Now-a-days, one revolutionary concept has been making waves and reshaping the way we perceive and interact with traditional financial systems – Decentralized Finance, or DeFi. DeFi represents a paradigm shift, liberating financial transactions from the constraints of centralized institutions and fostering a more inclusive and accessible global economy.

As blockchain technology continues to mature, the development of DeFi protocols has emerged as a beacon of innovation, offering a decentralized alternative to traditional banking and financial services. Entrepreneurs, developers, and blockchain enthusiasts are increasingly drawn to the limitless possibilities presented by DeFi protocols, seeking to contribute to the democratization of finance.

In this guide, we will get into the key features, fundamental principles, and the intricate development process behind a DeFi protocol. From understanding the core tenets of decentralized finance to exploring the essential components that make a DeFi protocol robust and secure, we will embark on a journey to unravel the intricate tapestry of this groundbreaking financial ecosystem.

- What is a DeFi Protocol?

- Key Market Takeaways on DeFi

- Fundamentals of DeFi Protocol

- Latest Emerging DeFi Protocols

- How to Develop a DeFi Protocol?

- Must Have Features to Have in a DeFi Protocol

- Tips for Developing Smart Contract For DeFi Protocol

- Tech Stacks to Consider for Developing a DeFi Protocol

- Top 10 DeFi Protocols You Should Know About in USA

- Conclusion

- FAQs

What is a DeFi Protocol?

A DeFi protocol, short for Decentralized Finance protocol, is a system of digital rules and instructions established on a blockchain, such as Ethereum. It operates as a programmable financial infrastructure that operates on a public, distributed ledger, allowing users to engage in various financial activities without the need for intermediaries like traditional banks. The core features of DeFi protocols include peer-to-peer transactions, ensuring that financial interactions occur directly between users without central authorities.

Additionally, transparency is maintained through public recording of all transactions on the blockchain, and the open-source nature of the code enables public scrutiny. Smart contracts automate financial processes, eliminating the need for manual intervention, and DeFi protocols facilitate a wide range of use cases, including lending, borrowing, trading, staking, and decentralized insurance.

Also read, “What are DeFi Apps? | DeFi App Development Guide”

Key Market Takeaways on DeFi

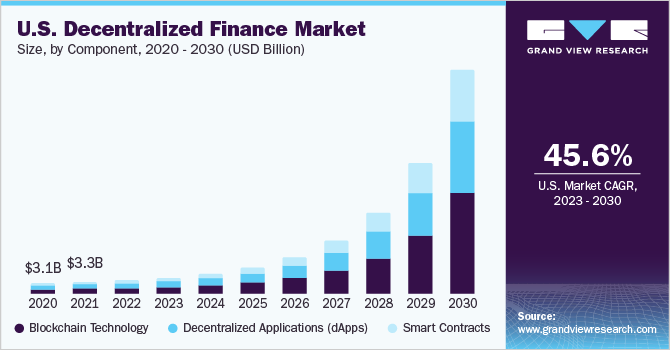

The allure of DeFi lies in its disruptive potential, revolutionizing traditional financial paradigms by eliminating intermediaries and fostering a decentralized ecosystem. For businesses venturing into DeFi protocol development, the integration of decentralized blockchain platforms is a pivotal step, offering the potential for widespread acceptance and market growth.

Source: GrandViewResearch

A key sector experiencing the profound impact of DeFi is insurance, where the protocol’s ability to streamline processes and eliminate complexities has brought about remarkable efficiency gains. By removing traditional bottlenecks such as paperwork and intricate audit systems, businesses can enhance operational agility and contribute to the overall growth of the DeFi market.

Crucially, the advantages offered by DeFi technology providers can be a driving force for businesses. The elimination of reliance on centralized financial institutions, with their associated controls and fees, presents a significant strategic advantage. Furthermore, the user-friendly nature and open accessibility of DeFi platforms ensure a seamless onboarding process for users, facilitating adoption without the need for extensive authorization procedures.

Fundamentals of DeFi Protocol

DeFi protocols are the building blocks of Decentralized Finance, empowering users with open access to diverse financial services without relying on intermediaries. Understanding their fundamentals is crucial for navigating this dynamic and evolving space. Here’s a breakdown of the key elements:

1. Decentralization: The bedrock of DeFi lies in eliminating centralized control. Transactions are facilitated through self-executing smart contracts deployed on blockchains, ensuring transparency and immutability. This disrupts traditional financial systems dominated by gatekeepers like banks, fostering greater inclusivity and user autonomy.

