If you are like most people, then you have dollar signs in your eyes whenever you think of money. Your phone vibrates with reminder after reminder about bills that need to be paid or loans that need approval. Thankfully, we have a finance app like Mint to help us out.

One of the biggest trends that are currently going on in the app development industry is the development of personal finance management apps. Such money management apps can help you become an efficient spender and save money.

With the popularity of such finance apps increasing day by day, there are major benefits to creating one. In this blog, we will understand how to develop a personal finance app like Mint.

Fintech: a market review

In 2022, the worldwide fintech market is estimated to be worth USD 133.84 billion. It is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.50% and reach USD 556.58 billion by the year 2030. This indicates a significant expansion in the global market over the forecast period.

The personal finance application marketplace is thriving with many top-notch players. If you have what it takes to build a remarkable app, here are some things to consider before building your personal finance application.

Major players in the fintech industry

Personal finance apps may differ from each other in functionality and focus, but they’re all aimed at the same audience and market segment. The current market leaders in this industry are:

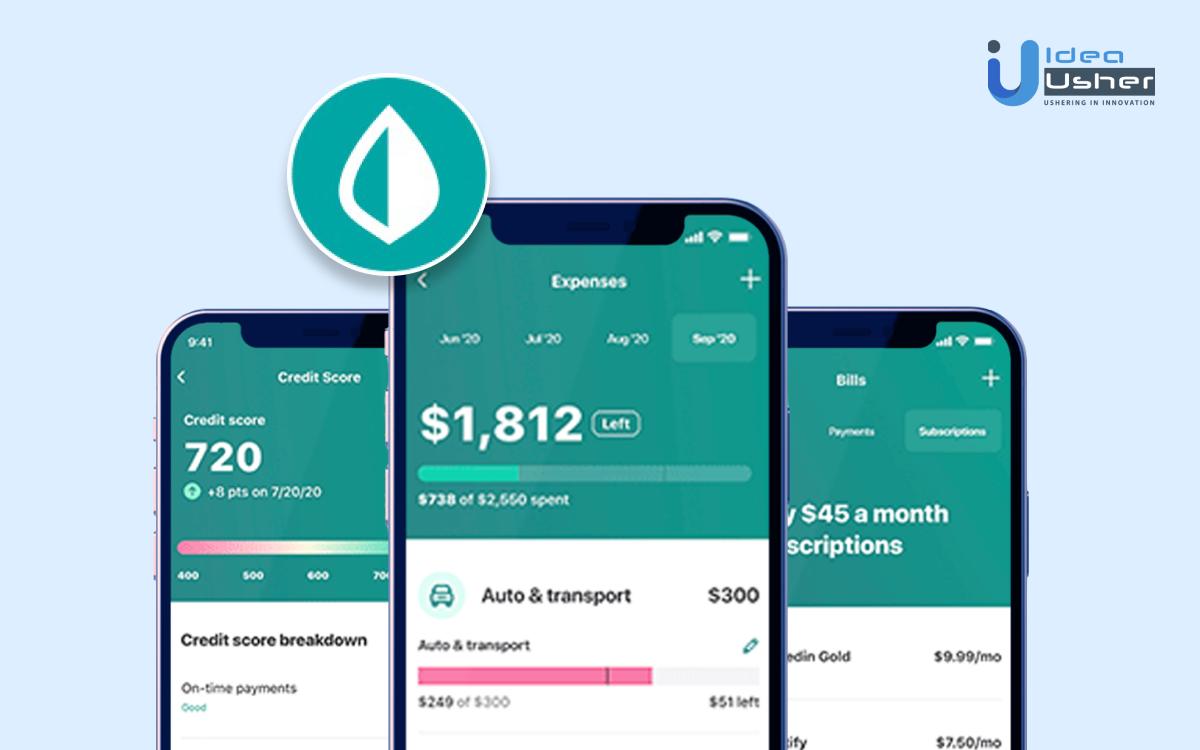

Mint: Personal budget tracking and planning app

| Type | Subsidiary |

| Industry | Personal Finance, Software |

| Founded | 2006 |

| Founder | Aaron Patzer |

| Products | Web application, Mobile application |

| Platforms | iOS, Android |

| All-time downloads (Android) | 10,000,000+ |

| App ratings | 4.5/5 (Google Play Store), 4.8/5 (iOS App Store) |

One of the best free budgeting apps

The Mint app offers you to sync all your bank accounts, credit cards, etc. to help track your income, savings, and more.

