Traditional credit cards, while widely used, often come with high interest rates and complex reward structures. This creates a gap in the market for a more transparent and accessible financing solution. Buy Now, Pay Later (BNPL) applications like Affirm address this need by offering instant credit decisions, flexible repayment plans, and a user-friendly experience. But here is the question: can your business benefit from the BNPL trend? For financial firms looking to capitalize on this burgeoning trend, developing a BNPL platform presents a brilliant opportunity.

This blog delves into the technical considerations and strategic planning required to build a successful BNPL app that rivals Affirm’s dominance. We will explore the technical considerations, core functionalities, and strategic partnerships needed to carve a niche in this dynamic and lucrative market, along with the required AI-powered underwriting, risk management strategies, and seamless integrations with e-commerce platforms.

What Is An Affirm App?

The Affirm App simplifies shopping by allowing users to make purchases and pay over time, either online or in-store. It provides clear benefits, such as flexible payment options customized to individual budgets and the ability to discover new brands while enjoying exclusive discounts. Even if Affirm isn’t directly integrated at checkout, users can still utilize its services across various retailers.

Financially, Affirm promotes responsible spending with straightforward terms and no hidden fees. It offers competitive APR rates, including options with 0% APR, ensuring affordability without the worry of compounding interest. Affirm enhances the shopping experience with transparency and ease of use, which empowers users to manage their finances wisely.

How Does The Affirm App Work?

The Affirm app is designed to be simple and transparent for both users and backend processes. Here’s a breakdown of how it functions:

Here Is How Affirm Works For Users:

- Shopping: Users can shop at their favorite stores, both online and in-store. The app shows how much they are prequalified to spend, letting them discover new brands and access special deals and discounts.

- Checkout: At checkout, users can choose Affirm as their payment method. The total amount they need to pay is displayed upfront and will never change, ensuring no surprises.

- Payment Schedule: Users can select a payment plan that suits their financial situation. They can make payments directly on affirm.com or through the Affirm app.

- No Hidden Fees: Affirm has no hidden fees. There are no late fees, no prepayment fees, no annual fees, and no fees to open or close an account.

- Interest: The terms of the purchase, including the total interest amount, are clearly presented at checkout. Users will always know how much interest they will pay, and this amount will never increase.

Here Is How Affirm Works In The Backend:

- Eligibility and Credit Check: When a user selects Affirm at checkout, a quick eligibility check takes place. This includes a soft credit inquiry to determine if the user qualifies for the desired loan without impacting their credit score.

- Loan Approval and Processing: Once eligibility is confirmed, Affirm promptly approves the loan for the purchase. This ensures users can proceed with their transactions smoothly.

- Payment Handling: Affirm acts as the intermediary between the user and the merchant while ensuring secure and efficient payment processing. This role guarantees that transactions are executed seamlessly.

- Loan Repayment: Users repay the loan according to agreed-upon terms. This structured approach allows for clear financial planning and management.

- Presentation-Oriented APIs: Affirm employs presentation-oriented APIs to separate business logic from user interface functionality. This ensures a responsive and dynamic user experience by delivering optimized data presentations in real-time.

- Backend for Frontends (BFFs) Strategy: Affirm utilizes Backend for Frontends (BFFs) microservices to enhance API performance and security. These specialized services cater to specific frontend applications and optimize usability and reliability.

- High Availability Commitment: Affirm aims for 99.99% service uptime by deploying a single-region architecture with multi-availability zone redundancy. This setup ensures minimal disruption and enhances service reliability.

- Transaction Management APIs: Affirm’s transaction management suite includes Authorize, Capture, Refund, Void, and Update APIs. These tools facilitate the efficient handling of financial transactions and ensure smooth authorizations, refunds, and updates.

