- What Is Clearpay?

- User Flow Of Clearpay

- How Does Clearpay Work In The Backend?

- Market Insight And Trends Of A BNPL App

- Benefits For Businesses From An App Like Clearpay

- Must-have Features For An App Like Clearpay

- Top Technologies For Your Clearpay - like BNPL App

- How To Develop An App Like Clearpay?

- Techstack Required To Develop An App Like Clearpay

- Revenue Model For The BNPL App Like Clearpay

- Factors That Affect The Cost Of Development

- Top Apps Like Clearpay In The Market

- Conclusion

- FAQ

Buy Now Pay Later (BNPL) has emerged as a favored payment option, reshaping the digital landscape and transforming the way consumers shop both online and offline. The escalating demand for flexible payment solutions has fueled remarkable growth in BNPL app development. Among these, platforms like Clearpay stand at the forefront, redefining the purchasing experience for users. If you harbor aspirations of entering the fintech realm and envision crafting an app like Clearpay, grasping the pivotal elements and essential steps becomes imperative for a triumphant venture.

From selecting the appropriate tech stack and designing a user-friendly interface to seamlessly integrating secure payment gateways and harnessing AI-driven functionalities, building a comprehensive BNPL app necessitates meticulous planning and seamless execution. In this blog, we delve into the fundamental factors influencing the development of a Clearpay-like app, exploring key functionalities, technologies, and monetization strategies pivotal to delivering a flawless user experience and fostering commercial triumph. Set sail on this enlightening voyage to gain invaluable insights and confidently pave the path towards creating your tailored BNPL app catered to the needs of the modern consumer.

- What Is Clearpay?

- User Flow Of Clearpay

- How Does Clearpay Work In The Backend?

- Market Insight And Trends Of A BNPL App

- Benefits For Businesses From An App Like Clearpay

- Must-have Features For An App Like Clearpay

- Top Technologies For Your Clearpay – like BNPL App

- How To Develop An App Like Clearpay?

- Techstack Required To Develop An App Like Clearpay

- Revenue Model For The BNPL App Like Clearpay

- Factors That Affect The Cost Of Development

- Top Apps Like Clearpay In The Market

- Conclusion

- FAQ

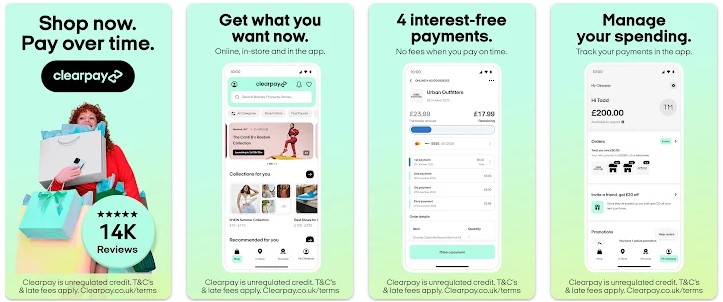

What Is Clearpay?

Clearpay is a widely recognized buy now, pay later (BNPL) service that allows consumers to split their purchases into interest-free installments over six weeks. Founded in 2015, it is now available in multiple countries, including the UK, Australia, New Zealand, and the US. Clearpay requires users to be at least 18 years old and possess a valid debit or credit card. Notably, no credit check is performed during sign-up, making it accessible to individuals with diverse credit backgrounds.

The service’s key benefit lies in interest-free payments, providing enhanced financial flexibility. However, users must be cautious about timely repayments to avoid late fees, which have been increased to £8 in 2023. New features introduced in 2023 include Clearpay Plus, a premium subscription service with exclusive benefits, and Clearpay for Business and Clearpay for Retail, catering to businesses and retailers for offering BNPL options.

Although Clearpay lacks FCA regulation, the implementation of a soft credit check during sign-up shows a commitment to responsible lending practices. By using Clearpay wisely and staying mindful of repayment schedules, customers can make the most of its convenient “buy now, pay later” service and ensure a positive and stress-free shopping experience.

Advantages And Disadvantages Of Using Clearpay

Advantages

- Interest-Free Installments: Clearpay does not impose any interest on your purchases, ensuring you only pay for the actual cost of the items.

- Flexible Repayment Options: With the option to spread payments over a 6-week period, Clearpay offers increased financial flexibility, making it easier to manage your budget.

- No Credit Check: During the sign-up process, Clearpay does not conduct a credit check, enabling individuals with poor credit scores to use the service without any hindrance.

Disadvantages

- Late Payment Fees: Failure to make timely payments results in a £6 late fee, making it crucial to adhere to the payment schedule.

- Eligibility Requirements: To use Clearpay, you must be at least 18 years old and possess a valid debit or credit card, limiting access to those who do not meet these criteria.

