- AI In Fintech Market Takeaway

- How Are AI And ML Affecting Fintech App Development?

- Benefits Of AI In Fintech App Development For Businesses

- Use Cases of AI in Fintech App Development in 2024

- Challenges That Must Be Overcome In Fintech App Development

- Future Trends Of AI In FinTech

- Examples Of Fintech Startups Using AI

- Tech Stack To Consider To Integrate AI in Fintech App

- Conclusion

- Looking to make an AI-powered fintech app?

- FAQ

Artificial intelligence has played a significant and expanding role and continues to generate a lot of attention in the app development market due to its vast potential.

User expectations are growing as technology progresses. Maintaining competitiveness in the market requires meeting these standards.

Today’s users need functionality together with experiences that are personalized and easy to use. This is the point at which AI in app development becomes useful. In recent years, the fintech sector has used AI to give specific financial insights, strengthen security, and improve consumer experiences.

This blog covers the future of AI in finance, as well as the challenges of app development. But first, let’s look at how the demand for AI is growing in the fintech industry.

- AI In Fintech Market Takeaway

- How Are AI And ML Affecting Fintech App Development?

- Benefits Of AI In Fintech App Development For Businesses

- Use Cases of AI in Fintech App Development in 2024

- Challenges That Must Be Overcome In Fintech App Development

- Future Trends Of AI In FinTech

- Examples Of Fintech Startups Using AI

- Tech Stack To Consider To Integrate AI in Fintech App

- Conclusion

- Looking to make an AI-powered fintech app?

- FAQ

AI In Fintech Market Takeaway

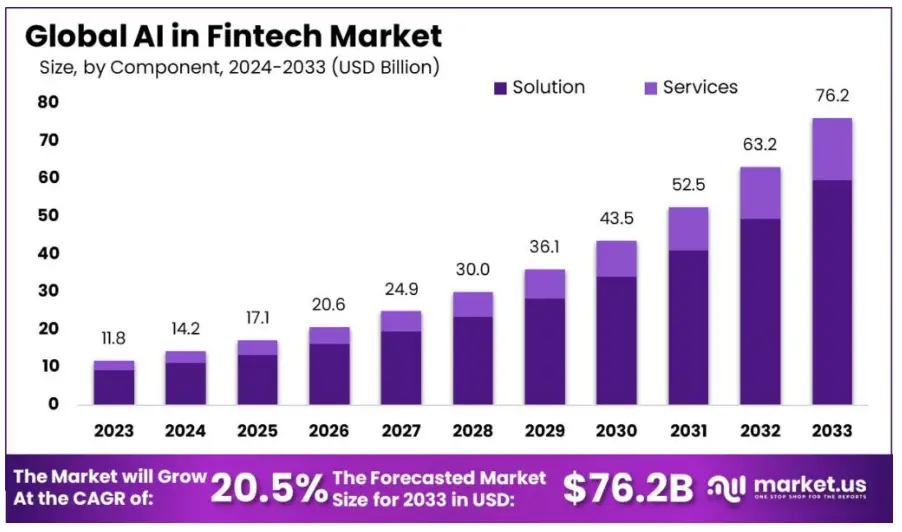

Source: Market.us

The financial sector is surging in AI adoption due to its transformative potential. This growth is fueled by several factors, such as the financial services industry’s increasing digitalization and the need for sophisticated analytics and data-driven choices.

AI in the financial industry offers many services, such as risk analytics, predictive modeling, and trade analytics. These applications are considered essential for enhancing decision-making, effectively managing risks, and streamlining business processes.

How Are AI And ML Affecting Fintech App Development?

Artificial intelligence is a wide concept in which robots mimic human intellect. Machine learning is a subfield of artificial intelligence that focuses on computers learning from data without explicit programming.

AI can be used in a variety of fintech app development situations, including chatbots for customer service and fraud detection. It makes applications smarter, allowing them to figure out user inquiries and respond in intelligent ways.

