher

- It’s a Wrap

- FAQ

The growing curiosity of the entrepreneur demands to know how to build an app for a Neobank. But before coming to the development of the application, it is essential to know about the concept in detail.

The fintech community has a new word that is buzzing these days – NEOBANK. This word is gaining popularity and spotlight in every sector. Be it news or media, and we often hear this word everywhere. But are we really aware of this concept?

Let us have a detailed analysis of these payment applications. Every day something new is coming up in the market. But Neobanking has brought a storm to the fintech industry. It has eased the process of financial services to a large extent.

Let us begin with understanding the meaning of Neobank.

- What is Neobank?

- Overview of the Neobank Market

- Top 10 examples of Neo Banks That Have Succeeded

- Differences Between Neobanks and Traditional Banks

- 10 Key Characteristics of a Neobank

- Challenges to Overcome When Starting a Neobank

- Know How To Build An App for a Neobank In 7 Steps

- Build Your Own Neobanking Apps With Idea Usher

- It’s a Wrap

- FAQ

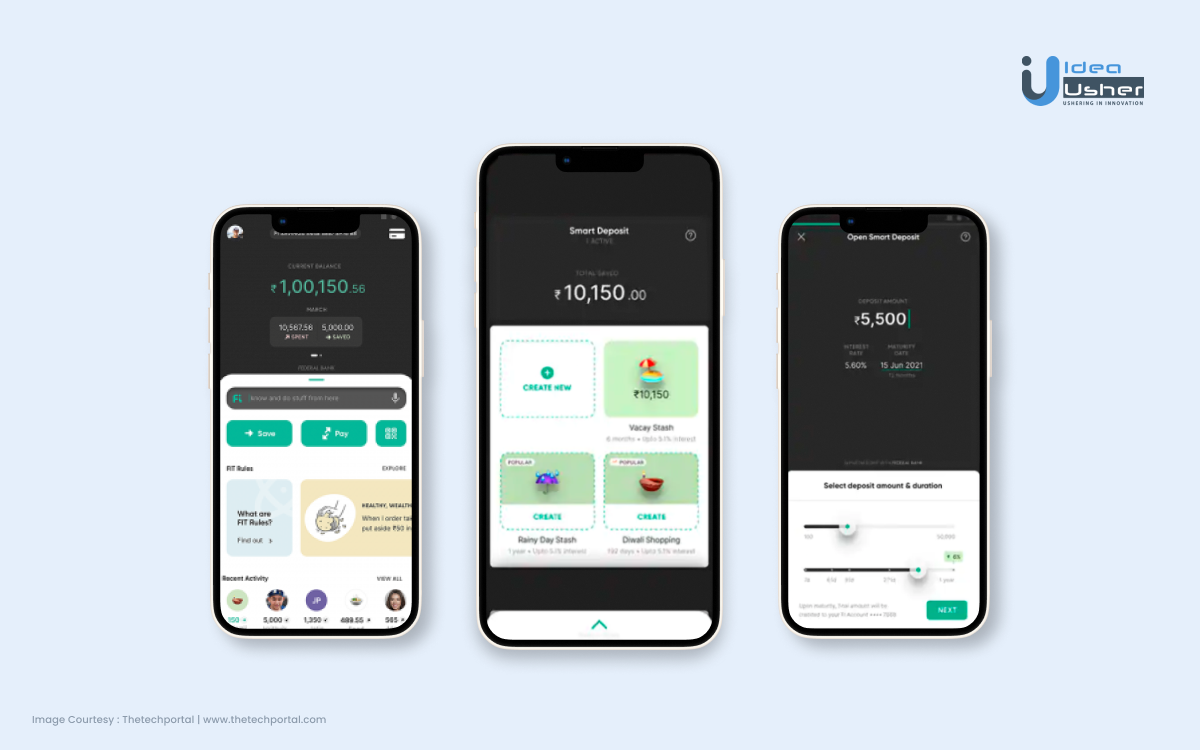

What is Neobank?

Neobank is a sort of digital bank that has no branches. The concept of neobanking completely operates online and hence has no physical branches. In the digital age, customers have more expectations, which Neobanks tries to fulfill.

