The future of banking is digital.

Traditional brick-and-mortar banks are now accessible at the click of a button. More and more people are using online and mobile banking services because it’s more convenient, faster, and secure than traditional banking.

As the demand for digital banking grows, so does the need for banking software development. It is the backbone of digital banking that powers online banking websites and mobile banking apps.

In this guide, we will delve deep into the intricacies of banking software development, exploring its types, the future of the digital banking industry, and the step-by-step process of bringing a banking software idea to life. Finally, we will discuss some of the challenges and best practices for banking software development.

Without any further ado, let’s begin.

What is Banking Software?

Banking software is the foundation of modern financial institutions. It powers the systems that allow us to make transactions, keep our data safe, and enjoy convenient banking experiences. It includes various software applications carefully designed to improve how we interact with our money.

At its heart, banking software combines technologies that drive digital finance. It consists of strong systems, smart algorithms, and user-friendly interfaces that work together to transform how banks operate and shape the future of the financial world.

Exploring the Future of the Digital Banking Industry

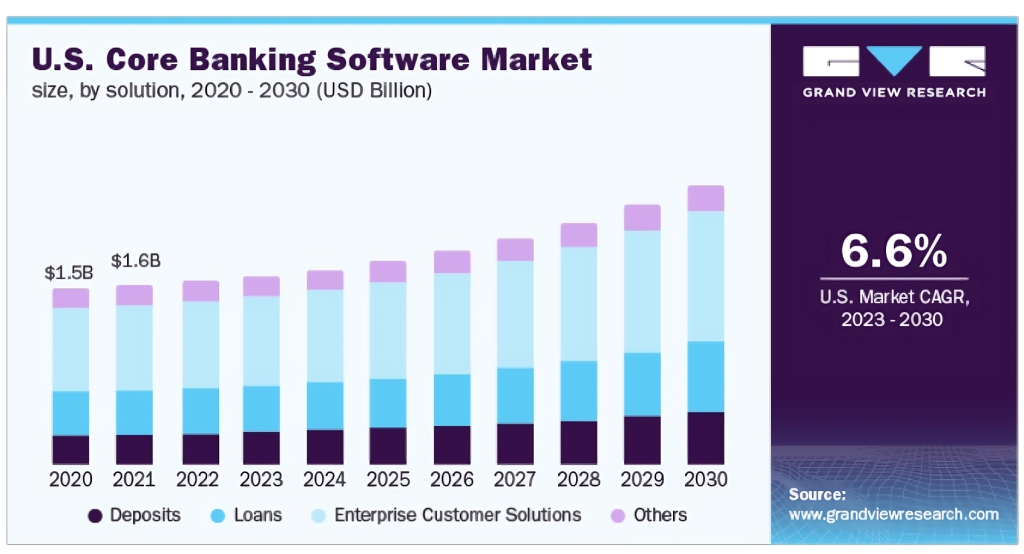

The Asia-Pacific core banking software market is expected to grow significantly in the coming years. The market was valued at USD 3.16 billion in 2022 and is projected to reach USD 12.2 billion by 2031, with a compound annual growth rate (CAGR) of 16.2%.

Among the various kinds of banking software, the cloud-based banking software market is expected to grow from USD 4.4 billion in 2022 to USD 14.3 billion by 2030, at a CAGR of 12.5%. Temenos, Oracle, Fiserv, SAP, and Infosys are the top five banking software makers in the industry.

The future of digital banking is full of promise. As technology advances, the banking industry will become more efficient, convenient, and personalized.

Types of Banking Software

Various types of software play pivotal roles in streamlining operations and delivering seamless financial services. Let’s explore the key types of banking software that empower institutions to better serve their customers:

1. Core Banking Software

At the heart of a bank’s operations, core banking software manages essential functions such as account management, deposits, loans, and transaction processing. It provides a centralized platform for seamless financial operations and customer management.

2. Mobile Banking Applications

With the rise of smartphones, mobile banking applications have become indispensable tools for customers to access their accounts, make payments, transfer funds, and perform other banking activities conveniently on their mobile devices.

