In today’s dynamic insurance landscape, customer expectations are rapidly evolving towards personalized, real-time interactions with insurers to maximize benefits. RPA, particularly, offers significant promise in streamlining tedious tasks such as data entry and transaction facilitation, thereby optimizing workflow efficiency.

Embracing automation enables insurers to digitize operations, freeing up time to focus on value-added activities such as enhancing customer experiences and product innovation. To leverage automation effectively, insurance businesses must strategize implementation across their daily operations.

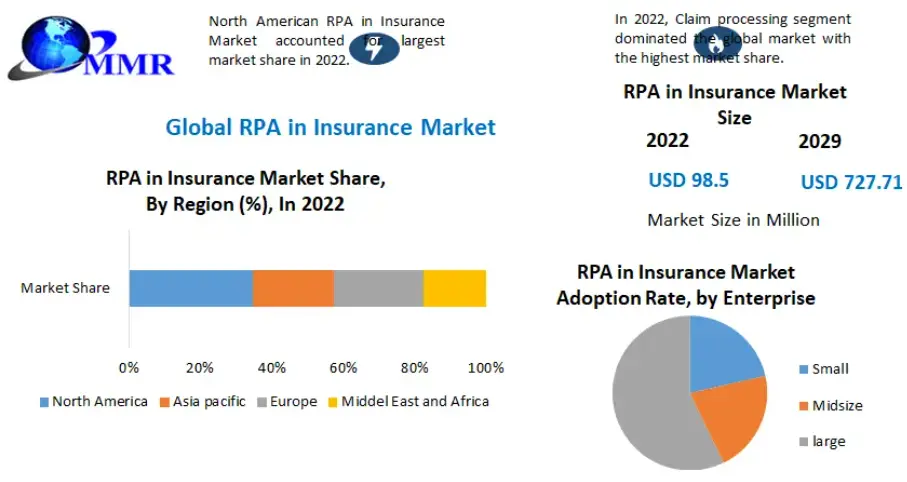

Source: MaximizeMarketResearch

This forecast underscores the immense opportunities presented by RPA in reshaping the future of insurance and unlocking new avenues for value creation.

This article aims to make the concept of RPA (Robotic Process Automation) in insurance easier to understand. It explains how automation works in insurance and helps companies use its innovative power to stay competitive in a tough market.

- What Is Robotic Process Automation In Insurance?

- How Does RPA Work For The Insurance Industry?

- Why Is Insurance Automation Important For Businesses?

- Use Cases Of RPA Automation In Insurance

- Examples Of Companies Using RPA In Insurance

- How To Implement RPA In Insurance?

- Conclusion

- How Can Idea Usher Help You With RPA Implementation?

- FAQ

What Is Robotic Process Automation In Insurance?

Robotic Process Automation (RPA) in the insurance industry refers to the use of software robots or bots to automate repetitive, rule-based tasks across various insurance processes. These processes can encompass a wide range of activities including sales, marketing, renewals, claims processing, underwriting, and policy administration. RPA technology enables insurers to streamline their operations, increase efficiency, reduce errors, and ultimately deliver better customer service.

In insurance sales and marketing, RPA can be employed to automate lead generation, customer data entry, and communication with potential clients. Bots can extract relevant information from various sources, such as websites and databases, and input it into customer relationship management (CRM) systems. This automation accelerates the sales process and frees up agents to focus on more complex tasks and customer interactions.

Renewal processes can also benefit from RPA by automating the retrieval of policy information, calculating premiums, and generating renewal notices. By automating these routine tasks, insurers can ensure timely renewals and improve customer satisfaction. Additionally, RPA can be used to manage underwriting processes by automatically gathering and analyzing applicant data, facilitating risk assessment, and generating quotes.

Claims processing is another area where RPA can make a significant impact. Bots can be programmed to extract data from claim forms, validate policy coverage, and process payments. This automation reduces the time and effort required to handle claims, leading to faster resolution and improved customer experience. Furthermore, RPA can help streamline document management by automatically categorizing and organizing client documents, policy forms, and correspondence.

Overall, RPA holds great potential for revolutionizing insurance operations by automating repetitive tasks, increasing efficiency, and enhancing the quality of service. By leveraging this technology, insurers can achieve cost savings, improve productivity, and stay competitive in an increasingly digital landscape.

How Does RPA Work For The Insurance Industry?

