‘Buy Now Pay Later’ or ‘BNPL’ has been the talk of the town or at least the talk of the “online shopping” world. Why? The reason isn’t quite hard to guess. It’s because of the growth of e-commerce!

If you are an avid reader of tech news, or even if you skim through tech information once in a while, you must have seen how e-commerce has witnessed unrivaled growth. The boom in the e-commerce industry has been a significant contributor to the booming of BNPL platforms.

At the same time, the incorporation of new payment methods and unparalleled perks have contributed to the growth of e-commerce. BNPL is one such payment method with delightful extras.

But, there are still varied methods of payment. Why are people so attracted to Buy Now Pay Later? We will soon look at the features which may answer this question. But, before proceeding to that, let’s understand what BNPL is.

What exactly is Buy Now Pay Later?

BNPL, as the term suggests, is a way of buying products before paying money. However, you spend money while making the purchase, just not from your pocket. The company you signed up with for this facility pays for you.

Though, after the company pays for you, a time is provided to you to repay the money. Using this service is more like taking a loan and repaying it without interest or hidden charges. You may even refund the money in installments.

Everything will remain smooth if you pay the money back on time. If you fail to do so, the company has every right to charge interest. Additional delays may harm your credit score.

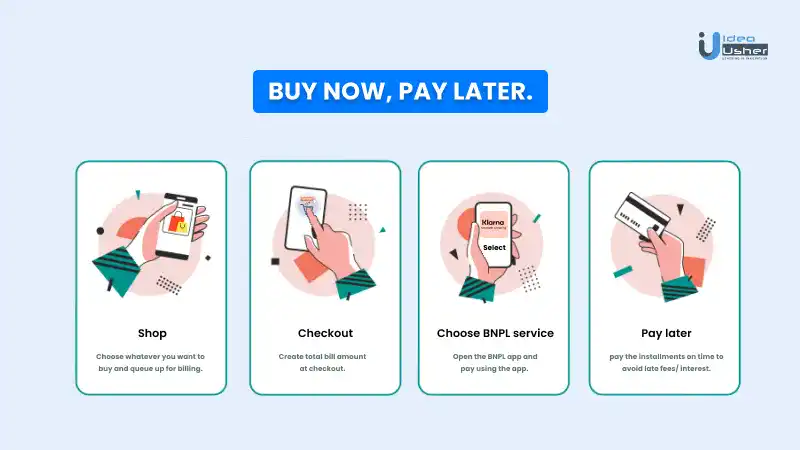

How does Buy Now Pay Later work?

Various e-commerce platforms now offer Buy Now Pay Later option. It operates the same way on all the platforms; the only difference is observed in the terms and conditions.

So, how does BNPL work?

- Purchase a product from an e-commerce platform.

- Select the “buy now, pay later” option for payment.

- You need to pay a small amount during the time of purchase.

- You must pay the balance through successive installments– no interest or hidden charges.

Learn more about the BNPL app working here.

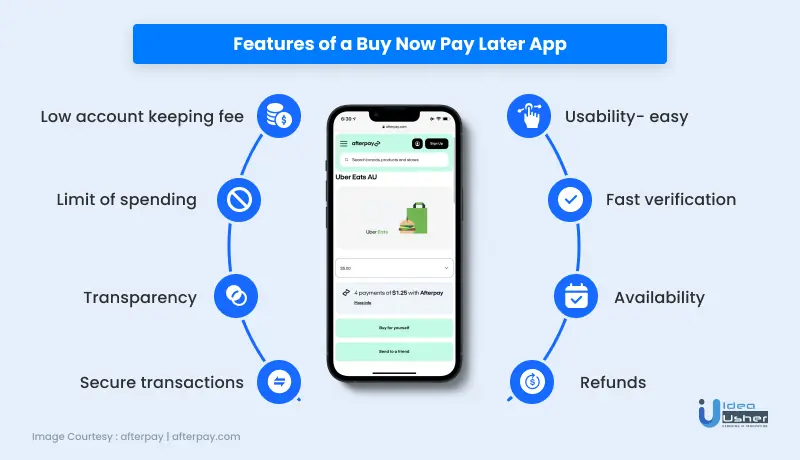

Top features of a Buy Now Pay Later app

BNPL apps have different but advantageous features that set them apart from any other mode of payment. Here are some of those features.

