- Car Insurance Market Size

- What Is A Car Insurance App?

- How Does A Car Insurance App Work?

- Types Of Car Insurance Apps

- Use Cases Of Car Insurance Apps

- Latest Trends To Look In Car Insurance App Development

- Business Benefits Of Developing A Car Insurance App

- Must-Have Features In A Car Insurance App

- How To Develop A Car Insurance App?

- Cost Affecting Factors To Consider To Develop A Car Insurance App

- Top 5 Car Insurance Apps In The Market Right Now

- Tech Stack To Consider To Develop A Car Insurance App

- Conclusion

- FAQ

The global pandemic has shown us that mobile apps and digital tools are no longer just nice to have—they’re essential.

The insurance industry has a clear trend toward using mobile-first technologies. Nowadays, having an app gives a strong competitive edge, and soon, it will be a must-have. An all-in-one app is a very effective way to offer insurance services.

Mobile apps help car insurance business save money on support and operational costs, gather more data, gives detailed insights about the customers, automates tasks like processing claims, boosts user interaction, and increases earnings.

Businesses in the car insurance industry looking to expand their services and benefit from digitalization through mobile apps can explore the important aspects of developing a car insurance app such as steps, essential features, factors affecting the cost, and more.

- Car Insurance Market Size

- What Is A Car Insurance App?

- How Does A Car Insurance App Work?

- Types Of Car Insurance Apps

- Use Cases Of Car Insurance Apps

- Latest Trends To Look In Car Insurance App Development

- Business Benefits Of Developing A Car Insurance App

- Must-Have Features In A Car Insurance App

- How To Develop A Car Insurance App?

- Cost Affecting Factors To Consider To Develop A Car Insurance App

- Top 5 Car Insurance Apps In The Market Right Now

- Tech Stack To Consider To Develop A Car Insurance App

- Conclusion

- FAQ

Car Insurance Market Size

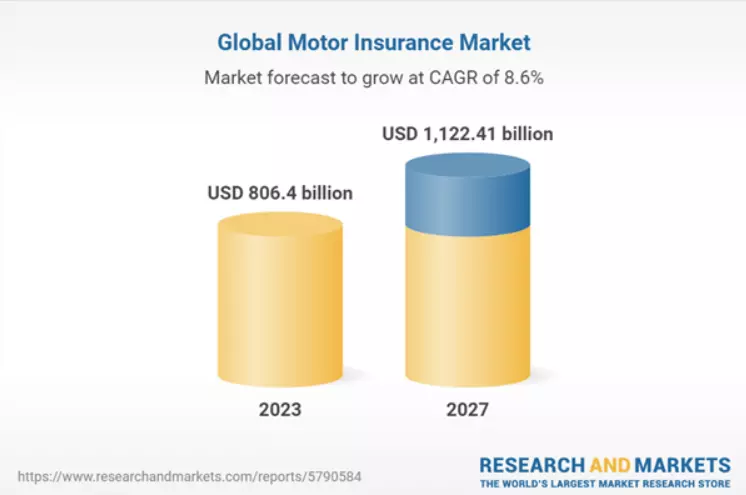

Image Source: Researchandmarkets.com

A boosting vehicle insurance market size is a good indicator for new and established firms. It denotes a significant need for insurance services, leaves flexibility for innovation and customization, and promotes healthy competition, which can accelerate industry advancement.

Businesses can seize the opportunity to develop tailored insurance products, incorporate advanced technologies, and introduce customer-centric features in response to the varied needs of a growing and dynamic market.

What Is A Car Insurance App?

A car insurance app is a mobile application designed to facilitate various aspects of the car insurance process, offering users a convenient and efficient way to manage their auto insurance policies. Insurance companies typically provide these apps to their policyholders, allowing them to access and control their insurance-related activities from the convenience of their smartphones.

Users can view their policy details, coverage information, and premium payments. The app often provides tools to make policy adjustments, such as updating personal information or adding and removing vehicles from the coverage. This real-time accessibility empowers users to stay informed about their insurance status and make necessary changes without traditional paperwork or phone calls.

These apps are typically offered by insurance companies and serve as a digital interface for policyholders to access various services related to their auto insurance coverage.

How Does A Car Insurance App Work?

A car insurance app works by providing a digital platform for users to manage various aspects of their car insurance policies. The specific functionalities can vary between insurance apps, but here is a general overview of how a typical car insurance app works:

1. User Registration

Car insurance apps begin by facilitating the user registration process, ensuring a seamless onboarding experience. Users download the app from the relevant app store and provide necessary details such as personal information and policy specifics during registration. This information is securely stored to create a user account, enabling personalized access to policy-related features.

2. Policy Access

Upon successful registration, users can log in to the car insurance app to gain immediate access to vital policy information. The app serves as a centralized hub where users can review comprehensive details about their car insurance policies, including coverage limits, premium amounts, and policy duration. This instant accessibility enhances transparency and empowers users to stay informed about their coverage.

3. Claims Submission

In the unfortunate event of an accident or damage to the insured vehicle, users can leverage the app to initiate the claims process efficiently. The app guides users through the necessary steps, prompting them to provide incident details, upload photos, and submit any required documentation. This streamlined claims submission process expedites response times and enhances user convenience.

4. Premium Payments

Car insurance apps prioritize user convenience by offering a secure platform for managing premium payments. Users can easily view their premium amounts within the app and choose from multiple payment options, such as credit/debit cards or bank transfers. This functionality ensures that users can fulfill their financial obligations conveniently and on time.