RPA plays a crucial role in modernizing insurance operations, improving efficiency, and driving digital transformation. By automating routine tasks and integrating legacy systems with newer technologies, RPA enables insurers to stay competitive in today’s rapidly evolving marketplace.

1. Email Data Extraction and Core System Integration

In the insurance industry, Robotic Process Automation (RPA) acts as a crucial bridge between legacy systems and modern technologies, facilitating seamless communication and integration. With many insurance companies still relying on legacy applications, RPA offers a way to automate tasks across these disparate systems without the need for extensive coding or system overhaul.

One key function of RPA in insurance is its ability to open emails, extract relevant data, and input it into core systems. This automation significantly reduces the time and effort required for manual data entry, enabling insurers to process information more efficiently and accurately. By automating mundane tasks such as data extraction from emails, RPA frees up employees to focus on more value-added activities.

2. Integration with Workflow Automation and Rules Engines

Moreover, RPA can integrate with workflow automation and rules engines to create fully automated processes within insurance operations. By defining rules and workflows, insurers can streamline processes such as claims processing, policy administration, and underwriting. RPA bots can navigate through various systems and applications, ensuring that tasks are completed according to predefined rules and standards.

3. Utilizing AI to Enhance Bot Capabilities

Another aspect where RPA adds value in the insurance sector is its ability to utilize artificial intelligence (AI) to enhance bot capabilities. By incorporating machine learning algorithms, RPA bots can adapt to changing scenarios, make data-driven decisions, and improve their performance over time. This AI-powered automation enables insurers to handle complex tasks with greater efficiency and accuracy.

4. Data Analytics for Profitability Reports and Insights

Furthermore, RPA in insurance can leverage data analytics to generate profitability reports and insights. By analyzing vast amounts of data from different sources, RPA bots can identify trends, patterns, and anomalies that can inform strategic decision-making and risk management. This data-driven approach enables insurers to optimize processes, enhance customer experiences, and drive business growth.

5. Automating Repetitive Tasks Across Systems

Lastly, RPA excels at automating repetitive tasks such as copying and pasting data among various systems and applications. Whether it’s updating client information across multiple platforms or synchronizing data between backend systems, RPA bots can execute these tasks with speed and precision. This automation not only saves time but also minimizes the risk of errors associated with manual data entry.

Why Is Insurance Automation Important For Businesses?

Insurance automation for businesses is crucial for enhancing efficiency, reducing manual errors, and improving customer service. By streamlining processes through automation, businesses can accelerate claims processing, underwriting, and policy issuance, leading to cost savings and increased productivity.

1. Enhanced Customer Perceptions of Responsiveness

Automation in insurance, particularly through tools like Robotic Process Automation (RPA), is instrumental in enhancing customer perceptions of responsiveness. In today’s fast-paced world, customers expect quick and efficient service. RPA enables insurers to automate repetitive tasks such as data entry, document processing, and policy updates, allowing them to respond to customer inquiries and requests promptly. For example, when a customer submits a claim, RPA can automatically initiate the claims processing workflow, accelerating the resolution process and providing timely updates to the customer. This streamlined approach not only improves customer satisfaction but also strengthens the insurer’s reputation for reliability and responsiveness in the market.

2. Increased Capacity and Operational Efficiency

Automation plays a crucial role in increasing the capacity and operational efficiency of insurance businesses. By automating repetitive and time-consuming tasks, such as data entry, policy administration, and claims processing, insurers can free up a significant amount of capacity within their organizations. This allows employees to focus on more strategic initiatives, such as improving customer experiences, developing innovative products, and enhancing risk management practices. Moreover, automation reduces the likelihood of errors and delays associated with manual processes, leading to smoother workflows and improved overall efficiency across the enterprise.

3. Transformed Customer Experience with Cognitive Capabilities

Combining RPA with cognitive capabilities such as Artificial Intelligence (AI) and analytics can transform the customer experience in insurance. Natural Language Processing (NLP), for instance, enables insurers to analyze unstructured data from various sources, such as customer emails, social media posts, and call transcripts, to extract valuable insights and sentiments. By understanding customer preferences and behaviors, insurers can personalize their interactions, offer tailored product recommendations, and anticipate customer needs more effectively. Furthermore, cognitive technologies empower insurers to create intelligent, self-learning systems that continuously adapt and improve based on real-time feedback, ultimately enhancing the overall customer experience and loyalty.

