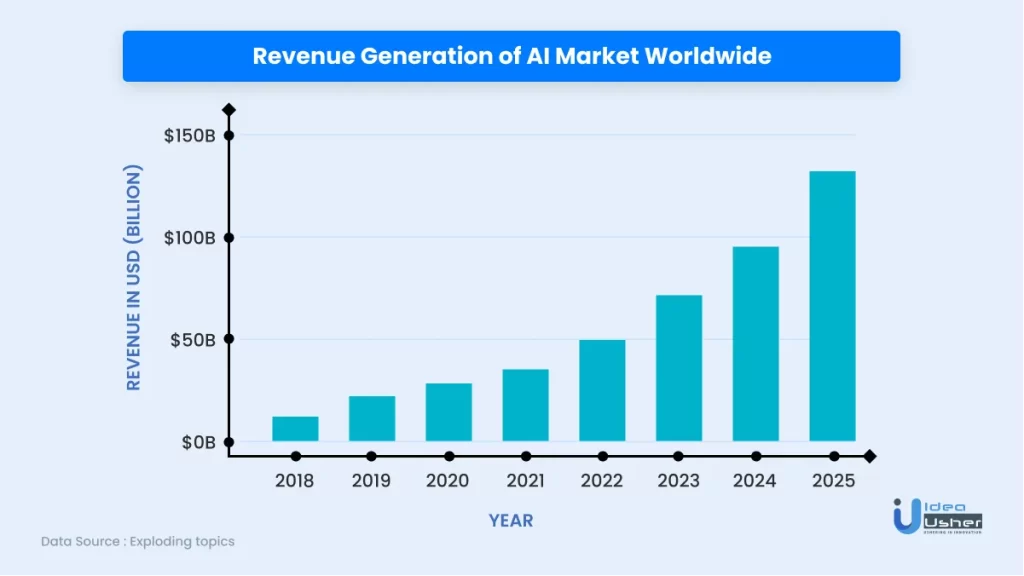

A report by McKinsey reports that across an array of functions and use cases AI investments, AI in the insurance industry can drive up to a whopping $1.1 trillion in potential annual value.

As insurers increasingly adopt technology, they are beginning to focus on AI (Artificial Intelligence) as their next big growth opportunity. They target improving the customer experience, reducing claims leakages and increasing operational efficiency by using data analytics and machine learning techniques.

In this blog, we will see how AI can add value in the insurance sector, how it is impacting different areas of insurance and what’s in store for the future!

Understanding AI in Insurance

AI stands for artificial intelligence, but what does this mean?

AI is a combination of machine learning, natural language processing, computer vision and machine reasoning. It’s a subset of the broader field of artificial intelligence which can be used to automate certain tasks, improve decision making and enhance the customer experience.

AI in insurance can be defined as the incorporation of artificial intelligence tools and technologies into the insurance value chain to help improve processes and customer experience. AI adds value to the insurance industry through automation, cognitive computing, deep learning and big data analytics.

How AI in insurance adds value to the sector?

Insurance companies are embracing and investing in new AI techniques that are supported by large volumes of data to build propositions or products that are nimble, robust and scalable with as close to zero manual intervention as possible.

Insurers are improving customer experience by using AI to:

- Identify when a customer is unhappy and offer them a better deal.

- Understand exactly what the customer wants, so they can provide an improved service.

- Automate processes that don’t require human intervention. For example, if you have to ask your insurer dozens of questions every time you make a claim, it will take longer than necessary. By using AI-enabled technology (e.g., chatbots), this process becomes quicker and easier for both parties involved in the transaction.

- Improve decision making by using data analytics tools that help assess risk accurately

- To have access to more accurate data with AI. The quality and accuracy of data improve with machine learning algorithms which leads to better decision making by the insurer. A closer look at how AI can add value:

