Decentralized finance (DeFi) has transformed traditional financial systems and introduced opportunities for users to engage in a permissionless and decentralized manner, making a remarkable surge in innovation.

However, continuous hacks and protocol breaches have spurt DeFi’s growth by acting as a bottleneck where investment loss is one of the key obstacles that prevent the widespread commercial adoption of DeFi.

DeFi insurance emerged as a unique solution to counter the vulnerable threats in the crypto space, representing a groundbreaking approach to managing risk within the decentralized financial space.

The demand for protection against undesirable events such as hacks, vulnerabilities, and protocol failures surged as investors seek to explore various DeFi protocols, smart contracts, and liquidity pools to protect their crypto assets.

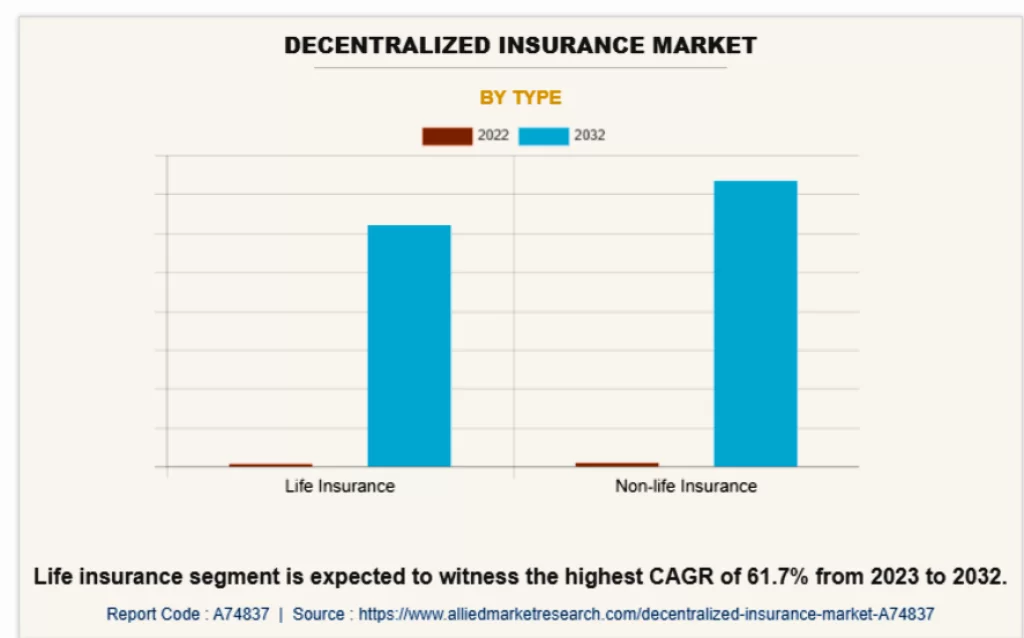

Source: Allied Market Research

The growing market size of defi insurance indicates a better opportunity for entrepreneurs and businesses seeking to invest in a profitable industry.

Let’s understand what is DeFi insurance, how it functions, its development steps, and what business opportunities and use cases it offers to help you completely understand the concept,

What is DeFi?

Defi, built on blockchain technology, is a set of financial services and applications. The Defi system aims to simplify, recreate, and innovate traditional economic systems, such as banking, lending, and trading, by leveraging the principles of decentralization, transparency, and programmability provided by blockchain.

From governance to lending platforms to stablecoins and tokenized BTC, the DeFi ecosystem has created an extensive network of corresponding DeFi insurance protocols and financial products.

DeFi has made a transformational shift from centralized toward peer-to-peer financing, as no centralized entity oversees the entire system.

Also, the emergence of decentralized finance has created various exclusive products such as synthetic assets, decentralized exchanges, and flash loans.

There is rapid change across the banking sector due to the development of defi products where investors and entrepreneurs can look into new possibilities and enter this profitable industry.

Pros and cons of DeFi

Decentralized Finance (DeFi) has gained significant attention for its potential to transform traditional financial services. However, like any emerging technology, DeFi has its own advantages and challenges. Here are some pros and cons of DeFi:

I. Defi Insurance Pros

From global scaling to transparency, the major pros of defi insurance are discussed below:

1. Accessibility

There is no need for intermediaries which makes Defi services accessible to anyone with an internet connection. This is particularly beneficial for the unbanked and underbanked populations.

