The metaverse represents a promising shift away from our physical reality. As envisioned by PwC Japan Group, it offers the potential for experiences that are impossible in the real world, creating an entirely new economic landscape. In this visionary metaverse, insurance companies enter the digital realm by adopting avatars to seamlessly engage with their clients’ virtual counterparts. This digital dimension empowers them to create immersive scenarios free from the limitations of the physical world, all within the confines of the metaverse.

The concept of this “new economic sphere” isn’t just theoretical; it’s a thriving virtual economy, and here, blockchain technology facilitates transactions involving virtual assets like cryptocurrencies and non-fungible tokens (NFTs). Within this ecosystem, digital representations of virtual properties become essential components of individuals’ economic assets, prompting the need for insurance coverage.

However, the metaverse’s impact extends beyond insurance; it enhances operations and elevates customer experiences. Even Forbes emphasizes how insurers, by embracing the metaverse’s unique capabilities, can improve operations, address emerging risks, and enhance customer interactions. As the “InsurTech” converges with the metaverse, it presents a compelling opportunity to explore this transformative technology. So, let’s explore this blog further and delve into the opportunities in detail.

The Conventional Operations Of An Insurance Firm

Traditional insurance companies function by offering risk management through insurance contracts. The core concept is straightforward: the insurer promises to provide financial protection in the event of an unforeseen occurrence, while the insured pays regular premiums for this coverage. These companies meticulously assess risks, employing actuarial analysis to gauge statistical likelihoods and adjust premiums accordingly. One distinct aspect is the ability to invest policyholders’ funds, often referred to as “the float.” This investment generates returns for the insurer, akin to a financial institution.

Technological Challenges In Traditional Insurance Operations

Traditional insurance companies encounter several technological challenges as they navigate a changing business landscape:

1. Legacy Systems

Many insurers rely on outdated legacy systems that can hinder efficiency, making it challenging to adapt to new technologies and processes.

2. Data Management

Handling vast amounts of customer data is crucial in insurance. Challenges arise in data collection, storage, and analysis to make informed decisions and improve customer experiences.

3. Cybersecurity

With increasing cyber threats, safeguarding sensitive customer information is a paramount concern. Insurers must invest in robust cybersecurity measures to protect against data breaches and privacy violations.

4. Automation and Process Streamlining

Automating manual processes is crucial for efficiency and cost savings. Traditional insurers may struggle with integrating automation into their operations.

5. Customer Expectations

Meeting evolving customer expectations for digital access, personalized services, and seamless experiences can be challenging for insurers with outdated systems and processes.

6. Regulatory Compliance

Balancing regulatory compliance with technological innovation is an ongoing challenge, as insurance is a highly regulated industry.

7. Data Analytics

Leveraging advanced analytics to improve risk assessment and pricing models can be challenging for traditional insurers with limited data analytics capabilities.

Can Metaverse Address These Challenges?

The metaverse holds the potential to offer innovative solutions to the technological challenges facing traditional insurance companies. Its modern infrastructure can serve as a digital lifeline, replacing outdated legacy systems and ushering in a seamless transition to new technologies. Within the metaverse, robust data management tools empower insurers to efficiently collect, store, and analyze vast amounts of data, facilitating data-driven decision-making.

Moreover, the metaverse prioritizes cybersecurity, providing secure environments to safeguard sensitive customer information, thus mitigating the risks associated with cyber threats. Automation capabilities inherent to metaverse ecosystems enable insurers to streamline processes, bolstering operational efficiency and reducing costs.

By embracing the metaverse, insurance companies can create immersive, customer-centric experiences, meeting evolving customer expectations for digital access and personalized services. This digital environment integrates compliance mechanisms, ensuring regulatory adherence while fostering innovation. Furthermore, the metaverse’s data-rich nature allows insurers to harness advanced analytics, improving risk assessment and pricing models. In this way, the metaverse stands as a promising frontier for traditional insurers to overcome technological hurdles, enhance their operations, and adapt to the demands of the digital era.

Let’s further explore the profound influence of the Metaverse on the insurance sector and thoroughly explore the extensive opportunities it presents.

Metaverse Impact On The Insurance Industry

The impact of the Metaverse on the insurance sector is profound, reshaping the way insurers operate and interact with policyholders and agents. Metaverse introduces innovative components that hold the potential to revolutionize the insurance landscape across three key dimensions:

1. Economic Paradigm

The Metaverse’s economy is underpinned by virtual currencies, NFTs, and blockchain-based digital assets, ushering in a new era for insurers. The prospect of insuring metaverse assets emerges prominently as insurers explore investment opportunities within this burgeoning space.

