Decentralized Finance (DeFi) and Centralized Finance (CeFi) represent two distinct paradigms within the financial ecosystem, each offering unique features and functionalities.

DeFi, as the name suggests, operates on decentralized blockchain platforms, removing the need for traditional intermediaries like banks. This revolutionary approach aims to create a more open and accessible financial system, allowing users to engage in various financial activities without relying on centralized authorities.

In contrast, CeFi adheres to the conventional centralized model, where financial services are facilitated by traditional institutions such as banks and brokerage firms.

The argument between DeFi and CeFi is becoming more passionate as the financial environment changes, with supporters of each model highlighting their own advantages. Comprehending the characteristics and distinctions of these two methodologies is vital for anyone attempting to navigate through the evolving financial scene.

Learn about the distinctions between defi and cefi in this blog, as well as the advantages and disadvantages of each financial environment for businesses.

- What Is DeFi (Decentralized Finance)?

- Features of DeFi (Decentralized Finance)

- Pros of DeFi (Decentralized Finance)

- Cons of DeFi (Decentralized Finance)

- Top 5 DeFi Platforms In The Market Right Now

- What Is CeFi (Centralized Finance)?

- Features Of CeFi (Centralized Finance)

- Pros Of CeFi (Centralized Finance)

- Cons Of Cefi (Centralized Finance)

- Top 5 CeFi Platforms In The Market Right Now

- Key Differences Between Defi vs Cefi

- Conclusion

- How Idea Usher Can Help?

- FAQ

What Is DeFi (Decentralized Finance)?

DeFi, short for Decentralized Finance, represents a revolutionary shift in the traditional financial landscape by leveraging blockchain technology to create a global and open financial system. Unlike traditional financial systems that rely on centralized institutions like banks, DeFi operates on decentralized networks, providing transparency and accessibility to anyone with an internet connection. This groundbreaking approach aims to democratize financial services, making them available to a broader audience around the world.

One of the key features of DeFi is its ability to allow users to self-manage a wide array of financial services. These services include but are not limited to trading, insurance, lending, issuance of money, staking, payments, financial data provision, over-the-counter (OTC) trading, asset management, and more. Users can directly interact with smart contracts, which are self-executing agreements with the terms of the contract directly written into code. This eliminates the need for intermediaries, reducing costs and increasing efficiency in financial transactions.

DeFi platforms often operate on blockchain networks, most commonly on Ethereum. Smart contracts on these platforms automatically execute actions based on predefined conditions, enabling a trustless and automated financial ecosystem. The open nature of DeFi means that anyone can participate, providing a level playing field for users globally, irrespective of their geographical location or socioeconomic status.

While DeFi offers numerous opportunities and benefits, it also comes with challenges and risks. Security concerns, regulatory uncertainties, and the potential for smart contract vulnerabilities are among the issues that the DeFi space continues to navigate. As the ecosystem evolves, it is likely to shape the future of finance by fostering innovation and providing greater financial inclusivity.

Features of DeFi (Decentralized Finance)

Decentralized Finance, or DeFi, is reshaping the financial landscape by leveraging blockchain technology to create an open and inclusive ecosystem. Explore the key features that make DeFi a game-changer, from decentralized lending and borrowing to automated smart contracts, ushering in a new era of financial autonomy.

1. Permissionless Accessibility

Decentralized Finance (DeFi) distinguishes itself by offering permissionless access to financial services. Unlike traditional financial systems that may require approval or adherence to specific criteria, DeFi blockchains enable anyone, regardless of geographical location or background, to participate in the ecosystem. This inclusivity promotes financial freedom and allows users to engage with decentralized finance platforms without the need for intermediaries or gatekeepers. The absence of restrictive entry barriers fosters a more open and inclusive financial environment, encouraging greater community involvement and interaction.

2. Trustless Nature

One of the key features that sets DeFi apart is its trustless nature. Trustlessness in DeFi refers to the ability of users to transact and interact with the ecosystem without relying on a central authority or intermediary. Users can scrutinize the underlying smart contract code governing DeFi protocols, providing transparency and accountability. Tools like Etherscan allow users to verify the execution of transactions and ensure the efficient performance of DeFi services. This trustless framework enhances security and reduces the need for blind faith in centralized entities, aligning with the core principles of blockchain technology.

3. Continuous Innovation

The DeFi landscape is characterized by ongoing innovation and the continuous development of new financial products and services. The decentralized nature of the ecosystem encourages experimentation and the exploration of novel ideas. Smart contracts, which form the backbone of DeFi protocols, enable the creation of diverse financial instruments, including decentralized exchanges, lending and borrowing platforms, yield farming, and more. The DeFi crypto list showcases a dynamic and evolving space where developers and projects actively contribute to the expansion and enhancement of the ecosystem. This culture of innovation ensures that users have access to cutting-edge financial tools and services within the DeFi space.