5. Digital ID Cards

To eliminate the hassle of carrying physical ID cards, car insurance apps provide users with the ability to access and display digital copies directly from the app. This not only ensures that users can quickly verify their coverage when needed but also contributes to a more eco-friendly and paperless insurance experience.

6. Coverage Information

Car insurance apps go beyond basic policy details by offering comprehensive information about coverage options, deductibles, and any additional features associated with the insurance policy. This detailed breakdown empowers users to make informed decisions about their coverage and understand the extent of protection offered by their insurance plan.

7. Roadside Assistance

In situations requiring immediate assistance, some car insurance apps feature integrated roadside assistance services. Users can request help directly through the app, reporting emergencies or breakdowns. This valuable feature enhances user safety on the road and reinforces the app’s role as a versatile tool for car-related contingencies.

8. Policy Renewal

To ensure continuous coverage, car insurance apps incorporate features that notify users about upcoming policy expirations. Through reminders and notifications, users are prompted to initiate the policy renewal process seamlessly within the app. This proactive approach helps users avoid lapses in coverage and ensures ongoing protection.

9. Communication and Support

Effective communication is facilitated through messaging features and direct access to customer support services within the car insurance app. Users can seek clarification on policy-related queries, resolve concerns, or receive assistance promptly. This two-way communication channel enhances the overall customer experience and fosters a sense of trust between the user and the insurance provider.

10. Security Measures

Recognizing the sensitivity of the information handled, car insurance apps implement robust security measures. Encryption protocols and other security features are employed to safeguard user data, ensuring the confidentiality and integrity of personal and policy-related information. These measures are crucial for building user trust and compliance with data protection standards.

Types Of Car Insurance Apps

From money-saving applications to time-efficient tools and risk-reducing platforms, these apps offer a range of features to enhance the driving experience and promote safer roads. Here are car insurance app types:

1. Money-Saving App

Money-saving car insurance apps focus on enhancing user driving efficiency and reducing overall costs. These applications offer valuable tips to users on driving safely, optimizing fuel consumption, and locating nearby gas stations with the best prices. In addition to providing helpful insights, these apps often reward users for adopting safe driving practices and behaviors that decrease the risk of accidents.

These apps can also serve as reminders for policy renewals and other insurance-related tasks, making them multifunctional tools for cost-conscious and safety-conscious drivers.

2. Time-Saving App

Time-saving car insurance apps aim to streamline the driving experience for users by offering features that save both time and effort. These applications help drivers plan optimal routes to their destinations by considering real-time traffic conditions and other relevant factors. By providing efficient navigation, these apps contribute to minimizing travel time and enhancing the overall user experience.

Additionally, these apps facilitate swift policy registration, ensuring that users can access insurance coverage without unnecessary delays.

3. Risk-Reducing App

Risk-reducing car insurance apps are designed to empower drivers with insights and guidance that minimize the likelihood of accidents. These apps provide users with safe driving tips, guides, and educational content to enhance driving skills and promote responsible behavior on the road.

By offering real-time advice and alerts, these apps contribute to creating a safer driving environment. Users can proactively adopt measures to reduce risks and avoid potential accidents, fostering a culture of safety.

Use Cases Of Car Insurance Apps

Car insurance apps have transformed the landscape of auto coverage, introducing innovative functionalities that cater to the evolving needs of policyholders. The notable use cases of car insurance apps are as follows:

1. Policy Management

Efficient policy management is a hallmark feature of car insurance apps, empowering policyholders to effortlessly navigate and update their coverage details. Through user-friendly interfaces, individuals can easily access policy documents, review coverage specifics, and make necessary personal information updates. This streamlined communication channel fosters a convenient platform for interactions between insurers and customers, enhancing overall user experience.

2. Claims Processing

Car insurance apps revolutionize the claims processing experience by offering users a seamless and digital way to report accidents. With the ability to submit photos of damages and real-time tracking of claim status, these apps significantly reduce paperwork and expedite resolution times. This digital transformation not only benefits policyholders but also modernizes the entire claims management process for insurers, promoting efficiency and transparency.

3. Telematics and Driving Behavior Analysis

Modern car insurance apps leverage telematics to monitor driving behavior, utilizing smartphone sensors or connected devices. This data-driven approach allows insurers to assess risk accurately and determine personalized insurance premiums. For users, this means gaining insights into their driving habits, creating transparency, and incentivizing safer driving practices.

4. Digital ID Cards and Proof of Insurance

The shift towards digital ID cards in car insurance apps eliminates the need for physical documents, providing users with quick and eco-friendly access to critical information. This feature enables policyholders to present proof of insurance directly from their mobile devices, ensuring convenience while contributing to sustainable practices.

5. Roadside Assistance

Car insurance apps with integrated roadside assistance features offer users a lifeline in emergencies. From flat tires to dead batteries, users can swiftly request help through the app, enhancing the overall customer experience by providing quick and efficient solutions to unexpected situations.

6. Premium Payment and Billing Management

The convenience of making secure premium payments and managing billing within a car insurance app is a key benefit for policyholders. Through automated payments, billing reminders, and streamlined payment method management, these apps ensure timely payments, reducing the risk of policy lapses and contributing to financial stability for both insurers and users.

