In today’s rapidly evolving digital landscape, the intersection of technology and finance has revolutionized the way individuals manage their money.

With the proliferation of smartphones and the increasing dependence on digital solutions for everyday tasks, the demand for finance apps has surged dramatically.

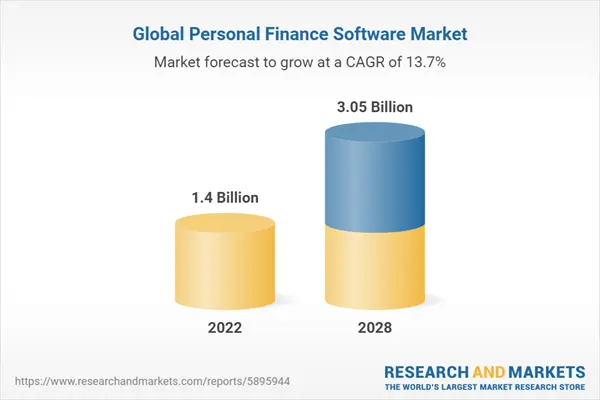

Source: ResearchAndMarkets

Given the importance and value of financial literacy in today’s world, developing a finance application like Zogo appears to be a desirable goal. Zogo’s success in combining financial education with gamification is an appealing model for others to follow.

Building such an app requires the combination of several skills, including expertise in finance, technological competency, and a thorough understanding of user interaction.

This blog will help you through the complex process, from defining your platform’s essential objective to addressing difficulties such as safely integrating financial data for developing a financial app like Zogo.

- What Is A Zogo App?

- Why Are Financial Apps Like Zogo Are In Demand?

- Business Benefits Of Developing An App Like Zogo

- Must-Have Features In A Finance App Like Zogo

- Advanced Features For Financial Applications

- How To Develop A Finance App Like ZOGO?

- Top 5 Financial Apps Like Zogo In The Market Right Now

- Cost Affecting Factors To Consider To Develop An App Like ZOGO

- Tech Stack To Consider To Develop An App Like ZOGO

- Conclusion

- How Idea Usher Can Help Develop An App Like Zogo?

- FAQ

What Is A Zogo App?

Zogo is an engaging application geared towards assisting young adults in acquiring financial literacy while also rewarding them for their learning efforts. Tailored particularly for Gen Z individuals who may lack sufficient financial education from traditional schooling, Zogo offers easily digestible lessons on essential financial topics such as taxes and savings.

Within the app, users can explore brief and accessible lessons presented in manageable increments of knowledge. After completing a lesson, users take enjoyable quizzes to assess their understanding. Successful quiz completion earns them ‘pineapples,’ a virtual currency that can be exchanged for gift cards at popular retailers like Target, Nike, Amazon, and others.

Zogo further enhances the learning experience through Pineapple Parties, where users can earn additional pineapples by answering more questions. Moreover, users can invite friends and family to join the app, earning even more pineapples in the process, and creating a synergistic environment where learning about finance is both rewarding and enjoyable.

Market statistics indicate Zogo’s significant impact, with its impressive ranking of 102nd in the educational sector in the USA. Additionally, the app has experienced steady user growth of 10% over the five-year period from 2019 to 2023 and has amassed a market valuation of approximately US $120K thus far.

Why Are Financial Apps Like Zogo Are In Demand?

Explore reasons behind the surging demand for financial apps like Zogo, highlighting how they address the growing need for financial education in a rapidly evolving digital landscape.

1. Gamification

Zogo and similar apps use gamification techniques to make learning about personal finance fun and engaging. By turning financial education into a game with rewards and challenges, users are more motivated to participate and learn.

2. Accessibility

These apps provide easy access to financial education for people of all ages, particularly younger individuals who may not have had much exposure to personal finance concepts. The convenience of having financial education available on a smartphone makes it more accessible to a broader audience.

3. Incentives and Rewards

Zogo incentivizes learning by offering rewards such as gift cards or discounts to users who complete financial education modules or quizzes. This not only encourages users to engage with the app but also reinforces positive financial behaviors.