2. Global Accessibility

DeFi operates on blockchain networks, enabling global access to financial services without restrictions based on geography or traditional banking infrastructure.

3. Interoperability

DeFi protocols often operate on open standards, allowing for platform interoperability. This can foster innovation and the development of a more interconnected financial ecosystem.

4. Transparency

Transactions on blockchain networks are transparent and can be verified by anyone, reducing the risk of fraud and giving users greater visibility into decentralized applications’ financial operations (DApps).

5. Censorship Resistance

DeFi applications are typically censorship-resistant, operating on decentralized and distributed networks. This can protect users from potential interference by central authorities.

6. Permissionless Innovation

Developers can create and deploy financial applications without requiring permission. This encourages innovation and the rapid development of new financial products and services.

7. Yield Farming and Liquidity Mining

Users can earn rewards through yield farming and liquidity mining by providing assets to decentralized platforms. This incentivizes participation and liquidity provision.

II. Defi Insurance Cons

Like every other emerging technology, DeFi Insurance also has some drawbacks that we have discussed in detail.

1. Lack of Consumer Protection

Traditional financial services often come with consumer protections, such as deposit insurance. DeFi, being decentralized, may lack similar safeguards, exposing users to higher risks.

2. Smart Contract Risks

DeFi relies on smart contracts, which are susceptible to bugs and vulnerabilities. Exploits and security breaches can result in significant financial losses.

3. Regulatory Uncertainty

The regulatory environment for DeFi is evolving, and uncertainty can pose challenges for users and developers. Legal and compliance issues may arise as regulators seek to understand and regulate the space.

4. Market Volatility

Cryptocurrencies, which often encourage DeFi projects, are known for their price volatility. This can introduce risk and uncertainty, affecting the value of assets within the DeFi ecosystem.

5. Market Maturity

DeFi is still in its early stages of development, and the market is evolving. This introduces uncertainties, including the potential for projects to fail or undergo significant changes.

6. User Experience and Adoption

DeFi platforms might not provide the same user experience as traditional financial services. Additionally, adoption barriers may limit widespread use, including the complexity of interacting with blockchain wallets and protocols.

7. Scalability Issues

Blockchain networks face scalability challenges, leading to congestion and higher transaction fees during high-demand periods. This can impact the user experience and the cost-effectiveness of using DeFi platforms.

What Is DeFi Insurance?

DeFi insurance provides a mechanism for users to safeguard their funds against potential losses due to events like smart contract vulnerabilities, hacks, or other threats. It aims to minimize risks associated with various DeFi protocols, platforms, and smart contracts.

Also, DeFi insurance protocols offer coverage against specific risks due to protocol failures such as smart contract exploits, security breaches, or losses and operate under decentralized autonomous organization (DAO) structures responsible for collectively deciding on matters like policy terms, claims, and platform upgrades.

DeFi insurance protocols provide preventative steps where users can also buy DeFi insurance as a precaution against losing their money on the DeFi platform.

In the rapidly evolving crypto space, DeFi insurance is designed with the aim of addressing the unique risks and challenges associated with financial threats. However, it is also the responsibility of users to safely perform transactions in the decentralized finance to prevent any possible threats.

How Does DeFi Insurance Work?

As the Defi industry expands, decentralized protocols, systems, and processes will develop and evolve. However, it is essential to understand how decentralized insurance works for developing effective decentralized financial products. Here are the workings of the Defi insurance:

1. Selection of DeFi Protocol

Users choose a specific DeFi protocol or platform they want to participate in. They may purchase insurance coverage before using the protocol to protect their funds.

2. Insurance Purchase

Users acquire insurance coverage by interacting with a decentralized insurance platform. This process often involves purchasing insurance using the platform’s native tokens or other specified tokens.

3. Smart Contract Integration

The insurance coverage is integrated with smart contracts. These smart contracts define the terms and conditions of the insurance policy, including the covered risks, the duration of coverage, and the payout conditions.

4. Premium Payments

Users typically pay a premium to purchase insurance coverage. Depending on the insurance protocol, this premium may be a one-time payment or a recurring fee. The premium payment contributes to the pool of funds available for claims payouts.

5. Claims Process

In a covered incident (e.g., a hack a smart contract exploit), users can file a claim with the decentralized insurance platform. The smart contract governing the insurance policy automatically processes and verifies the claim against the predefined conditions.

