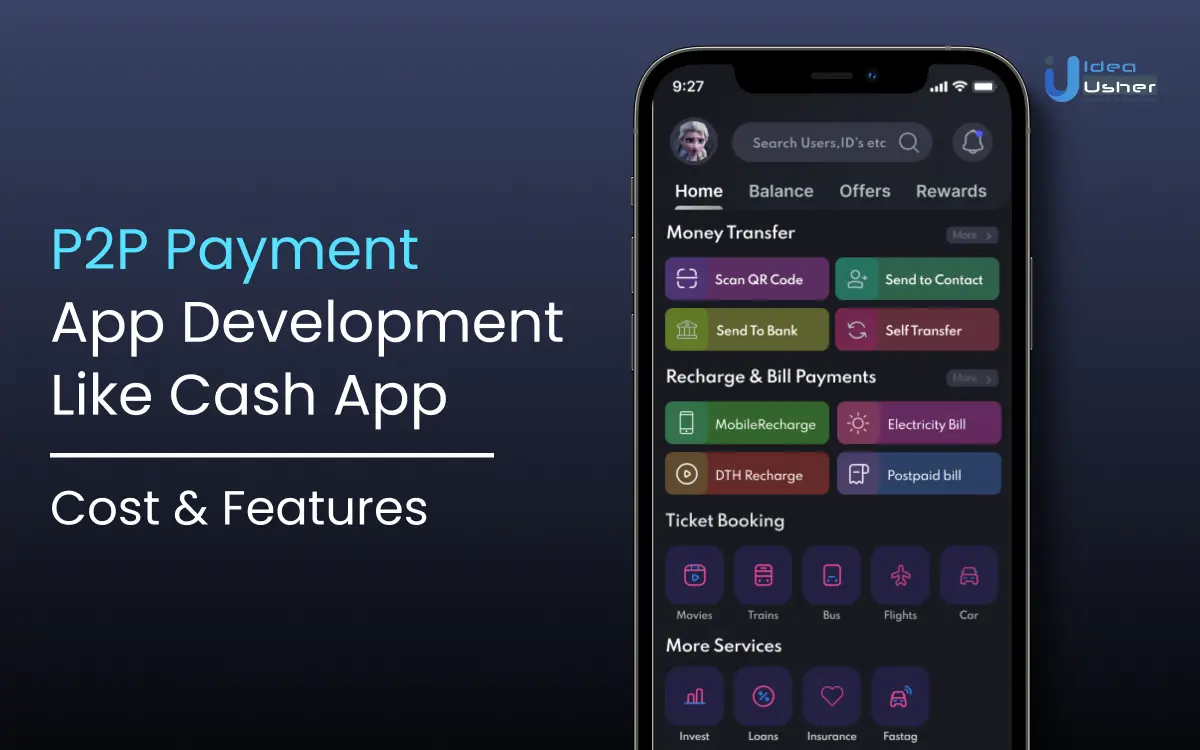

Nowadays, we no longer need to frantically search for cash to split a bill or deal with the annoyance of waiting for checks to clear. Peer-to-peer payment apps like Cash App have become an integral part of our financial lives, turning money exchange into a smooth and social experience. Cash App has attracted millions of users, with over 70 million active users every month. This widespread adoption reflects a strong desire for financial tools that reflect the ease and connection of our daily interactions.

Developing a P2P payment app can allow you to capitalize on this trend. Your app can empower users to share, support, and transact with a simple tap, fostering a community built around seamless financial interactions. It’s more than just sending money; it’s about creating a space where finances feel effortless and social.

What is the Cash App?

Developed in 2013 by Block, Inc. (formerly Square), Cash App is a smart payment application that gained momentum by offering a user-friendly platform for sending and receiving money between friends, often with a playful social media twist. Cash App’s feature set has since expanded significantly, allowing users to deposit paychecks, invest in stocks and Bitcoin, and even order a debit card linked to their account. This growth strategy has proven fruitful, with Cash App generating billions in revenue annually and boasting over 70 million active users.

What Makes the Cash App Unique?

Cash App’s unique appeal lies in its ability to blend social interaction with financial transactions seamlessly. Features like “$cashtags,” personalized usernames, and a sleek social feed for sharing payments create a sense of community around money transfers. This fosters a more casual approach to splitting bills, paying rent to roommates, or even sending a quick gift to a friend. Beyond the social aspects, Cash App goes a step further by offering a suite of financial tools that empower users.