2. Governance Challenges

The Metaverse demands a framework of rules and regulations governing user-platform interactions, presenting insurers with governance complexities. Navigating these uncharted waters requires a proactive approach as laws and regulations continue to evolve.

3. Enhanced Customer Experiences

In this immersive 3D digital environment, users revel in personalized and bespoke experiences, a phenomenon that insurers can leverage through avatars and interactive engagement. This presents an opportunity to heighten policyholders’ awareness of the importance of comprehensive coverage.

The Metaverse promises higher efficiency, cost savings, and heightened satisfaction among policyholders and agents. However, insurers must adapt swiftly to these transformative components, positioning themselves at the forefront of the Metaverse’s impact on the insurance industry.

Use Case Of Metaverse In Insurance Companies

The Metaverse offers a world of possibilities for insurance companies. It’s a place where they can transform how they connect with customers, develop new ways to do business, and create innovative insurance plans. In this digital world, there are many practical ways insurers can change how they work with their customers.

1. Enhanced Customer Engagement And Education

Within the Metaverse, insurance companies have the power to craft immersive, interactive experiences for their customers. These experiences extend to educating policyholders and potential clients by providing hands-on demonstrations of insurance products in action. Such engagement equips customers with the knowledge needed to make well-informed decisions regarding their insurance coverage.

2. Revolutionizing Risk Assessment And Claims Processing

The Metaverse empowers insurers to revolutionize risk assessment. Instead of sending underwriters to physically inspect properties, they can harness extended reality (XR) technology to assess risks virtually. Claims adjusters can also benefit, as they gain the ability to investigate claims with remarkable precision, even recreating accident scenes digitally to identify fraudulent claims.

3. Transforming Training And Onboarding

The Metaverse reimagines training and onboarding processes for insurance employees. Regardless of their physical location, employees can now access immersive learning experiences, reducing the need for physical training facilities and effectively cutting overhead expenses.

4. Virtual Events And Customer Connections

Insurance companies can host a myriad of virtual events within the Metaverse, ranging from conferences to meetings. This opens new avenues for connecting with customers and stakeholders in a digitally immersive setting, fostering stronger, more meaningful relationships.

5. Virtual Insurance Agents For Personalized Support

Insurers can create virtual insurance agents within the Metaverse, representing the company and providing customers with personalized, interactive support. This innovative approach enhances the customer experience and streamlines interactions.

6. Embracing Digital Asset Coverage

With the Metaverse introducing novel types of digital assets such as virtual currencies, NFTs, and blockchain-based assets, insurance companies have the opportunity to expand their coverage offerings. They can adapt to the evolving landscape by including these digital assets in their insurance portfolios.

7. Boosting Operational Efficiency

The Metaverse doesn’t just enhance customer-facing aspects; it also boosts operational efficiency. Tasks like risk assessment, training, and claims processing can be streamlined through Metaverse technologies, resulting in reduced costs and improved overall efficiency.

As the line between the physical and digital realms continues to blur, insurers must embrace this “phygital” environment, harnessing its vast potential. By investing in the Metaverse and harnessing its unique capabilities, insurers can elevate their operations, elevate customer experiences, and effectively navigate emerging risks in this rapidly evolving domain.