4. Financial Literacy

There’s a growing awareness of the importance of financial literacy, especially among younger generations. With rising student loan debt, increasing credit card usage, and other financial challenges, there’s a greater need for tools and resources to help people make informed financial decisions. Apps like Zogo address this need by providing accessible and engaging financial education.

5. Partnering with Financial Institutions

Many apps like Zogo partner with financial institutions or educational organizations to expand their reach and offer more comprehensive financial education resources. These partnerships can provide additional credibility and resources to the app, making it more attractive to users.

Business Benefits Of Developing An App Like Zogo

Developing an app like Zogo, which gamifies financial education, can bring several business benefits:

1. Acquisition and Retention of Customers

Gamification attracts users, particularly younger demographics, who are drawn to engaging and interactive experiences. By offering a fun and educational platform like Zogo, you can attract new customers and retain existing ones by providing value-added services beyond traditional banking products.

2. Brand Distinction and Positioning

In a competitive market, offering a unique and innovative solution like a gamified financial education app sets your brand apart. It positions your company as forward-thinking, tech-savvy, and genuinely interested in the financial well-being of your customers, enhancing brand loyalty and attracting positive attention from the media and industry.

3. Data Insights and Personalized Marketing

By analyzing user behavior within the app, you can gather valuable insights into their financial habits, preferences, and knowledge gaps. Leveraging this data allows you to personalize marketing efforts, tailor product offerings, and provide targeted financial advice, ultimately increasing conversion rates and customer satisfaction.

4. Partnerships and Revenue Streams

Collaborating with financial institutions, educational organizations, or even other businesses looking to promote financial literacy can open up partnership opportunities. These partnerships can lead to additional revenue streams through licensing agreements, sponsored content, or affiliate marketing arrangements, further monetizing the app and expanding its reach.

Must-Have Features In A Finance App Like Zogo

To create a successful finance app that resonates with users, it’s essential to incorporate essential features that streamline the learning process and foster engagement. In this section, we’ll explore the must-have features of a finance app like Zogo,

1. Streamlined Registration Process

In today’s landscape, many app sign-up processes involve cumbersome formalities. Simplify your app’s registration feature by requiring only essential information such as name, phone number, and email. Utilize OTP verification for added security. Following sign-up, prompt users to provide additional details, if necessary.

2. Comprehensive Learning Modules

A pivotal feature for your financial literacy app is its Learning Module. Clearly outline available courses and their respective modules to facilitate easy access for users. Categorize courses effectively to enhance navigation and ensure a seamless learning experience.

3. Engaging Trivia Challenges

Upon course completion, engage users with trivia challenges. These tests serve as checkpoints for users’ comprehension and retention. If users don’t qualify initially, prompt them to revisit the material before attempting the trivia again, ensuring mastery before progressing.

4. Accessible Offline Resources

Enhance user convenience by offering offline access to e-books, video tutorials, and other study materials. This feature empowers users to continue learning even without an internet connection, promoting uninterrupted progress toward financial literacy goals.

5. Informative Dashboard

Provide users with a comprehensive dashboard presenting their course history, ongoing progress, and earned rewards. Transparently display earned ‘pineapples’ and their redemption status, fostering a sense of accomplishment and motivation.

6. Incentivized Rewards System

Implement a reward system akin to Zogo’s ‘pineapple’ rewards. Offer incentives for various achievements such as test qualification, course completion, and referrals. Users can redeem these rewards for e-books, subscriptions, or at partnered establishments, enhancing engagement and loyalty.

7. Responsive Help & Support

Ensure seamless communication between users and your app with real-time help and support options. Enable in-app chat, email, and phone support to promptly address user queries and concerns, fostering a positive user experience and bolstering customer satisfaction.

Advanced Features For Financial Applications

To offer a cutting-edge user experience and stay competitive in today’s dynamic market, integrating advanced features is essential. Explores several advanced features tailored to enhance user engagement, convenience, and overall satisfaction within financial applications.