- Limited Availability: Unfortunately, Clearpay is not universally accessible and may not be available in all countries, restricting its usage in certain regions.

User Flow Of Clearpay

The user flow of Clearpay for users can be outlined as follows:

1. Select Clearpay As The Payment Option

When a user is shopping online or in-store at a participating retailer, they choose Clearpay as their payment method during the checkout process.

2. Register Or Log-in

If the user is new to Clearpay, they are directed to either register on the Clearpay app or website or log in if they already have an account.

3. Provide Payment Details

During the registration process, the user needs to provide their payment details, such as a valid debit or credit card.

4. Approval And Purchase Processing

Clearpay verifies the user’s information and eligibility. Once approved, the purchase is processed, and the user’s order is confirmed.

5. First Payment

At the time of purchase, the user makes the first payment, which is typically a fraction of the total cost, as specified by Clearpay.

6. Installment Plan

Clearpay divides the remaining purchase amount into three equal installments to be paid over the following six weeks.

7. Automatic Deductions

The user’s linked debit or credit card is automatically charged for the remaining three installment payments at regular intervals, usually every two weeks.

8. Account Management

Users can manage their Clearpay account through the Clearpay app or website, where they can view their payment schedule, check transaction history, and update their payment information.

9. Late Payment Fees

If a user misses a scheduled payment, Clearpay charges a late fee of £6. If two consecutive payments are missed, the user’s Clearpay account may be suspended.

10. Responsible Usage

Clearpay encourages users to use the service responsibly, ensuring they can afford the installments and make payments on time to avoid late fees and account issues.

Clearpay’s user flow provides a straightforward and convenient way for users to make purchases while spreading the cost over time with interest-free installments, promoting financial flexibility and ease of use.

How Does Clearpay Work In The Backend?

Here are the technical steps and components involved in the working of a buy-now-pay-later app like Clearpay in the backend:

1. Server Architecture And Frameworks

- Clearpay’s backend likely utilizes a microservices architecture to handle various functionalities independently.

- Common backend frameworks used for building microservices in languages like Java, Python, Node.js, or Go.

2. APIs And Webhooks

- Clearpay’s backend exposes APIs to handle various operations, such as user registration, payment processing, and transaction history retrieval.

- Webhooks are used to allow real-time communication with third-party systems, such as payment gateways or retailers’ systems, to update transaction status and handle order processing.

3. Payment Gateway Integration

Clearpay needs to integrate with payment gateways to process payments. This involves handling various payment methods, such as credit cards or direct debit, to ensure secure and efficient transactions.

4. User Authentication And Security

- The backend handles user authentication and authorization using industry-standard protocols like OAuth or JWT.

- Security measures are implemented, such as encryption, to protect sensitive user data and prevent unauthorized access.

5. Database And Data Storage

- Clearpay’s backend uses databases to store user information, transaction details, and purchase histories.

- Common databases like PostgreSQL, MySQL, or NoSQL databases like MongoDB may be employed.

6. Background Jobs And Workers

Backend services may use background jobs and workers for tasks like sending reminders for upcoming payments or handling asynchronous tasks.

7. Scalability And Load Balancing

The backend infrastructure is designed to handle high volumes of traffic and transactions, utilizing load balancing and auto-scaling techniques.

8. Caching

Caching mechanisms, like Redis or Memcached, may be employed to optimize performance and reduce database queries for frequently accessed data.

9. Error Logging And Monitoring

Backend services are equipped with error logging and monitoring tools, allowing developers to track issues, monitor performance, and ensure reliability.

10. Integration With External Systems

Integration with various external systems, such as retailers’ inventory management or order processing systems, is essential for smooth transaction processing.

11. Compliance And Security Standards

The backend follows industry standards and compliance regulations, such as PCI DSS, to ensure secure handling of payment-related data.

12. API Documentation And Testing

Clearpay provides comprehensive API documentation for developers and conducts rigorous testing to ensure seamless integration with partners’ systems.