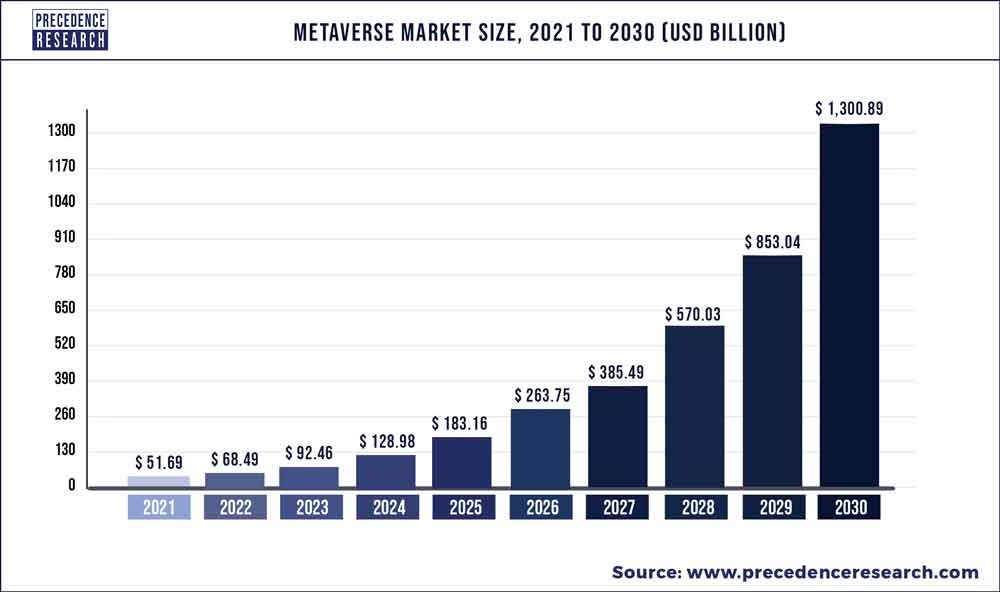

Metaverse Market Size Worldwide 2022-2030

In 2022, the worldwide metaverse market achieved a valuation of approximately USD 68.49 billion. Projections indicate a remarkable ascent, with expectations that it will exceed USD 1.3 trillion by the year 2030, demonstrating a notable Compound Annual Growth Rate (CAGR) of 44.5% throughout the forecast period spanning from 2022 to 2030.

According to another survey, in 2022, the global metaverse market was valued at around 65.5 billion U.S. dollars. Looking ahead to 2023, this figure is set to surge to approximately 82 billion U.S. dollars, with further meteoric growth projected to reach a staggering 936.6 billion U.S. dollars by the year 2030.

The metamorphosis of the metaverse from concept to reality garnered substantial attention, particularly with Facebook’s rebranding as Meta Platforms. Beyond Meta, industry giants like Apple, Nvidia, and Qualcomm have demonstrated keen interest in investing in this intricate digital landscape.

Business Opportunities By Metaverse In The Insurance Value Chain

The emergence of the metaverse presents ample business opportunities that could reshape the entire insurance value chain. These opportunities span various aspects of the insurance industry and offer transformative potential:

1. Revenue Generation

In the metaverse, avatars take center stage as key players, paving the way for innovative sales approaches. Insurance companies can engage directly with avatars in diverse ways, opening up avenues for future sales strategies. This could encompass novel marketing and branding endeavors within the virtual realm, leveraging the absence of physical limitations to explore creative advertising methods. Additionally, targeting the metaverse may prove highly effective in reaching younger demographics drawn to its gamified elements.

2. Immersive Customer Experiences

Immersive experiences in the metaverse can enhance customers’ comprehension of insurance products’ value. Rather than relying solely on statistical data and traditional explanations, insurance companies can offer virtual scenarios where customers experience the significance of insurance firsthand. This approach enables customers to grasp risks more effectively and comprehend the necessity of insurance, albeit with caution, to prevent emotional harm.

3. Data-Driven Insights

The metaverse inherently records all user interactions and behaviors as data. Analyzing this data, including activity history, purchases, and avatar relationships, allows insurers to offer tailored risk protection products. However, meticulous attention to personal data protection and compliance with evolving regulations is essential.

4. Digitization Of Operations

As insurance policies extend to cover digital assets and utilize technologies like NFTs and cryptocurrencies, insurance processes will undergo comprehensive digitization. This encompasses contracting, billing, claims processing, and sales activities, reducing the reliance on physical spaces. Digital twins of physical environments in the metaverse further expedite the shift toward virtual operations, notably for employee training in damage investigation.

5. Asset Integration

With avatars, 3D models, spatial environments, and mixed reality, a new era of asset classes unfolds. These assets and their associated metadata collaborate to build profiles for individuals and businesses in the metaverse. Achieving asset and content interoperability will be pivotal for enabling seamless processes like insurance applications, approval, and claims submission.

6. Cross-Platform Accessibility

The metaverse’s success hinges on cross-platform compatibility, ensuring users can seamlessly interact regardless of their chosen platforms. This will empower business owners to apply for insurance, obtain approval, and file claims without exiting the metaverse environment.

7. Enhanced Insurance Processes

Beyond meeting existing demand, insurers can leverage metaverse technology to innovate in claims processing, risk assessment, underwriting, and broker-client interactions. This includes using metaverse headsets for property assessments, remote asset examination by underwriters, risk profiling by brokers, and training for loss adjusters using new realities technology.

8. Visualizing Scenarios

Exposure managers and insurers can harness metaverse capabilities to bring real-world scenarios to life, fostering deeper customer engagement and emotional connections in sales and marketing endeavors.

9. Streamlined Loss Adjustment

Emerging technologies empower loss adjusters with real-time, objective visual data, claim history, legal references, third-party information, and historical precedents. This wealth of information accelerates claim settlements, elevates customer satisfaction, and reduces fraudulent activities.