4. Interoperability and Collaboration

DeFi platforms often prioritize interoperability, allowing different protocols and projects to seamlessly interact with each other. This interoperability fosters collaboration and the creation of comprehensive financial ecosystems. Users can leverage a variety of DeFi services within a connected environment, enhancing the overall utility of decentralized finance. Collaborations between projects can lead to the creation of integrated solutions that address multiple financial needs, contributing to the growth and maturity of the DeFi ecosystem. This collaborative approach further strengthens the decentralized finance space by promoting the development of robust and interconnected financial infrastructures.

Pros of DeFi (Decentralized Finance)

The DeFi movement seeks to bring forth a range of advantages for both customers and investors. Notably, these benefits encompass the removal of intermediaries and centralized control within the financial ecosystem.

1. Permissionless Nature

One of the primary advantages of decentralized finance (DeFi) is its permissionless nature. The decentralized aspect, inherent in blockchain technology, reduces dependence on traditional financial institutions. This decentralization extends to various aspects, including oversight, data storage, and server space. By leveraging blockchain networks, transaction histories become accessible to all participants, fostering a democratized approach to banking and finance. Ethereum, as a prominent blockchain for DeFi applications, exemplifies this with its permissionless nature. This openness encourages accessibility, allowing individuals involved in the development and utilization of DeFi applications to participate. Additionally, the permissionless blockchain features promote interoperability, facilitating diverse third-party integrations.

2. Immutability

Immutability, achieved through the utilization of cryptography and consensus algorithms like proof-of-work, is a key feature of blockchain technology. In the context of decentralized finance, immutability ensures the integrity and security of financial transactions. Records on the blockchain become practically tamper-proof, providing a robust defense against manipulation. The cryptographic principles and consensus mechanisms employed contribute to the immutability of DeFi solutions, instilling confidence in the reliability and security of financial operations.

3. Transparency

Transparency is a crucial benefit offered by decentralized finance. Decentralization inherently promotes transparency, as the distributed ledger records all activities on the blockchain network. Cryptographic principles ensure that information is documented only after authentication, enhancing the credibility of DeFi applications. Transparent systems enable better due diligence, aiding users in identifying and avoiding potential scams and unethical practices. With a comprehensive audit trail, DeFi applications empower users to trace and verify transaction changes, contributing to the overall integrity of financial ecosystems.

4. Lending and Borrowing Applications

Decentralized finance has significantly contributed to the development of peer-to-peer lending and borrowing solutions. These applications bring about faster and more straightforward verification processes, eliminating the need for traditional intermediaries such as banks. Cryptographic verification mechanisms and smart contract integration ensure the security and efficiency of lending and borrowing transactions. Notable examples include platforms like Compound, a decentralized lending platform that allows users to supply crypto assets to lending pools, facilitating faster transaction settlements and improved accessibility.

5. Savings Applications

The rise of DeFi savings products has provided users with new avenues for managing and earning interest on their savings. DeFi allows users to lock their assets in lending protocols like Compound, earning interest on the locked-in assets. This has led to the emergence of various DeFi savings applications that plug into lending protocols, enhancing users’ ability to earn interest on their idle crypto assets. The concept of yield farming, where users move their crypto assets across different lending protocols for optimal returns, has gained prominence within the DeFi ecosystem.

6. Tokenization

Tokenization is a significant aspect of the advantages offered by decentralized finance. Enabled by smart contract capabilities on platforms like Ethereum, tokenization involves the issuance of crypto tokens representing various digital assets with diverse features and uses. Examples include utility tokens for specific decentralized applications (dApps), real estate tokens, and security tokens. Tokenization provides functionalities such as fractional ownership of physical properties and digital shares in specific applications. It also facilitates exposure to a range of assets, including digital currencies, fiat currencies, and commodities. Platforms like Synthetix showcase the substantial value, with millions of dollars locked in smart contracts for synthetic assets.

Cons of DeFi (Decentralized Finance)

While much of the current discourse surrounding decentralized finance (DeFi) emphasizes its numerous advantages, it is equally crucial to examine the potential drawbacks to form a balanced understanding of its overall impact. In this section we will explore into some of the notable setbacks that may be encountered when embracing DeFi.

1. Scalability

Scalability is a persistent challenge within the DeFi space. The scalability issues arise primarily due to the limitations of blockchain technology. Most decentralized networks, such as Ethereum, face bottlenecks in terms of transaction speed and throughput. The confirmation times for transactions on DeFi platforms can be significantly prolonged during periods of network congestion. This delay not only affects the user experience but also limits the potential for mass adoption. Additionally, transaction fees can skyrocket during high-demand periods, making DeFi transactions economically impractical for certain users. Solving scalability concerns is crucial for the long-term success and widespread acceptance of decentralized finance.

Moreover, the scalability challenge extends beyond transaction processing. The limited capacity of decentralized networks to handle a large number of smart contracts simultaneously can hinder the growth of complex financial products and services within the DeFi ecosystem. Innovations in blockchain technology or the successful implementation of layer 2 scaling solutions are essential for addressing these scalability issues.