Integration with direct deposit allows users to receive their paychecks directly into the app. “Cash Boost” provides users with instant discounts at select businesses, while the “Investing” feature opens the door to buying and selling stocks or Bitcoin, all within the same platform. This comprehensive approach positions Cash App as a one-stop shop for managing daily finances, attracting both individuals and small businesses seeking a convenient and feature-rich financial solution.

How does Cash App Generate Revenue?

Cash App, though free to download and use for basic functions like peer-to-peer payments and transfers, has become a money-making machine for Square, its parent company. Cash App strategically generates revenue through various channels. Their bread and butter comes from transaction fees. Users sending money instantly to their bank or using credit cards for transfers incur fees ranging from 1.5% to 3%. Businesses using Cash App as a payment solution also pay a processing fee of 2.75% per transaction.

However, the real goldmine for Cash App is Bitcoin. By offering a user-friendly platform to buy and sell Bitcoin, Cash App has become a major player in the cryptocurrency market. They make money by spreading the price of Bitcoin between buying and selling, and this has become their biggest revenue source. In fact, reports suggest that Bitcoin trading on Cash App surpassed transaction fees as the top revenue generator in 2023.

Key Market Takeaways for P2P Payment Apps

According to StraitsResearch, the P2P payment market is experiencing a boom, with a projected growth of over 17% annually until 2030. Consumers are rapidly embracing online and mobile financial services, with younger generations leading the charge in smartphone adoption.

Source: StraitsResearch

A prime example is Venmo, a popular P2P app in the US, which saw a surge in user adoption among millennials and Gen Z for splitting bills and sending quick payments. This digital shift, coupled with the flourishing mobile commerce industry in emerging markets, is creating a fertile ground for P2P payment businesses. As a result, P2P payment companies are well-positioned to capitalize on this growing demand for convenient and secure money transfer solutions.

What Features Make Fintech Apps Like Cash so Popular in the market?

Cash App has become a dominant force in the mobile payment market, boasting 51 million active users in 2022 and generating a whopping $10.60 in revenue. Cash App’s active user base grew by a staggering 54.55% between 2021 and 2022, highlighting its increasing popularity among users.

Let’s explore some of the features that make Cash App a leader in the market.

1. Transaction Monitoring

Cash App provides robust transaction monitoring, allowing users to keep an eye on their financial activities easily. This feature helps users maintain a detailed record of their spending and income, which is essential for personal and business financial management.

2. Brand Personalization

For businesses, brand personalization is a valuable feature. It allows companies to tailor their Cash App interface to match their brand identity. This customization helps enhance brand recognition and provides a more cohesive user experience.

3. Bitcoin Compatibility

Cash App’s compatibility with Bitcoin sets it apart from many other payment apps. Users can buy, sell, and hold Bitcoin directly within the app. This feature attracts cryptocurrency enthusiasts and provides an additional investment option.

4. Equity Investment

Cash App enables users to invest in equities, making it a versatile financial tool. Users can buy fractional shares of companies, allowing them to diversify their investment portfolio without needing a large amount of capital. This feature democratizes stock investment and attracts a broader audience.

5. SSL Encryption

Security is a top priority for any financial app. Cash App uses SSL (Secure Sockets Layer) encryption to protect data and ensure safe transactions. This level of security helps protect user information and builds trust among users.

6. Multi-Currency Support

The multi-currency support feature allows users to send and receive money in different currencies. This can be really beneficial for businesses and individuals who engage in international transactions. It simplifies the process of converting currencies and reduces transaction costs.

7. User Verification

Cash App employs strong user verification methods to protect accounts. Two-factor authentication and biometric verification add extra layers of security, ensuring that only actual users can access their accounts.

8. Digital Payments

Cash App facilitates digital payments, making it easy for users to transfer money instantly. This feature is convenient for both personal and business transactions, enhancing the overall user experience.

9. Referral Rewards

Cash App offers users the opportunity to receive referral rewards for introducing new customers to the app. This referral program incentivizes users to promote the app, contributing to its rapid growth and increased user base.

10. Secure Information Storage

Secure information storage is essential for maintaining user trust. Cash App guarantees that all user data is securely stored, protecting it from unauthorized access and breaches. This is crucial for safeguarding sensitive financial information.