3. Online Banking Systems

Online banking systems enable customers to access their accounts and perform various transactions through web-based interfaces. They offer features such as balance inquiries, fund transfers, bill payments, and account statements, providing users with convenient and secure access to their finances.

4. Payment Processing Software

Payment processing software facilitates the secure and efficient processing of transactions, enabling businesses to accept customer payments through multiple channels, such as credit cards, debit cards, and electronic transfers. It ensures smooth and reliable payment handling, enhancing the overall customer experience.

5. Risk and Compliance Solutions

Risk and compliance software plays a crucial role in mitigating financial risks and ensuring adherence to regulatory requirements. It helps banks monitor transactions, detect fraudulent activities, manage compliance with laws and regulations, and maintain data security, fostering trust and integrity within the banking ecosystem.

These are just a few of the many different banking software available. Other types include Wealth Management software, Loan Origination software, Customer Relationship Management (CRM) software, and Anti-Money Laundering software solutions.

End-to-End Banking Software Development Guide

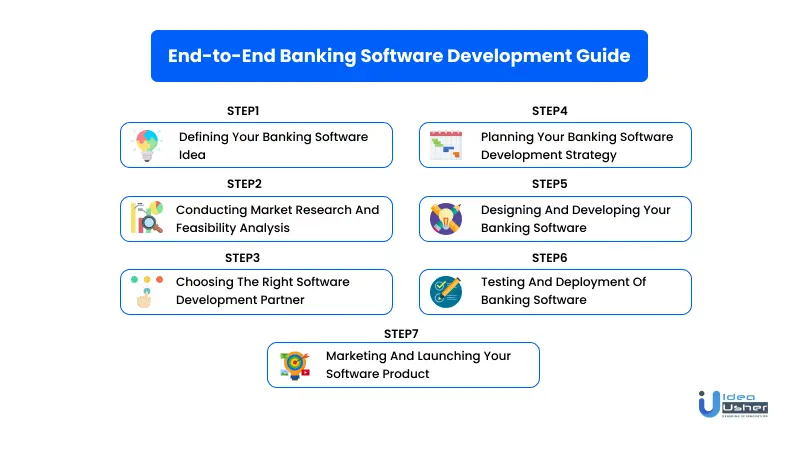

Now that we have an idea of the various types of banking software that exist, here’s a step-by-step guide to how you can actually develop a banking software:

Step I. Defining Your Banking Software Idea

The first step in developing a banking software product is to define the problem you want to solve. What are the pain points that your target customers are experiencing? What are their unmet needs?

Once you have a good understanding of the problem, you can start to brainstorm solutions. What kind of software product could you develop that would address these pain points? What features would it need to have?

It’s important to come up with a unique and innovative solution. There are already many banking software products on the market, so you need to find a way to differentiate your product.

One way to do this is to focus on a specific niche. For example, you could develop a software product that helps businesses manage their finances. Or, you could develop a software product that helps people with poor credit histories get loans.

Another way to differentiate your product is to use cutting-edge technology. For example, you could develop a software product that uses artificial intelligence to help people make better financial decisions.

Once you have a good idea for your banking software product, you need to do some market research to see if there is a demand for it. You can use SWOT analysis to help you assess your product’s strengths, weaknesses, opportunities, and threats.

Step II. Conducting Market Research and Feasibility Analysis

Market research and feasibility analysis are essential in developing a successful banking software product.

i) Economic factors

- Market size: How big is the market for your product?

- Competition: Who are your competitors? What are their strengths and weaknesses?

- Pricing: What will you charge for your product?

- Customer demand: Is there a demand for your product?

ii) Technical considerations

- Technology: What technology will you use to develop your product?

- Security: How will you protect customer data?

- Scalability: Can your product be scaled to meet demand?

- Maintenance: How will you maintain and support your product?

iii) Establishing a realistic timeline

- How long will it take to develop your product?

