- Market Overview For Banking And Finance Applications

- Why There Is A Need For Finance Application?

- Types Of Finance Applications

- Technologies You Can Use For Finance Application Development

- How To Develop A Finance Application?

- What Features To Include In The Finance Application?

- Where Can You Find A Fintech App Developer?

- Wrapup!

- FAQ

Are you struggling with your finance management or failing to keep track of your finances and transactions? Or do you know someone who might be struggling with the same? Do you know you can convert this struggle into a business opportunity?? Yes, with the Finance and Mobile Banking Application. You can build an application to ease the effort of managing finance and transaction-related issues. Let’s look at the benefits and the process of Finance Application Development.

- Market Overview For Banking And Finance Applications

- Why There Is A Need For Finance Application?

- Types Of Finance Applications

- Technologies You Can Use For Finance Application Development

- How To Develop A Finance Application?

- What Features To Include In The Finance Application?

- Where Can You Find A Fintech App Developer?

- Wrapup!

- FAQ

Market Overview For Banking And Finance Applications

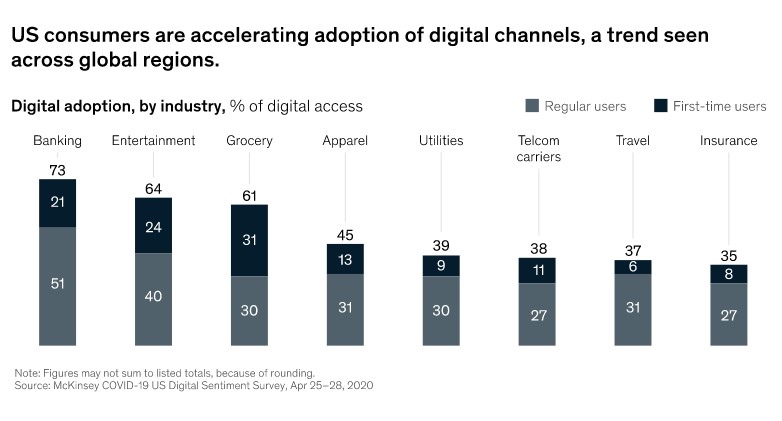

Present and future generations are mobile-dependent and most likely to prefer technology over traditional banking. There are various trends to support this statement and encourage the technological shift. Some of them are listed below:

- The current state of mobile banking innovation is marked by an impressive level of ambition, which bodes well for the industry’s future growth and constant quest for improvement. Forecasts predict that by 2021, there will be 7 billion mobile users, with 3 billion of them using mobile banking.

- Citibank, Wells Fargo, USAA, Ally Bank, and Capital One are among the greatest innovators in the banking business. When it comes to mobile payment apps, 73% of users choose PayPal, while only 6% prefer Samsung Pay.

- According to EY, about half of all customers now apply for financial products online. Statista estimates that by the end of this year, the total value of all mobile payments will be $189.97 billion. The fact that the COVID-19 epidemic has prompted 55% of consumers to shift toward contactless payment methods is hardly shocking.

- Findings from the Mobile Banking Competitive Edge survey conducted by Insider Intelligence revealed that 97% of Millennials and 89% of Gen Zers reported using mobile banking. It’s not only millennials who prefer online banking to visit a branch; 91 percent of Gen Xers and 79 percent of Baby Boomers also see the advantages of this method.

Why There Is A Need For Finance Application?

The growing significance of banking applications in today’s world may be traced, at least partly, to the acceleration of the creation of new financial applications. Gratitude goes to:

- Constant availability

- Simple access to all pertinent information as well as a record of all prior transactions

- Remote monetary deposits

- The most effective strategies for ensuring optimum safety

- Instant payment of bills using a single click.

- Simple monetary exchanges

- Repayment of Debt Through the Use of the Internet

In exchange, financial institutions such as banks and other financial organizations that use mobile banking applications can enjoy several benefits:

- A decrease in total overhead expenses

- Improved quality of service for clients

- Profitability: a positive ROI (ROI)

- Data analytics allow for more customized service delivery (powered with artificial intelligence)

- The full potential of the benefits of push notifications

Banks really need to be ready with mobile applications if they want to remain competitive and ultimately prevail in this race. And as a business, you can develop your financial application to embark on your journey of opportunities.