11. Peer-to-Peer Transfers

P2P transfers are one of Cash App’s core features. Users can quickly transfer money to friends, family, or businesses. This functionality is straightforward and widely used, contributing to the app’s popularity.

12. Investment Opportunities

In addition to Bitcoin and stocks, Cash App allows users to invest in other assets. This broad investment capability makes it a comprehensive financial tool for users looking to grow their wealth.

13. Client Accounts

Cash App supports the creation of multiple client accounts, catering to both personal and business needs. This flexibility allows users to manage different financial activities within a single app.

14. Mobile Access

Cash App is designed for mobile access, providing app users with the convenience of managing their finances on the go. The mobile-friendly interface ensures a seamless experience across various devices.

15. User Support

User support is readily available within the Cash App. Users can access help for any issues they encounter, ensuring that their questions and concerns are addressed promptly. This customer service enhances user satisfaction and loyalty.

16. Remote Check Deposit

Remote check deposit is a feature that enables app users to deposit checks by taking a photo using their mobile device. This convenience saves time and makes banking more accessible, particularly for those who cannot visit a bank branch.

17. Free Debit Card Option

Cash App provides users with an optional free debit card called the Cash Card, which can be used for purchases and ATM withdrawals to provide easy access to funds.

18. Discount Boosts

Discount Boosts are special savings available to Cash Card users. These boosts provide discounts at various merchants, adding value to the Cash App experience. This feature can be very appealing to users looking to maximize their purchasing power.

Why Fintech Apps Like Cash Are Growing in the Industry

The increasing preference of consumers for the convenience and security provided by mobile wallets is evident in Juniper Research’s projection that global mobile payment transactions could reach $58 trillion by 2028. This rapid adoption suggests a large potential user base for mobile payment apps.

1. Demand for Financial Convenience

Today’s consumers prioritize speed and convenience in managing their finances. Mobile payment apps cater to this need by enabling instant money transfers, bill payments, and seamless in-store purchases directly from a user’s smartphone. This convenience factor significantly drives the adoption of mobile payment apps among a diverse demographic.

2. Financial Inclusion and Accessibility

Furthermore, mobile payment apps play a crucial role in enhancing financial inclusion. By offering intuitive interfaces and bypassing traditional banking prerequisites, these apps democratize access to financial services for underserved populations. For instance, Cash App has been instrumental in simplifying banking and investment access for younger demographics, thereby promoting financial inclusion.

3. Lucrative Revenue Potential

From a business perspective, the mobile payment industry presents substantial revenue opportunities. In 2022 alone, global consumer spending through mobile payment apps surpassed $2 trillion, highlighting the sector’s profitability. Cash App stands out as a prime example, generating over $10 billion in revenue during the same period. Revenue streams in this sector encompass transaction fees, subscription models for premium features, and in-app advertising, offering diverse avenues for monetization.

How to Develop a P2P App Similar to a Cash App?

Developing a P2P payment app akin to Cash App requires meticulous planning and technological finesse. Here are the essential steps to navigate the complex process of creating a successful payment app.

1. In-depth Market Research and Planning

Before embarking on development, thorough market research is paramount. Understanding the dynamics of the payment app market, analyzing competitors like Cash App, PayPal, and Venmo, and identifying target demographics are crucial steps. This ensures alignment with market needs and enhances the app’s marketability.

Identifying Target Audience and Business Goals

Define your target audience precisely, considering factors such as age, income level, and financial behavior. Align business goals with market insights to tailor the app’s features and functionalities effectively.

Analyzing Competitive Landscape

Study existing payment apps to discern their strengths and weaknesses. Learn from successful strategies while identifying gaps in the market that your app can fill, enhancing its competitive edge.

2. Building a Competitor Strategy

To stand out in a crowded market, devise a clear strategy that highlights your app’s unique value proposition. Emphasize features that differentiate your app from competitors like Cash App, leveraging innovative solutions or enhanced user experiences.

Craft a compelling narrative around your app’s unique features, targeting regions and demographics where competitors dominate. This strategic positioning aids in capturing market share and fostering user loyalty.

3. Choosing the Tech Stack for Payment App Development

Selecting the perfect technology stack is pivotal for ensuring the app’s scalability, security, and performance. Consider platforms (Android, iOS), backend frameworks (Node.js, Django), database solutions (PostgreSQL, MySQL), and cloud services (AWS, Google Cloud Platform) that align with your app’s requirements.