1. Low account keeping fee

Most Buy Now Pay Later apps have a pretty low account maintenance fee. They charge this fee monthly. The late fees are particularly pretty low. Thus, this specific feature makes such apps affordable for most people.

Keeping in mind that most of their users are students, BNPL platforms contain this feature. Better yet, some platforms do not even require account maintenance fees.

2. Limit of spending

As can be observed, you can use most BNPL platforms for small purchases only. Due to this, you have lesser chances of going into debt. The last thing you want is to dig a hole in your pocket using Buy Now Pay Later platforms.

3. Transparency

Most credit cards come with hidden charges. The last thing someone relatively new to this credit game wants is to get themselves trapped in debt.

BNPL is, thus, preferred by most individuals. There are no hidden charges. All you need to pay is EMIs. Millennials do appreciate transparency and no hidden charges.

4. Secure transactions

While making a payment, what will you look for the most? A safe and secure environment for transactions. BNPL platforms provide a secure environment for transactions. So, without any worries, you can make your payments.

5. Usability- easy

People mostly get confused with all the workings of a FinTech app. It’s pretty frustrating, to be honest. BNPL platforms save you from this annoyance! Using these applications is relatively easy. When you still get confused, just scouring the internet will help you.

6. Fast verification

Isn’t it frustrating when the simple verification process eats up a humongous amount of time? We do understand that, and so do BNPL platforms. Thus, the process of verification in such apps is pretty fast. You do not waste your precious time. Users do appreciate the quick procedure.

7. Availability

BNPL is not accepted universally, but it is available in most stores all around the globe. With these apps, availability is not an issue. Most e-commerce platforms allow users to shop now and pay later. Visit any online store; the probability of coming across the BNPL option is reasonably high.

8. Refunds

Some studies have discovered that most buyers purchase multiple products at once using BNPL. They usually have all the intention of returning some of the products. Thus, these platforms offer a no-obstacle refund process. Moderately impressive feature.

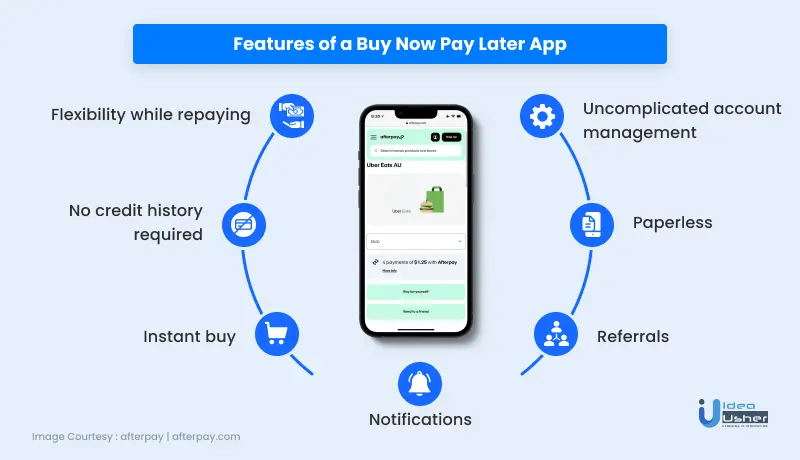

9. Flexibility while repaying

Users prefer having their own choices while repaying a loan. BNPL platforms allow users to select the way they want to repay. They offer enough flexibility to the users while repaying. This flexibility provides users with more grip on their finances.

