Recently, businesses have started questioning their reliance on traditional card networks. Rising transaction fees, long settlement times, and increasing fraud concerns are pushing companies to look for better options. That’s why many companies have started using A2A pay-by-bank apps. These solutions allow direct bank-to-bank transfers, cutting out the expensive middlemen that have been part of payment processing for years.

For forward-thinking companies, this change is more than just an upgrade in payment methods. It’s a chance to cut operational costs, boost financial control, and provide better customer experiences in a competitive market.

Having worked with various enterprises to streamline their payment systems, we’re uniquely positioned to guide you through the intricacies of integrating A2A Pay-by-Bank technology, ensuring faster settlements and a reduction in fraud risk compared to traditional card payments. IdeaUsher’s expertise in this space has made us a trusted partner for companies seeking smoother, more cost-effective solutions. We’re writing this blog to help you understand how A2A Pay-by-Bank apps compete with card payments. Let’s begin!

Key Market Takeaways for A2A Pay-by-Bank Apps

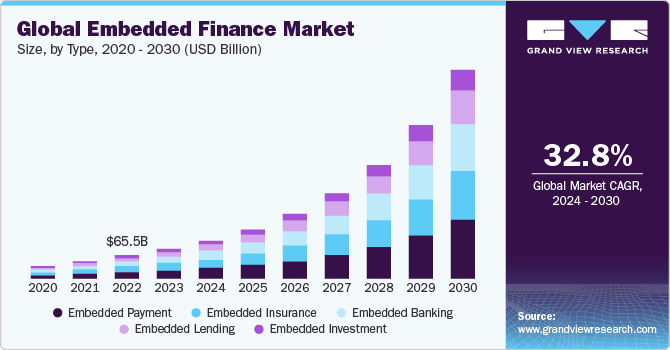

According to GrandViewResearch, the embedded finance market is growing fast, valued at USD 83.32 billion in 2023 and expected to reach USD 588.49 billion by 2030 at a CAGR of 32.8%. Within this surge, A2A (Account-to-Account) Pay-by-Bank apps are gaining momentum, with transaction volumes projected to rise from 60 billion in 2024 to 186 billion by 2029. By enabling instant, low-cost transfers and bypassing traditional card networks, these apps are redefining how businesses and consumers handle payments.

Source: GrandViewResearch

The rise of A2A solutions is driven by the need for quicker settlements, lower fees, and smoother payment experiences. Leveraging open banking frameworks, these apps support real-time transfers, recurring payments, and bill settlements, often built directly into e-commerce platforms and mobile apps.

In Europe, nearly one in four consumers is expected to use A2A payments by 2025, while U.S. and Asia-Pacific markets are rapidly scaling thanks to instant payment systems and supportive regulations.

Partnerships are accelerating adoption and innovation. Visa’s collaboration with Plaid combines trusted payment rails with open banking networks to offer secure, user-friendly pay-by-bank solutions for merchants and consumers.

Similarly, Tink’s integration with platforms like Splitwise demonstrates how A2A capabilities can be embedded into everyday apps, making payments faster, simpler, and more seamless for users globally.

What Are A2A Pay-by-Bank Apps?

A2A Pay-by-Bank apps are a smarter way to transfer money directly from one bank account to another, skipping the middlemen like card networks. They use secure APIs to make payments simple, fast, and secure. By cutting out extra layers, A2A payments make transactions more efficient and cost-effective for both sides.

A2A Payments Differ Vs. Traditional Card-Based Payments

The differences between A2A Pay-by-Bank apps and traditional card-based payments are significant, impacting everything from costs to security. Here’s a breakdown of the key distinctions:

| Aspect | Card Payments | A2A Payments |

| Architecture | Four-party model with card networks and banks. | Two-party model, directly linking payer and payee banks. |

| Transaction Initiation | Merchant “pulls” funds through card networks. | Customer “pushes” funds directly to merchant. |

| Cost Structure | Complex fees (interchange, assessment, etc.). | Flat fees or lower percentage-based costs. |

| Settlement Time | 2-3 business days due to batch processing. | Real-time or near-instant settlement. |

| Security Model | Relies on card details and CVV codes. | Uses bank-level authentication (biometrics, 2FA). |

Types of A2A Payments

A2A Pay-by-Bank solutions come in various forms, each tailored to specific markets and payment use cases. Here’s a breakdown of the different types:

1. Real-Time Payment Systems

These are government or central bank-backed infrastructures designed to enable instant transfers:

- UPI (Unified Payments Interface – India): A revolutionary platform that allows users to create virtual payment addresses (VPAs), enabling smooth peer-to-peer and merchant payments with minimal friction.