Integrate secure payment gateways like Stripe or PayPal for seamless financial transactions. For apps targeting cryptocurrency enthusiasts, integrate APIs from platforms like Coinbase to facilitate crypto trading within the app.

4. Hiring a Dedicated Mobile App Development Company

Given the complexity of payment app development, partnering with a specialized mobile app development firm is advisable. Ensure the company has expertise in fintech and can manage the app’s lifecycle from design to deployment efficiently.

Outsourcing to experts streamlines development, reduces time-to-market, and ensures compliance with industry standards and regulations. This approach allows fintech companies to focus on core competencies while leveraging specialized skills.

5. Ensuring Legal Compliance

Compliance with regulatory standards is quite important for any payment app. Ensure adherence to laws like GDPR, AML, and CCPA to safeguard user data and maintain legal integrity.

Deploy robust security measures such as two-factor authentication (2FA) and data encryption to protect user information from unauthorized access and cyber threats.

6. Scalability and Performance Optimization

Ensure the app can handle large volumes of transactions and users concurrently without compromising performance. Optimize database architecture and leverage cloud services for scalability and real-time transaction processing.

Implement mechanisms for instant transaction processing, reflecting updates in user balances promptly. Efficient integration with payment gateways ensures seamless financial operations.

7. Fraud Prevention and Risk Management

Implement comprehensive fraud detection systems and risk management protocols to mitigate potential threats like money laundering and unauthorized transactions.

Educate users about app security measures and best practices for transactions to build trust and confidence in using the payment app.

What is the Cost of Developing a P2P Payment App?

| Stage | Cost Range | Description |

| Pre-Development Research | ~$5,000 – $15,000 | Understand target audience, competitors, and regulations. |

| Independent Research | ~$5,000 | Utilize market research reports, competitor analysis tools, and government data. |

| Market Research Firm | ~$10,000 – $15,000 | Hire a firm specializing in Fintech for in-depth research and competitor analysis. |

| App Development | ~$80,000 – $200,000+ | |

| Front-End Development | ~$30,000 – $75,000 | User Interface (UI) for a seamless user experience. |

| * Basic UI | ~$30,000 | Simple design with core functionalities. |

| * Advanced UI/UX Design | ~$50,000 – $75,000 | Dynamic and customizable interface with advanced features. |

| Back-End Development | ~$50,000 – $100,000+ | The engine powering your app, security is paramount. |

| * Secure Data Storage | ~$10,000 – $20,000 | Data encryption and access controls to protect user information. |

| * Payment Processing Integration | ~$20,000 – $40,000 | Integration with secure payment processors. |

| * APIs (Application Programming Interfaces) | ~$10,000 – $30,000+ | Building APIs for functionalities and potential future integrations. |

| App Features | Highly Variable | |

| Core P2P Functionality | ~$20,000 – $40,000 | Core functionalities for sending/receiving money and managing accounts. |

| * Sending/Receiving Money | ~$10,000 – $15,000 | Core functionality for transferring funds between users. |

| * Contact Management | ~$5,000 – $10,000 | Add, manage, and search contacts for easy transactions. |

| * Transaction History | ~$5,000 – $10,000 | View past transactions and manage financial activity. |

| Advanced Features (Variable Cost) | Additional functionalities beyond core P2P features. | |

| * Splitting Bills | ~$10,000 – $15,000 | Split bills with friends and settle payments. |

| * Instant Transfers | ~$15,000 – $20,000+ | Real-time transfers may require additional security measures. |

| Testing & Quality Assurance | ~$10,000 – $20,000 | Ensure app stability, security, and functionality. |

| Manual Testing | ~$5,000 – $10,000 | Manual verification of functionalities across different devices and scenarios. |

| Automated Testing | ~$5,000 – $10,000+ | Utilize automated testing tools to ensure app stability and performance. |

| UI/UX Design | ~$10,000 – $30,000 | User-friendly and intuitive design. |

| Basic UI/UX Design | ~$10,000 – $15,000 | Straightforward design with clear navigation and basic visual elements. |

| Advanced UI/UX Design | ~$20,000 – $30,000+ | Engaging design with animations and focus on user experience. |

drive_spreadsheetExport to Sheets

Total Estimated Cost Range: ~$125,000 – $325,000+

Building a peer-to-peer payment app similar to Cash App can be an exhilarating opportunity for companies aiming to enter the expanding digital payments market.

