Are you aiming to enhance revenue streams and broaden your market presence across diverse industries through a successful application? If so, venturing into buy now, pay later (BNPL) app development and crafting an app similar to Klarna could be transformative.

The buy now, pay later app trend stands out as one of the most compelling developments aligning with recent advancements in the global business landscape. Industries under travel and hospitality, entertainment, eCommerce, and online delivery have embraced the shop now, pay later concept.

While consumers appreciate the convenient payment options offered by BNPL apps, businesses are drawn to higher returns, enhanced brand recognition, and increased profit-generating capabilities. The notable success of leading apps like AfterPay, Klarna, Affirm, and ZipLook has motivated organizations worldwide to invest significantly in buy now, pay later app development.

Among these, Klarna has particularly surged in popularity in recent years. If you’re considering creating a buy now, pay later app similar to Klarna, this post provides valuable insights into the development steps, essential features, and technologies involved in BNPL app development.

- What Is A Buy Now Pay Later Application?

- Business Benefits Of Developing A BNPL App

- Must-Have Features In A Custom BNPL App Like Klarna

- How To Develop A Buy Now Pay Later App Like Klarna?

- Top 5 BNPL Apps Like Klarna In The Market Right Now

- Tech Stack To Consider To Develop A Buy Now Pay Later App

- Conclusion

- How Can Idea Usher Help You Develop a Buy Now Pay Later App like Klarna?

- FAQ

What Is A Buy Now Pay Later Application?

A Buy Now Pay Later (BNPL) app is like a digital version of a credit card that allows people to buy things and pay for them later without added fees. These apps usually break down the purchase cost into smaller payments over a few weeks or months. This makes it easy for users to buy things online and pay for them gradually. It’s a simple process to apply for, and users must ensure they pay back on time.

With more people shopping online, the demand for interest-free payment options has increased, making BNPL apps popular. One well-known app, Klarna, offers extra features such as flexible payment choices, clear information about costs and interest, a quick checkout, and additional rewards and discounts. Klarna also works with various currencies, making it accessible to many users worldwide.

Klarna offers many features, such as:

- Options to pay flexibly and customize your payments.

- Clear info about costs and interest fees.

- A quick checkout process that takes only a few seconds.

- Cool rewards and special discounts.

- Works with different currencies, so it’s easy for lots of people to use.