2. Open-source nature: DeFi protocols are typically built with open-source code, allowing anyone to inspect and audit their inner workings. This promotes trust and security, as potential vulnerabilities can be readily identified and addressed by the community. It also fuels innovation, as businesses can build upon existing protocols to create new applications.

3. Interoperability: A growing emphasis is placed on interoperability between DeFi protocols. This involves seamless interaction and data exchange between platforms, regardless of their underlying blockchain technology. Layer 2 scaling solutions and cross-chain bridges are facilitating this connectivity, expanding the DeFi ecosystem and maximizing user-friendliness.

4. Liquidity pools: To facilitate lending, borrowing, and trading, DeFi protocols rely on liquidity pools. These are smart contract-managed reserves of various crypto assets deposited by users. In exchange for providing liquidity, users earn rewards like interest or trading fees. Liquidity pools drive the functionality of various DeFi applications and create a decentralized market for digital assets.

5. Governance mechanisms: The decision-making processes within DeFi protocols are often governed by token holders. Users holding DeFi protocol tokens, like Compound’s COMP or Uniswap’s UNI, can vote on proposals affecting the protocol’s future, such as fee structures, feature implementations, and upgrades. This promotes community involvement and democratic control over the protocol’s direction.

Latest Emerging DeFi Protocols

Let’s go over some of the emerging DeFi Protocols, businesses should know about,

1. Fractional Ownership Protocols

Democratizing Access to Exclusive Investments

In DeFi, protocols like Fractional.art have pioneered fractional ownership. This innovation allows the division of ownership of high-value assets, such as NFTs, into smaller, fungible ERC-20 tokens. The result? A democratized approach to exclusive investments, opening doors for a wider range of participants.

Protocols like Fractional.art

One of the leading platforms facilitating fractional ownership is Fractional.art. Here, users can seamlessly engage in the fractionalization of NFTs, ushering in a new era of accessibility and liquidity within the decentralized space.

2. Decentralized Autonomous Communities (DACs)

Empowering Communities with On-chain Governance

DACs, exemplified by platforms like Boardroom and Colony, leverage on-chain governance and reputation systems. These tools empower communities to collectively manage resources and make decisions, ushering in a new era of decentralized decision-making.

Boardroom and Colony

Platforms like Boardroom and Colony serve as incubators for decentralized governance models. Through these DACs, communities can actively participate in shaping the trajectory of shared resources, fostering a sense of ownership and collaboration.

3. Modular Blockchains

Celestia and Optimism stand at the forefront of modular blockchain development. By separating security and processing functions, these platforms pave the way for a more scalable and adaptable DeFi ecosystem.

4. Token Standards

ERC-4626 (Tokenized Vaults)

Emerging standards like ERC-4626 focus on tokenized vaults, providing a unified interface for yield-generating vaults. This integration streamlines interactions, fostering seamless collaboration across diverse DeFi platforms.

Also read, “Cross Chain Defi Technology- Everything You Need To Know”

EIP-1559 (Fee Market for Ethereum)

EIP-1559 introduces a novel fee model for Ethereum, featuring base fees and priority fees. This innovation aims to enhance transaction predictability and efficiency for DeFi users, marking a significant stride in the evolution of token standards.

Zero-Knowledge Rollups (ZK-Rollups)

ZK-Rollups, including platforms like Loopring and StarkNet, bring forth substantial scalability and privacy enhancements for DeFi transactions. These advancements reduce fees and boost user adoption, marking a pivotal moment in the DeFi landscape.

5. Interoperability

Cross-chain Liquidity Protocols

Protocols like Hop Protocol and Ren facilitate atomic swaps and liquidity routing across different blockchains. This interoperability maximizes capital efficiency and user returns, bridging the gap between diverse blockchain ecosystems.

Inter-Blockchain Communication (IBC)

Cosmos ecosystem chains leverage Inter-Blockchain Communication (IBC) for seamless communication and value transfer. This fosters a truly interconnected DeFi landscape, where assets can seamlessly move across different chains.

Layer 2 Bridges with Security Guarantees

In the pursuit of secure interoperability, bridges like Synapse and Multichain implement advanced security mechanisms. These include optimistic rollups and threshold signatures, mitigating trust assumptions and fortifying bridge vulnerabilities.

