Imagine a world where complex financial decisions are made with the precision of a virtuoso violinist, where chatbots converse with the fluidity of a seasoned jazz singer, and where scientific discoveries unfold with the meticulousness of a symphony conductor. This isn’t a futuristic fantasy; it’s the reality being orchestrated by quantitative programming.

Quantitative programming, the harmonious blend of mathematics, statistics, and coding, is rapidly transforming industries. It acts as the invisible conductor, composing intelligent solutions that seamlessly integrate data and decision-making. As we move through 2024, the melodies of quantitative programming are reaching a crescendo in various fields.

Let’s delve into the top 10 use cases that are shaping a future driven by data-driven insights and algorithmic ingenuity.

What is Quantitative Programming

Quantitative programming, or quant programming, is a powerful field that blends math, statistics, and coding to tackle problems in finance, science, and beyond. Imagine building complex models to predict stock prices or using algorithms to analyze massive datasets – that’s the world of quantitative programming.

At its core, it involves:

- Mathematical Modeling: Creating equations and formulas to represent financial instruments, scientific phenomena, or market behaviors.

- Statistical Analysis: Sifting through mountains of data to uncover patterns and trends that inform decisions.

- Algorithmic Development: Translating models and analysis into step-by-step instructions (algorithms) for computers to execute.

- Programming Languages: Using languages like Python or R to bring these algorithms to life.

While finance is a big player, quantitative programming’s applications are exploding:

- Scientific Computing: Simulating complex systems, analyzing astronomical data, or modeling protein structures are just a few examples.

- Machine Learning: The algorithms used in quantitative programming are the building blocks for machine learning, a field that’s revolutionizing everything from self-driving cars to facial recognition.

- Big Data Analytics: Extracting meaningful insights from massive datasets is crucial for businesses and quantitative programming techniques are key to making it happen.

The future of quantitative programming is bright, fueled by advancements in AI and machine learning. Expect to see:

- AI Integration: Imagine even smarter and adaptable models that make real-time decisions by combining quantitative programming with AI algorithms.

- Explainable AI: As algorithms get more complex, ensuring we understand how they reach conclusions will be important. This transparency builds trust and fosters responsible development.

- New Frontiers: Quantitative programming’s reach will extend to areas like climate modeling, personalized medicine, and even social science research.

Quantitative Programming – Market Analysis

Quantitative programming is a booming field driven by AI, machine learning, and big data. It’s revolutionizing industries like finance (algorithmic trading), retail (personalized recommendations), and healthcare (medical imaging analysis) with a projected market size of billions by 2027. From optimizing supply chains to creating smarter chatbots, quantitative programming is shaping the future of technology.

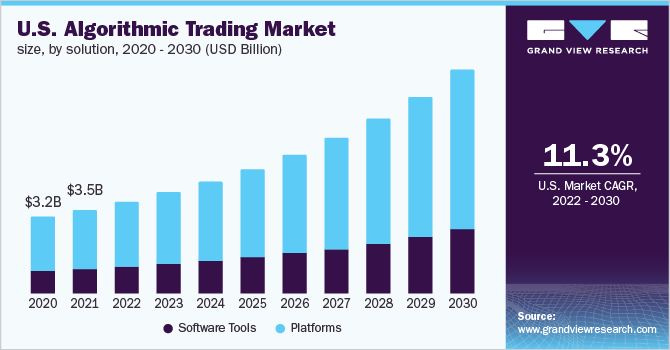

For example, The market for algorithmic trading is booming, with a projected value exceeding USD 41.9 billion by 2030. This surge is driven by several key factors:

- Speed and Efficiency: Algorithmic programs can react to market fluctuations in milliseconds, capitalizing on fleeting opportunities that human traders might miss. This translates to potentially better entry and exit points for your investments.

- Reduced Emotional Bias: Human emotions can cloud judgment in the fast-paced world of trading. Algorithmic programs, devoid of emotions, execute trades based on pre-defined parameters, minimizing the impact of impulse decisions.

- Backtesting and Optimization: Algorithmic trading allows for historical data analysis (backtesting) to fine-tune trading strategies and optimize performance over time. This data-driven approach helps identify patterns and potential weaknesses in your investment strategy.

- Accessibility for All: Algorithmic trading platforms are becoming increasingly user-friendly, making this sophisticated strategy accessible to even novice investors. This democratization of investment tools empowers individuals to participate in the market more effectively.