6. Payouts

If the claim is valid and meets the specified criteria, the decentralized insurance platform triggers a payout to the user. The payout is often made in the form of the platform’s native token or another specified token.

7. Governance Mechanism

Many DeFi insurance platforms operate under a decentralized governance model. The community of token holders has the power to make decisions about policy terms, claims processing, and other important aspects of the platform.

8. Staking and Rewards

Some DeFi insurance platforms encourage user participation by offering rewards for staking tokens or providing liquidity. These rewards may include additional insurance coverage, governance voting power, or native tokens.

Top Platforms Offering DeFi Insurance

Many businesses have emerged as the defi insurance platform that helps users ensure their crypto investments are safe against various cybersecurity threats. Here are some businesses offering DeFi insurance right now

1. Opium Insurance

Opium is a decentralized derivatives platform with insurance offerings. On the Opium platform, users can create and exchange personalized insurance contracts that cover a variety of hazards in the DeFi space.

Also, the platform offers Opium turbo, through which users can access a chance for high returns in a day a week by staking their crypto into a liquidity pool that covers turbo products. The platform offers a stable return on staked funds in exchange for fees.

2. Nexus Mutual

Nexus Mutual works as a decentralized mutual, covering smart contract risks, making them a pioneering endeavor in DeFi insurance. Members of the mutual pool funds provide coverage, and claims are assessed through a community-driven voting process. Moreover, platform users with risk and pricing expertise can work staked NXM, create a staking pool, earn a fee, and underwrite risk where the risk is assessed and managed in individual staking pools.

3. ArmorFi

ArmorFi offers decentralized insurance for various DeFi protocols. Users can protect themselves against smart contract failures, hacking, and other threats by purchasing coverage and staking their assets in the ArmorFi ecosystem to gain incentives.

4. Unslashed Finance

Unslashed Finance specializes in covering protocol failures and smart contract attacks. Users can stake their assets in the Unslashed pool to gain prizes and participate in platform governance. Other market participants that supply the capital to the platform ensure the coverage and protection offered by Uslashed Finance, where they can join by contributing Ether (ETH) to individual pools found on the Unslashed Finance app.

Use Cases Of DeFi Insurance

DeFi insurance offers many use cases through which users can avoid threats such as hacking of smart contracts, cyberattacks on exchange platforms, and other crypto fraud incidents. The few use cases of Defi insurance are as follows:

1. Crypto Insurance

From cyberattacks to rug pulls, the crypto market is likely to be exposed and vulnerable to everything; therefore, investors are seeking measures to prevent their investments from being stolen. Through crypto-insurance, users can ensure they get their money back even after any terrible event.

Also, crypto insurance coverage helps users recover funds lost due to unauthorized access, ensuring financial security when using centralized exchanges. Users can purchase DeFi insurance to protect their assets held on exchanges, covering losses in the event of a security breach.

Market volatility protection is another use case under crypto insurance where users can get coverage against rapid and severe market fluctuations, as insurance minimizes the impact of sudden market downturns, providing a safety net for investors and traders.

2. Collateral For Protection

Borrowers and lenders can experience a feeling of security from cryptocurrency lending networks as the insurance contract typically repays the loan if the borrower’s specified collateral is lost or stolen.

Investors can secure loans on DeFi lending platforms to reduce the risk of liquidation if the value of their collateral falls below a certain threshold. Moreover, users participating in staking or yield farming activities often lock up assets as collateral, as DeFi insurance provides coverage against potential losses due to protocol vulnerabilities or market fluctuations.

Collateral protection through DeFi insurance helps develop a more reliable environment for users to engage in decentralized finance by minimizing risks associated with collateralized assets, where DeFi insurance contributes to the overall stability of the decentralized finance ecosystem.

3. Smart contract coverage

DeFi insurance provides a crucial tool to manage and mitigate risks associated with Smart contract coverage by utilizing the foundational elements of decentralized finance protocols.

There were three well-planned hacks of the Ethereum smart contracts in 2016, which resulted in a significant loss of investors.

As users increasingly recognize the importance of securing against smart contract vulnerabilities, the demand for such insurance solutions is likely to grow, contributing to the overall improvement of the DeFi ecosystem.

4. Crypto wallet protection

After the growing adoption of decentralized finance, the need for comprehensive insurance solutions covering various aspects of the ecosystem, including wallet protection, becomes crucial.