1. Integration of Social Media Sharing

In today’s digital age, individuals seek to share their accomplishments on social media platforms with their circle. Integrating social media sharing functionalities into your application can facilitate users in connecting their accounts and sharing achievements with friends and family. This feature not only enhances user engagement but also serves as a means to promote your app across various social media channels.

2. Diverse Payment Options

To ensure maximum convenience for users, your application should offer a range of payment methods. Whether users opt for credit cards, PayPal, or cryptocurrencies, your app should accommodate their preferences seamlessly. By providing multiple payment options, users can bid farewell to payment complexities and enjoy the flexibility they desire.

3. Implementation of AI-Powered Assistant

Elevate user experience by incorporating advanced financial guidance through an AI-powered assistant within your app. This assistant delivers tailored insights, round-the-clock support, and real-time market analysis, empowering users to make informed decisions and manage their finances proficiently. Collaborating with an artificial intelligence development firm can assist you in integrating this feature seamlessly into your app.

4. Introduction of Gamification Elements

Transform financial learning into an engaging experience by introducing gamification elements within your app. Users can earn rewards and badges as they complete challenges, making the learning process more enjoyable and motivating. By gamifying financial education, your app becomes more enticing and interactive for users.

5. Adoption of Multi-Language Support

Embrace diversity by incorporating multi-language support into your app. Regardless of users’ geographical locations, your application should cater to their linguistic preferences, providing seamless financial assistance and education in their native language. This ensures a personalized and tailored experience for users worldwide.

How To Develop A Finance App Like ZOGO?

From market research to monetization strategies, and technological considerations to user engagement tactics, this guide provides a roadmap for crafting a robust and impactful application in the financial education realm.

A. Conducting Market Research

Conduct thorough research to understand user needs, competitor landscape, and market trends to identify opportunities and challenges.

1. Exploring the Market Landscape for Learn-and-Earn Applications

Before initiating the development process, it’s imperative to gather insights into user engagement within the learn-and-earn app market. Conducting thorough market research will entail analyzing user demographics, growth trends, and market size, particularly in the realm of financial education apps like Zogo.

2. Identifying Target Demographics and Addressing Their Needs

A crucial initial step involves pinpointing the target demographic and understanding their specific requirements. This can be achieved through diverse methods such as polls, surveys, and interviews to cater effectively to the financial literacy needs of both millennials and Gen Z users.

3. Conducting Competitive Analysis in the Learn-and-Earn App Sector

For the development of a fintech application aimed at facilitating learning and earning simultaneously, it’s essential to conduct a comprehensive competitive analysis within the same category. Key competitors such as Zogo, NerdWallet, Onomy, and GravyStack should be examined to ascertain their standout features and functionalities.

B. Establishing Your App’s Concept

Clearly outline the features, functionalities, and value proposition of your finance app to meet user demands effectively.

1. Defining Core Features and Functionalities

Identifying the essential features and functionalities to incorporate into our app is crucial. We’ll examine existing financial education apps to understand basic features and consider adding advanced functionalities to enhance user engagement and attract a broader audience. Let’s compile a comprehensive list to discuss with our development partner.

2. Establishing Clear Learning Objectives

In crafting an app akin to Zogo, it’s imperative to establish distinct learning objectives for users. These objectives outline the specific financial data users should grasp within a defined timeframe, encompassing topics such as loans, credit management, budgeting skills, and requirements to pass trivia tests to progress to higher learning levels. Well-defined goals not only guide users’ progress but also serve as a motivating factor, fostering continued engagement and enabling users to acquire valuable financial knowledge effectively.

C. Monetization Strategies

Explore various revenue streams such as in-app purchases, subscription models, or advertisements to generate sustainable income.

1. Exploring Diverse Revenue Models

Selecting the appropriate monetization strategy for your application is crucial for generating revenue. To design the optimal monetization approach, consider the following methods:

- Freemium Model: Offer basic features for free while charging for premium features or content.

- Free Trial: Provide a limited-time trial period for users to experience the full functionality of the app before requiring payment.