2. Uncertainty

Uncertainty is a significant drawback associated with decentralized finance, especially when it comes to the stability of the underlying blockchain hosting a DeFi project. Blockchain networks, such as Ethereum, often undergo upgrades or transitions that introduce uncertainties and risks. For example, Ethereum’s transition from a Proof-of-Work (PoW) consensus mechanism to Proof-of-Stake (PoS) with Eth 2.0 raises concerns about potential disruptions, bugs, or vulnerabilities during the migration.

Moreover, the reliance on decentralized autonomous organizations (DAOs) for decision-making in many DeFi projects introduces governance risks. Disputes or disagreements within the community regarding protocol upgrades or changes can lead to uncertainty and even forks in the blockchain. Navigating these uncertainties is essential for the DeFi ecosystem to gain trust and attract more mainstream users and investors.

3. Concerns of Liquidity

Liquidity is a crucial factor in the success of DeFi projects and blockchain protocols. While the total value locked in DeFi projects has grown significantly, the market is still relatively small compared to traditional financial systems. This limited size can lead to challenges in handling large transactions or accommodating substantial trading volumes. In times of market stress or sudden demand, liquidity shortages can result in increased slippage and higher transaction costs.

Additionally, the dependence on decentralized exchanges (DEXs) for liquidity poses challenges, as these platforms may lack the depth and breadth of liquidity found in centralized exchanges. This can make it difficult for users to execute trades efficiently, especially for assets with lower trading volumes. Building robust and sustainable liquidity pools is an ongoing challenge for DeFi projects aiming for broader adoption.

4. Shared Responsibility

One notable aspect among the disadvantages of DeFi is the concept of shared responsibility. While the removal of intermediaries is a core principle of decentralized finance, it shifts a significant burden onto users. Unlike traditional financial systems where institutions may provide security and insurance, users in the DeFi space are responsible for the security of their assets. This includes safeguarding private keys, using secure wallets, and understanding the intricacies of smart contracts.

The absence of a central authority to mitigate errors or rectify issues means that users need to be more vigilant and proactive in managing their funds. Instances of hacking, smart contract vulnerabilities, or even user mistakes can result in irreversible financial losses. The need for user-friendly security solutions and education becomes paramount to reduce the risk of human errors and enhance the overall security posture of the DeFi ecosystem.

Top 5 DeFi Platforms In The Market Right Now

The landscape of decentralized finance (DeFi) platforms is constantly evolving, with the continual emergence of new platforms offering diverse functionalities. Identifying the top-performing platforms is crucial for users seeking to tap into the growing DeFi sector. Explore best examples of Defi platforms:

1. Optimism

Optimism is a layer 2 scaling solution for Ethereum that addresses the network’s scalability issues. As one of the leading DeFi platforms, Optimism enhances the efficiency of Ethereum by processing a large number of transactions at lower costs. It aims to provide a better user experience for decentralized applications (dApps). The Optimism ecosystem hosts over 30 protocols, including decentralized exchanges, cross-chain bridges, NFT tools, and various trading instruments. This diversity makes it a comprehensive solution for both beginners and experienced users. With seamless management of cryptocurrency assets, Optimism stands out as a promising choice in the evolving DeFi landscape.

Optimism’s commitment to addressing Ethereum’s scalability issues is further evident in its user-centric approach. By significantly reducing transaction costs and increasing throughput, the platform enhances the accessibility of decentralized applications for a broader audience. The community-driven nature of Optimism fosters continuous innovation, with developers actively contributing to the growth of the ecosystem. Moreover, the seamless integration of various protocols, including decentralized exchanges and NFT tools, showcases Optimism’s versatility, making it a hub for diverse DeFi activities. As the platform continues to evolve, its user-friendly features and robust infrastructure position it as a pivotal player in the DeFi landscape.

2. Metacade

Metacade represents an innovative fusion of play-to-earn games and DeFi, offering a unique approach to decentralized finance in the gaming sector. The platform introduces play-to-earn, compete-to-earn, create-to-earn, and work-2-earn functionalities, providing users with diverse ways to engage and earn rewards. Metacade’s play-to-earn arcade games reward users with MCADE tokens, creating opportunities for both casual and professional gamers.

The platform also emphasizes community engagement through create-to-earn, where users contribute to the community and earn crypto rewards. Additionally, staking features enable users to earn passive yields on their MCADE token deposits, enhancing the overall user experience. Metacade’s unique blend of play-to-earn features and DeFi mechanisms promotes engagement and inclusivity within the gaming community. The platform’s commitment to rewarding not just skillful players but also contributors and creators ensures a dynamic ecosystem. The staking functionalities, allowing users to earn passive income, provide an additional layer of utility for the MCADE token. With an emphasis on community building and a range of earning opportunities, Metacade stands out as a pioneering project that explores the intersection of gaming and decentralized finance, capturing the interest of both gamers and DeFi enthusiasts alike.

