For years, the traditional finance insurance has been weighed down by long claim processes, hidden fees, and limited transparency. But in the crypto and decentralized finance, those outdated systems no longer fit the need for speed, trust, and automation. That’s where the DeFi Insurance Protocol steps in to change how digital assets and investors are protected in this new, trustless world.

By combining blockchain transparency with smart contracts, DeFi insurance protocols like InsurAce allow users to access coverage without intermediaries, automate claims through verified events, and stake assets to support the network. This decentralized approach eliminates the inefficiencies of traditional insurance and makes coverage faster, fairer, and more accessible to everyone in the ecosystem.

In this blog, we’ll look at how to build a DeFi Insurance Protocol like InsurAce, covering core architecture, tokenomics, governance, and security layers. IdeaUsher brings extensive experience in launching blockchain and DeFi solutions, helping platforms design secure, scalable, and efficient decentralized insurance systems. By the end, you’ll have a clear idea of what it takes and how we help to create a reliable insurance platform in the decentralized space.

What is the DeFi Insurance Platform, InsurAce?

InsurAce is a decentralized, multi-chain insurance protocol that provides risk protection for users in the decentralized finance (DeFi) ecosystem, covering vulnerabilities such as smart contract exploits, exchange hacks, and stablecoin depegging.

By leveraging blockchain and community governance, Defi Insurance Protocol provides secure, transparent, cost-efficient insurance. Users participate in underwriting, governance, and staking, creating a DeFi risk management ecosystem.

- Multi-Chain Coverage: Supports over 100 DeFi protocols across Ethereum, Polygon, BNB Chain, and Avalanche.

- Diverse Insurance Products: Offers protocol cover, stablecoin depeg cover, and custody cover.

- Optimized Pricing: Uses a portfolio-based approach to provide competitive premiums and reduce gas fees.

- Governance via INSUR Token: Community members can participate in decision-making, influencing platform policies and product offerings.

- Staking & Rewards: Users can stake INSUR tokens and provide underwriting liquidity to earn rewards, supporting a decentralized and community-driven ecosystem.

Business Model

InsurAce is a decentralized insurance protocol for DeFi users, involving the community in governance, underwriting, and claims. It covers smart contract failures, exchange hacks, and DeFi risks, ensuring transparency, security, and efficiency through blockchain.

Revenue Model

InsurAce earns revenue through insurance premiums, staking rewards, and investment returns, creating a sustainable and community-driven financial model.

- Premiums: Users pay premiums to get insurance coverage for DeFi risks like smart contract failures or exchange hacks. These premiums fund the pool that pays out claims.

- Staking & Governance Participation: INSUR token holders can stake their tokens to participate in governance and earn rewards. This encourages community involvement in decisions like approving insurance products or managing risk pools.

- Investment Income: InsurAce invests part of the collected premiums to generate returns, which helps maintain financial stability and ensures claims can be paid reliably.

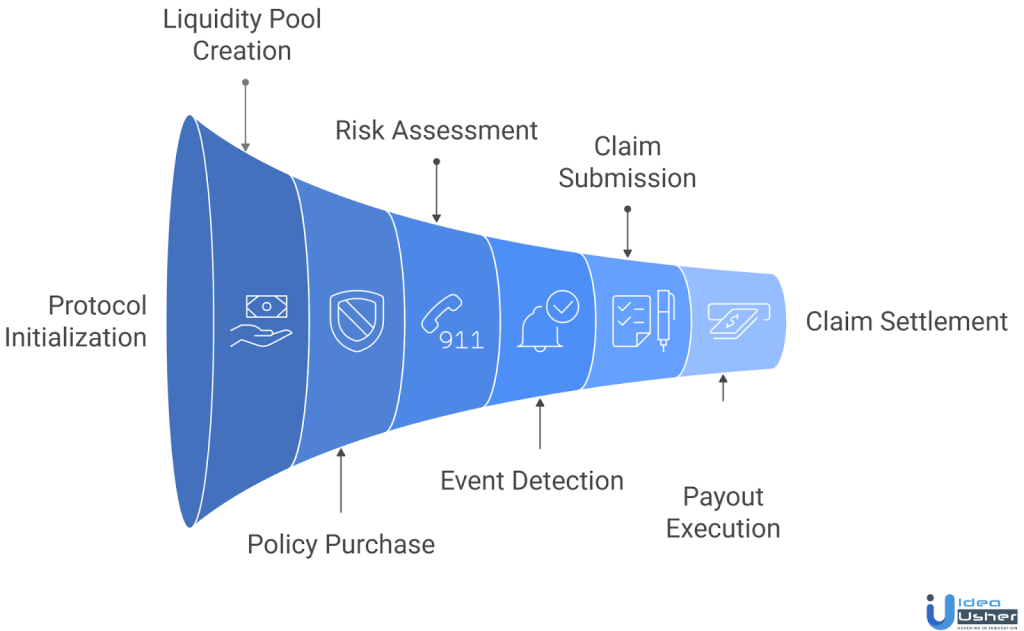

How a DeFi Insurance Protocol Works?