Top 10 Use Cases That Are Shaping The Future Of Apps and Software

Here are some intriguing use cases to look out for –

1. From Wall Street to Main Street: Algorithmic Trading & Portfolio Optimization

Forget the days of relying solely on intuition in the stock market. Quantitative algorithms are now democratizing investing. These complex models analyze vast datasets, identifying trading opportunities and optimizing investment portfolios for maximum return within a user’s risk tolerance. Robo-advisors and algorithmic trading platforms leverage this power, making sophisticated investment strategies accessible to everyone.

Example: Robinhood, a popular investment app, leverages quantitative algorithms to power its robo-advisor feature. Users can create a personalized investment plan based on their risk tolerance and financial goals. The algorithm then automatically allocates and rebalances their portfolio based on market conditions.

2. Guardians of the Gates: Fraud Detection & Risk Management

With the ever-increasing reliance on online transactions, the need for robust security measures is paramount. Quantitative algorithms play a critical role in safeguarding our digital lives. By analyzing financial transactions, user behavior, and other data points, they can detect anomalies and flag potential fraudulent activities in real time. This empowers financial institutions and online businesses to protect user accounts and mitigate risk.

Example: PayPal utilizes sophisticated algorithms to analyze user transactions in real time. By identifying suspicious patterns like unusual purchase locations or sudden spikes in spending, these algorithms can flag potential fraudulent activities and prevent unauthorized access to user accounts.

3. The Machines Are Making Money (the Good Kind): High-Frequency Trading (HFT)

HFT algorithms operate at lightning speed, executing trades in milliseconds to capitalize on fleeting market inefficiencies. These sophisticated programs rely on complex optimization techniques and machine learning to identify and exploit arbitrage opportunities, generating profits for investment firms. While the world of HFT is complex, it contributes to overall market liquidity and efficiency.

Example: Citadel, a leading hedge fund, employs complex HFT algorithms that can execute thousands of trades per second. These algorithms analyze market data feeds and exploit tiny price discrepancies across different exchanges, generating profits for the firm through arbitrage opportunities.

4. Know Your Next Binge: Recommender Systems & Content Personalization

Ever wondered how Netflix knows exactly what show you’ll love next? The answer lies in recommender systems powered by quantitative algorithms. These algorithms analyze user data, such as viewing history and ratings, to suggest personalized content recommendations. This not only enhances user engagement but also drives sales conversions for businesses like Amazon and Spotify.

Example: Netflix’s recommendation engine is a prime example of this concept. By analyzing your viewing history, ratings, and browsing behavior, the algorithm recommends movies and shows that align with your preferences. Similarly, Spotify uses recommendation algorithms to curate personalized playlists based on your listening habits.

5. Playing the Price Game: Price Optimization & Revenue Management

Airlines constantly adjust ticket prices based on demand and competitor pricing. The magic behind this? Quantitative algorithms! These programs analyze real-time data to optimize pricing strategies, maximizing revenue while maintaining competitiveness. This ensures you get the best deal possible (sometimes) and businesses stay profitable.

Example: Airlines like United Airlines dynamically adjust ticket prices based on factors like demand, competitor pricing, and booking time. Quantitative algorithms analyze this data in real time, allowing airlines to optimize pricing strategies and maximize revenue while remaining competitive.

6. From Farm to Store: Supply Chain Management & Logistics Optimization

The efficiency of the modern world relies heavily on optimized supply chains. Quantitative algorithms play a vital role here. They analyze data on inventory levels, transportation costs, and customer demand to ensure the smooth flow of goods. This translates to faster deliveries, reduced costs, and a win-win situation for businesses and consumers.

Example: Amazon relies heavily on quantitative algorithms to optimize its vast supply chain network. These algorithms analyze data on inventory levels, transportation costs, and customer demand to ensure efficient delivery of products to customers. This translates to faster delivery times and reduced costs for both Amazon and consumers.

7. Taking the Gamble Out of Risk: Quantitative Risk Analysis & Insurance Underwriting

Insurance companies rely on a multitude of factors to assess risk and determine policy premiums. Quantitative algorithms are a powerful tool in this process. By analyzing vast datasets on past claims, demographics, and other relevant factors, they help insurers create accurate risk profiles and set appropriate premiums, making the insurance industry more data-driven.