Market Stats Of Buy Now Pay Later Services

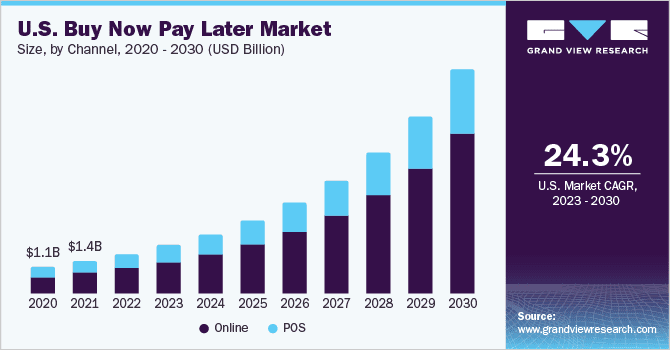

The global buy now, pay later (BNPL) market was valued at USD 30.38 billion in 2023. It is expected to grow from USD 37.19 billion in 2024 to USD 167.58 billion by 2032, with an annual growth rate of 20.7% during this period.

According to another report, the global buy now pay later market size is anticipated to grow at a compound annual growth rate of 26.1% from 2023 to 2030. A key factor driving this growth is the consumer preference for flexible and convenient payment methods. BNPL services allow customers to purchase items without paying immediately, offering financial flexibility and reducing the burden of upfront costs.

The increase in e-commerce has also significantly contributed to the expansion of the BNPL market. As online shopping becomes more prevalent, consumers seek seamless and efficient payment options. BNPL services integrate smoothly with online checkout processes, providing a quick and hassle-free payment experience. The growth of e-commerce platforms and the adoption of digital wallets have made BNPL solutions attractive to both consumers and merchants.

Why Should Businesses Invest In Developing A BNPL App Like Affirm?

Investing in a Buy Now, Pay Later (BNPL) app similar to Affirm offers multiple benefits for businesses. Here are the reasons why it makes sense:

1. Boost Sales Revenue

Integrating BNPL services can significantly increase sales. Data shows that businesses using BNPL options see a 27% rise in sales volume. Additionally, a study by Affirm found that retailers experienced an 87% increase in average order value. This demonstrates the strong potential for revenue growth.

2. Improve Conversion Rates

Offering BNPL can lead to better conversion rates, with increases of up to 30%. This is because BNPL makes purchases more manageable for customers. The flexibility to pay over time encourages more customers to complete their transactions, which boosts overall sales.

3. Increase Average Order Size

Businesses that offer BNPL often see larger cart sizes. Reports indicate a 50% increase in average order size when customers use BNPL. Knowing they can pay in installments, customers are more likely to add extra items to their cart, which leads to higher sales per transaction.

4. Attract New Customers

A BNPL platform like Affirm can help businesses reach new customers. Affirm has over 17 million active users who might discover your business through their app. This can expand your customer base and increase your market reach.

5. Offer Flexibility To Merchants

Merchants can customize BNPL terms to suit their needs. This includes setting minimum purchase amounts for installment eligibility, the repayment period for customers, and offering interest-free financing.

Essential Features To Build An App Like Affirm

Creating a Buy Now, Pay Later (BNPL) app similar to Affirm requires careful planning and integration of key features to enhance user experience and ensure secure transactions. Here are ten essential features to consider:

1. Customized Credit Limits And Payment Plans

The app should offer personalized credit limits and payment schedules based on individual user profiles. Assessing the user’s creditworthiness and spending history helps provide terms that fit their financial situations.

2. Automatic Payment Scheduling And Reminders

To ensure timely repayments, the app should include automatic payment scheduling with reminders. This helps users track due dates and avoid missed payments, contributing to better financial management.

3. Integration With Popular Online Retailers

Seamless integration with major online retailers is crucial. This allows users to access a wide variety of shopping options directly through the app, making it convenient to use BNPL services across multiple platforms.

4. Strong Fraud Detection And Security Measures

Advanced fraud detection and prevention systems are essential to safeguard transactions. Implementing security protocols like AI-driven fraud detection and multi-factor authentication protects users from fraudulent activities and builds trust in the app.