Its budgeting app features a daily budget planner that suggests budget goals based on spending. These goals can be later adjusted and/or increased.

Mint automatically updates and categorizes expenses. The user has the option to revise and add categories as and when needed. It also offers to set savings goals and track investments in the app.

You need a budget (YNAB): Budget, Personal Finance Management App

| Type | Personal Finance |

| Industry | Personal Finance, Software |

| Founded | 2004 |

| Founder | Jesse Mecham |

| Products | Web application, Mobile application |

Automatic syncing of your accounts is an extremely helpful feature of YNAB.

The app parses the entire history of your transactions to make it easy to see where your money is going and how much you can afford to save each month.

For example, if you have $700 in your account, you would divide it into sub-categories like ‘groceries’, ‘rent’, or ‘going out’.

So now, every time you have to go out, rather than directly taking out money from your checking account, you can simply deduct the expense from the ‘going out’ tab. If the balance is too low, it will indicate that you don’t have the budget to go out in that period of time.

How does this help? Over time you learn how to scale in your needs and wants and spend accordingly.

Mvelopes: Personal finances and asset reviewing app

| Type | Personal Finance |

| Industry | Personal Finance, Software |

| Founded | 2000 |

| Founder | Nich Thomas |

| Products | Web application, Mobile application |

This app functions around the envelope budgeting method. Similar to what we read above, envelope budgeting is setting aside envelopes of money for different purposes like ‘food’, ‘fees’, etc.

Now, You don’t need to carry around envelopes, but you do need to manage your money wisely. Mvelopes is a web-based personal finance software that helps you get control of your finances via digital envelopes.

They claim that this method helps you to:

- Get a handle on your personal finances and manage to save a part of your income (approximately 10%) from otherwise being spent.

- Attain peace of mind by giving a real-time review of assets under management.

- Build financial freedom

EveryDollar: Personal budget management app

| Type | Personal Finance |

| Industry | Personal Finance, Software |

| Founded | 2015 |

| Founder | Dave Ramsay |

| Products | Mobile application |

With EveryDollar, you can enter your monthly income and budget for expenses. You can add categories that make sense for your spending plan and monitor where you go over or under budget.

EveryDollar gives you a visual overview of your income and expenses, so you can quickly see how much money you have available in each budget category.

PocketGaurd: Personal budget management and tracking app

| Type | Personal Finance |

| Industry | Personal Finance, Software |

| Founded | 2015 |

| Founder | Igor Kuznetsov |

| Products | Mobile application |

The perfect app for overspenders

The app will link to your bank account and automatically calculate how much money you have after setting aside enough for bills, goals, and necessities. You can then keep track of your spending and see all of your accounts in one place.

When you use PocketGuard, the app will let you know exactly how much money you have available to spend. But if you go over budget, it will send you an alert.

Other potential competitors

Banking apps

Banks have recently begun to address the personal finance management segment. Today, almost any banking app has budgeting features. Take Alliant Mobile Banking or Ally Mobile, for instance. This means more competition for you and your product. On the other hand, it also presents an opportunity for you to sell your product to these giants.

Virtual assistants and chatbots

Another growing segment apart from the banking apps and your direct competitors are chatbots and virtual assistants. These can either be found in the form of added features in platforms like banking apps or can be in the form of standalone applications.

By offering features such as budgeting, finance advice, etc. – these chatbots and assistance become a thing to look out for in the Fintech industry.

A younger demographic

Many app users in today’s world are teens (mostly 15-year-olds). Many fintech apps have hence started to target this fact in the smartest way possible.

Finance app like mint chooses to serve this younger audience. The app interface is designed in a manner that suits this audience. You can also see a rise in the number of apps that teach kids and teens how to manage their finances. Some of them include:

- Greenlight

- Plan’it Prom

- BusyKid

C for Cash, C for Crypto

The rise of Cryptocurrencies cannot and should not be ignored.

By enabling crypto wallets to be linked in the same way as bank accounts, the last remaining barrier in the market is removed. This makes managing expenses easier than ever before, and with far more benefits than when using fiat money alone.

Finance app like Mint offers their users to link their Bitcoin accounts and manage them efficiently.

Tap into the market

Personal finance management apps offer users a chance to understand the market and increase financial inclusion. They also teach the users about the best money management strategies and financial literacy – something that the users of today need.

Features of personal finance apps

It’s time to think about a way to surprise your own future users. You ought to build a personal finance app, knowing what functionality it will have.