3. Synthetix

Synthetix operates as a liquidity provider protocol for DeFi platforms, offering essential services to the DeFi ecosystem. Its deep liquidity pools, supported by minting synthetic assets, enable users to gain exposure to digital assets without direct ownership. Synthetix plays a crucial role in providing liquidity to various DeFi protocols on Ethereum and Optimism, addressing inefficiencies caused by liquidity issues. As a promising DeFi project, Synthetix enhances the value proposition of decentralized applications such as Curve, 1Inch, and Lyra by ensuring liquidity and improved financial services.

As the demand for diverse financial instruments on DeFi platforms grows, Synthetix’s robust infrastructure positions it as a vital component in the evolving landscape of decentralized finance. Synthetix’s role as a liquidity provider is further complemented by its commitment to decentralization and efficiency. The protocol’s synthetic assets, mirroring the value of various assets, create a flexible environment for users to navigate different market conditions. Synthetix’s collaboration with other DeFi platforms enhances the overall liquidity in the ecosystem, contributing to the seamless functioning of decentralized exchanges and lending protocols.

4. PAX Gold

PAX Gold distinguishes itself in the DeFi space by offering a decentralized approach to purchasing gold-backed tokens. Users can buy fractions of gold using cryptocurrency, with each token having a 1:1 backing with physical gold assets. The platform’s focus on gold, a trusted instrument for hedging against inflation, provides users with a traditional yet decentralized solution. PAX Gold’s commitment to reducing accessibility barriers makes it beginner-friendly. By pegging the value of PAXG tokens to the price of gold, the platform provides users with the advantages of decentralization, security against market volatility, and a reliable instrument for long-term gains in the DeFi sector.

The platform’s commitment to maintaining a 1:1 backing with physical gold assets ensures transparency and trust. The accessibility of gold-backed tokens through cryptocurrency provides users with an alternative store of value in the decentralized space. PAX Gold’s alignment with traditional financial instruments, combined with the benefits of blockchain technology, creates a unique value proposition that caters to a diverse user base. As a decentralized hedge against market volatility, PAX Gold remains an intriguing option for DeFi participants looking for stability.

5. GMX

GMX is a decentralized exchange that supports spot trading and perpetual trading, distinguishing itself by allowing users to trade with leverage without requiring KYC verification. In response to the demand for decentralized alternatives, GMX has gained popularity as a resilient DeFi project, particularly during challenging market conditions. It offers a range of advanced trading tools on a decentralized protocol with an intuitive user interface. GMX incentivizes liquidity providers with rewards obtained from asset balancing, market making, and futures trading. Its deflationary tokenomics model and scarce asset supply suggest potential for significant price growth over time.

The platform’s emphasis on decentralized principles aligns with the core tenets of the DeFi movement. The deflationary tokenomics model, coupled with scarce asset supply, introduces an element of scarcity that may contribute to potential price growth over time. GMX’s commitment to providing advanced trading tools within a decentralized framework showcases the platform’s dedication to meeting the evolving needs of the DeFi community. As a resilient project during market challenges, GMX remains a noteworthy option for users looking for decentralized trading solutions without the need for extensive KYC processes.

What Is CeFi (Centralized Finance)?

CeFi, short for Centralized Finance, refers to a financial ecosystem where individuals and institutions rely on centralized entities, typically in the form of cryptocurrency exchange platforms or financial service providers, to store and manage their assets. In this model, users entrust these centralized platforms with the custody of their funds, allowing them to conduct various financial activities such as trading, lending, and borrowing within the centralized framework.

One key feature of CeFi platforms is the implementation of stringent regulatory measures, such as Know Your Customer (KYC) and Anti Money Laundering (AML) policies. These policies are designed to comply with the regulatory requirements of the jurisdictions in which these platforms operate. As a result, users are often required to disclose personal information during the onboarding process, ensuring that the financial activities conducted on the platform adhere to legal standards and do not involve illicit practices.

The implementation of KYC and AML policies in CeFi platforms serves to enhance security and mitigate the risk of illegal activities, providing a layer of protection for both users and the platform itself. While this centralized approach offers a level of regulatory oversight and user protection, it also raises concerns about privacy and the potential for data breaches. Despite these considerations, Centralized Finance continues to be a popular choice for many individuals seeking a structured and regulated environment for their financial activities in the cryptocurrency space.

Features Of CeFi (Centralized Finance)

Centralized Finance, or CeFi, is a financial ecosystem that operates on traditional, centralized structures. In contrast to decentralized finance (DeFi), which leverages blockchain and smart contracts for peer-to-peer transactions, CeFi relies on intermediaries such as banks, financial institutions, and other centralized entities. Explore key attributes that define and distinguish Centralized Finance in today’s dynamic financial landscape.

