- What Is A Financial Super App?

- Top Features Of The Finance Super App

- How To Build A Super Finance App?

- How Is the Finance Super App Beneficial?

- Do Financial Super Apps, Affect Banks?

- Are Finance Super Apps Rising?

- What Does The Future Hold For Financial Super Apps?

- Challenges Of Finance Super Applications

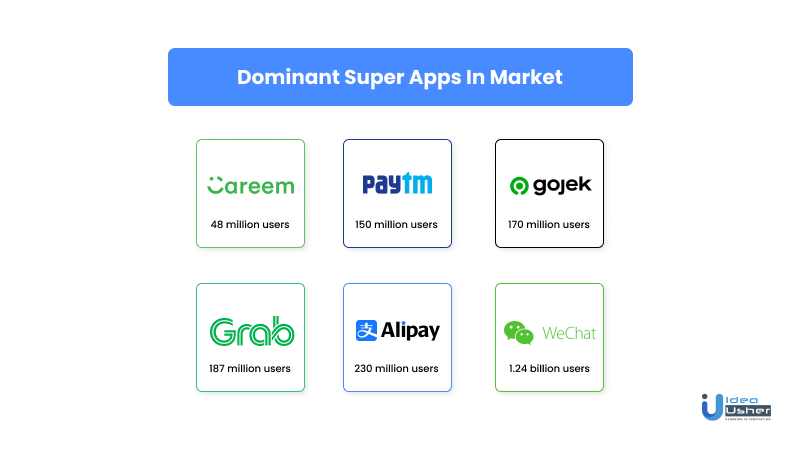

- Market Trends For Super Apps

- Case Study

- Conclusion

- FAQ

In the past few years, financial apps that offer single-use services have been rapidly increasing. Now, there is a new type of application from Southeast Asia that has entered the Western market, and it’s gaining momentum while also capturing market share. Super app in finance have the potential to cause significant disruption to the digital financial services industry. However, this raises the question: should lenders be concerned? Are super apps a threat or an opportunity for digital lending businesses and the overall financial industry? Let’s find out.

- What Is A Financial Super App?

- Top Features Of The Finance Super App

- How To Build A Super Finance App?

- How Is the Finance Super App Beneficial?

- Do Financial Super Apps, Affect Banks?

- Are Finance Super Apps Rising?

- What Does The Future Hold For Financial Super Apps?

- Challenges Of Finance Super Applications

- Market Trends For Super Apps

- Case Study

- Conclusion

- FAQ

What Is A Financial Super App?

A financial super application is a collection of customized tools and services tailored to meet the user’s individual needs, presented in a user-friendly and seamless manner. The core element of this application is a smooth and uninterrupted user experience, enabling easy and efficient access to all available features. These features include a joint wallet, reminders for bills, automated bill payments, subscription management, investment opportunities, savings accounts, and budgeting utilities.

What Is A Super App?

Super apps refer to mobile applications that offer a wide range of digital services integrated into a single, all-encompassing ecosystem. These apps create a unified platform that enables users to access various services like social media, e-commerce, banking, entertainment, and travel, among others. Generally, super apps incorporate third-party marketplaces within the ecosystem, and they utilize big data to engage users while providing diverse experiences and services. Originating from Asia, super apps have now become popular worldwide, providing a seamless and convenient user experience by consolidating multiple services into one application.

Super-apps are integrated with other apps, giving a seamless experience across the device. They’re contextual – aware of things like your location and status. SuperApps are apps that once you start using them, you wonder how you ever previously lived without them.

– Mobile World Congress 2010, Blackberry CEO Mike Lazaridis.

Top Features Of The Finance Super App

- Digital banking with a debit card – offering standard banking services.

- High-yield savings account – with interest rates keeping up with the Fed Funds Rate.

- Peer-to-peer payments – enabling integration with multiple P2P payment networks.

- Savings goal setting – providing separate buckets to allocate cash.

- Buy Now Pay Later – integrated BNPL functionality.

- Shopping – integration with popular stores, possibly including BNPL.

- Loyalty program management – centralizing all loyalty programs in one place.

- Instant transfers to external bank accounts – making this a standard feature.

- Consumer loans – using data to offer instant loan approvals.

- Credit cards – providing rewards and no-fee options.

- Overdraft protection – no overdraft fees, with access to up to maybe $100 instantly.

- Stock trading – a necessary feature for a finance app.