Nonetheless, the ultimate cost may vary based on numerous factors beyond the initial estimates. Here’s a breakdown of several key variables to take into account:

1. Compliance and Regulations

P2P payment apps operate within a complex web of financial regulations. Ensuring compliance with KYC and AML regulations requires additional development effort. This includes features for user verification, identity checks, and transaction monitoring, all of which add to the cost.

2. Payment Processing Integration

Seamless money transfers are the core functionality of any P2P app. Integrating with secure and reliable payment processors is crucial, but these integrations come with fees. The expense can vary depending on the chosen processor, transaction volume, and any negotiated rates. Additionally, features like instant transfers may require additional security measures within the integration, further impacting development costs.

3. Security Features

Building trust with users hinges on robust security. P2P payment apps require a more secure infrastructure compared to many other app types. This translates to features like data encryption at rest and in transit, multi-factor authentication for logins and transactions, and sophisticated fraud prevention measures. Implementing these features requires specialized development expertise, driving up the cost.

4. Dispute Resolution Systems

Frictionless transaction resolution is key to user satisfaction. Building a robust system for handling disputes, including communication channels, investigation procedures, and potential chargeback functionalities, requires dedicated development effort.

5. Scalability and Performance

As your user base grows, your P2P app needs to handle increased transaction volume efficiently. Investing in a scalable backend infrastructure and performance optimization techniques from the outset helps avoid costly bottlenecks and ensures a smooth user experience.

Conclusion

Creating a peer-to-peer payment app can be a strategic move for businesses looking to reach and engage with a growing tech-savvy demographic. These apps offer convenience, security, and efficiency, enhancing the experience of the users and creating new revenue streams. By incorporating innovative features and focusing on user-friendliness, businesses can develop P2P apps that become an integral part of their financial ecosystem, fostering customer loyalty and driving business growth.

The success of a peer-to-peer app depends on figuring out the target audience and the competitive landscape. Businesses and companies should conduct comprehensive market research to identify unmet needs and customize their app’s features accordingly. By embracing the evolving FinTech landscape, businesses can use P2P payment apps to unlock new possibilities and achieve sustainable growth.

Looking to Develop a P2P Payment App Like Cash App?

Idea Usher can be your partner in building a secure, feature-rich P2P payment app that rivals Cash App. With over 500,000 hours of development experience under our belt, our team of experts can craft a solution that leverages cutting-edge encryption, intuitive UI/UX design, and robust backend infrastructure to ensure seamless and secure transactions. Let’s turn your P2P payment app vision into reality – contact Idea Usher today for a free consultation.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

Q1: How to build a P2P payment app?

A1: Creating a P2P payment app involves following a clear plan. To start, identify your target audience and highlight what makes your app unique. Collaborate with a trustworthy development team to build a secure and easy-to-use platform, incorporating features such as KYC verification and fraud prevention. Focus on providing a smooth UX and think about adding functions like bill payments and budgeting tools. Thorough testing and compliance with regulations are crucial before the app is launched. Lastly, formulate a strategy to attract users and form a strong P2P community.

Q2: How much does it cost to build a peer-to-peer app?

A2: The cost of building a P2P app hinges on several factors. Complexity is a major one – a basic app will be significantly cheaper than one loaded with features and advanced security protocols. The location and experience level of your development team also play a role. To be cost-effective, consider launching a MVP first. This allows you to test core functionalities with real users and gather valuable feedback before investing in a full-fledged feature set.

Q3: How do I start a P2P platform?

A3: To successfully launch a P2P platform, you need to take a multi-pronged approach. First, define your niche and target audience in order to tailor the platform’s functionalities. Secure the necessary licenses and ensure regulatory compliance. Develop a secure and user-friendly platform, incorporating features such as robust KYC procedures and fraud prevention. Attract users by building trust and offering competitive rates or features. Marketing and user acquisition are crucial – consider strategic partnerships and targeted campaigns to grow your P2P community.

Q4: How do P2P payment apps make money?

A4: P2P payment apps aren’t just about convenience for users. They generate revenue through a few key methods: transaction fees for instant transfers or credit card funding, premium subscriptions that unlock budgeting tools or investment options, and partnerships with businesses that bring in advertising or commission fees on bill payments processed through the app.