1. Streamlined Customer Assistance

Centralized Finance (CeFi) platforms offer a distinct advantage in the form of seamless customer support. Every Centralized Exchange (CEX) has an internal account management system dedicated to handling users’ funds. This centralized approach allows for efficient and prompt customer support, as the exchange’s customer support team is well-equipped to address user queries and concerns. Large CeFi companies prioritize user data security and assist dedicated customer support channels, contributing to enhanced trust between the platform and its users. The availability of a responsive support system is a crucial factor in the overall user experience within the centralized financial ecosystem.

2. Adaptable Currency Conversion

One of the key features of CeFi is its ability to facilitate flexible and user-friendly conversion between fiat currencies and cryptocurrencies. Platforms like Coinbase exemplify this by offering a straightforward process for converting traditional currencies into digital assets. This ease of conversion is pivotal in attracting a broader user base, evident in Coinbase’s impressive 89 million global users. The simplicity and accessibility of the conversion process contribute to a smoother onboarding experience for customers, making CeFi an attractive choice for individuals looking to easily enter the cryptocurrency space.

3. Seamless Interoperability

CeFi platforms excel in interoperability, enabling a seamless integration of various financial services. This includes lending, trading, borrowing, and payment-based services that can utilize funds held in custody across multiple blockchain networks. Operating on multiple chains enhances the overall efficiency of financial transactions within the centralized ecosystem. This interoperability distinguishes CeFi from its decentralized counterpart, DeFi, where complexities and delays often arise in performing cross-chain swaps. CeFi’s approach to obtaining asset custody from multiple chains ensures a more versatile and interconnected financial infrastructure.

4. Robust Cross-Chain Swap Services

Centralized finance platforms offer robust services for cross-chain swaps, allowing users to trade cryptocurrencies based on independent blockchain platforms. Unlike decentralized finance (DeFi), which may face challenges in executing cross-chain swaps due to complexities and delays, CeFi streamlines the process. CeFi platforms acquire custody of assets from multiple chains, enabling users to engage in efficient and secure cross-chain transactions. This feature contributes to the liquidity and accessibility of a wide range of digital assets, further solidifying the role of CeFi in providing comprehensive and reliable financial services across different blockchain networks.

5. Advantages of Centralized Exchanges

CeFi’s utilization of centralized exchanges (CEX) brings notable advantages to users. Individuals can avoid the transaction fees associated with blockchain transfers by managing portfolios through an internal account on a centralized exchange. Additionally, the centralized nature of these exchanges simplifies the management of funds, as users don’t have to navigate the intricacies of blockchain protocols. The funds being held on the exchange provide a level of convenience and ease of use, making CeFi an appealing choice for users seeking a more straightforward and centralized approach to cryptocurrency management.

Pros Of CeFi (Centralized Finance)

Centralized Finance (CeFi) has emerged as a dominant force in the financial landscape, revolutionizing the way we perceive and interact with traditional financial systems. While often contrasted with decentralized alternatives, CeFi offers a plethora of advantages that cater to the needs of a broad user base

1. Security

Centralized Finance (CeFi) platforms have the advantage of centralized control and responsibility, which can enhance security measures. The centralized nature allows these platforms to implement robust security protocols, conduct regular security audits, and quickly respond to emerging threats. They typically have dedicated security teams focused on safeguarding user funds and sensitive information. In the event of a security breach, CeFi platforms can take immediate action to mitigate risks and compensate affected users. Additionally, centralized platforms often provide insurance coverage to protect users against losses, offering an extra layer of security.

CeFi platforms also excel in customer support services, providing users with assistance in case of issues such as account access problems, transaction disputes, or general inquiries. The ability to contact a support team can be reassuring for users, especially those who may not be familiar with the complexities of decentralized systems. Password resets and account recovery procedures are typically more straightforward on CeFi platforms, contributing to a smoother user experience.

2. Ease of Use

The user interface of CeFi platforms is designed with a focus on simplicity and accessibility. This ease of use makes them attractive to a broader audience, including individuals who may not have a deep understanding of blockchain technology or decentralized systems. CeFi platforms often resemble traditional financial interfaces, making it easier for users to navigate and perform various financial activities. The familiar layout and features contribute to a more comfortable onboarding process for new users who might find decentralized alternatives intimidating.

Furthermore, CeFi platforms usually offer a centralized point of control, simplifying account management and transactions. Users can easily monitor their balances, initiate transfers, and engage in trading activities without navigating complex decentralized protocols. The streamlined user experience on CeFi platforms facilitates faster adoption and a smoother transition for those accustomed to traditional banking services.

3. Higher Yields

CeFi platforms often provide users with the opportunity to earn higher yields on their investments compared to traditional banking and savings accounts. This is primarily due to their ability to leverage user funds for various financial activities, including lending, margin trading, and liquidity provision. CeFi platforms can offer competitive interest rates and rewards to attract users and incentivize them to deposit their assets.

Additionally, centralized platforms may have partnerships with institutional players, enabling them to access diverse financial instruments and investment opportunities. The ability to tap into a broader market and deploy more sophisticated financial strategies can result in higher returns for users. This potential for increased profitability makes CeFi platforms an appealing choice for those seeking to maximize their returns on deposited funds.