Market Insight And Trends Of A BNPL App

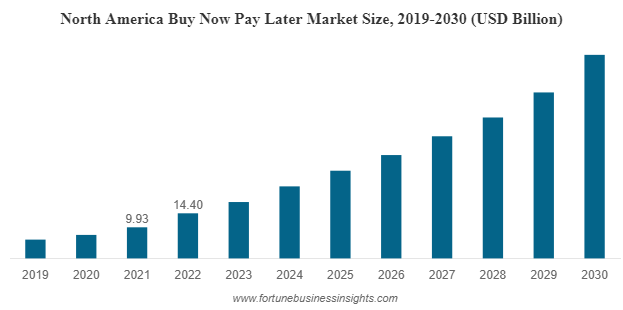

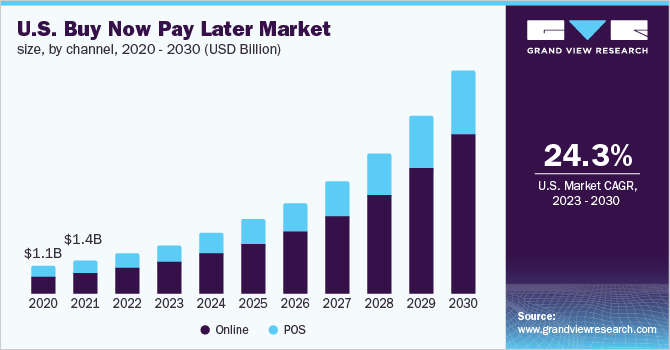

The worldwide buy now pay later (BNPL) market achieved a valuation of USD 23.22 billion in 2022 and is anticipated to witness substantial growth, reaching USD 122.19 billion by 2030, with a robust compound annual growth rate (CAGR) of 22.0% during the forecast period.

According to an alternative report, the global BNPL market was valued at USD 6.13 billion in 2022 and is projected to experience a notable compound annual growth rate (CAGR) of 26.1% from 2023 to 2030. Notably, the value of global BNPL transactions exceeded USD 200 billion in 2022.

Buy Now Pay Later (BNPL) is a payment alternative enabling customers to make online and in-store purchases without the need to pay the entire amount upfront. Several factors are driving the market’s expansion, including digitization, increasing adoption among merchants, growing usage among younger consumers, and the entry of new players offering lending through BNPL services.

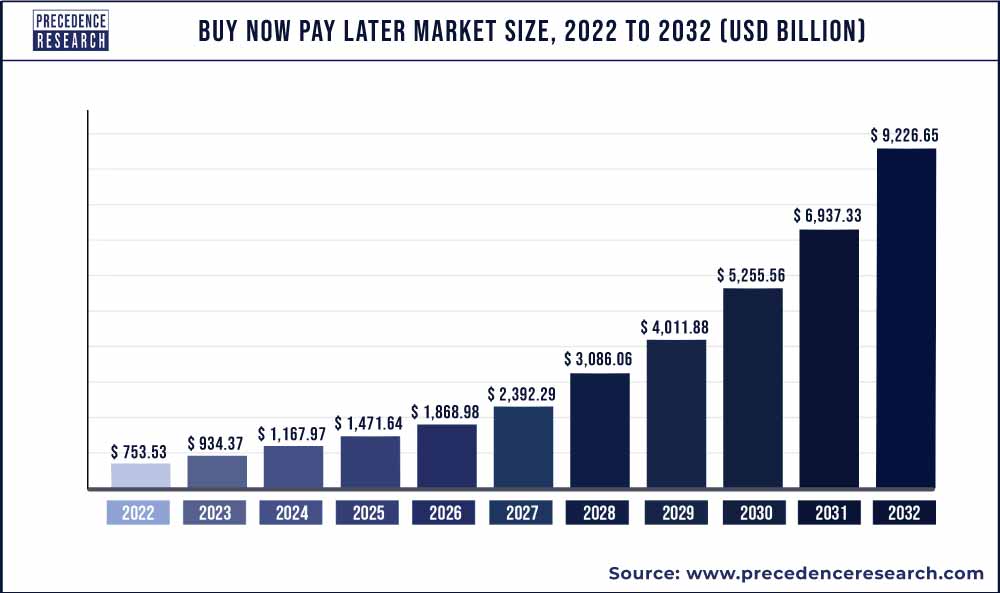

Moreover, the global buy now pay later market size was estimated to be USD 753.53 billion in 2022, and it is poised to witness substantial growth, surpassing USD 9,226.65 billion by 2032, with an impressive CAGR of 29% during the forecast period from 2023 to 2032.

Benefits For Businesses From An App Like Clearpay

Businesses should consider investing in an app like Clearpay for several compelling reasons:

1. Increase Sales And Conversion Rates

Offering a “buy now, pay later” (BNPL) option like Clearpay can attract more customers and boost sales. The convenience of spreading payments over time can encourage hesitant buyers to complete their purchases, resulting in higher conversion rates.

2. Enhance Customer Experience

Providing a BNPL service improves the overall shopping experience for customers. It offers flexibility and financial convenience, leading to increased customer satisfaction and loyalty.

3. Competitive Advantage

In a competitive market, having a BNPL app like Clearpay sets businesses apart from their competitors. It can be a unique selling point that attracts more customers and keeps them engaged.

4. Reach New Customer Segments

Clearpay appeals to customers who prefer installment-based payment options or those with limited budgets. By integrating this feature, businesses can reach and cater to a broader audience, including millennials and Gen Z, who are drawn to such payment models.