10. Virtual Items Marketplace

The metaverse’s virtual items marketplace is poised to exceed a hundred billion dollars, presenting an enticing growth opportunity. With an existing worth of approximately $50 billion, insurance companies must seize this potential to remain at the forefront of technological advancements.

Threats And Challenges Of Metaverse In The Insurance Industry

The Metaverse promises to revolutionize the insurance sector; however, alongside the promises lie significant threats and challenges that insurance companies must navigate to safeguard their operations and protect their customers. Here are the key threats and challenges associated with the Metaverse in the insurance industry:

1. Cybersecurity Vulnerabilities

The Metaverse is not immune to cyber threats. Insurance companies operating within this virtual realm face the risk of attacks by malicious third parties. These attacks can result in the theft or manipulation of customer data, potentially leading to substantial financial losses and reputational damage.

2. Legal And Intellectual Property Complexities

In the Metaverse, the lines between the virtual and real worlds blur. This ambiguity can lead to unintentional violations of real-world rights, including intellectual property rights and privacy rights. Navigating the legal complexities of these virtual spaces can pose a significant challenge for insurers.

3. Regulatory Uncertainty

The rapid evolution of the Metaverse has outpaced the development of comprehensive regulatory frameworks. This regulatory uncertainty can create challenges for insurance companies as they strive to operate within the Metaverse while adhering to compliance requirements.

4. Data Security And Privacy

With the Metaverse collecting and storing vast amounts of customer data, ensuring data security and privacy becomes paramount. Insurers must invest substantially in robust cybersecurity measures to protect sensitive customer information from breaches.

5. Emerging And Unquantifiable Risks

The Metaverse introduces novel risks that may be difficult to understand and quantify. Insurance companies must develop new strategies to assess and manage these emerging risks effectively.

6. Technical Expertise Requirement

Operating within the Metaverse necessitates a deep understanding of advanced technologies like virtual reality, blockchain, and artificial intelligence. Insurers must invest in developing the technical expertise required to thrive in this digital landscape.

7. Customer Adoption Challenges

While the Metaverse offers exciting possibilities for customer engagement, insurers may face difficulties in convincing customers to embrace these new technologies and experiences. Developing effective strategies to educate and encourage customer adoption is crucial.

8. Server Downtime And Technical Glitches

Virtual spaces are not immune to technical glitches and server downtime. Unexpected disruptions can affect virtual assets, events, and data, potentially leading to economic damage. Insurers need to consider these risks in their coverage offerings.

Our Expert Advice To Overcome Challenges Associated With Metaverse In The Insurance Industry

Overcoming the challenges posed by the Metaverse in the insurance industry requires a proactive and innovative approach. Here are some tips to address these challenges:

1. Cybersecurity Investments

To mitigate the risk of attacks by malicious third parties, insurers should invest in robust cybersecurity measures. This includes encryption, threat detection systems, and regular security audits to protect customer data.

2. Legal Expertise

Given the legal complexities of the Metaverse, insurers should work closely with legal experts to navigate issues related to copyright infringement, intellectual property, and real-world rights. Staying compliant with evolving regulations is crucial.

3. Redundancy And Fail-Safes

To address the risk of server downtime and digital glitches, insurers should implement redundancy and fail-safe mechanisms. This ensures the continuity of services and minimizes disruptions for customers.

4. Education And Awareness

Insurers can educate customers about the potential risks and responsibilities in virtual spaces, promoting responsible usage to avoid accidents and negligence.

5. Innovation And Collaboration

Collaborating with tech partners and participating in the development of Metaverse technologies can help insurers stay at the forefront of risk assessment and management.

6. Flexible Insurance Products

Develop flexible insurance products that adapt to the unique risks of the Metaverse, providing coverage for virtual assets, data loss, and liability in virtual spaces.

7. Monitoring Regulatory Changes

Stay vigilant about evolving regulations and adapt policies accordingly to remain compliant and ensure customer protection.

By embracing these strategies, insurers can navigate the challenges of the Metaverse while providing innovative and secure insurance solutions to their customers.

Insurance Company Entering In The Metaverse

The digital world is witnessing a groundbreaking evolution as insurance companies embark on an unprecedented journey into the metaverse, heralding a new era of innovation.

1. Heungkuk Life Insurance

Heungkuk Life Insurance, a subsidiary of the Taekwang Group, made history by becoming the inaugural life insurance entity to join the Metaverse Alliance. Hosted by the Ministry of Science and ICT, this alliance boasts over 300 signatories, including tech giants Samsung, LG, and Hyundai.