We suggest that you consider creating such features as:

- User authorization and account creation;

- A personal page with all the information about the user.

- Linking to bank cards and user accounts (if you decide to create a second type of finance mobile apps)

- The ability to track all transactions and store their history;

- Setting a day and month budget. A useful feature that will allow users to save money and plan large purchases.

- Exhaustive financial statistics and detailed analytical reports for a specified period of time. With financial apps, users can compare the amounts spent in different stores (or by different family members).

- Categorization of expenses: “food,” “clothing,” “perfumery,” etc.

- A reminder of obligatory payments, fines, and taxes.

- Interactive search and relevant information.

- Online currency conversion.

- The possibility to make payments on templates.

- Regular payment calendar

Development of an app like Mint

7 tips for creating a powerful financial app

A successful personal finance management app must have extended functionality, and we’ve already discussed the issue thoroughly. However, this is not enough to attract the maximum number of users and interest them in your program. There are 7 more points to think through before starting personal finance app development.

#1. Security is a must

It’s crucial not only to build a personal finance app but also to ensure its security. People should trust you and know that data on their money is being protected.

What are “secure financial apps”?

Two-factor authentication. The user identity is being verified through two independent channels:

- username (login) & password or a secret encrypted value (1st protection factor);

- PIN code or a password for one-time use (2nd protection factor).

Encryption of transmitted and stored information at the level of the data channel. These can be a standard SSL protocol.

Session mode. Also, it’d be smart of you to provide short-term sessions (meaning with a limited lifetime) in order to maximally avoid situations when programs are running unprotected (of course, we’re talking about client-server apps).

Additional tips:

You should carefully display private user information which a person wouldn’t be happy to see stolen. This means catchy large fonts can be beautiful but undesirable when it comes to financial saving apps.

Don’t trust open-source libraries implicitly. The exceptions are time-tested libraries with a well-deservedly high reputation (like the Realm database).

It’s also undesirable to use closed-source cryptographic libraries because such solutions don’t allow checking their reliability and efficiency.

Of course, this is only a part of the recommendations regarding mobile and web protection. Moreover, technologies are being constantly evolved, and developers are inventing more sophisticated methods to improve the security of money management software apps.

#2. Think as your users

It would seem obvious: you’ll have to deal with people facing finance management problems. However, there are nuances. If you remember, we mentioned that the target audience of the Acorns service is millennials: users aged 18 years and up to 34 years. That is, the brand focuses on them and speaks in their language.

Analyze your potential user, try to start thinking as he does, and then create an app for personal finance according to his needs.

#3. Simplicity

People aren’t fond of unnecessarily complex programs, especially if it’s about their money (after all, any mistake here is fraught with unpleasant consequences). So simple finance apps are your key to the user’s liking and loyalty.

The golden rule says that 3 clicks (or taps) should be enough to lead the user to the desired (say, he’d like to see statistics or something else, no matter what). Keep it in mind when building the finance management app.

And one more important point. Some money management apps offer the possibility of payment, and such a procedure is more complicated than it seems at first glance. You should check all the data properly without tiring the user or confusing him.

Related Read: How To Create A Payment App: A Comprehensive Guide | Idea Usher

You have 2 ways to solve the problem:

a single screen containing all the key information required for user verification and conducting transactions. However, such a page may be too complicated.

several screens which consistently lead the user to the cherished goal, step by step. Do your best to find a middle ground and create the minimum number of screens allowed.

#4. Thoughtful UX design

The 4th rule follows logically from the previous one since the application simplicity implies, among other things, an appealing and clean design. Users avoid programs with an obscure interface overloaded with details. You need to ask the advice of an experienced UI/UX expert who will tell you how to create a financial app able to attract customers with its design.

And remember, UI/UX trends are changing, and app design should change with them to go with the times.

Thoughtful UX design

Take a look at another personal finance app concept; we hope it’ll inspire you!

#5. 24\7 customer support

Sooner or later, one of your users may face a certain problem, and we’ll contact you with a question related to the operation of your financial management software. Your task is to respond as quickly as possible.

And be ready to stay in touch round the clock, providing 24\7 customer support.

#6. Mobility

Today, there are a lot of devices for mobile banking and finances management, and you should satisfy users of all of them. It means you need to create a powerful financial app that works with both iOS and Android platforms (and if it also supports Windows devices, it’d be splendid!). Take this necessity into account in the development process.

