Almost 1 out of 10 investors have invested their money in cryptocurrencies. However, the price volatility of cryptocurrencies makes it hard for investors to hold their investments.

The inability to keep crypto assets on hold encourages many investors to explore alternate ways to generate profits with their crypto investments. It can be crypto mining, trading, etc.

Defi Staking has also become a lucrative option where investors can generate returns as an interest on their crypto holdings.

The high engagement of users on the Defi Staking platforms offers a great opportunity for developing a crypto-staking platform.

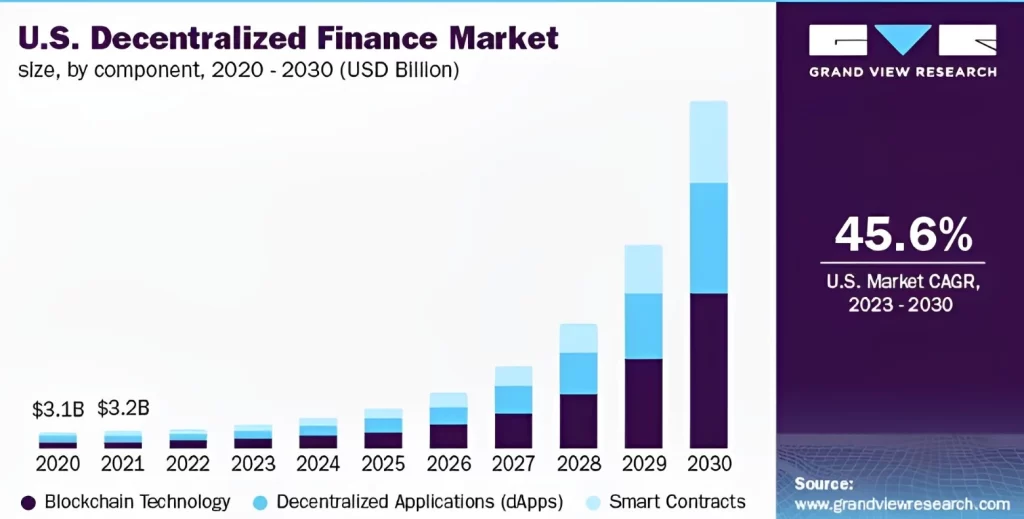

The global decentralized finance market was valued at $13.61B in 2022 and is expected to expand at a CAGR of 46.0% between 2023 and 2030.

The above data indicates the market potential of Defi platform development and better explains why one should enter the market with platform development.

Anyone seeking to develop their Defi staking platform can explore the development steps, must-have features, and required tech stack mentioned in the blog.

What Is DeFi Staking?

A process where investors lock their crypto assets in a smart contract in exchange for rewards. Many investors consider them a source of passive income where they stack their cryptocurrencies and generate rewards.

Consider the process as a form of a fixed deposit that offers high-interest returns during the locking period of crypto assets.

Types Of DeFi Staking

The process of locking and generating interest in crypto assets has been classified in the following ways.

1. Staking In DeFi Protocol

The process generally consists of locking tokens in a Defi protocol to generate a return for interest in the form of yields. The staking mechanism involved in staking defi protocol consists of decentralized exchanges like Uniswap and SushiSwap or lending platforms like Aave.

2. Yield Farming

In yield farming, the investors act as liquidity providers by depositing their funds in liquidity pools and offering liquidity to other users. Users other than investors on a decentralized exchange take a loan or borrow from deposited tokens.

After taking a loan from the platform, the defi exchange distributes a platform fee among liquidity providers in line with their owners based on their contribution level in the liquidity pool.

3. Liquidity Mining

A subcategory of yield farming where there is the involvement of depositing crypto assets and tokens into liquidity pools.

The pools enable trading without intermediaries in Decentralised Exchange(DEX), an Automated Market Maker.

A liquidity pool consists of two assets that create of particular trading pair. Therefore, the system relies on liquidity providers who make assets available to other users.