Crypto wallet through DeFi insurance can add an extra layer of security for investors, recognizing the importance of safeguarding the protocols and the individual wallets holding valuable crypto assets.

Investors can obtain insurance coverage to protect against the loss or theft of their private keys, where they can receive compensation for the value of the assets associated with the compromised keys.

Also, investors can ensure compensation for losses caused by technical failures beyond their control, as they may face losses if their crypto wallet experiences technical failures, glitches, or malfunctions that result in the inability to access or transact with their assets.

Business Opportunities Of DeFi

Businesses using DeFi technology can expand globally and attract additional clients, helping them to increase profitability, client satisfaction, and scalability. Here are some of the business opportunities of Defi:

1. Rapid transactions

Entrepreneurs and developers can create innovative solutions that fullfill the growing demand for fast and efficient financial services by working under the DeFi space to boost the speed of transactions.

Investors and users can have a far smoother financial experience through exchanges equipped with the DeFi application, as the system guarantees that all their transactions will be smooth, quick, and extremely safe, as a single entity does not control transactions.

Businesses that are involved in executing several transactions regularly can reduce the costs associated with using third-party payment services such as the key DeFi exchanges to convert payments into stablecoins and directly send money, such as Tranglo in ASEAN and BitPesa in Africa.

With fast transaction capabilities, liquidity providers can respond quickly to changes in market demand, optimizing their positions for maximum returns.

Liquidity providers can quickly respond to changes in market demand and optimize their positions for maximum returns with fast Defi transaction capabilities. Also, businesses can establish a liquidity provision service that supplies assets to decentralized exchanges and utilize rapid transactions to adjust liquidity dynamically and earn fees from trades.

2. Lending Protocols

Entrepreneurs build successful and sustainable lending protocol businesses by carefully considering the regulatory landscape, security measures, and user experience. Offering liquidity provision services allows users to earn a passive income from their assets, and you can charge a fee or take a percentage of the interest earned as revenue.

Users can earn a passive income from their assets by offering them liquidity provision services where you can benefit by charging users a fee or taking a percentage of the interest earned as revenue.

Also, businesses can benefit from crypto investors by offering coverage against the risk of default, smart contract exploits, or other undesirable events affecting their loans.

3. Trading digital assets

Businesses can develop a decentralized exchange that facilitates the peer-to-peer trading of digital assets where there is no need for a centralized intermediary by charging transaction fees, offering liquidity pools, or introducing unique features to attract investors and users.

Also, businesses can earn fees and incentives for providing liquidity and offering digital assets to decentralized exchanges or liquidity pools for trading pairs.

Trading digital assets often involves market analysis tools, trading signals, and insights specific to decentralized finance and digital asset markets where businesses can charge subscription fees, premium content, or freemium models for advanced features.

4. Yield farming

Entrepreneurs can benefit and contribute to the evolution of decentralized finance by exploring opportunities to offer yield farming services to their users as the potential to innovate applications and services continues to grow.

Crypto investors, through yield farming, can stake their cryptocurrency assets in different non-custodial DeFi protocols to earn high fixed or floating interest rates. Idle Finance, Yearn, Vesper, and Enzyme are some of the best yield farming protocols.

Businesses can create a platform that promotes yield farming opportunities across multiple DeFi protocols where investors can deposit funds, and the platform automatically allocates the capital to different protocols to optimize returns.

5. Improved tokenization

Tokenization on blockchain platforms represents real-world assets as digital tokens, which helps in increased liquidity, accessibility, and efficiency.

Businesses can explore various industries for tokenization such as real estate, art, collectibles, games, and the like, contributing to the growth and innovation within the decentralized finance ecosystem.

Also, tokenization advances the encryption process where businesses can distribute the encrypted information nodes across decentralized networks, making it impossible for hackers to alter the data.

Moreover, businesses can enhance the crypto community by improving governance tokens with more robust voting mechanisms, decentralized governance structures, and innovative incentive models.

How To Develop Defi Insurance Apps?

Blockchain technology, smart contracts, and conventional insurance concepts are critical to developing decentralized finance (DeFi) insurance programs. To get you started, consider the following general guide:

1. Understand DeFi and Insurance

Acquire an in-depth understanding of the operation of insurance in conventional financial systems and decentralized finance (DeFi). Understand risk assessment, premium computation, and claims processing for deep understanding.