Compared to that, machine learning helps apps improve over time by learning from user behavior. For example, it can tailor investment suggestions to a user’s tastes.

Thus, although AI gives fintech apps intelligence and flexibility, machine learning is essential to their ongoing development as it learns from data. Despite their similarities, these technologies have different uses, which improve the effectiveness of fintech app development services.

The basic differences between AI vs. ML in Fintech App Development are as follows:

| Feature | Artificial Intelligence (AI) | Machine Learning (ML) |

| Concept | A broader field of intelligent machines | A subset of AI focused on learning from data |

| Techniques | NLP, computer vision, robotics, etc. | Algorithms that improve data |

| Human Intervention | Often requires significant programming | Relies on data patterns, reducing programming needs |

| Applications | Virtual assistants, chatbots, intelligent automation | Fraud detection, personalized recommendations, risk management |

Benefits Of AI In Fintech App Development For Businesses

The rise of artificial intelligence has revolutionized the development of financial technology apps. AI integration brings a wave of advantages that empower both users and businesses. Let’s explore deeper into how these benefits are transforming the fintech landscape.

1. Reduction of Operational Costs

Fintech apps offer broader access to financial services by leveraging AI-powered automation, which significantly cuts operational costs. As these savings often translate to benefits for users, AI becomes a cost-efficient approach for building fintech applications.

2. Increased Interaction with Users

Keeping users engaged is essential in today’s fast-paced world. Attention spans, as highlighted in Usability Engineering, can dip after just ten seconds. Fortunately, Artificial Intelligence offers a solution by providing immediate answers to user queries. This swift response ensures customer satisfaction and fosters a more engaging experience.

3. Improved Payment System

Artificial intelligence is revolutionizing the way we pay. By analyzing vast amounts of data, it can identify suspicious transactions in real time, stopping fraudsters in their tracks. Companies like PayPal leverage this technology to keep your money safe. This translates to faster checkouts and helpful support, making a win-win for both businesses and consumers.

4. Data-Driven Decision-Making

The financial world is getting a makeover, and AI is leading the charge. Fintech companies are using this powerful technology to develop user-friendly financial services that cater to your needs. But it’s not just about convenience. In today’s competitive market, with a vast array of options at your fingertips, fintech businesses recognize the importance of AI-powered decisions. This translates to smarter services and a more informed approach to your financial well-being.

5. Improved Process

Imagine getting instant and reliable answers to your questions 24/7. That’s the power of AI in customer support. By automating repetitive tasks like finding information and answering common inquiries, AI streamlines the workflow. This not only frees up human representatives to tackle more complex issues but also minimizes the chance of errors. The result? A smoother, faster, and more accurate customer support experience for everyone.

Use Cases of AI in Fintech App Development in 2024

AI is now being used to power features that can understand your spending habits, predict future expenses, and even offer personalized financial advice, all presented in a clear and user-friendly way. Here are several use cases of AI in fintech

1. Automated Customer Support

Chatbot technology, powered by AI, is transforming customer support in the fintech industry. These virtual assistants can answer your questions in multiple languages, 24/7, significantly reducing costs and improving your overall experience. This AI revolution is pushing the boundaries of convenience and satisfaction within the world of financial services.

2. Robotic Process Automation

RPA uses software robots to automate tasks like onboarding new customers, verifying security, and processing loans. This frees up fintech companies to focus on what they do best: innovate and deliver exceptional financial services to you. It’s a win-win for both efficiency and security.

3. Personalization

By using AI, the app can analyze your social media habits, spending patterns, and even how you talk about money to recommend products that truly fit your needs. This is the power of AI-based app development. It personalizes your experience, saving you time and money by suggesting the right financial solutions for you.

4. Financial Advisor

By understanding your transactions through a technology called Natural Language Processing (NLP), they can suggest financial products and services tailored to your needs. This innovative approach is making personal finance easier and more accessible, empowering you to make informed decisions about your financial future.