#7. Start small

If you don’t have a sufficient finance software app budget, start small – build an MVP model.

Related Read: What is MVP minimum viable product: development stages, benefits.

Financial app development process:

1. Identify Your Target Audience

The finance app is an engaging medium that allows you to build up a lot of trust in your brand. It gives you the ability to demonstrate expertise in finance, which in turn will lead to building trust with your audience.

But before you can attract anyone to your app, you need to know who it is you want to reach.

Where are they located?

How old are they?

Do they have children?

Where do they live?

These questions are important because the answers will help determine what kinds of information you’ll be presenting in your app.

2. Conduct Research on Competitors

This step is important because it helps you to know what your competitors are up to. It is crucial that you conduct thorough research on the competition and their app.

Once an idea has been generated, the next step is to undertake some thorough research of competition. It’s important to note that the goal of this research is not to copy competitors but rather to find out what they are doing well and what can be improved upon.

3. Identify the Platform

So, you have a great idea for a finance app. Great! Now what?

To build a successful app, you have to identify the problem your new app will solve. What is it about the existing solutions that are keeping users from achieving their goals? Are there any new technologies on the horizon that would make this experience easier? Can you solve a problem that has been overlooked by other financial apps?

4. App Designing & Development

Building a finance app means that you have to learn about the various methods and technologies that can be used in building a financial app for a customer.

From the front end to the back end, there are some important techniques and technologies that need to be understood before building a finance app.

So, what are the steps involved in building a finance app?

Understand your customers

It is very important to know who your customers are and how they use their smartphones. This will help determine the type of features and design that you need in your app. Also, you’ll need to understand whether they’re ready to pay for your services or if they want something for free.

Create wireframes

A wireframe is basically a blueprint of how your future app is going to look like. It doesn’t have any color or graphics but it has essential elements such as headers, navigation buttons, and so on. You can create wireframes using pen and paper or software tools such as Balsamiq.

Create mockups

A mockup is like a prototype of the finished product. It’s something that looks like the actual product but it’s not functional yet. You can create mockups using software such as Photoshop or Figma.

UI/UX Designing

The design of a finance app is a very important step. A nice-looking app will always increase the number of downloads, and it will also encourage users to spend more time in the app. This is the reason why companies have started putting more effort into the UX and UI design of their app.

Backend/ Frontend designing

Frontend/backend coding steps are the same for any finance app. The backend coding is done with PHP, while the frontend is done with HTML, CSS, and JavaScript, or Swift. But, the steps are different for each type of app. For instance, if you are dealing with a stock market app, then backend coding will be more important because it will contain all the business logic.

5. Testing

The most important thing before you go live with your app is to find out if it is working as desired by running a test version on your local development environment.

Testers usually use a combination of manual and automated testing to simulate real user scenarios and validate that the application behaves as expected and produces the desired results.

The tests can be run on different levels – from UI (user interface) to integration tests, which include database interaction. It is done to make sure that the app is error-free and runs smoothly before it goes live.

6. App Marketing

After building a finance app, you need to market it. For this purpose, you need to choose the right marketing strategies and channels for your finance app. We at Idea Usher make sure that we provide post-development marketing services so that the app establishes itself perfectly in the market.

Final Take:

Working on a finance app or any other app? The team of experts from Idea Usher would be happy to help you to build the best finance app for you. We have been working with our clients to develop their ideal apps for years, and we have been able to create the most amazing apps for them. You can check our portfolio and know yourself!

We have experience in developing several finances and other niche-specific apps And we can help you create a high-quality app that will skyrocket your business. We have made the finance app development process as smooth as possible by using the best tools and practices. So it will be much easier for you to create an amazing app in record time with us!

For more information about app development services, contact us.

FAQs

Q. Which is the other best investment app like Mint?

A, Personal Capital is another investment app that works similarly to Mint and is a popular choice among people.

Q. Which is considered a good idea for finance app development?

A. There are thousands of app possibilities in the fintech market. However, a few ideas like P2P lending, personal finance, and banking are some of the most trending app businesses in the current times.

Q. What are banking apps?

A banking app brings your bank to your doorstep! You can conduct all your banking transactions through this app. Many banking apps are popular in the market, like Bank of America, Westpac, etc. They have built-in security features and keep customer data safe.

Q. Is finance app development a budget-friendly app idea?

A. Yes! Choosing the right development team that values your time and money is the key to building a feasible app. A fintech app gives assured returns and therefore is generally considered a good business idea.