- Pix (Brazil): A 24/7 instant payment system where users can send money using identifiers like phone numbers or tax IDs, making transactions faster and simpler.

- RTP (Real-Time Payments – USA): The Clearing House’s network that offers instant, irrevocable settlements 24/7, facilitating seamless payments for businesses and consumers.

- FedNow (USA): The Federal Reserve’s instant payment service, designed to support 24/7 real-time payments across the U.S., enhancing the speed of transactions in the financial ecosystem.

2. Open Banking-Enabled A2A Payments

These solutions leverage Open Banking APIs, which are governed by regulatory frameworks to facilitate direct bank-to-bank payments securely:

- Trustly: Uses Open Banking APIs to connect customers’ bank accounts directly to merchants, offering quick and secure payments without needing to store card information.

- Klarna’s Pay Now: An instant bank payment option where customers can pay directly from their bank accounts without needing to register, enhancing convenience.

- Plaid-powered solutions: Enable secure bank account linking, providing a seamless and direct payment initiation process between users’ bank accounts and merchants.

3. QR Code-Based Pay-by-Bank Systems

These systems combine the simplicity of QR codes with the efficiency of direct bank transfers:

- UPI QR Codes (India): Merchants display static or dynamic QR codes for customers to scan and complete payments directly from their bank accounts via the UPI system.

- BancNet QR (Philippines): This system allows interoperable QR code payments across multiple banks, simplifying transactions for customers and merchants alike.

- PromptPay (Thailand): Uses national QR standards to enable instant payments across banks, enhancing the accessibility and speed of payments.

Benefits of A2A Pay-by-Bank Apps for Businesses

A2A Pay-by-Bank apps cut out card networks, saving businesses big on transaction fees. With instant settlements, cash flow improves, and access to funds is faster. Plus, secure payments reduce fraud and chargebacks, boosting conversions and making transactions smoother.

1. Extreme Cost Efficiency

Traditional card payments come with high fees from multiple intermediaries, such as banks and card networks. These fees can eat into profits. A2A payments eliminate these intermediaries, lowering transaction costs to a fraction of the typical card fees. This can save businesses thousands annually.

2. Instant Access to Funds

Card payments often take 2-3 days to settle, delaying access to funds. A2A payments settle instantly using real-time payment systems like RTP or SEPA Instant. This allows businesses to access funds right away, improving cash flow and financial agility.

3. Reduced Fraud & Chargebacks

Fraud and chargebacks are costly for merchants. A2A payments are more secure because they use a “push” model, where customers authorize payments directly from their bank with strong authentication. This reduces the risk of fraud and chargebacks.

4. Higher Conversion Rates

Card payments can fail for various reasons, such as expired cards or insufficient funds. A2A payments authenticate directly against the customer’s bank balance, reducing the chances of payment failures. This leads to fewer abandoned carts and higher conversion rates.

5. Scalable & Future-Proof

Open Banking is driving a global shift towards standardized, secure financial data sharing. A2A payments align with these standards, future-proofing your business. This allows for easier integration with new services and expansion into international markets.

The Broken Legacy: Why the Card Kingdom is Crumbling

For years, we’ve relied on the card payment system because it’s convenient—but the truth is, it’s outdated and costly. It’s a clunky middleman that takes a cut of every transaction, slowing down innovation. It’s time we move past this system that’s holding businesses back and embrace something more efficient and future-ready.

The Four-Party Tax: A Toll Road for Your Revenue

At first glance, processing a card payment seems simple: the customer swipes their card, and the merchant gets paid. In reality, it’s a much more complicated journey, involving a network of intermediaries who each take their cut before the merchant sees a single cent.

The payment journey looks like this:

Customer → Issuing Bank → Card Network (Visa/Mastercard) → Acquiring Bank → Merchant

Every step in this chain comes with a fee:

- Interchange Fees: Paid to the customer’s issuing bank.

- Assessment Fees: Paid to the card network (Visa/Mastercard).

- Acquiring Markup: Paid to the merchant’s bank or payment processor.

For a $100 sale, by the time the merchant gets their money, as much as $2.90 or more could already be siphoned off by these intermediaries.