Business Benefits Of Developing A BNPL App

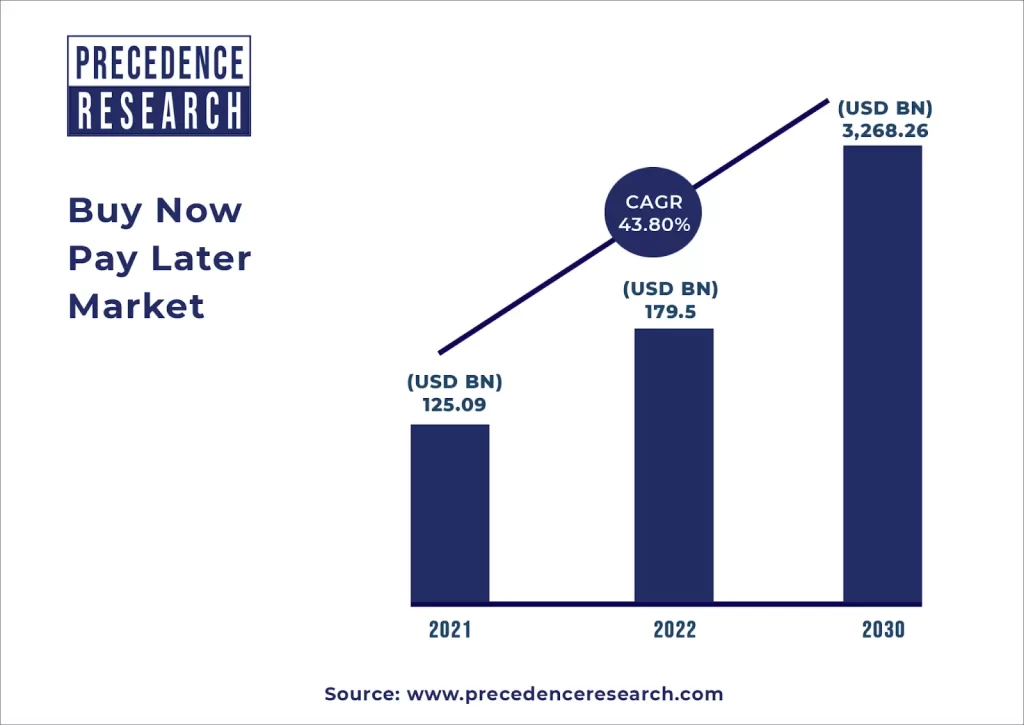

So far, you may have compelling reasons to develop a buy now pay later app similar to Klarna. However, for those seeking additional motivations to invest in this burgeoning trend within the mobile app development market, here’s why venturing into buy now pay later app development could prove to be a lucrative decision!

According to Statista, the buy now, pay later option is predominantly utilized in Northwestern Europe, Australia, and New Zealand. Nevertheless, the younger demographic in North America is also embracing BNPL apps like Klarna, particularly for purchasing clothing and fashion accessories. Recent studies affirm that Millennials and Gen X, when engaging in online shopping, prefer apps such as Klarna.

The onset of the COVID-19 pandemic has further spurred the adoption of BNPL apps, with more consumers turning to online shopping during lockdowns and periods of social distancing. However, these factors represent just a fraction of why investing in buy now, pay later app development holds substantial promise in the current market landscape.

1. Growing Popularity Across Regions

The buy now pay later (BNPL) model, exemplified by apps like Klarna, is gaining immense popularity, particularly in Northwestern Europe, Australia, and New Zealand, according to a report by Statista. Additionally, younger demographics in North America are increasingly turning to BNPL apps for purchasing clothes and fashion accessories. The trend’s accelerated adoption during the COVID-19 pandemic, driven by the surge in online shopping amid lockdowns, highlights the market’s potential.

2. Better Reach and Flexibility

Investing in buy now pay later app development offers a strategic advantage in reaching a wider audience, especially among younger consumers seeking flexible payment options. With a growing demand for such apps, businesses can not only tap into this expanding user base but also leverage the platform to introduce and promote other services or products.

3. Higher Returns through Fees and Interest

Buy now pay later apps typically charge fees or interest on the provided loans, presenting a lucrative revenue source for businesses. The increasing popularity of these apps indicates the potential for high returns for investors who capitalize on this payment model.

4. Repeat Customer Potential

Users of BNPL apps, enticed by discounts and rewards, exhibit a tendency to make frequent purchases, sometimes up to 20 times a year. Once an app attracts users, there’s a high probability that they will become repeat customers, contributing significantly to the long-term success of the business.

5. High Conversion Rates

Reports suggest that investing in BNPL app development can lead to 20%-30% higher revenues for organizations compared to traditional payment methods. This shift is prompting more companies to prioritize the development of BNPL apps over traditional credit card offerings, indicating the robust potential for increased conversion rates and revenue generation.

6. Opportunity for Innovation

The constantly evolving nature of buy-now-pay-later apps, with ongoing innovations and improvements, presents an exciting opportunity for growth and development within the industry. This dynamism can open new avenues for innovation, ensuring that businesses in this sector remain competitive and continue to attract users.

Must-Have Features In A Custom BNPL App Like Klarna

To determine the ideal features for your app, you must also study the market and your top rivals.

1. Multi-Payment Gateway Integration

In today’s dynamic market, users have diverse payment preferences. Integrating multiple payment gateways, such as popular credit cards, secure bank transfers, and digital wallets, ensures your Buy Now Pay Later (BNPL) app caters to a wide audience. Offering flexibility with short-term and extended loan choices enhances user convenience, making bill management a seamless process. By accommodating various payment methods, your app becomes an all-encompassing financial solution, appealing to a broader user base.

2. Automated Payments

The automated payment feature is a game-changer in enhancing user experience and minimizing the risk of late payments. Enabling users to set up automated payments not only ensures timely transactions but also provides them with a worry-free payment experience. Leveraging push notifications for timely alerts about upcoming deals, due payments, and remaining installments keeps users informed and engaged. This proactive approach contributes to a smoother user journey, fostering trust and loyalty towards your BNPL app.