- Cryptocurrency trading – enabling buying and selling of major crypto tokens.

- Debt management – assisting with debt management for optimal interest savings.

- Earned Wage Access – accessing part of your paycheck early for emergency expenses.

- Credit building and monitoring – providing guidance for building a credit score.

- On-ramp to DeFi – this may be required for future finance super apps.

- Investment account connection – enabling the app to view all/most investment accounts.

- Open banking connections – viewing where bank account information has been shared.

- Financial dashboard – offering KPIs to provide a complete financial overview and trends.

- Budgeting tools: helping you create and track your budget, showing you your spending patterns and providing insights into where you can save.

- Insurance products: offering various insurance products, such as health, life, and auto insurance, that can be purchased directly through the app.

- Personal finance education: providing educational resources to help you learn more about personal finance, investing, and budgeting.

- Rewards programs: rewards programs that provide cashback, discounts, or other incentives for using the app’s services.

- Bill management: these tools can allow you to track and pay bills from within the app.

- Tax preparation: these features can offer tax preparation services, including tax filing and tax advice.

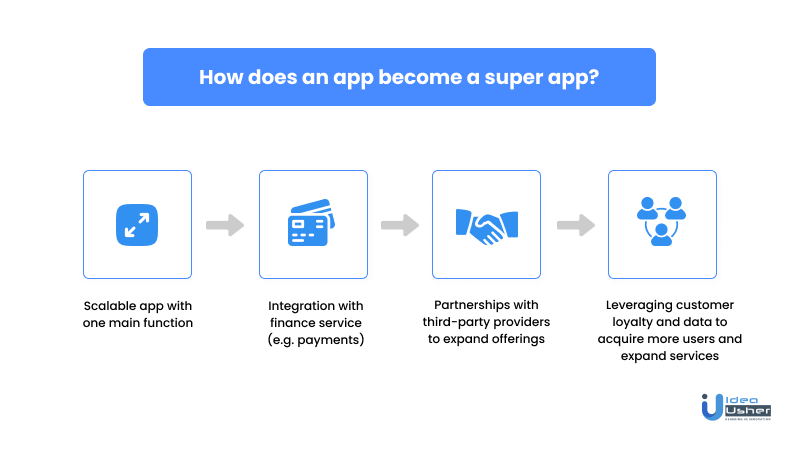

How To Build A Super Finance App?

Here is a step-by-step guide to the super app development process:

1. Conduct Market Research And Plan Business Strategies:

Before you start developing a super app, conduct thorough market research to identify user needs and business opportunities. Plan your business strategies and make sure that your super app development is inclusive and can cater to a diverse range of users.

2. Create And Grow With Partners:

Consider partnering with third-party online service providers to enhance the functionality and growth of your super app. Collaborate with other market aspirants and allow your partners to grow with your business to create a long-term profitable business relationship.

3. Define Features And Functionalities:

Determine the core features and functionalities that will make your super app thrive in the marketplace. Start with integrating functions with wider use cases and higher open rates, and offer prime services to make your super app development decent.

According to Accenture research, the essential super app feature groups include:

| Payments and financial services | Retail services | Other functions |

| Mobile payments | Event ticket bookings (e.g., movies, theater, sporting events) | Cloud storage |

| Cashless payments | Restaurant and grocery ordering | Job search |

| Insurance | Transportation ticketing (e.g., bus, train, flight) | News and media content |

| QR code payments and rewards | E-pharmacies | Entertainment (e.g., music, videos) |

| Credit and loans | Hotel bookings | Real estate and rentals |

| Investment platforms | Other e-commerce | Calling and messaging |

4. Design User Interface And User Experience:

Prioritize easy navigation and conduct market and user behavioral research to know what kind of UI helps the best to attract and retain more app users. Consider color scheme, typography, placement of important app services for easy navigation, eye-soothing effects and transitions, and more.

5. Select The Right Technology Stack For Development:

Choose the best technology stack to meet your native and cross-platform development requirements, considering code space consumption, code loading time complexity, development complexity, resource availability, and budget.

| Front-end | ReactJS, VueJS, HTML, CSS |

| Back-end | Node.js, Python, Goland, Laravel |

| Mobile Platform | Swift, Kotlin, Java for Native, Flutter, React Native |

| Database | MySQL, PostgreSQL, MongoDB, Redis |

| Cloud Services | AWS, Google Cloud, Microsoft Azure |

| Server | NGINX, Apache |

| Payments | Paypal, Braintree, Stripe, EWallets |

| Push Notifications | Push, Twilio, Firebase Cloud Messaging |

| Find Location | Google Places API, Google Maps, CoreLocation Framework |

| Analytics | BigData, Hadoop, Spark, Apache Flink |

6. Perform App Quality Assurance:

Test the build in all situations and make it bug-free and crash-free for the initial release. Conduct functional, usability, compatibility, performance and load, security, installation, localization, and manual testing.

