In today’s economy, people have held onto many significant assets in their names and acquired them to gain profits, maintain a portfolio, or earn or generate profits and income. Still, these assets are always prone to significant risks that can cause losses worth millions of dollars. So to protect these assets, insurance comes into play.

Insurance is available for the smallest to the most significant assets ranging from phones to cars and machines to buildings. The possibility of getting insured is endless, and insurance is a must to protect assets from any significant loss; thus, the insurance industry is growing rapidly.

Since the insurance industry has been at a peak and people have been getting insured, it is estimated that at a global level, the amount of premium that was collected in the year 2022 was estimated at 7 trillion dollars, which was a 40 percent increase from the premium collected in the year 2022.

Cars have become a necessity in the fast-moving world more than a luxury today, and owning a car can be a risk, risk including accidents, thefts, and damages; thus, major companies like State Farm Insurance are responsible for holding a major stake in auto insurance in the United States alone.

So if you are looking forward to building an insurance application for yourself, here is a guide.

So let us start without any further ado.

What Exactly is State Farm Insurance: Looking in Depth

Before we get onto the building part of the app, it is important to understand the company alone. Thus, here is some information about the company.

State Farm Insurance is a leading insurance company in the United States that offers a wide range of insurance products and financial services. The company was founded in 1922 by George J. Mecherle, a retired farmer who believed in the importance of providing affordable insurance to rural communities. Today, State Farm has grown to become the largest insurer of cars and homes in the United States, with over 58,000 employees and more than 19,000 agents serving customers across the country.

Below are the major features of the company let us discuss them below.

Products and Services

State Farm offers a range of insurance products, including auto, home, life, and health insurance. The company also offers business insurance, which includes property, liability, and worker’s compensation coverage for small businesses. In addition, State Farm provides financial services such as mutual funds, annuities, and banking products like checking and savings accounts, credit cards, and loans.

Customer Service

State Farm prides itself on providing excellent customer service. The company has a large network of agents who are available to help customers with their insurance needs. Customers can also manage their policies online through the company’s website and mobile app. State Farm also has a 24/7 customer service hotline that customers can call for assistance.

Community Involvement

State Farm is committed to giving back to the communities it serves. The company has a long history of supporting education, safety, and community development initiatives. State Farm also encourages its employees to volunteer and get involved in community service projects.

Thus to conclude, State Farm Insurance is a trusted and reliable insurance provider that has been serving customers for over 100 years. With a wide range of insurance products and financial services, State Farm is well-equipped to meet the needs of individuals, families, and businesses. The company’s commitment to excellent customer service and community involvement has helped it build a strong reputation as a leader in the insurance industry.

Developing an Insurance App: Factors Affecting the Process

Here are the major factors that can affect the cost and process of developing an insurance application; let us discuss them in detail.

Factor #1: Platform

One of the most significant factors affecting the cost of developing an auto-insurance app is the platform you choose. There are two primary platforms to choose from: iOS and Android. Each platform has its own set of features and benefits, and your app development budget will vary depending on the platform that you choose. Here are some key differences between the two platforms:

iOS

Developing an app for iOS can be more expensive than developing an app for Android. This is because the development process for iOS is more complex, requiring specialized skills and knowledge. Additionally, iOS devices are generally more expensive than Android devices, which can impact the overall cost of app development.

Android

Developing an app for Android is generally less expensive than developing one for iOS. This is because the development process for Android is more straightforward, and there are more developers available who are familiar with the platform. Additionally, Android devices are generally less expensive than iOS devices, which can impact the overall cost of app development.

Factor #2: Choosing a Team Type

Choosing between an in-house development team and outsourcing to a third-party company is an important decision that can impact the cost of app development. Here are some pros and cons to consider

In-house team

If you choose to develop your app with an in-house team, you will have complete control over the development process. However, this comes at a higher cost, as in-house teams require a lot of overhead, including salaries, benefits, and office space.