- Subscription Model: Charge users a recurring fee for continued access to premium features or content.

- Advertisement Integration: Generate revenue by displaying ads within the app.

- In-App Store: Offer additional content, features, or virtual goods for purchase within the app.

- Partnership Initiatives: Collaborate with external entities such as banks or businesses to provide added value to users and generate revenue through partnerships.

2. Zogo’s Monetization Approach and Key Insights

Zogo generates revenue by forming partnerships with banks and credit unions. Their app educates users about financial literacy, and financial institutions pay Zogo to attract younger customers. Zogo discovered that blending financial education with entertainment can be both enjoyable and financially rewarding, fostering smarter saving and spending habits for all users.

3. Choosing the Optimal Strategy for Your App

Selecting the most suitable monetization strategy involves careful consideration of various factors. It is essential to experiment with different approaches, monitor performance metrics closely, and adapt the strategy based on user feedback and market trends to determine the most effective monetization model for your app.

D. Selecting the Technology Stack

Choose appropriate technologies, frameworks, and APIs for backend, frontend, and database development to ensure scalability and performance.

1. Choosing the Ideal Tech Stack for App Development

Selecting the appropriate technology stack for app development is akin to solving a complex puzzle. A misstep in this process can result in inefficient development and hindered app performance.

It is imperative to enlist the expertise of top app developers to guide the selection of a suitable tech stack. Opt for a stack capable of seamlessly supporting both static and dynamic components of your app, ensuring smooth performance even amidst user growth or feature expansions.

2. Exploring Backend, Frontend, and Database Technologies

Choosing the right tech stack is instrumental in expediting the development process. Begin by determining whether to focus on Android, iOS, or cross-platform development. Subsequently, engage in discussions with your development team regarding backend, frontend, and database technologies to gain insights into optimal choices. Numerous options exist for each aspect, offering varied strengths for your financial literacy app.

3. Prioritizing Scalability and Security in Tech Selection

Emphasizing scalability and security in your tech choices is paramount. Scalability guarantees that your app can accommodate growth without succumbing to crashes as user numbers increase. Likewise, robust security measures safeguard sensitive data, shielding it from potential breaches. These decisions contribute to the creation of a dependable and secure app, crucial for fostering user satisfaction and ensuring long-term success.

E. Crafting Design and Enhancing User Experience (UX)

Create an intuitive and visually appealing interface with smooth navigation to enhance user satisfaction and engagement.

1. Creating Intuitive UI/UX for a Learn and Earn App

Developing a user-friendly interface is essential for ensuring an enjoyable user experience in your learn and earn app. The design should be straightforward, allowing users to effortlessly navigate through its various features. Since your app caters to both millennials and Gen Z users, it should strike a balance between captivating Gen Z users and being user-friendly for millennials.

2. Enhancing Engagement with Gamification Elements

Integrating gamification elements adds depth to your app’s design and enhances user engagement. Features such as rewards, badges, and challenges make the app more interactive and enjoyable to use. Users feel motivated to explore and participate, leading to a more dynamic and satisfying experience. Ultimately, this improves overall app design and boosts user retention.

F. Enhancing User Engagement and Retention

Implement features like gamification, personalized recommendations, and loyalty programs to keep users engaged and loyal.

1. Enhancing User Engagement through Community Features

Incorporating community features can significantly enhance user engagement and retention. By enabling users to connect, share, and discuss, you foster a sense of belonging within your platform. This fosters enduring relationships, encouraging users to return for social interaction, thus fostering sustained engagement and loyalty.

2. Implementing Effective Notification Systems

Incorporating a notification feature is essential for boosting customer retention. Customized pop-ups or messages serve as gentle reminders, prompting users to revisit your app or website. These notifications maintain user interest and encourage regular usage, thus contributing to higher retention rates.

3. Effective Strategies for Sustaining User Engagement

Utilizing intelligent strategies to sustain user engagement is vital for enhancing overall user experience and retention rates. Consistently providing fresh content, rewards, and interactive features enriches users’ experience on your platform, encouraging repeated visits and fostering a strong bond that nurtures user loyalty and long-term commitment.