7. Vehicle Maintenance and Services

Some car insurance apps extend their functionality beyond traditional offerings by incorporating features related to vehicle maintenance. Users can receive alerts for scheduled maintenance, access their vehicle’s service history, and even locate nearby service centers. This comprehensive approach addresses both insurance and vehicle care needs, providing a holistic platform for users.

8. Usage-Based Insurance (UBI)

Car insurance apps supporting usage-based insurance bring a personalized touch to coverage plans. By tailoring premiums based on individual driving patterns, users exhibiting safe driving behaviors can enjoy discounted rates. This approach fosters a more equitable and customized insurance pricing strategy, aligning with the evolving needs and expectations of modern consumers.

Latest Trends To Look In Car Insurance App Development

From advanced technologies like blockchain and machine learning to user-friendly features like on-demand insurance, these trends are reshaping the industry and enhancing the overall user experience.

1. Business Process Automation

The integration of automation technologies enhances customer experiences by providing quick and responsive services, contributing to a competitive advantage in the insurance market.

Automating key business processes, such as customer support through chatbots, claim processing, and transaction processing, leads to operational efficiencies, faster service delivery, and ultimately, a more cost-effective final product.

2. All-in-One Convenience

The adoption of an all-in-one approach within car insurance apps is a growing trend aimed at enhancing user convenience. By consolidating various services into a single mobile application, insurers can save time for both themselves and their customers. This eliminates the need for customers to contact insurance agents or visit physical offices, as they can access all offers and services directly through the mobile app.

3. Data Analysis and Risk Assessment

Harnessing the power of data analysis for risk assessment is a prominent trend in car insurance app development. With access to customer data from smart systems in their cars, insurers can track driving behavior, assess crash risks, and gather additional information such as vehicle technical status and mileage.

This data-driven approach, known as usage-based insurance, allows companies to tailor insurance plans to individual driving behaviors.

4. Blockchain Integration

The use of blockchain in car insurance app development contributes to a more secure and efficient ecosystem for managing insurance-related information. Blockchain allows insurers to record data on contracts, customers, and insurance claims in an immutable and independent database. This not only ensures data integrity but also creates a transparent and traceable system, bolstering trust between insurers and policyholders.

5. On-Demand Insurance Services

On-demand insurance apps cater to situations where individuals, for instance, renting a car, need temporary coverage promptly. These apps enable users to input trip details and obtain instant insurance coverage for specific durations, offering flexibility and convenience. This trend aligns with the changing lifestyle preferences of users who seek insurance solutions tailored to their immediate needs.

6. Machine Learning and Big Data Integration

The integration of machine learning and big data is instrumental in car insurance app development, particularly for automation, risk assessment, forecasting, and audience segmentation. Machine learning algorithms, coupled with vast datasets, empower insurers to process information about their customers dynamically.

Business Benefits Of Developing A Car Insurance App

Developing a car insurance app offers significant business advantages, revolutionizing the insurance industry by leveraging technology to streamline operations, reduce costs, and enhance customer engagement. The detailed benefits of car insurance app development are as follows:

1. Streamlined Operations with Reduced Workforce

Developing a car insurance app allows companies to automate various processes, leading to increased operational efficiency and the potential for a smaller workforce. With automated tasks such as claim processing and customer support through the app, the need for a large number of employees diminishes. This streamlining not only improves the speed and accuracy of operations but also reduces labor costs, contributing to overall business savings.

2. Cost-Efficient Operations

The implementation of a car insurance app brings tangible cost-saving benefits to businesses by eliminating the need for extensive customer support, traditional marketing channels, and paperwork. Mobile apps provide a cost-effective platform for customer interaction, allowing users to access information, file claims, and engage with services seamlessly. The reduction in paperwork and manual processes not only cuts operational expenses but also enhances the environmental sustainability of the business.

3. Opportunities for Upselling Through Mobile App

A car insurance app opens avenues for upselling additional products and services directly to the user base. By strategically integrating upsell opportunities within the app interface, insurers can promote supplementary coverage, add-ons, or other relevant products. This not only increases revenue streams but also enhances the overall value proposition for customers, fostering a more comprehensive and personalized insurance experience.

4. Task Automation for Agent Productivity

The development of a car insurance app allows for the automation of routine tasks traditionally handled by insurance agents. By automating processes such as policy issuance, document verification, and data entry, agents can focus on more critical and client-facing responsibilities. This optimization of agent tasks not only boosts productivity but also enables agents to dedicate more time to customer acquisition, relationship building, and strategic initiatives.

5. Data Insights for Targeted Marketing

A car insurance app serves as a valuable tool for collecting extensive data about customer preferences and behaviors. This data-rich environment provides insurers with actionable insights for targeted marketing strategies. By understanding user preferences, engagement patterns, and demographic information, insurers can tailor marketing campaigns, promotions, and product offerings to specific segments of their target audience. This data-driven approach enhances marketing precision and increases the likelihood of customer engagement and satisfaction.

Must-Have Features In A Car Insurance App

A car insurance app should include essential features to provide users with a seamless and efficient experience. Here are some must-have features for a car insurance app:

1. User Registration and Profile Management

User registration and profile management are critical components of a car insurance app, ensuring a smooth onboarding process for customers. By streamlining the registration process, users can quickly input their information, reducing friction and enhancing the overall user experience. The profile management feature allows users to update their personal details and vehicle information easily. This ensures that the insurance provider has accurate and up-to-date information, leading to more precise policy quotes and efficient communication with the policyholder.