Outsourcing

Outsourcing your app development to a third-party company can be more cost-effective than hiring an in-house team. This is because outsourcing companies can offer competitive pricing due to their economies of scale. Additionally, outsourcing can save you time, as you won’t have to spend time recruiting and training an in-house team.

Factor #3: Choosing the Team Location

- The location of the team can also impact the time zone differences, which may affect communication and collaboration during the development process.

- Choosing a team in a different country or culture may also introduce differences in work styles, communication norms, and expectations that may require additional effort to navigate.

- While outsourcing to a team in Asia can offer cost savings, it’s important to carefully evaluate the quality of work, expertise, and experience of the team to ensure they can meet your project needs.

- On the other hand, choosing a team in the United States or the UK may offer some advantages, such as greater familiarity with the target market, regulatory requirements, and industry standards. However, this may come at a higher cost.

- Ultimately, the decision of where to outsource the development of your app will depend on a variety of factors, including your budget, project requirements, and preferences for communication and collaboration.

- It’s important to thoroughly research and evaluate potential teams, regardless of their location, to ensure they can deliver high-quality work and meet your project goals within your budget and timeline.

Factor #4: Features and Functions Integrated in the App

The cost of developing an auto insurance app is heavily influenced by the features that you choose to include in your app. The more features you include, the more expensive it will be to develop your app. This is why it’s important to carefully consider the features that you want to include in your car insurance business app before you start the development process.

Payment Gateway

Including a payment gateway is a must-have feature for any auto insurance app. This feature allows customers to make payments directly through the app, making the payment process more convenient and secure.

Chatbot

Another feature that can be very useful is a chatbot. A chatbot can help customers quickly get answers to their questions and resolve any issues they may have. However, this feature can be expensive to implement and may require ongoing maintenance.

GPS Tracking

GPS tracking can be a useful feature for auto insurance apps, allowing customers to track their vehicle’s location and monitor driving behavior. However, this feature can be costly to implement and may require additional hardware and software.

Customization

Customization is another important factor to consider when developing an auto insurance app. The more customization options you provide, the more complex and costly the app will be to develop. However, offering customization can help your app stand out from the competition and provide a better user experience for your customers.

Essential Features to Include in Your Auto Insurance App

Here is a list of major features that are a must-have in your auto insurance app and should be appealing to users.

Adding the Vehicle Information

Vehicle information is a critical feature to include in any auto insurance app, whether it’s developed for Android or iOS. This feature allows users to easily input their vehicle details and find relevant insurance policies that meet their needs. By reducing the time and effort required to search for insurance policies, this feature can greatly enhance the user experience and improve customer satisfaction.

Here are some additional benefits of including vehicle information in your auto insurance app:

Accuracy

By allowing users to input their vehicle information directly into the app, you can ensure that the policy recommendations provided are accurate and tailored to their specific needs.

Convenience

This feature also offers the convenience of not having to manually enter their vehicle details each time they search for insurance policies, which can save time and effort for the user.

Customization

Additionally, including vehicle information in your app can allow for greater customization of policy recommendations, taking into account factors such as the make and model of the vehicle, driving history, and other relevant information.

Push Notification Feature

Push Notification is an important feature that must be included in any automobile insurance app. It serves as a reminder for users to renew their insurance policies and also helps insurance companies to market their services more effectively.

Here are some tips to help you build the best push notification strategy for your automobile insurance app:

Personalization

Personalizing your push notifications can greatly increase their effectiveness, as users are more likely to engage with content that is relevant and tailored to their interests and preferences.

Timing and Frequency

Timing and frequency are important considerations when sending push notifications. Avoid sending notifications during non-business hours or too frequently, as this can lead to user frustration and potentially result in users disabling push notifications altogether.

Clear Messaging

The messaging used in your push notifications should be clear, concise, and compelling. Use language that resonates with your target audience, and avoid using technical jargon or overly complex language.

Incentives and Promotions

Offering incentives and promotions through push notifications can be a powerful way to increase engagement and drive conversions. However, make sure that these incentives are relevant and valuable to your users, and avoid being too pushy or aggressive in your messaging.