10. No credit history required

Getting a traditional credit card requires you to have a credit history. Even if you get a credit card without a credit history, a higher interest rate will be heaped on you. BNPL platforms do not require you to have a credit history. Hence, no high-interest rates.

11. Instant buy

Some payment methods require users to go through a hectic payment process. But, BNPL apps offer a reasonably fast payment method. Most users value a speedy payment process.

12. Uncomplicated account management

Users prefer those apps, which makes it easier for them to manage their accounts. BNPL platforms allow users to access all their information at once. They can easily access information like their purchases, payments, and personal details.

13. Paperless

One of the best features of BNPL platforms is that everything is digitized. Users are not required to produce any offline papers. The whole process of applying for a loan and its approval occurs online. Nowadays, the paperless method has become the most approved process same as paytalk app.

14. Referrals

Most BNPL platforms offer referral programs to their existing customers. These referral programs earn users some rewards. For example, users recommend a BNPL app to their friends or family. When the said friends make purchases using the platform, the users earn some rewards. Isn’t it a good deal?

15. Notifications

Good BNPL apps make sure to make their users feel cared for. There are various ways in which Buy Now Pay Later platforms show their appreciation towards their users; a highlighting way is through notifications. These platforms ensure to notify their users of payment deadlines. This way, users can be saved from paying late fees.

Top Buy Now Pay Later apps in 2022

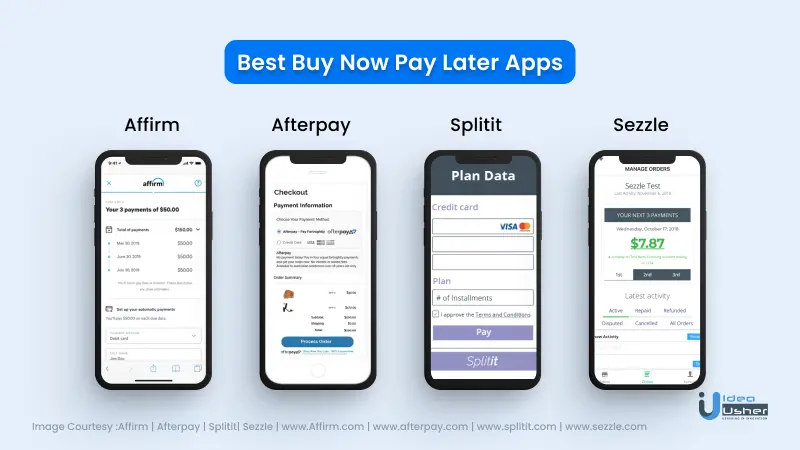

1. Affirm

Affirm is a BNPL app whose most striking feature is no fees (not even late fees). You can borrow upto $17,500 and repay over time with no interest or simple interest charges from 10% to 30%, depending on the payment plan chosen. Many users pay loans in three, six, or twelve months without additional fees (only interest).

| Owner | Affirm Inc. |

| Launch year | 2017 |

| iOS rating | 4.9/5 |

| Android rating | 4.6/5 |

| Price | Free |

2. Sezzle

Sezzle is an app that allows you to make 25% payment upfront, the remaining in three installments every two weeks. However, it also allows you to reschedule payments upto two weeks later. This flexibility makes this app a popular choice among customers. A thing to note here is that you can reschedule for free only once. Subsequently, the app will charge fees for rescheduling.

| Owner | Sezzle |

| Launch year | 2017 |

| iOS rating | 4.9/5 |

| Android rating | 4.7/5 |

| Price | Free |

3. Afterpay

Afterpay is an ideal app for students with limited financial resources. The app allows you to make purchases with no fees or interest, as long as you repay on time. Each purchase attempt is subject to an instant approval decision using smart credit limits.

| Owner | Afterpay |

| Launch year | 2014 |

| iOS rating | 4.9/5 |

| Android rating | 4.7/5 |

| Price | Free |

4. Splitit

Splitit is an app that allows you to use your Visa, Mastercard, Discover, and UnionPay credit cards to earn rewards on purchases and pay over time with no interest. It doesn’t require separate registration and does not charge any fees or interest. It only uses credit card information, and there is no credit check.