6. Bonus Points

Flashbots and Maximal Extractable Value (MEV)

Understanding advanced strategies like flashbots and MEV is crucial for navigating arbitrage opportunities and protecting against potential exploits in DeFi markets. This section sheds light on these nuanced aspects of the decentralized space.

Decentralized Identity (DID) and Soulbound Tokens

Exploring the role of Decentralized Identity (DID) and Soulbound Tokens in building trust and reputation within DeFi is pivotal. These elements enable permissionless credit scoring and community-driven KYC solutions, enhancing the overall integrity of the ecosystem.

How to Develop a DeFi Protocol?

Here’s a detailed stepwise-guide you can follow to develop a DeFi protocol,

1. Conceptualization and Market Analysis

Identify a problem: Begin by pinpointing a pain point in traditional finance or existing DeFi protocols. Does your concept address limitations in lending platforms, offer innovative risk management solutions, or cater to a niche user segment?

Market research: Analyze the competitive landscape for DeFi protocols addressing similar problems. What are their strengths and weaknesses? How can your protocol differentiate itself and capture market share?

Technical feasibility: Assess the technical feasibility of your concept. Choose a suitable blockchain platform based on your protocol’s needs for scalability, security, and transaction speed.

2. Protocol Design and Architecture

Define functionality: Determine the core functionalities of your protocol, such as lending and borrowing mechanisms, tokenomics, governance structure, and smart contract interactions.

Algorithmic modeling: Design the algorithms governing your protocol’s core mechanics, like interest rates, collateralization ratios, and fee structures. Consider factors like risk management, market dynamics, and user incentives.

Smart contract development: Develop secure and efficient smart contracts using industry best practices. Implement security measures like reentrancy guards, access control, and timelocks. Prioritize modularity and code clarity for future maintenance and upgrades.

3. Security and Testing

Formal verification: Utilize tools like Mythril and Solhint to statically analyze your smart contracts for vulnerabilities. Consider formal verification using Zokrates or Viper for critical functions.

Unit testing: Write comprehensive unit tests for each function in your contracts to isolate and identify potential bugs.

Integration testing: Test your contracts in conjunction with other components of your DeFi protocol to ensure smooth integration and functionality.

Penetration testing: Engage ethical hackers or professional auditing firms to conduct penetration testing to uncover hidden vulnerabilities. Encourage responsible disclosure through bug bounties.

4. Tokenomics and Fundraising

Token design: Craft a well-defined tokenomics model that aligns with your protocol’s functionality and incentivizes user participation. Determine token supply, distribution, utility, and governance rights.

Fundraising strategy: Choose a suitable fundraising method, such as Initial Coin Offering (ICO), Initial Exchange Offering (IEO), or venture capital funding. Develop a fundraising pitch deck and prepare for due diligence from potential investors.

5. Community Building and Launch

Community engagement: Actively engage with the DeFi community through online forums, social media, and developer channels. Build trust and gather feedback to refine your protocol based on user needs.

Marketing and branding: Develop a cohesive marketing strategy to attract users and investors. Highlight your protocol’s unique value proposition and differentiate yourself from competitors.

Protocol launch: Prepare for a smooth protocol launch by thoroughly testing all functionalities, conducting final security audits, and ensuring sufficient liquidity in your platform. Monitor performance closely and continuously improve based on user feedback and market conditions.

6. Mainnet Launch Strategies

Phased deployment: Consider a phased launch, starting with a limited set of trusted users or a closed beta program. This allows for controlled testing and refinement based on real-world data and user feedback before broad exposure.

Liquidity bootstrapping: Utilize liquidity mining or incentive programs to attract initial liquidity to your protocol. Consider decentralized asset pools like Uniswap or Curve to facilitate smooth token exchange and price discovery.

Decentralized governance: Businesses can gradually transition to a decentralized governance model, empowering token holders to vote on key protocol decisions like parameter adjustments and fee structures. Utilize tools like Snapshot or Aragon for on-chain voting mechanisms.

Continuous monitoring and iteration: Implement robust monitoring tools to track protocol performance, user activity, and potential security risks. Actively iterate and adapt based on data and user feedback to ensure the ongoing stability and success of your platform.