7. Deploy The Finance Super App:

Refactor the code and ensure the resiliency of your super app architecture before deploying it in the public app registries or hosting platforms like Google Play Store and Apple App Store.

8. Release Updates Frequently:

Keep your users happy by releasing new features, bug fixes, and security patches, and more frequently to ensure resilient super app performance and a higher user base retention ratio.

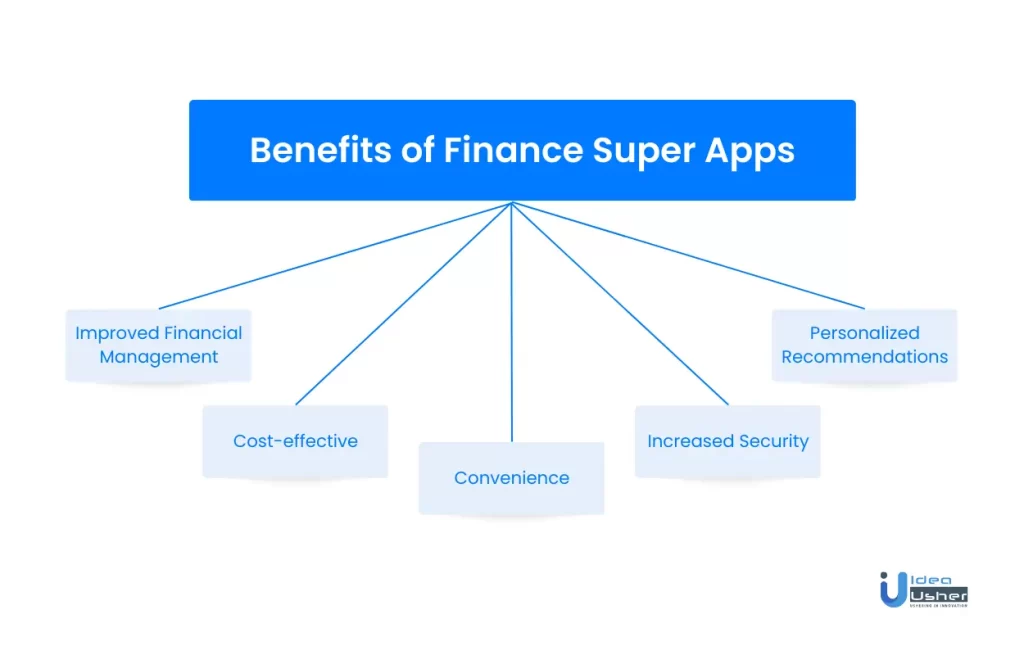

How Is the Finance Super App Beneficial?

The emergence of the super app has transformed the financial services industry, providing consumers with unprecedented access to financial management tools and services. By placing power back in the hands of the consumer, the super app has revolutionized the traditional banking process, making it more flexible and responsive to user needs.

Contrary to popular belief, open banking is also now an essential ally that can benefit both banks and businesses. In this section, we will explore why finance super apps are beneficial for both consumers and financial institutions.

1. Benefits For Consumers

- The convenience offered by finance super apps is the main advantage for consumers.

- Users can access multiple services within a single app instead of downloading and using multiple finance apps.

- This simplifies the customer experience, saving time and effort for the user.

- The finance super app empowers consumers to make smarter financial decisions. It eliminates the need for intermediaries such as bankers, brokers, and accountants.

- With these apps, users have a comprehensive view of their entire finance world, allowing them to make more informed decisions.

- The app also offers real-time insights into spending patterns, helping users to identify areas where they can cut costs and save money.

- The app also offers personalized recommendations, notifications, and reminders based on the user’s behavior, helping them to stay on top of their finances.

Super apps for finance are beneficial not only to consumers but also to financial institutions, who can benefit from the data insights and customer engagement opportunities provided by the app.

