- What is an Employee Payroll App Like Hourly?

- How Does An Employee Payroll App, like an Hourly App, Work?

- Business Benefits Of Developing An Efficient Payroll System

- Must-Have Features in a Payroll App Like Hourly

- Advanced Hourly Payroll App Features

- Challenges In Payroll Management App Development

- How To Develop An Employee Payroll App Like Hourly?

- Tech Stack To Consider To Develop An App Like Hourly

- Conclusion

- How Can We Help in Developing an Employee Payroll App Like Hourly

- FAQ

Juggling spreadsheets and managing mountains of paperwork sounds like a familiar payroll nightmare, right? In today’s fast-paced business world, there’s a better way. Imagine an employee payroll app that streamlines the entire process, saving you time, money, and frustration. That’s the power you can unleash by developing a user-centric app specifically designed for effortless payroll management.

This guide will equip you with the roadmap to build a groundbreaking employee payroll app that rivals industry leaders like Hourly. We’ll delve into the essential features, navigate the development process, and explore strategies to ensure your app stands out. By the end, you’ll be armed with the knowledge to transform your payroll system from a burden into a strategic advantage.

- What is an Employee Payroll App Like Hourly?

- How Does An Employee Payroll App, like an Hourly App, Work?

- Business Benefits Of Developing An Efficient Payroll System

- Must-Have Features in a Payroll App Like Hourly

- Advanced Hourly Payroll App Features

- Challenges In Payroll Management App Development

- How To Develop An Employee Payroll App Like Hourly?

- Tech Stack To Consider To Develop An App Like Hourly

- Conclusion

- How Can We Help in Developing an Employee Payroll App Like Hourly

- FAQ

What is an Employee Payroll App Like Hourly?

An Employee Payroll App like Hourly is a digital tool designed to streamline the process of managing employee wages and related tasks for businesses that pay employees on an hourly basis.

The growth of such apps has been impressive, with many businesses adopting them to modernize their payroll systems. This adoption is driven by the need for better time tracking, reduced payroll errors, and compliance with labor laws. As a result, these apps have seen a steady increase in their user base, contributing to their revenue growth.