Must Have Features to Have in a DeFi Protocol

Building a successful decentralized finance (DeFi) protocol goes beyond a revolutionary concept; it requires strategic features to enhance user experience, foster community engagement, and ensure the sustainability of the protocol. Here are some important features to consider,

1. Dynamic Fee Mechanisms

Adaptive Fee Models: Move beyond static fees by implementing adaptive models that adjust based on factors like network congestion, transaction size, and market volatility. This ensures fair pricing for users and sustainable revenue for the protocol.

Gas Fee Optimization: Integrate gas fee prediction tools and aggregators to help users find the most cost-effective transaction times. Consider offering on-chain fee payment options for improved convenience.

Also read, “DeFi Lending and Borrowing Platform Development”

2. Layer 2 Scalability

Embrace Layer 2 Solutions: Bridge your protocol to Layer 2 networks like Optimism or Polygon to achieve faster transaction speeds and lower fees. This caters to a wider user base and improves the overall user experience.

Modular Architecture: Design your protocol with modularity in mind, allowing for seamless integration with various Layer 2 solutions and future blockchain advancements.

3. Advanced Analytics and Reporting

Granular On-Chain Data Analysis: Provide users with comprehensive dashboards and tools to analyze their DeFi activity, portfolio performance, and risk exposure. Integrate AI-powered insights and prediction models for informed decision-making.

Real-Time Market Monitoring: Offer real-time data feeds and trading signals to help users navigate market fluctuations and optimize their strategies.

4. Decentralized Governance and DAO Integration

Enhanced Voting Mechanisms: Explore novel on-chain voting systems like quadratic voting or delegated voting to ensure inclusive and fair decision-making within the protocol’s DAO.

Inter-DAO Collaboration: Facilitate interaction and collaboration between DAOs of different DeFi protocols. This enables resource sharing, joint initiatives, and the development of a more cohesive DeFi ecosystem.

5. Cross-Chain Interoperability

Seamless Asset Movement: Enable frictionless transfer of assets between different blockchains through cross-chain bridges and liquidity protocols. This unlocks new investment opportunities and expands the protocol’s reach.

Multichain DeFi Strategies: Allow users to create and execute DeFi strategies involving assets across multiple blockchains, diversifying their portfolios and maximizing returns.

6. Security and Privacy Enhancements

Formal Verification and Penetration Testing: Proactively identify and mitigate vulnerabilities by employing formal verification techniques and conducting regular penetration testing.

Advanced Privacy Features: Integrate zk-SNARKs or other privacy-preserving technologies to allow users to participate in DeFi activities without revealing their transaction details.

7. Gamification and Community Engagement

Interactive Reward Systems: Implement gamified elements like badges, leaderboards, and quests to incentivize user activity and promote community engagement.

Decentralized Social Features: Create on-chain communication channels and forums for users to interact, share strategies, and build a strong community around the protocol.

8. Flash Loans and Permissionless Innovation

Support for Advanced DeFi Strategies: Enable advanced users to leverage flash loans for arbitrage, collateralization, and other complex DeFi strategies.

Open Development Platform: Facilitate the creation of new DeFi applications and integrations by providing developers with open-source code and developer tools.

Also read, “Popular DeFi Use Cases”

Choosing the Right Blockchain Platform for Developing DeFi Protocol

Now, let’s discuss some of the important blockchain platforms which can help in developing a DeFi protocol,

1. Ethereum (ETH)

Security Enhancements: Ongoing development efforts, such as the implementation of EIP-1559 fee market and sharding solutions, position Ethereum as a secure and scalable choice for DeFi protocols. These enhancements aim to reduce gas fees and improve overall network performance.

Developer Tools & Resources: Ethereum boasts a robust toolkit, including Truffle, Metamask, and Remix, streamlining the development process. The large community surrounding Ethereum provides extensive documentation and support, making it an attractive choice for developers.

Decentralized Governance: The DAO model on Ethereum empowers token holders to actively participate in protocol decisions, fostering a sense of community engagement and ownership.

2. BNB Chain (BNB)

Cross-Chain Bridges: BNB Chain stands out with seamless cross-chain bridges, enabling easy interaction with Ethereum and other blockchains. This facilitates asset movement and integration with the broader DeFi landscape.

Smart Contract Compatibility: The Ethereum Virtual Machine (EVM) compatibility of BNB Chain simplifies the porting of existing Ethereum decentralized applications (dApps). This compatibility reduces development time and costs, making it an attractive option for developers.

Developer Incentives: BNB Chain’s grant programs and funding initiatives actively attract developers, fostering innovation within the ecosystem and ensuring a vibrant DeFi development landscape.

