- FinTech Market Overview

- What Is Financial Software Development?

- Why Investing In Financial Software Development Solutions Is Profitable?

- Innovative FinTech Startup Ideas

- Must have Features for A Successful Financial Software

- Essential Technologies To Consider For Developing Financial Software

- How To Develop Financial Software?

- Cost-Affecting Factors To Consider Before Developing A Financial Software

- Regulatory Compliance Requirements For Businesses In The FinTech Sector

- Challenges In Custom Financial Software Development

- FinTech Trends That Will Revolutionize The Industry

- Considerations Before Hiring A Financial Software Application Development Company

- Conclusion

- How Idea Usher Can Assist With Your FinTech Project?

- FAQ

Navigating the complexities of the financial industry has become more manageable with the advent of innovative solutions.

Financial software development comprises tools, including advanced analytics and accounting systems, designed to address diverse user needs. It combines financial services and technology and is characterized by an architecture prioritizing a digital-first approach. The industry is rapidly expanding, with an increase in enterprises capitalizing on its promises and benefits.

For those seeking to enter into the FinTech industry, this guide aims to provide a comprehensive understanding of essential aspects and strategies for success in developing and establishing a robust FinTech business model.

- FinTech Market Overview

- What Is Financial Software Development?

- Why Investing In Financial Software Development Solutions Is Profitable?

- Innovative FinTech Startup Ideas

- Must have Features for A Successful Financial Software

- Essential Technologies To Consider For Developing Financial Software

- How To Develop Financial Software?

- Cost-Affecting Factors To Consider Before Developing A Financial Software

- Regulatory Compliance Requirements For Businesses In The FinTech Sector

- Challenges In Custom Financial Software Development

- FinTech Trends That Will Revolutionize The Industry

- Considerations Before Hiring A Financial Software Application Development Company

- Conclusion

- How Idea Usher Can Assist With Your FinTech Project?

- FAQ

FinTech Market Overview

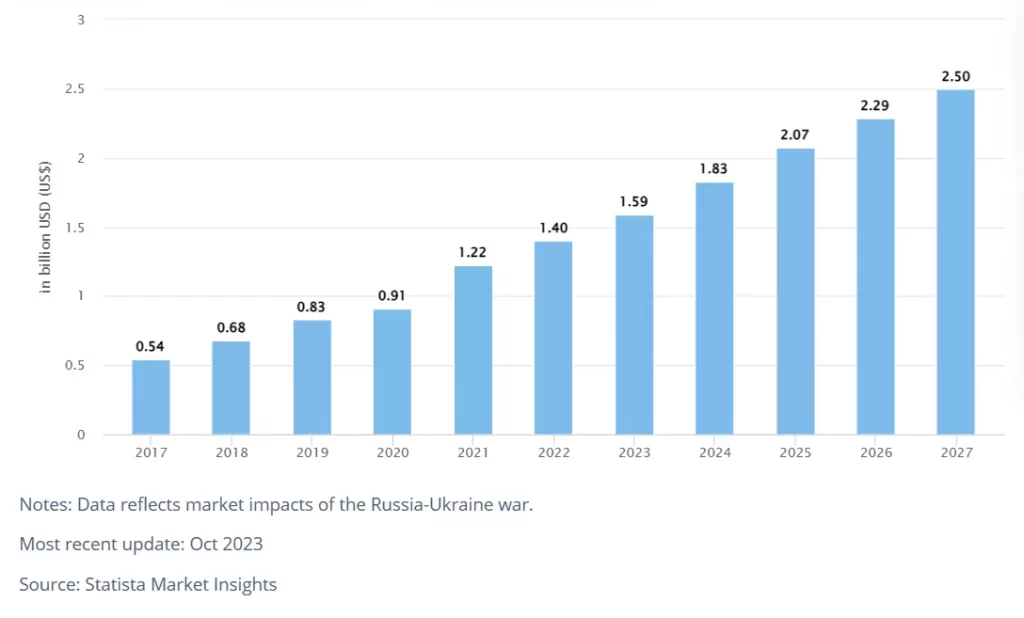

Source: Statista

The expansion of this market is primarily attributed to the pervasive adoption of digital platforms, leading to a considerable impact on its overall size. Users increasingly favor digital solutions, such as mobile apps and online banking, as efficient alternatives to traditional, in-person banking activities.