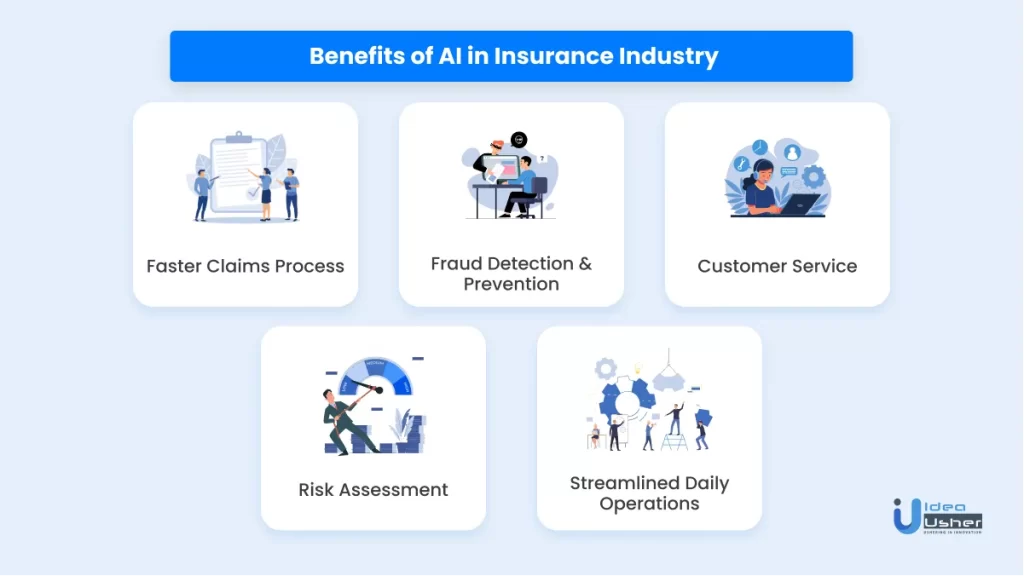

Benefits of AI in insurance

AI in insurance is a revolutionary technology that has the potential to impact the sector in a multitude of ways. It can:

Faster Claims Process

AI can be used to identify relevant information, speeding up the claims review process. It can help identify patterns in claims history and recommend optimum solutions. Insurance companies will benefit from better insights into customers’ behavior, thus making it easier to anticipate their future needs.The use of AI in insurance claims processing will increase over time as more data is processed.

Fraud Detection & Prevention

Fraud detection is one of the most obvious benefits of AI for insurance companies. AI easily identifies suspicious activity when analyzing large amounts of data. Also, it is used to review policy applications for inconsistencies. In addition, with the use of machine learning algorithms, it is possible for an insurance company to detect patterns that indicate fraud or abuse by customers. AI also identifies inconsistencies in policy applications, claims history, and customer behavior.

Customer Service

AI helps customers find the right policies for their needs, and offer them more personalized service. Therefore, this means that you can offer 24/7 support without having an in-house employee on call at all times. Also, customers can have access to information about insurance policies anywhere anytime with AI in place. Using AI bots, you can help customers find the right policies for their needs. These bots can also provide helpful information about your services.

Risk Assessment

The most important feature of AI is its ability to analyze data in order to identify patterns and make predictions. You can use AI to assess risk after taking into account all variables, which may allow you to offer more personalized prices, which will improve your reputation with customers and reduce pricing disputes with customers who feel they’re being treated unfairly by a standard fee structure.

Streamlined Daily Operations

AI can automate routine tasks, allowing employees to focus their attention on other areas of the business that might require human attention. AI can also help insurance providers extract insights from their data, giving them a better understanding of the industry and its customers. Finally, AI can lead to increased efficiency by helping optimize processes across all departments of an insurance provider’s business.

AI Use Cases in Insurance

As artificial intelligence grows more powerful every day, companies have begun to adopt AI technologies and machine learning in their efforts to improve customer experience.

Here’s the list of few top companies who have held the hands of AI to maximize their growth potential:

Nauto: Predictive Analytics for Autonomous Vehicles

Nauto is a software platform that uses data to help cars drive themselves. Nauto’s software uses artificial intelligence and machine learning to analyze the collected data in order to predict an autonomous vehicle’s probability of crashing. The technology behind Nauto helps prevent vehicle crashes by evaluating a driver’s behavior and providing recommendations on how they can improve their driving habits.

Lemonade: Chatbots and AI-enabled Claims Process

Lemonade uses AI to help customers understand their insurance policies, file claims and get the best price. It has developed a chatbot that is available 24/7 via text message to help customers understand their insurance policies. The bot uses NLP (natural language processing) and AI to provide an interactive experience for users, who can ask questions about how different types of claims will be handled by Lemonade’s policyholder protection plan.