5. Stock Trading

AI-powered trading platforms, often used by robo-advisors, analyze vast datasets to find the best opportunities and make trades at optimal prices. This not only benefits investors by potentially increasing returns, but it also arms analysts with more precise forecasting tools. Trading firms are jumping on board, too, using AI to minimize risks and maximize profits for their clients.

6. Early Fraud Detection

Artificial intelligence (AI) can analyze massive amounts of data to spot suspicious activity that might slip by unnoticed. This allows fintech apps to flag potential fraud early on before any money is lost. By staying ahead of fraudsters, these technologies can help keep your financial information safe and secure.

Challenges That Must Be Overcome In Fintech App Development

While AI promises to revolutionize financial apps, bringing it from concept to reality requires navigating some hurdles. By addressing these challenges, developers can build financial apps that are not only powerful but also trusted and user-friendly.

1. Scalability Issues

Scaling AI systems gets particularly tricky when massive data volumes and growing user demands collide. Imagine a fintech platform stuck with transactions during peak hours. Their existing system might struggle to keep up.

To overcome this hurdle, the platform can leverage techniques like parallel processing, distributed computing, and cloud infrastructure. These tools can significantly boost performance and seamlessly manage even the most demanding workloads.

2. Difficulty in Automating Processes

While AI-powered automation offers significant advantages, identifying the perfect processes for it can be tricky. Unlike simpler automation, AI thrives on learning and continuous improvement.

This means choosing the right tasks within your fintech startup is crucial. Think customer service chatbots, advanced fraud detection, or streamlining various workflows – these are all areas where AI automation can shine.

3. Security

Consider incorporating AI algorithms built with robust security features. These AI safeguards act as a watchful eye, preventing unauthorized access and breaches that could expose sensitive financial information. Remember, security should be the cornerstone of any AI development and implementation within the financial sector.

4. Legal Concerns

The financial industry operates under a comprehensive set of rules designed to protect consumers and ensure the stability of the system. These regulations dictate how financial institutions handle everything from data security to creditworthiness assessments.

Additionally, compliance with regulations like GDPR and HIPAA, which govern data privacy, is mandatory. By adhering to these guidelines, fintech companies can ensure they operate lawfully and build trust with their customers.

Future Trends Of AI In FinTech

As AI continues to evolve, its efficiency in current FinTech applications will not only be maintained but also expanded into exciting new territories. Here’s a glimpse into some of the promising trends shaping the future of AI in FinTech:

1. Natural Language Processing (NLP)

Bridging the communication gap between humans and AI is a key priority for engineers. To enable productive conversations, computers need to become more adept at understanding natural languages, including interpreting context and remembering past interactions with individual users.

2. Deep Learning

Machine learning, the backbone of AI, requires continuous improvement. Deep learning, which utilizes multi-layered neural networks to analyze information, mimics the human brain’s thought processes. This is crucial for FinTech applications, where data processing is at the core of AI’s functionality.

3. Hyper-Automation

A core objective for FinTech companies is maximizing efficiency and profitability. To achieve this, businesses will leverage AI to automate various tasks through the integration of bots within their infrastructure. This hyper-automation will streamline processes, reduce human error, and ultimately lead to a more streamlined FinTech experience.

4. Predictive Analytics

Advancements in machine learning will empower AI to perform more intricate analyses and make data-driven decisions with greater accuracy. This will be particularly beneficial for robo-advisors, risk management systems, and other FinTech applications that rely on precise predictions.

5. Blockchain Integration

The convergence of AI and blockchain technology holds immense potential. By combining their strengths, these technologies can create a future of secure, automated transactions with unparalleled transparency. This integration will be particularly impactful for subscription-based services and other areas that involve regular financial exchanges.

Examples Of Fintech Startups Using AI

Globally, fintech enterprises are competing to use AI to provide cutting-edge financial services and solutions. The following finance enterprises are using AI:

1. Enova

Established in 2011, they use cutting-edge technology like AI and machine learning to create accessible online financial services. Unlike traditional institutions, Enova personalizes its offerings to fit each customer’s unique needs, making it easier for people to get the credit they deserve.