3. Purchase Tracking

Data analytics is a powerful tool for understanding user behavior and preferences. By incorporating robust data tracking tools, your BNPL app can offer users insights into their spending patterns. Allowing users to monitor their purchases, check paid amounts, and view outstanding balances promotes financial transparency. This feature empowers users to make informed decisions about their finances, strengthening their trust in your app and encouraging continued engagement.

4. Interest Rates and Fees

Transparency in communicating interest rates and fees is a fundamental aspect of building user trust. Clearly outlining the total cost of purchases ensures users are well-informed about their financial commitments. Additionally, introducing rewards and loyalty incentives for significant purchases creates a positive incentive structure, attracting and retaining users who seek value and benefits from their transactions.

5. Customizable Payment Plans

Recognizing that each user has unique preferences and financial situations, providing customizable payment plans is a key feature. Allowing users to tailor their repayment schedules, whether monthly, quarterly, or annually, ensures the payment structure aligns with individual needs. This personalization not only enhances the user experience but also establishes your BNPL app as a flexible and user-centric financial solution.

6. Implementing a Custom Chatbot for Enhanced Customer Support

Embracing the trend, it is imperative for your BNPL app, akin to Klarna, to deploy a custom chatbot. This intelligent virtual assistant should not only offer round-the-clock real-time support but also utilize Natural Language Processing (NLP) and conversational AI services. By doing so, your chatbot can mimic human-like behavior, creating a seamless and personalized interaction for users.

7. Security Measures for Critical User Information

Recognizing the sensitivity of the information stored within BNPL apps, including bank details, personal information, and payment passwords, security becomes paramount. It is essential to implement robust security models and tools to safeguard this critical data from online theft and fraud. Secure encryption and authentication protocols should be integral components of your BNPL app’s security infrastructure.

8. Integration with eCommerce Stores

To provide users with a comprehensive shopping experience, your BNPL app must seamlessly integrate with a diverse range of retailers and online eCommerce stores. This integration not only facilitates purchases from favorite stores but also enables the provision of smart recommendations based on ongoing deals. This feature enhances user engagement and increases the likelihood of users making payments through your app.

9. Facilitating Easy Returns for Increased Credibility

Building trust and credibility are essential for the success of a BNPL app. Offering instant returns when customers decide to cancel purchases or opt for full payments outside the app enhances the credibility of your service. This customer-centric approach attracts a more valuable audience globally and contributes to the long-term success of the BNPL platform.

10. Online Documentation for Swift Approvals

Overcoming the traditional loan approval challenges, the BNPL concept thrives on its efficiency. To further streamline the process, your app should provide online documentation facilities. Allowing users to submit necessary documents online contributes to a swift and hassle-free approval process, aligning with the core principle of the shop now, pay later model. This enhances user satisfaction and positions your BNPL app as a convenient and user-friendly financial solution.

How To Develop A Buy Now Pay Later App Like Klarna?

Developing a buy now pay later app encompasses several crucial steps, ranging from designing the user interface and developing the backend infrastructure to integrating payment gateways and ensuring security and compliance.

An in-depth understanding of the key technologies, tools, and next-gen tech employed in crafting a shop now pay later app is essential. Alternatively, you can hire a professional team of app developers with expertise in creating financial loan lending apps. Whether you decide on in-house app development or enlist the services of a reputable mobile app development company, the following steps will guide you towards creating a successful app.

1. Research and Planning

The initial step in crafting a successful buy now pay later app, like Klarna, involves understanding your target market, identifying trends, and analyzing competitors. Define your app’s objectives – whether it’s introducing a new payment option or differentiating yourself with a unique BNPL service. This clarity will guide the inclusion of features and functionality. Questions like identifying target audiences, their benefits from the BNPL app, popular market apps, potential monetization models, and required resources are pivotal in framing a successful app development strategy.

Additionally, thorough market research and competitor analysis are essential to pinpoint unique features that can set your app apart. Based on these insights, formulate a comprehensive plan outlining the app’s objectives, features, and target audience. This strategic approach ensures better brand value, user-centric app development, and satisfied customers.