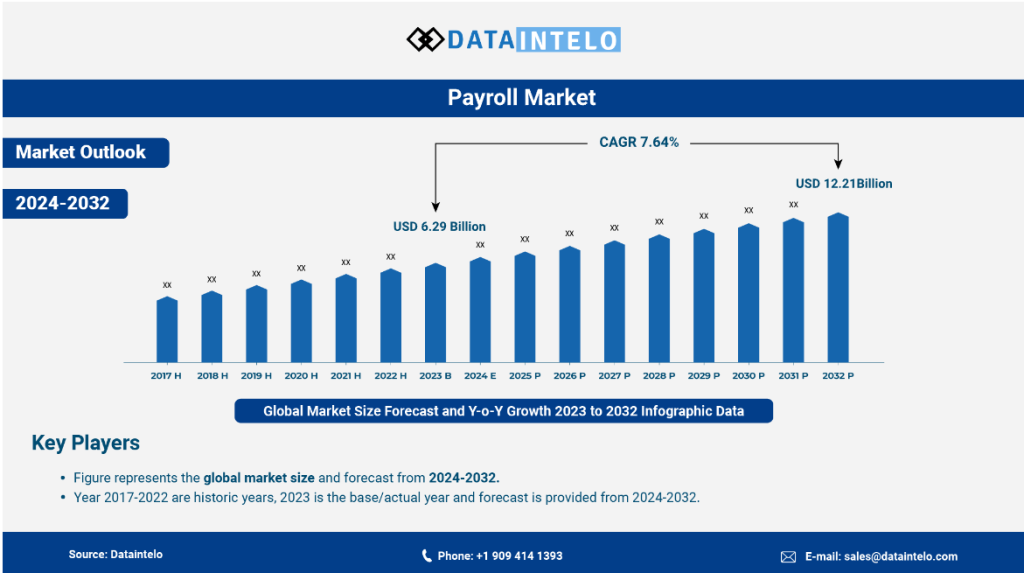

The growth rate of employee payroll apps is quite significant. The global payroll market size was valued at USD 6.29 Billion in 2023 and is projected to reach USD 12.21 Billion by 2032, expanding at a compound annual growth rate (CAGR) of 7.64% during the forecast period from 2024 to 2032. This growth is driven by the increasing demand for cloud payroll services across various industries. As businesses continue to recognize the efficiency and scalability that these apps provide, the market for employee payroll apps is expected to flourish.

How Does An Employee Payroll App, like an Hourly App, Work?

For businesses with hourly employees, tracking time worked can be tedious and error-prone. Hourly apps come to the rescue, offering a user-friendly platform to streamline time tracking, boosting employee productivity and payroll accuracy.

Here’s a breakdown of how an hourly app typically functions:

Registration and Setup

To begin using an hourly app, users must first download the app and create an account. This typically involves providing basic personal information, verifying identity, and setting up payment preferences.

Finding Tasks or Services

Once registered, users can browse through available tasks or services listed on the app’s platform. These tasks are often categorized based on type, location, and urgency, making it easier for users to find opportunities that match their skills or needs.

Bidding or Accepting Tasks

When users come across a task they’re interested in, they have the option to either bid on the task by proposing their hourly rate or directly accept the task if the rate is predetermined by the requester.

Completing Tasks and Payments

Once a task is assigned, the user can begin working on it according to the agreed-upon terms. Upon completion, both parties confirm the task’s fulfillment, and payment is processed through the app’s secure payment system.

Business Benefits Of Developing An Efficient Payroll System

A well-organized payroll system contributes significantly to a business’s overall success and stability, from ensuring accurate and timely payments to mitigating risks.

1. Enhanced Employee Satisfaction and Retention

A streamlined and efficient payroll system ensures that employees are paid accurately and on time, a fundamental aspect of job satisfaction. Timely and error-free payments contribute significantly to employee morale, reducing the likelihood of staff seeking alternative employment due to payment issues. By fostering a reliable payroll process, businesses can enhance employee retention and create a positive work environment.

2. Compliance and Risk Mitigation

An efficient payroll system helps businesses comply with tax regulations, reducing the risk of fines associated with underpayment or late payment of taxes.

Compliance with insurance premiums and 401(k) contributions is critical for avoiding policy cancellations and maintaining a favorable relationship with employees and regulatory authorities. A well-managed payroll system is a proactive measure to mitigate financial and legal risks.

3. Long-Term Adaptability

As businesses evolve, scalability and ease of management become crucial. Designing a payroll system that is user-friendly and easily transferable ensures long-term viability.

An efficient system should be intuitive, allowing seamless transitions when appointing payroll responsibilities to new personnel or outsourcing to a payroll processing firm. This adaptability ensures continuity and minimizes disruptions in payroll operations.

4. Strategic Tax Preparation and Reporting

A well-organized payroll system simplifies tax preparation by providing accurate and readily available data. Employers must withhold and pay various taxes, including the employee portion of FICA, income tax, and the employer portion of FICA.

A robust payroll system facilitates the generation of comprehensive reports, ensuring that tax obligations are met punctually. This strategic approach prevents last-minute hassles during tax season and contributes to financial planning and compliance.

Must-Have Features in a Payroll App Like Hourly

The app is designed to streamline business tasks effortlessly, from automated tax calculations to precise filings. Here are the features through which businesses can effortlessly manage hourly payroll, taxes, and filings:

User-Friendly Interface

One of the most important features of a payroll app is its user interface. It should be intuitive and easy to navigate, even for users with minimal technical expertise. A clean and organized layout makes it effortless to access different functions and perform tasks efficiently.