2. Policy Information

Access to detailed policy information is paramount for users to understand their coverage and make informed decisions. The car insurance app should provide a comprehensive overview of the policy, including coverage details, premium amounts, and the policy renewal date. Additionally, having digital copies of insurance documents within the app ensures that users can access and share their policy information conveniently, reducing the need for physical paperwork.

3. Quote Generation

The quote generation feature is a pivotal aspect of a car insurance app, offering users the ability to customize coverage options and receive instant quotes. The user-friendly interface simplifies the process of entering relevant information, such as vehicle details and coverage preferences. A clear breakdown of coverage options and associated costs empowers users to make decisions aligned with their needs and budget, enhancing transparency in the insurance selection process.

4. Claims Processing

Efficient and user-friendly claims processing is essential for a positive customer experience during stressful situations. The app should facilitate easy reporting of claims, allowing users to submit necessary information and documentation seamlessly. The option to upload photos and documents related to the claim ensures a faster and more accurate claims assessment process, promoting customer satisfaction.

5. Document Upload and Storage

Secure document upload and storage features add convenience and organization to the insurance process. Users can easily upload and store important documents such as driving licenses and vehicle registration within the app. Cloud storage ensures that these documents are accessible anytime, anywhere, reducing the risk of loss and providing users with a centralized location for their essential paperwork.

6. Payment Gateway

A secure and convenient payment gateway is crucial for hassle-free premium payments and policy renewals. The app should support various payment options, including credit/debit cards and digital wallets. Reminders for upcoming premium payments, coupled with a straightforward renewal process, contribute to a positive user experience and help prevent policy lapses.

7. Notifications and Alerts

The notifications and alerts feature keeps users informed about important updates, policy changes, and renewal reminders. Push notifications provide real-time information, ensuring that users stay informed about their insurance status. Additionally, personalized alerts for potential discounts or promotions contribute to customer engagement and satisfaction.

8. Customer Support

A responsive customer support feature is essential for addressing user queries and concerns promptly. The in-app chat or messaging functionality allows users to communicate with customer support agents in real-time, fostering a sense of trust and reliability. FAQs and self-help resources within the app provide users with quick answers to common questions, promoting a positive customer support experience.

9. Accident Assistance

The accident assistance feature goes beyond traditional insurance services, offering users emergency contact information and on-the-spot assistance. In the event of an accident, users can access immediate help through the app. The integration of GPS-enabled location services ensures a quick response, providing users with peace of mind during challenging situations.

10. Policy Comparison

Empowering users with the ability to compare different insurance policies and coverage options is a valuable feature. The app should include tools that allow users to assess benefits, limitations, and costs across multiple policies. Transparent information aids users in making well-informed decisions that align with their specific needs and preferences.

11. Discounts and Rewards

The discounts and rewards feature incentivizes users to maintain safe driving habits and loyalty to the insurance provider. Clear eligibility criteria for discounts are outlined, encouraging users to adopt behaviors that may lead to reduced premiums. Loyalty programs and rewards create a positive feedback loop, enhancing the overall customer experience and fostering a long-term relationship between the policyholder and the insurance company.

12. Telematics Integration

The integration of telematics devices adds a layer of sophistication to the car insurance app, allowing for the monitoring of driving behavior. Users who opt-in to telematics programs may benefit from potential discounts based on their safe driving habits. This data-driven approach promotes transparency and fairness in determining insurance premiums.

13. Multi-Platform Access

Ensuring accessibility on multiple platforms is vital for reaching a broad user base. The app should be available on both iOS and Android platforms, catering to users with different devices. A responsive design further enhances the user experience, adapting to various screen sizes and ensuring consistent functionality across platforms.

14. Security Measures

The implementation of robust security measures is paramount to safeguard user data and instill confidence in the app’s reliability. Stringent security protocols protect user information from unauthorized access, ensuring that sensitive data such as personal details and payment information remains secure. Two-factor authentication adds an extra layer of protection, enhancing overall app security.

15. Feedback and Ratings

The feedback and ratings feature invites users to share their experiences, providing valuable insights for continuous improvement. Users can provide feedback on the app’s functionality, customer service, and overall satisfaction. This two-way communication not only fosters transparency but also enables the insurance provider to address user concerns and enhance the app based on real-time feedback.

How To Develop A Car Insurance App?

From backend infrastructure to mobile and frontend development, each stage plays a vital role in creating a seamless and efficient application for insurance agents and users. Here are steps to create a car insurance app:

A. Discovery Phase

The initial stage of a project, known as the discovery phase, involves extensive research to determine the most efficient development workflow. Information on project requirements is gathered through regular meetings between the startup and the development team.

During this phase, the development team defines the functionalities to be implemented, identifies applicable compliance laws, and establishes key milestones for the project. These critical phases ensure a comprehensive understanding of the project’s scope, laying the groundwork for successful development and collaboration between the startup and the development team.

1. Target Market Analysis

The first step in the discovery phase involves conducting a thorough analysis of the target market. This encompasses researching and understanding the potential market for the car insurance app. It also involves evaluating the accident risks associated with different demographic groups. By identifying the specific needs and preferences of the target audience, the development team can tailor the app to meet the unique requirements of potential users. Market research is a critical component to ensure that the app addresses the pain points of the audience and stands out in a competitive landscape.