2. Business and Digital Consulting

Moving forward in developing a buy now, pay later app like Klarna, the second crucial step involves engaging in business and digital consulting. Even if you possess a general awareness of the app development market, there might be unfamiliar trends and tools, especially considering the industry’s dynamic nature. This is where the significance of expert consultation becomes evident.

Professional developers, working extensively in creating similar apps for various businesses, can offer valuable insights through digital consulting services. Reputable companies worldwide specialize in understanding the genuine pain points of your business and customers, identifying the latest trends in your domain, and providing tailored solutions that align with your specific requirements.

For example, beyond the eCommerce sector, the shop now, pay later concept is utilized in various other industries. Additionally, incorporating AI, data analytics, and predictive analytics can significantly enhance your app’s success. Expert digital consulting becomes indispensable in uncovering these trends and technological advancements. Therefore, it is essential to collaborate with professionals who comprehend your needs and assist in formulating an effective roadmap for the development of your buy now pay later app.

3. Hiring an Expert App Development Company

Choosing the right app development partner is a pivotal step in creating a buy now pay later application, similar to Klarna. The success of your app hinges significantly on the expertise and reliability of your chosen app development company. Opting for a seasoned and reputable firm alleviates concerns and offers numerous advantages.

For instance, a proficient app development company provides a comprehensive array of services under one roof. This all-encompassing approach ensures you receive everything needed in a single place, encompassing consultation, design, development, and testing. This consolidated service model streamlines the development process and proves to be a cost-effective and time-saving solution.

4. Designing the App and MVP Development

Once you have conceptualized your ideas and assembled a team of skilled app developers, the pivotal next step is crafting the design for your app, drawing inspiration from successful platforms like Klarna. This is where the concept of MVP (Minimum Viable Product) development plays a crucial role.

Leveraging MVP development services enables you to create a scaled-down app version, incorporating only the essential features. This approach allows you to test and validate your product with the target market, gather valuable user feedback, and make necessary improvements before committing to the development of the fully-fledged app. Examining the app’s navigation and user interface during this stage provides the flexibility to make adjustments, significantly reducing development and testing time.

5. Developing Your Buy Now Pay Later App

You can initiate the actual development process by focusing on building the backend infrastructure that supports key app features, including payment gateways, customer account management, and transaction history. Prioritize scalability in the development to ensure the app can accommodate a growing user base seamlessly.

Additionally, integrate the app with one or more secure payment gateways, enabling users to make installments for their purchases. This integration should adhere to strict security and regulatory requirements, ensuring a safe and compliant financial transaction environment. This development stage lays the foundation for a robust and scalable Buy Now Pay Later app, aligning with the success achieved by industry leaders like Klarna.

6. Security and Compliance

In the current digital landscape, cybersecurity remains a paramount concern for businesses, and the Buy Now Pay Later (BNPL) sector is no exception. Given that your BNPL app, similar to Klarna, holds crucial customer information, it must be fortified with robust security measures and adhere to regulatory standards. Therefore, your development partner must ensure the app’s security and compliance, encompassing adherence to the Payment Card Industry Data Security Standards (PCI DSS) and the General Data Protection Regulation (GDPR).

7. Testing and Deployment

Conducting thorough testing is a pivotal stage to identify any glitches or errors in your app. Testing is critical as it unveils even the minutest unidentified mistakes that may have occurred during development. While some organizations may be tempted to skip this step to save costs and expedite product launch, it often leads to technical and performance issues that can adversely impact the brand. To tackle such challenges, opt for testing services for your BNPL app, choosing between manual or automated testing based on project requirements. Post-testing, deploy your app on a specific platform.

8. Maintenance

Maintenance stands as a crucial step for ensuring the sustained success of your BNPL app over the years. By staying ahead of the latest advancements in the niche through proper maintenance and support services, you can attract more users and secure better ratings globally. Maintenance and support services typically encompass UI/UX enhancement, testing, feature upgrades, technology migration, cloud integration, and more. Therefore, it is essential to select a development partner that offers comprehensive services for the ongoing success of your BNPL app.

