- Types Of DeFi Yield Farming

- The Working Of A Yield Farming Platform

- Must-Have Features For The DeFi Yield Farming Platform

- Top 5 Defi Yield Farming Platforms

- Cost Effecting Factors For Developing A Defi Yield Farming Platform

- Steps To Develop Defi Yield Farming Platform

- Tech Stack For Defi Yield Farming Platform Development

- Conclusion

- FAQ

The blockchain is closing the gap with the traditional financial ecosystem with its various use cases, including cryptocurrencies, NFTs, smart contracts, etc.

Defi yield farming is also one of the emerging practices where users can generate passive income by giving money to borrowers on a DeFi yield farming app in return for interest.

Moreover, defi yield farming applications benefit platform owners in various ways, such as through transaction fees, deposit and withdrawal fees, insurance and risk mitigation services, etc.

The following figures have encouraged many entrepreneurs towards DeFi yield farming development.

In this article, we will explore how to start Defi field farming development with the required development steps, must-have features, and tech stack.

- Types Of DeFi Yield Farming

- The Working Of A Yield Farming Platform

- Must-Have Features For The DeFi Yield Farming Platform

- Top 5 Defi Yield Farming Platforms

- Cost Effecting Factors For Developing A Defi Yield Farming Platform

- Steps To Develop Defi Yield Farming Platform

- Tech Stack For Defi Yield Farming Platform Development

- Conclusion

- FAQ

Types Of DeFi Yield Farming

In DeFi, there are many yield farming strategies, each with unique traits and risk profiles. Here are some of the common yield farming techniques:

1. Liquidity Provision (LP) Farming

Users deposit pairs of assets into liquidity pools to provide liquidity to decentralized exchanges (DEXs) like Uniswap or SushiSwap and receive LP tokens in return, representing their pool share.

Users earn trading fees and often additional rewards (e.g., governance tokens) for providing liquidity to exchanges.

2. Staking

Staking is a practice of locking up tokens in a DeFi protocol’s smart contract to support its operations, where users receive rewards in return, such as tokens. Operations supported by staking are network security, consensus mechanisms, and governance.

3. Farming Pools

Users can access various farming pools for token staking and earning rewards. These rewards can be governance rights within the project, tokens, or interest. Moreover, users can participate in multiple farming pools simultaneously to earn rewards from different farming pools.

4. Governance Token Farming

Users can earn governance tokens by participating in a DeFi project’s governance activities. Governance tokens allow holders to vote on protocol proposals, upgrades, and decisions, allowing them to influence the project’s direction.

5. Yield Aggregators

Users can save time managing multiple yield farming strategies by accessing yield aggregators like Harvest Finance and Beefy Finance, as yield aggregators move users’ funds to the highest-yielding opportunities across various DeFi protocols.

The Working Of A Yield Farming Platform

Users can earn LP tokens as rewards by providing liquidity to various defi yield farming platforms like Uniswap, SushiSwap, or PancakeSwap. The general overview of how the yield farming app works is as follows:

1. Connect a Wallet

Users have to connect their cryptocurrency wallet to the platform to interact with the yield farming app. MetaMask, Trust Wallet, or hardware wallets like Ledger are popular for yield farming.

2. Provide Liquidity

Users can participate in yield farming by providing liquidity through depositing their assets into a liquidity pool. Liquidity pools are smart contracts that facilitate trading on DEXs with pairs of tokens (e.g., ETH and a stablecoin like DAI).

3. Receive LP Tokens

Users receive LP (Liquidity Provider) tokens in return for providing liquidity to the pool. Liquidity Provider tokens help users track their contribution to providing liquidity and know their share of the liquidity pool.

4. Monitor and Withdraw

Users can withdraw their LP tokens and rewards after completing lock-up periods or paying withdrawal fees through the app interface of defi yield farming platforms.

Must-Have Features For The DeFi Yield Farming Platform

The defi yield platform consists of many features that enable the platform to allocate liquidity providers across different liquidity pools. The features that must be on the Defi yield farming app are as follows.

1. Wallet integration

Integration with existing wallets is the key part of DeFi yield farming development. The cryptocurrency gets saved in a wallet, right from depositing the token to the platform to getting the returns from the liquidity pools.