Types Of Finance Applications

As a business, you can offer various types of financial applications for users and businesses in the banking sector. You can develop applications for the iOS platform from Apple, Android from Google, and Windows from Microsoft. These are the three most popular mobile and desktop operating systems. Along with this, you can include those that are native to specific platforms, cross-platform, and hybrid.

1. Custom Finance Application Development

You can offer customized support in the development of finance applications so your user may meet the specific requirements of their financial organization. The introduction of payment channels and real-time data exchanges into the apps can result in a significant improvement in the user experience that you may provide to your client.

2. Banking Software Solutions

The most recent advancement in financial-software technology is banking software. You can develop or offer core banking systems, loan and credit management systems, and banking customer-relationship management systems. These are the solutions that help users in several ways. Companies operating in the financial industry prefer to take advantage of these services irrespective of their size and location.

3. Digital Wallet Development

In order to provide superior support for customers to make secure payments, you can develop an e-wallet solution. A mobile device has the potential to be converted into a safe digital wallet by utilizing the adaptable application in the appropriate manner.

4. Blockchain-Based Finance Application Development

You can develop mobile applications for the financial industry by using Blockchain technology. Your and your client’s company will benefit from trustworthy and efficient apps that are built on blockchain technology.

5. Mobile Banking Application Development

When it comes to developing a mobile banking application, you can offer a dependable and secure solution that may allow full access to bank accounts and assure safe, hassle-free transactions made from a mobile device.

6. Trading Platform Solutions

You can develop complete solutions for trading platforms. The platform may be able to automate trading processes, which is beneficial for traders, brokers, and asset managers.

7. Accounting Application Development

You can develop an application for financial administration that is both robust and user-friendly. These apps may have a wide variety of functions, including document scanning, financial report management, invoices, and transaction tracking, and dealing with other financial matters.

Technologies You Can Use For Finance Application Development

Invest in the appropriate technology stack to build a robust finance app. Due to the wide variety of fintech projects and their varying goals, each one has its own specialized technology stack.

Choose the correct technology stack and you may use it as a strategy to save the time and money spent on creating financial technology apps. Java, Swift, Ruby, C#, Python, C++, and Kotlin are some of the most used development environments for finance apps. You may then use Android’s Kotlin or iOS’s Swift, or both, to create an app.

| Type Of Work | Tech Stack |

| Backend | Laravel, PHP, NodeJS, etc. |

| Frontend | HTML5, CSS, JS, etc. |

| Mobile | React Native, NuxtJS |

| Database | SQL, XQuery, and QOL |

| Verification | Nexmo |

| Chatbots | Amazon Lex, Azure, Teneo, Houdify |

| Push Notifications | Twilio, Urban Airship, Amazon SNS |

| Consumer Data Analytics and Tracking | Hotjar, Marketo, Optimizely, Bottomline |

| SMS/E-mail Management | Mandrill |

| QR Code Scanning | ZBar Code Reader |

| Hosting | Vultr, AWS, DigitalOcean |

To provide top-notch fintech/finance application development services, you can offer a solution based on the most cutting-edge tools and techniques like:

1. Blockchain

Take advantage of the capabilities offered by blockchain technology to build specialized applications that facilitate the safe exchange of funds and the completion of other financial operations. It’s a reliable method of keeping tabs on financial dealings.

2. Deep Encryption

When it comes to money, we know how important it is to keep information safe. Therefore, app security is crucial. During transmission and reception, the data is encrypted using deep encryption so that only the sender and the intended recipient can read it.

3. Python

The majority of financial application frameworks are written in Python. Due to its superior data processing and analysis capabilities, it is an excellent choice for developing high-end apps employed in monetary dealings.

4. Big Data

The use of big data in fintech software development enables the efficient administration of structured and unstructured data, which in turn permits the accurate prediction of client behavior and the provision of highly customized services. With so much information being produced by the financial sector, it’s no surprise that big data is useful for those creating financial apps.

5. Artificial Intelligence

The advent of AI might dramatically alter the financial industry. Therefore, you can use AI-based solutions while creating apps for your customers. It paves the way for banks and other financial institutions to provide individualized services and products.

6. Cloud Integration

Integrating cloud services allows for seamless communication between programs in real time. Cloud integration is an excellent way to access and manage data via a shared network. It is becoming increasingly popular in the contexts of both business software development and the creation of specialized mobile banking apps.

How To Develop A Finance Application?