A booming FinTech sector indicates a profitable business potential by proving rising demand for new financial solutions. The expansion suggests a market ready for innovations, creating a perfect environment for entrepreneurs to capitalize on developing financial technology trends.

As the FinTech industry grows, there is plenty of opportunity for businesses to grow by providing solutions that match the changing requirements of a dynamic and technologically adept customer base.

What Is Financial Software Development?

Financial software development involves creating various tools and programs for banking, stock trading, and everyday financial activities. This field is broad, covering everything from simple budgeting apps to complex trading systems. The goal of financial software is to make financial institutions and businesses more efficient, help them make better decisions, and ultimately increase their profits. Financial technology is rapidly growing and includes many different types of applications.

Here’s how financial software helps achieve its goals:

- Efficiency: Repetitive tasks become automated, freeing up human resources for more complex work. Imagine not having to manually calculate your monthly budget – an app can do that for you!

- Better Decisions: Financial software provides powerful analytics and insights. Businesses can analyze their spending patterns, banks can assess loan risks, and investors can track market trends. This data helps everyone make informed choices.

- Increased Profits: By saving time and resources and enabling better decision-making, financial software ultimately helps businesses and institutions become more profitable.

Why Investing In Financial Software Development Solutions Is Profitable?

There are several reasons why investing in customized financial software application development is a beneficial option for businesses. Let us make a list of them.

1. Digitalization of Currency

The continuous digitization of currency, particularly among Gen Z and millennial groups, marks a huge paradigm change with profound implications for the FinTech sector. FinTech businesses hope to gain from this transformational trend as physical currency transactions decline in favor of digital alternatives.

The rising use of digital transactions not only reflects shifting customer tastes but also opens up new opportunities for financial technology solutions. This change emphasizes the significance of investing in robust financial software development capable of meeting the changing demands of a digitally driven financial world.

2. Extensive Mobile Application Landscape

The role of mobile applications in driving the expansion of the FinTech industry cannot be overstated. Both modern FinTech startups and traditional banks have effectively leveraged the power of mobile apps to broaden their market reach and enhance customer services.

Mobile applications have become integral to financial interactions, functioning as a digital wallet where users manage their money and conduct various transactions. Investments in cutting-edge financial software development are imperative to capitalize on this trend. Ensuring seamless, secure, and user-friendly mobile applications will be pivotal for FinTech firms aiming to stay competitive in an increasingly mobile-centric financial ecosystem.

3. Reduced Dependence on Physical Banking Visits

A noticeable trend in consumer behavior is the decreasing reliance on traditional banking systems, with customers increasingly favoring neobanks and FinTech solutions. This shift creates a unique opportunity for FinTech firms to diversify their service offerings beyond the conventional banking spectrum.

By investing in custom financial software development, these companies can provide innovative solutions, including streamlined credit and stock investment services. This strategic move aligns with the changing preferences of consumers seeking convenient and flexible financial solutions outside the confines of traditional brick-and-mortar banking.

4. Enhanced Potential for Innovation

The FinTech sector, with its dynamic landscape and growing customer requirements, offers an ideal environment for innovation. While new enterprises are emerging to solve long-standing issues, the industry remains an ideal environment for creative ideas and innovative technologies.

The surprising surge of virtual currencies over traditional fiat money shows FinTech’s endless potential for innovation. To remain competitive, FinTech firms must promote a culture of constant innovation and invest in financial software development that adapts to evolving trends, ensuring they are well-positioned to pioneer the next wave of breakthrough financial solutions.

Innovative FinTech Startup Ideas

Understanding the model with which you are making your entry is an important component of being a leader in the FinTech market. There are various FinTech models to consider when beginning your firm, and it wouldn’t be surprising if several more emerge by the end of the year.

1. Banking

FinTech addresses inefficiencies, lack of flexibility, and limited accessibility in traditional banking institutions. Utilizing customer-centric tools such as app-based money transfers, neo-banking debit and credit cards, and microcredits, FinTech offers diverse banking solutions.

Powered by APIs, FinTech companies bridge the gap between traditional banks and modern app development firms, facilitating real-time access to the data and information customers need.