3. Polygon (MATIC)

Multiple Sidechains: Polygon’s customizable sidechains offer fine-grained control and efficient resource allocation. This feature caters to the specific needs of different DeFi applications, providing scalability and versatility.

Decentralized Governance: The influence of MATIC token holders in protocol upgrades and development direction through decentralized governance mechanisms ensures a community-driven approach to decision-making.

Growing DeFi Ecosystem: Polygon’s expanding DeFi offerings, including lending platforms, decentralized exchanges (DEXs), and prediction markets, cater to diverse user needs and attract new participants to the ecosystem.

4. Avalanche (AVAX)

Subnet Customization: Avalanche’s unique feature allows developers to create personalized subnets with adjustable fees and functionalities. This facilitates the development of niche DeFi applications and tailored user experiences.

Cross-Chain Integration: Avalanche’s bridge infrastructure connects it to various blockchains, enabling interoperable DeFi functionalities and seamless asset transfers between different ecosystems.

Security-Focused Design: The proof-of-stake consensus mechanism with a validator set chosen through a nomination process enhances security and stability, making Avalanche an appealing choice for DeFi projects.

5. Solana (SOL)

Unique Consensus Mechanism: Solana stands out with its hybrid Proof-of-History and Proof-of-Stake design, combining fast transaction confirmation with enhanced security compared to pure PoS systems.

Scalability Focus: Solana’s scalable architecture supports thousands of transactions per second, making it suitable for high-frequency trading and other time-sensitive DeFi applications.

Developing DeFi Ecosystem: Solana’s growing ecosystem features a multitude of lending protocols, DEXs, and NFT marketplaces, offering diverse DeFi functionalities and contributing to the platform’s prominence.

6. Cosmos (ATOM)

Interoperability Bridge: Cosmos excels in fostering ecosystem connectivity through the IBC protocol, facilitating seamless data and asset transfer between connected blockchains.

Modular Design: Sovereign blockchains within the Cosmos ecosystem are designed with modularity in mind. This allows for specialization and tailored solutions to meet the diverse needs of different DeFi applications.

Active Community: Cosmos benefits from a strong developer community and ongoing interchain initiatives, fostering collaboration and accelerating the growth of the overall ecosystem.

Tips for Developing Smart Contract For DeFi Protocol

Smart contracts are like the backbone of any DeFi protocol, so let’s go over some of the essential tips of building smart contracts,

1. Layer 2 Scaling Solutions

Ethereum’s gas fees are a hurdle for adoption. Use Layer 2 solutions like Optimism, Polygon, and StarkNet for smart contracts that offer faster transactions and lower fees, enhancing accessibility for real-world applications.

2. Security Best Practices

Formal Verification

Tools like Mythril and Solhint offer static analysis capabilities to identify potential vulnerabilities in your code. For critical components, consider employing formal verification tools like Zokrates or Viper to ensure mathematical correctness and security.

Reentrancy Guards

Implementing reentrancy guards is vital to prevent attackers from exploiting vulnerabilities in your smart contracts, particularly in functions where funds are involved. This practice helps safeguard against re-entry attacks that could drain funds unexpectedly.

Access Control

Granularly controlling access to functions and variables based on roles and permissions adds an extra layer of security. Define roles within your smart contracts and restrict access to sensitive operations, minimizing the risk of unauthorized activities.

Timelocks

Introduce timelocks for critical actions, such as parameter changes or emergency fund withdrawals. This practice allows for community review and intervention in case of malicious actions, promoting transparency and security.

ZKPs and Encryption

While blockchain offers transparency, certain scenarios require confidentiality. Zero-knowledge proofs (ZKPs) and homomorphic encryption are emerging technologies enabling private transactions and computations on public chains, preserving privacy without compromising security.

3. Oracles in DeFi Protocols

Decentralized Oracles

Prioritize decentralized oracle networks such as Chainlink or Band Protocol to enhance data security. By avoiding reliance on single points of failure, decentralized oracles contribute to the resilience of your DeFi protocol.

Aggregator Oracles

Utilize aggregator oracles that consolidate data from multiple sources. These oracles provide more reliable and tamper-proof data feeds, reducing the risk of inaccurate information influencing your protocol’s decisions.

Incentivize Oracle Providers

Design reward mechanisms to incentivize oracle providers. Consistent and high-quality data availability is crucial for the proper functioning of your DeFi protocol, and incentivizing providers ensures a reliable data stream.