Following are the steps involved in the development of Finance Application:

Step 1: Start With Discovery Phase

Information exchange is crucial to the discovery phase, the primary goal of which is to increase the development team’s familiarity with the project at hand. The discovery phase’s process is highly variable based on the project, organization, and management preferences of the team lead. Still, there is a relatively consistent pattern to the discovery phase:

- A look at the financial application’s fundamental concept

- Analysis of the market, potential customers, and other competing businesses in fintech sector

- Insight into the whereabouts of competitors

- The method of doing business used by competitors

- Characteristics and features of their financial technology offering

- Searching for any problematic areas in the financial apps developed by other companies

- Wireframing the user interface for your application

- Projection of time and money needed for development of your advanced finance app

- Specification and requirements writing for software development and budgeting

- Prototyping your app idea

- The handing off of the project plan as agreed upon.

At this point in the process, in order for you to finish your research and analysis so you may go on to the next level. You will be able to respond to questions such as,

- Which area of fintech do you wish to concentrate on?

- Does your intended audience fall into a certain demographic category or reside in a particular part of the world?

- Do you plan to introduce your fintech app to the local market first, and then take it to the international stage?

- Do you have any experience working in this field?

Step 2: Take Care Of Compliance Issues

Following an awareness of the specific use case of the finance application, the following stage is to address compliance concerns.

- When a development team begins work on mobile applications for a financial organization, it is imperative that they consider and address all applicable Fintech legislation.

- In order to accomplish this, it is important to have the most advanced protection measures, such as KYC (Know Your Customer) and AML (Anti Money Laundering), integrated into their fintech apps. They are able to better track compliance with the assistance of these methods.

- In addition to this, every firm that uses a fintech application must ensure that it complies with applicable privacy legislation such as the PIA, CCPA, LGPD, and GDPR. This contributes to the protection of the users’ financial information that is stored within the financial app.

- Along with this, the region in which the app is going to be used has a significant impact on the level of privacy that may be selected for premium applications. The reason for this is because some nations have particular regulatory bodies while others don’t have any at all. For instance, the United States of America does not have a dedicated fintech regulator to ensure compliance with the numerous federal regulations.

Step 3: The Core Developmental Steps For Finance Application

It starts after the discovery and analysis phase, where you actually work to bring the idea into reality, and it includes:

- UX Design

- Think through a visual style

- Identify a reputable app development team

- Quality assurance testing

- App deployment & support

- Collect feedback and improve on the budgeting app

1. UX Design

Designing a mobile app isn’t just about making it seem reasonable; it should also boost productivity, responsiveness, and user engagement. These three key activities and their corresponding deliverables should make up a perfect design phase:

- Outline your thoughts with a mind map:

This is a graphical representation of the features that support the actions taken by the user. Any good user experience mind map aims to serve as a reliable bridge between the research and development phases.

- UX design:

This is the expected flow of a customer’s interaction with your financial planning software. The design needs to be comprehensive enough to meet the target audience’s requirements and intuitive enough not to divert attention away from the app’s intended function.

Keep in mind that we are now focusing on the fintech app in particular, and that the design should always be appropriate for the type of app being used. It’s possible that using a plethora of gradients and a wide variety of colors will be overwhelming. Users of fintech applications shouldn’t have any trouble navigating the app’s various functions. That’s why, when making a financial technology app, simplicity is best.

- UI design:

If you’re making a finance app, for instance, users won’t like confusingly huge forms for making bill payments. In addition, there has to be a way to send money to someone or pay a bill without entering any financial information manually.

Designing the user interface (UI) is the process of creating a layout that allows users to navigate and utilize the capabilities of a program. Make sure the delivered product is visually appealing and easy to use for new visitors to increase the likelihood of repeat business.

2. Developing And Testing Phase

The design phase’s outputs should be handed off to the development team after gathering them. It is the job of the development team to provide a functioning app that is consistent with the blueprint established during the design stage.

If you want to create a successful financial application, you should prioritize adding features that will make your app more cutting-edge, efficient, affordable, safe, and user-friendly. Cross-platform compatibility, two-factor authentication, one-time password access, and a chatbot available around the clock are just some of the features that are required of any financial app. Think beyond the basics to identify the elements that are essential to the app’s success.

At this point, you should have either a minimum viable product (MVP) app or a fully scaled app with many user-focused features. Your minimum viable product may include the following:

- User authorization: A system security feature that allows users to access the mobile app’s functions and resources.