2. Investment

Investments play a crucial role in the financial landscape, with a growing trend among Gen Z and millennials diversifying portfolios across equity, debt, gold, and virtual currencies. FinTech applications like Coinbase and Robinhood cater to this trend, providing opportunities for startups to enhance investment platforms with features such as in-app wallets, AI-based automatic fund allocation, and goal-specific segregation within the app.

3. Insurtech

Emerging InsurTech firms offer customers benefits such as low premiums, extended repayment periods, expedited fund disbursement, and automated claim processing, making insurance more accessible to a broader demographic. FinTech companies are expanding into new insurance categories, including pet insurance, insurance for blue-collar workers, car insurance, and sachet insurance.

4. Virtual Currency-Driven Platforms

Virtual currency, particularly cryptocurrency, is increasingly considered the future fiat currency. FinTech startups can explore various models, including cryptocurrency development, crypto exchanges, and metaverse-focused cryptocurrencies.

Establishing cryptocurrency exchanges provides a platform for users to buy, sell, and trade various digital assets. Startups can focus on developing user-friendly interfaces, robust security measures, and advanced trading features to attract users. Offering a diverse range of cryptocurrencies for trading enhances the exchange’s appeal.

5. Payments

Payment solutions remain a preferred FinTech model, offering businesses the convenience of making payments, generating invoices, and monitoring upcoming payments. Continuous innovation is encouraged within this sector, addressing everyday challenges like splitting expenses with friends and facilitating international money transfers.

Focusing on user experience, FinTech startups can introduce features such as intuitive and personalized payment interfaces, ensuring a seamless and user-friendly transaction process.

6. Lending

The credit industry undergoes a significant transformation with the advent of financial software and solutions. Some firms provide streamlined credit facilities with minimal paperwork, while others leverage artificial intelligence for borrower analysis, approval, and loan disbursement within 24 hours.

The peer-to-peer lending model has gained prominence, allowing platform users to receive loan support from other users or the platform’s parent company (examples include Zopa and Lendable).

Must have Features for A Successful Financial Software

Financial software is a crowded space, so it’s crucial to have features that grab attention and keep users engaged. Here’s a breakdown of essential features, advanced features, and those that can truly set you apart:

Security

Financial software thrives on user trust. Prioritize industry-leading encryption standards and multi-factor authentication to safeguard sensitive financial data. Be transparent about your commitment to regular security updates, and consider offering reports that detail your security approach. This builds user confidence and sets your software apart.

Effortless Usability

An inclusive and user-friendly interface is key to attracting a broad audience. Design your software with clear navigation, well-defined menus, and logical workflows. Explain complex financial concepts within the software and offer multiple learning resources like tutorials and interactive guides. Streamline data entry with features like auto-complete and mobile compatibility.

Core Functionalities

Every financial software has a core function, but exceeding expectations can be a game-changer. Budgeting apps can offer intelligent expense categorization and gamified goal tracking for a more engaging experience. Banking apps can provide real-time transaction monitoring, location-based bill reminders, and integrated fraud detection for ultimate convenience. Accounting software can go beyond data entry by automating tasks, offering insightful reports, and integrating with business management tools for streamlined workflows.

Automation

Repetitive tasks will become a thing of the past with automation features. Automated expense categorization saves time by intelligently sorting transactions based on spending habits, and automatic investment deposits help users stay on track with their long-term financial goals.

Integration

Financial data often resides in scattered locations. Seamless integration with other financial tools like bank accounts, credit cards, or investment platforms allows users to see a holistic view of their finances in one place. This eliminates the need to manually log in to multiple platforms and juggle different sets of data, providing a unified financial picture for informed decision-making.

Personalization

A one-size-fits-all approach doesn’t work for finances. Customization features empower users to personalize their experience. This could involve creating custom budgeting categories that align with their specific spending habits, setting personalized financial goals based on their unique needs, or customizing dashboards to display the most relevant financial information at a glance.

Advanced Analytics

Basic reports are a good starting point, but advanced analytics provide deeper insights. Features like trend analysis can help users identify spending patterns and areas for potential savings. Budgeting forecasts allow users to predict future financial needs and make informed adjustments to their plans. For investment-focused software, advanced analytics can track investment performance and help users make data-driven investment decisions.