They provide excellent services that traditional banks fail to provide. The concept has facilitated the money management concept of tech-savvy customers. Neobanks have succeeded in cutting down the operating costs because they operate only online, with no physical branches.

Overview of the Neobank Market

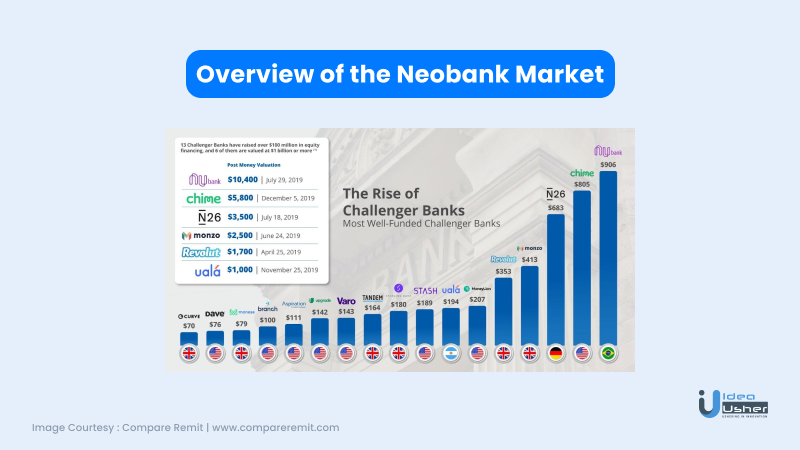

The Neobank market was approximately USD 18,604 million in 2018. This was expected to grow to USD 394,648 million by 2026. This makes a CAGR of around 46.5 % from 2019 to 2026.

During the COVID-19 outbreak, many economic setbacks were experienced by different sectors of the economy. But the Neobanks proved to be a tempting alternative to the physical banking system. And hence they grew in popularity. Research has shown that the teens in the age group of 18 to 20 years have opened their accounts with Neobanks during the pandemic.

Let us have a look at the latest figures of the neobank market now:

| Neobank Market Size In 2020 | USD 35 billion |

| Neobank Market Size In 2021 | USD 47.39 billion |

| Compound Annual Growth Rate (CAGR) | 53.4% |

| Forecast Period | 2022 to 2030 |

| Quantitative Units | Revenue in USD billion and CAGR from 2022 to 2030 |

| Historical Data | 2017 to 2020 |

| Big Names in Neobanking | Chime, Current, Aspiration, Varo, etc. |

| USP of Neobanks | To offer a level of customer experience that traditional banks could never offer |

| Services Offered by Neobanks | Savings account, direct deposits, cash account and more |

| First Neobank | NERVE – which was founded by John Waupsh (CEO) and Ben Morrison (CTO) |

Top 10 examples of Neo Banks That Have Succeeded

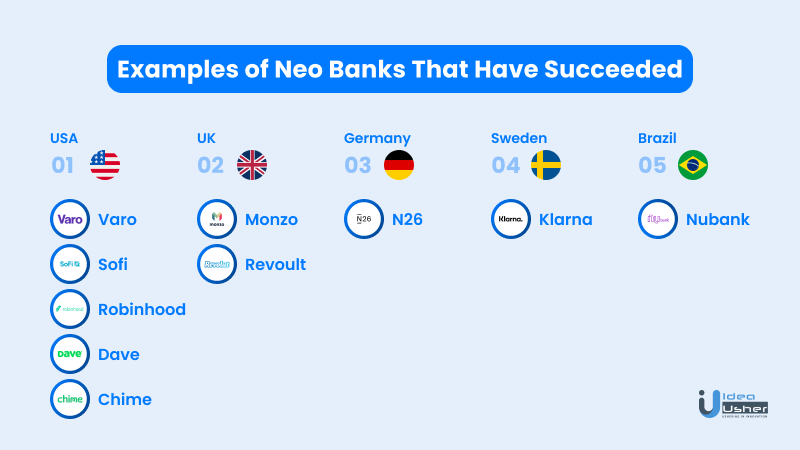

In the past few years, the momentum of neobanking has witnessed a drastic rise. Many neo banks have succeeded during the years. To name a few, we have the following Neobank examples:

1. Chime (USA)

Chime is a US-based fintech offering financial services like savings and checking accounts, bill payments, early paychecks, credit building tools, etc. It has been the most downloaded application in the past years due to its easy-to-use interface and stellar features.