4. Regulatory Compliance

CeFi platforms are often subject to regulatory oversight, which can be seen as a positive aspect for some users. Regulatory compliance can provide a sense of legitimacy and accountability, as these platforms are required to adhere to established financial regulations and standards. This oversight may involve regular audits, reporting requirements, and adherence to anti-money laundering (AML) and know your customer (KYC) regulations.

For users who prioritize regulatory compliance and legal protections, CeFi platforms offer a level of assurance that decentralized alternatives may lack. Compliance with financial regulations can also lead to partnerships with traditional financial institutions, expanding the range of services and financial products available on these platforms. Ultimately, the regulatory framework surrounding CeFi platforms can contribute to a more stable and predictable financial environment for users.

Cons Of Cefi (Centralized Finance)

Centralized Finance (CeFi) has emerged as a major player in the financial environment, providing simple and accessible services. CeFi, like any other technology, has several downsides. In this part, we will look at the disadvantages of centralized finance, putting light on the issues and concerns that come with relying on centralized financial platforms.

1. Losses

Trusting a centralized entity with your funds in the realm of Centralized Finance (CeFi) can be a double-edged sword. Several instances have surfaced where users experienced substantial losses, with notable cases on platforms like Celsius, Voyager, BlockFi, and FTX. These incidents highlight the risks associated with placing trust in a single entity for financial transactions. Users, at times, faced significant financial setbacks, emphasizing the importance of thorough research and due diligence before engaging with CeFi platforms.

2. Centralization Concerns

One of the primary drawbacks of CeFi lies in its inherent centralization. Unlike decentralized systems, CeFi platforms operate under the control of a single entity, making them susceptible to external influences and regulatory oversight. The centralized nature of these platforms can lead to potential vulnerabilities, as they become focal points for malicious attacks or regulatory interventions. This central control contradicts the ethos of decentralization often associated with blockchain technology and cryptocurrencies.

3. Counterparty Risk

CeFi platforms introduce a substantial counterparty risk, wherein users entrust the platform to securely hold their funds and fulfill financial obligations, such as interest payments. This reliance on a central authority poses a potential threat if the platform faces insolvency, mismanagement, or any unforeseen financial troubles. Unlike decentralized alternatives that operate on trustless protocols, CeFi users are exposed to the financial stability and integrity of the centralized entity, emphasizing the need for caution and prudence in engaging with such platforms.

4. Regulatory Oversight and Compliance

Operating within the framework of centralized financial systems means that CeFi platforms are subject to regulatory oversight. While this can provide a sense of legitimacy and security for some users, it also introduces compliance challenges and the potential for changes in regulatory frameworks. Shifts in regulations may impact the services offered by CeFi platforms, leading to uncertainties for users. Additionally, regulatory interventions can influence the privacy and autonomy that users might expect from decentralized financial solutions.

Top 5 CeFi Platforms In The Market Right Now

In the changing world of centralized finance (CeFi), various platforms have emerged as important participants, providing users with access to traditional financial services within the crypto domain. Explore best CeFi platforms:

1. Nexo

Nexo, a subsidiary of Credissimo, has established itself as a prominent centralized finance (CeFi) platform offering lending, borrowing, and a crypto credit card. Founded in 2007, the Nexo platform was launched in 2018, attracting over 6 million users across 200 jurisdictions. While it has faced legal scrutiny in January 2023, the platform remains operational and widely used.

Nexo offers competitive lending rates, with interest on Bitcoin and Ether reaching as high as 8% for fixed-term deposits paid in Nexo tokens. Rates for other cryptocurrencies, including DOT, AVAX, and MATIC, have also been notable, at 15%, 17%, and 20%, respectively. Notably, Nexo allows lending in fiat currencies like USD, EUR, and GBP, mirroring rates similar to stablecoins.

On the borrowing side, Nexo provides flexibility, offering interest rates as low as 0% in certain situations and capping at 13.9%. An interesting feature is the ability to apply for a loan against NFTs, currently supporting collections like Crypto Punks and Bored Ape Yacht Club, allowing users to borrow up to 20% of the floor price.

2. Crypto.com

Crypto.com has evolved into a comprehensive platform offering various crypto services, including trading, NFT marketplace, DeFi wallet, blockchain network, crypto cards, and crypto loans. With a wide range of offerings, Crypto.com has become a go-to platform for users with diverse crypto needs.

Users can earn interest through the Earn program, with rates reaching up to 12.5% APY on crypto holdings. The platform also provides crypto-collateralized loans with a Loan-to-Value (LTV) ratio of up to 50%, and interest rates are influenced by the amount of CRO tokens staked. Crypto.com offers competitive returns across various assets, with up to 6.5% p.a on stablecoins and high returns on multiple altcoins. The platform’s flexibility allows users to pay back loans on their own schedule, and it supports 20+ crypto assets as collateral.