Example: Progressive, a major car insurance provider, utilizes quantitative algorithms to assess risk profiles for potential customers. By analyzing data on driving history, vehicle type, and demographics, these algorithms help Progressive determine appropriate insurance premiums for each customer, ensuring a more data-driven approach to risk assessment.

8. Seeing is Believing: Computer Vision & Image Recognition

From facial recognition software to medical imaging analysis, quantitative algorithms are revolutionizing the way computers perceive the visual world. These algorithms can identify patterns and objects within images with exceptional accuracy, enabling functionalities like security access control and automated medical diagnoses.

Example: Apple’s Face ID technology utilizes advanced computer vision algorithms to recognize users’ faces for secure device unlocking. Similarly, medical imaging analysis software powered by quantitative algorithms can assist doctors in identifying abnormalities in X-rays and MRIs, leading to earlier diagnoses and improved patient outcomes.

9. Talking to Machines: Natural Language Processing (NLP) & Chatbots

Ever interacted with a chatbot that seems to understand your questions surprisingly well? That’s the power of NLP algorithms at play. These algorithms process and understand human language, allowing chatbots and virtual assistants to engage in more natural conversations with users. They also enable features like sentiment analysis and machine translation, breaking down communication barriers across languages.

Example: Many banks and customer service providers now offer chatbots powered by NLP algorithms. These chatbots can understand user queries and provide relevant information or complete basic tasks, improving customer service efficiency and reducing wait times.

10. Simulating the Future: Scientific Computing & Simulations

Quantitative programming isn’t just about finance and apps. It’s a powerful tool for scientific discovery. These algorithms are used to model complex phenomena, analyze experimental data, and perform simulations in fields like physics, chemistry, and climate modeling. This empowers researchers to explore new frontiers of knowledge and make groundbreaking discoveries.

Example: Climate scientists use complex quantitative models to simulate future climate change scenarios. These models take into account factors like greenhouse gas emissions, ocean currents, and atmospheric conditions, helping researchers predict potential climate impacts and develop mitigation strategies.

Conclusion

Quantitative programming is rapidly transforming the software landscape. From financial optimization to AI-powered chatbots, these algorithms are making apps smarter and our interactions with technology more intuitive. As this field merges with artificial intelligence, the possibilities are endless. The future belongs to those who can leverage the power of data, and quantitative programming is equipping us with the tools to do just that.

Ready to Quantify Your Future?

The future of technology is powered by data, and Idea Usher is here to help you harness its potential. Our team of expert quantitative programmers is passionate about building intelligent and efficient software solutions using cutting-edge algorithms.

We can help you:

- Optimize your business processes: Leverage quantitative algorithms to streamline logistics, personalize marketing campaigns, and make data-driven decisions for maximum impact.

- Unlock hidden insights: Our developers can extract valuable insights from your data, empowering you to understand your customers better, identify new market opportunities, and gain a competitive edge.

- Develop innovative applications: Whether you envision a next-generation financial trading platform, a smart recommendation engine, or a groundbreaking scientific simulation tool, Idea Usher has the expertise to turn your vision into reality.

Don’t get left behind in the quantitative revolution. Contact Idea Usher today for a free consultation and let’s discuss how we can leverage the power of quantitative programming to propel your business forward.

FAQs

1. What is quantitative programming and how can it benefit my business?

Quantitative programming utilizes mathematics, statistics, and coding to solve complex problems and optimize processes. Idea Usher’s team of experts can leverage this approach to streamline your operations, extract valuable insights from data, and develop innovative applications that give your business a competitive edge.

2. What kind of quantitative programming services does Idea Usher offer?

We offer a comprehensive range of services, including:

- Algorithmic development for financial modeling, risk management, and automated trading.

- Data analysis and visualization to uncover hidden patterns and trends within your data.

- Machine learning integration to create intelligent and adaptive software solutions.

- Building custom applications powered by quantitative algorithms, tailored to your specific needs.

3. Do I need a background in finance or mathematics to benefit from your services?

Not at all! Our team will work closely with you to understand your business goals and translate them into actionable quantitative solutions. We can explain complex concepts clearly and concisely, ensuring you’re fully informed throughout the process.

4. How can Idea Usher help me stay ahead of the quantitative revolution?

Our developers are constantly keeping pace with the latest advancements in quantitative programming and artificial intelligence. We’ll work with you to identify emerging trends and implement cutting-edge solutions that position your business for long-term success.