2. Varo (USA)

Varo offers users a bank for everyone. It provides a contactless debit card, branchless mobile banking, free transfers, FDIC-insured deposits, cashback and rewards, and money growing opportunities. It gives users the necessary control over their finances.

3. Dave (USA)

Dave is a banking app helping users cover their bills with small advances. It does not have an intensive credit check procedure for such loans and enables repayment whenever possible. Paying rent and utilities on time enhances your credit score.

4. Monzo (UK)

This UK-based fintech offers banking and financial solutions. Users can buy insurance, get complete financial visibility, save, manage, spend, borrow, and travel with the secure application.

5. Revolut (UK)

From quick account opening to intelligent money management, Revolut offers various financial tools to send, spend, and save. It enables hassle-free payments, good saving interest (0.7% annually, paid daily), exclusive rewards, debit and credit cards, open banking with all bank accounts in one place, and many more services.

6. N26 (Germany)

This mobile bank helps users manage their bank accounts from anywhere, track expenses, and create budgets in real-time. It is free to open a bank account and get insights into the spending habits for better control.

7. SoFi (USA)

SoFi, also known as ‘Social Financing,’ offers banking, investing, personal loans, credit score, budgeting, student loan refinancing, home loans, credit card, insurance, and other related services. It is a one-stop finance shop with reward points, customer support, and complimentary member benefits.

8. Robinhood (USA)

Robinhood is a commission-free investing application. It enables real-time trading and building a balanced portfolio. It offers tools to put the money into the flow and grow.

9. Klarna (Sweden)

This unique application enables users to split a purchase into four and enjoy flexibility in paying installments interest-free. Referring friends to the app can generate amazing deals and earnings.

10. Nuвank (Brazil)

A straightforward, transparent, and innovative app, Nubank embeds practicality in controlling financial life. It provides access to a digital account, credit card, loans, business accounts, business credit card, investments, and more.

Differences Between Neobanks and Traditional Banks

1. Place of Operation

Neobanks operate solely on the internet. They do not have any physical branch, thereby reducing the operational costs. On the other hand, traditional banks have various branches. Also, they have established their virtual presence via applications and websites.

2. Services Offered

Neobanks do not have 100% digital banking licenses. Therefore, they can only provide a limited range of services, from money deposits to convenient payments, etc. In contrast, traditional banks offer a variety of services like money deposits, lending, and even locker services. Because conventional banks have physical branches, the customers can keep their jewelry safe in the bank.

3. Cash Flow Tracking

Neobanks have features to categorize your money spending. It classifies expenses as personal care, shopping, investments, etc. It allows you to monitor your costs and view where you spend the most. On the other hand, traditional banking offers no such features. At the end of the period, you can get a bank statement and classify expenses yourself.

4. Revenue Source

Traditional banks make money from the difference between savings and loan accounts interest. That is why their main focus is on promoting and attracting fixed deposits, loans, etc. Neobanks earn by charging a small percentage when customers pay the merchant (interchange revenue model). They can also make money through interest on deposits. They invest the money in securities, and interest earned is higher than what they offer to the depositors.

5. Customer Support

Neobanks prioritize customer care and support. They focus on attracting customers’ trust and attracting more users. Therefore, instead of leaving you on hold for minutes or hours, they provide quick and convenient customer assistance for a healthy relationship. In comparison, traditional banking may or may not be efficient with customer care services. It can vary with different banks.

6. Tracking Multiple Bank Accounts

With a traditional bank, you can only access the account of a particular bank. Because it is a closed system, you have to log in your credentials every time to avail of information. On the other hand, Neobanks lets you access different bank accounts at a single instance, thus increasing visibility.