5. Increase Average Order Value

With Clearpay, customers may feel comfortable spending more on a purchase since they can divide the cost into smaller installments. This can lead to an increase in the average order value, benefiting the business.

6. Improved Cash Flow

Businesses receive the full payment from Clearpay at the time of purchase, reducing cash flow challenges that might arise from waiting for traditional installment payments.

7. Reduced Cart Abandonment

Clearpay can help address cart abandonment issues by making high-value purchases more manageable and encouraging users to proceed with their transactions.

8. Partnership Opportunities

Integrating with Clearpay can open up partnership opportunities and collaboration with other retailers who use the same BNPL service, expanding the business’s reach and customer base.

9. Data Insights And Analytics

Clearpay provides businesses with valuable data insights and analytics on customer behavior, enabling them to make informed decisions about marketing strategies, product offerings, and customer preferences.

10. Brand Affiliation And Trust

Associating with a well-established BNPL service like Clearpay can enhance a business’s reputation and instill trust among customers, leading to repeat business and positive word-of-mouth referrals.

Overall, investing in an app like Clearpay can be a strategic move for businesses, as it not only improves customer experience and drives sales but also positions them competitively in the market and fosters long-term growth and success.

Must-have Features For An App Like Clearpay

An app like Clearpay typically offers buy now pay later (BNPL) services to users and retailers. To ensure a smooth and efficient user experience, as well as effective management for retailers and administrators, the app should include the following must-have features for each panel:

1. User Panel

1.1. User Registration And Authentication

Seamless sign-up and log-in processes for users to create accounts and access the app securely.

1.2. Product Browsing And Filtering

A user-friendly interface to browse through a wide range of products offered by various retailers. Filtering options based on categories, brands, and prices should be available.

1.3. Buy Now Pay Later Option

Users should have the ability to select the BNPL option while checking out, splitting the total cost into interest-free installments.

1.4. Transaction History

A dedicated section where users can view their transaction history, upcoming payments, and details of previous purchases.

1.5. Payment Reminders And Notifications

Timely reminders about upcoming installment payments and notifications for successful transactions or order updates.

1.6. Payment Method Management

Users should be able to manage their preferred payment methods and add new cards or accounts for payments.

1.7. Profile Management

The option to edit personal information, delivery addresses, and communication preferences.

1.8. Customer Support

Access to customer support channels, such as live chat or email, to address any queries or issues.

1.9. Wishlist And Favorites

A feature allowing users to save products to their wishlist or mark them as favorites for future reference.

1.10. Referral Program

Incentivize users to refer the app to friends and family through a referral program, earning rewards for successful referrals.

2. Retailer Panel

2.1. Retailer Registration And Approval

A streamlined process for retailers to apply for participation in the BNPL program, followed by approval from the admin.

2.2. Product Management

Retailers should have the ability to add, update, and manage their products within the app, including product images, descriptions, and pricing.

2.3. Order Processing And Tracking

Retailers should be able to manage incoming orders, process payments, and update the status of orders to keep users informed.

2.4. Real-Time Analytics

Access to data and analytics on product performance, customer behavior, and sales trends to make informed business decisions.

2.5. Settlement And Payouts

Retailers should have clear visibility into their earnings and a streamlined process for receiving payouts.

2.6. Customer Insights

Access to customer data and profiles to understand their preferences and demographics better.

2.7. Promotions And Offers

Retailers should be able to create and manage promotional campaigns and special offers to attract more customers.

3. Admin Panel

3.1. User And Retailer Management

The ability to manage user accounts, retailer profiles and ensure compliance with platform policies.

3.2. Dashboard And Reporting

A comprehensive dashboard providing an overview of app performance, transaction data, and key metrics.

3.3. Transaction Monitoring

Real-time monitoring of transactions, payment processing, and detecting any suspicious activities.

3.4. Customer Support Management

Tools to manage customer support requests and escalate issues when necessary.

3.5. Compliance And Security

Features to enforce security protocols, privacy policies, and compliance with regulatory requirements.

3.6. Content Management

The ability to manage app content, including banners, promotions, and announcements.

3.7. Settings And Configurations

Options to customize app settings, including installment plans, payment schedules, and currency preferences.

3.8. Notifications And Alerts

Admins should have the ability to send important notifications and alerts to users and retailers.

Top Technologies For Your Clearpay – like BNPL App

1. Artificial Intelligence (AI)

AI offers valuable enhancements to the BNPL experience through various means. For instance, it enables personalized BNPL offers tailored to individual customers, considering their spending patterns and creditworthiness. Additionally, AI plays a pivotal role in fraud detection, safeguarding against illicit transactions.