2. Cost Analysis

The development team, led by Business Analysts (BAs) and Project Managers (PMs), undertakes a comprehensive cost analysis. This involves estimating the financial implications associated with the creation and design of the car insurance app. Lack of detailed cost analysis is a common factor contributing to business failures, making this step crucial for project success. The team evaluates various aspects, including development resources, technology requirements, third-party integrations, and potential ongoing expenses. Accurate cost estimation is essential for budget planning and avoiding unforeseen financial challenges during the development process.

3. Outline Your Goals

Setting clear and realistic goals is a fundamental aspect of project success. In this phase, the startup and the development team collaboratively identify and outline the goals for the car insurance app. These goals should align with the overall objectives of the startup and provide a roadmap for the development process. Failing to establish clear goals is a common reason for business failures, emphasizing the importance of this step. Goals may include user acquisition targets, feature implementation milestones, or specific metrics related to user engagement and satisfaction.

4. Competitor Analysis

A thorough competitor analysis is conducted to evaluate and compare features and designs with existing car insurance apps in the market. This step involves studying examples from competitors such as Allstate Mobile, Esurance Mobile, and Geico Mobile. By understanding the strengths and weaknesses of competitor apps, the development team gains insights into industry trends, user expectations, and potential areas for innovation. This analysis guides the decision-making process, helping the team identify opportunities to differentiate the app and deliver a unique value proposition. Learning from competitors is an integral part of creating a successful product that meets or exceeds user expectations.

B. Design Phase

In the Design Phase, the focal point is the creation of an architectural blueprint that visually represents the intended appearance and functionality of the car insurance app. Leveraging insights and requirements gathered during the Discovery Phase, the UI/UX design process is guided by a comprehensive understanding of user needs and market dynamics. While the detailed steps of the design process are beyond the scope of this discussion, it’s noteworthy that an in-depth guide on insurance application design is available on our blog.

The significance of app design in car insurance app development cannot be overstated. The design phase serves as a crucial communication tool for the entire development team, elucidating the product’s value and purpose. The deliverables from this phase include designed pages that align with the app’s goals, providing developers with a clear roadmap for feature implementation and expected outcomes. As a foundational element, the design undergoes multiple iterations, ensuring it serves as a guiding document for coders. It represents the initial tangible solution that facilitates a shared understanding of the logic and functionality underlying the envisioned product.

C. Development and Testing

This is the most technical aspect of the car insurance app-building process. Here, programmers will write codes using several tech stacks to create the features in the mobile application.

The step here is split into the backend, mobile, and in some instances, frontend development. Here’s what each step entails.

1. Backend Development

Backend development is a crucial phase involving the creation of server-side functionalities that form the foundational framework for the entire insurance app. Skilled backend developers spearhead this stage, leveraging various technology stacks such as Java, Node.js, and others. They focus on implementing the server logic, managing databases, and designing robust APIs that facilitate seamless communication between the mobile app and the server. This backend infrastructure is fundamental for ensuring the app’s reliability, security, and efficient data processing, laying the groundwork for a fully functional car insurance application.

2. Mobile Development

In mobile development, the emphasis is on creating the application and ensuring its compatibility across various mobile devices. Mobile developers play a pivotal role in implementing endpoint APIs from the backend, enabling insurance agents and users to interact seamlessly with server-side features. For cross-platform apps, developers often opt for frameworks like Flutter or React Native, allowing them to write code that can be deployed on both iOS and Android platforms. Additionally, Swift is employed for iOS app development, while Kotlin is utilized for crafting applications specifically tailored for Android devices. This stage is essential for bringing the envisioned features and user interface to life, ensuring a consistent and reliable user experience.

3. Frontend Development

Frontend development involves crafting interfaces, primarily focusing on web-based pages. While traditionally associated with web applications, frontend developers play a vital role in mobile app development when creating admin panels. Utilizing frameworks such as Angular, Vue.js, and React.js, frontend developers ensure that the user interfaces are visually appealing, intuitive, and responsive. In the context of mobile app development, they contribute to designing the administrative components that facilitate the management and oversight of the car insurance application. Their work enhances the overall usability and accessibility of the application, both for end-users and administrators.

Cost Affecting Factors To Consider To Develop A Car Insurance App

Developing a car insurance app involves various cost factors that need careful consideration. Understanding these cost factors is essential for planning and budgeting. Here are some key factors that can affect the cost of developing a car insurance app:

1. Features and Functionality

The complexity and range of features in the app significantly impact development costs. Basic features such as policy management and claims submission will have a different cost compared to advanced functionalities like real-time analytics, AI-driven chatbots, or integration with telematics.

2. User Interface (UI) and User Experience (UX) Design

Investing in a user-friendly and visually appealing UI/UX design is crucial for the success of the app. The more intricate the design requirements, the higher the cost. Customized graphics, animations, and a seamless user journey contribute to development expenses.

3. Platform and Device Compatibility

Deciding whether to develop the app for a single platform (iOS or Android) or both affects costs. Additionally, ensuring compatibility with various devices, screen sizes, and resolutions can add complexity and expenses to the development process.

4. Security Measures

Car insurance apps deal with sensitive user data. Implementing robust security features such as encryption, secure data storage, and secure APIs is crucial. Higher security standards often translate to increased development costs.

5. Integration with External Systems

If the app needs to integrate with external systems, such as payment gateways, third-party APIs, or databases, the complexity of integration can impact costs. Compatibility testing and ensuring smooth data flow between systems contribute to development expenses.