10 Key Characteristics of a Neobank

Neobanks add considerable value to the economic processes, and users must realize their worth. If you wish to know how to build an app for a Neobank, these features must form a part of your application.

1. Enhanced Customer Experience

Neobanks employ an interchange fee model that lowers customer costs. They focus on offering money management techniques in real-time. These banks use AI-powered credit scoring to streamline the decision-making process. These Neobanks bring convenience in routine tasks like depositing cheques or peer-to-peer payments without high fees. They have a more straightforward account setup and accelerated processing time.

2. Financial Services Are Accessible From Anywhere and at Any Time

Neobanks tap into the busy lives of users and provide anywhere-anytime access. They care for the utmost customer comfort and give 24*7 access to banking. The application and tech-oriented Neobanks offer quick, efficient, simplified, and paperless procedures. They bundle various financial services on the go hassle-free.

3. International Transfers and a Nationwide ATM Network

Neobanks streamline the processes and enable international transfers through mid-market exchange rates. They allow customers to make secure global payments in real-time at affordable costs.

Neobanks also makes the withdrawal process seamless and hassle-free through a network of ATMs available at nearby locations. Customers can open their accounts without paper or fees with a few clicks.

4. Open Technical Infrastructure

Instead of the outsourcing tech stack, open technical infrastructure enables adding as many solutions as needed. Neobanks can create ‘plug and play’ cutting-edge instruments. They prevent the pitfalls of a heavy, slow-moving system. Instead, Neobanks can add new products and services in real-time and give their clients an edge.

Traditional banks have difficulties integrating with new capabilities. Neobanks overcome it through open technical infrastructure.

5. Customer-Centric Design

Traditional banks use offline and online methods to manage customers and their portfolios. It is a time-consuming and cumbersome process. However, Neobanks have a customer-centric design that prioritizes the users’ needs. Analytics and business intelligence offer enriching features like budget suggestions based on monthly expenses, real-time data monitoring, reconciliation, etc.

6. Customer-Friendly UX

Neobank is not just an application but a personalized user experience. It entails functions that allow customers to interact and customize their banking experience. For example, adding customized notes near the receipts makes customers find the transactions easily.

5. Gamification Elements

Gamification is a process of enhancing the user experience by adding game-like elements to a non-gaming app. Adding gamified movable icons can enrich and personalize their experience. They can apply tiny pics and icons to mark receipts and visualize personal notes. For example, adding a home icon for house expenses, kids icon for costs spent on children, etc. are a few instances of the same.

8. Biometric Technology

Neobanks use cutting-edge technology, and biometrics is one of them. They include fingerprint recognition, eye print, or ear scanning technology. This can become one of the authentication layers as the younger generation does not like putting in passwords. It can lead to positive and authentic user reviews on the app stores.

9. Real-Time Fraud Detection

Neobanks can add an extra layer of security threat for out-of-pattern behavior detection. It can notify the users’ behavior, locations, devices used, large transfer amount, etc., and alert them to unusual activities.

10. Sustainable Operations (Reduce Carbon Footprints)

Unlike traditional banking trying to cut fossil fuel costs, Neobanks can help fight climate change and reduce environmental footprint. It decreases paper use and enables reforestation by rounding up the transaction into the whole dollar and transferring the extra money to the ‘Plant your change’ account.

Challenges to Overcome When Starting a Neobank

Although Neobank applications offer a variety of benefits, it is not free from challenges. Let us know about a few challenges that cannot be overlooked.

1. Finding Your USP Is a Challenge

Finding USP (Unique Selling Proposition) for Neobanks is a daunting task. Already available Neobanks in the market touch upon the critical customer areas and offer convenient and timely services. Therefore, it becomes difficult for a new developer to target a unique aspect. It requires thorough research and analysis to understand the actual pain points and incorporate them into the application. Developers can look into the shortcomings and potential issues and provide a better solution.

2. Regulation Is a Challenge

Although Neobanks provide financial services, they do not have a 100% banking license. This restricts their services and leads to confusing regulations. Neobanks can work globally but have to abide by the rules of different jurisdictions. Also, because they work exclusively on a digital platform, cyber security regulations are an additional hassle for Neobank apps.