G. Ensuring Security and Privacy Measures

Prioritize data encryption, secure authentication, and compliance with regulations like GDPR to build trust and protect user data.

1. Protecting User Privacy and Confidential Information

Ensuring the safety of your information within a learning and reward application such as Zogo is of utmost importance. Robust security measures, including encryption and firewalls, are employed to safeguard user data. There is a commitment to refrain from sharing or selling personal information, allowing users to engage in learning and earning activities with confidence. Employing blockchain development further enhances data security within the app.

2. Implementing Measures Against Cheating or Abuse

In a financial literacy application like Zogo, addressing the threat of data breaches is imperative. Utilizing robust defenses is essential to thwart attempts by hackers to access user information illicitly. Regular security assessments and updates are conducted to maintain the app’s integrity, ensuring user data remains confidential and their learning experiences are protected.

H. Implementing the Development Process

Adopt Agile methodologies for iterative development, collaborate closely with cross-functional teams, and maintain code quality with version control.

1. Agile Development Principles

Agile development methodologies, as exemplified in the creation of apps like Zogo, can be likened to constructing with LEGO bricks. Rather than constructing the entire product at once, the process is broken down into small, manageable sections known as “sprints.” Each sprint represents a piece of the puzzle, wherein you build, test, and refine individual components iteratively.

2. Minimum Viable Product (MVP) Strategy

Engaging an Android app development company to initiate the MVP phase of your app mirrors the process of developing a rudimentary model with fundamental features. The focus is on constructing the core elements necessary for functionality. Though simplistic, this version provides a tangible representation of the app’s intended purpose. Subsequently, additional features and functionalities can be integrated to enhance its effectiveness and utility.

3. Prototyping and Quality Assurance

Within the Zogo app development journey, prototyping and testing are pivotal stages. Prototyping involves crafting a preliminary version of the app to assess its functionality. Subsequent testing is conducted to identify and rectify any bugs or issues encountered. This iterative process continues until the app achieves a state of being free from bugs and glitches.

I. Performing Testing and Ensuring Quality Assurance

Conduct rigorous testing, including functional, performance, and security testing, to ensure a bug-free and reliable app experience.

1. Importance of Comprehensive Testing

Thorough testing of an application is paramount. Ensuring every aspect functions flawlessly is essential. Testing serves to detect and rectify any issues, guaranteeing smooth operation for users. Neglecting testing can result in crashes and errors, ultimately leading to user dissatisfaction. Effective testing maintains the reliability and enjoyability of the application.

2. Bug Detection and Resolution

Bug detection and resolution within an application are akin to identifying and correcting flaws in a masterpiece. When users encounter issues, they report them, prompting developers to investigate and debug the problems. This process enhances the functionality of the application and enhances the user experience.

3. Beta Testing Involving Real Users

Beta testing involving real users provides invaluable insights into an application’s performance. It allows for early evaluation of functionality and user experience. Real users provide feedback, suggesting improvements such as the addition of new levels. This feedback loop contributes to the refinement and enhancement of the learning application for all users.

J. Introducing Your App to the Market

Plan a strategic launch with effective marketing campaigns, app store optimization, and user feedback mechanisms for a successful debut.

1. Pre-launch Marketing Tactics for a Financial Literacy App

Before introducing a financial literacy app similar to Zogo, it’s essential to execute robust pre-launch marketing strategies. Initiate promotional campaigns across various social media platforms to generate interest among the intended audience. Tease potential users with sneak peeks and hints to pique their curiosity. Additionally, consider organizing contests or giveaways to captivate user attention and collaborate with influencers for broader outreach. A well-crafted pre-launch strategy lays a solid foundation for future success.

2. Enhancing App Store Visibility through ASO Techniques

To ensure your learn and earn app gains visibility in the competitive app store landscape, prioritizing app store optimization (ASO) is imperative. Select precise and pertinent keywords for your app’s description to enhance its discoverability. Craft an attention-grabbing app icon and utilize high-quality screenshots for effective illustration. Consistently update your app with enhancements to maintain relevance. ASO facilitates increased app downloads by enabling more users to find and install your app.