3. Yield App

Yield App differentiates itself as a regulated digital wealth platform with a risk-averse approach to yield generation strategies. Established in 2020, the platform has survived market fluctuations and focuses on secure yield generation through access to DeFi protocols and arbitrage trading.

Yield App emphasizes security and is recognized as a Virtual Assets Service Provider (VASP) in the European Union. The platform integrates with Fireblocks for wallet services, featuring insurance on all assets in custody and in transit. Yield App generates yield through its involvement in DeFi protocols and arbitrage trading. Users can earn up to 11% on stablecoins and impressive returns on Bitcoin and Ethereum, depending on loyalty levels and lock-in terms.

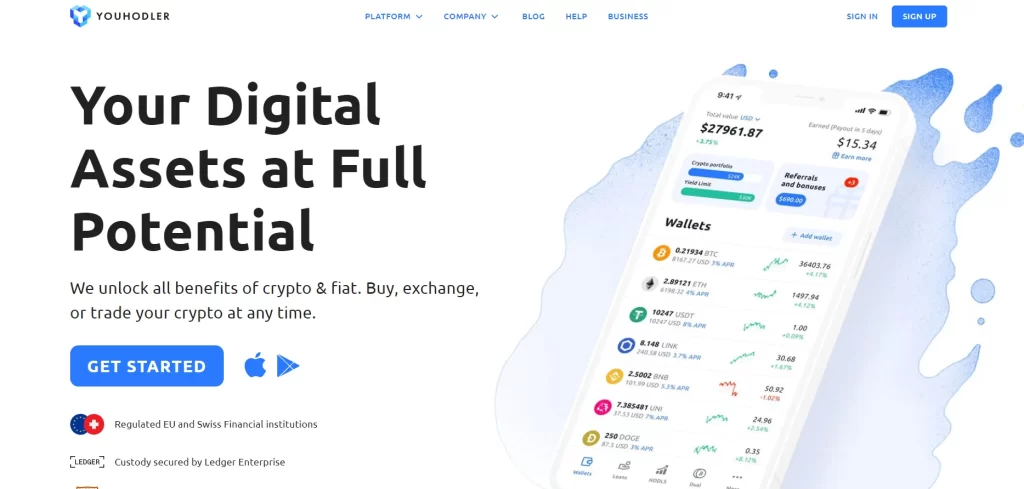

4. YouHodler

YouHodler, founded in 2018, distinguishes itself by supporting a wide array of currencies and unique features in the CeFi space. Regulated in the EU and Switzerland, YouHodler offers both lending and borrowing services.

YouHodler provides competitive interest rates, offering up to 15% on most stablecoins and varying rates on other cryptocurrencies, including BTC, ETH, YFI, and Sushi. Notably, the platform allows borrowing against collateral of up to 90%, a higher ratio compared to many other platforms. Apart from traditional lending and borrowing, YouHodler introduces innovative features like Turbocharge and Multi-Hodl. These features involve leveraging loans to buy more crypto automatically, emphasizing high risk and the need for cautious allocation.

5. SwissBorg

SwissBorg stands out as a user-friendly crypto wealth management platform, providing centralized finance services since 2017. Unlike lending platforms, SwissBorg generates yield through leveraging DeFi protocols and blockchain-based earning methods, positioning itself as a crypto wealth management platform.

SwissBorg offers yields based on a user’s premium plan, with the Genesis premium plan providing a 2x boost to earnings. Yields vary, with stablecoins earning 4%, and BTC and ETH earning roughly 1% and 5%, respectively. The platform supports earning on 14 different cryptocurrencies. The platform provides a comprehensive suite of products, including analytical tools, portfolio statistics, a swap aggregator, and innovative investment products. The platform’s transparency and adherence to industry best practices instill confidence among users.

Key Differences Between Defi vs Cefi

DeFi (Decentralized Finance) and CeFi (Centralised Finance). These new approaches to financial services appeal to a wide range of requirements and interests, with each having unique benefits and cons. In this section, we look into the main differences between DeFi and CeFi.

1. Transparency and Public Verification

DeFi platforms emphasize transparency and openness by allowing users to verify the execution of state changes publicly. While the code of DeFi projects may not always be open source, the execution is accessible for anyone to observe. This commitment to non-custodial principles means users can independently verify the platform’s actions. In contrast, centralized finance (CeFi) needs this level of public transparency. In CeFi, users rely on the platform’s assurances without having direct visibility into the execution of financial operations.

Additionally, the public verification aspect in DeFi promotes a trustless environment where users don’t have to rely solely on the reputation of a centralized entity. This decentralized nature aligns with the core principles of blockchain technology, providing users with more control and oversight.

2. Atomicity in Transactions

Blockchain transactions in decentralized finance can be designed to be atomic, ensuring that a series of actions complete or fail together. This programmable atomicity feature adds a layer of reliability to DeFi transactions, as it helps prevent partial or incomplete executions. In contrast, centralized finance lacks this inherent atomicity. CeFi transactions may involve multiple intermediaries and steps, making it more challenging to ensure the completion or failure of all actions simultaneously.