6. Regulatory Compliance

Adhering to insurance industry regulations and compliance standards adds complexity to the development process. Ensuring that the app meets legal requirements and data protection standards might involve additional development effort and cost.

7. Testing and Quality Assurance

Thorough testing is essential to identify and resolve bugs, security vulnerabilities, and usability issues. The more comprehensive the testing process, including compatibility testing, security testing, and user acceptance testing, the higher the associated costs.

8. Scalability

Planning for future scalability is important. If the app needs to handle a growing user base or increased data volume, the architecture should be scalable. Designing and implementing scalable solutions may incur additional costs during the development phase.

9. Maintenance and Updates

Post-launch, ongoing maintenance and updates are necessary for bug fixes, security patches, and incorporating new features. Estimating the long-term costs of maintenance and support is essential for sustainable app performance.

10. Legal and Insurance Considerations

Legal consultations for compliance, insurance coverage for potential liabilities, and obtaining necessary licenses may contribute to the overall development cost. Ensuring the app aligns with industry regulations is a crucial aspect of development.

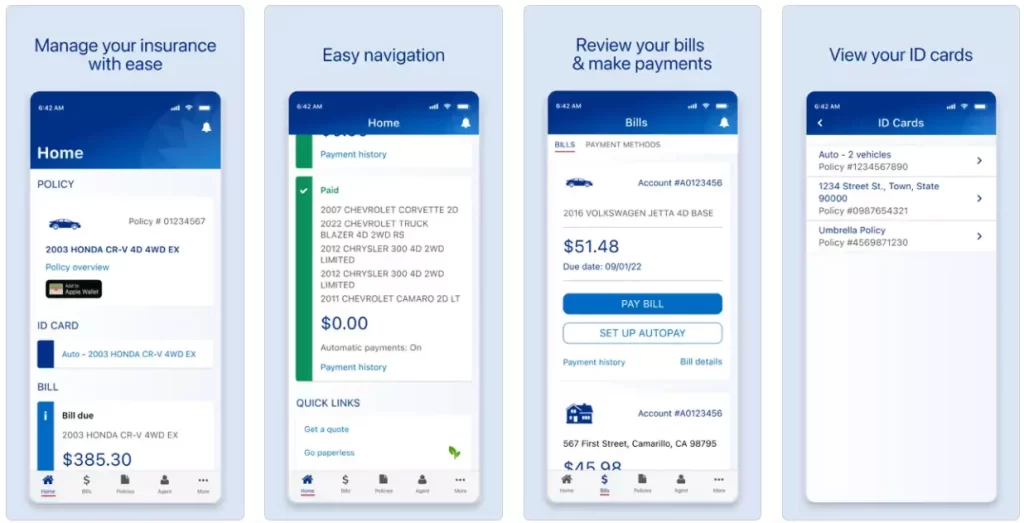

Top 5 Car Insurance Apps In The Market Right Now

In this section, we will explore car insurance apps, each with its own set of features and functionalities to improve the user experience in the field of vehicle insurance.

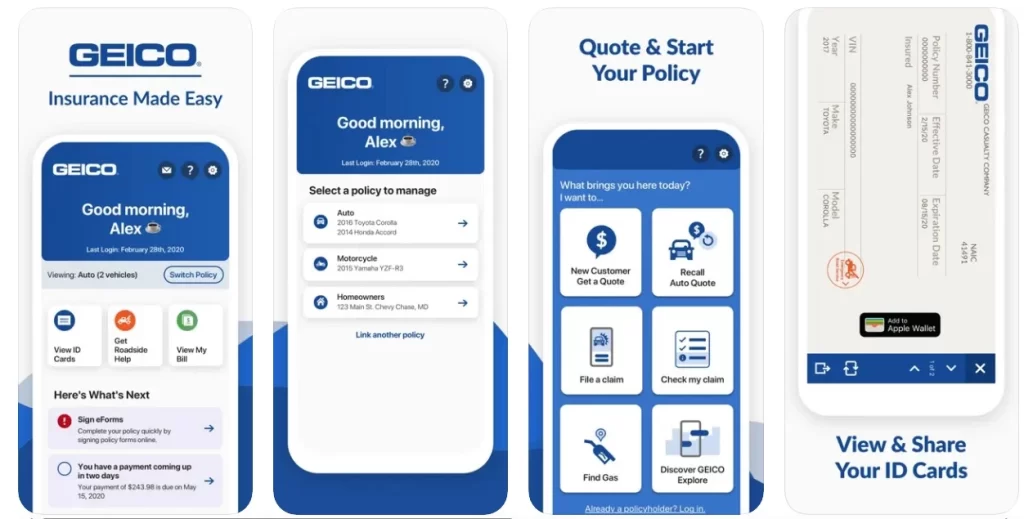

1. GEICO

The GEICO mobile app stands out as a highly comprehensive auto insurance application. Noteworthy features include the Easy Photo Estimate, which provides repair estimates based on submitted photos of vehicle damage.