3. Iterative Monitoring and Enhancement of Launch Strategies

Post-launch, it’s vital to continuously monitor the performance of your app and refine your strategies accordingly. Stay attuned to user feedback and reviews, implementing necessary improvements based on their suggestions. Keep track of download metrics and user engagement data to iteratively refine your marketing approach. Maintaining flexibility and responsiveness is crucial to fostering the growth and success of your app following its launch.

K. Acquiring Users and Marketing Strategies

Utilize social media, content marketing, influencer partnerships, and ASO techniques to attract and retain a sizable user base.

1. Utilizing Digital Marketing Tactics

Utilizing a variety of digital marketing channels can greatly benefit your app’s promotion. Commence with social media advertising to broaden your app’s audience reach. Employ email marketing to maintain user engagement and awareness. Additionally, collaborate with influencers to boost brand visibility and garner attention from diverse audiences.

2. Harnessing Partnerships and Collaborations

Forming partnerships with businesses targeting similar audiences can be a strategic move to promote your app. Implement cross-promotional strategies to expand your respective customer bases. Through collaboration, you can extend your outreach, foster credibility, and enhance the appeal of your app to a broader demographic.

3. Zogo’s Approaches to User Acquisition

Zogo employs astute techniques to attract a significant user base to its app. Offering incentives and rewards incentivizes users to download and engage with the app. The company prioritizes social media advertising to effectively target its intended audience. Additionally, forging partnerships with educational institutions and organizations aids in spreading awareness. By infusing the app with elements of enjoyment and rewards, Zogo successfully entices users and cultivates their ongoing engagement with financial education.

L. Planning for Scaling and Future Growth

Prepare for scalability by optimizing server infrastructure, monitoring user feedback, and continuously innovating to meet evolving market needs.

1. Strategies for App Growth and Sustainability

To ensure the optimal performance of a financial learning application, it’s crucial to consistently scale its operations. This entails not only expanding hardware resources like servers and infrastructure but also updating software and app content regularly. Continuous updates to content and features are vital for maintaining user engagement and satisfaction as the user base grows.

2. Exploring International Markets

Expanding your app’s reach to international markets presents significant opportunities for growth. Collaborating with influencers or organizations can facilitate the promotion of your app in different countries, enabling it to reach a wider audience. Global expansion allows apps like Zogo to disseminate financial knowledge across borders and expand their user base globally.

3. Diversifying Revenue Streams

Diversifying revenue streams is essential for ensuring the financial sustainability of your app and enhancing user value. In addition to traditional advertising, offering premium subscription tiers with added features, establishing partnerships with financial institutions for referral fees, selling educational content such as e-books, and creating financial literacy-related merchandise are all viable strategies to explore.

Top 5 Financial Apps Like Zogo In The Market Right Now

Financial apps aim to empower users with greater control over their finances and help them achieve their financial goals with ease. Let’s delve into the world of finance apps and discover how they can revolutionize the way we manage our money.

1. Digit

Digit is a savings program that automatically collects funds on your behalf. It uses an algorithm to analyze your purchasing habits and automatically deposits tiny amounts into a specified savings account. You have the freedom to set your own savings goals and adjust the program to your interests. While Digit has a free version, there is an optional premium subscription that provides access to individualized financial advice and the services of a financial adviser.

2. Qapital

Qapital is an educational finance software designed for children and teenagers, promoting financial literacy through interactive elements. Gamification enables users to receive virtual prizes for performing activities, conserving money, and learning about financial principles. These awards can subsequently be utilized for a variety of objectives, including stock investments, charity donations, and purchases. Qapital provides a free version for up to three children, with the option of upgrading to a premium membership that unlocks extra features and allows you to include more children.