The atomicity in DeFi transactions contributes to the overall reliability of the decentralized system, reducing the risk of inconsistencies or errors that may arise in more complex CeFi processes.

3. Anonymous Development In Defi

Many DeFi projects are developed and maintained by anonymous groups of individuals, fostering a culture of decentralization and community-driven initiatives. The anonymity of developers in decentralized finance aligns with the ethos of blockchain technology, emphasizing community involvement and reducing reliance on centralized authorities. This starkly contrasts centralized finance, where institutions and companies typically operate with greater transparency and accountability.

While anonymity can be a double-edged sword, as it may raise concerns about accountability, it also exemplifies the decentralized and permissionless nature of DeFi projects, where contributions can come from anyone in the global community.

4. Custodial Models

DeFi platforms prioritize giving users complete control over their assets, adhering to the ethos of self-custody and ownership. While this approach empowers users, it also means that they are responsible for the security and technical aspects of managing their assets. On the other hand, centralized finance platforms act as custodians, taking on the responsibility of safeguarding users’ assets. This custodial model provides convenience but introduces a reliance on the security measures implemented by the centralized entity.

The trade-off between control and convenience plays a crucial role in users’ preference for either DeFi or CeFi based on their risk tolerance and the level of involvement they want in managing their cryptocurrency assets.

5. Malleability of Execution Order

In permissionless blockchains, where DeFi operates, users broadcast their transactions on a peer-to-peer network. This openness introduces the concept of order malleability, allowing for various market manipulation tactics. DeFi platforms may experience challenges related to front-running and other manipulation techniques due to the decentralized and open nature of their transaction ordering. This contrasts with centralized finance, which adheres to more stringent regulatory requirements, leaving less room for market manipulation.

CeFi platforms implement regulatory measures to ensure fair and transparent trading practices, creating a more controlled environment for financial transactions. The absence of order malleability in CeFi contributes to a more regulated and secure trading experience.

Conclusion

Centralized Finance (CeFi) offers the assurance of fund security and equitable trading practices. It provides a pathway for investors using fiat currency to engage in crypto trading while benefiting from robust customer support. On the contrary, Decentralized Finance (DeFi) strives to create a blockchain environment that is devoid of intermediaries and external interference.

Each of these financial models comes with its own set of advantages and drawbacks. Opting for DeFi would be suitable if privacy and transparency are paramount considerations for you. On the other hand, if you prioritize greater flexibility and the ability to share risks with fellow participants in the blockchain network, CeFi may be the preferable choice.

Ultimately, the decision between DeFi and CeFi hinges on your specific preferences and requirements in the evolving landscape of decentralized and centralized financial systems.

How Idea Usher Can Help?

Our blockchain service professionals expect an integration of decentralized finance (DeFi) and centralized finance (CeFi), with the strengths of each infrastructure supporting the other.

This integration is evident in a variety of examples, including oracles like Chainlink facilitate the transfer of centralized finance data to decentralized finance, and Synthetix, which allows users to trade CeFi financial elements as DeFi derivatives.

The professionals at Idea Usher understand the importance of combining the strengths of both infrastructures to create a robust and versatile financial ecosystem.

Idea Usher’s blockchain experts excel in designing and implementing solutions that bridge the gap between these two financial paradigms. They work towards creating a harmonious integration that maximizes the benefits of decentralization without compromising on the stability and regulatory adherence essential in the financial industry.

Idea Usher boasts a portfolio of diverse blockchain projects for clients, including SALVAcoin, Metaverse Retail Store, EQL Trading Blockchain, and more.

This approach ensures that businesses can enjoy the innovation and efficiency gains offered by DeFi while maintaining the reliability and trust associated with traditional financial systems.

Contact us today to understand more about how we help with our blockchain development services.

FAQ

Q. How does DeFi differ from traditional cryptocurrencies?

A. While the primary cryptocurrency associated with DeFi is Ethereum, it’s essential to note that the DeFi vs Crypto discussion involves only a few aspects. Cryptocurrencies serve as a means of storing value, similar to fiat currencies, whereas DeFi represents a platform or architecture facilitating lending and trading of cryptocurrencies.

Q. What sets DeFi apart from CeFi?

A. Decentralized finance (DeFi) enthusiasts say that it outperforms centralized finance (CeFi) owing to its intrinsic characteristics. DeFi is based on an open-source architecture, allowing users to maintain sovereignty over their assets without relying on a central authority. Furthermore, DeFi excels at protecting user privacy, which is sometimes compromised in CeFi because to severe regulatory regulations.

Q. Which model is suitable for starting a business?

A. Opt for a DeFi model if you prefer maintaining control of the blockchain system without ceding authority to regulatory bodies. On the other hand, choose CeFi if you aim to establish a system where users can benefit from the assurance of oversight by a centralized authority managing their crypto assets and data.

Gaurav Patil