4. Cross-Chain Interoperability

Blockchain ecosystems are evolving, and communication between different chains is becoming essential. Cross-chain bridges like Cosmos IBC and Ren Protocol enable interoperable smart contracts, allowing assets and data to flow seamlessly across multiple networks.

5. Quantum-Resistant Cryptography

While a distant threat, the potential of quantum computing poses challenges to existing blockchain cryptography. Research on post-quantum cryptography schemes like lattice-based cryptography aims to ensure long-term security for smart contracts.

6. Additional Helpful Tips

Modular Design

Adopt a modular design approach with clearly defined functions and dependencies. This enhances maintainability and upgradeability, allowing for seamless updates and improvements to your DeFi protocol.

Documentation

Thoroughly document your smart contracts with comments, explanations, and function descriptions. Clear documentation facilitates understanding, making it easier for developers to contribute and for future development teams to maintain the codebase.

Community Engagement

Actively engage with the DeFi community to gather feedback, address concerns, and build trust in your protocol. A transparent and collaborative approach fosters a sense of community ownership and strengthens the overall resilience of your DeFi project.

Tech Stacks to Consider for Developing a DeFi Protocol

Here’re the list of tech stack you need to know, before developing a DeFi protocol,

1. Blockchain Platform

Layer 1: Ethereum stands as a dominant force with robust security and a mature DeFi ecosystem. Explore scaling solutions like Optimism or Arbitrum to address gas fees efficiently.

Layer 2: Avalanche, Polygon, and Solana offer impressive scalability and reduced transaction fees. Choose based on specific performance needs for your platform.

Specialized chains: Platforms like Cosmos prioritize interoperability, allowing seamless integration with other DeFi protocols. Assess your requirements for multi-chain functionality.

2. Smart Contract Development

Languages: Solidity is the go-to language for Ethereum smart contracts. Consider alternatives like Rust (Solana) or Move (Aptos) for specific performance benefits.

Development Environments: Remix, Truffle, and Hardhat provide efficient development environments for various platforms. Choose based on your blockchain and developer preferences.

Libraries and Frameworks: Utilize existing libraries like OpenZeppelin for security-tested code modules. Explore frameworks like Uniswap or Aave for inspiration and reference implementations.

3. Oracles

Centralized Oracles (CDOs): Chainlink is a popular CDO offering reliable data feeds. However, concerns about centralization should be considered.

Decentralized Oracles (DOs): Band Protocol, DIA, and Tellor provide decentralized alternatives, though challenges in data accuracy and security may arise.

Hybrid Oracles: Combining CDOs and DOs ensures data integrity while mitigating centralization risks. Evaluate trade-offs for the optimal balance.

4. Front-End Technologies

JavaScript Frameworks: React and Angular are popular for building interactive interfaces. Consider libraries like Material UI or Bootstrap for pre-built components.

Web3 Libraries: Web3.js and Ethers.js enable seamless interaction with smart contracts from the front-end. Choose libraries compatible with your chosen blockchain.

dApps Frameworks: Aragon and Colony offer modular frameworks for building and managing DAOs, relevant for governance functionality in your DeFi protocol.

5. Testing and Security Tools

Smart Contract Analysis: Mythril, Solhint, and Slither can statically analyze your code for vulnerabilities. Consider formal verification tools like Zokrates or Viper for critical functions.

Unit Testing Frameworks: Truffle and Hardhat provide built-in unit testing frameworks for isolating and identifying bugs in your smart contracts.

Penetration Testing: Engage reputable security firms or ethical hackers to uncover hidden vulnerabilities before launch.

Top 10 DeFi Protocols You Should Know About in USA

Here’re some top DeFi protocols you should know about,

1. Compound

Estimated Annual Revenue: $165 M

Compound is a lending and borrowing protocol, offering user-friendly interface and reliable interest rates.

Latest Updates Implemented

Interest Rate Model Proposal V2: EIP-5662 discussions continue, exploring adjustments to dynamic interest rate fluctuations based on utilization and market volatility.

Governance Portal: Updated platform launched for improved community governance experience, facilitating proposal creation, voting, and discussions.

Integration with Arbitrum: Compound V3 deployed on Arbitrum One, offering another Ethereum Layer 2 option for users seeking faster and cheaper transactions.

2. Uniswap

Estimated Annual Revenue: $15.2 M

Uniswap is pioneering DEX (Decentralized exchange) with high liquidity and diverse token pairings, ideal for basic swaps and price discovery.

