- What Is Generative AI?

- How Generative AI Technology Is Reshaping Insurance?

- Why Should Insurers Embrace Generative AI Now?

- Traditional vs. Generative AI In Insurance Operations

- Types Of Generative AI Models Used In The Insurance Sector

- The Benefits Of Generative AI In Insurance

- Key Considerations For Implementing A Generative AI Framework

- Steps To Develop A Robust Generative AI Framework

- Steps To Implement Generative AI For Insurance

- Use Cases Of Generative AI In The Insurance Industry

- Real-world Examples: Generative AI In Insurance Industry

- The Future Of Generative AI In Insurance

- Case Study: Leading Insurer's GenAI Transformation

- Conclusion

- FAQ

The insurance industry, marked by data-centric decision-making and the increasing need for personalized customer experiences, finds itself in the midst of a sweeping transformation driven by Generative AI. Within this dynamic scenario, insurance providers are compelled to pioneer inventive solutions that not only align with evolving customer expectations but also boost operational efficiency. Generative AI, a subset of Artificial Intelligence (AI), is poised to revolutionize the traditional norms of the insurance sector.

Generative AI revolutionizes the insurance landscape by utilizing advanced Machine Learning models to create custom recommendations and insurance products, guaranteeing precise individualized pricing and heightened customer contentment. This data-driven approach not only refines insurers’ decision-making processes but also streamlines the digital purchasing journey for policyholders, making it effortless. Furthermore, Generative AI plays a pivotal role in operational efficiency in the insurance realm, and it achieves this by automating tasks, resulting in swift responses, decreased dependency on manual interventions, and the delivery of outstanding customer experiences.

- What Is Generative AI?

- How Generative AI Technology Is Reshaping Insurance?

- Why Should Insurers Embrace Generative AI Now?

- Traditional vs. Generative AI In Insurance Operations

- Types Of Generative AI Models Used In The Insurance Sector

- The Benefits Of Generative AI In Insurance

- Key Considerations For Implementing A Generative AI Framework

- Steps To Develop A Robust Generative AI Framework

- Steps To Implement Generative AI For Insurance

- Use Cases Of Generative AI In The Insurance Industry

- Real-world Examples: Generative AI In Insurance Industry

- The Future Of Generative AI In Insurance

- Case Study: Leading Insurer’s GenAI Transformation

- Conclusion

- FAQ

What Is Generative AI?

Generative AI is a subset of artificial intelligence technology encompassing machine learning systems capable of producing various forms of content, such as text, images, or code, often prompted by user input. These models learn from their training data, discerning patterns and structures and then generating new data with analogous characteristics. Deep learning, a complex computational process, is employed to scrutinize prevalent patterns within extensive datasets, subsequently crafting convincing outputs. This is accomplished through the utilization of neural networks, drawing inspiration from the human brain’s information processing and learning mechanisms. Consequently, the volume of content produced by a generative AI model directly correlates with the authenticity and human-like quality of its outputs.

Presently, generative AI predominantly responds to natural language prompts, eliminating the need for coding knowledge. However, its applications span various domains, including advancements in drug and chip design and materials science development.

Market Insight For Generative AI

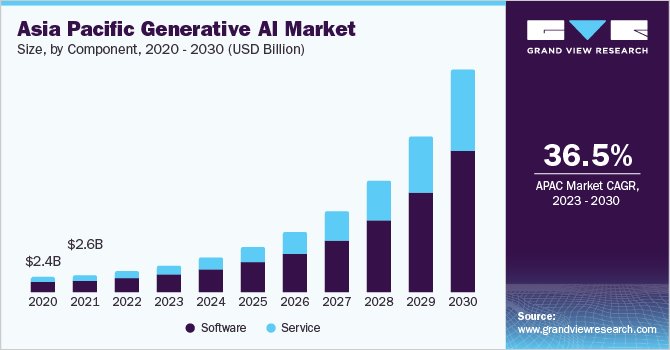

The global artificial intelligence (AI) market attained a valuation of nearly USD 59.67 billion in 2021 and is projected to witness a robust compound annual growth rate (CAGR) of 39.4 percent, reaching a substantial figure of USD 422.37 billion by 2028.

Similarly, the global generative AI market exhibited a value of USD 10.14 billion in 2022 and anticipates steady expansion with a compound annual growth rate (CAGR) of 35.6% from 2023 to 2030.

As per a report from Bloomberg Intelligence, the generative AI sector is poised to burgeon into a colossal $1.3 trillion market by 2032, with expectations of a remarkable 42% CAGR over the ensuing decade. This surge in demand for generative AI products is anticipated to contribute approximately $280 billion in fresh software revenue. The growth trajectory is initially propelled by training infrastructure, gradually transitioning toward inference devices for large language models (LLMs), digital advertising, specialized software, and services in the medium to long term.

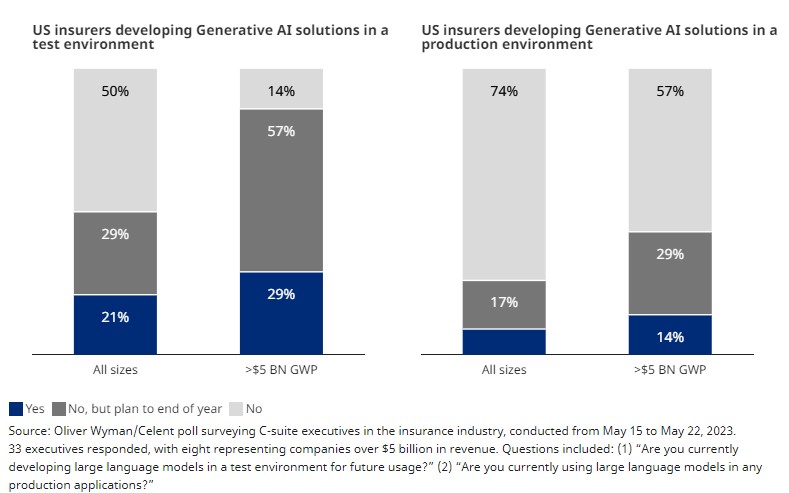

Moreover, findings from an Oliver Wyman/Celent survey reveal that numerous insurers are actively exploring generative AI solutions, with 25% planning to have such solutions in production by the conclusion of 2023.