Top 5 BNPL Apps Like Klarna In The Market Right Now

In the rapidly evolving landscape of Buy Now Pay Later (BNPL) apps, many options cater to diverse consumer needs. Here are the top 5 BNPL apps like Klarna currently dominating the market.

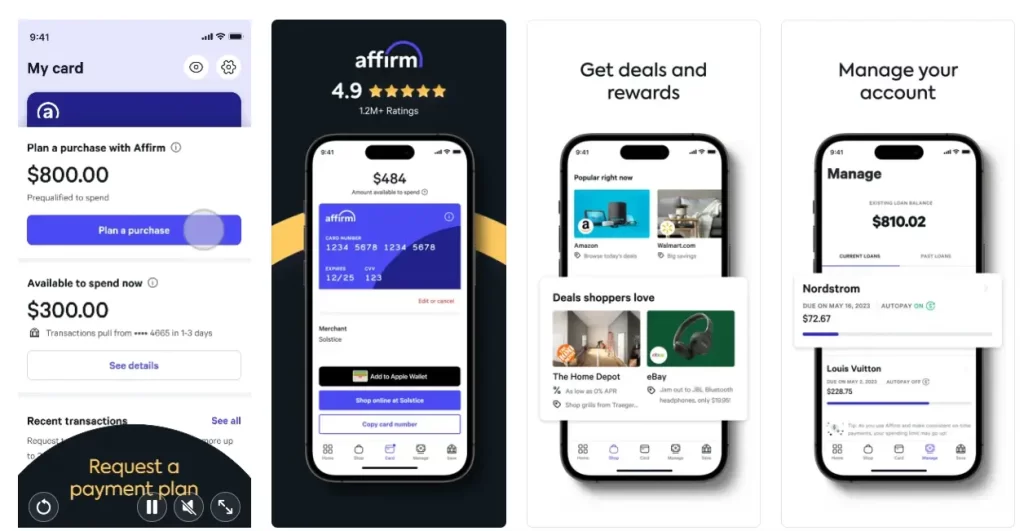

1. Affirm

Affirm stands out for its flexibility, allowing users to make interest-free purchases through a four-installment payment plan. Accepted at many retailers, Affirm offers a longer repayment period and a credit limit of up to $17,500 for those opting for the monthly payment option. Simple interest prevents balances from growing over time, providing users with a transparent and manageable payment structure.

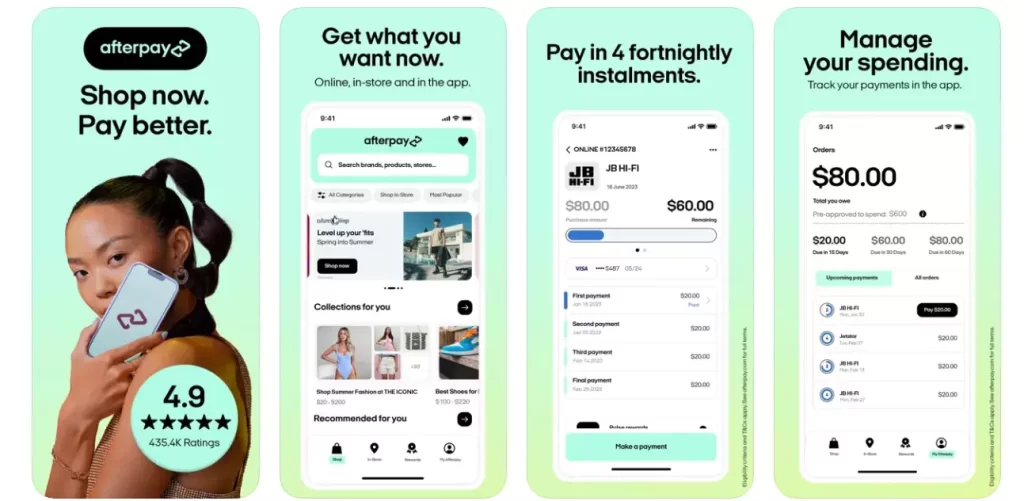

2. Afterpay

Afterpay offers a user-friendly experience by allowing consumers to make purchases and pay over six weeks in four interest-free installments. Its versatility extends to online and in-store transactions through a virtual card. Notably, Afterpay accommodates changes in payment due dates without penalties and conducts only a soft credit pull, ensuring that the initial sign-up process does not impact the user’s credit score.