3. Acorns

Acorns function as an investment app that facilitates investing spare change from everyday purchases. By rounding up transactions to the nearest dollar, it allocates the difference into a diversified portfolio comprising ETFs. Users can also establish recurring investments and customize their investment objectives. While Acorns offers a free version, an optional premium membership grants access to features like financial advice and personalized investment strategies.

4. Stash

Stash operates as an investment platform simplifying the process of investing in fractional shares of stocks and ETFs. With a low entry threshold of just $1, users gain access to a range of investment options. Stash also provides educational materials to enhance users’ understanding of investment concepts. While Stash does require a monthly subscription fee, a free trial option is available for new users.

5. YNAB

YNAB, or You Need A Budget, functions as a budgeting application aimed at helping users monitor their spending habits and achieve their financial objectives. Employing a zero-based budgeting approach, every dollar of income is assigned to specific categories before the start of each month. YNAB offers a monthly subscription model, accompanied by a free trial period for users to explore its features.

Cost Affecting Factors To Consider To Develop An App Like ZOGO

Developing an app like Zogo requires careful consideration of various factors to ensure its success in the competitive mobile application market. Understand each factor in detail:

1. Platform for the App

When considering the platform for developing an app like Zogo, it’s essential to evaluate the advantages and disadvantages of targeting iOS, Android, or both platforms simultaneously. By opting for both iOS and Android, the app can reach a broader audience, maximizing its potential user base. However, this approach also entails higher development costs compared to focusing on a single platform.

2. Features of the App

The success of an app like Zogo hinges on its ability to offer engaging and educational features that make learning about personal finance enjoyable for users. Key features such as quizzes, educational content, leaderboards, rewards, and community engagement play a crucial role in driving user engagement and retention. However, incorporating such features comes with its own set of challenges, including increased development complexity and costs.

3. Developer’s Location

The location of the development team can significantly impact the overall cost and success of developing an app like Zogo. Outsourcing development to offshore teams in regions with lower labor costs, such as India or Eastern Europe, can offer cost savings but may pose challenges related to communication barriers, time zone differences, and cultural nuances. Conversely, opting for onshore development in regions like North America or Western Europe may entail higher hourly rates but offers advantages in terms of proximity, cultural alignment, and legal protection.

4. Technology Stack

Choosing the right technology stack is a critical decision that can significantly impact the development process, scalability, and long-term maintenance of an app like Zogo. Factors such as performance, scalability, security, and developer expertise should be carefully evaluated when selecting frameworks, libraries, and infrastructure components. Leveraging open-source technologies and frameworks can help reduce development costs by capitalizing on existing resources and community support.

Tech Stack To Consider To Develop An App Like ZOGO

To develop an app like Zogo, which is a financial education and gamified platform, you would need to consider various technologies and components. Here’s a tech stack you might consider:

1. Mobile App Development

- iOS: Swift programming language with Xcode IDE

- Android: Kotlin or Java with Android Studio IDE

2. Backend Development

- Server-side programming: Node.js, Python (Django or Flask), Ruby on Rails, or Java (Spring Boot)

- Database: PostgreSQL, MySQL, MongoDB (for NoSQL), or Firebase Realtime Database

- RESTful API: Express.js (Node.js), Django REST Framework (Python), Spring Boot (Java)

3. Cloud Services

- Hosting: Amazon Web Services (AWS), Google Cloud Platform (GCP), Microsoft Azure

- Database Hosting: Amazon RDS, MongoDB Atlas, Google Cloud SQL

4. Payment Integration

- Payment Gateway: Stripe, PayPal, Braintree

- In-app Purchases: Apple App Store (iOS), Google Play Billing (Android)

5. Security

- User Authentication: JWT (JSON Web Tokens), OAuth

- Data Encryption: HTTPS (SSL/TLS), AES encryption for sensitive data

- App Security: Regular security audits, OWASP guidelines adherence

6. Data Analytics and Reporting

- Analytics Platform: Google Analytics, Mixpanel, Firebase Analytics

- Data Visualization: Chart.js, D3.js, Plotly

7. Gamification Features

- Game Engine: Unity (for 3D games), Phaser, Cocos2d-x (for 2D games)