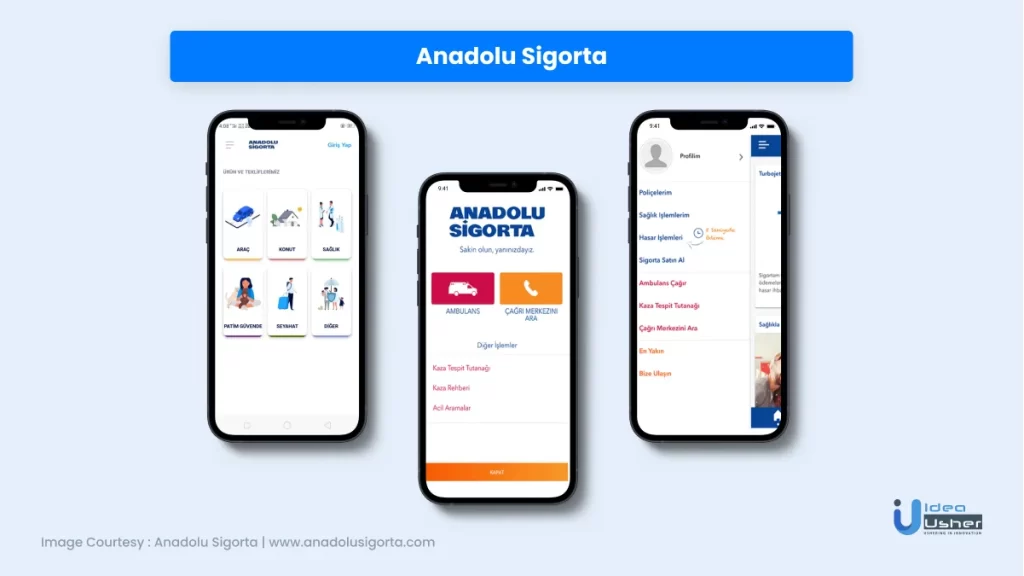

Anadolu Sigorta: Anti Fraud and Activity Detection

Anadolu Sigorta is a famous Turkish insurer platform that suffered high costs due to manual reviewal process of claims. But tables turned when they switched to AI predictive system. The system allowed the company to detect fraudulent activities and even fraudulent customers in real time. As a result, they realized a 210% ROI in just one year and attributed over $5.7 million in saved fraud detection.

Tokio Marine: Automation of underwriting and reinsurance analysis

This Japanese insurance company, known as TMW Group, is one of the early adopters of AI in its industry. Tokio Marine recently made news by deploying an AI-based computer vision system for analyzing damaged vehicles. The system helped the company to shorten their processing time from 2-3 weeks to less. And as a result they have seen significant improvements in customer experience, efficiency and cost control. The company uses a combination of machine learning and natural language processing to automate claims process, underwriting and reinsurance analysis.

Make your insurance app AI Smart with Idea Usher

Insurance companies, it’s time to make your app AI smart!

There are so many ways to do this, but one of the easiest is with Idea Usher. We are known for helping insurance companies improve their user engagement and retention, and we’re excited to offer our services to help you get started on your AI journey.

We know that insurance is a complicated industry—but what if we told you that making your app AI smart doesn’t have to be? The Idea Usher platform lets you plug in existing data from your existing CRM system and start gathering insights into how customers interact with your app. We help you identify the areas where users are getting stuck (or are just plain bored), and then work with you to make those parts of the experience more fun and engaging for everyone. When we’re done, you’ll have an app that makes users feel like they’re actually interacting with a human being, not just another computer program!

For more information and a detailed understanding of the application development process, you can contact them at.

E-mail: [email protected]

Phone Numbers : (+91)9463407140, (+91)8591407140, and (+1)7329624560

Conclusion

AI is becoming a mainstream tool for insurance companies. More than half of them have deployed intelligent systems and chatbots to engage with their customers. 48% of insurers are using AI for fraud detection, and nearly 50% are using it for underwriting and claims processing.

It also helps to improve fraud detection. Thus, this will ultimately help in the retention of customers. AI has a huge role to play in improving operational efficiency, which is an integral part of the insurance business.

As AI evolves, insurers can expect better ROI, increased renewal premiums, decreased costs, better engagement. All this through chatbots and voice assistants such as Amazon Alexa etc.

FAQs

Why is AI important for insurance?

AI has many benefits for insurance companies, including:

- Lower costs: AI can help reduce costs by eliminating errors, streamlining processes and automating manual tasks. It can also increase revenue by improving customer service.

- Increased productivity: AI enables insurers to automate manual tasks and improve customer service by providing 24/7 coverage.

- Improved customer experience: AI allows insurers to provide better customer experiences by analyzing data about customers’ preferences and habits.

How does AI affect insurers?

In the insurance industry, artificial intelligence applies in a variety of ways. For example, it’s helpful in identifying fraudulent claims or fraudulent claimants. It’s also being used by some insurers to predict which customers will most likely file claims.

What is the smart insurance app?

The Smart Insurance AI app is a tool to help you get better insurance rates. It uses algorithms and other data to predict your risk of getting into an accident. Thus, this gives you personalized recommendations on how to lower your premiums.

Kamalpreet Kaur