5. Detailed Analytics And Reporting

Providing comprehensive analytics and reporting features helps users monitor their spending and payment history. Visual reports, spending summaries, and trend analysis enable users to manage their finances effectively.

6. In-store Payment Support

To enhance usability, the app should support in-store payment options. This allows users to use BNPL services at physical retail locations, which broadens the app’s convenience for everyday shopping.

7. Loyalty And Reward Programs

Introducing loyalty programs can encourage continued use of the service. Rewards for frequent use, timely repayments, and referrals can increase user engagement and build long-term customer loyalty.

8. Reliable Customer Support

Providing excellent customer support is crucial. The app should offer multiple support channels, including phone support, email, and chat, to assist users with any issues or questions.

9. Multiple Payment Options

Offering a range of payment methods gives users flexibility. This can include linking multiple bank accounts, using different credit cards, and incorporating digital wallets. It ensures that users can choose their preferred payment method.

10. User-friendly Interface

A well-designed, user-friendly interface is vital for user satisfaction. The app should be easy to navigate, with a clear layout and straightforward instructions, while ensuring users can access all features without difficulty.

Five Advanced Features To Consider For The Affirm-like App

- Instant credit assessments: Evaluate user creditworthiness in real-time using advanced algorithms for swift loan approvals that ensure seamless transactions.

- Flexible pricing strategies: Implement dynamic pricing models to tailor loan terms based on credit history and repayment preferences, providing fair financing options.

- AI-powered financial guidance: Offer personalized financial advice through AI analysis of spending patterns, aiding users in budgeting, saving, and debt management.

- Comprehensive analytics dashboard: Provide a dashboard to track spending trends, view payment histories, and monitor credit scores with visual aids for clarity.

- Digital wallet integration: Integrate with popular digital wallets for convenient and secure transactions while supporting diverse user preferences.

How To Develop A BNPL App Like Affirm: A Step-By-Step Guide

Developing a Buy Now, Pay Later app similar to Affirm requires a systematic approach integrating advanced technical components and user-centric features. Here are the important steps to consider:

1. Define Requirements And Features

Begin with in-depth market research to grasp the specific needs of consumers and merchants. Analyze existing BNPL services like Affirm to identify key features such as real-time credit assessments, customizable payment schedules, analytics, integration with digital wallets, and personalized financial advice.

2. Architecture Design

Design a scalable and resilient architecture capable of handling varying transaction volumes and user interactions effectively. Opt for a microservices architecture to modularize components like credit assessment algorithms, payment processing, and analytics. Ensure database design to securely store user profiles, transaction data, payment schedules, and analytical insights. Develop well-defined APIs to facilitate seamless communication between the front-end UI, back-end services, payment gateways, and external APIs.

3. Frontend Development

Prioritize intuitive UI/UX design to ensure a seamless user experience. Design responsive interfaces for key functionalities such as loan applications, payment management, and account settings. Utilize modern frontend technologies and frameworks for dynamic UI components and real-time updates.

4. Backend Development

Implement advanced server-side logic to power features such as real-time credit assessment algorithms and automated payment scheduling. Integrate with third-party services such as digital wallets and payment gateways for smooth transactions. Ensure efficient data handling and retrieval. Make sure to emphasize scalability and performance optimization.

5. Security Implementation

Implement security measures to safeguard transactional information and user data. Utilize encryption protocols such as HTTPS and SSL/TLS for data encryption in transit and at rest. Develop secure authentication mechanisms like OAuth and JWT, complemented by role-based access controls. Integrate advanced fraud detection algorithms to detect and prevent fraudulent activities during transactions.

6. Testing

Conduct thorough testing across all stages of development. Perform unit tests to validate individual components and integration tests to ensure seamless interaction between modules. Conduct extensive user acceptance testing (UAT) to validate usability, functionality, and performance under real-world scenarios.

7. Deployment And Scaling

Deploy the BNPL app on scalable cloud platforms such as AWS or Azure to utilize scalability and global accessibility. Utilize containerization technologies like Docker for efficient deployment and management of application components. Implement monitoring tools to track and optimize application performance and performance metrics based on usage patterns.