- Profile creation and management: It contains user-specific information and can use personalized accounts.

- Synchronization of payment cards: It links financial information with a budgeting app and automates financial tracking processes.

- Real-time transaction tracking and storage: It provides functionality to identify the source of a transaction.

- Settings for a daily and monthly budget, analytical and statistical reports, expenses categorization, notifications, etc.

In case you’d want to design an app that puts the user first, here are some features to think about implementing:

- Authentication and authorisation of users

- Query-based exploration

- Converting money online

- Payment schedules

- Schedule of regular payments

- On-demand API integration

- The ability to have several accounts

- Machine learning for cost forecasting

- Customer support

- Notification

This could be your advanced features to include in a full-scale finance application. However, you can have more features to ease the customer experience and grow your customer base.

3. Required Team

Similar to technology requirements, your application needs a team of professionals who can be freelancers, in-house teams, or application development agencies.

Time, resources, and complexity of the project will all play a role in determining the optimal team size. For instance, you’ll need Flutter or React Native developers to create a Finance app that works on both iOS and Android. It will take longer to build, but you will end up with apps for two platforms instead of just one.

As a result, the following members of a development team are essential:

- Project manager: They can plan, organize and manage the completion of your application development on time.

- Business analyst: They will conduct research, analyses, and make suggestions to make applications more market-friendly.

- UI/UX designer: They will provide you with a user experience map representing your FinTech app.

- Backend developer: They provide the code which links the backend elements to what the frontend developer creates. These codes are needed for the primary operations of the application

- Frontend developers: They are responsible for implementing UI/UX design and features that link to what the backend developer creates.

- QA testers: They are the ones who ensure the quality of the end product through testing.

- DevOps engineer: They oversee the coding process of the backend and frontend developers.

Step 4: Create A Monetization Model Your Finance Application

Income potential should be considered before adding features to a financial app. This requires both the development of a monetization strategy based on the identification of the most promising future opportunities and the prioritization of the few most valuable revenue sources.

Step 5: Launch & Make Improvements

Completing a financial technology application does not signify the end of development work. Instead, development proceeds as usual due to the ongoing necessity of support and upkeep. Testing begins for a fintech app as soon as consumer feedback is collected; from there, iterative improvements are made to the app’s user interface and underlying code in response to feedback from actual users. The application’s processes and features will inevitably need updating as time and technology pass. Users can expect prompt solutions to issues they face while using the application.

What follows is a rundown of the critical actions involved in the application’s ongoing maintenance and support:

- In order to ensure that the software is always running on the most recent OS version, regular updates must be performed.

- Improvisation of the application by updating its libraries and externally provided services

- Ensuring that all patches have been installed and that all security checks have been performed

- Fixing the problems and fixing the issues

- The goal is to restructure the existing code without compromising its functionality

What Features To Include In The Finance Application?

It’s essential to include the elements that make up the backbone of mobile banking apps.

1. Authentication And Authorization Flows

The question “Who are you?” and “What are you permitted to do?” in your application gives a sense of authorization and authentication. You can apply biometric authentication, like fingerprints, look, voice, and even motions, to provide a first-rate user experience.

Even if it extends the time and money needed to create a finance application, developers should add sufficient levels of protection. Testing the system’s security is also crucial, and the development team should preferably run these tests periodically after the product has been released.

2. Account Management

Facilitate access to account balances, expenditure histories, and pattern analyses. And if you want to go above and beyond, you can help them save money, invest, and pay bills automatically.

3. Customer Support

Make sure customers have access to help representatives around the clock. Adopting an AI chatbot is also a great way to improve the customer service provided to your users.

4. Locator Service For Banks And Nearest ATMs

Make it easy for your consumers to find ATMs and branch locations near them, along with service details, hours of operation, and driving instructions.

5. Secure Payment And Transaction Processing

In-app purchases and other financial dealings should always go through safely and conveniently. It would be wise to enable payment via QR codes as well.

6. Push Notifications

The fact that consumers of financial institutions are not immediately informed when something significant occurs on their accounts – is one of the most significant problems that these organizations face.

You can embed a feature to send mobile banking alerts to keep your consumers abreast of account activity. However, push intelligently and avoid being invasive since your messages may be lost in the “data noise” and drive away potential consumers.

7. Expense Trackers

Having a firm grasp of your financial status is a prudent move. Encourage people to maintain their financial discipline and put away more money. You might divide the timeframe into daily, weekly, monthly, and annual segments.