To succeed, insurance carriers must develop a roadmap for AI pilot programs, invest in skill-building, and create a milestone-driven schedule. The insurance industry is evolving, and Generative AI offers substantial benefits, particularly for casualty and property insurers.

McKinsey & Company

How Generative AI Technology Is Reshaping Insurance?

Generative Artificial Intelligence (AI) is making profound waves in the insurance sector. It leverages advanced algorithms and deep learning models to create original content and enhance data-driven decision-making processes. Here’s a comprehensive overview of how Generative AI is reshaping the insurance landscape:

1. Personalized Risk Assessment And Pricing

Generative AI empowers insurers to analyze historical data with precision, resulting in accurate risk assessment and pricing. By identifying intricate patterns and trends, insurers can tailor insurance premiums to individual policyholders, optimizing risk management strategies.

2. Adapting To A Digitalized World

As the world becomes increasingly digitized, the nature of risks covered by insurers is evolving. Generative AI helps insurers adapt by comprehensively assessing risk, detecting fraud, and minimizing errors in the application process.

3. Enhanced Customer Experiences

Generative AI streamlines services and claims processing, offering customers faster, more efficient interactions with insurers. Automation of insurance processes expedites claims handling and ensures a smoother customer journey, enhancing satisfaction and loyalty.

4. Augmenting Human Underwriting

While AI’s role in underwriting is expanding, the replacement of human underwriters is a gradual process. Generative AI complements human underwriters by providing valuable insights and data-driven assessments, enabling insurers to offer tailored insurance plans that precisely meet customers’ needs.

5. Data Augmentation And Content Generation

Generative AI bridges data gaps by creating synthetic data and enhancing predictive models’ performance. Additionally, AI-generated content is used in policy documentation, marketing materials, customer communications, and product descriptions, facilitating effective communication.

6. Fraud Detection And Risk Simulation

Generative AI is a potent tool for fraud detection, generating examples of both fraudulent and non-fraudulent claims to train machine learning models effectively. It can also simulate various risk scenarios based on historical data, aiding in precise premium calculations.

7. Operational Efficiency And Customer Service Enhancement

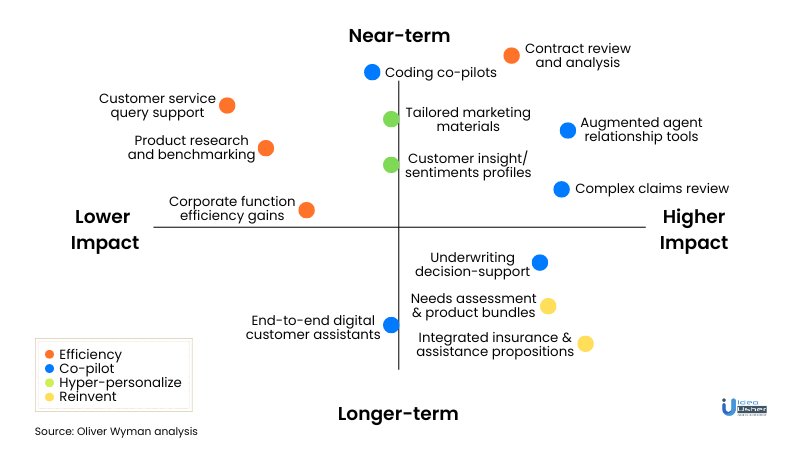

Across the insurance value chain, Generative AI drives operational efficiencies, influencing strategy, product design, marketing, distribution, pricing, underwriting, claims processing, and governance. It enables real-time customer service, answering inquiries and providing customer service agents with comprehensive customer information.

Why Should Insurers Embrace Generative AI Now?

Here are some reasons for insurers to adopt Generative AI promptly:

Reason 1. Future-Proofing Insurance

Generative AI is a vital component for future-proofing insurance operations. Recent surveys highlight that AI and digital strategies rank as top priorities for organizations that have successfully transformed. Insurers must recognize the urgency of integrating Generative AI into their systems to remain competitive and relevant.

Reason 2. Strong Management Focus

The substantial attention from management dedicated to Generative AI is a clear signal of its significance. This technology warrants immediate consideration, as its capabilities are poised to reshape the insurance landscape.

Reason 3. ChatGPT Revolution

OpenAI’s ChatGPT has swiftly gained popularity across industries. With millions of users, it offers insurers powerful tools for improving search, gaining customer insights, content creation, coding, and more. Leveraging ChatGPT can provide a competitive edge in a rapidly evolving market.

Reason 4. Transformative Potential

Generative AI presents transformative opportunities for insurers. It can redefine how insurers operate, interact with customers, and handle data, ultimately enhancing efficiency, customer service, and risk assessment.

Reason 5. Anticipated Integration

The trend indicates that generative AI will become increasingly integral to insurance operations. Insurers should prepare for its widespread incorporation in 2024 and beyond. Acting now positions insurers as industry leaders, ready to harness the benefits of this innovative technology.

Traditional vs. Generative AI In Insurance Operations

Traditional AI In Insurance

Traditional AI, often termed rule-based or narrow AI, operates on predefined rules and patterns, offering specific task-oriented solutions. In the insurance realm, it finds its niche in data analysis, risk assessment, and fraud detection. Key differentiators include:

- Rule-Based Approach: Traditional AI relies on explicit rules and algorithms, offering deterministic outputs based on input data.