AI-powered Intelligence

Go beyond basic budgeting tools. Leverage artificial intelligence (AI) to provide personalized financial advice. Imagine AI analyzing spending habits to identify potential leaks or predict future financial trends. This allows users to make informed decisions and achieve their financial goals with the help of AI-powered insights.

Financial Wellness Tools

Financial health is more than just numbers. Integrate features that promote financial wellness. This could include credit score monitoring to help users track their creditworthiness and identify areas for improvement. Debt repayment plans can help users develop a personalized strategy to manage outstanding debts. Educational resources on financial literacy empower users to make informed financial decisions throughout their lives.

Gamification

Managing finances shouldn’t feel like a chore. Add gamification elements to make the process engaging. Imagine earning badges for reaching savings goals or receiving rewards for consistent budgeting. Challenges can add a competitive element, motivating users to stay updated with their financial plans. By injecting elements of fun, gamification can make financial management a more positive and engaging experience.

Niche Focus

Don’t try to be a jack-of-all-trades. Identify a specific user group with unique financial challenges and tailor features to address their needs. Software designed for freelancers might offer features for managing project income and expenses, while software for small businesses could focus on streamlining payroll and invoicing. Financial software for families could integrate features for budgeting for childcare or college savings plans. By focusing on a specific niche market, you can create a more targeted and valuable user experience

Essential Technologies To Consider For Developing Financial Software

The core of finance software development is technological innovation, which will continue developing new business models for the sector.

1. Artificial Intelligence (AI)

In the realm of financial software development, Artificial Intelligence (AI) emerges as a transformative force. The synergy between AI and the data-intensive nature of the financial sector is evident in its applications. AI facilitates fraud detection, advanced analytics, and predictive modeling, empowering businesses to navigate the intricate finance landscape.

From front-end customer interactions to back-office processes, AI streamlines operations, enhance accuracy, and boost efficiency.

2. Blockchain

Blockchain technology is ushering in a new era for FinTech, offering solutions to age-old challenges in the financial sector. Through applications like Distributed Ledger Technology, Crypto Exchanges, Non-Fungible Tokens (NFTs), Decentralized Finance (DeFi), and Know Your Customer (KYC), blockchain introduces immutability and speed to financial transactions.

The transformative potential of blockchain is amplified in its role as a core banking solution, allowing functionalities like wire transactions with crypto, buying and selling of cryptocurrencies, wallet recharges, and payments using popular digital currencies like Bitcoin and Ethereum.

3. Cloud Computing

The benefits of cloud computing in the financial sector are extensive, encompassing improved security, reduced infrastructure costs, real-time access to software, and the facilitation of usage-based payments.

As financial institutions seek to optimize their operations, cloud-powered financial services software development emerges as a strategic imperative. This not only enables the launch of new businesses but also enhances market responsiveness, customer engagement, and scalability, positioning cloud computing as a driving force in the evolution of FinTech.

4. Big Data Analytics

Implementing robust big data analytics in financial software involves the utilization of advanced algorithms and machine learning models. These technologies enable the identification of hidden correlations, risk factors, and emerging opportunities, contributing to more accurate predictions and proactive risk management.

Additionally, real-time data processing capabilities ensure that financial professionals have access to up-to-the-minute information, facilitating quicker and more informed decision-making.

How To Develop Financial Software?

Developing financial software requires a keen business perspective to ensure it meets market needs, complies with regulations, and contributes to your overall strategy. Here’s a breakdown of the key steps:

Understanding Your Business Landscape

The first step is to define your business goals and target market clearly. Who are you building this software for? What specific needs will it address? Researching industry regulations early on is crucial to avoid roadblocks and ensure your software operates within legal boundaries. Aligning the software with your overarching business goals, whether it’s generating revenue, increasing customer engagement, or improving existing financial products, is essential for long-term success.

Prioritizing User Experience

Financial software should empower users, not intimidate them. Invest in a user-friendly design that is clear, easy to navigate, and caters to users with varying technical backgrounds. Security is paramount, so implement robust measures like data encryption and multi-factor authentication to build user trust and safeguard their financial information. Ultimately, your software’s value proposition hinges on solving a specific problem for your target market. Ensure the features directly address their financial needs and goals.