Accurate Time Tracking

Accurate time tracking is essential for calculating employee wages accurately. A payroll app should offer integration with time clock systems to automatically record hours worked. Additionally, it should allow manual time entry for situations where employees forget to clock in or out.

Customizable Payroll Settings

Every business has unique payroll requirements, and a good payroll app should accommodate this variability. It should offer customizable settings for payment frequencies, allowing businesses to pay employees weekly, bi-weekly, or monthly. Moreover, it should support various payment methods, including direct deposit, checks, and pay cards.

Tax Calculation and Filing

Tax compliance is a complex aspect of payroll management, and a reliable payroll app should simplify this process. It should automatically calculate taxes based on current tax rates and regulations. Furthermore, it should generate tax forms such as W-2s and 1099s and facilitate electronic filing to regulatory agencies.

Employee Self-Service Portal

Empowering employees to access their payroll information can reduce administrative overhead for HR departments. A payroll app should provide an employee self-service portal where staff can view their pay stubs, tax documents, and benefits information. Additionally, they should be able to request time off and update personal details directly through the portal.

Compliance and Security

Payroll data is sensitive information, and it’s imperative to ensure compliance with data protection laws. A payroll app should adhere to labor regulations and industry standards to safeguard employee information. This includes data encryption, secure servers, and regular security audits to identify and address vulnerabilities.

Integration with Accounting Software

For seamless financial management, a payroll app should integrate smoothly with accounting software such as QuickBooks or Xero. This integration allows for the automatic synchronization of payroll data with general ledger accounts, simplifying reconciliation and reporting processes.

Mobile Accessibility

In today’s mobile-centric world, employees and managers expect access to payroll information on the go. A payroll app should have a mobile app version compatible with iOS and Android devices. This enables employees to view their pay stubs, submit time-off requests, and approve payroll from anywhere with an internet connection.

Automated Reporting

Generating reports is a vital aspect of payroll administration, and a good payroll app should offer robust reporting capabilities. It should allow users to create customizable reports tailored to their specific needs. Additionally, it should support scheduled report generation, ensuring timely delivery of essential financial data.

Employee Onboarding Features

Streamlining the onboarding process is crucial for new hires, and a payroll app can facilitate this task. It should offer features such as digital document management, allowing new employees to complete tax forms and other paperwork online. This saves time and reduces paperwork for HR departments.

Notifications and Alerts

To avoid missing payroll deadlines and compliance requirements, a payroll app should provide notifications and alerts. Users should receive reminders for upcoming payroll runs, tax filing deadlines, and regulatory changes. This proactive approach helps businesses stay compliant and avoid penalties.

Customer Support

Responsive customer support is essential when using a payroll app, especially during implementation and troubleshooting. The app should offer multiple channels of support, including phone, email, and live chat. Additionally, comprehensive help resources such as FAQs and tutorials should be readily available.

Cost-Effective Pricing Plans

Cost is a significant factor when choosing a payroll app, and businesses should look for transparent pricing plans with no hidden fees. The app should offer scalable pricing options that align with the company’s size and budget. Moreover, it should provide value-added features without inflating costs unnecessarily.

Advanced Hourly Payroll App Features

With the following advanced Hourly Payroll app features, businesses can elevate their payroll management to new heights. Therefore, consider adding the same features to your employee payroll platform.

1. Payroll Reports

Efficient payroll management goes beyond processing payments; it involves insightful analysis and reporting. The advanced hourly app includes a robust feature allowing users to generate detailed payroll reports. These reports can be conveniently downloaded in Excel and PDF formats, providing a comprehensive overview of payroll data.

2. Integrated Pre-tax Benefits

Streamlining the payroll process, the advanced hourly app offers integrated pre-tax benefits management. This feature automatically deducts pre-tax benefits such as medical insurance and 401(k) contributions directly from the payroll.

3. Prevailing Wages Support

Users can easily configure the app to incorporate prevailing wages specific to a project. This ensures accurate and compliant payroll processing, addressing the unique needs of industries where prevailing wage rates play a crucial role in determining employee compensation.

