In the tech-verse, open markets have a tendency to centralize. When Web 2.0 emerged, we observed that Microsoft, Google, and Amazon swiftly assumed market domination. It is the same story with the NFT market till now. For instance, huge volumes of NFTs are currently passing via OpenSea, which is a private company. Add to that, two prominent centralized crypto-exchanges, namely Coinbase and FTX, are trying out their NFT marketplaces. So, what are the advantages and disadvantages of centralized exchange NFT platforms? Let’s dive deep!

For the uninitiated reading the blog, an NFT marketplace acts as a platform to hold & trade NFTs easily. In simpler words, it’s a platform that rewards creators as they showcase their creativity. Investors/traders can purchase, own, and sell digital collectibles.

One can purchase the tokens on the NFT marketplace using a cryptocurrency wallet. It functions similarly to an online marketplace such as eBay. While centralized platforms come with some significant advantages, the downside is that they seek to become the dominant NFT exchanges.

What Is A Centralized NFT Platform?

NFT stands for Non Fungible Tokens. Before understanding what a centralized NFT platform is, let us know what exactly do NFTs seek to solve? The platform risk.

Imagine buying an in-game item where the purchase can only exist on the game publisher’s platform. Such paid in-game items (their files) are hosted on the publisher’s servers until the game retires, during which everything vanishes.

NFTs interact with underlying blockchains directly. Each computer within the network has a full-proof record of what is being done with the files. Since no single institution is responsible for storing the data, a new front-end interface can step in if one crumbles. This is what we call a decentralized system!

But what if the theme of decentralization ebbs away in reality?

Take this for an example. OpenSea is the most popular NFT marketplace. However, at its core, OpenSea operates as a centralized service.

OpenSea Outage & Perfect Display Of Centralization Risks

Recently, MetaMask & Twitter failed to display images of newly uploaded tokens all of a sudden. It happened even when the users had evident ownership records.

The problem crawled back to the NFT marketplace OpenSea, which suffered a massive database outage. It resulted in the shutdown of OpenSea’s image-loading API, which choked all the services dependent on it for token uploading.

It was an embarrassing scenario & yet a revealing one, showing that even a noble & decentralized idea like NFT can be weirdly centralized!

If you go deeper, you will realize that it is hard to mint or do anything with an NFT collection without being dependent on OpenSea.

The platform has emerged as the central intermediary & the prime enforcer of NFT community rules. Tokens minted elsewhere eventually land there, thanks to its gravity!

Web3 projects with no immediate linkage with OpenSea were taken aback when the recent outage happened. It showed the entire industry’s dependency on OpenSea infrastructure (centralization).

Also Read: Top apps related to buying cryptocurrency in 2022

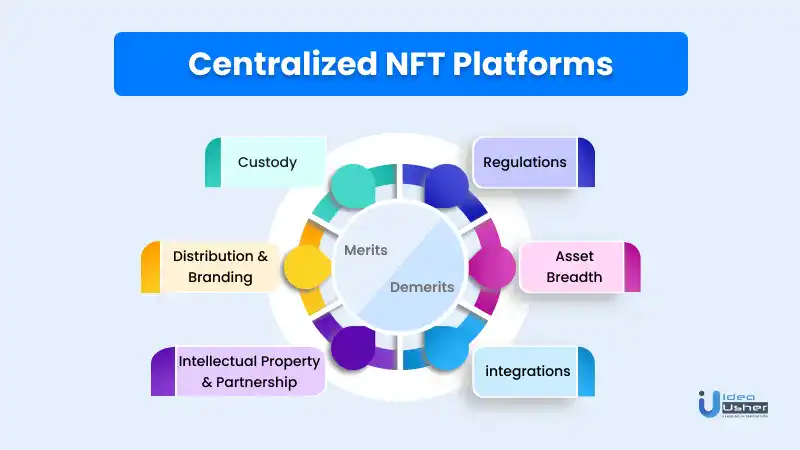

Advantages of Centralized Exchange NFT Platforms

Thanks to their sheer size & resource pool, centralized NFT exchanges offer several advantages. We have discussed some of them here.

1. Custody

A notable advantage of centralized platforms is asset custody undoubtedly. Coinbase protects retail traders from losing their assets or being locked out of their accounts if they forget their passwords. Also, centralized trading platforms help prevent errors that a novice might make while transferring cryptocurrencies.