Building a Minimum Viable Product (MVP)

Start by focusing on building the core functionalities that provide the most value to your target market. Don’t try to be everything at once. Prioritize security by integrating these measures from the very beginning to avoid costly rework later. The MVP serves as a springboard to validate your assumptions and gather user feedback. Use this feedback to refine your offering before investing in extensive development.

Integration and Partnerships

Consider partnering with various financial institutions and payment processors to enable functionalities like account management, real-time transactions, and secure data exchange. Ensure your software adheres to standardized protocols like APIs to connect with external systems seamlessly, promoting flexibility and future adaptability. Remember that integrating with third-party systems may introduce new regulatory considerations, so ensure compliance is maintained throughout the process.

Launch, Monitor, and Maintain

Plan your launch strategy carefully, considering the target audience, marketing channels, and pricing models. Actively solicit user feedback after launch to identify areas for improvement, prioritize future features, and address usability issues. The financial software landscape is constantly evolving, so commit to ongoing maintenance and updates. This includes addressing security vulnerabilities, incorporating new features as per user feedback and market trends, and adapting to changing regulations.

Cost-Affecting Factors To Consider Before Developing A Financial Software

It is crucial to consider various factors that can significantly impact the overall cost of the project. Understanding these cost-affecting factors ensures a comprehensive approach to financial software development.

1. Feature Complexity

The intricacy of features and functionalities within the financial software significantly impacts development costs. Advanced capabilities such as real-time analytics, AI integration, or blockchain implementation will contribute to a higher development cost.

2. Security Measures

Given the sensitive nature of financial data, the level of security required plays a crucial role in determining costs. Implementing robust security measures, encryption standards, and compliance with regulatory frameworks will influence the overall expense.

3. Integration Requirements

The extent to which the financial software needs to integrate with existing systems, third-party services, or external APIs affects development costs. Seamless integration with banking platforms, payment gateways, or other financial institutions may add to the complexity and expenses.

4. User Interface (UI) and User Experience (UX) Design

Creating an intuitive and user-friendly interface is vital in financial software. The complexity of UI/UX design, incorporating features like multi-device compatibility and accessibility, can impact costs as it requires careful planning and skilled design implementation.

5. Regulatory Compliance

Financial software must adhere to strict regulatory standards, and the level of compliance needed can influence costs. Ensuring compliance with regulations like GDPR, PCI DSS, or regional financial laws may involve additional development efforts and expenses.

Regulatory Compliance Requirements For Businesses In The FinTech Sector

Navigating the uncertain landscape of the FinTech business requires a thorough understanding of regulatory compliance. Businesses in this industry must follow strict regulations to maintain ethical conduct and legal compliance.

1. KYC

The Know Your Customer (KYC) regulatory requirement is a fundamental practice for every financial firm, including those in the FinTech sector. This process aims to verify a user’s identity and assess their risk profile, ultimately minimizing the occurrences of money laundering and fraud. As a standard operating procedure for financial service providers and banks, adherence to KYC is imperative for any FinTech business.

2. GDPR

The General Data Protection Regulation (GDPR) stands as a cornerstone among the EU’s data protection regulations, outlining strict guidelines for how businesses collect, process, and store the data of EU users. Similar regulations, such as the Consumer Data Rights (CDR) and the California Consumer Privacy Act (CCPA), align with GDPR principles and should be observed by every FinTech entity to ensure data privacy and legal conformity.

3. EFTA

The Electronic Fund Transfer Act (EFTA), overseen by the Consumer Financial Protection Bureau, specifically addresses electronic money transfers via ATMs, POS terminals, and debit cards. This compliance framework aims to protect users in the event of transaction errors, ensuring accountability and safeguarding the integrity of electronic fund transfers. FinTech apps involved in electronic money transfers must comply with EFTA regulations to enhance user trust and ensure legal compliance.

4. FTC

Two key regulations under FTC consideration for the FinTech sector are the Gramm-Leach-Bliley Act (GLBA) and the Fair Credit Reporting Act (FCRA). The GLBA emphasizes the protection of customer data and transparency in processing, while the FCRA is relevant for FinTech apps dealing with lending or processing user credit scores.