4. Enterprise Scalability

Insurance automation, including the implementation of RPA, is essential for achieving enterprise scalability without compromising workflow efficiency. As insurance businesses grow and expand their operations, they must be able to handle increased volumes of transactions, customer inquiries, and policy updates effectively. RPA enables insurers to automate scalable processes, such as data entry, underwriting, and claims processing, ensuring consistent and reliable service delivery even during periods of high demand. Moreover, by leveraging automation technologies, insurers can optimize resource allocation, minimize manual intervention, and adapt to changing market conditions more efficiently, thereby enhancing their scalability and competitiveness in the industry.

5. Cost Reduction and Operational Efficiency

One of the most significant benefits of insurance automation is the reduction of costs and improvement of operational efficiency. Manual processes are often time-consuming, error-prone, and resource-intensive, leading to inefficiencies and increased operational expenses. By automating tasks such as data entry, document processing, and claims management, insurers can streamline their operations, reduce errors, and lower costs associated with labor, paper-based processes, and compliance management. Additionally, automation enables insurers to achieve greater operational transparency and control, allowing them to identify areas for optimization and cost savings more effectively, ultimately leading to improved profitability and competitiveness in the market.

6. Minimized Human Error

Automation in insurance operations plays a crucial role in minimizing the risk of human error, which can have significant financial implications and damage the insurer’s reputation. Manual processes are inherently prone to errors, such as data entry mistakes, calculation errors, and processing delays, which can result in costly claims disputes, compliance violations, and customer dissatisfaction. By leveraging RPA and intelligent automation tools, insurers can automate repetitive tasks, enforce standardized processes, and implement error-checking mechanisms to ensure accuracy and consistency across all operations. Moreover, automation enables insurers to proactively identify and address potential errors before they escalate, thereby reducing the likelihood of costly mistakes and preserving the integrity of their operations and brand reputation.

7. Facilitated Sales Growth

Automation provides insurance businesses with valuable insights and tools to facilitate sales growth and customer acquisition. By analyzing customer data, market trends, and competitor strategies, insurers can identify new sales opportunities, target high-potential prospects, and personalize their marketing and sales efforts more effectively. For example, automation enables insurers to segment their customer base, analyze buying behaviors, and tailor product offerings and pricing strategies to meet the needs and preferences of different customer segments. Moreover, automation streamlines the sales process by automating routine tasks such as lead generation, quote generation, and application processing, enabling sales teams to focus on building relationships, providing value-added services, and closing deals more efficiently. Additionally, automation enhances cross-selling and upselling opportunities by identifying complementary products and services that meet the evolving needs of existing customers, ultimately driving revenue growth and profitability for insurance businesses.

Use Cases Of RPA Automation In Insurance

RPA, or Robotic Process Automation, is revolutionizing the insurance industry by automating high-volume data processing tasks. Here are some key areas where RPA is making significant impacts:

1. Automating Insurance Claim Processing

RPA plays a significant role in automating insurance claim processing, a task that is document-sensitive, detail-oriented, and time-consuming. With RPA, this process can be expedited by up to 75% compared to manual processing. By utilizing Natural Language Processing (NLP) and Optical Character Recognition (OCR) technologies, RPA bots can extract data from various sources and verify fraudulent claims, reducing the need for manual intervention. This automation streamlines the claims process, minimizes errors, and ensures timely payouts, enhancing customer satisfaction.

2. Underwriting Processes

In insurance underwriting, RPA simplifies tasks such as filling data fields, analyzing customer histories, accessing internal and external data sources, and identifying risks and fraudulent cases. By automating these processes, underwriters can make quicker and more informed decisions, improving efficiency and accuracy. RPA enables underwriters to evaluate loss runs, assess risk factors, and enhance the overall underwriting process, leading to more effective risk management and better outcomes for insurers.

3. Sales and Distribution

RPA streamlines sales and distribution activities in the insurance sector by automating tasks such as creating sales reports, conducting legal and credit checks, and ensuring compliance with regulations. By automating these processes, insurers can improve the efficiency of their sales operations, reduce manual errors, and enhance customer satisfaction. RPA enables insurers to manage sales funnels, generate quotes, and streamline sales processes, ultimately driving business growth and profitability.

4. Regulatory Compliance

Compliance with regulatory requirements is crucial for insurance companies to avoid penalties and maintain trust with customers. RPA helps insurers ensure compliance by automating tasks such as customer data validation, data security operations, account closure management, and compliance report generation. By automating these processes, insurers can reduce the risk of regulatory breaches, streamline compliance efforts, and improve overall regulatory compliance posture.