- How long will it take to market and launch your product?

- How long will it take to generate revenue from your product?

iv) Operational requirements

- Infrastructure: What infrastructure will you need to support your product?

- Staffing: How many people will you need to staff your product?

- Training: How will you train your staff on your product?

By considering all of these factors, you can increase your chances of developing a successful banking software product.

Step III. Choosing the Right Software Development Partner

When choosing the right software development partner for your banking software project, it’s essential to find a team with the necessary skills and expertise to bring your vision to life. Consider the following key factors:

i) Essential Skills and Expertise

Look for a partner with a proven track record in banking software development. They should deeply understand financial systems, industry regulations, and customer expectations, ensuring they can deliver solutions tailored to your specific needs.

ii) Crafting Engaging Web Applications

Collaborate with developers who excel in crafting intuitive web applications. They should be adept at creating user-friendly interfaces and seamless navigation, enhancing the overall user experience for both customers and bank employees.

iii) Creative Front-end Development

Seek experts in front-end development who can breathe life into your banking software’s visual elements. They should possess an eye for design, ensuring a modern and visually appealing interface that captivates users.

iv) Powerful Back-end Development

Partner with professionals who possess strong back-end development skills. They should excel in building robust and scalable systems that handle complex data processing, transactions, and integrations with third-party services, enabling seamless operations.

v) Master Mobile App Development

Choose a team that excels in mobile app development, crafting feature-rich applications for iOS and Android platforms. They should be proficient in creating responsive designs and optimizing performance for a seamless mobile banking experience.

vi) Security as a Top Priority

Ensure your software development partner prioritizes secure software development practices. They should be well-versed in implementing encryption, authentication mechanisms, and data protection measures to safeguard sensitive financial information.

vii) Harnessing the Power of Cloud Computing

Collaborate with experts in cloud computing to leverage its benefits for your banking software. They should have experience developing cloud-native solutions, enabling scalability, flexibility, and efficient resource utilization.

viii) Embracing Artificial Intelligence

Seek out developers who understand the potential of artificial intelligence (AI) in banking. They should be capable of integrating AI technologies like chatbots, predictive analytics, and fraud detection systems to enhance customer service, risk management, and operational efficiency.

ix) Robust Blockchain Development

Consider partners with expertise in blockchain technology. They can assist in integrating distributed ledger systems, enhancing security, transparency, and efficiency in areas such as payments, identity verification, and smart contracts.

By carefully selecting a software development partner with the right mix of skills and expertise, you can embark on a collaborative journey to create innovative banking software that sets you apart in the industry.

Idea Usher has years of experience in developing robust banking solutions for clients from all over the world. Contact us for your banking software development needs.

Step IV. Planning Your Banking Software Development Strategy

Several different SDLC (software development life cycle) strategies can be used to develop banking software.

Agile is a popular SDLC strategy for banking software development. Agile is iterative and incremental, meaning the development process is broken down into smaller, more manageable phases. This allows for more flexibility and adaptability, which is important in the ever-changing banking industry.

Two different agile frameworks are mainly used.

i) Scrum

Scrum characterizes short sprints, daily stand-ups, and retrospectives. This framework helps to keep the development process focused and efficient.

ii) Kanban

Kanban is another agile framework that is a visual way of managing work, and it helps to ensure that work is prioritized and that the development process is not overloaded.

Ultimately, the best way to choose the right SDLC strategy is to talk to your team and stakeholders and consider the specific needs of your project.