5. PCI DSS Compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a critical regulation governing secure credit card payments. Ensuring that transactions are processed securely, PCI DSS outlines six key areas that businesses must address to meet compliance standards.

Challenges In Custom Financial Software Development

The journey of custom financial software development presents a landscape of challenges that demand careful consideration and strategic navigation. Here are some of the challenges:

1. Selecting FinTech Sub-Sectors

Discovering a niche that effectively addresses widespread issues is crucial for successful custom financial software development. In the FinTech realm, choosing the right sub-sector can be overwhelming. Market research becomes pivotal at this stage to identify untapped opportunities and formulate a solid business idea.

2. Crafting a Competitive MVP

While entrepreneurs may have a clear vision for their app’s problem-solving capabilities, determining the Minimum Viable Product (MVP) features that distinguish it from competitors can be challenging. Seeking expert guidance is essential. By listing market problem areas and proposed solutions, a reverse engineering approach is employed to define crucial features. This ensures that the app is equipped with the necessary functionalities to succeed in the market.

3. Ensuring App Security

In the realm of financial software development, where dealing with money and sensitive data is inherent, making the application hack-proof is imperative. Collaborating with a team that follows a security-first development approach is the key. Beyond adopting best practices during development, they establish a data governance framework, serving as an in-house standard measure for sustained security.

4. Navigating Regulatory Compliance

With numerous global compliances in play, identifying and adhering to the relevant regulations is a critical challenge. Ensuring that the app’s features align with compliance standards adds another layer of complexity. For entrepreneurs and developers unfamiliar with these intricate regulations, navigating and implementing compliance measures can be particularly challenging.

5. Leveraging Next-Gen Technologies

While incorporating technologies like Blockchain, IoT, and AI can be exciting for FinTech businesses, the actual integration poses challenges. It’s insufficient to claim a technology-driven approach solely based on having features like an AI chatbot. True integration of these technologies requires in-depth subject matter expertise, a rare quality that only a select few in-house developers possess.

FinTech Trends That Will Revolutionize The Industry

The financial technology landscape continues to evolve, introducing trends gearing towards enhancing accessibility and convenience through relentless innovation. Here’s a glimpse into some of these transformative FinTech trends.

1. Neobanks

Neobanks, characterized by their digital-only presence, are reshaping the banking landscape by providing online services with enhanced convenience. Offering features like budgeting tools and instant money transfers, these banks cater to a tech-savvy audience, often with lower fees than their traditional counterparts.

2. Artificial Intelligence and Machine Learning

By analyzing extensive datasets, AI and ML technologies provide valuable insights, contributing to more informed decision-making in the dynamic FinTech landscape. Automation of tasks, improved customer experiences, and advanced fraud detection are some key benefits.

3. Buy Now, Pay Later

The rising popularity of Buy Now Pay Later (BNPL) services signifies a shift in consumer payment preferences, especially among the younger demographic. With this service, customers can pay for their purchases through installment plans rather than relying on traditional credit cards.

4. Embedded Finance

In the Buy Now Pay Later (BNPL) model, users can make purchases on credit with convenient monthly installment plans. Despite potential impacts on credit scores, the BNPL model is gaining traction, with projections indicating a market size of $680 billion in transactions by 2025. Embedded finance, with its emphasis on accessibility and convenience, continues to reshape the FinTech landscape.

5. Blockchain

Blockchain technology in the FinTech landscape offers unparalleled security features that are nearly impossible to hack or breach. Its applications in identity management, financial record maintenance, and transaction history tracking have gathered attention from traditional banks and FinTech firms.

6. Super Apps

Inspired by successful models like GO-JEK and PayPal, the FinTech industry is on the verge of introducing finance super apps. These applications aim to provide users with a comprehensive platform offering diverse financial services, including managing insurance, bill payments, event ticket purchases, and more.

7. Open Banking

Open banking emerges as a trend that fosters collaboration between traditional banks and FinTech firms. By commercializing infrastructure through the Banking as a Service (BaaS) model, banks offer core services to FinTech entities. This collaborative approach eliminates the threat of banks being replaced or compelled into direct competition with FinTech companies.