2. XRHealth

XRHealth, an Israeli pioneer in therapeutic care Virtual Rooms, has secured a substantial $10 million investment, marking a significant step toward the realization of Metaverse Health Insurance. Partnerships with HTC, Bridges Israel, AARP, and crowdfunding on StartEngine.com are propelling XRHealth into the trillion-dollar potential market of virtual healthcare.

3. IMA Financial Group

IMA Financial Group, an esteemed insurance broker and wealth management firm, is poised to unlock the metaverse’s insurance potential. Their pioneering move includes the establishment of a research facility in Decentraland, where they explore innovative insurance product development and the utilization of NFTs as collateral in decentralized finance (DeFi) lending scenarios.

4. Hubb

Hubb, a trailblazing usage-based insurance broker, is embracing metaverse technology with the integration of VR devices, preparing to pivot into this digital frontier. This strategic shift involves investments in VR headsets and hybrid onboarding infrastructure designed to elevate the onboarding process and enhance the overall customer experience.

5. Allianz

Allianz has integrated Augmented Reality (AR) and Virtual Reality (VR) technologies into its operations. This move aims to enhance customer awareness regarding potential hazards within their homes while also extending insurance services for these risks. Clients now have the capability to use their smartphone cameras to detect concealed threats in their residences, ranging from sink floods to malfunctioning toasters and water pipe ruptures.

6. UnitedHealth

UnitedHealth has unveiled NavigateNOW, a novel health plan that prioritizes virtual healthcare services. This innovative approach combines virtual and in-person care, encompassing various healthcare aspects such as general well-being, routine check-ups, management of chronic conditions, as well as immediate and behavioral health support.

Conclusion

The Metaverse represents a transformative landscape for the insurance industry, offering both challenges and immense opportunities. It has the potential to revolutionize how insurers operate by redefining customer engagement and streamlining operations while addressing traditional marketing challenges through immersive experiences and deeper customer connections.

With vast business opportunities within the Metaverse, if you are considering investment in this domain, Idea Usher is your ideal partner for bringing Metaverse projects to life. We possess innovative ideas that set your project apart and the expertise to turn them into reality.

Our proficiency in VR, AR, Web3, Blockchain, and AI, the foundational elements of the Metaverse, positions us to redefine operations, particularly within the insurance sector. With Idea Usher by your side, anticipate a more interactive, precise, and customized approach to your business in this new digital landscape.

Feel free to reach out to us today to explore the incredible innovations in the Metaverse that will revolutionize the way we work and play.

Hire ex-FANG developers, with combined 50000+ coding hours experience

Contact Idea Usher at [email protected]

FAQ

Q. What is the Metaverse, and how does it relate to the insurance industry?

A. The Metaverse encompasses a network of virtual, augmented, and digital realities, encompassing VR environments, video games, and digital marketplaces, among others. It is rapidly bridging the gap between digital and physical realms as businesses increasingly engage, market products, offer entertainment, and generate income within these virtual domains. For insurers, the Metaverse introduces complexities and transformations in how they assess risk and manage investment portfolios, given the growing interplay between the physical and virtual spheres.

Q. How can insurance companies prepare for the Metaverse?

A. Insurance companies should embrace Metaverse technologies as early adopters. They need to proactively anticipate the impact of Metaverse technologies and methodologies on all aspects of their operations. Initiating actions now, such as employing virtual technologies for insurer training and upskilling, can provide a competitive advantage as these practices become commonplace.

Q. What does the Metaverse mean for insurers?

A. The Metaverse Continuum represents a spectrum of digitally enhanced worlds, realities, and business models that are poised to revolutionize life and enterprise in the coming decade. This transformation spans all facets of business, from consumers to employees and across the organizational landscape, traversing between physical and virtual domains. The Metaverse Continuum raises expectations regarding how insurers engage with customers, design and deliver products and experiences, and manage their enterprises.

Q. What are some trends leading the insurance industry into the Metaverse?

A. One notable trend propelling the insurance sector into the Metaverse is the widespread adoption of remote claims processing. Insurers can now effectively assess property or vehicle damage without physical presence, thanks to technologies like Visual Intelligence.

Q. What are some risks associated with the Metaverse for insurers?

A. As Metaverse-related risks materialize and users begin filing claims under conventional insurance policies, insurers may start introducing exclusions to limit their exposure. However, this presents an opportunity for the industry to develop and market new products that cater to these emerging needs.