This isn’t a streamlined process; it’s a toll road where each party demands a fee for simply letting the money pass through. For businesses, especially those with tight profit margins, this “tax” can be a significant barrier to growth and sustainability.

The Delayed Reality of “Sales”

These days, we expect everything to happen instantly, so why should payments be any different? The card system still relies on outdated batch processing, causing delays that mess with cash flow and make it harder to react quickly to opportunities. It’s time for a change—businesses need real-time payments, not sluggish processing.

The Chargeback Gambit: A System Skewed Against You

The card payment system was designed with consumer protection in mind, but this well-intended feature has evolved into a costly burden for merchants. The chargeback process, in particular, is skewed heavily against businesses.

- Friendly Fraud: A customer buys something, receives the product, and then disputes the charge with their bank, claiming it was unauthorized. In this case, the burden of proof falls entirely on the merchant.

- Administrative Burden: Fighting a chargeback requires significant time and effort, gathering evidence, filling out forms, and investing staff resources—all with no guarantee of success. Even if the merchant wins, they lose valuable time and money.

What was once a consumer protection system has turned into an adversarial process that drains resources and harms merchant profitability.

For years, businesses have been told that this is simply the cost of accessing a global payment network.

But what if the underlying technology is outdated? What if there’s a better way to break free from this toll road?

The New Architecture: Engineering a Smarter Way with A2A

The solution to the crumbling card payment kingdom isn’t just a minor update; it’s a complete overhaul. A2A Pay-by-Bank payments are not just a new method, they represent a revolutionary shift in how we handle transactions. A2A bypasses the legacy intermediaries entirely, creating a direct, secure, and efficient connection between the payer and payee.

1. The “Push” Revolution

The most significant difference between card payments and A2A payments lies in the way money moves: A2A payments are “push” payments, while card payments are “pull” payments.

- Card “Pull”: In the card payment model, the merchant initiates a request to “pull” funds from the customer’s account through the card network. This is like giving a stranger your mailbox key and hoping they only take the right letter.

- A2A “Push”: In the A2A model, the customer actively initiates the payment from their bank, instructing it to “push” the funds directly to the merchant. This is like handing the letter directly to the mail carrier yourself. It’s intentional, secure, and direct.

This “push” model significantly improves security. Since the customer initiates the payment from within their own trusted banking environment, the risk of fraud drops dramatically. Furthermore, the liability for fraud shifts away from the merchant, as the transaction is authenticated at its source.

2. The Magic of Open Banking APIs

One common misconception is that A2A payments involve risky methods like “screen scraping” or sharing bank login details. This is simply untrue. Modern A2A payments are built on the secure foundation of Open Banking and regulated APIs, ensuring a safe, streamlined process.

Here’s how A2A payments work securely and seamlessly:

- Initiation: On the merchant’s checkout page, the customer selects “Pay-by-Bank.”

- Secure Redirect: The customer is redirected to their bank’s secure authentication portal via an OAuth 2.0 handshake.

- Bank-Level Authentication: The customer uses their bank’s robust security (biometrics, PIN, or two-factor authentication) to verify their identity.

- Authorization: The bank confirms the customer’s identity and account details and sends a secure, time-limited token to the payment system authorizing the transaction.

- Execution: The payment is then processed directly between the customer’s bank and the merchant’s bank.

3. The Power of Real-Time Rails

While A2A provides the structure for these transactions, real-time payment networks provide the infrastructure. Unlike the slow, batch-processed ACH transfers of old, modern A2A payments use always-on, real-time payment rails:

- RTP (Real-Time Payments): A network providing 24/7/365 instant settlement in the U.S.

- FedNow: The Federal Reserve’s instant payment service, further accelerating real-time adoption in the U.S.

- SEPA Instant: A pan-European network that guarantees settlement in under 10 seconds.

These systems allow for funds to be transferred and settled instantly—no more waiting for days for the transaction to clear. This is the infrastructure that the modern economy needs, moving money at the speed of the internet.

How A2A Pay-by-Bank Apps Compete With Card Payments?

For years, card payments ruled digital commerce, but A2A Pay-by-Bank apps are turning the tide with a more efficient, cost-effective approach. They’re not just copying the card model; they’re tackling its weaknesses head-on. A2A apps are rewriting the rules, offering faster, cheaper, and more secure transactions that challenge the old system.

1. The Economic Battle: Slashing the “Interchange Tax”

Card payments are built on a multi-layered fee structure that takes a cut at every step.