- Data Dependency: It demands labeled data for training and relies heavily on human-crafted features, limiting performance to the quality and quantity of labeled data available.

- Structured Data Focus: Traditional AI excels in analyzing structured data, ideal for assessing known patterns of fraudulent activities based on predefined risk and fraud rules.

Generative AI In Insurance

Generative AI, driven by deep learning models and advanced algorithms, introduces a dynamic dimension to insurance operations. It sets itself apart in the following ways:

- Creative Output: Unlike traditional AI, generative AI can create novel and dynamic outputs extending beyond predefined rules.

- Data Autonomy: It learns from unlabelled data, producing meaningful outputs without direct supervision, making it adaptable to evolving datasets.

- Risk Enhancement: Generative AI enhances risk assessment by simulating diverse risk scenarios, detecting novel fraud patterns, and offering truly personalized insurance policies.

- Ethical Considerations: However, its complexity raises ethical concerns, demanding careful attention to responsible implementation, fairness, and bias mitigation.

In insurance, while traditional AI excels in structured data analysis and rule-based tasks, generative AI empowers insurers with creativity, adaptability, and the potential for highly personalized services. Both have their place, but recognizing their unique capabilities is pivotal in harnessing their full potential for insurance operations.

Types Of Generative AI Models Used In The Insurance Sector

In the dynamic landscape of the insurance sector, staying competitive requires harnessing cutting-edge technologies. One such innovation is the utilization of generative AI models, which have revolutionized the way insurance companies handle data, assess risks, and develop products. In this article, we will explore the various types of generative AI models that have found their niche in the insurance industry, each offering unique capabilities to enhance data analysis, risk assessment, and product development.

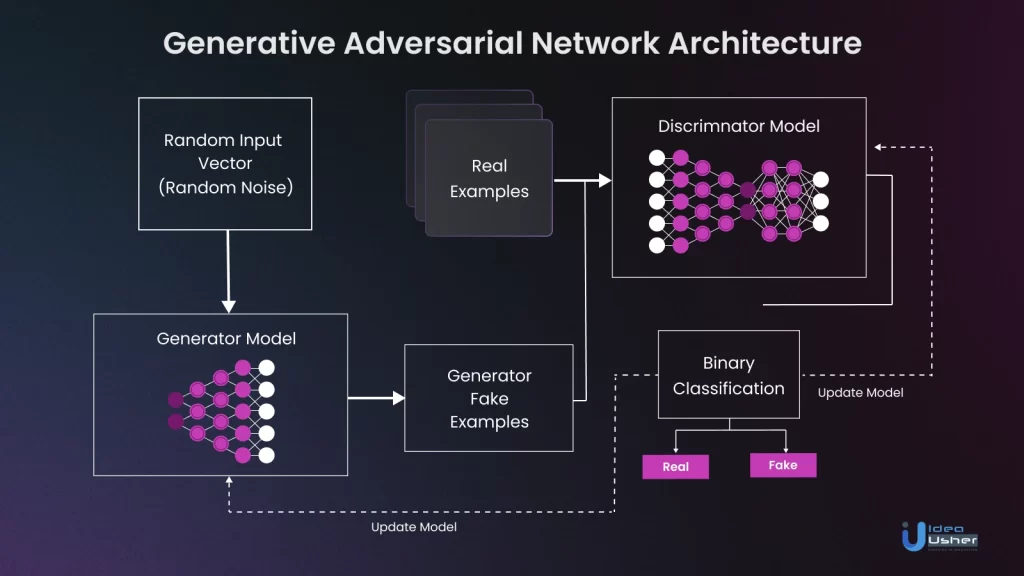

1. Generative Adversarial Networks (GANs)

Generative Adversarial Networks (GANs) have gained prominence since their inception in 2014, thanks to their ability to create highly realistic and coherent data samples. In the context of insurance, GANs are invaluable for generating synthetic data that closely mirrors real-world insurance-related information. Here’s how they work:

- The Generator: GANs consist of two neural networks—the generator and the discriminator. The generator’s role is to craft fake data samples.

- The Discriminator: Simultaneously, the discriminator aims to distinguish between genuine and synthetic data. This adversarial setup results in a constant push and pull, driving the generator to produce increasingly realistic samples.

Applications In Insurance

Insurers are using GANs to generate synthetic insurance data, such as policyholder demographics, claims records, and risk assessment data. These synthetic datasets improve the robustness of AI models for fraud detection, customer segmentation, and personalized pricing. By enhancing data quality and enabling the creation of more accurate predictive models, GANs are elevating overall efficiency and accuracy in insurance operations.

2. Variational Autoencoders (VAEs)

Variational Autoencoders (VAEs) represent a different facet of generative AI models. They leverage probabilistic methods to generate diverse data samples with inherent uncertainty. In insurance, this diversity is a game-changer:

Encoder And Decoder: VAEs comprise an encoder, responsible for transforming input data into a latent space representation, and a decoder, which reconstructs data from the latent space into the original data space.

Applications In Insurance

VAEs find utility in generating a wide array of risk scenarios, aiding risk assessment, portfolio optimization, and innovative product development. By producing novel and diverse data, VAEs empower insurers to adapt to changing market dynamics and customer preferences with greater agility.

3. Autoregressive Models

Autoregressive models, renowned for their sequential data generation capabilities, are very well suited for handling time-series data in insurance. They operate by predicting each data point based on the values of preceding data points:

Sequential Data Generation: Autoregressive models generate data sequentially, one element at a time, considering the probability distribution of each element given its predecessors.