4. Digital Signatures

Users can sign all necessary forms directly within the app using a digital signature, eliminating the need for physical paperwork. This feature not only enhances the efficiency of the payroll process but also contributes to a more sustainable and environmentally friendly workflow.

5. Email Payroll Reminders

Timely payroll processing is critical, and the advanced hourly app takes proactive measures to ensure that users never miss a payroll run. The app facilitates email payroll reminders, alerting administrators to upcoming payroll deadlines.

6. Collaboration

Recognizing the collaborative nature of payroll management, the advanced hourly app allows users to enhance teamwork. Administrators can add collaborators such as accountants, bookkeepers, or other team members to assist with payroll tasks.

Challenges In Payroll Management App Development

Payroll administration is challenging and time-consuming, and payroll managers can face various issues. The following are some of the most typical payroll management challenges:

1. Data Accuracy

Data accuracy is a critical concern in payroll administration. Payroll administrators must correctly enter and monitor employee data, including hours worked, pay rates, and deductions.

Even minor data entry errors might result in significant employee wage differences, potentially leading to unhappiness. Implementing strict data validation checks and automated data input systems might help solve this difficulty.

2. Compliance with Employment Law and Tax Legislation

Payroll administrators continually struggle to navigate the complicated environment of employment legislation and tax requirements. These laws are often changed, and failing to comply can result in legal implications and financial fines.

Staying current on legislative changes, hiring legal experts, and deploying compliance management technologies may all help ensure that the payroll system meets the most current legal requirements.

3. Managing Remote Employees

The rise in remote labor adds a new degree of complexity to payroll management. Tracking remote employees’ hours, verifying their location for tax purposes, and assuring appropriate compensation can be difficult.

Implementing time-tracking software, employing geolocation services, and setting explicit remote work standards can help overcome these obstacles and maintain equal payment procedures for both in-office and remote employees.

4. Timeliness

Payroll processing must be completed on time to ensure employee satisfaction and regulatory compliance. Larger organizations with complex payroll systems may find it more challenging to execute payroll effectively and on time.

Investing in effective payroll software, automation technologies, and having well-defined processes may all help to ensure that payroll is processed on time and without errors.

5. Security

Payroll data security is critical. Payroll administrators must develop robust security procedures to protect data from illegal access and potential abuse.

This includes encryption mechanisms, access controls, frequent security audits, and employee training on data security standards. Maintaining a proactive approach to cybersecurity is critical for preventing data breaches and protecting the confidentiality of payroll information.

How To Develop An Employee Payroll App Like Hourly?

Developing an employee payroll app like Hourly involves creating a user-centric solution to streamline payroll management. This section outlines key steps and considerations to embark on this development journey successfully.

Understanding the Need

Before embarking on the journey of app development, it’s crucial to conduct a thorough analysis of the existing payroll management systems. Identify the pain points, inefficiencies, and challenges faced by businesses in managing employee payroll. By understanding the needs of your target audience, you can tailor your app to address specific pain points and deliver tangible solutions.

Defining Your Objectives

Setting clear objectives is paramount to the success of any app development project. Determine the key features and functionalities you want your payroll app to offer. Whether it’s automating payroll processing, facilitating tax calculations, or providing real-time insights, articulate your goals to serve as a guiding framework throughout the development process.

Choosing the Right Technology Stack

Selecting the appropriate technology stack is instrumental in ensuring the scalability, performance, and security of your payroll application. Evaluate different programming languages, frameworks, and databases based on your project requirements and budget constraints. Additionally, consider factors such as ease of integration, maintenance overhead, and future scalability when making your technology choices.

Designing the User Experience

The user experience (UX) design plays a pivotal role in the success of any mobile application. Focus on creating an intuitive, user-friendly interface that simplifies the payroll management process for end-users. Incorporate features such as easy navigation, visual cues, and interactive elements to enhance usability and engagement.