2. Benefits For Banks And Businesses

- Finance super apps offer a captive audience for businesses, as users rely on the app for multiple services. This provides more opportunities for companies to market their products and services, as well as collect valuable user data.

- Banks can benefit from the automation of traditional banking functions provided by financial super apps, allowing them to focus on building meaningful relationships with their users.

- By alleviating the burden of transaction processing and data compilation using super apps, financial institutions create a more personalized and empathetic approach to customer service.

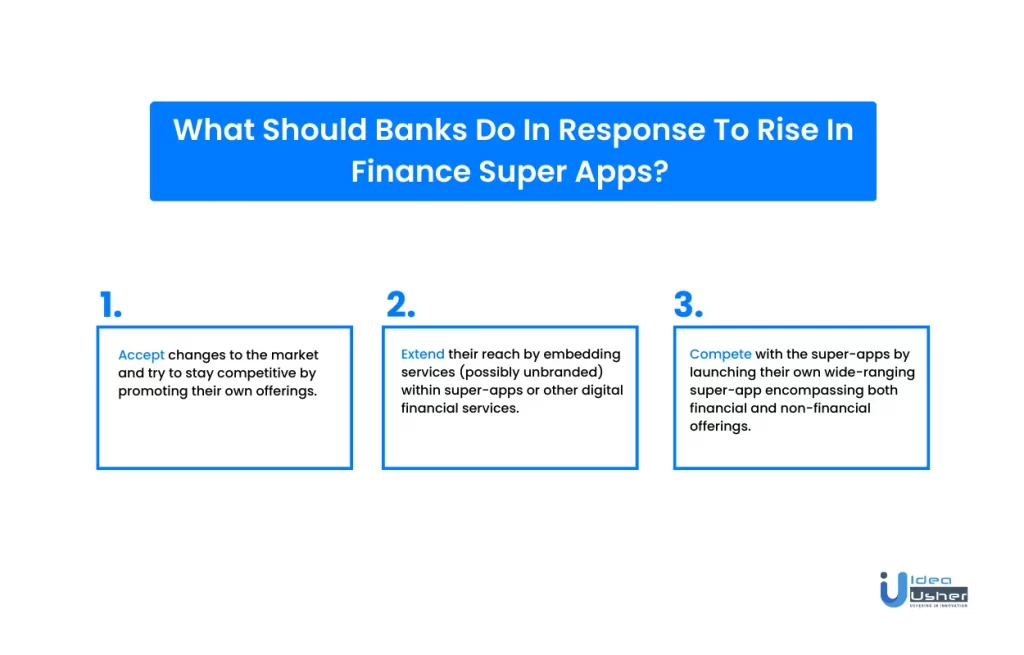

Do Financial Super Apps, Affect Banks?

Super-apps are changing the landscape of financial services, offering a more seamless and engaging experience for customers. Here are some ways by which super apps are affecting traditional banks:

- Super-apps provide customers with a more seamless financial experience, potentially bypassing the need for stand-alone banking apps.

- Digital wallets within super-apps reduce users’ dependence on cash and credit cards, further increasing engagement with the app rather than traditional banks.

- Banks are becoming part of the super-app ecosystem by offering unbranded “banking-as-a-service” to the apps.

- Regulatory complexity makes it challenging for super-apps to navigate financial services across multiple markets, leading to strategic partnerships with banks and fintech.

- Super-apps may become a bigger source of competition for banks than neobanks or fintech by keeping users engaged on their platform.

Are Finance Super Apps Rising?

- A key factor in the success of super apps is the existence of a market that primarily uses smartphones to connect to the internet.

- Finance super apps offer a convenient one-stop shop for users to perform multiple tasks online, eliminating the need for juggling between different apps.

- They merge diverse services and experiences into a familiar platform, providing uninterrupted user experiences that ensure user engagement.

- Incorporating financial and payment services is the second most appealing feature of super apps.