Documentation

Documentation is a key feature that must be included in any auto insurance app. This feature allows users to upload images of important documents such as driver’s license, vehicle registration, and insurance certificates directly through the app. This makes the registration process easier and more convenient for users, saving them time and effort.

In addition, allowing users to upload images of their documents reduces the risk of errors and improves the accuracy of the information provided. This ensures that the insurance policies are properly issued and reduces the chances of disputes and claim rejections.

Overall, including a documentation feature in your auto insurance app can greatly enhance the user experience and make the process of purchasing and managing insurance policies much more streamlined and efficient.

Location Integration

Geolocation is a crucial feature for any auto insurance app that wants to provide a seamless and personalized experience to its users. With geolocation, drivers can easily find nearby service stations, repair shops, or hospitals in case of an emergency. It also helps insurance companies to track vehicles and assess risks accurately, which can result in more personalized insurance policies.

Furthermore, geolocation data can be used for geo-based marketing, which allows insurance companies to target users based on their location and behavior. For example, if a driver frequently parks their car in an area with a high crime rate, insurance companies can offer them a more comprehensive insurance policy that covers theft or vandalism.

However, it’s important to ensure that the geolocation feature is implemented securely and with user privacy in mind. Users must be given full control over their location data and how it is shared. It’s also essential to comply with local regulations and laws governing the collection and use of geolocation data.

Overall, incorporating geolocation into your car insurance app can significantly enhance the user experience and provide valuable data for insurance companies to improve their services.

Features Option

To cater to the diverse needs of users, it can be advantageous to include a filter option in your car insurance app. This allows users to customize their search results and view only the insurance packages that meet their specific requirements. By providing this level of customization, you can improve the overall user experience and increase the likelihood of users choosing your app for their insurance needs.

Option to Review Policy

Policy Details are an important feature that should be included in any auto insurance app. This feature allows users to access all the relevant details related to their insurance policies in one place, making it easier to manage and keep track of their coverage.

Here are some key pointers to consider when implementing the Policy Details feature in your auto insurance app:

Easy Access

Ensure that users can access their policy details quickly and easily within the app without having to navigate through multiple screens or menus.

Policy Information

Include all relevant policy information, such as the policy number, type, effective and expiration dates, and the vehicles covered under the policy.

Premium Details

Provide users with access to premium details, including the amount due, payment history, and any outstanding balances.

Claims History

Allow users to view their claims history, including any past claims they have made and the status of current claims.

Document Upload

Enable users to upload and store important insurance documents, such as policy certificates and proof of insurance, within the app.

Customer Support

If you’re in the auto insurance market, adding a customer support option to your app is a great idea. This allows users to get real-time solutions to their queries, building better relationships with insurance companies. While this feature can attract users, it’s not the only thing that matters. The technology stack of the mobile app is what brings these features to life.