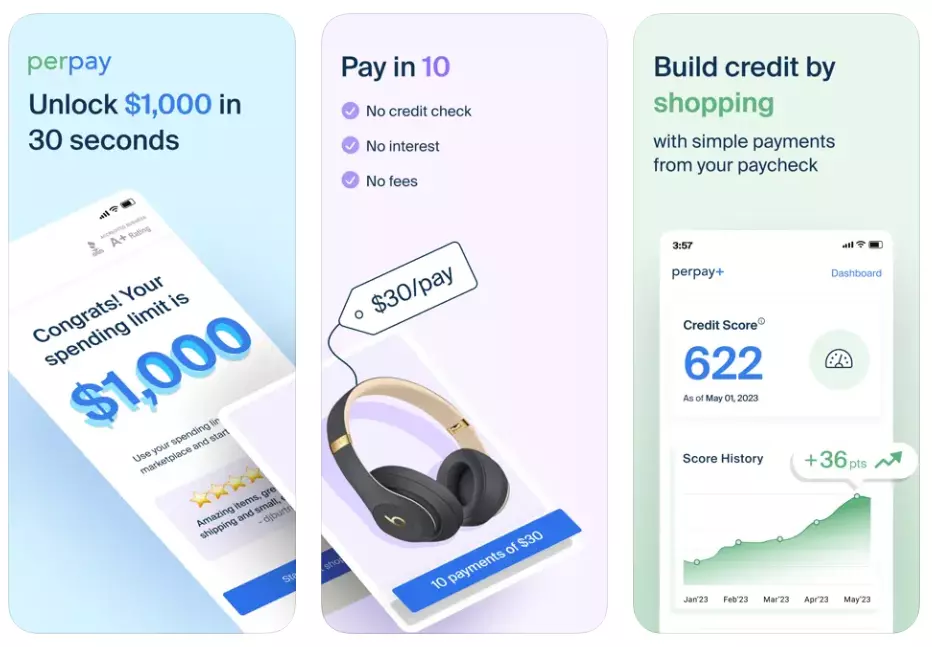

3. Perpay

Perpay uniquely combines the benefits of a BNPL app with credit-building features. It approves users without a credit check, making it accessible to those with less-than-perfect credit. Users can conveniently make everyday purchases and build credit simultaneously. Payments are automatically deducted from paychecks, simplifying account management, and positive payment history is reported to major credit bureaus for credit health improvement.