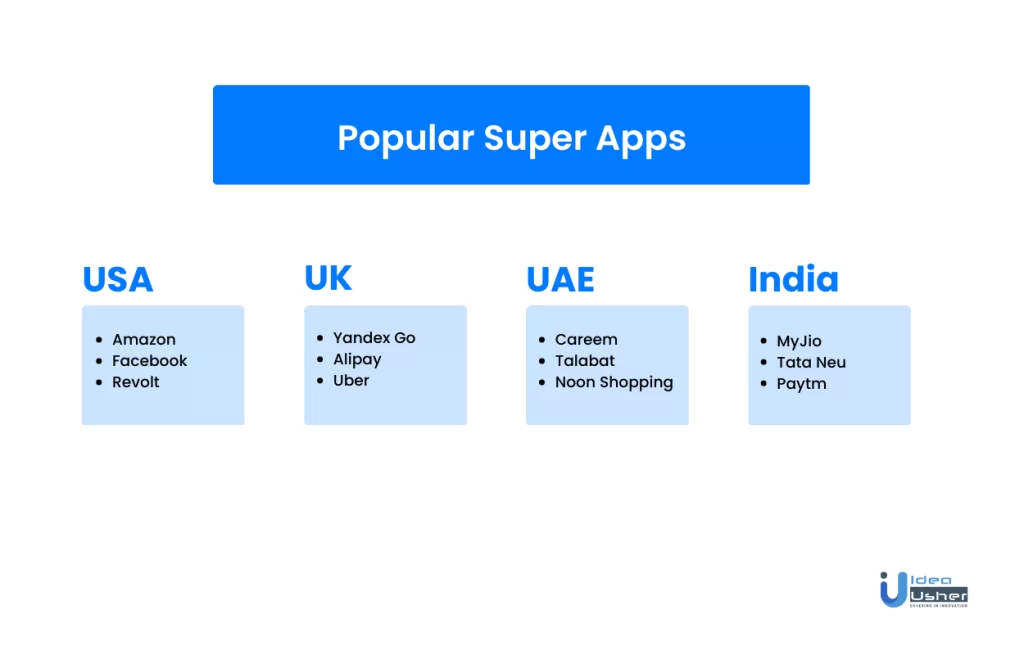

- Recent examples of super apps that have centered their services around financial or banking services include Paytm in India, Grab in Singapore, Goto in Indonesia, and Zalo in Vietnam.

- Jumia, a digital e-commerce platform in Nigeria with over 6.8 million active customers, launched its digital payment service JumiaPay in 2021.

Why Are Financial Super Apps Gaining Momentum?

Finance super-apps utilize open banking technology that helps these apps to extract data from multiple sources. This enables the creation of user-centric products and services that are designed with the end user in mind.

By utilizing open banking technology, these apps can provide a seamless and personalized experience while also complying with regulatory requirements and maintaining data privacy and security. Open Banking technology provides several benefits to super-apps:

- It allows for personalization by gathering user data from their bank accounts, identifying trends, habits and tendencies, and making recommendations based on their behavior.

- Centralisation is made possible as the technology brings all financial management features and tools under one roof, reducing the need to switch between multiple platforms and apps.

- This technology facilitates Open Finance by enabling seamless communication between different financial areas, such as savings, mortgages, pensions, insurance, and credit, resulting in a uniform financial profile.

- Through advanced technology like AI and machine learning, open banking data can fuel data-driven decision-making and customer-relevant product development in super apps.

These super apps can utilize the expansion of open banking into open finance and open data to connect with more partners, launch new products quickly, and expand their customer base.

What Does The Future Hold For Financial Super Apps?

The future for super financial apps is bright as they continue to grow in popularity and functionality. As more people turn to digital banking and payments, super apps will become even more essential for managing finances on the go. Here are some potential developments we can expect to see in the future:

- Greater specialization: As the market becomes more crowded, super apps must differentiate themselves by catering to specific customer needs, such as insurance or investment.

- Increased regulation: As super apps continue to grow, they will likely come under greater scrutiny from regulators, who want to ensure they comply with data privacy and other regulations.

- Integration with other services: Super apps may expand beyond traditional banking and payment services to include additional features such as ride-sharing, food delivery, and more.

- Advanced AI and machine learning: Super apps will likely integrate more AI and machine learning technologies to personalize the user experience and provide more sophisticated financial advice.

- Global expansion: As super apps expand their services and partnerships globally, they will face new challenges and opportunities in navigating diverse regulatory and cultural landscapes.