- The Card Model: Each card transaction involves interchange fees (paid to the card-issuing bank), assessment fees (paid to card networks like Visa/Mastercard), and processor markups. This can easily add up to 2.9% + $0.30 per transaction.

- The A2A Model: A2A apps bypass these intermediaries entirely, with flat fees or much lower percentages, often under 1%.

The Competitive Edge: For businesses, this isn’t just cost-saving, it’s margin expansion. The 2-3% saved goes directly to the bottom line, allowing businesses to reinvest, offer better prices, or simply enjoy higher profitability. A2A doesn’t just compete on price; it highlights how inefficient the card model is.

For example, iDEAL in the Netherlands offers a fixed fee per transaction, typically ranging from €0.10 to €0.30, with no percentage-based charges. This makes it a great option for high-value transactions, unlike card payments which take a cut of the sale.

Dutch e-commerce businesses save around 2.5-3% per transaction compared to using cards, making iDEAL a more cost-effective choice.

2. The Speed Battle: Real-Time Settlement vs. the 3-Day Float

In today’s fast-paced world, the card payment system’s settlement cycle feels outdated.

- The Card Model: Payments are batched and settled over 1-3 business days. A Friday sale doesn’t become available as working capital until the following Wednesday.

- The A2A Model: A2A payments settle in real-time, with funds available immediately, 24/7/365.

The Competitive Edge: A2A apps eliminate the cash flow delays that the card system imposes, allowing businesses to access funds instantly. This boosts business agility, helping companies manage inventory, pay suppliers, and reinvest capital at the speed of the market.

3. The Security Battle: “Push” vs. “Pull”

Card payments have a security model that leaves room for vulnerability.

- The Card Model: Merchants pull funds by presenting static card details like the card number, expiration date, and CVV. These details can be stolen or replicated, leading to fraud and chargebacks.

- The A2A Model: The customer pushes funds directly from their bank’s secure environment, using bank-level authentication methods like biometrics, PINs, or two-factor authentication (2FA).

The Competitive Edge: A2A apps reduce fraud and eliminate the chargeback nightmare. The transaction is authenticated at the source, shifting the liability away from merchants and reducing administrative costs.

4. The User Experience Battle: Frictionless and Familiar

While card payments are familiar, A2A apps offer a different kind of simplicity, particularly in regions where bank-based payments are already ingrained.

- The Card Model: Requires entering a 16-digit card number, expiration date, CVV, and billing address, leading to errors and abandoned carts.

- The A2A Model: In many countries, users can click “Pay by Bank” and authenticate via their bank’s app with a fingerprint or PIN.

The Competitive Edge: A2A payments align with local payment habits, offering a quicker and more intuitive checkout process. This leads to fewer cart abandonments and avoids issues like expired cards or exceeded credit limits.

For example, Swish in Sweden lets users pay using just their mobile number linked to their bank account. Customers can scan a QR code displayed by the merchant for instant payments, and both parties get real-time payment notifications. This seamless, fast system makes transactions effortless and immediate.

5. The Strategic Battle: Future-Proofing with Open Banking

A2A payments aren’t just a new payment method—they’re a gateway to the future of financial services, built on Open Banking.

The Card Model: A closed-loop system that is slow to innovate.

The A2A Model: Built on APIs and open architecture, allowing for continuous innovation, such as:

- Variable Recurring Payments (VRPs) for dynamic subscriptions.

- Embedded Finance, enabling payments to be seamlessly integrated into software platforms.

- Enhanced Data Sharing, offering richer transaction data alongside payments.

The Competitive Edge: A2A apps are more than just a payment solution; they’re paving the way for the future of financial services. By adopting A2A, businesses are positioning themselves ahead of the curve, ensuring they are ready for the next generation of payments.

For example, Klarna’s Pay Now uses Open Banking integration through PSD2-compliant APIs for direct bank payments. It allows for a one-time authorization, making payment processing fast and seamless.

The result is a smoother checkout experience with fewer steps compared to traditional card entry, making it quicker and easier for customers.

How A2A Payments Apps Work?

A2A payment apps let you pay directly from your bank account with just a few taps. The process involves securely authenticating through your bank and then transferring funds instantly, cutting out the middleman. It’s faster, safer, and more cost-effective than using a credit or debit card.

The Flow of an A2A Transaction: From Consumer to Merchant

In an A2A transaction, the customer kicks off the payment, and the merchant’s system connects securely with the payment provider. The funds then move directly from the customer’s bank to the merchant, with everything settled instantly. It’s a smoother, quicker way to handle payments without all the middlemen.