5. Policy Administration

RPA automates policy administration tasks such as bidding, quoting, rating, issuing, endorsing, and renewing policies. By automating these processes, insurers can improve operational efficiency, reduce administrative overhead, and enhance customer satisfaction. RPA enables insurers to automate accounting settlements, tax settlements, credit control, and other policy administration tasks, leading to faster turnaround times and improved service quality.

6. Business and Process Analytics

RPA enhances business and process analytics in the insurance industry by automating data collection, analysis, and reporting tasks. By leveraging RPA, insurers can gain insights into operational efficiency, identify areas for improvement, and make data-driven decisions to optimize processes and enhance customer experiences. RPA enables insurers to automate audit trails, analyze process metrics, and improve overall business performance.

7. Query Resolution

RPA facilitates query resolution in the insurance industry by automating the interpretation of incoming calls, emails, and other customer queries. By using predefined rules and natural language processing technology, RPA bots can resolve basic queries without manual intervention, improving response times and customer satisfaction. RPA enables insurers to streamline query resolution processes, reduce manual errors, and enhance overall customer service.

8. Usage of Legacy Applications

Many insurance companies rely on legacy software and applications to execute their business processes. RPA bridges the gap between legacy applications and modern systems by automating communication and integration tasks. By leveraging RPA, insurers can connect legacy applications with new software solutions, streamline data exchange, and improve overall system interoperability. RPA enables insurers to optimize legacy systems, enhance operational efficiency, and support sustainable business growth.

Examples Of Companies Using RPA In Insurance

By automating repetitive tasks and optimizing processes, firms like Bajaj Allianz General Insurance, American Fidelity, Hollard Group, and EXL are revolutionizing how insurance services are delivered, driving efficiency, accuracy, and ultimately, higher levels of customer satisfaction.

1. Bajaj Allianz General Insurance

Bajaj Allianz General Insurance has implemented Robotic Process Automation (RPA) to streamline 22 processes, including the procurement of proposals, approvals, and issuance within their policy issuance operations. This initiative has significantly reduced redundant tasks, leading to improved operational efficiency and higher levels of customer satisfaction. By leveraging RPA, Bajaj Allianz has transformed its workflow, allowing for smoother and more streamlined operations across various stages of policy issuance. The adoption of RPA technology has enabled the company to enhance its agility in responding to customer needs while maintaining high standards of service quality.

2. American Fidelity

American Fidelity leverages RPA primarily in customer-facing processes, particularly in managing customer emails. By implementing RPA, the company has experienced increased productivity and accuracy, allowing employees to redirect their focus towards enhancing customer service delivery. The integration of RPA into customer email management has revolutionized the way American Fidelity interacts with its clients, ensuring prompt responses and personalized communication. This has not only improved customer satisfaction but also strengthened customer relationships, driving long-term loyalty and retention.

3. Hollard Group

The Hollard Group has integrated RPA to streamline broker communications through email automation. This implementation has resulted in significant time savings, with approximately 2,000 hours per month of processing time being saved. Moreover, the process has been fully automated, achieving a remarkable 98% automation rate, leading to a 600% reduction in execution time and a 91% decrease in the cost per transaction. The successful deployment of RPA within broker communications highlights Hollard Group’s commitment to innovation and efficiency in delivering seamless services to its stakeholders.

4. EXL

EXL utilizes RPA for end-to-end claims processing, aiming to enhance efficiency and accuracy within their operations. This adoption of RPA has led to reduced processing times, decreased audit requirements, and improved overall accuracy in claims handling processes. By leveraging RPA technology, EXL has been able to optimize its claims processing workflow, ensuring faster resolution times and better outcomes for both the company and its customers. The implementation of RPA underscores EXL’s dedication to leveraging cutting-edge technology to drive operational excellence and deliver superior value to its clients.

How To Implement RPA In Insurance?

Implementing Robotic Process Automation (RPA) in the insurance industry holds significant potential for streamlining operations and enhancing customer service. Below is a step-by-step guide to effectively implement RPA in insurance.