3. Challenges of Traditional Banks Owning Neobanks

Neobanks do not hold a banking license. They cannot lend or accept deposits on their books. Thus, they have to tie up with traditional banks to offer different services. These banks may provide resources to Neobanks but do not guarantee success and may even crowd the market with more competition.

4. COVID’s Negative Impact Is a Challenge

Covid-19 has had a negative effect on every industry, and Neobanks is no exception to it. Neobanks could not gain adequate trust to keep the customers around despite the rise in people transactions through mobile apps. Users relied on mobile banking apps more than Neobanks, causing a drop in the latters’ users.

5. Gaining Users’ Trust

For a Neobank application to start and grow, users must trust its operations. Because it deals with finances, people will ensure its worthiness. This poses a challenge for Neobanque apps looking for a breakthrough. They must have the ability to convince people to switch from traditional banks or better link them. Security issues linger in users’ minds.

6. Security Challenges

The financial services industry requires utmost protection and security from fraud, theft, misplacement, etc. Especially when it is online, it is vulnerable to cyber-attacks. Integrating with payment gateways, analytics, social networks, etc., can compromise the products’ safety. Therefore, Neobanks must create a sense of security and privacy in users’ minds.

7. Less Transferable Business Models

Establishing and growing a Neobank application across geographical regions can pose adaptation and cultural challenges. What fits good in one area may not work in another. It can affect the growth and functioning of Neobanks in different areas. Although scalability is an inherent feature in Neobank apps, it is challenging in other areas.

8. Better Digital Experience

The Neobank market is crowded with many applications. Therefore, offering a digital experience better than others has become highly challenging. An easy-to-use and navigate interface with attractive elements, layout, loading speed is tricky to develop.

9. Lack of Initial Resources

Developing a Neobank app requires adequate economic, technological, and human resources. It is challenging to gather all the resources and ensure profitability soon in the crowded market. Many Neobanks tie up with traditional banks for some services.

10. Limited Services

Despite the convenience and comfortability of a Neobank app, it cannot offer many services. It can cause a lack of interest among users and discourage them.

Know How To Build An App for a Neobank In 7 Steps

For the neobanking startups, the development process is a matter of concern. These steps will help the entrepreneurs and will guide them towards the more profitable mobile application development process.

Step 1: Define Your Target Audience and Value Proposition

Before beginning app development, there must be adequate research to find the target audience and value proposition. Neobanks challenge traditional banks and capture their market. Therefore, they must have a clear view of the niche to target and add value.

The market research also includes competitor analysis to view their standpoints. You must understand what they offer, their efficiency, profitability, shortcomings, and issues.

It helps you in:

- Decision-making

- Planning

- Strategizing

For example, Chime and Varo focus on high-yield savings to customers, whereas Dave helps in credit building. Acorns and Aspiration are investor-friendly apps, while Revolut is traveler-friendly. Thus, all these applications concentrate on a specific user purpose.

Similarly, apps must define the target audience- the young or older generation. The concept of Neobanks is more relevant to the tech-savvy younger generation as opposed to the older audience. The latter may face challenges and need a bit of a learning curve. Therefore, it becomes the app developers’ responsibility to provide a seamless and hassle-free experience to their potential customers.

Analyzing the market thoroughly provides developers’ insights into the most profitable, potential-holding, and untapped market. For example, a Neobank application for homemakers can let them handle accounts and track expenses on groceries, personal care, shopping, etc. It can encourage their savings by rounding off the amounts to the nearest dollar and putting it in a virtual pot.

A Neobank app dedicated to investors, travelers, or other untapped roles can lead to highly favorable results if captured perfectly. Competition can indicate what customers want, how to build an app for a Neobank to achieve success, etc.

A thorough understanding of the target audience can help businesses know their pain points. Developers can add those features to attract the right customers. It will help gain their trust and loyalty. Also, you stand apart from your rivals by filling in the gaps through your knowledge.

Step 2: Create a Fundamental Basis for a Neobank

Once you know the target audience and competition well, you must jump to the features you want in your application. These features must address the issues faced by the target audience. These features form the basis for the application.