Step 1: Payment Initiation

The process starts when the customer selects “Pay by Bank” at checkout. The merchant’s system sends a payment request to the A2A provider through Open Banking APIs, like Plaid or Tink. This request includes the transaction details (amount, merchant ID, etc.), which are securely transmitted to the provider for processing.

Step 2: Bank Selection & Redirect

After choosing their bank, the customer is redirected to their bank’s secure authentication environment. OAuth 2.0 protocols ensure secure communication between the A2A provider and the bank. SSL/TLS encrption protects the data exchanged during this step.

Step 3: Bank-Level Authentication

The customer authenticates the transaction using their bank’s security methods, such as biometrics or a PIN. The bank verifies the user’s identity and generates a secure token confirming the customer’s approval. This token is sent back to the A2A provider, allowing the payment to proceed.

Step 4: Payment Execution

Once authorized, the A2A provider sends the payment instruction to the customer’s bank via real-time payment rails like RTP or FedNow. The funds move directly from the customer’s account to the merchant’s account, with both banks verifying account details and fund availability.

Step 5: Confirmation & Settlement

After the payment is processed, both the customer’s and merchant’s banks send confirmation. The funds are credited to the merchant’s account immediately, and the transaction is recorded in both bank systems. The customer is redirected to the merchant’s website with an order confirmation.

The Authentication Backbone

A2A payments offer robust security, making them more secure than traditional card payments. They use advanced authentication methods, including biometrics and multi-factor authentication, to ensure that only authorized users can make payments. Real-time fraud monitoring also helps detect and prevent fraudulent activity.

- Biometric Authentication: A2A payments use Touch ID, Face ID, or fingerprint scanners to verify identity, reducing password vulnerabilities and ensuring secure identification.

- Multi-Factor Authentication (MFA): MFA adds an extra security layer, requiring a combination of PIN, mobile device, or biometrics for transaction approval.

- Bank-Grade Security Features: Behavioral analytics, device fingerprinting, and real-time fraud detection monitor for unusual patterns, ensuring the security of A2A transactions.

Instant Settlement: The Real-Time Payment Rails

A2A payments use real-time systems that settle transactions instantly, unlike traditional card payments that can take days. This means the money moves right away, and the process is final. Plus, it’s available 24/7, so you can make payments anytime.

Real-Time Payment Rail Architecture

Real-time payment rails, such as RTP and FedNow, use the ISO 20022 standard to format transaction data. This ensures that each transaction is processed individually in real-time. The clearing and settlement process is immediate, and once completed, the transaction is final and irreversible.

Key Real-Time Rail Systems

Real-time payment systems like RTP (USA), FedNow (USA), UPI (India), and PIX (Brazil) enable instant settlements. These systems use secure encryption and operate 24/7, ensuring fast and secure transactions, no matter the time.

Use Case: Revolutionizing E-commerce Payments

Our client, a rapidly growing e-commerce marketplace, faced a major challenge: their success was being undermined by high fees and friction from traditional card payment networks. With every transaction, they were paying 2.9% + $0.30 in fees to card providers, and sellers were frustrated by delays in receiving their funds. It was clear: they needed a solution to improve their bottom line and enhance the user experience.

The Challenge: The High Cost of Success

As their transaction volume grew, so did the hefty fees to card networks, eroding profitability. On top of that:

- Eroding Profits: The 2.9% + $0.30 fee on every sale significantly impacted their margins.

- Cash Flow Lag: Sellers had to wait days for card settlements, causing frustration and cash flow issues.

- Chargeback Headaches: Fraudulent disputes and chargebacks were costly, time-consuming, and created operational friction.

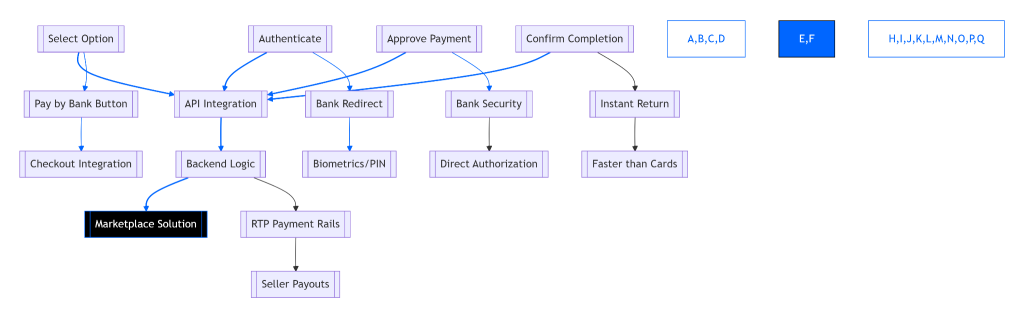

Our Solution: Engineering a Frictionless, Direct Payment Rail

The answer wasn’t a quick fix; it was a game-changing overhaul. We designed and implemented a seamless A2A Pay-by-Bank solution directly into the marketplace’s checkout process, transforming payments into a strategic advantage.