2. Liquidity Pools list

The DeFi interface’s list of liquidity pools is where the lenders deposit their tokens. The interface’s current value information is carried through the following section.

Total Value Locked (TVL): The total amount of coins kept in a pool securely.

APY (yearly Percentage Yield): The yearly rate of return imposed on borrowers and then paid to providers.

APR (yearly Percentage Rate): The annual rate of return imposed on capital borrowers and then paid to capital providers.

3. Charts of Liquidity Pools

Charts will enable the liquidity providers and borrowers to track a time-range-based growth of the pools, attached risks, and estimated returns, helping users to make better decisions in terms of investing their tokens.

4. Swap token

Swapping mechanism enables lenders to swap their tokens with other tokens that are supported by a particular platform. The mechanism is a solution to trade tokens and profit from the price change between various tokens.

5. Deposit and Withdraw

The secure deposit and withdrawal functionality is another crucial feature of defi yield farming help. The lender can use this feature to invest their money in a platform and withdraw returns when the invested token price reaches the expected rate of the lender.

6. Insurance

With the rising cases of security breaches and hacks, it is beneficial for DeFi yield applications to offer their users insurance cover, one that can be charged every week on the deposited number of tokens.

Top 5 Defi Yield Farming Platforms

In this section, we will explore the best Defi yield farming platforms in 2023 based on their reward mechanism for allowing users to make passive income on their crypto holdings.

1. Coinbase

Coinbase recently introduced staking rewards for certain cryptocurrencies, making it an attractive platform for beginners exploring yield farming without navigating complex DEXs or decentralized platforms.

For beginners, Coinbase is an attractive platform looking to explore yield farming without needing to access complex DEXs or decentralized platforms. Additionally, Coinbase offers an opportunity to earn passive income by staking on crypto holdings. Users can participate in staking with their contribution to the network validation process and earn rewards in return.

| Founded In | 2012 |

| Founded By | Brian Armstrong and Fred Ehrsam |

| Headquarters | San Francisco, United States |

2. BlockFi

BlockFi is a centralized finance platform, which means it operates as a traditional financial institution rather than being decentralized like many other crypto platforms. It offers competitive Annual Percentage Yields (APYs) for cryptocurrencies, including Bitcoin and other major digital assets.

Moreover as a centralized finance platform, BlockFi operates as a traditional financial institution rather than being decentralized. Also, the platform offers competitive Annual Percentage Yields (APYs) for various cryptocurrencies, including Bitcoin and other major digital assets.

| Founded In | 2017 |

| Founded By | Zac Prince and Flori Marquez |

| Headquarters | New Jersey, United States |

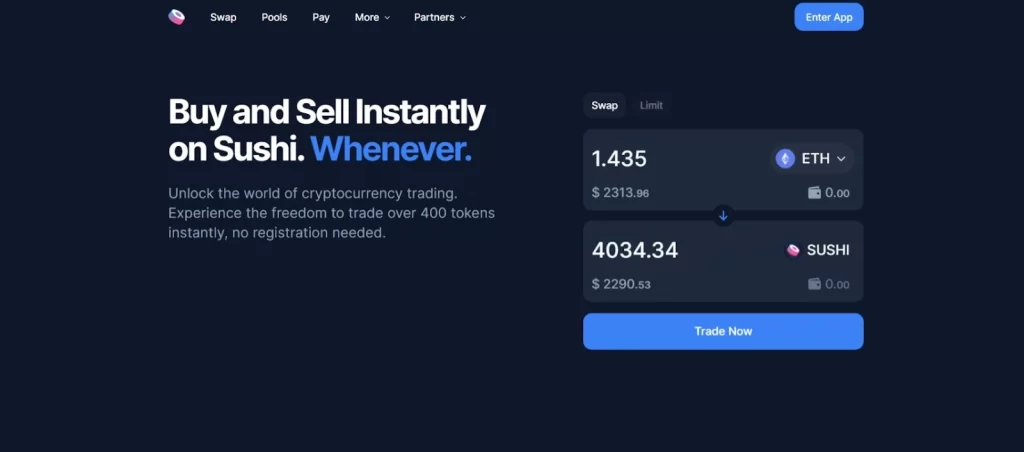

3. SushiSwap

SushiSwap has become a popular choice for yield farming due to its wide range of supported tokens and potential for high returns.