Latest Updates Implemented

Uniswap V3 v2 rollout: Near completion, introducing concentrated liquidity v2 with tighter spreads and more customization options for liquidity providers.

NFT Liquidity Pools: Pilot program in testing phase, enabling on-chain NFT trading and liquidity pools directly within the Uniswap protocol.

Governance DAO: Establishment of a decentralized autonomous organization (DAO) under consideration, potentially granting token holders voting rights on key protocol decisions.

3. Aave

Estimated Annual Revenue: $147 M

Aave is a llexible lending platform with features like flash loans and variable interest rates, catering to advanced users and complex strategies.

Latest Updates Implemented

Flash Loan Expansion: Integration with Optimism and Arbitrum networks, allowing flash loans to be executed across Layer 2 platforms for increased speed and scalability.

Credit Delegation V2: Improved version of credit delegation launched, enhancing security and streamlining the process for users to borrow without collateral using delegated borrowing power.

Risk Module Upgrade: Proposed upgrade to the risk module, introducing finer-grained risk assessment for different asset classes and borrowers, optimizing lending efficiency and security.

4. MakerDAO

Estimated Annual Revenue: $185 M

MakerDAO is a decentralized stablecoin ecosystem anchored by DAI, enabling borrowing and leveraging against crypto assets.

Latest Updates Implemented

Real World Asset Integration: RWA pilot program initiated with Centrifuge, exploring the inclusion of tokenized carbon credits as collateral for DAI issuance.

Multi-Collateral DAI Testnet: Development of a testnet for the multi-collateral DAI system, allowing community testing and feedback before mainnet launch.

DAO Treasury Optimization: Proposals under discussion for optimizing the DAO’s treasury management, potentially using DeFi strategies to generate additional revenue for protocol development.

5. Synthetix

Estimated Annual Revenue: $2.1 M

Synthetix provides synthetic assets tracking traditional markets like stocks, commodities, and fiat within DeFi, offering alternative investment opportunities.

Latest Updates Implemented

Synthetic Debt Pools V2: Upgraded version of synthetic debt pools implemented, featuring improved capital efficiency and lower borrowing costs for users.

Off-chain Data Integrations: Chainlink alternatives like Band Protocol and Tellor integrated for specific synthetic assets requiring external data feeds beyond financial markets.

Decentralized Exchange Integration: Testing phase for integrating Synthetix with decentralized exchanges like Curve and SushiSwap, enabling direct trading of synthetic assets.

6. Chainlink

Estimated Annual Revenue: $1.3 M

Chainlink is a leading oracle network, bridging the gap between real-world data and smart contracts, critical for data-driven DeFi applications.

Latest Updates Implemented

Fairchain LINK Staking Rewards: Distribution of staking rewards for LINK token holders participating in network security commenced, incentivizing user participation and decentralization.

Decentralized Randomness Service (DRaaS) Expansion: DRaaS integration with Avalanche and Polygon blockchains, supporting more on-chain applications beyond Ethereum.

Chainlink Automation: Integration with OpenZeppelin Contracts, simplifying the development and deployment of automated smart contracts utilizing Chainlink oracles.

7. Curve

Estimated Annual Revenue: $20.4 M

Curve specializes in stablecoin swaps, known for low fees and tight price spreads, optimal for high-volume stablecoin trading.

Latest Updates Implemented

Stablecoin Gauge Wars: Increased competition between stablecoin projects for liquidity mining rewards on Curve, leading to tighter spreads and accelerated adoption of newer stablecoins.

Curve DAO Governance: Enhanced voting functionalities implemented within the Curve DAO, allowing token holders more granular control over protocol decisions.

Integration with Optimism: Curve deployed on Optimism, offering high-speed and low-cost stablecoin swaps for DeFi users on Layer 2.

8. Lido Finance

Estimated Annual Revenue: $135 M

Lido Finance is a liquid stacking solution for Ethereum and other PoS assets, allowing users to earn staking rewards without maintaining their own nodes.

Latest Updates Implemented

Liquid Staking Derivatives: Launch of Lido Staked Ether (stETH) options on decentralized options platforms like Deribit and Opyn, enabling advanced trading strategies for staked ETH positions.

Cross-Chain Staking Expansion: Integration with Solana and Cosmos ecosystems in progress, allowing Lido to offer liquid staking solutions for PoS assets on multiple blockchains.