Step V. Designing and Developing Your Banking Software

Designing and developing your banking software requires careful planning and execution. Follow the steps below to create a solution that meets the needs of your users:

i) User-centric UI/UX

Ensure a seamless user experience, and prioritize user-centric design principles. Conduct thorough research, create intuitive interfaces, and focus on usability. Technologies like Adobe XD, Sketch, or Figma can aid in creating interactive prototypes and visual designs.

ii) Front-end Development

For the front-end, use technologies like HTML5, CSS3, and JavaScript frameworks (such as React.js or Angular) to build responsive, intuitive, and visually appealing UI.

iii) Back-end Development

The backbone of your banking software lies in the back-end development. Leverage Java, Python, or .NET for robust server-side logic and database management. Frameworks like Spring Boot or Django can expedite development, ensuring scalability and security.

iv) Mobile Application Development

Extend your banking software’s reach by developing mobile applications. For iOS, consider using Swift with the SwiftUI framework, while for Android, Kotlin with the Android Jetpack can deliver native, feature-rich experiences. Technologies like React Native or Flutter offer cross-platform development options.

v) Security Compliance

Banking software requires stringent security measures. Implement technologies like encryption algorithms (AES, RSA), secure authentication protocols (OAuth, OpenID Connect), and security frameworks (such as OWASP) to safeguard user data and protect against cyber threats.

vi) Database Management

Embrace scalable and flexible database management through cloud computing. Leverage platforms like Amazon Web Services (AWS) or Microsoft Azure for reliable hosting, data storage, and serverless computing. Containers and orchestration tools like Docker and Kubernetes can streamline deployment and management.

vii) Additionals

For additional tech inclusion, explore technologies like machine learning libraries (TensorFlow, PyTorch) for fraud detection, natural language processing (NLP) for chatbots and voice assistants, and predictive analytics for personalized financial recommendations.

Integrating blockchain can better aid in secure and transparent transactions. Technologies like Ethereum or Hyperledger provide frameworks for building decentralized applications (dApps) and smart contracts, enabling enhanced trust and traceability.

Step VI. Testing and Deployment of Banking Software

Once finished with development, test and deploy your banking software to ensure its functionality, security, and reliability.

Types of testing include unit testing, integration testing, system testing, and user acceptance testing.

As for deployment options, you can choose on-premises deployment for more control, cloud deployment for cost-effectiveness and scalability, and hybrid deployment for a combination of both.

Utilize test automation frameworks, implement a CI/CD pipeline for streamlined deployment, secure the deployment environment, and monitor the software post-deployment to ensure optimal performance.

Follow these steps and best practices for successfully testing and deploying your banking software.

Step VII. Marketing and Launching Your Software Product

Once you have developed and deployed your banking software, it is time to start marketing it.

There are a number of different ways to market your banking software product, including:

- Online marketing: Online marketing includes search engine optimization (SEO), pay-per-click (PPC) advertising, and social media marketing.

- Offline marketing: Offline marketing includes print advertising, direct mail, and trade shows.

- Word-of-mouth marketing: Word-of-mouth marketing is getting people to talk about your product to their friends and colleagues.

Here are a few additional tips that will help you tailor your launching your product’s marketing strategy:

- Start early: Start marketing your product early to build awareness and generate interest.

- Set realistic expectations: Don’t expect your product to be an overnight success. It takes time to build a successful product.

- Be patient: Don’t give up if you don’t see results immediately. Keep marketing your product, and eventually, you will start to see traction.

By following these tips, you can increase your chances of successfully marketing and launching your banking software product.

Challenges and Best Practices Related to Banking Software Development

With all said and done, various factors could hinder your banking software development process. Here are some common challenges and recommended best practices:

1. Security and Compliance:

Challenge: Ensuring robust security measures to protect sensitive customer data and comply with industry regulations.

Best Practices: Implement strong encryption, secure authentication mechanisms, and regular security audits. Stay updated with regulatory guidelines such as GDPR, PCI DSS, etc.

2. Scalability and Performance:

Challenge: Building software that can handle increasing transaction volumes and user demands without compromising performance.

Best Practices: Employ scalable architecture, utilize caching mechanisms, optimize database queries, and conduct load testing to identify and resolve performance bottlenecks.

3. Integration with Legacy Systems:

Challenge: Integrating new banking software with existing legacy systems, which may have outdated technology or lack proper documentation.

Best Practices: Conduct a thorough analysis of existing systems, use standardized protocols (e.g., REST, SOAP), and consider adopting middleware or API management platforms to facilitate integration.