Applications in Insurance:

Insurers leverage autoregressive models to predict future trends, identify anomalies, and make data-driven decisions. For instance, these models can forecast claim frequencies and severities, enabling proactive resource allocation and preparedness for potential claim surges. Additionally, they excel in anomaly detection, flagging irregular patterns that may indicate fraudulent activities.

These Generative AI models not only elevate insurers’ decision-making capabilities but also lay the groundwork for a streamlined and expedited digital purchasing experience for policyholders.

The Benefits Of Generative AI In Insurance

Beyond the buzz, Generative Artificial Intelligence (AI) offers a plethora of benefits that redefine how insurers operate, interact with customers, and manage risks. Here are some ways generative AI can deliver business value for insurers:

1. Enhanced Customer Experience

Generative AI has the power to revolutionize customer experiences. By processing extensive volumes of customer data, AI algorithms tailor insurance products to meet individual needs and preferences. Virtual assistants, driven by Generative AI, engage in real-time interactions, guiding customers through inquiries and claims processing, leading to higher satisfaction and increased customer loyalty.

Generative AI facilitates personalized marketing materials, creating a deeper customer understanding (e.g., personas and social listening). It aims to generate higher revenue through increased conversion, retention, cross-selling, and customer engagement.

Its challenges include ensuring the accuracy of AI-drafted materials and navigating legal and compliance governance processes.

2. Precision in Risk Assessment and Underwriting

Generative AI excels in assessing risks and optimizing underwriting processes. Through the analysis of historical data and advanced pattern recognition, AI algorithms predict potential risks with greater precision. This enables insurers to offer tailored coverage options, reduce the risk of adverse selection, and optimize underwriting decisions.

Generative AI can be used to simulate different risk scenarios based on historical data and calculate premiums accordingly, contributing to more accurate and personalized premium calculations.

Its challenges include data quality, data exhaustivity, and the training/upskilling of decision-makers.

3. Streamlined Claims Processing

Generative AI automates claims processing, extracting and validating data from claim documents with remarkable speed and accuracy. This streamlines the entire claims settlement process, reducing turnaround time and minimizing errors. Faster and more accurate claims settlements lead to higher customer satisfaction and improved operational efficiency for insurers.

Generative AI can drive efficiency via automation, automating repetitive or manual tasks, thus freeing up time for higher-skill activities, such as customer support and operations.

Its challenges include the need for human review, a few off-the-shelf models, and the transition from “doing” to “validating.”

4. Advanced Fraud Detection and Prevention

Generative AI employs advanced algorithms to detect fraudulent behavior patterns and anomalies with unparalleled accuracy. By analyzing vast datasets, it enhances fraud detection capabilities, safeguarding insurers from potential financial losses and maintaining their credibility.

Generative AI can generate examples of fraudulent and non-fraudulent claims for training machine learning models to detect fraud. This contributes to significant cost savings and ensures that insurers can prevent fraudulent claims.

Its challenges include incomplete or inaccurate data that can hinder the effectiveness of fraud detection. Moreover, fraudsters constantly evolve their tactics, so Generative AI must adapt to these changes and stay ahead of new fraud schemes.

5. Proactive Risk Management

Generative AI’s predictive modeling capabilities allow insurers to simulate and forecast various risk scenarios. By identifying potential risks in advance, insurers can develop proactive risk management strategies, mitigate losses, and optimize their risk portfolios effectively.

Generative AI empowers insurers to take control of their data by implementing a zero-party data strategy. This approach gathers valuable data efficiently through personalized questions, benefiting both insurers and consumers. Consumers receive more customized insurance, while insurers gain actionable data insights.

Its challenges include the prediction of complex and interconnected risk factors. Generative AI needs to account for a wide range of variables and their potential interactions. Additionally, accessing relevant and timely data for proactive risk management can be a hurdle. Insurers need robust data sources to feed AI models

6. Data-Driven Insights

Generative AI-driven customer analytics provides invaluable insights into customer behavior, market trends, and emerging risks. This data-driven approach empowers insurers to develop innovative services and products that cater to changing customer needs and preferences, leading to a competitive advantage.

Its challenges include handling customer data for insights that must align with privacy regulations and ethical standards. Maintaining customer trust while using their data is crucial. Also, while generative AI can provide insights, human interpretation is often required to translate these insights into actionable strategies effectively.

7. Cost Savings And Operational Efficiency

By automating various processes, Generative AI reduces the need for manual intervention, leading to cost savings and improved operational efficiency for insurers. Automated claims processing, underwriting, and customer interactions free up resources and enable insurers to focus on higher-value tasks.

Its challenges include implementing generative AI into existing systems, which can be complex, as compatibility and integration with legacy systems can pose challenges. Furthermore, developing the necessary expertise to manage and maintain generative AI systems may also require substantial training and resources.

8. Regulatory Compliance And Transparency

Generative AI can incorporate Explainable AI (XAI) techniques, ensuring transparency and regulatory compliance. Insurers can understand the reasoning behind AI-generated decisions, facilitating compliance with regulatory standards and building customer trust in AI-driven processes.

Its challenges include keeping up with evolving regulatory requirements in the insurance industry, which can be demanding. AI models must adapt to ensure ongoing compliance. Furthermore, achieving transparency in AI decision-making, especially in complex models, remains a challenge. Ensuring AI-generated decisions are explainable is essential for compliance.

9. Empowering Data Control

Generative AI offers a unique advantage – it allows insurers to implement a zero-party data strategy. This strategy involves gathering data efficiently by posing personalized questions to consumers, who willingly provide insights. This non-invasive and transparent approach not only benefits insurers by providing actionable data but also enhances the customization of insurance products, ultimately benefiting consumers.