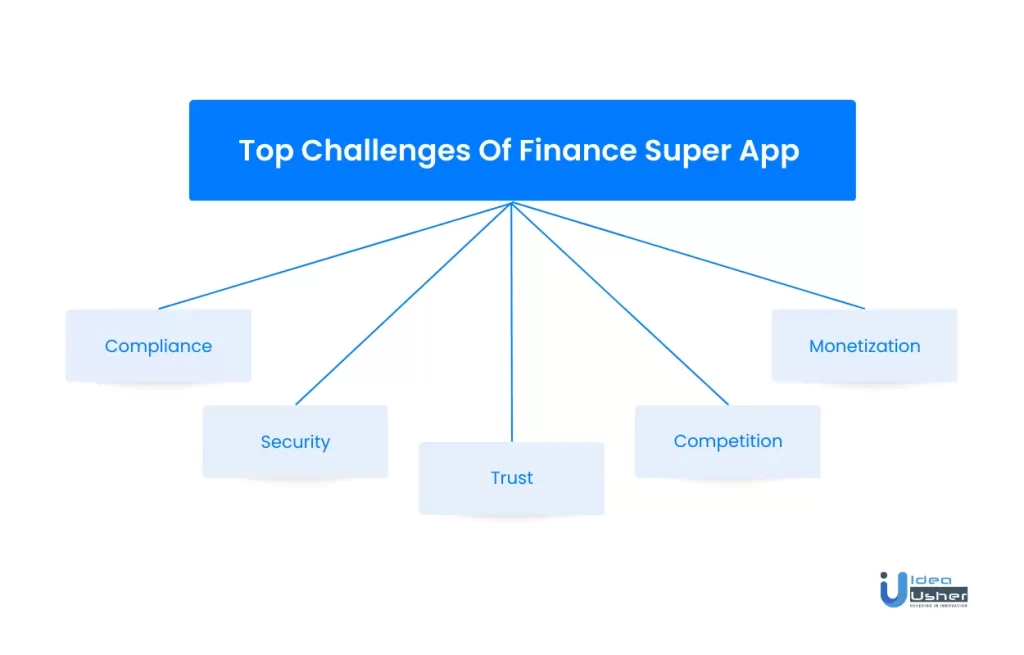

Challenges Of Finance Super Applications

Finance super applications have enormous potential to offer convenience and value to users. However, they are facing significant structural obstacles, such as strict financial services regulations, legacy systems of traditional financial institutions and antitrust laws that limit their operation in many countries.

Finance super apps handle sensitive financial information, making them attractive targets for cybercriminals. Ensuring the security of the application and the protection of user data requires significant investments in technology and cybersecurity measures.

Finance super apps typically offer many services for free or at a low cost, which can make it challenging to generate revenue. Finding a sustainable business model that can support ongoing investments in technology and development can be challenging.

The primary concern with these banking apps is that they may result in monopolies and a concentration of economic activity in the hands of a few players, which has proven detrimental to the financial services industry in the past.

As a consequence, established players must find ways to adapt, which many of them are currently exploring. One such solution is Banking-as-a-Service, in which traditional banks continue to manage the back-end banking operations while new-age apps handle the front-end interface through APIs.

Market Trends For Super Apps

1. Consumers worldwide who would trust selected providers as publishers of a super app as of January 2022, by country:

Consumers in US, Germany, and Australia trust their banks as the most reliable super app publishers, while UK users trust PayPal the most. Government is not a trusted provider, and 11-14% entrust Big Tech.

2. Estimated number of the super app early adopters and consumer spending in selected markets as of January 2022:

Early adopters of super apps are estimated to reach 98 million people with an annual spending of $3.25 trillion. The study was conducted in Australia, Germany, UK, and the US in January 2022.

3. Factors influencing the trust of consumers worldwide in super app publishers as of January 2022:

Consumers trust a super app publisher mainly based on their overall reputation (25%) and data security and fraud prevention (50%). The survey was conducted in January 2022 in Australia, Germany, UK, and the US.

4. Concerns of consumers worldwide in using a super app as of January 2022:

50% of consumers surveyed in January 2022 would be concerned about data security while using a super app. Access problems and providing too much personal data concern 40% and 38% of respondents, respectively.

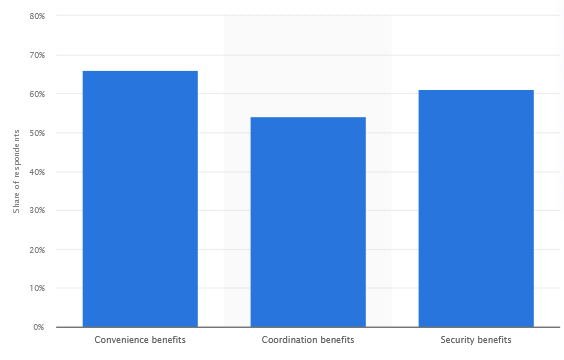

5. Most valued aspects of super apps for global consumers January 2022:

Convenience benefits (66%), security benefits (61%), and coordination benefits (54%) are the most valued aspects of super apps. The survey was conducted in Australia, Germany, UK, and the US in January 2022.