4. User Experience (UX) and Interface Design:

Challenge: Creating intuitive, user-friendly interfaces that cater to diverse user needs while ensuring security and compliance.

Best Practices: Conduct user research and testing, adopt user-centric design principles, leverage responsive design for multi-device support, and prioritize accessibility standards.

5. Continuous Testing and Deployment:

Challenge: Maintaining a seamless and efficient testing and deployment process to ensure software reliability and minimize downtime.

Best Practices: Adopt agile development methodologies, automate testing processes, implement continuous integration and delivery (CI/CD) pipelines, and establish proper version control practices.

6. Collaboration and Communication:

Challenge: Facilitating effective collaboration among development teams, stakeholders, and business users throughout the software development lifecycle.

Best Practices: Utilize collaborative tools, conduct regular meetings and status updates, promote clear and transparent communication channels, and foster a culture of teamwork.

7. Regular Updates and Maintenance:

Challenge: Keeping banking software up-to-date with the latest technologies, security patches, and bug fixes.

Best Practices: Establish a structured maintenance process, monitor industry trends, conduct regular code reviews, and allocate resources for ongoing updates and improvements.

Remember that these challenges are not exhaustive and may vary according to your unique considerations. It is hence crucial to conduct a comprehensive analysis, consider your project’s intricacies, and adapt best practices accordingly.

Conclusion

Developing state-of-the-art banking software could potentially revolutionize the entire financial industry. A pinnacle banking software can help improve operational efficiency, improve customer service, and drive innovation. But having a comprehensive layout of the exact purpose of your software is necessary before delving into the development process.

Idea Usher is a great development partner for banking software development. They have a proven track record, a dedicated team of experts, and a commitment to delivering exceptional solutions. With our deep understanding of the banking industry and the latest technologies, we can help you precisely design, develop, and deploy banking software efficiently.

Looking for a development partner to revolutionize the financial landscape with banking software?

Contact Idea Usher Today!

Get in touch with us now!

FAQs

Q) What is software development in banking?

A) Software development in banking is the process of creating and maintaining software used by banks to manage their operations. This software can include a wide range of applications, such as core banking, treasury management, customer relationship management (CRM), and others.

Q) Which software is used in banking?

A) There are a wide variety of software used in banking, but some of the most common include:

- Core Banking Systems: These systems handle essential banking functions such as customer information management, account management, transaction processing, and reporting.

- Online Banking Platforms: Software that enables customers to access and manage their bank accounts, make transactions, view balances, pay bills, and perform other banking activities through web-based interfaces.

- Mobile Banking Applications: Mobile apps that allow customers to perform banking tasks using their smartphones or tablets, including account access, funds transfers, mobile deposits, and bill payments.

- Payment Processing Software: Applications that facilitate secure and efficient processing of financial transactions, including credit card payments, electronic fund transfers, and automated clearinghouse (ACH) transactions.

- Risk Management Software: Solutions that assist banks in monitoring and managing financial risks, including credit risk assessment, fraud detection, and regulatory compliance.

Q) How to create a bank software?

A) Creating a bank software can be a complex and challenging process. However, there are a few key steps that you can follow:

- Defining your requirements. What features do you need your software to have? What are your security and compliance requirements?

- Selecting a development partner. A good development partner will have the experience and expertise to help you create a successful software product.

- Designing and developing your software. Work with your development partner to create a detailed plan and then implement it.

- Testing and deploying your software. Thoroughly test your software to ensure that it is working as expected. Deploy it to production so that your customers can use it.

- Maintaining your software. Fix bugs, add new features, and update your software to keep it secure and compliant.

Q) Can Idea Usher develop a banking software for me?

A) Yes, Idea Usher can develop a banking software for you. We have the experience, expertise, and resources to help you create a successful software product. We understand the banking industry and the latest technologies, and we can work with you to understand your specific requirements and create a tailored solution that meets your needs.

Sayan Chakraborty