Its challenges include collecting and storing consumer data securely. Data breaches can lead to significant legal and reputational consequences. Ensuring consumers willingly participate in a zero-party data strategy while maintaining transparency and consent can be intricate. Striking the right balance is crucial.

10. Improve Claims Productivity

Enhancing claims productivity through Generative AI involves automating routine tasks in claims management, empowering claims adjusters to focus on assessing claims and achieving better outcomes. This approach includes features like summarization and risk assessment, which are essential for efficient claims processing. Additionally, organizations need to evaluate their existing technology stack, develop a data strategy, and ensure compliance with governance and regulations.

Implementing Generative AI begins with pilot programs to measure its impact on note editing frequency, time savings, and adjuster adaptation. In the long term, this technology can significantly improve cycle times, raise quality scores, and reduce administrative burdens, ultimately leading to increased productivity and efficiency in the claims process. Generative AI has the potential to save anywhere from 5% to 20% of time, depending on factors such as claim type and the extent of automation.

Using generative AI in insurance has numerous benefits, both in the short and long term:

Key Considerations For Implementing A Generative AI Framework

The power of Generative AI can be a game-changer; however, before diving in, insurers must carefully weigh several crucial technical considerations to ensure seamless integration and optimal performance. Here are the essential factors:

1. Data Quality And Availability

The availability and quality of industry-specific datasets are paramount. Insurers must ensure that the datasets used for training Generative AI models possess good lineage and quality. This enables models to grasp the intricacies of the insurance business context effectively.

2. Architectural Decisions

A strong technical and architectural understanding is essential for choosing the right Generative AI tech stack and model. It’s critical to differentiate between various technologies and make informed choices. The architecture and training methodology significantly influence a model’s accuracy, efficiency, and cost-effectiveness.

3. Handling Large Datasets

The size of the dataset plays a pivotal role in determining the suitability of a Generative AI tech stack. Large datasets often necessitate the use of distributed computing frameworks like Apache Spark for efficient data processing, as they demand robust hardware and software capabilities.

4. Data Security And Privacy

Insurance datasets frequently contain sensitive information. Therefore, data security becomes a paramount concern when implementing Generative AI systems. Ensuring the utmost data security and privacy safeguards against vulnerabilities and breaches.

5. Real-Time Applications

In cases requiring real-time processing, such as instant claim assessment or virtual advisory services, the frequency of Generative AI model operations becomes critical. Insurers may need to opt for solutions that prioritize speed, such as lightweight models or performance-optimized code, to ensure responsiveness and efficiency.

Steps To Develop A Robust Generative AI Framework

1. Define Clear Objectives

Begin by meticulously defining your objectives for Generative AI integration. Specify the desired outcomes, such as improved claims processing efficiency or enhanced customer service through chatbots. Ensure alignment with broader business strategies, emphasizing measurable KPIs like reduced processing time or increased customer satisfaction scores.

2. Identify Pertinent Use Cases

Conduct a comprehensive analysis of your insurance organization to pinpoint precise use cases where Generative AI can provide substantial value. In underwriting, for instance, Generative AI can automate risk assessment by generating predictive models from historical data. Similarly, in customer service, AI-driven chatbots can offer personalized assistance. This detailed use case identification sets the stage for focused AI implementation.

3. Data Collection And Curation

The backbone of any Generative AI system is data. Gather a diverse and comprehensive dataset encompassing historical claims, customer interactions, policy information, and other relevant data sources. Ensure the data’s quality and cleanliness by addressing issues like missing values and outliers. Comply with stringent data privacy regulations, implementing encryption and access controls to protect sensitive information.

4. Model Selection

Choose Generative AI models based on the specific requirements of your identified use cases. For instance, consider using Variational Autoencoders (VAEs) for generating personalized marketing materials or Generative Adversarial Networks (GANs) for simulating risk scenarios. Evaluate the models based on factors like scalability, interpretability, and their capacity to handle the diversity of insurance data.

5. Model Training And Refinement

Initiate the model training process using high-quality, pre-processed data. Implement techniques like transfer learning or fine-tuning pre-trained models to expedite the training process. Continuous refinement is crucial, driven by iterative feedback loops that incorporate new data and adapt to evolving insurance scenarios.

6. Implementation And Evaluation

Seamlessly integrate Generative AI models into your insurance infrastructure. Deploy models within your claims processing systems or incorporate AI-driven chatbots into customer service channels. Rigorously evaluate model effectiveness by monitoring key performance metrics. Assess the impact on efficiency, accuracy, and customer satisfaction. Realize that AI models may require periodic retraining to stay relevant and effective.

Steps To Implement Generative AI For Insurance

Implementing Generative AI within the insurance sector can revolutionize operations and enhance customer experiences. To effectively incorporate this transformative technology, consider the following steps:

1. Define Strategic Objectives

Begin by clearly defining your strategic objectives for implementing Generative AI in insurance. Identify what specific outcomes you aim to achieve, such as improving claims processing efficiency, enhancing fraud detection, or streamlining underwriting processes.

2. Conduct A Readiness Assessment

Assess your organization’s readiness to adopt Generative AI. Ensure you have the necessary technical infrastructure, expertise, and resources in place to support the implementation.

3. Identify High-Impact Use Cases

Analyze your insurance operations to pinpoint high-impact use cases where Generative AI can deliver significant value. Examples include claims automation, risk management, intelligent underwriting, and content generation.

4. Data Strategy And Preparation

Develop a robust data strategy that addresses data collection, storage, and privacy concerns. Gather diverse and high-quality datasets relevant to your chosen use cases. Ensure compliance with data privacy regulations.

5. Model Selection And Customization

Select Generative AI models that align with your use cases. Customize these models to suit the specific requirements of the insurance industry, considering factors such as data volumes, model interpretability, and scalability.