Decentralized Staking Router Beta: Beta testing of the staking router platform, aggregating staking rewards from various PoS validators across different chains for simplified and diversified staking opportunities.

9. Yearn.finance

Estimated Annual Revenue: $5.1 M

Yearn.finance is a yield optimization platform, automatically aggregating the best lending and borrowing opportunities across DeFi protocols to maximize user returns.

Latest Updates Implemented

Vaults V2 Optimization: Ongoing integration of cross-chain bridges and advanced strategies, further optimizing vaults for diversified asset management and higher yield generation.

Active Portfolio Management Alpha: Alpha testing of active portfolio management features for Yearn vaults, utilizing machine learning and market analysis to dynamically adjust user holdings for increased returns.

Community Grants Program: Establishment of a grants program to support development of the Yearn ecosystem and incentivize contributions from DeFi developers and builders.

10. Avalanche

Estimated Annual Revenue: $28 M

Avalanche is a powerful blockchain platform hosting a thriving DeFi ecosystem, offering fast transaction speeds, low fees, and subnet customization features.

Latest Updates Implemented

Subnet Governance Expansion: Subnet DAO voting functionalities implemented, allowing individual subnets to govern their own validators, transaction fees, and application deployment.

Interoperability Bridge Enhancements: Upgrades to the Avalanche-Cosmos bridge, improving transaction speed and reliability for cross-chain asset transfers.

Avalanche Foundation Grants: Increased funding allocated for grants supporting DeFi development on Avalanche.

Conclusion

This blog covers key aspects such as the foundational principles of DeFi, smart contract integration, security considerations, and user experience optimization. It navigates through the intricacies of liquidity pools, yield farming, and decentralized exchanges, offering practical insights and best practices for creating a robust DeFi protocol. Whether you’re a seasoned developer or a newcomer to the DeFi space, this comprehensive guide equips you with the knowledge and tools to embark on the exciting journey of crafting your own decentralized financial ecosystem.

At Ideausher, we understand the transformative potential of decentralized finance, and we’re here to empower your journey into DeFi protocol development. If you’re passionate about DeFi and ready to embark on a development journey, we’ve got the expertise to bring your vision to life.

FAQs

Q1: What are the features of DeFi?

A1: Decentralized Finance (DeFi) is characterized by several key features that distinguish it from traditional financial systems. Firstly, DeFi operates on blockchain technology, ensuring transparency, immutability, and security. Smart contracts, self-executing agreements with the terms of the contract directly written into code, automate various financial processes. Additionally, DeFi is accessible to anyone with an internet connection, promoting financial inclusion. Decentralization eliminates the need for intermediaries like banks, providing users with more control over their assets.

Q2: What is the fundamental of DeFi?

A2: At its core, DeFi aims to recreate traditional financial services in a decentralized manner. This involves leveraging blockchain and smart contracts to enable peer-to-peer transactions and financial activities without relying on centralized authorities. The fundamental principles include open access, transparency, security, and interoperability. Users can engage in lending, borrowing, trading, and other financial activities directly without the need for traditional intermediaries, fostering a more inclusive and efficient financial ecosystem.

Q3: What is DeFi protocol development?

A3: DeFi protocol development involves creating the smart contracts and underlying infrastructure that power decentralized financial applications. Developers use programming languages such as Solidity to code these smart contracts, defining the rules and logic governing various financial transactions. Security is paramount, and rigorous testing and auditing processes are crucial to identify and mitigate vulnerabilities. Interoperability is another consideration, as many DeFi protocols are designed to work seamlessly with one another, creating a cohesive decentralized financial ecosystem.

Q4: What are the different DeFi protocols?

A4: The DeFi ecosystem encompasses various protocols, each serving distinct financial functions. Notable among them are lending and borrowing platforms like Compound and Aave, where users can earn interest by lending assets or borrow against deposited collateral. Decentralized exchanges such as Uniswap and SushiSwap facilitate trustless trading of various tokens. Yield farming platforms, exemplified by Yearn.finance, enable users to optimize returns by automatically moving funds between different liquidity pools. Stablecoins like MakerDAO’s DAI provide stability amid market volatility. Additionally, decentralized oracles like Chainlink ensure the integration of real-world data into smart contracts. These protocols collectively contribute to the diverse and dynamic landscape of decentralized finance, offering users a range of options for managing and growing their assets.