8. Compliance And Regulations

Adhere strictly to data privacy regulations (e.g., GDPR, CCPA) for secure handling of user data and privacy rights. Comply with financial regulations such as PCI-DSS for secure payment processing throughout the application lifecycle, along with adherence to industry standards.

9. Continuous Improvement

Establish a feedback loop for user feedback and analytics for iterative improvement of features and user experience. Regularly update the BNPL app with enhancements and new features based on trends and user needs to maintain competitiveness.

10. Maintenance And Support

Ensure proactive maintenance to address bugs, security vulnerabilities, and performance issues promptly. Provide responsive customer support to handle user inquiries and technical support needs effectively, ensuring ongoing user satisfaction and operational efficiency.

Tech Stack Required To Develop A BNPL App Like Affirm

| Aspect | Technology |

| Frontend | HTML, CSS, JavaScript, React.js, Angular, Redux, Context API |

| Backend | Node.js, Express.js, GraphQL, REST APIs, MongoDB, PostgreSQL |

| Microservices architecture | Docker, Kubernetes, RabbitMQ, Kafka |

| Security | SSL/TLS, OAuth, JWT, Data Encryption (e.g., AES) |

| Payment gateways and integrations | Stripe, PayPal, Financial APIs |

| DevOps and cloud infrastructure | AWS, Azure, CI/CD Pipelines, Monitoring and Logging (e.g., Prometheus, ELK stack) |

| Compliance and regulations | GDPR, CCPA, PCI-DSS |

| Additional considerations | Mobile App Development (React Native, Flutter), Analytics and Reporting |

5 Popular BNPL Apps Like Affirm

Here are some of the popular BNPL apps like Affirm in the market:

1. Klarna

Klarna offers a flexible BNPL service that allows users to shop online and pay over time. They provide Klarna Plus, a subscription service with exclusive shopping perks for a monthly fee. Klarna also features a rewards program where users earn points for their purchases.

2. Splitit

Splitit is a distinct BNPL service enabling users to split payments using their existing credit cards. It requires no additional fees, applications, or credit checks, catering to responsible credit card holders who prefer not to take out new loans.

3. Afterpay

Afterpay allows users to divide purchases into four equal installments. The first payment is made at checkout, with subsequent payments due every two weeks. Afterpay is widely accepted at major retailers like Target, Lowe’s, and PetSmart.

4. Sezzle

Sezzle offers a BNPL option where purchases can be split into four payments. Payments start with the first at checkout, followed by three more every two weeks. Sezzle targets responsible credit card users seeking flexibility without new loans.

5. PayPal Pay In 4

PayPal Pay in 4 allows users to split purchases into four equal payments. The first payment is due immediately, followed by three subsequent payments every two weeks. It is available at various online retailers accepting PayPal payments.

Cost To Build An App Like Affirm

The investment required to develop a Buy Now, Pay Later (BNPL) app akin to Affirm varies significantly based on several critical factors.

- Cost factors: The development cost for a BNPL app like Affirm varies based on complexity, features, UI/UX design, and backend needs.

- Baseline estimate: Starting costs typically begin around $25,000 for a basic version of the app with essential features and functionalities.

- Potential cost range: Actual costs can rise significantly depending on specific project requirements and customization.

- Additional Expenses: Incorporating advanced features, hiring experienced developers, and refining UI/UX design can escalate project expenses.

- Hourly Rates: In the USA, hourly rates for app development range between $100 to $150 per hour. You can also explore other regions for varied prices.

- High-end estimates: At these rates, total project costs can reach $485,000 to $727,500, particularly for complex projects.

- Median costs: Projects with more modest requirements may still incur costs ranging from $100,000 to $200,000, reflecting variations in developer rates and project scope.