Benefits Of DeFi Staking Development

Defi staking offers additional advantages for investors and companies besides generating interest in locking digital assets.

I. Advantages To Investors

The companies can generate greater yields than traditional banking models. The businesses can prevent themselves from market volatility in the long run as they are free to decide the duration of a locking period of their Defi assets.

II. Advantages To Companies

When the companies strategize the tokenomics of their platform, they can attract worldwide users to appreciate the value of their tokens.

On the other hand, companies can profit from every transaction charge that users make on their platform.

Must-Have Features For The DeFi Staking Platform

The required features of the DeFi staking platform are as follows:

1. Onboarding

The user journey of every application starts with an easy onboarding process. Defi staking platforms are no different than other platforms when joining users to the app through login/signup.

The onboarding will enable users to join platforms through their e-mail ID and further required details to let them stake their digital assets.

2. Yield Calculator

The feature will help users know the approximate amount they will gain after locking their crypto assets for a fixed duration.

The yield calculator will be helpful for users to let them avoid moving to third-party platforms. Users can get total returns estimates after locking their specific amount of digital assets.

3. Deposits And Withdrawals

The investors should be given an easy-to-access user interface for depositing crypto assets in the staking protocol. Likewise, there should be easy earning withdrawals at the time of payouts.

You can enable users to make easier deposits and withdrawals without trouble by integrating popular third-party payment gateways.

4. Crypto Wallet Integration

A must-have feature for every defi staking platform. The crypto wallet will allow users to store their digital assets to let them stake in your platform.

However, we recommend you avoid developing your crypto wallet during the MVP stage. Instead, you can integrate crypto wallets to your platform that is popular among your targeted users.

5. Reports

The feature will give users a comprehensive view of their transactions, the number of crypto assets they have staked, their performance, details of the staking duration, and other required information to all in one dashboard.

6. Portfolio Management

Allowing users to manage their portfolios will help them to make informed decisions based on crypto asset type and the amount they need to invest/stake on decentralized exchanges.

7. Trading

Many investors want to trade their crypto assets to make short-term profits. Enabling the trading feature will help you get more user base to your platform for those interested in trading.

Consider adding technical indicators and other trading tools to help your app users make better trading decisions and profits with their crypto assets.

8. Referral

Increase the audience base of your platform by enabling a referral feature. Introducing a referral program to your platform will enable users to earn rewards such as crypto assets when they invite someone to your platform.

Platform Features Based On User Types

The app features have been classified based on the type of users who are going to access your platform.

I. Essential Features For User Module

Incorporate the following features into your platform so users can easily stake their crypto assets:

1. Asset Staking

Implementing the asset staking feature will enable users to manage the following things

- Sending profit to the wallet

- Viewing reward details

- Accessing stacking summary

- Functioning the minimum stake amount

- Ability to buy crypto assets

- Staking conditions like lock-in period and status

2. Asset Unstacking

Users and investors should be able to withdraw their staked amount after paying the gas fees and withdrawal charges. Moreover, the platform should offer ways and means to move the profit to other assets.

3. Medal Pool

The medal holder can be decided by their amount of investment in crypto staking. The feature will enable medal orders to receive weekly distributions of shares from the pool.

II. Essential Features For Admin Module

The following features will enable users to manage their crypto-staking platform better.

1. Access Pools

There is a need for everyone to access all the pools in terms of estimated earnings and rewards, and they should be able to update the staking setting of every pool and modify the reward set.

2. Rewards Management

The feature will enable users to manage their rewards and decide how to receive rewards.

3. Security

Special attention should be on the security side as well. The security level will comprise three levels, i.e., core, general, and operational

I. Core Security

The security architecture will be drawn to address the following security issues:

- Sensitive document confidentiality

- The information’s integrity

- Service availability is determined using metrics such as Service Level Agreement (SLA) components such as Maximum Tolerable Downtown Time [MTD] and Recovery Time Objective

- Authorizing the accountability of user activity

II. General Security

Security should be prioritized to the following factors.