2. Canoe

Founded by Kamil Kowlek, Canoe is a financial technology startup that utilizes artificial intelligence to streamline business processes. Their innovative platform automates tasks like accounting, expense management, and financial reporting to free up valuable time and resources for businesses.

3. ZestFinance

This fast-growing startup specializes in AI-powered underwriting solutions. Their technology utilizes machine learning to provide lenders with a more precise picture of creditworthiness and translates to better-informed lending decisions, ultimately benefiting both lenders and borrowers.

4. Bud Financial

A UK-based fintech company empowers users with a comprehensive financial management platform and offers a variety of services to streamline their financial lives.

Bud offers personalized suggestions for financial products, from inspecting accounts across different banks to providing valuable spending insights, which makes it a one-stop shop for all your financial needs.

Tech Stack To Consider To Integrate AI in Fintech App

Integrating AI into your Fintech app can offer a powerful boost to functionality and user experience. Here’s a breakdown of the tech stack components to consider:

1. Data & Analytics:

- Databases: Secure storage for vast amounts of financial data is crucial. Popular options include PostgreSQL, MongoDB, and MySQL.

- Big Data Frameworks: Apache Spark for complex data analysis, machine learning, and risk assessments. Apache Hadoop for distributed data storage and historical financial data analysis. Apache Flink for real-time analytics on data streams.

2. AI & Machine Learning (ML):

- Libraries & Frameworks: TensorFlow, PyTorch, and scikit-learn are popular choices for building and deploying AI models.

3. Cloud Platforms:

- Cloud Providers: Leverage the scalability and reliability of cloud platforms like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP) to train and deploy your AI models.

4. Other Important Considerations:

- Security: Fintech demands robust security. Implement strong authentication, encryption, and regular security audits.

- Regulatory Compliance: Ensure your AI solutions comply with relevant financial regulations.

- Front-End & Back-End Technologies: Choose technologies that align with your app’s functionalities and user interface needs. Consider frameworks like React Native for a smooth user experience.

Conclusion

The financial services industry is experiencing a boom thanks to the integration of AI, which is impacting everything from space exploration to the apps on our phones.

Financial services can leverage AI’s potential and propel the industry forward. By incorporating AI, financial institutions can achieve smarter risk management, create personalized financial products, and streamline back-office operations.

AI will not only benefit institutions but also empower customers with faster loan approvals, fraud detection, and even automated financial advisors. The future of finance is intelligent, and AI is the key to unlocking its potential.

Looking to make an AI-powered fintech app?

At Idea Usher, we specialize in crafting innovative financial applications that empower users to manage their money with confidence. With over a decade of experience, we understand the complexities of financial technology and the critical need for security and user-friendliness.

Here is a case study of JabaPay; you can read it to gain an idea of our expertise in AI-powered fintech app development.

Our portfolio showcases real-world examples of our success in translating complex financial concepts into user-friendly interfaces that drive engagement and positive financial outcomes.

Let us be your partner in bringing your groundbreaking financial app idea to life with our AI development services.

FAQ

Q. How AI can be used in fintech?

A. AI is revamping financial technology (fintech) by automating tasks, analyzing vast datasets, and identifying patterns invisible to humans. This translates to fraud detection, streamlined loan approvals, and personalized financial advice.

Q. What are the trends in fintech and AI?

A. Fintech trends are being shaped by AI, with a focus on robo-advisors offering automated investment management and chatbots handling customer service inquiries. Regulatory compliance is another area where AI-powered solutions are seen rising.

Q. How is AI being used in financial services?

A. The financial services industry is embracing AI across various functions. From fraud detection and risk management to algorithmic trading and credit scoring, AI is making processes faster, more accurate, and data-driven.

Q. How AI is changing the finance industry?

A. Ultimately, AI is transforming finance by making it more accessible, efficient, and personalized. From everyday banking interactions to complex financial decisions, AI is weaving itself into the fabric of the financial world.

Gaurav Patil