Also, the platform is known for allowing users to earn rewards by providing liquidity to different trading pairs within their pools.

SushiSwap offers additional features, such as yield aggregation and staking of SUSHI tokens, in addition to being known for its simple and user-friendly interface.

| Founded In | 2020 |

| Founded By | Chef Nomi |

| Headquarters | Tokyo, Japan |

4. Crypto.com

Crypto.com offers one of the highest APYs on stablecoins in the market. Its Best DeFi Yield Farming Platforms wallet provides a seamless experience for those looking to get started with yield farming And earn high returns on their stablecoin investments.

Crypto.com offers a wide range of financial services, making it a comprehensive option for users looking to maximize their earnings through yield farming. The platform has a great reputation for its reliability and security.

Also, the users can maximize their earnings through yield farming by earning interest on their stablecoin investments and participating in various yield farming strategies.

| Founded In | 2016 |

| Founded By | Bobby Bao, Rafael Melo, Gary Or, Kris Marszalek |

| Headquarters | Singapore |

5. PancakeSwap

A leading DEX on the Binance Smart Chain network known for its lucrative yield farming opportunities. Users can stake LP tokens and earn PancakeSwap (a native token) as a reward.

PancakeSwap supports a wide range of tokens and has a user-friendly interface. However, PancakeSwap has risks, such as potential centralization and security vulnerabilities due to being developed on the Binance Smart Chain network.

| Founded In | 2020 |

| Founded By | A group of anonymous developers |

| Headquarters | Fukuoka, Japan |

Cost Effecting Factors For Developing A Defi Yield Farming Platform

The cost of developing a decentralized finance yield farming platform can vary depending on several factors, which are discussed in detail throughout the section.

1. Frontend and Backend Development

The front-end part will involve creating a user interface that will enable your users to access the features and functionalities of your Defi yield farming app.

Meanwhile, the back-end development will develop features like data processing, account management, and transaction handling. The complexity and number of features will determine the cost of platform development.

2. Smart Contracts Development

Smart contracts are self-executing agreements that automatically execute after meeting certain conditions. However, developing and auditing smart contracts can be expensive. Therefore, consider using established smart contract templates and libraries to reduce development costs and security risks.

3. Compliance and Legal Costs

Making your defi yield farming platform compliant with financial regulations and legal considerations is crucial to avoid legal issues when launching your platform. However, the cost of complying with your application with relevant laws can vary by jurisdiction.

4. Ongoing Maintenance and Updates

Even after launching your platform, maintaining and updating your deFi yield farming app regularly is crucial to staying competitive in the market and offering your users an enhanced platform experience. Platform maintenance will involve identifying and removing technical bugs and glitches, while platform updates will involve adding new features and functionalities to your app.

5. Technology Stack

The selection of the technologies stack is another factor that can impact the development cost of your defi yield farming platform.

Ethereum is a popular choice for the platform for application development; however, you can consider other blockchain networks, such as Binance smart chain, PolkaDot, and Solana. Etc. Many other factors can impact the cost of developing your platforms, such as hiring a blockchain development company, marketing and community building, etc.

Consulting with an experienced blockchain development company is a great way to estimate the overall development cost of your project.

Steps To Develop Defi Yield Farming Platform

There is an involvement of several key steps and considerations for developing a DeFi yield farming project. The basic overview of the process for developing a DeFi yield farming platform is as follows:

1. Conceptualization and Planning

The first step is to define the objectives and goals of the yield farming project. Also, determine the type of assets or tokens for liquidity users provide and what they will earn in return (e.g., tokens, interest, governance rights).

2. Market Research

Identify potential competitors, analyze their strategies, and assess gaps in the market by successfully conducting market research and understanding the market demand related to your yield farming project.

3. Regulatory Compliance

DeFi projects often face legal and compliance challenges, therefore, consult legal experts to navigate the regulatory environment to avoid any legal challenges by addressing them early in development.

4. Blockchain Platform Selection

The selection of an appropriate blockchain platform will depend on factors such as security, scalability, and development support. Ethereum and Binance Smart Chain are popular blockchain platforms for deFi yield farming.

Consult with a blockchain development company to select a suitable blockchain platform for your project.

5. Smart Contract Development

The development of smart contracts will help you implement functionalities such as liquidity pools, yield, distribution, staking, and others that require automated contracts. Consider using programming languages such as Solidity (for Ethereum) or Vyper for smart contract development.