- Management of sessions through user authentication

- Tracking the authenticated state through users’ ID

- Error management

- Prevention of data loss and security breaches through configuration management

III. Operational Security

The following factors have to be dealt with in the operational security:

- Capturing information about deployment environments around users, compliance, and industry standards

- Giving priority to anti-piracy measures for identifying the process of IP protection, licensing, and anti-tampering

Tech Stack To Build Defi Staking Platform

There is a need for specific tools and technologies to develop a Defi-staking platform. However, the standard tech stack for building staking platforms is as follows.

| Android | Java, FCM, Retrofit, Kotlin, Oreo API.Java, FCM, Retrofit, Kotlin, Oreo API |

| iOS | Stripe & Braintree (split fare option), PayPal’s Card.io. |

| Front End | React, Java, HTML, CSS, Angular, Swift |

| Database | MongoDB |

| Social Media Login | Google, Facebook, Twitter API |

| Units of Value | USDT, USDC, WBTC, renBTC, tBTC |

| Transactional Layer | SKALE, StarkWare, and Optimism |

| Price Oracles | Coinbase (centralized) and MakerDAO’s medianizer, Chainlink, Band, Tellor, UMA, API3, Compound Open Oracle, and Nest |

| Lending Protocols | Compound, Aave, Cream, bZx, Yield, Notional, Mainframe |

| AMM Trading Pools | Curve, Uniswap, Balancer, Bancor, mStable, BlackHoleSwap, DODO, Serum Swap |

| Order Book Exchanges | 0x, IDEX, Loopring, DeversiFi, Serum |

| Derivatives Networks | MCDEX, Perpetual Protocol, DerivaDEX, Potion, Opyn, Synthetix, dYdX, Pods, Primitive, BarnBridge |

| Asset Management Platforms | Set, Melon, dHEDGE |

| Supply-side aggregators | Yearn Finance, RAY, Idle Finance, APY.Finance, Harvest Finance, Rari Capital |

| Demand-side aggregators | 1inch, DEX.ag, Matcha, Paraswap |

| Aggregator of aggregators | yAxis |

| Novel aggregators | Swivel Finance, Benchmark |

| Relayers | Tokenlon, Dharma, PoolTogether, Guesser |

| Wallets | Coin98, MetaMask, Math, imToken, Bitpie, Exodus, Trust Wallet |

| DeFi-Native Front ends | DeFi Saver, Zerion, Zapper, Argent, Instadapp |

If you are facing challenges understanding the above tech stack, we suggest consulting with a blockchain development company. Here is a guide on how to hire blockchain developers for your project.

Their blockchain developers can help you select a suitable tech stack based on your project needs and requirements.

Defi Staking Platform Development Steps

The following steps will guide and help you develop your Defi staking platform.

STEP #1: Tokenomics

Tokenomics is a crucial part of every crypto blockchain-related project. We can’t keep aside tokenomics when considering developing a defi staking platform.

The tokenomics will decide the following factors for your staking platform:

- Defi tokens that users will stake

- Required defi staking protocol to integrate with the platform

- The working of appropriate fees model

- Deciding the payout frequency, either daily, weekly, or monthly

- Considering whether to add lock-up terms

- Deciding the staking limits to impose on the platform

- Deciding whether to add compound interest

Many other essential factors need to decide during the implementation of tokenomics.

Consulting with the right blockchain development company can help you go through all the essential factors you need to cross-check when introducing tokenomics to your platform.

STEP #2: User Flows And Design

The next part is to design the interface and user experience of the decentralized exchange platform. Prototyping is the best way to decide the real design of your platform. You can limit your budget for designing the UI part of your app with prototyping.