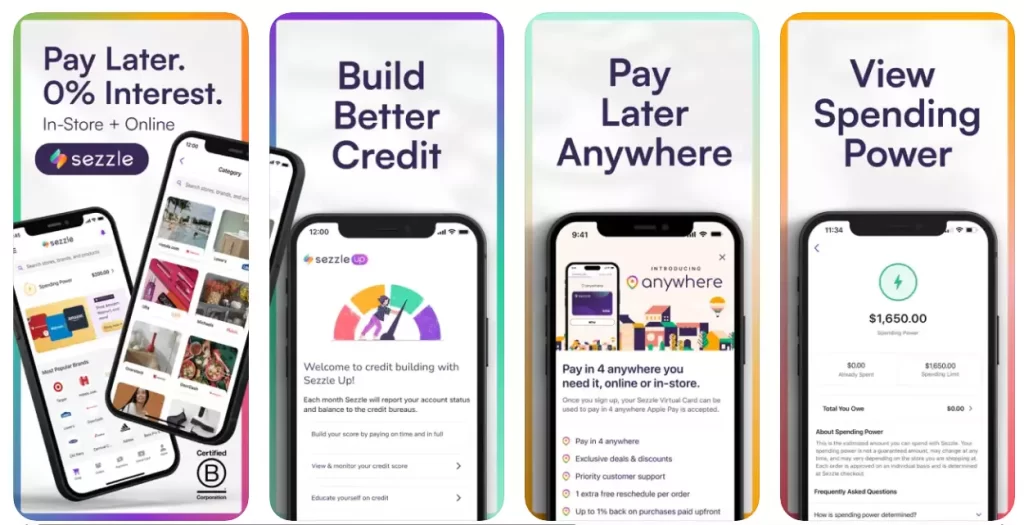

4. Sezzle

Sezzle offers a flexible, interest-free BNPL option, allowing users a generous credit limit of up to $2,500. With the convenience of four interest-free payments over six weeks, Sezzle stands out for its user-friendly features. Users can even reschedule payments without additional fees, providing added flexibility. While the first payment is due at the point of sale, subsequent payments can be adjusted to meet the user’s needs.

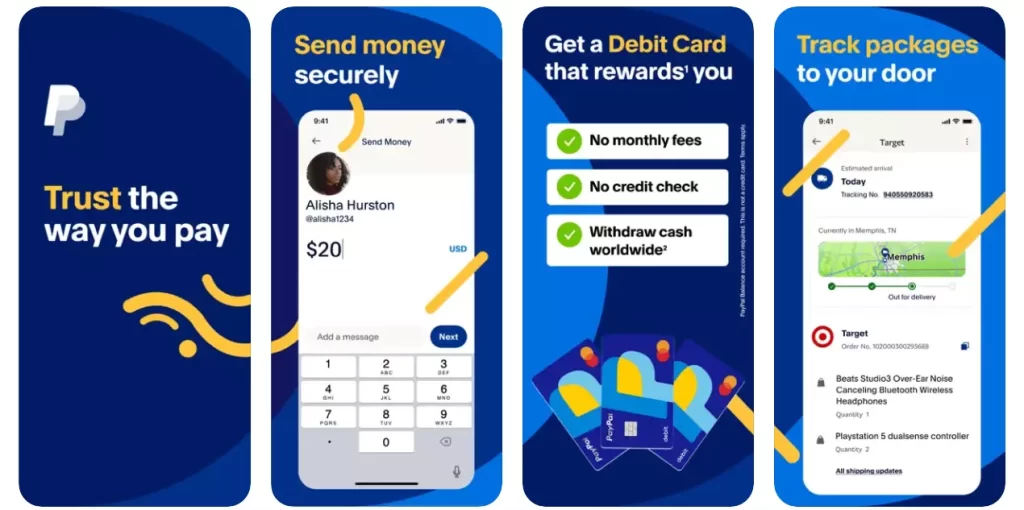

5. PayPal Pay in 4

PayPal Pay in 4 enables users to split purchases between $30 and $1,500 into four bi-weekly payments, enhancing affordability. With no sign-up fees or interest charges, users benefit from a straightforward payment structure. The absence of late payment penalties and the convenience of spreading payments over time make PayPal Pay in 4 an appealing BNPL option.

Tech Stack To Consider To Develop A Buy Now Pay Later App

Discover the essential tech stack elements crucial for developing a robust Buy Now Pay Later app, ensuring seamless transactions, user security, and optimal functionality

1. Frontend Development

- React Native

- Flutter

- Xamarin

2. Backend Development

- Node.js

- Django

- Ruby on Rails

3. Database Management

- MongoDB

- MySQL

- PostgreSQL

4. Payment Gateway Integration

- Stripe

- PayPal

- Braintree

5. Security

- SSL Encryption

- OAuth

- JWT (JSON Web Tokens)

6. Push Notifications

- Firebase Cloud Messaging (FCM)

- OneSignal

- Pusher

7. Analytics and Monitoring

- Google Analytics

- Mixpanel

- AppDynamics

8. Customer Support and Chatbot

- Intercom

- Zendesk

- Drift

9. Cloud Services

- AWS (Amazon Web Services)

- Azure (Microsoft Cloud)

- Google Cloud Platform (GCP)

10. Machine Learning (ML) for Fraud Detection

- TensorFlow

- Scikit-learn

- IBM Watson

Conclusion

The surge in popularity of Buy Now Pay Later (BNPL) apps has been driven by the increasing demand for online shopping and the preference for flexible payment solutions. Venturing into BNPL app development presents a potentially lucrative opportunity for entrepreneurs and startups. However, it is imperative to thoroughly assess market dynamics and the competitive landscape before committing significant resources to app development.