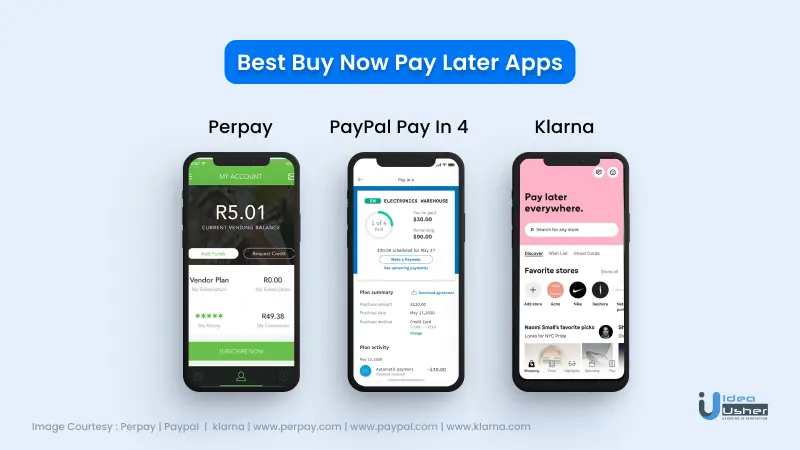

5. Perpay

Perpay is an ideal app for customers with bad credit scores. This app allows you to shop from over 1,000 brands through its marketplace. You can increase your credit score by 39 points if you repay on time. Unlike other BNPL apps that allow four equal installments, Perpay allows you to choose 4, 8, 16, or 18 installments.