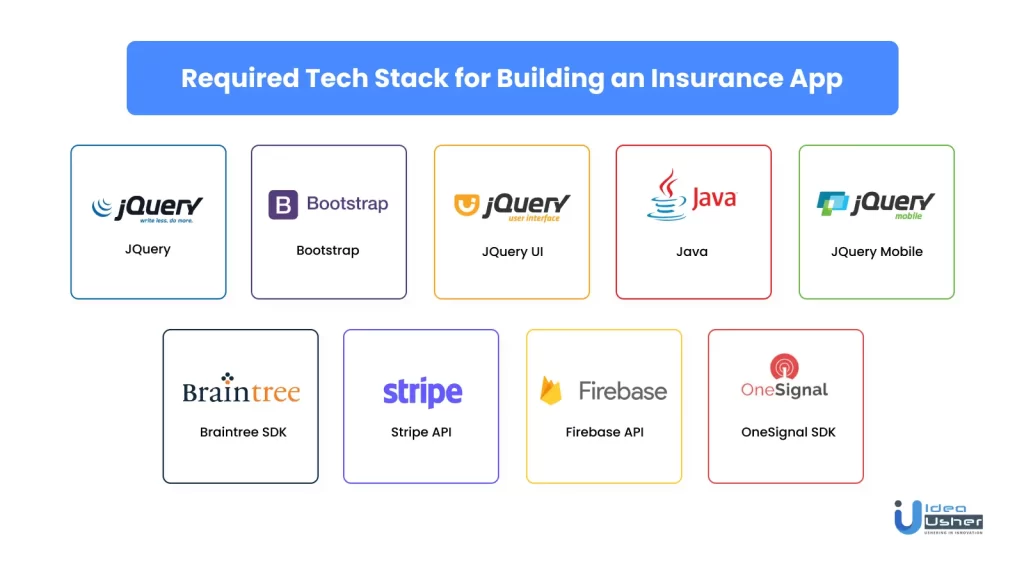

Required Tech Stack for Building an Insurance App

Application and Data

JQuery

A fast, small, and feature-rich JavaScript library used for DOM manipulation and event handling.

Bootstrap

A popular front-end development framework that provides a responsive grid system, CSS styles, and JavaScript plugins.

JQuery UI

A collection of user interface widgets, effects, and themes built on top of JQuery.

Java

A popular programming language used for developing desktop, web, and mobile applications.

JQuery Mobile

A framework that allows for the creation of mobile-friendly websites and applications using HTML, CSS, and JavaScript.

Ensighten – A tag management system to manage and deploy marketing and analytics tags across a website or application.

Utilities

Braintree SDK

A software development kit that allows developers to integrate Braintree’s payment gateway and merchant services into their applications.

Stripe API

A set of APIs that allows developers to integrate Stripe’s payment processing and management services into their applications.

Firebase API

A platform that provides developers with a set of tools and services for building mobile and web applications, including authentication, real-time database, storage, and messaging.

OneSignal SDK

A software development kit that allows developers to integrate push notifications and in-app messaging into their mobile and web applications.

Conclusion

Building an app like State Farm Insurance can be a great way to attract and retain customers in the auto insurance market. With the right features and technology stack, your app can offer users a seamless experience while accessing insurance information and customer support.

To build a successful app like State Farm, it’s important to start with a clear understanding of your target audience and their needs. This will help you determine what features and functionality to include in your app. Consider adding features like a claims center, roadside assistance, and customer support to provide users with a comprehensive experience.

In addition to features, the technology stack of your app is crucial for ensuring a smooth and intuitive user experience. Look for a team of experienced developers who can build your app using cutting-edge technologies like AI and machine learning to provide personalized recommendations and support to users.

If you’re looking to build an app like State Farm, Idea Usher is here to help. Our team of skilled developers and designers can bring your dream app to reality with a focus on providing a seamless and intuitive user experience. Contact us today to get started on building your own successful auto insurance app.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQ’s

Q. What are some key features to include in an app like State Farm Insurance?

A. Some key features to include in an app like State Farm Insurance are claims filing, policy information access, roadside assistance, customer support, and personalized recommendations based on user data.

Q. What is the technology stack required for building an app like State Farm Insurance?

A. The technology stack required for building an app like State Farm Insurance includes programming languages like Java and Kotlin, database management systems like MySQL, cloud computing platforms like AWS, and frameworks like React Native.

Q.How long does it take to develop an app like State Farm Insurance?

A. The time required to develop an app like State Farm Insurance depends on several factors, such as the complexity of the features, the size of the development team, and the level of customization required. On average, it can take anywhere from 3 to 12 months to develop such an app.

Q. How much does it cost to build an app like State Farm Insurance?

A. The cost of building an app like State Farm Insurance depends on several factors, such as the features, the level of customization, the size of the development team, and the geographic location of the development team.

Q.How can I ensure that my app, like State Farm Insurance, is successful?

A. To ensure the success of your app, like State Farm Insurance, it’s important to conduct thorough market research to understand your target audience and their needs. Additionally, you should focus on creating a seamless and intuitive user experience, leveraging the latest technology and trends, and continually improving and updating your app based on user feedback. Finally, marketing and promotion efforts are also important to increase visibility and attract new users.