2. Machine Learning (ML)

ML contributes significantly to enriching the BNPL journey in multiple ways. It facilitates the prediction of customers who might default on payments, aiding in more informed approval decisions for BNPL services. Moreover, ML enhances the customer experience by delivering personalized recommendations and exclusive offers.

3. Blockchain

The integration of blockchain technology bolsters security and transparency in BNPL transactions. By establishing an immutable record of all BNPL transactions, blockchain prevents fraud and ensures robust customer protection. Furthermore, blockchain streamlines BNPL operations, elevating their security and transparency levels.

4. Open Banking

The emergence of open banking allows banks to share customer data with third-party entities, benefiting BNPL providers. By leveraging this data, BNPL providers gain deeper insights into customers, facilitating identity verification and credit score assessment. Consequently, this information empowers more informed decisions regarding BNPL approvals.

5. Customer Experience (CX)

The focus on customer experience becomes increasingly vital for BNPL providers. Ensuring a seamless and convenient experience for customers encompasses effortless BNPL sign-ups, smooth payment processes, and efficient order tracking. Stellar customer support is equally crucial to meet user expectations and satisfaction.

How To Develop An App Like Clearpay?

Here are the technical steps involved in the development of an app similar to Clearpay:

1. Market Research

- Analyze regional and international regulations related to BNPL services, including consumer protection laws and financial compliance requirements.

- Analyze competitor apps to identify their strengths and weaknesses.

- Conduct user surveys and focus groups to gather insights into user preferences, pain points, and expectations from a BNPL app.

- Explore partnership opportunities with retailers to onboard them onto the BNPL platform.

2. Tech Stack Selection

- Choose a suitable frontend framework (e.g., React Native, Flutter) for cross-platform app development to reach both Android and iOS users.

- Consider using microservices architecture to ensure scalability, modularity, and easy maintenance.

- Choose the appropriate programming language (e.g., Java, Kotlin, Swift) for mobile app development.

- Select the backend technologies, such as Node.js, Ruby on Rails, or Django, for managing transactions and data.

3. Database Design

- Design a robust and scalable database schema to handle user data, transactions, and order details.

- Choose a suitable database management system (e.g., MySQL, PostgreSQL, MongoDB) for data storage.

- Implement a caching mechanism to improve app performance and reduce database load.

- Use NoSQL databases for handling unstructured data, such as user preferences and behavior.

4. User Interface (UI) And User Experience (UX) Design

- Focus on an intuitive and user-friendly app interface and onboarding process to minimize user drop-offs during registration.

- Implement a smooth and frictionless checkout process to encourage users to complete their purchases.

5. Authentication And Security

- Implement secure user authentication methods, including two-factor authentication (2FA) and biometrics.

- Incorporate solutions, like OAuth 2.0, OpenID Connect, or, AuthO, for secure third-party authentication and to provide a seamless log-in experience for users.

- Employ encryption techniques to safeguard sensitive user information and payment data.

- Use tokenization to ensure sensitive data, such as credit card information, is securely transmitted and stored.

6. Payment Gateway Integration

- Integrate with reputable payment gateways (e.g., Stripe, PayPal) to enable secure and seamless transactions.

- Implement a dynamic installment calculation mechanism to show users the breakdown of payments based on their selected BNPL plan.

- Allow users to schedule automatic payments to avoid missed payments and late fees.

7. Artificial Intelligence And Machine Learning

- Integrate AI/ML algorithms for personalized BNPL offers based on user behavior and creditworthiness.

- Utilize ML models for fraud detection and prevention, protecting both users and the platform.

- Employ natural language processing (NLP) to enhance customer support through chatbots capable of understanding user queries and providing relevant responses.

8. Push Notifications And Real-Time Updates

- Implement WebSockets or server-sent events (SSE) to provide real-time updates on order processing, refunds, and payment reminders.

- Personalize push notifications based on user preferences and behavior to increase engagement.

9. Backend Development And API Creation

- Develop backend functionalities for user account management, order processing, and payment handling.

- Set up a scalable and resilient cloud infrastructure (e.g., AWS, Azure) to handle fluctuating user demand and ensure high availability.

- Design APIs with proper authentication mechanisms (e.g., OAuth 2.0, API keys) to secure access to sensitive user data and smooth communication between the frontend and backend.

10. Third-party Integrations

- Integrate with third-party services like social media platforms for referral programs and marketing.

- Utilize open banking APIs to access customer data for identity verification and credit assessment.

- Integrate with credit bureaus or financial data providers to fetch credit scores and financial information for BNPL credit assessments.

- Partner with payment processors to support a wide range of payment methods, including credit cards, debit cards, and digital wallets.

11. Analytics And Data Tracking

- Implement event tracking and user behavior analytics to understand user engagement, feature usage, and conversion rates.