Given the differences across countries and governments, it is critical to prioritize compliance with appropriate rules and consumer protection legislation. Creating a similar app like Klarna necessitates skills in software development, payment systems, and security. If you are lacking in these areas, hiring a professional development team may be a good idea.

How Can Idea Usher Help You Develop a Buy Now Pay Later App like Klarna?

Are you considering the development of a buy now pay later app similar to Klarna? Look no further than Idea Usher! As a seasoned app development company, we bring extensive expertise in crafting e-commerce apps, particularly in the realm of buy now pay later solutions resembling Klarna.

Empowered by a team of skilled developers and designers, we stand ready to collaborate with you in developing an app that prioritizes user-friendliness, security, and customization tailored to your specific requirements.

1. Comprehensive Development Expertise

At Idea Usher, we understand the vision of building a Buy Now Pay Later (BNPL) app like Klarna. With a wealth of experience in crafting e-commerce solutions, including BNPL apps, our skilled developers and designers are committed to creating a user-friendly, secure, and customizable application tailored to your specific requirements.

2. Free Competitor Analysis and Market Research

As a leading app development company, we prioritize transforming businesses by providing tailored digital solutions. Partnering with us grants you access to free competitor analysis and market research services. This enables you to explore insights into trends, features, and technologies essential for the success of your BNPL app project.

3. Customized Solutions

Our collaborative approach involves working closely with you to comprehend your business needs. Subsequently, we craft a customized solution aligned with your specifications, including the incorporation of desired features and functionalities for your customers.

4. Quality UI/UX Services

Ensuring a seamless shopping experience, our team is committed to delivering a user-friendly interface that facilitates quick and easy purchases and payments for your customers.

5. Secure Transactions

Recognizing the significance of secure financial transactions, we implement robust security measures to safeguard your customers’ sensitive data, ensuring confidence in the safety of their transactions.

6. Integration with Payment Gateways

Facilitating convenience for your customers, we seamlessly integrate your app with various payment gateways, allowing them to choose and use their preferred payment methods.

7. Next-gen Tech Integration

Embrace innovation and profitability by integrating cutting-edge technologies such as AI, IoT, data analytics, or cloud services. Our experts ensure a smooth incorporation of next-gen tech to enhance your app’s performance.

8. Support and Maintenance

Our commitment extends beyond development with ongoing support and maintenance services. This ensures the continual smooth operation of your app, incorporating the latest security measures and features. Our comprehensive maintenance offerings include services such as UI/UX enhancement, legacy app modernization, testing, and technology/platform migration.

Reach out to us today to explore and discuss your BNPL app development needs, and let Idea Usher enhance your app development experiences.

FAQ

Q. What is a BNPL app, and how does it work?

A Buy Now Pay Later (BNPL) software allows users to make immediate purchases while postponing payments, which are usually done in installments. Users like the ability to stretch payments over time without the need of traditional credit cards.

Q. What are the key features to consider in BNPL app development?

A. Important features include multiple payment gateways, automated payments, and purchase tracking, transparent interest rates and fees, customizable payment plans, robust customer support, secure transactions, integration with eCommerce stores, easy returns, and online approval processes.

Q. How can a BNPL app enhance user engagement?

A. By offering a seamless, user-friendly interface, providing personalized payment plans, and integrating with popular retailers, BNPL apps encourage frequent use. Additionally, features like rewards for significant purchases and loyalty incentives contribute to increased user engagement.

Q. What security measures should be implemented in a BNPL app?

A. To ensure the security of sensitive user data, BNPL apps should employ robust security protocols such as SSL encryption, two-factor authentication, and firewalls. Integration with fraud detection APIs further enhances the app’s protection against online theft and fraud.

Q. How can AI and machine learning be utilized in BNPL app development?

A. AI and machine learning algorithms play a vital role in analyzing user data, providing personalized credit offers, and enhancing the overall user experience. Additionally, AI chatbots powered by tools like PyTorch and TensorFlow contribute to efficient customer support, offering real-time assistance and improving customer satisfaction.

Gaurav Patil