The Vehicle Care feature, powered by CARFAX, tracks service history, identifies recalls, and assists in creating a maintenance schedule. For participants in GEICO’s DriveEasy telematics program, the separate GEICO DriveEasy Pro app offers detailed driving performance tracking, scores, and feedback.

| Released Year | 1936 |

| Founded By | Leo Goodwin, Lillian Goodwin |

| Industries | Auto Insurance, Financial Services, Government, Insurance, Internet, Mobile |

| Headquarters | Chase, Maryland, United States |

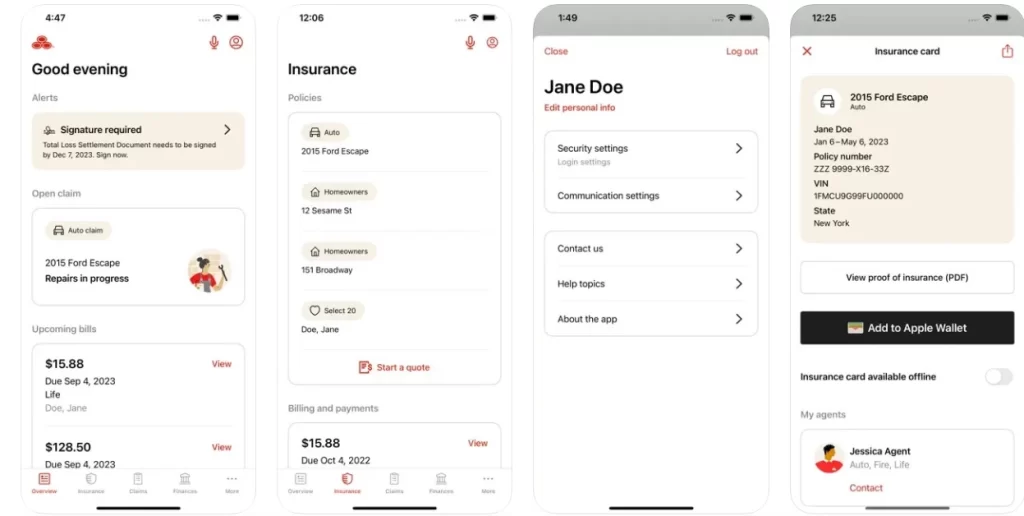

2. State Farm

State Farm boasts a top-rated mobile app, offering customers a versatile platform for account management, roadside assistance requests, claims filing, access to auto insurance ID cards, and document uploads during the claims process.

The Drive Safe & Save telematics program, as well as Steer Clear for drivers under 25, requires separate apps for recording trips and accessing driving feedback.

| Released Year | 1922 |

| Founded By | George J. Mecherle |

| Industries | Auto Insurance, Finance, Financial Services, Health Insurance, Life Insurance |

| Headquarters | Bloomington, Illinois, United States |

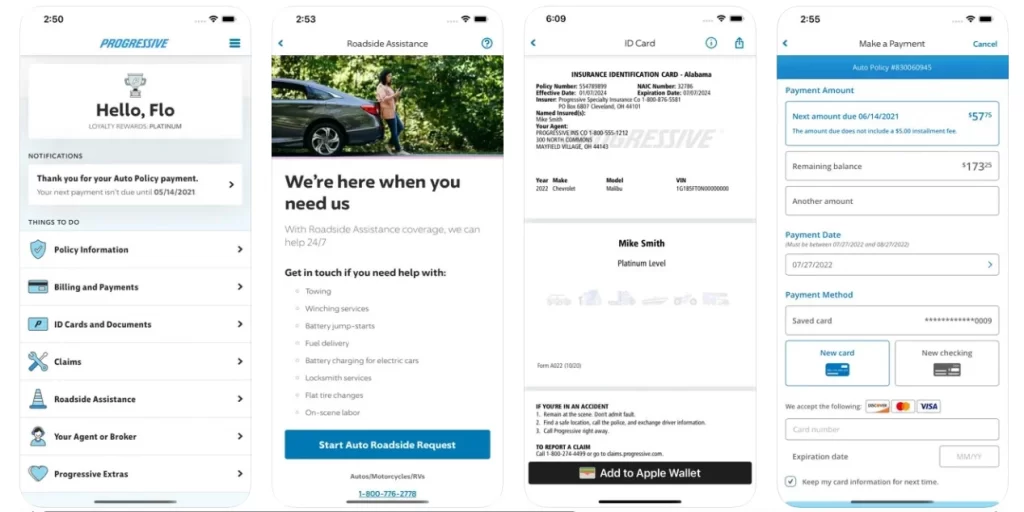

3. Progressive

The Progressive app empowers drivers to view coverage details, pay bills, save ID cards, report claims, request roadside assistance, and obtain quotes for various insurance products. Prioritizing user privacy, Progressive’s app encrypts and discards personal information after submission.

The Snapshot telematics program has its own app, showcasing recent trips, complete driving history, performance details, and tips for improving driving habits.

| Released Year | 1937 |

| Founded By | Joseph Lewis and Jack Green |

| Industries | Auto Insurance, Commercial Insurance, Health Insurance, Insurance |