- Utilize A/B testing to optimize user flows, UI elements, and promotional offers.

- Use data insights to optimize the app and make data-driven business decisions.

12. Compliance And Security

- Ensure compliance with financial regulations and data protection laws (e.g., GDPR, PCI DSS) to safeguard user data and financial transactions.

- Implement secure API endpoints and utilize OAuth or JWT for authorization.

13. Scalability And Performance

- Design the architecture with scalability in mind to handle a growing number of users and transactions.

- Optimize app performance to reduce loading times and ensure a smooth user experience.

14. Offline Mode

- Implement offline capabilities to allow users to view products and access essential features even without an internet connection.

- Enable data synchronization when the connection is restored.

15. Automated Repayment Scheduling

- Develop a system that automatically schedules installment repayments based on the user’s chosen payment plan.

16. Deployment And Maintenance

- Consider utilizing containerization (e.g., Docker) and container orchestration (e.g., Kubernetes) for seamless deployment and scaling.

- Set up continuous integration and continuous deployment (CI/CD) pipelines for automated testing and rapid updates.

- Deploy the app to app stores (Google Play Store, Apple App Store) and ensure compliance with their guidelines.

- Regularly update and maintain the app to fix bugs, add new features, and enhance performance.

17. Continuous Improvement

- Conduct regular security audits to identify and fix potential vulnerabilities in the app and infrastructure.

- Stay updated with changes in financial regulations and adapt the app accordingly to remain compliant.

Note: Clearpay’s success was attributed not only to its technology but also to its user-centric approach. Consider conducting usability testing and gathering feedback from potential users to ensure the app meets their needs and expectations. Continuous improvement and adaptation to user preferences will be essential for the long-term success of the BNPL app.

Techstack Required To Develop An App Like Clearpay

| Development Area | Tools/Technologies/Frameworks/Libraries |

| Programming Languages | Java, Kotlin (for Android); Swift (for iOS) |

| Backend Development | Node.js, Ruby on Rails, Django, or similar frameworks |

| Database | MySQL, PostgreSQL, MongoDB, or other suitable options |

| Frontend Framework | React Native, Flutter, or other cross-platform frameworks |

| Authentication | OAuth 2.0, JWT (JSON Web Tokens) |

| Security | Encryption (SSL/TLS), OWASP security standards |

| Payment Integration | Stripe, PayPal, Braintree, or other payment gateways |

| Push Notifications | Firebase Cloud Messaging (FCM) or similar services |

| Artificial Intelligence | TensorFlow, PyTorch, or other ML libraries |

| User Tracking & Analytics | Google Analytics, Mixpanel, or similar tools |

| Real-time Updates | WebSockets, Server-Sent Events (SSE) |

| Cloud Infrastructure | Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), or other cloud services |

| Continuous Integration/Deployment | Jenkins, GitLab CI/CD, or similar tools |

| Offline Mode | Local data caching, Service Workers (for web apps) |

Revenue Model For The BNPL App Like Clearpay

Making money from an app similar to Clearpay involves implementing various revenue-generating strategies. Here are some ways to monetize a BNPL app:

1. Transaction Fees

Charge a small percentage or fixed fee on each transaction made through the app. This revenue model is common among BNPL providers to cover operational costs and generate income.

2. Merchant Commission

Partner with retailers and charge them a commission for each sale made through the BNPL platform. Retailers benefit from increased sales and customer loyalty, while the app earns revenue from the commission.

3. Interest Or Late Fees

If the BNPL service offers interest-based installment plans or imposes late fees for missed payments, the app can earn revenue from the interest charges and penalties.

4. Subscription Plans

Introduce premium subscription plans for users, offering additional benefits like faster approval processes, lower interest rates, or exclusive offers. Users pay a subscription fee to access these enhanced features.

5. Referral Program

Implement a referral program where existing users are rewarded for referring new users to the app. When a referred user signs up and makes transactions, both the referrer and the new user receive incentives, creating a win-win situation.

6. Sponsored Promotions

Offer sponsored promotions and advertisements within the app. Retailers or brands may pay for prominent placement of their products or services to gain exposure to a targeted audience.

7. White-Label Solution

Offer a white-label solution of the BNPL app to other businesses or financial institutions. They can rebrand the app and use it to provide BNPL services to their customers while paying licensing fees or revenue-sharing.

Note: It’s essential to strike a balance between revenue generation and providing a valuable and seamless user experience. Implementing multiple revenue streams can ensure financial sustainability while offering users attractive incentives to use the app for their BNPL needs. However, transparent communication with users regarding fees and charges is crucial to building trust and maintaining a loyal customer base.