8. Cashback Services

Customers of the bank will be more likely to utilize the app if it offers this incentive. In addition, cashback serves as a reliable foundation for your loyalty program.

9. Customized Offers

Providing customers with exclusive deals and savings may go a long way toward establishing trusting connections. You can count on them to attract new customers and boost your bottom line.

10. Specialized Assistance

Mobile banking app development may extend to less obvious services, such as online ticket purchases, rental car reservations, restaurant table bookings, food delivery services, and more.

11. Wearable Applications

The use of wearable technology has the potential to improve many aspects of daily life, including health, exercise, and financial transactions. The potential for wearable technology to show financial data, provide notifications, and facilitate payments or transactions is exciting.

12. Bill-splitting

Different consumers, payers, or service providers may be individually or jointly billed for the same service. The bill-splitting function permits precise expense allocation amongst party members. It’s a great hook since it appeals to common feelings and interests many customers. More users are attracted to apps that advertise and endorse the split bill option since it eliminates the awkwardness of settling the cost with many people.

13. Chatbot Or Voice Assistant

Both customers and businesses may gain from integrating an AI-based chatbot into their operations. Customers are likely to have inquiries on any facet of the financial services business. For the sake of their standing, organizations must address problems as soon as they arise. For that kind of productivity, you need a large team of people working around the clock.

Protecting humans from harm is one use for AI-powered chatbots and personal assistants. Although chatbots are limited in their ability to answer complex inquiries, they can provide guidance on making a deposit or increasing a credit limit.

Voice-enabled digital banking chatbots are the icing on the cake for providing engaging, cutting-edge, and conversational user experiences in both the informative and transactional realms.

14. Cardless ATM Access

Permit customers to withdraw cash from their bank accounts without physically possessing their card. Make them verify their account with a phone call from their banking app or a text message instead.

15. Card Number Scanning

To some, providing card information may seem like a monumental waste of time in a world where things change every minute and something significant happens every second. A card number scanning feature may seem like common sense, yet many banking applications still don’t have one. Because of this, it’s possible that consumers may prefer your app above others that offer a similar service.

Where Can You Find A Fintech App Developer?

You may engage a freelancer, put up an in-house team, or contract with an app development business to create your financial app.

You’ll need a team of app developers with expertise in designing applications if you want to develop and launch your financial app on your preferred platform. The best choice is to work with experienced mobile app developers to develop your finance app.

Finding quality app developers for your platform using a freelancing service is possible, but doing so is less efficient than working with an app development company. The biggest risk of hiring freelancers is that they can quit in the middle of your project, causing you to lose money and time.

When you outsource your project to skilled software developers from top app development firms like Idea Usher, managing your application/project becomes a breeze. They have experienced specialists and project managers on board, with experience in effectively managing several mobile applications for clients.

Wrapup!

Now that you know the benefits and requirements of finance application development, it’s time to bring the idea into existence and generate revenue from it. Idea Usher is your one-go solution if you need a professional team to deliver a money-making product. At Idea Usher, you will get experienced finance app developers, end-to-end software development, quick turnaround, top-notch security & regulatory compliance in your application, impressive UI & UX Design, data security, and a technical support team to solve all app-related issues, even after application deployment.

You can get in touch with our team at any time!

Contact Idea Usher at [email protected]

Or reach out at: (+1)732 962 4560, (+91)859 140 7140

FAQ

Q. How much time does it take to build a finance application from scratch?

A. Creating a financial app might take anything from three to six months. However, there are numerous variables that affect how long it takes to complete, such as the nature of the app, its level of complexity, and the amount of desired features.

Q. Is there a preferred programming language for developing a finance application?

A. The most widely used languages for developing financial applications are Java, C, C++, C#, and Ruby.

Q. How much does it cost for a development of finance application?

A. When estimating how much it will cost to build a fintech app, it’s important to think about a number of factors, including the needs of your intended audience, the features and technologies you’ll implement, the size of the development team you’ll hire, the location of your banking app’s provider, and the rate per hour. In order to get an accurate price estimate, it is prudent to think about all of these things.

Q. What does finance application development depend on?

A. It depends on the type of team which can be an in-house team, freelancers, an application development agency. Along with this, the development process also depends on the location of the team that may affect the budget and working hour.

Rebecca Lal