Additionally, centralized NFT exchanges like Coinbase synergize with high-end NFT custody (such as BAYC, Punks, etc). The HNIs (High Net-worth Individuals) prefer Coinbase custody over self custody when it comes to valuable NFTs.

Individuals can bid on NFTs held in Coinbase custody & listed on Coinbase. With Coinbase naturally having some high-end NFTs available, this will help to bring NFT liquidity in the marketplace.

Other potential benefits include leveraging the exchanges’ vertically integrated services such as staking, node infrastructure, etc. They add additional value, but custody remains the most immediate benefit.

2. Partnerships & Intellectual Property

With the mammoth user base, centralized exchanges have a better chance of partnering with top businesses & influencers.

For example, FTX has sneakily acquired the name rights of fan-favorite franchises. Rumors suggest that they are even targeting the high school football stadiums!

Similarly, Coinbase has revealed a partnership with the NBA & WNBA. The partnership will allow the exchange to provide basketball fans with exclusive content & experiences.

Large sport/production organizations are naturally inclined to partner with established centralized platforms like FTX/OpenSea/Coinbase. The fact that they can present legal contracts tips the balance in favor of them over permissionless protocols.

3. Brand & Distribution

Centralized NFT exchanges have a lot of money to spend, & their brand value implies that they already have a solid customer base. For example, Robinhood is a mighty competitor to Coinbase owing to its large user base. On the other hand, Coinbase is trying to compete with established NFT marketplaces like OpenSea in the same way by leveraging its customer base.

Even if Coinbase/FTX succeeds in encouraging a small fraction of their customer base to jump into NFT trading, that can boost the number of NFT traders by millions! For a quick reference, OpenSea has facilitated NFT trading for 500,000+ unique addresses & is currently the largest NFT marketplace.

Beyond distribution, centralized NFT exchanges such as FTX/Coinbase have tremendous brand value. It allows them to scout for top-notch NFT artists. They have the heft to drive the artists to launch projects (or carry out NFT drops) on their platforms. It enables the centralized trading platforms to bootstrap liquidity.

Also Read: How To Make A Public Blockchain Platform In 2022?

Major Disadvantages Of Centralized NFT Platforms

While centralized NFT exchange platforms wield considerable power in the NFT industry, permissionless NFT marketplaces such as Genie, Rarible & NFTX still offer benefits over their centralized counterparts!

1. Regulation

Regulation is, by far, the biggest drawback for centralized U.S. exchanges such as Coinbase. Many NFTs are similar to securities & blur the thin line between consumer & financial products.

Is the NFT in charge of a DAO that levies a royalty on overall trade volume? Well, we are talking about security here!

Isn’t it possible that the fancy NFT someone buys gets royalties from a content, song, or video? We are talking about security again!

Does owning a specific NFT provide access to other NFTs (potentially having monetary worth) released by the project? Again, there is a potential security value of that NFT.

2. Asset Breadth

Liquidity is perhaps the most crucial metric of a marketplace. Binance initially gained traction as it allowed access to trade assets that one wouldn’t find listed anywhere else. It attracted capital, and new users flocked to Binance, as it also offered a smooth UX & onboarding experience.

On a similar note, Uniswap became popular as it offered assets quicker than even the fast-moving exchanges (such as Binance).

The permissionless protocols & alternative exchanges may script a similar success story by listing a larger number of NFT assets at a blistering pace. If regulatory concerns clouding specific NFTs are taken into account, permissionless NFT protocols offer a distinct edge. That edge comes from accruing liquidity via fractionalized & cash-flowing NFTs.

3. Easy Integrations

Ever since smart contracts & software became a cakewalk on Ethereum, it became its flagship feature. Alchemix can effortlessly use Yearn vaults for yield generation. And, InstaDapp can help people transfer their collaterals from a lending protocol to a different one with just a single click (for example, Compound to Aave).

These integrations & secondary applications help to drive liquidity in platforms. Owing to their open nature, permissionless marketplaces are better placed than centralized NFT exchanges to integrate with other protocols (such as Coinbase, FTX).