Factors That Affect The Cost Of Development

Here are the cost-affecting factors for a Buy Now Pay Later (BNPL) app like Clearpay:

1. App Development Platform

The choice between iOS, Android, or cross-platform development impacts the cost. Developing for iOS may be more expensive but can target high-income consumers, while Android has a larger market share but may have more device compatibility issues. Cross-platform development is cost-effective but may result in a less polished user interface.

2. Must-Have Features

Integrating features like personalized credit limits, automated payment scheduling, fraud detection measures, analytics, in-store payment options, and customer support can influence the development cost based on the complexity and functionality required.

3. UI/UX Design

The cost of UI/UX design is a crucial factor as it directly impacts user experience and engagement. Well-designed UI/UX can lead to increased revenue, while a poorly designed one may result in lower customer satisfaction.

4. Location Of App Development Team

The location of the development team affects the labor rates and cost of hiring. Different regions have varying expenses, and it’s essential to consider language barriers, time zone differences, and cultural factors when choosing a team.

5. Hiring Approach

Opting for a development company provides more comprehensive services but may be more expensive. On the other hand, hiring individual freelancers may be cost-effective, but it can carry risks related to expertise and accountability.

6. Security Measures

To ensure user data protection and prevent fraud, a BNPL app must employ robust security measures. Implementing biometric authentication, such as fingerprint or face recognition, enhances user verification. Additionally, end-to-end encryption for sensitive data during transmission and storage adds an extra layer of security. These advanced security features necessitate specialized technical expertise and thorough testing, contributing to the overall development cost.

7. Regulatory Compliance

Compliance with industry regulations and data protection laws, like GDPR or PCI DSS, is paramount for a BNPL app. Ensuring adherence to these standards may involve dedicated legal and compliance teams, rigorous audits, and ongoing updates to meet changing requirements, which can impact the development cost.

Top Apps Like Clearpay In The Market

| Provider | Interest | Late payment fees |

| Clearpay | No | 20% of the purchase amount |

| Affirm | Yes, from 0% to 30% APR | Up to 25% of the purchase amount |

| Balance | No | 25% of the purchase amount |

| Humm | Yes, from 0% to 49% APR | Up to 25% of the purchase amount |

| Afterpay | No | 25% of the purchase amount |

| Sezzle | Yes, from 0% to 26.99% APR | Up to 25% of the purchase amount |

| Splitit | Yes, from 0% to 24.9% APR | Up to 25% of the purchase amount |

| Apruve | Yes, from 0% to 36% APR | Up to 25% of the purchase amount |

| Zinia | Yes, from 0% to 39% APR | Up to 25% of the purchase amount |

1. Affirm

- Offers interest-free installments on purchases between $50 and $15,000.

- No late payment fees; customers won’t be penalized for delayed payments.

- Flexible repayment schedule with options for 3, 6, or 12 equal installments.

- Widely accepted at various merchants, both online and in-store.

- Requires a soft credit check for loan approval, avoiding any impact on credit scores.

2. Balance

- Interest-free installments available for purchases up to $1,000.

- No late payment fees, providing flexibility for payment schedules.

- Offers a repayment schedule with options for 3 or 6 equal installments.

- Widely accepted at various merchants, both online and in-store.

- Requires a soft credit check for loan approval, safeguarding credit scores.

3. Humm

- Interest-free installments available for purchases up to $5,000.

- No late payment fees, offering flexibility for payment schedules.

- Provides a repayment schedule with 4 equal installments.

- Widely accepted at various merchants, both online and in-store.

- User-friendly and accessible through the Humm app for easy management.

4. Afterpay

- No interest charge on loans, enabling interest-free payments.

- No late payment fees; customers won’t face penalties for delayed payments.

- Provides a repayment schedule with 4 equal installments.

- Widely accepted at various merchants, both online and in-store.

- User-friendly and accessible through the Afterpay app for easy management.

5. Sezzle

- Interest-free installments available for purchases up to $1,000.

- No late payment fees, providing flexibility for payment schedules.

- Offers a repayment schedule with 4 equal installments.

- Widely accepted at various merchants, both online and in-store.

- Easy to use, with an accessible app for convenient payment tracking.

6. Splitit

- Interest rates range from 0% to 24.9% APR, offering various rate options.

- Accepted at a wide range of merchants, both online and in-store.

- Allows for a flexible repayment period of 6 to 24 months.

- No late payment fees if payments are made on time; a fee is charged for missed payments.

- No hard credit check for loan approval, preventing any impact on credit scores.

7. Apruve

- Provides a unique “Approval in Seconds” feature for quick loan approval.

- Interest rates range from 0% to 36% APR, offering flexible choices.

- Accepted at a wide range of merchants, enhancing purchasing options.

- Offers a repayment schedule with options for 3, 6, or 12 equal installments.