6. Integration And Testing

Integrate Generative AI models into your existing insurance systems and processes. Thoroughly test the integration to ensure seamless functionality and data flow. Validate the accuracy of generated outputs.

7. Continuous Monitoring And Optimization

Implement continuous monitoring of Generative AI models. Regularly assess their performance and fine-tune them as needed. Ensure that the models adapt to evolving insurance scenarios.

8. Compliance And Data Governance

Pay close attention to compliance with regulatory standards and data governance practices. Maintain transparency in AI-driven processes and ensure adherence to industry regulations.

9. User Training And Adoption

Provide training and support to insurance professionals who will work alongside Generative AI systems. Foster user adoption by highlighting the benefits and capabilities of the technology.

10. Measure Impact And ROI

Continuously measure the impact of Generative AI implementation on key performance indicators (KPIs) such as claims processing times, fraud detection rates, and customer satisfaction scores. Calculate the return on investment (ROI) to assess the technology’s effectiveness.

Use Cases Of Generative AI In The Insurance Industry

Generative AI has ushered in a new era for the insurance sector, revolutionizing processes and introducing novel solutions. Here are some use cases of Generative AI:

1. Personalized Insurance Policies

Generative AI leverages customer data to craft tailored insurance policies. For example, it can analyze driving history, vehicle details, and personal characteristics to create bespoke auto insurance policies, enhancing customer satisfaction and retention.

2. Automated Underwriting

Automating risk assessment and decision-making, Generative AI optimizes underwriting. By analyzing medical records, lifestyle data, and family history, it expedites life insurance underwriting decisions, resulting in quicker policy approvals.

3. Claims Processing Automation

Generative AI accelerates claims processing by automating data extraction and validation. For instance, it can streamline the assessment and settlement of property insurance claims following natural disasters, ensuring faster and more accurate claim resolutions.

4. Fraud Detection And Prevention

Through data analysis, Generative AI identifies suspicious claims, aiding in the prevention of insurance fraud. It can spot anomalies in medical billing data, proactively mitigating fraud risks.

5. Virtual Assistants And Customer Support

Generative AI-powered virtual assistants offer real-time customer support, handling inquiries and improving customer interactions. They guide policyholders through claims processes and provide information efficiently.

6. Risk Modeling And Predictive Analytics

Generative AI simulates risk scenarios, helping insurers optimize risk management and decision-making. For instance, it forecasts weather-related risks for property insurers, enabling proactive risk mitigation.

7. Product Development And Innovation

Generative AI plays a pivotal role in fostering product development, enabling insurers to craft innovative offerings that align with the dynamic demands of their customers. For instance, it empowers the creation of travel insurance plans meticulously tailored to cater to the unique requirements of distinct travel destinations.

8. Natural Language Processing (NLP) Applications

Generative AI employs NLP to process unstructured data like customer feedback. NLP-powered sentiment analysis helps insurers gauge customer sentiments, enhancing service quality and product offerings.

9. Anomaly Detection

Generative AI excels in identifying irregular data patterns, such as unusual customer behavior or suspicious claims. Early anomaly detection strengthens risk mitigation and decision-making.

10. Data Augmentation

Generative AI creates synthetic data to enhance predictive models. It addresses data scarcity issues, improving model performance while safeguarding customer privacy.

11. Content Creation

Generative AI tools like ChatGPT assist in content creation for marketing and policy documentation. It can generate policy documents, marketing materials, customer communications, and product descriptions, saving time and enhancing quality.

12. Predictive Analysis & Scenario Modeling

Generative AI models simulate potential future scenarios, aiding insurers in understanding emerging risks. For instance, they can predict health conditions’ evolution, helping insurers set accurate premiums.

13. Chatbots And Customer Service

Generative AI-driven chatbots provide human-like text responses, improving customer interactions and offering round-the-clock support.

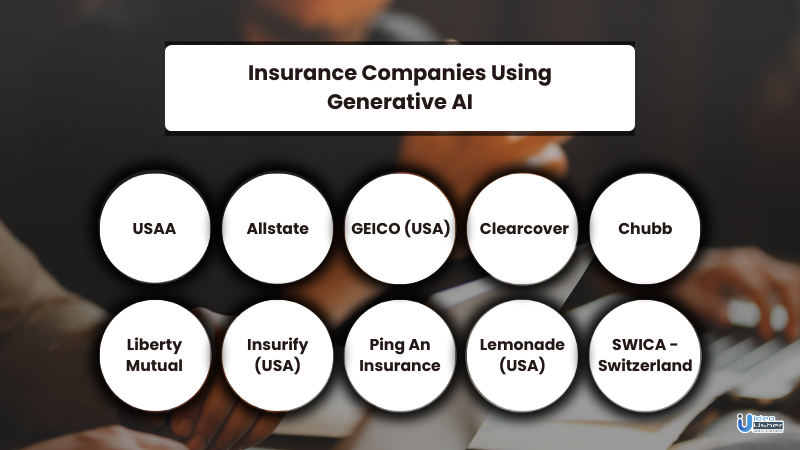

Real-world Examples: Generative AI In Insurance Industry

Here are the real-world examples that represent insurance organizations leveraging Generative AI to enhance customer experiences, streamline processes, and achieve remarkable feats in efficiency and customer support.

1. USAA

- USAA has partnered with Google Cloud to enhance the claims process for minor automobile accidents using AI and machine learning. They’ve developed an automated solution that can predict car part repair or replacement based on images of vehicle damage.

- Additionally, USAA has integrated Clinc’s artificial intelligence platform with its Alexa skills. This integration enables USAA members to engage in natural, human language conversations with AI, offering a more personalized and conversational experience.