6. Token & Liquidity Pool Setup

Also allow your users to provide assets in exchange for LP (liquidity provider) tokens by creating liquidity pools on your platform. Moreover, implements various mechanisms for users to deposit and withdraw funds from liquidity pools.

7. Testing

Ensure that the platform functions as intended and is free from critical bugs by rigorously testing your platform, including smart contract testing, integration testing, and user acceptance testing.

8. Launch and Deployment

Deploy your DeFi yield farming platform on the chosen blockchain network to make it available for yield farming to your targeted users.

Encourage user participation through social media, forums, and other channels.

Also, implement marketing strategies to attract users and liquidity providers and announce the launch of your DeFi yield farming platform to the community.

Tech Stack For Defi Yield Farming Platform Development

The selection of the technology stack will depend on your Web 3 banking application’s specific requirements and use cases. Here’s a general tech stack outline for Web 3 banking:

Moreover, based on your platform-specific requirements and use cases, there may be some moderation for selecting an appropriate tech stack. The general tech stack for defi yield farming development is as follows:

1. Blockchain Platform

The choice of a blockchain platform is a critical decision. Consider the following options:

- Ethereum

- Binance Smart Chain

- Hyperledger Fabric

- Polkadot

2. Smart Contract Development

- Ethereum: Solidity

- Solana: Rust

3. Frontend Development

- Interface: HTML, CSS, and JavaScript

- Libraries and frameworks: like React, Angular, or Vue.js

4. Backend Development

- Node.js

- Python

- Go

5. Development Frameworks and Tools

- Truffle

- Hardhat

- Remix

6. Decentralized Identity Solutions

- SelfKey

- Sovrin

- uPort

7. Front-End Development

- React

- Angular

- Vue.js

8. Back-End Development

- Node.js

- Express.js

- Python

9. Database Management

- MongoDB

- MySql

10. API Integration

- APIs for financial market data

- Payment gateways APIs

11. Security Measures

- Encryption

- Multi-factor authentication

- Auditing tools

12. Testing Tools

- Smart contract testing: Truffle

- Front-end testing: Jest

13. Monitoring and Analytics

- Prometheus

- Grafana

14. Compliance Framework

- KYC

- AML procedures

15. Scalability and Performance Optimization

- Sharding

- Layer-2 scaling solutions

Conclusion

DeFi yield farming apps represent an opportunity for users to earn returns on cryptocurrency holdings by providing liquidity to DeFi platforms. Due to the potential for passive income and the promise of high yields, the practice of DeFi yield farming has gained momentum.

The benefits of DeFi Yield Farming are equally high for the users and the platform owners. The platform owners can generate revenue with transaction fees, while the users get a passive income stream. The fast-paced nature and rapidly evolving landscape of the Defi space also attract risks and challenges such as impermanent loss, smart contract vulnerabilities, and market volatility.

However, the platform owner can still benefit and become profitable with the transaction fee regardless of the market volatility. This makes a defi yield farming application development a better option than investing in tokens or yield farming. Defi yield farming development requires expertise across the different domains of blockchain development, such as API & wallet integration, smart contract development, app development, etc.

Therefore, it is essential to work with blockchain experts who have expertise in Defi yield farming application development to help you successfully start your project.

You can contact our team if you are looking for blockchain development experts who can ensure the success of your defi yield farming development project from its ideation to launch on your preferred blockchain network. Contact us today to understand more about how we can help you with the defi yield farming application development.

Here is more information about our blockchain development service.

FAQ

Q. What is DeFi yield farming?

A. Yield farming is the practice of lending or staking digital assets in DeFi platforms to receive incentives, which are frequently token bonuses or interest. This practice enables cryptocurrency owners to earn returns on their holdings by contributing liquidity or participating in different DeFi platforms and protocols.

Q. What are the features of the DeFi staking platform?

A. Wallet integration, Liquidity Pools list, Charts of Liquidity Pools Swap token, Deposit and Withdraw and Insurance are some of the must-have features for the Defi yield farming app.

Q. What is the best platform for yield farming?

A. Coinbase, YieldFlow, PancakeSwap, SushiSwap, and BlockFi are some of the best platforms for yield farming.

Gaurav Patil