The Simple, Secure Customer Flow:

- Select: At checkout, customers simply click the “Pay by Bank” button.

- Authenticate: They’re redirected to their bank’s secure app or online portal via Open Banking APIs.

- Approve: Using their bank’s security (biometrics or PIN), they authorize the payment directly.

- Confirm: The customer is immediately redirected back to the marketplace with payment confirmation—faster than entering a 16-digit card number.

Behind the Scenes

While the customer flow was seamless, the technology behind it was complex:

- Secure API Integration: We integrated real-time payment rails (like RTP) using secure Open Banking standards. No sensitive bank details were shared with the marketplace.

- Seamless UX/UI: “Pay by Bank” was natively embedded in the checkout process, ensuring a smooth user experience.

- Robust Backend: We developed backend logic to handle instant payment confirmations, update order statuses in real-time, and initiate immediate seller payouts.

The Impact: Cost Center to a Competitive Advantage

The results were immediate and transformative:

- Direct Cost Savings of 3%: By bypassing card networks, the marketplace cut its payment processing fees by 3%, directly boosting profitability.

- Instant Seller Payouts: With funds settling in seconds, payouts to sellers could happen immediately, becoming a strong selling point for attracting high-quality sellers.

- Near-Zero Chargebacks: Since A2A payments are authenticated by the bank, fraudulent chargebacks dropped dramatically, saving time and resources on dispute management.

- Enhanced Trust & Security: Bank-grade security reassured customers that their financial data was protected by their own institution, boosting trust.

Conclusion

A2A pay-by-bank apps are quickly becoming a strong alternative to traditional card payments, offering significant advantages in terms of cost savings, faster cash flow, and enhanced security. For platform owners and enterprises, these apps present an opportunity to stay ahead in a competitive market by delivering a more efficient payment solution to users. By partnering with an experienced developer like IdeaUsher, businesses can ensure seamless integration, scalability, and a smooth user experience, setting them up for long-term success in the evolving payment landscape.

Looking to Develop an A2A Pay-by-Bank App?

The future of payments is all about being direct, secure, and cost-effective, and now’s the time to get ahead of the curve. At Idea Usher, we don’t just build apps; we create innovative, market-leading A2A Pay-by-Bank solutions that help businesses reduce transaction fees, speed up cash flow, and fight fraud more effectively.

Why build with us?

- Elite Engineering: With over 500,000 hours of coding experience, our team of ex-MAANG/FAANG developers doesn’t just build apps, they craft scalable, future-proof solutions.

- Proven Excellence: Our track record speaks for itself. Take a look at our latest projects to see the high-quality results we deliver.

- Your Vision, Executed Flawlessly: We combine deep fintech knowledge with agile development practices to transform your ideas into a competitive reality.

Let’s work together to challenge the payment status quo and build something great.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: A2A payments are direct bank-to-bank transfers, cutting out intermediaries like card networks. This means that money moves directly between the payer’s and payee’s banks, offering faster transactions and lower fees compared to the traditional card payment process, which involves multiple middlemen and added costs.

A2: Yes, A2A payments are highly secure, leveraging bank-grade authentication methods such as biometrics and multi-factor authentication (MFA). Unlike card payments, where security largely relies on CVV checks that can be stolen, A2A payments are protected by more robust systems, making them safer for both businesses and consumers.

A3: Yes, A2A apps can support global payments through various payment rails like SEPA Instant in Europe, UPI in India, and FedNow in the US. These systems enable cross-border payments, making it easier for businesses to operate internationally without dealing with the complexities and fees of traditional card networks.

A4: Enterprises should consider adopting A2A apps now due to the significant advantages they offer, lower transaction fees, faster settlement times, and enhanced security. These benefits provide businesses with a competitive edge, allowing them to offer a better payment experience to customers while optimizing their own payment processes.