2. Allstate

- Allstate Business Insurance utilizes AI models to help agents quickly gain knowledge about insurance products and streamline the quoting process.

- It has introduced ABIE, an AI-powered chatbot designed to provide real-time insights and advice to small business owners.

- The company employs AI-based solutions to monitor and identify suspicious claims, contributing to fraud detection efforts.

3. GEICO (USA)

- GEICO, based in the USA, utilizes Generative AI to enhance customer experiences through a user-friendly virtual assistant.

- This virtual assistant engages in conversations, answers queries, and provides relevant information to policyholders.

- Its innovative use of Generative AI improves customer engagement and overall user experiences.

4. Clearcover

- Clearcover, a digital car insurance provider based in Chicago, USA, is known for its Auto Insurance offerings and significant investments.

- The company leverages ClearAI, an AI-powered tool, to automate the claims process.

- Through ClearAI, customers benefit from swift and efficient responses, ensuring timely claims settlements.

5. Chubb

- Chubb, a global insurance company headquartered in Switzerland, is strategically integrating Generative AI into its operations.

- Their primary focus is on revolutionizing key aspects such as underwriting and claims processing.

- The aim is to maximize operational efficiency and drive innovation within the insurance industry.

6. Liberty Mutual

- Liberty Mutual, headquartered in Boston, USA, is actively exploring the potential of AI in its operations.

- As part of its AI initiatives, Liberty Mutual has successfully developed an AI-powered auto damage estimator.

- This technology is designed to enhance customer experiences by streamlining the assessment of vehicle damage and expediting the claims settlement process.

7. Insurify (USA)

- Insurify, an insurance comparison website in the USA, has been an early adopter of chatbots in the insurance industry.

- Their chatbot employs natural language processing and machine learning technologies to interact with users.

- It assists users in finding the right insurance policy based on their needs and preferences.

- Remarkably, the chatbot can process not only text messages but also images, such as photos of license plates, within the Facebook Messenger app.

8. Ping An Insurance

- Ping An Insurance, headquartered in Shenzhen, China offers a comprehensive suite of services, including life insurance, property and casualty insurance, banking, and financial services.

- The company is dedicated to championing cutting-edge technologies, including AI.

- Ping An’s AI-driven initiatives encompass generative models applied to underwriting, risk assessment, and automated customer service.

- The objective is to deliver efficient and tailored solutions to a diverse customer base.

9. Lemonade (USA)

- Lemonade, an innovative AI-powered insurance company based in the USA, offers a chatbot named Maya for policyholders.

- Maya seamlessly guides users through their entire customer journey, from policy application to claim processing.

- An impressive feat achieved by Lemonade’s chatbot is processing and paying a $979 claim in under 3 seconds.

- This remarkable efficiency showcases Lemonade’s innovative use of Generative AI to provide real-time customer support and efficient claims processing.

10. SWICA (Switzerland)

- SWICA, a health insurance company, has innovatively developed a sophisticated chatbot for customer service.

- This chatbot not only answers frequently asked questions but also seamlessly handles policy changes within the chat window.

- Customers can perform various actions, including changing franchises, updating addresses, ordering insurance cards, and more, all without being redirected to different pages.

- SWICA’s chatbot exemplifies the effective use of Generative AI to enhance the customer experience and streamline policy management processes.

The Future Of Generative AI In Insurance

The future promises a remarkable transformation, where Generative AI will reshape insurance operations and interactions with policyholders. Let’s embark on this journey and explore the road ahead:

1. Personalized Products And Services

Generative AI is set to usher in an era of hyper-personalization. Insurance policies will be precisely tailored to each customer’s unique needs, thanks to AI’s ability to craft custom solutions for every policyholder.

2. Streamlined Customer Experiences

In the coming years, insurance queries will be swiftly resolved by intelligent chatbots and virtual assistants. Generative AI will automate and enhance customer interactions, making them faster and more convenient.

3. Transparent And Fair Pricing

Generative AI’s prowess will extend to improving risk assessment and underwriting. This will lead to fairer pricing and coverage, with AI-driven processes ensuring transparency for customers.

4. Advanced Risk Management

The future holds the promise of AI-powered risk assessment that identifies potential risks with pinpoint accuracy. This will enable insurers to devise more effective risk management strategies and mitigate losses effectively.

5. Underwriting Evolution

Underwriting will undergo a significant evolution because of Generative AI. This means not only lower premiums for policyholders but also more efficient underwriting processes for insurers.

6. Effortless Claims Processing

Claims processing will become a breeze with Generative AI automating tasks like evidence gathering and damage assessment. This translates to quicker settlements and lighter workloads for claims adjusters.

7. Fraud Detection

Insurers will leverage Generative AI to develop sophisticated fraud detection systems. These systems will be highly effective in identifying and preventing fraudulent claims, saving insurers substantial sums.

8. Innovative Product Development

Generative AI will fuel the creation of novel insurance products. These offerings will cater to diverse customer segments and address emerging needs, expanding insurers’ product portfolios.

9. Customer-centric Service

AI-powered chatbots and virtual assistants will become your go-to insurance companions. They will provide real-time assistance, enhancing the overall customer service experience.

10. Data-driven Insights

Generative AI’s data analysis capabilities will enable insurers to offer highly personalized services. It will draw insights from vast datasets, enabling tailored insurance solutions for customers.

11. Claims Automation

Generative AI will take claims processing to new heights by automating and expediting the entire process. This translates to faster claims settlements for policyholders.

12. Personalized Marketing Campaigns

Insurers will utilize Generative AI to craft marketing campaigns tailored to individual customers, resulting in higher engagement and satisfaction.

13. IoT Integration

Generative AI and the Internet of Things (IoT) will converge, creating a network of interconnected devices. Insurers will use real-time data from smart devices to offer personalized safety recommendations.