1. Identify RPA Opportunities in Insurance Operations

Conducting a comprehensive assessment of insurance operations is the initial step in identifying areas where RPA can have a significant impact. This involves scrutinizing processes such as claims processing, policy issuance, data entry, and customer service to pinpoint tasks that are repetitive, rule-based, and prone to errors. By analyzing workflows and identifying pain points, organizations can prioritize which processes to automate first, thereby maximizing the benefits of RPA implementation.

2. Setting Clear Objectives for RPA Implementation

Defining specific objectives is crucial to ensure that RPA initiatives align with business goals in the insurance sector. These objectives could range from reducing errors and enhancing operational efficiency to improving customer experiences and regulatory compliance. Clear objectives serve as guiding principles throughout the RPA implementation process, helping organizations stay focused and measure the success of their automation efforts effectively.

3. Selecting the Right RPA Solution for Insurance

Choosing the appropriate RPA software is essential for successful implementation in the insurance industry. Factors to consider include ease of use, scalability, compatibility with existing systems, and vendor support. Additionally, organizations should look for RPA solutions tailored to the insurance sector, offering features such as pre-built automation templates for common processes. Integration capabilities with other technologies used in insurance operations, such as CRM systems and legacy applications, should also be evaluated.

3. Building an Effective RPA Team

Assembling a proficient team with diverse skills and expertise is crucial for the successful implementation of RPA in insurance operations. This team typically comprises RPA developers, business analysts, project managers, subject matter experts, and IT professionals. Collaboration with stakeholders from different departments ensures that RPA initiatives are aligned with business objectives and requirements, fostering a more holistic approach to automation.

4. Ensuring Infrastructure Readiness for RPA Deployment

Assessing the readiness of IT infrastructure is essential to support RPA deployments effectively. This involves evaluating server capacity, network reliability, and cybersecurity measures to safeguard sensitive insurance data. Collaboration with the IT department is imperative to address any infrastructure requirements or constraints that may impact RPA implementation and scalability.

5. Conducting Pilot Projects to Test RPA Solutions

Commencing with small-scale pilot projects allows organizations to evaluate RPA technology in real-world insurance scenarios before full-scale deployment. Processes that are well-suited for automation and offer high potential for ROI should be prioritized. Pilot projects enable organizations to assess RPA bot performance, identify challenges, and refine automation strategies based on user feedback and stakeholder input.

6. Ensuring Regulatory Compliance in RPA Processes

Adhering to regulatory requirements is paramount when implementing RPA in the insurance sector. Collaboration with legal and compliance teams helps ensure that RPA processes comply with industry-specific regulations such as HIPAA, GDPR, and others. Implementing robust security measures, including encryption and access controls, protects sensitive customer information and maintains data privacy and confidentiality.

7. Planning for Scalability in RPA Implementations

Scalability is a critical consideration to accommodate future growth and increasing workloads in RPA implementations. Organizations should select RPA solutions that offer scalability features, allowing for the deployment of additional bots and automation of new processes as needed. Anticipating how RPA infrastructure will evolve over time is essential to support larger transaction volumes and expanding business operations effectively.

8. Providing Staff Training and Effective Change Management

Offering comprehensive training to insurance staff working alongside RPA systems is essential for successful implementation. Developing robust change management strategies addresses any concerns or resistance to automation among employees. Effective communication about the benefits of RPA adoption, involvement of employees in the implementation process, and ongoing support and training facilitate a smooth transition to automated workflows.

9. Establishing Performance Monitoring Mechanisms

Establishing key performance indicators (KPIs) is vital for measuring the impact of RPA on insurance operations. Monitoring RPA performance regularly allows organizations to identify areas for improvement and optimization. Utilizing analytics and reporting tools enables organizations to track the success of RPA initiatives and make data-driven decisions about future automation projects.

10. Embracing Continuous Improvement in RPA Processes

RPA implementation in insurance is an iterative process that requires continuous monitoring, evaluation, and optimization. Staying abreast of the latest developments in RPA technologies and industry best practices ensures that automation initiatives remain effective and competitive. Continuously seeking opportunities to optimize RPA processes, streamline workflows, and drive further efficiencies enables organizations to maximize the benefits of automation and stay ahead in the evolving insurance landscape.

Conclusion

Process automation has emerged as a cornerstone of competitiveness within the insurance landscape. By proactively integrating automation solutions into their operations, insurers can unlock efficiencies, mitigate risks, and enhance customer satisfaction.

The evolution towards AI-driven processes, coupled with the adoption of BPA and no-code platforms, underscores a strategic imperative for insurance companies to stay ahead in a dynamic market environment.