- No late payment fees; customers won’t face penalties for delayed payments.

8. Zinia

- Interest-free installments are available for purchases up to $1,500.

- No late payment fees, offering flexibility for payment schedules.

- Provides a repayment schedule with 6 equal installments.

- Widely accepted at various merchants, both online and in-store.

- Requires a soft credit check for loan approval, ensuring credit score protection.

Conclusion

Venturing into the realm of Buy Now Pay Later (BNPL) apps opens an enticing gateway for entrepreneurs aiming to tap into the burgeoning e-commerce landscape. The development of a successful BNPL app akin to Clearpay demands meticulous planning and harnessing the right technologies. In this pursuit, Idea Usher emerges as the trusted partner, offering not only expert app development services but also conducting invaluable market research to ensure app viability. Our specialized proficiency in crafting clone apps, complemented by extensive customization options and white-labeling, empowers entrepreneurs to unleash their creativity and launch their distinctive BNPL platform. Armed with a ready-to-launch Clearpay clone script, entrepreneurs can swiftly hit the market, catering to the dynamic needs of the modern consumer.

For unrivaled app solutions that deliver both reliability and viability, Idea Usher stands tall as your ultimate destination, transforming your BNPL app vision into a tangible reality.

Contact Idea Usher at [email protected]

Or reach out at: (+1)732 962 4560, (+91)859 140 7140

FAQ

Q. Why should I develop a BNPL app like Clearpay?

A. Developing a BNPL app like Clearpay offers numerous benefits. With the increasing demand for flexible payment solutions, BNPL apps have gained immense popularity among consumers. By entering this lucrative market, you can tap into the booming e-commerce landscape and cater to modern shoppers’ preferences for convenient and budget-friendly payment options. Additionally, BNPL apps foster customer loyalty and repeat business, attracting retailers who seek to offer their customers a seamless and interest-free installment option.

Q. What tech stack is suitable for developing a BNPL app like Clearpay?

A. Building a robust BNPL app requires a suitable tech stack. A popular choice is to use React Native or Flutter for cross-platform development, enabling the app to run seamlessly on both Android and iOS devices. For the backend, Node.js or Ruby on Rails are common options, providing scalability and performance. Databases like MySQL or PostgreSQL can handle user data and transactions securely. Additionally, integrating with payment gateways like Stripe or PayPal ensures secure and seamless payment processing.

Q. How to ensure the security of user data and transactions in the BNPL app?

A. Ensuring robust security is essential for a BNPL app. Implement SSL/TLS certificates to encrypt data during transmission, preventing unauthorized access. Utilize OAuth 2.0 or JWT (JSON Web Tokens) for secure user authentication. Hash sensitive information like passwords before storing them in the database. Integrate secure payment gateways with tokenization to protect credit card information. Regularly perform security audits, use penetration testing, and adhere to industry standards to mitigate potential vulnerabilities.

Q. Can AI be integrated into a BNPL app like Clearpay?

A. Yes, integrating Artificial Intelligence (AI) is advantageous for a BNPL app. AI can personalize offers based on user behavior, enhancing the user experience. It can also assist in fraud detection by analyzing transaction patterns, reducing the risk of fraudulent activities. Furthermore, AI-powered chatbots can improve customer support, addressing user queries promptly and efficiently.

Q. How can I optimize the app’s performance for a smooth user experience?

A. Optimizing app performance is critical for a seamless user experience. Implementing lazy loading for images and content reduces initial load times. Utilize caching mechanisms to store frequently accessed data locally, minimizing server requests. Employ asynchronous programming to prevent UI freezes during resource-intensive tasks. Regularly monitor and analyze app performance using tools like Google Analytics to identify bottlenecks and optimize the app’s efficiency.

Q. How can I handle peak traffic and ensure scalability for my BNPL app?

A. Scalability is vital to handle peak traffic and accommodate growing user bases. Adopt a microservices architecture to break the app into smaller, manageable components, ensuring independent scalability. Utilize cloud-based services like AWS or Google Cloud Platform, enabling automatic scaling based on user demand. Load balancing and caching mechanisms distribute traffic efficiently across servers, preventing system overload during high-demand periods. Regular load testing helps identify and address potential scalability issues.

Q. What makes Ideausher the right partner for developing my BNPL app?

A. Ideausher distinguishes itself as a trusted partner for BNPL app development due to its extensive expertise and services. We conduct essential market research to ensure the app’s viability and success. Our team’s proficiency in crafting clone apps, along with white-labeling and customization options, allows entrepreneurs to showcase their unique brand identity. We offer ready-to-launch Clearpay clone scripts, expediting the app development process and reducing time-to-market. With our reliable and comprehensive app solutions, you can confidently transform your BNPL app idea into reality.

Rebecca Lal