2. Choose a Blockchain Platform

Choose a blockchain system that is compatible with smart contracts. Platforms like Binance Smart Chain, Polkadot, or Solana could be considered the best options, whereas Ethereum is a popular option for DeFi applications.

3. Smart Contract Development

Create smart contracts that specify your insurance platform’s policies and procedures, such as contracts for forming policies, premium payments, processing claims, and payouts. In Ethereum-based applications, Solidity is a frequently used tool.

4. Risk Assessment & Premium Calculation

Create a system for measuring the risk associated with each policy. This may involve employing oracles to collect real-world data that aids in determining the risk profile of an insured asset or business.

Also, develop algorithms to determine insurance rates based on risk assessment. Consider the type of coverage, the amount covered, and historical statistics.

5. Claim Processing

Create a transparent and automated claims processing system using smart contracts. Define conditions under which claims are valid and specify the process for verifying and approving claims.

6. User Interface (UI) and User Experience (UX)

Create an easy-to-use interface for policyholders to engage with your DeFi insurance app. Depending on your target demographic audience, the platform can be a web-based interface or a mobile app.

7. Integration with Wallets

Integrate your DeFi insurance app with popular Bitcoin wallets to make premium payments and claim processing more convenient. Users should be able to manage their policies using their wallets simply.

8. Security Audits

Conduct extensive security audits of your smart contracts and system where security is critical in DeFi, as flaws can result in serious monetary losses.

9. Regulatory Compliance

Be informed of and follow all applicable laws and regulations in the areas in which you operate. Compliance requirements might differ, and knowing legal factors is critical to the success of your DeFi insurance app.

10. Testing

Test your Defi insurance program carefully to confirm that it works as planned and is bug-free. This includes both smart contract unit testing and platform-wide end-to-end testing.

11. Launch and Marketing

Launch your DeFi insurance app after completing testing and resolving any issues, and develop a marketing plan to attract consumers and get their trust in your insurance platform.

Tech Stack To Consider For Defi Insurance App Development

Developing decentralized finance (DeFi) insurance app involves using various tools and platforms to streamline the development process. Here are some commonly used tools for DeFi app development:

1. Smart Contract Development

- Remix

- Truffle

- Hardhat

2. Blockchain Platforms

- Ethereum

- Solana

3. Smart Contract Auditing

- MythX

- ConsenSys Diligence

4. Oracle Services & Decentralized Storage

- Chainlink

- IPFS (InterPlanetary File System)

5. Wallet Integration

- Metamask

- WalletConnect

6. Web3 Libraries

- Web3.js

- Ethers.js

7. Monitoring and Analytics

- The Graph

- Covalent

8. IPFS Hosting & Version Control

- Pinata

- Git

Conclusion

Decentralized insurance is a fast-growing industry. Due to the security and transparency of DeFi and applications, it dominates the industry.

However, there are currently only a few Defi products on the market. Still, there is room for growth and expansion as DeFi insurance plays a crucial role in the rapidly evolving industry of decentralized finance.

DeFi insurance offers a decentralized and innovative solution, where users can safeguard their funds against smart contract vulnerabilities, protocol exploits, or other unexpected incidents.

As users continue engaging with various DeFi protocols, the demand for Defi products will go further to protect against unforeseen risks.

Work with us to enhance your insurance products using our Defi development services. We are an app development company that suggests and develops a milestone-based approach toward technology for our clients based on their long-term and short-term business goals and visions.

Our team will closely analyze your business needs and will suggest and develop Blockchain-based solutions for your DeFi insurance products.

Contact us today to learn more about how we can help you establish and scale your business with our development services.

FAQ

Q. What is DeFi?

A. A decentralized financial industry concept that leverages blockchain-based systems to recreate and improve traditional financial systems and services without the need for traditional intermediaries, such as banks or brokerages.

Q. What is DeFi insurance?

A. A type of insurance that operates within the decentralized finance ecosystem which involves a set of financial services and platforms built on blockchain technology. Defi insurance aims to recreate and improve traditional financial systems, such as lending, borrowing, and trading, without the need for traditional intermediaries like banks.

Q. What are some of the key applications of DeFi insurance?

A. Crypto insurance, protection of collateral for loans backed by cryptocurrency, smart contract coverage, and crypto wallet protection are some of the key applications of DeFi insurance.

Q. How safe is DeFi?

A. DeFi initiatives eliminate middlemen from traditional financial services, they may not always provide the same level of security.

Gaurav Patil