Additionally, prototyping will help you decide whether the users will interact with your app at each stage of their app journey. The dull UX/UI is a way to look your platform untrustworthy. Therefore, you should hire professional UX/UI designers to design your platform’s user interface.

Also, it would be best for you to visit many Defi staking platforms to get ideas and inspiration regarding the UX/UI for your platform.

STEP #3: Development And Security

Smart contracts and mobile/web front end are two crucial parts the development team will work on during the development stage.

Both parts will get developed in parallel, so the mobile app development team can only wait until blockchain developers are done with smart contracts.

On the other hand, establishing and maintaining security is another crucial factor in building trust among your app users.

To protect your app users from hackers, consider following a security-first development approach where every user is given a private key and seed phrase. Consider identifying and fixing all the security loopholes to strengthen the security of your platform.

STEP #4: Deploy And Maintain

There is a straightforward process of dealing with regular applications and software regarding their deployment and maintenance:

- Uploading apps to the Google Play and Apple App Store

- Moving the servers to a production, stress-tested environment

- New versions release with updates and new features

However, when there is the involvement of blockchain technology, there is a requirement to integrate smart contracts within products.

Moreover, updating the platform with new features and functionality will not affect the blockchain portion of your app. Another thing worth adding is Google Analytics and Mixpanel to front-end apps for analyzing user behavior.

Consider adding Crashlytics to monitor the stability of your app’s performance. The tool can help you identify bugs and new issues proactively and let you fix them so you can offer a stable platform experience to your users.

How Much Does It Cost To Develop A DeFi Staking Platform?

After exploring the different aspects of building a Defi staking platform, including development steps, must-have features, and the required tech stack, the next part is to determine the estimated cost to build a Defi staking platform.

Platform development cost depends entirely on multiple factors, including project scope, features, platform selection for product launch, tech stack, level of personalization in terms of user interface and functionality, and many other factors that decide the defi staking platform development cost.

The best way to determine the app building cost is to consult a reliable blockchain development company with experience building Defi staking platforms for their past clients.

Conclusion

Defi platform has become a new passive income source, and people are interested in engaging with that. Bitcoin’s Proof of Work (PoW) failed to grab the attention of global crypto investors.

Compared to proof of work, proof of stack has become an economical option where users can generate significant investment returns. Moreover, PoS is secure and nature friendly as well.

Anyone seeking the right opportunity to develop their defi staking platform should consult a reliable blockchain development company.

The company can help you proceed with the further steps regarding developing and launching your defi staking platform.

Developing a Defi platform by oneself needs years of expertise in blockchain development that only a reliable development company can have.

Partner with Idea Usher if you are looking for a blockchain development company for complete blockchain development support from strategizing to designing, from developing to launching your Defi staking platform.

We can efficiently work with your existing teams to help you build your staking platform based on blockchain technology. So, if you’re seeking a company to help you develop a Defi staking platform, look no further than IdeaUsher.

Contact us today to understand how we can turn your app idea into reality.

Contact Idea Usher

Build Better Solutions With Idea Usher

Professionals

Projects

Email:

Phone:

FAQ

Q. What are the features of the DeFi staking platform development?

A. The features of the Defi staking platform are the following: Onboarding, Yield calculator, Deposits and withdrawals, Crypto wallet integration, Reports, Portfolio Management, Trading, Referral, Asset Staking, Asset Unstacking, Medal Pool, Access pools, and Rewards management.

Q. What is DeFi staking development?

A. The process of developing our defi staking platform where users can invest their crypto assets to generate returns.

Q. Which platform allows staking?

A. Coinbase, KuCoin, Binance, Crypto.com, Nexo, Lido, Stakely, Kraken, Cake DeFi, Rocket Pool, and many other platforms allow staking.

Q. What is a Defi staking platform?

A. The platform enables users to act as a validator for the crypto transition and return rewards as passive income. The user who becomes a validator makes returns as a fractional part of cryptocurrencies on their investment.