14. Explainable AI (XAI)

As Generative AI becomes more widespread, the need for Explainable AI (XAI) will grow. This will ensure transparency in AI-generated decisions, fostering customer trust.

15. Ethical AI And Compliance

The rise of Generative AI necessitates robust governance frameworks to address bias, fairness, and privacy concerns. Ethical AI practices and regulatory compliance will be paramount.

16. Health And Well-being

Generative AI will align with the trend of holistic health and well-being. Insurers will use AI-generated insights to offer customized health insurance plans that incentivize healthy living.

In conclusion, the future of Generative AI in insurance holds immense promise, reshaping operations, customer interactions, and risk management. By embracing this transformative technology, insurers can unlock unprecedented efficiency, enhance customer satisfaction, and thrive in the dynamic world of insurance. The journey has begun, and the destination is innovation.

Case Study: Leading Insurer’s GenAI Transformation

In August 2023, Christopher Freese, Managing Director & Senior Partner of BCG’s Insurance practice, discussed the profound impact of Generative Artificial Intelligence (GenAI) on the insurance industry as summarised below:

Challenges Faced by the Insurance Industry

The insurance sector has historically faced challenges in fully realizing the potential of Artificial Intelligence (AI). Traditional AI solutions were often limited to optimizing specific use cases, failing to bring about transformative change. However, GenAI presents a new paradigm, democratizing access to AI and simplifying its usage.

Approaches to Transformation

Leading insurers are adopting two distinct approaches to leverage GenAI:

a. Game-Changing Applications Scaling:

Insurers are identifying key applications like knowledge assistants and coding assistants, which enhance productivity and can be deployed across various operational areas. Knowledge assistants, for instance, can reduce customer service agents’ information retrieval time by more than half.

b. End-to-End Vertical Transformation:

Some insurers are completely rethinking specific verticals, such as the claims process in auto insurance. GenAI automates every step in this journey, significantly reducing settlement times and enhancing customer experiences.

Impact on Efficiency and Cost Savings

The deployment of GenAI across the value chain is expected to yield substantial efficiency gains and cost savings. Customer service productivity can increase significantly, with up to 35% of agents’ time saved. Claims management costs can be reduced through streamlined documentation and end-to-end automated claims appraisals.

Beyond Cost Reductions: Driving Growth

While cost savings are a significant driver, GenAI offers opportunities for top-line growth as well. It allows employees to focus on value-adding activities, particularly in sales and distribution. Hyper-personalized policies and improved customer service boost customer satisfaction, retention, and cross-selling opportunities.

Building GenAI Applications

Insurers are building powerful GenAI applications by leveraging four key functions: search, summary, content, and code. These building blocks are combined creatively to develop applications like knowledge assistants that simplify complex information for customers.

Advice for Insurance Leaders

Christopher Freese advises insurance leaders to:

- Deploy big-win GenAI applications that scale effectively.

- Establish a multilayered operating model with a clear strategy.

- Future-proof the organization by proactively planning for skill shifts.

- Build partnerships and tech architecture to develop and scale GenAI applications.

- Shape GenAI to align with corporate values and goals.

A cohesive approach encompassing these dimensions will empower insurance leaders to harness the full potential of GenAI, ensuring transformative change across the organization. By embracing GenAI, leading insurers are not only reducing costs but also revolutionizing the way they interact with customers, ultimately securing their competitive edge in the evolving insurance landscape.

Conclusion

In recent years, the insurance landscape has been undergoing a remarkable transformation. Central to this revolution is the emergence of generative AI, a technology that not only automates critical business processes but also ushers in an era of unparalleled operational efficiency. Beyond that, it fosters highly personalized customer experiences and significantly improves risk assessment methods. Esteemed industry leaders like USAA, Allstate, Chubb, and more have vividly illustrated how generative AI can reshape customer interactions, simplify policy management, and expedite claims processing.

As we look ahead, the horizon of generative AI in the insurance sector is promising indeed. It envisions the delivery of tailor-made insurance solutions, proactive risk management, and a robust fraud detection system. However, amidst these promising prospects, there exists a need to navigate the intricate terrain of data privacy, adhere to regulatory compliance, and uphold ethical considerations. Striking the right balance becomes imperative in unlocking the full potential of generative AI in the insurance domain.

If you’re contemplating the integration of generative AI into your insurance operations, you’ll find your ideal partner in Idea Usher. Our distinguished team of seasoned AI experts, coupled with our extensive experience in developing customized solutions, is poised to supercharge your operational efficiency, streamline processes, and elevate your customers’ experiences. Embark on your AI journey with Idea Usher today and redefine your insurance landscape for a brighter, more innovative tomorrow.

Contact Idea Usher at [email protected]

FAQ

1. What are some use cases of generative AI in insurance?

Generative AI finds utility in several areas within the insurance field, including data augmentation, content generation, risk evaluation, premium calculation, and the detection of fraudulent activities.

2. How does generative AI enhance operational efficiency in insurance?

Generative AI acts as a catalyst for elevating operational efficiency within the insurance sector. By automating diverse tasks, such as claims processing and policy management, it optimizes processes, reduces manual labor, and accelerates the overall workflow.

3. What are the benefits of using generative AI in insurance?

Employing generative AI in insurance yields benefits such as enhanced decision-making capabilities, a swifter and smoother digital purchasing experience for policyholders, improved risk evaluation, more precise underwriting, and streamlined claims processing.

4. How is generative AI reshaping traditional practices in the insurance sector?

Generative AI is actively reshaping insurance practices, revolutionizing how insurers conduct their operations. This includes creating tailored recommendations and personalized products for customers and accurately determining individualized pricing—all while maintaining high levels of customer satisfaction.

Rebecca Lal