Implementing Robust Security Measures

Security is non-negotiable when it comes to handling sensitive employee information and financial data. Implement robust encryption protocols, authentication mechanisms, and access controls to safeguard against cyber threats and data breaches. Prioritize data privacy and compliance with regulations such as GDPR and CCPA to build trust and credibility among users.

Testing and Quality Assurance

Thorough testing and quality assurance are imperative to iron out any bugs, glitches, or performance issues before deploying your payroll app. Conduct rigorous testing across various devices, platforms, and scenarios to validate functionality, performance, and compatibility. Solicit feedback from beta testers and iterate on your app based on their insights to deliver a seamless user experience.

Launching and Marketing Your Payroll App

The launch phase is a critical juncture in the lifecycle of your payroll app. Develop a comprehensive marketing strategy encompassing digital channels, social media platforms, and targeted advertising to generate buzz and drive user adoption. Leverage compelling content, testimonials, and case studies to showcase the value proposition of your app and differentiate it from competitors.

Continual Improvement

The journey doesn’t end with the launch of your payroll app; it’s an ongoing process of refinement and enhancement. Embrace an iterative development approach based on user feedback, market trends, and technological advancements. Continuously monitor app performance, gather user insights, and iterate on features to stay ahead of the curve and deliver maximum value to your users.

Tech Stack To Consider To Develop An App Like Hourly

To develop an employee payroll app like Hourly, you would need a combination of programming languages, frameworks, libraries, and tools. Here is a list of tech stacks commonly used in the development of web and mobile applications, including payroll apps:

1. Programming Languages

- JavaScript

- TypeScript

- Node.js

- Python

- Java

2. Front-End Frameworks

- React

- Angular

- Vue.js

3. Back-End Frameworks

- Express.js (Node.js)

- Django (Python)

- Spring (Java)

4. Database Management

- MongoDB

- MySQL

- Firebase

5. Authentication and Authorization

- Firebase Authentication

- OAuth 2.0

6. Server Hosting

- AWS

- Azure

- Google Cloud

- Heroku

7. Development Tools

- Visual Studio Code

- Atom

- Postman

- Swagger

8. APIs

- Payment APIs

- Geolocation APIs

9. Task Runners

- Webpack

- Gulp

10. Testing Frameworks

- Jest

- Mocha

- Postman

- Insomnia

11. Continuous Integration/Continuous Deployment (CI/CD)

- Jenkins

- Travis CI

12. Monitoring and Logging

- Elasticsearch

- Logstash

- Kibana

13. Collaboration and Communication

- Slack

- Microsoft Teams

- Jira

- Trello

14. Security Tools

- SSL Certificates

- Security Headers

Conclusion

A well-designed and strategically developed employee payroll app can revolutionize payroll processes, saving business time and resources while providing employees with a transparent and efficient payment experience.

Developing an employee payroll app like Hourly involves a systematic and strategic approach to ensure its success and effectiveness. Throughout the development process, it is crucial to prioritize user experience, data security, and compliance with relevant regulations.

How Can We Help in Developing an Employee Payroll App Like Hourly

We’d love to hear from you! Contact Idea Usher today for a free consultation. Our expert team will discuss your vision and answer any questions you may have. Together, we can build a groundbreaking employee payroll app that will revolutionize your businesses.

FAQ

Q. How do you develop an employee payroll application?

A. To develop an employee payroll application, follow a systematic approach involving planning, design, development, testing, and deployment. Utilize a technology stack that aligns with the application’s requirements, ensuring compliance with legal regulations and prioritizing data security.

Q. What key features should an employee payroll app like Hourly include?

A. An effective payroll app should incorporate features such as time tracking, tax calculations, benefits management, reporting tools, and user-friendly interfaces for administrators and employees.

Q. What are the challenges in payroll management app development?

A. Data accuracy, compliance with employment law and tax legislation, managing remote employees, timeliness, and security are some of the challenges in payroll management app development.

Gaurav Patil