| Headquarters | Mansfield, Ohio, United States |

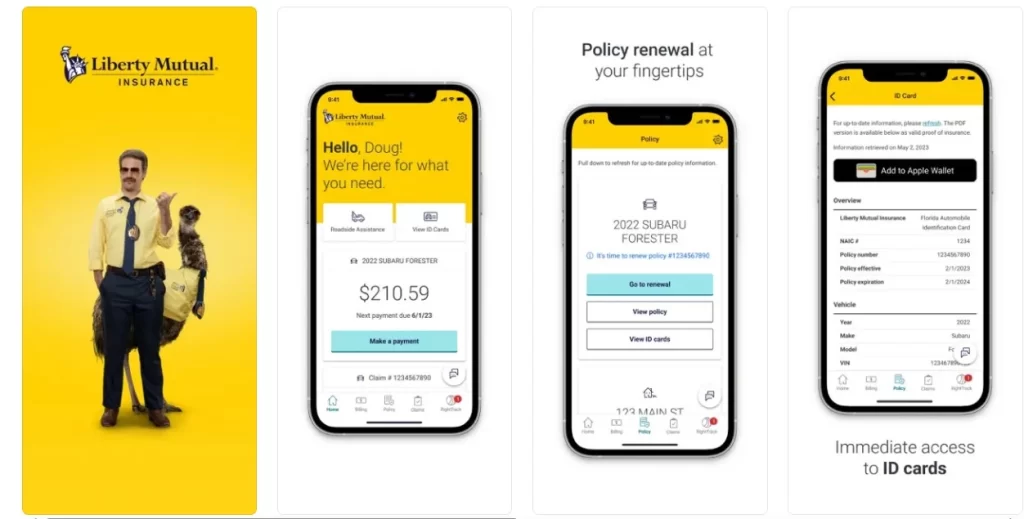

4. Liberty Mutual

Liberty Mutual’s app emerged as the easiest way to handle bill payments, update billing information, manage claims, store insurance ID cards, request roadside assistance, and review policy details. The Express Estimate feature swiftly provides repair estimates based on submitted photos.

For users in the RightTrack telematics program, driving performance tracking and scores are seamlessly integrated into the Liberty Mutual mobile app without the need for a separate application.

| Released Year | 1912 |

| Founded By | Cuong Tran |

| Industries | Finance, Financial Services, Insurance |

| Headquarters | Boston, Massachusetts, United States |

5. Farmers

Farmers have recently revamped its user-friendly mobile app, offering policyholders a range of functionalities such as bill payments, payment option management, document viewing, claims filing, roadside assistance requests, agent communication, and insurance product quotes.

Users enrolled in the Farmers Signal telematics program can track driving behavior and receive feedback through a separate app. Additionally, the optional CrashAssist feature notifies authorities in the event of a detected crash, enhancing safety features for policyholders.

| Released Year | 1928 |

| Founded By | Evan Tipton, John C. Tyler, Kevin Johnson, Thomas E. Leavey |

| Industries | Auto Insurance, Financial Services, Insurance, Life Insurance |

| Headquarters | Los Angeles, California, United States |

Tech Stack To Consider To Develop A Car Insurance App

Developing a car insurance app involves the use of various tools and technologies to streamline the development process and ensure efficiency. Here is the tech stack you can consider to develop car insurance apps:

1. Integrated Development Environment (IDE)

- Android Studio (for Android)

- Xcode (for iOS)

2. Security

- OWASP ZAP

- Veracode

- SonarQube

3. Project Management

- Jira

- Trello

- Asana

4. Communication and Collaboration

- Slack

- Microsoft Teams

5. Database Management

- Firebase

- MongoDB

- MySQL

6. Backend Development

- Node.js

- Django

- Flask

7. User Interface (UI) Design

- Adobe XD

- Sketch

- Figma

8. Cross-Platform Development

- React Native

- Flutter

9. Quality Assurance (QA)

- Appium

- Selenium

- XCTest (for iOS)

10. Continuous Integration/Continuous Deployment (CI/CD)

- Jenkins

- Travis CI

- CircleCI

11. Analytics and Monitoring

- Google Analytics

- Firebase Analytics

- Mixpanel

Conclusion

The development of an auto insurance app is a significant step towards modernizing and simplifying the insurance market. The use of cutting-edge technology not only improves the user experience but also makes operations more efficient and transparent for both insurers and policyholders.

The vehicle insurance app delivers a dynamic platform that matches the increasing demands of today’s tech-savvy consumers by using features such as real-time tracking, fast claims processing, and personalized policy management. The seamless contact between users and insurers generates a greater feeling of trust and involvement, which leads to increased customer satisfaction and loyalty.

Working with a professional app development company seems like a wise choice, especially considering the complex nature of car insurance app development.

Discover the advantages of our car insurance app development solutions and engage with our team to gain a competitive advantage for your business.

Our developers will thoroughly assess your company’s needs, employing state-of-the-art technology and adhering to best practices to craft a digital car insurance app platform that is user-friendly, scalable, and secure.

Get in touch with us to explore how our app development services can contribute to the establishment and expansion of your car insurance business.

FAQ

Q. How to build a car insurance app?

A. To build a car insurance app, start by assembling a diverse development team with expertise in project management, UI/UX design, mobile and backend development, and quality assurance. Define the app’s key features, including policy management, claims processing, and user-friendly interfaces. Utilize industry-standard tools, frameworks, and secure technologies to ensure a robust and efficient app that meets regulatory standards and user expectations.

Q. How much does it cost to build a car insurance app?

A. The cost of building a car insurance app depends on factors such as the app’s complexity, features, and platform compatibility (iOS, Android, or both). Integration of advanced technologies like telematics, AI-driven processes, and blockchain can significantly influence development costs. Additionally, the choice of development team, geographic location, and regulatory compliance considerations contribute to the overall budget for creating a comprehensive and competitive car insurance app.

Q. What are the best car insurance apps in the market?

A. GEICO, State Farm, Progressive, Liberty Mutual, and Farmers are some of the best car insurance apps in the market.

Gaurav Patil