A Neobank app strategy is agile, customer-centric, and innovative. Leveraging technology in the most helpful ways will generate convenience and comfortability for the user. Adding unique features will bring customers back and attract more.

A Neobank app must have some features, while others add more stars to its performance. These include:

Must-Have Features

- A structure with low-cost

- Seamless cash flow across regions

- The efficient account creation process

- User-friendly interface

- Real-time solutions

- High yield savings and effective money management

- Issuing physical or virtual personalized cards

Additional Features

- Zero joining, annual, documentation fees

- No hidden charges

- No-cost EMI

- Personalized banking services

- Investment in education or loans

- Budgeting

- Customized rewards to benefit unique user needs

Neobank applications must work on their monetization strategy. It must decide its core and additional revenue sources. Interchange and interest models are some of the most famous monetization strategies. However, it may vary depending upon the audience and features.

You must also decide the places to launch the application. Outlining these details in advance can help developers comply with the legalities of different jurisdictions. Gathering all the information before the development will eliminate future hassles.

You must also choose the platforms to launch your application. These include Android and iOS. The app can also be native or hybrid. You can hire your tech staff and developer team based on this information.

This information influences the planning, strategizing, and implementation. It enables them to stay prepared for every phase.

Step 3: Build Strong Cornerstones – Backend Infrastructure and Frontend Development

Having a robust infrastructure core is a must for Neobanking applications. The frontend and backend development must be powerful enough to enable swift transactions and movements. There should be no lags and app crashes for a seamless user experience.

A well-built Neobanking app includes the following:

- Application Programming Interface (API) connects Neobanks with other payment gateways and authentication segments.

- Card Processing Apps enable seamless transactions through cards.

- Back-office tools manage the overall Neobank operations.

Businesses can develop backend infrastructure in the following ways:

- Creating from scratch involves massive investments of time, money, and effort. You also need a banking license. You will develop the infrastructure, design, implementation, tech stack, etc., by yourself.

- Partnering with banks minimizes time and effort. However, it entails dependence on the traditional bank. Also, you do not need to spend on customer acquisition as you can leverage the banks’ customers initially.

- Partnering with Banking as a service provider or API provider will help you develop the core and backend infrastructure with lower time and effort investment. It enhances the go-to-market speed.

Using third-party solutions is the perfect way to accelerate the development process. However, you must be careful while selecting the vendors. You must check every open-source library for vulnerabilities and malware before applying.

Apart from the back-end infrastructure, the front-end should be attractive and expedited. The design should empathize with user requirements and must conform to app orientation. The animations must look smooth. The color schemes must engross the user, encouraging them to interact and stay longer on the application.

Humanizing transactions and personalizing experiences will ensure the apps’ success. The easy-to-use and understand user interface (UI) must be visually appealing and have a clear call to action. Aesthetics, speed, convenience, security, and seamlessness must be present for an improved customer experience.

Step 4: Maintain Neobank Security and Compliance

A Neobank app can work better and gain users’ trust only when it employs adequate security measures and follows regulations. Because customers’ personal and financial data is at stake, regulatory compliance and security infrastructure play a significant role in Neobanks.

Various regulations, including the following, are pretty cumbersome yet vital tasks.

- PCI DSS Compliance (Payment Card Industry Data Security Standard)

- Tokenization

- Payment Tokens Generation

- Issuance

- Token Vault Operation

- Maintenance

You must establish a Security Office Center to take care of all your infrastructure’s compliance and security regulations. It will work as the command center for the app. You can also apply software solutions like Security Information and Event Management (SIEM) to secure and analyze every activity.

If you want to offer more security, you can put in efforts to create your own security tools and solutions. Protecting customer data requires you to take a proactive approach to keep access to all the logs and platform activities for future reference.

You can prevent the breakdown of every operation due to a security breach by dividing every module. It means you employ solutions that focus on a specific service. If anything happens to it, the entire system will not crash.

Bots are perfect for detecting anomalies, running 24*7, and continuing with the routine without mental breakdown, low morale, and committing errors. They can work quickly and efficiently.