| Owner | Perpay Inc. |

| iOS rating | 4.7/5 |

| Android rating | 3.8/5 |

| Price | Free |

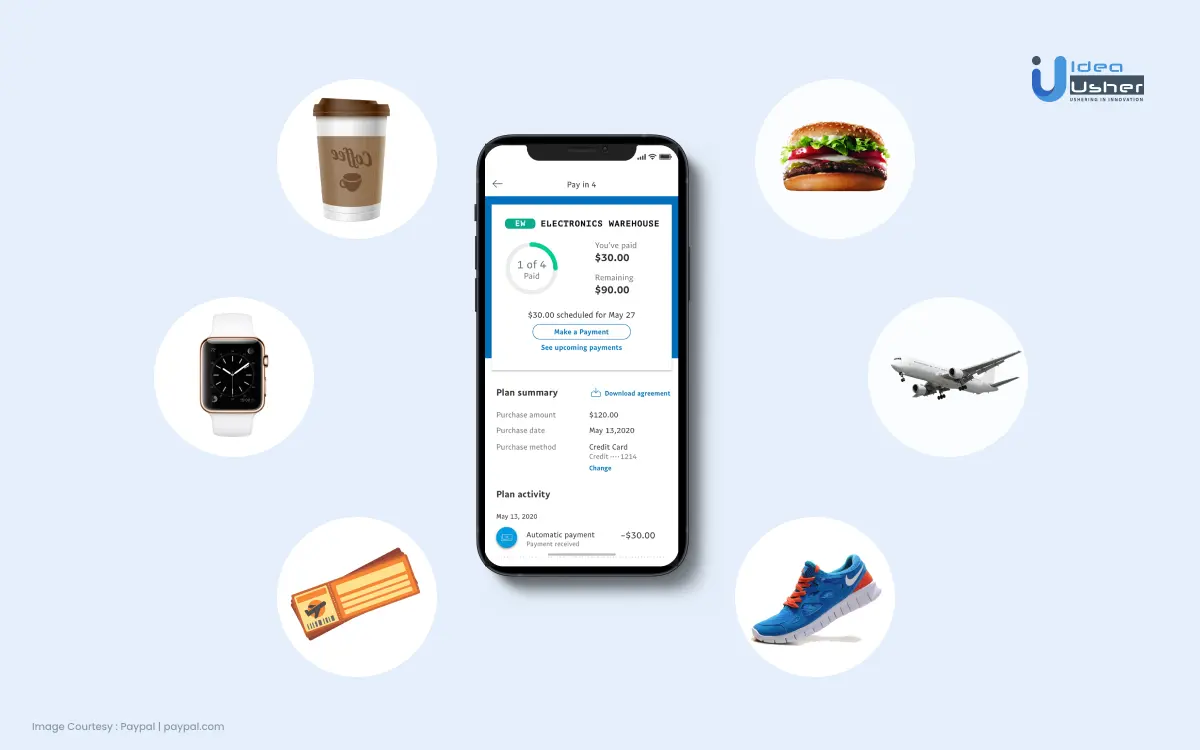

6. PayPal Pay in 4

PayPal offers its BNPL service called Pay in 4. To use this service, it is mandatory to have a PayPal account in good standing. You can select the Pay in 4 option during checkout and pay 25% upfront, with the remaining payments made in three equal installments every two weeks.

| Owner | PayPal Inc. |

| Launch year | 2020 |

| iOS rating | 4.8/5 |

| Android rating | 4.4/5 |

| Price | Free |

7. Klarna

Klarna is an app that offers three payment options to its users.

- First is the traditional pay-in-4 option, in which you make the payment in four equal installments.

- Second, you can choose to pay the balance amount within 30 days with zero interest.

- Third, you can use 6-to-36-month financing for larger purchases. This option charges interest.

| Owner | Klarna Bank AB |

| Launch year | 2017 |

| iOS rating | 4.8/5 |

| Android rating | 4.6/5 |

| Price | Free |

Advantages of using BNPL

Using BNPL apps offers several advantages to the users. Some of them are given below:

- With this service, you can choose not to pay immediately for some new products you are unsure about.

- Sometimes, mixing up other credit cards for online shopping complicates things. Face minor complications with BNPL.

- With flexible payment plans and varied payment options to choose from, repaying has never been easier.

- It provides you with a flawless buying experience.

Disadvantages of using BNPL

Like any other app, BNPL apps are also not free from shortcomings. Some of the disadvantages are as follows:

- BNPL now has become more available. But, that does not mean that every industry accepts it.

- While most credit cards have no limit, BNPL has credit limits.

- It may convert you into a shopaholic. You may even manage not to keep your spending under control anymore.

- Ultimately, late repayment will lead to high-interest rates.

Final words

For many, BNPL has become the ‘go-to’ payment mode. With no hidden charges and unparalleled transparency, it has gained the trust of many. Buy Now Pay Later still has the potential to grow more. Its bright future is pretty much visible.

But, at the end of the day, BNPL is a kind of loan. A customer has to repay the loan; failing to do so will impact the customers and the lender. Heavy interest rates will be imposed, making it impossible for the customer to repay.

Thus, before using BNPL, make sure you can repay your loans. However, Buy Now Pay Later is a great payment mode.

If you are an entrepreneur and wish to develop a similar app, you can get in touch with Idea Usher. Our experts provide customized app development services to clients across countries.

Frequently asked questions

Here are some interesting FAQs about the features of a Buy Now Pay Later App.

1. Are we required to pay interest on BNPL?

Most of the time, Buy Now Pay Later platforms do not require you to pay any interest. But, if you fail to make repayments on time, you will be charged a certain amount of interest.

2. When does BNPL affect credit score?

Buy Now Pay Later apps usually do not impact the credit score. However, your credit score might be affected if you fail to make the repayments on time.

3. How does BNPL differ from EMI?

Just like credit cards, EMI is a part of BNPL. The user is required to pay in regular installments.

Mayank Sharma