6. Most desirable super apps features for consumers worldwide as of January 2022, by lifestyle persona profile:

70% of convenience-seekers desire to find and apply discount rewards in super apps, while 50% of financial wellness-seekers value the same. 6 in 10 convenience-seekers desire to suggest different merchants and set automatic nudges.

7. Share of consumers in selected global markets who would be interested in using a super app as of January 2022 by country:

55% of UK and 50% of German consumers expressed interest in using super apps, while around 30% of US consumers showed either great interest or no interest. Australian respondents showed the least interest.

8. Share of consumers worldwide who value super apps benefits as of January 2022:

Minimizing the risk of losing sensitive information and coordinating different areas of one’s life in one place are the main benefits of super apps. The survey was conducted in Australia, Germany, UK, and the US in January 2022.

9. Most desirable super app features for consumers worldwide as of January 2022:

Ability to find and apply discounts and rewards, control which areas of life are integrated, and suggest payment method choices are the most desirable features in super apps. The study was conducted in January 2022 in Australia, Germany, UK, and the US.

10. Consumers in the US interested in integrating multiple digital experiences in one comprehensive super app as of November 2021 by type:

Approximately 67% of US consumers showed interest in consolidating various digital experiences into one comprehensive super app. Among them, 20.38% were labeled as “information seekers,” who sought an app that unifies online shopping, travel, entertainment, and banking services. In addition, 18% of respondents were dubbed “financial wellness seekers,” showing interest in apps that integrate banking and payment services.

Source: Statista

Case Study

Former Gemini CTO launches Fierce, a high-yield finance super app.

Fierce is a new finance app that aims to provide a range of financial services all in one place.

- Founder and CEO Robert Cornish says that the company’s goal is to bring together “the best of fintech for the customer” by providing access to features like an FDIC-insured checking account, stock trading with fractional shares and ETFs, and a Fully Paid Securities Lending program that allows users to earn income by lending their stocks.

- Fierce is available on iOS, with an Android version launching later this year, and has no monthly fees or restrictions.

- The company raised $10 million in seed funding and plans to expand its team, acquire new customers, and work on product development.

- Cornish also plans to offer insurance, personal loans, and mortgages in the future, as well as regulated crypto trading.

Conclusion

When considering the development of a finance super app, you may have concerns about its future relevance and popularity. However, with the growing number of mobile users and the increasing demand for all-in-one solutions, super apps will continue to be in high demand.

At Idea Usher, we have successfully helped our clients create their ideal app integrated with advanced technologies that offer a wide range of on-demand services and entertainment options. Our expertise in mobile app development is also showcased in our portfolio, which boasts an impressive user interface and functionalities.

If you have ideas for your industry-leading super app, contact our IT experts at Idea Usher for a demonstration and comprehensive consultation on your project.

Contact Idea Usher at [email protected]

Or reach out at: (+1)732 962 4560, (+91)859 140 7140

FAQ

Q. What are the differences between Super Apps and Stand-Alone Apps?

A. The distinction between super apps and stand-alone apps is quite evident. Stand-alone apps are created to perform specific functions and are typically limited to designated platforms, such as VoIP apps (Zoom), entertainment apps, banking and finance apps, and others. In contrast, a super app is a digital ecosystem that combines multiple micro-programs and services. Paytm, MyJio, Gojek, and Tata Neu are some of the most popular examples of super apps.

Q. Can Super Apps generate profits?

A. Super apps are both space and time-efficient, making it convenient for users to access all the essential apps and services at their fingertips. Thus, having a super app that houses all the necessary features and functionalities can undoubtedly increase your user base and lead to a considerable return on investment.

Q. How Super Apps can be a successful app?

A. The success factors of a super app include a superior mobile experience (providing necessary online services under one roof), a homogeneous marketplace, unbanked populations, and several others.

Q. How long does it take to develop a Super App?

A. The development time for a super app may vary depending on its type. The development of an organization/employee-facing super app may depend mainly on the functionalities and security. Meanwhile, for a customer-facing super app, the user interface and experience are the primary considerations that can affect its development time.

Rebecca Lal