Cost Of Maintaining An App Like Affirm

Maintaining a Buy Now, Pay Later (BNPL) app such as Affirm involves several ongoing expenses essential for its smooth operation and user satisfaction. Here’s a breakdown of these maintenance costs:

- Hosting fees: Depending on the scale and complexity of your app, monthly hosting fees typically range from $70 to $320. This cost covers server space, data storage, and ensuring the app runs smoothly without downtime.

- Updates and new features: The cost of updating and adding new features varies based on developer rates. In the United States, mobile app developers charge hourly rates between $41 and $54. This expense ensures your app remains competitive with new functionalities and security patches.

- Support: Providing ongoing customer support is important once your app is live. Customer support representatives charge hourly rates ranging from $15 to $19. This investment ensures prompt resolution of user queries and issues and enhances user satisfaction and retention.

- App store fees: To maintain visibility and accessibility, listing your BNPL app on platforms like the Apple App Store or Google Play Store incurs fixed fees. Apple charges an annual developer account fee of $99, while Google imposes a one-time registration fee of $25.

- Maintenance costs: Industry norms suggest that maintaining an app typically amounts to 15% to 20% of the original development costs annually. For instance, if your initial development expenditure was $100,000, you can expect maintenance costs to range between $15,000 and $20,000 per year. These costs encompass ongoing updates, server maintenance, customer support, and platform fees.

Understanding and budgeting for these ongoing expenses is important for ensuring the long-term success and functionality of your BNPL app. Consulting with experienced app development professionals can provide you with detailed insights and accurate estimates specific to your project’s needs and scale. This proactive approach will enable you to use effective financial planning and strategic resource allocation to sustain app performance and user satisfaction over time. So, get in touch today and book your free consultation call with us to get a complete quote.

Conclusion

Building a Buy Now, Pay Later (BNPL) app like Affirm presents a promising opportunity for businesses looking to improve customer engagement and boost revenue. With its seamless shopping experience, user-friendly interface, transparent financial terms, and flexible payment options, Affirm has set a benchmark in the BNPL market. By investing in such an app, you can tap into a growing consumer preference for convenient payment solutions and capitalize on the increasing popularity of e-commerce. With careful planning, development, and strategic maintenance, you can easily exceed customer expectations while enduring customer loyalty and market leadership in digital payments.

Build Your Affirm–like BNPL App With Idea Usher.

At Idea Usher, our team combines expertise with creativity in every app development project. With a track record of 800+ successful projects delivered and more than 50,000 hours of coding experience, we bring dedication and skill to every project. We are committed to developing a Buy Now, Pay Later (BNPL) app similar to Affirm that aligns with your goals. Our team specializes in creating solutions that offer flexible payment options, security features, user-friendly interfaces, and much more. Partner with Idea Usher today to ensure user satisfaction, enhance sales, and advance your business with a brilliant app. Contact us today.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQ

Is there another app like Affirm?

Yes, there are several apps similar to Affirm. Companies like Afterpay, Klarna, and Sezzle offer Buy Now, Pay Later (BNPL) services. These apps provide consumers with the option to make purchases and pay for them in installments, often with flexible payment terms and low or no interest rates.

Who is Affirm’s biggest competitor?

Affirm’s biggest competitor is likely Klarna, a leading BNPL service that offers similar features, including installment payments, instant credit decisions, and a user-friendly experience. Klarna is widely used across many online retailers and has a significant presence in the BNPL market, making it a strong competitor to Affirm.

Is Afterpay or Affirm better?

Whether Afterpay or Affirm is better depends on the user’s needs. Afterpay allows users to pay in four interest-free installments over six weeks, which is ideal for short-term payments. Affirm offers more flexible repayment terms, including longer-term financing with interest. Users should consider their repayment preferences and terms before choosing.

Is Sezzle or Affirm better?

Choosing between Sezzle and Affirm depends on individual preferences and financial needs. Sezzle offers interest-free installment payments over six weeks, making it suitable for short-term repayment plans. Affirm, on the other hand, provides flexible financing options, including longer-term loans with interest. Users should evaluate their specific financial situation and repayment preferences.