Passive defense strategies include setting up security groups, controlling servers to access limited data, ports, etc. It also involves volumetric control to limit the amount of access and identify issues at the protocol level. Machine learning can also assist in detecting patterns and unusual behavior.

The Neobank security measures must not intimidate customers but seamlessly work at the back end. Even at the front end, it should be in a user-friendly form.

Step 5: Testing

Before launching the application on different platforms, you must undertake thorough testing and debugging activities. You must identify and remove the issues that may cause hindrance to the app’s performance and functionality. Cover every aspect of the application the user will be affected by and run a series of following automated tests:

- Unit Testing

- Integration Testing

- Security Testing

- User Acceptance Testing

- Regression Testing

The tests should not occur prior to launch only. It must run continuously even after the app goes live. A custom infrastructure can help automate tests. It lowers the security and other operational issues.

Step 6: Deployment

Even after launching the app, developers’ cannot just sit back and relax. They need to ensure that the customers find the onboarding process simple, smooth, and effortless. The application must undergo changes constantly to develop into the best version for users.

Continuous updates and deploying new versions require tools like DevOps. It makes scalability and efficiency easier to employ. It kills the previous instances once the latest updates begin to attract heavy traffic.

Step 7: Marketing

The marketing efforts must be robust and lead to high customer attraction and retention. Keeping the customers engaged throughout the journey can make them return for more.

The profitability depends on customer lifetime value/ Customer acquisition cost ratio. Higher the ratio, the more the income generated per customer. Therefore, keeping customers happy is a must.

Build Your Own Neobanking Apps With Idea Usher

With adequate knowledge on building a Neobank app, entrepreneurs can now proceed to set up a successful business. Neobanking applications address the pain points of traditional banking solutions and aim at improving them.

However, building a Neobank application is not a walk in the park. It requires adequate resources and a professional team to resolve any issues. Idea Usher is amongst the best app development companies. It employs a highly proficient and qualified team with vast experience and expertise.

Idea Usher offers a great Neobank app development experience at affordable costs. Schedule a call with the experts and understand the unique functionalities better. Accomplishing your strategies and goals will become flexible.

It’s a Wrap

Neobanking is the future of the banking and finance industry. Although not wholly replaceable, it gives tough competition to the traditional banking industry. Neobanks offer the young generation the most convenient and flexible banking solutions. They address the painful point of unnecessary expenditure and encourage savings and investment.

Neobanks do not market deposits and lending solutions unnecessarily. Instead, they promote customer-centric solutions and designs to attract and retain users. Thus, Neobank applications offer vast profitability and growth potential. Businesses must explore and tap the market before it becomes crowded and uniqueness becomes common. In order to create a Neobank application that stands out of the crowd, feel free to contact Idea Usher for app development.

E-mail: [email protected]

Phone Numbers : (+91)9463407140, (+91)8591407140, and (+1)7329624560

FAQ

1. How Do Neobanks Make Money?

A popular revenue model for Neobanks is interchange. The merchant pays Neobanks a percentage of the amount spent by customers via debit card. They can also charge money for services like premium accounts, overdraft fees, providing a marketplace, etc.

Also Read: What is the cost of developing a banking app?

2. How Long Does it Take to Build a Neobank App From Scratch?

A Neobank application can take anywhere between 45-90 days, including development, deployment, and testing. It may vary depending upon your needs and features.

3. How Do Neobanks Acquire Customers?

Semi-automated onboarding processes like ‘Know Your Customer’ and low-cost channels like referrals, social media, and engagement programs help attract potential customers.

4. Are Neobanks Profitable?

Yes, Neobanks can offer high gains. However, it is necessary to understand the difference between growth and tangible results. You might be good at customer acquisition, but if your portfolio lacks, you won’t generate profitable returns.

5. What is Neobank’s Business Model?

Neobanks have the following three business model options:

- Obtaining a business license like traditional banks

- Cooperate with traditional banks

- A mixed model where a license is issued for specific financial services and rest through tie-ups with traditional banks

Sakshi Gautam