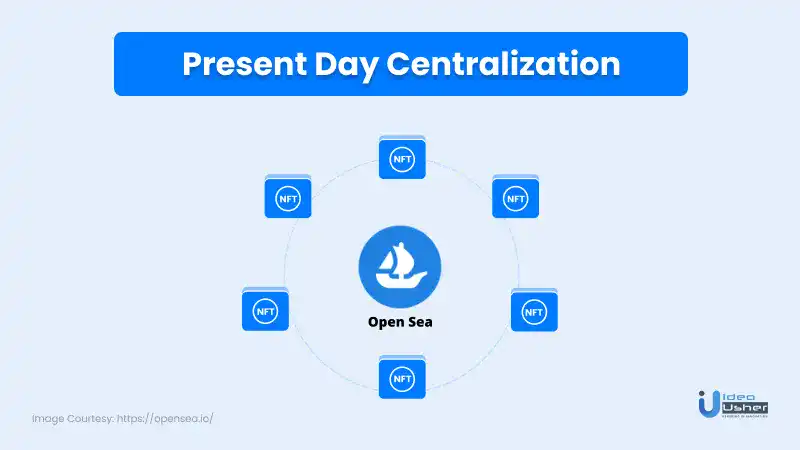

Present Day Centralization

When we discuss cryptocurrencies, one prominent facet that comes to everyone’s mind is decentralization. However, there is a stark difference between how a decentralized system must work & how some of them function in reality. The worst part is that the market becomes centralized with each passing day.

You need to swipe through the NFT marketplaces on the Ethereum network such as Rarible, KnownOrigin, Foundation, Nifty Gateway, SuperRare, Zora, etc., to observe the centralization phenomenon.

While all of these marketplaces are battling it out to emerge as the Web 3 Amazon of sorts, there is no denying that only one is close to reaching there- Opensea! What propels OpenSea’s dominance is that the platform focuses more on being a listings aggregator & not a gallery.

Other competing NFT exchanges like SuperRare & Foundation facilitate trades exclusively with distinct & curated NFT collections. But, OpenSea endorses a much more comprehensive range of projects. For instance, one can’t trade Foundation NFTs on SuperRare & vice versa, but it is possible to trade both on OpenSea! While Rarible offers a similar cross-project flexibility, it is way behind Opensea when it comes to popularity.

As two centralized crypto behemoths- Coinbase & FTX, play out with their own NFT marketplaces, we can definitely expect more market moderation. However, top-down moderation is never well-received by staunch-libertarian crypto enthusiasts.

For instance, we can all be on the same page that NFTs celebrating Hitler must be restricted on the open market. But is it a great idea to allow the centralized platforms to wield that kind of decision-making authority over the users? That’s something we should really think about without getting lost in the uproar of decentralization!

Closing Thoughts

To end with, we believe that Coinbase & FTX can develop superb NFT exchanges with distinct value propositions. We live in a shared NFT world at the moment, where both centralized and decentralized platforms attract users. If Coinbase & Uniswap can co-exist, and so can OpenSea & Coinbase!

The important part is that while the competition between NFT exchanges like OpenSea, Coinbase, Rarible, NFTX, etc., will intensify in the coming years, they will also compete for liquidity across a wide range of blockchains & a variety of assets. The meteoric growth of NFTs across industries will open a door of opportunities for both the centralized NFT exchange platforms & their permissionless peers.

To know more about NFT platform development, feel free to give us a call!

FAQs

Here are some interesting questions that are frequently asked by people regarding centralized NFT exchanges.

1. Can NFT Be Centralized?

While the data of an NFT’s token is mostly centralized, the NFT-related media is generally stored off-chain. Additionally, the NFT token metadata holds the hash value data for the files. An artist (sometimes, the platform) can determine the storage mechanism of an NFT.

2. Can You Sell The Same Artwork As NFT On Different Platforms?

If you’re asking if it’s theoretically possible to sell the same NFT on different platforms, the answer might be yes. However, you should avoid doing so since it will tarnish your reputation, and you will hardly find any buyers for your NFTs after that.

Additionally, one can sue an artist for fraudulently selling the same artwork as an NFT multiple times on different blockchains. Thus, if you are looking to earn more, the best way is to invest in other projects having great potential, apart from your pet projects.

However, you can always tweak the art a bit & mint it on another platform. The new unique NFT is not likely to pose a problem for the initial NFT buyer.

Soham Roy