- Leaderboards and Achievements: Custom development or using platforms like Google Play Games Services, Apple Game Center

8. Content Management System (CMS)

- WordPress with custom plugins

- Contentful

- Strapi

9. Push Notifications

- Firebase Cloud Messaging (FCM)

- Apple Push Notification Service (APNS)

10. Monitoring and Logging

- AWS CloudWatch

- Google Cloud Logging

- ELK Stack (Elasticsearch, Logstash, Kibana)

11. Testing and Continuous Integration/Continuous Deployment (CI/CD)

- Testing Frameworks: Jest (for JavaScript/Node.js), XCTest (for Swift/iOS), Espresso (for Kotlin/Android)

- CI/CD Tools: Jenkins, Travis CI, CircleCI

12. Version Control

- GitHub

GitLab - Bitbucket

13. Customer Support and Communication

- Chat Support: Intercom, Zendesk Chat

- Email Services: SendGrid, Amazon SES

Conclusion

The surge in popularity of finance learning apps like Zogo underscores a growing interest among both Gen Z and millennials in enhancing their financial literacy. These apps offer a convenient way to acquire knowledge from the comfort of one’s home or any location of choice. The development of a learn-and-earn app similar to Zogo presents numerous advantages worth considering.

To get started, you’ll need to partner with an experienced app developer with knowledge of a relevant tech stack. This ensures that your app’s functionality and user experience are enhanced by smoothly integrating critical and sophisticated features.

You can successfully boost your financial literacy platform to new heights by harnessing the experience of experienced experts, allowing users to enhance their knowledge and abilities in efficiently managing their finances.

How Idea Usher Can Help Develop An App Like Zogo?

Idea Usher, a reputable software and mobile app development firm is eager to help create an app similar to Zogo. Using our knowledge, we simplify the process, making it smooth and efficient.

With a proven track record of success and recognition in the industry, we specialize in crafting cutting-edge fintech applications that cater to diverse personal finance needs.

Our team is equipped to transform your concept into a fully realized personal finance app, complete with advanced functionalities and an intuitive user interface, ensuring optimal money management for your users.

By working with us, you can rest assured that your personal finance app will continue to evolve and thrive in an ever-changing digital landscape, empowering users to take control of their finances with confidence and ease.

Contact us today to understand more about how we can help you with our app development services.

FAQ

Q. What is Zogo and what does it offer?

A. Zogo is a finance app designed to educate users, particularly younger generations, about personal finance through gamification. It offers various educational modules, quizzes, and rewards to engage users in learning about topics such as budgeting, saving, investing, and more.

Q. What features need to be included in a finance app like Zogo?

A. Key features to consider include user profiles, educational modules, interactive quizzes, progress tracking, leaderboards, rewards systems (such as points or virtual currency), social sharing capabilities, notifications for new content or challenges, and integration with financial tools like budget trackers or investment platforms.

Q. What technologies businesses should use for developing an app like Zogo?

A. The choice of technologies depends on factors like your development team’s expertise, budget, and scalability requirements. Typically, a combination of programming languages (such as Swift for iOS, Kotlin for Android, or React Native for cross-platform development), backend frameworks (like Django, Node.js, or Ruby on Rails), and database systems (such as MySQL, MongoDB, or PostgreSQL) is used.

Q. How do ensure security and privacy for app users?

A. Security measures should include encryption for sensitive data, secure authentication methods (such as multi-factor authentication), regular security audits, and compliance with relevant data protection regulations (like GDPR or CCPA). Additionally, providing clear privacy policies and obtaining user consent for data collection and usage is crucial.

Q. How businesses can monetize a finance app like Zogo?

A. Monetization strategies may include offering premium subscriptions with access to exclusive content or features, integrating affiliate marketing for financial products or services, displaying targeted advertisements, partnering with financial institutions for referral commissions, or offering in-app purchases for virtual goods or premium content. It’s essential to balance monetization with user experience and trust.

Gaurav Patil