Through the systematic automation of critical workflows, insurers can realize significant cost savings, boost operational agility, and ultimately position themselves for sustained success in an ever-evolving industry.

Adopting process automation is about more than simply being competitive; it is about rewriting the insurance industry’s standards for efficiency, agility, and customer-centricity. As technology advances, insurers must remain dedicated to embracing automation as a strategic need for success in the digital age.

How Can Idea Usher Help You With RPA Implementation?

Idea Usher specializes in providing comprehensive financial software development services designed to drive digital transformation and innovation across various industries. Our team of experts is dedicated to reinventing the way businesses handle payments, purchases, investments, and more in today’s rapidly evolving digital landscape. Here’s how Idea Usher can assist you with automation solutions:

Investment Solutions: Our team develops cutting-edge investment solutions that leverage automation to streamline processes in the insurance and other sectors. By automating tasks such as data analysis, portfolio management, and risk assessment, we help businesses optimize their investment strategies and enhance their overall efficiency.

Dynamic KYC Platform Software: Idea Usher offers dynamic Know Your Customer (KYC) platform software that incorporates advanced automation capabilities. Our solutions enable businesses to automate the KYC process, ensuring compliance with regulations while minimizing manual efforts and errors. With our dynamic KYC platform software, businesses can onboard customers seamlessly and securely.

Fraud Prevention Mechanisms: We develop robust fraud prevention mechanisms powered by automation to safeguard businesses against fraudulent activities. By leveraging advanced technologies such as machine learning and artificial intelligence, our solutions can detect and prevent various forms of fraud in real time, protecting businesses and their customers from financial losses.

Wealth Management Software: Idea Usher delivers wealth management software solutions that empower businesses to automate key wealth management processes. From portfolio tracking and performance analysis to financial planning and reporting, our software streamlines wealth management operations, enabling businesses to provide personalized services and achieve better outcomes for their clients.

Digital Wallets: Our team develops innovative digital wallet solutions that leverage automation to offer seamless and secure payment experiences. By automating transaction processing, fund transfers, and payment reconciliation, our digital wallet solutions enable businesses to enhance customer convenience and drive the adoption of cashless payments.

Insurtech Solutions: Idea Usher offers a range of Insurtech solutions designed to automate various aspects of the insurance industry. From claims processing and policy management to customer service and risk assessment, our solutions leverage automation to improve operational efficiency, reduce costs, and deliver superior customer experiences.

Talk to our technology experts today to learn more about how Idea Usher can help you align your business processes with modern automation needs and drive digital innovation in your industry.

FAQ

Q. What are the benefits of using RPA in insurance operations?

A. RPA (Robotic Process Automation) offers several benefits to insurance companies, including increased efficiency, reduced errors, faster processing times, improved compliance, and enhanced customer satisfaction. By automating repetitive tasks such as data entry, document processing, and report generation, RPA frees up employees to focus on more complex and value-added activities, ultimately leading to cost savings and better business outcomes.

Q. What types of insurance processes can be automated using RPA?

A. Virtually all types of insurance processes can be automated using RPA technology. This includes policy administration, claims processing, underwriting, billing, customer service, regulatory reporting, and more. RPA can handle tasks such as data extraction from documents, updating customer records, validating information against databases, and generating correspondence automatically, streamlining operations across the insurance value chain.

Q. How can RPA improve the claims handling process?

A. RPA can significantly enhance the claims handling process by automating various repetitive and time-consuming tasks. For example, RPA bots can collect and validate claim information from multiple sources, such as emails, forms, and databases, and populate it into the claims management system. Bots can also perform fraud detection checks, calculate claim amounts based on predefined rules, and generate correspondence to keep claimants updated on the status of their claims. By automating these tasks, RPA reduces processing times, improves accuracy, and enables faster resolution of claims.

Q. Is RPA implementation in insurance complex and time-consuming?

A. While implementing RPA in insurance operations requires careful planning and coordination, it is generally less complex and time-consuming compared to traditional IT projects. RPA solutions are designed to be user-friendly and non-invasive, allowing organizations to automate processes without making significant changes to existing systems or infrastructure. Additionally, many RPA platforms offer intuitive development tools that enable business users to create and deploy automation workflows with minimal IT involvement. However, proper stakeholder alignment, process analysis, and training are essential to ensure successful RPA implementation and maximize its benefits.

Gaurav Patil