Considerations Before Hiring A Financial Software Application Development Company

The key to your success as an entrepreneur lies in the careful selection of the financial software development solutions provider you choose as your partner. Here are key factors to consider before hiring a software development company:

1. Aligning with Your Business Model

When considering a financial software development agency, prioritize evaluating their expertise in the specific model you intend to pursue. The more closely aligned they are with your business model, the better equipped they will be to navigate the unique challenges and opportunities presented in the digital space.

Validate their expertise by reviewing past works, examining client testimonials, and studying relevant case studies. A development partner with a proven track record in your targeted domain can significantly enhance the success of your financial software project.

2. Understanding of Compliances

In the data-intensive FinTech sector, a crucial factor in selecting a financial software development company is their thorough understanding of compliance requirements.

The chosen agency should possess in-depth knowledge of building features, running integrations, and designing solutions that align seamlessly with the intricate landscape of regulatory compliances. This proficiency is essential for ensuring the security, legal conformity, and smooth functionality of the financial software application.

3. Price Quote and Delivery Timeline

As you progress in your search for the right financial industry software development firm, you may encounter decisions based on price quotes and delivery timelines. While the allure of a lower price and a faster delivery may be tempting, exercise caution.

Prioritize a development partner that not only offers a reasonable price but also commits to delivering a high-quality product within a realistic timeline. Striking a balance between cost and quality ensures that your financial software meets the necessary standards and performs effectively in the market.

Conclusion

Financial software development is a dynamic field that plays a crucial role in reshaping the landscape of the financial industry.

The rapid evolution of technology has opened up new possibilities for innovation, allowing businesses to enhance accessibility, streamline processes, and provide users with tailored financial solutions.

Strategic collaboration with financial software developers can help you leverage their insights into market trends and user demands. It offers an approach to keeping ahead of the curve in the constantly evolving FinTech industry.

How Idea Usher Can Assist With Your FinTech Project?

Idea Usher is a leading financial software app development firm. Our expertise lies in delivering top-notch software development for financial services, catering to diverse business needs. With a wealth of experience encompassing various models, advanced features, and cutting-edge technology combinations, our financial software developers are well-equipped to tackle challenges and ensure the successful delivery of your FinTech app.

Contact us today to understand more about how we can help you with our financial software development service.

Here is a case study of our fintech project, “Jaba Pay,” we have built for our client.

FAQ

Q. How to develop a fintech software?

A. Developing fintech software involves a multifaceted approach that begins with clearly defining the product’s objectives and functionalities. Start by conducting a thorough analysis of regulatory requirements, ensuring compliance with industry standards. Design a secure architecture with robust authentication and access controls, integrate seamlessly with financial institutions through APIs, and prioritize scalability and performance optimization. Focus on creating an intuitive user interface backed by comprehensive testing, documentation, and training. Continuous monitoring and maintenance are crucial for ensuring ongoing security, compliance, and efficiency in the rapidly evolving fintech landscape.

Q. What are some of the best FinTech app ideas?

A. Finance app concepts continually evolve with industry trends. Presently, payment and personal finance software stand out as enduring and promising models for initiating your venture. It is essential to emphasize the significance of in-depth market research to comprehend user needs thoroughly. Identifying a viable app idea involves analyzing current market demands and tailoring your concept to meet user requirements effectively.

Q. How is the FinTech industry regulated?

A. Regulatory oversight in the FinTech industry is administered by governmental bodies globally, with compliance varying based on factors such as geographical location, service type, business scale, and revenue. Key compliance standards in the sector include GDPR, PCI DSS, and FTC, among others. Complying to these regulations is crucial for ensuring ethical practices, safeguarding user data, and maintaining transparency in financial technology operations.

Q. How do you choose a financial software application development company?

A. To select a financial software application development company, assess their expertise in the financial sector, examine their track record in software development, evaluate the technologies they specialize in, and consider the provided price quotes. These factors collectively contribute to making an informed decision in choosing the right partner for your financial services software development project.

Q. How long does it take to develop financial software?

A. The duration required for financial software development can vary based on factors like project complexity, scope, and customization needs. Taking into account phases such as analysis, design, programming, testing, and deployment, the development timeline typically ranges from 4-5 months to a year or more, depending on specific project requirements.

Gaurav Patil