A DeFi insurance protocol lets users buy, underwrite, and claim insurance without intermediaries. Smart contracts, liquidity pools, and governance automate the process, ensuring transparency and shared ownership.

1. Protocol Initialization

Smart contracts define coverage, premiums, liquidity, and claims. Once deployed, they automate all policy and payout activities, removing centralized control and enabling transparency.

2. Liquidity Pool Creation

Smart contracts are programmed to set rules for coverage, premiums, liquidity, and claims. Once deployed on a blockchain, they automatically manage all policy activities and payouts, eliminating centralized control and providing transparent execution.

3. Policy Creation & Purchase

Users choose coverage for DeFi protocols. Smart contracts calculate premiums based on risk and liquidity. After payment, the policy is activated on-chain and linked to the user’s wallet.

4. On-Chain Risk Assessment

The protocol uses actuarial models and analytics to assess risk, considering factors like protocol age, total value locked (TVL), security audit history, and past exploits. This process ensures premiums are fairly priced to reflect real market risk for both users and liquidity providers.

5. Event Detection & Trigger Verification

When a covered event (like a smart contract hack or exploit) occurs, the protocol automatically verifies it using on-chain data, decentralized oracles, and third-party audit feeds. This automation reduces the need for manual investigations and speeds up the claims process.

6. Claim Submission & Validation

After an incident is confirmed, policyholders submit claims through the platform’s interface. Claims are validated either automatically by smart contracts (for parametric policies) or by community governance voting, ensuring fair and transparent resolution without intermediaries.

7. Automated Payout Execution

Once validated, payouts are sent directly from the pool to the policyholder’s wallet. The process is fully automated, with instant or governance-approved disbursements based on policy type.

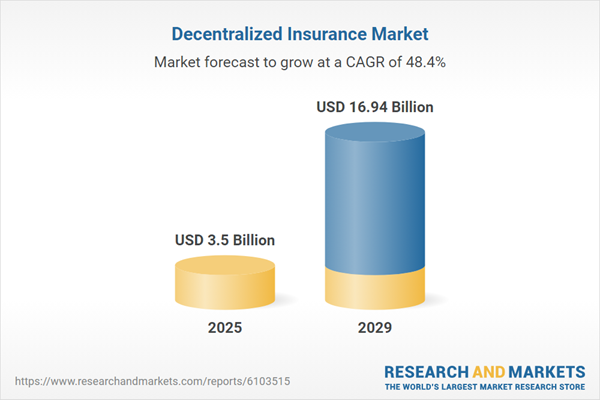

Why is the DeFi Insurance Platform Popular in the Insurance Market?

The decentralized insurance market will grow from $2.36 billion in 2024 to $3.5 billion in 2025 (CAGR 48%), reaching $16.94 billion by 2029 (CAGR 48.4%). Growth is driven by blockchain adoption and demand for transparent, automated coverage in DeFi.

InsurAce Protocol, a multi-chain DeFi insurance protocol, raised US$1 million in a seed round. It followed up with a US$3 million strategic round, bringing its total reported funding to around US$4 – 4.1 million across multiple rounds.

Nexus Mutual-backed broker Native secured US$2.6 million in seed funding in 2024, aiming to expand decentralized insurance coverage and enhance risk protection for DeFi users.

Meanwhile, Re, a blockchain-powered decentralised reinsurance protocol, raised US$7 million in venture capital following a US$14 million seed round.

Why Anyone Should Invest in a DeFi Insurance Protocol?

Investing in DeFi insurance platforms taps into insurance, blockchain, and growth risk markets, combining high potential, new risk-mitigation uses, and innovative underwriting.

- Addressing unmet coverage needs: According to research, only ~0.5% of DeFi total value locked (TVL) is covered by insurance/cover protocols.

- Lower cost, higher transparency: DeFi insurance platforms eliminate many intermediaries, use smart contracts, and offer more automated, transparent claims processes.

- Multiple risk vectors & innovation: Coverage goes beyond traditional insurance. It also protects against smart contract exploits, stablecoin de-pegs, protocol hacks, and more.

- Community & governance model: Many platforms let token-holders or pool participants underwrite or vote on claims, aligning incentives differently than traditional insurance.

- Early-stage investing upside: Given the relatively modest capital raised, there is potential for value creation if these platforms scale.

- Cross-chain/multi-protocol potential: DeFi Insurance Protocol works on several different blockchains and protocols. This approach helps them reach a wider market and stay relevant.

The DeFi insurance space is rapidly growing, with market forecasts showing significant growth, ongoing funding rounds, and a coverage gap in DeFi. Investing in these protocols offers a promising frontier, blending insurance innovation, blockchain scalability, and high growth, despite technology, regulatory, and risk uncertainties.

How DeFi Insurance Enables Quick & Transparent Payouts?

DeFi insurance platforms revolutionize protection via blockchain, community governance, and transparency. By removing intermediaries and utilizing smart contracts, they provide instant, tamper-proof, auditable coverage in decentralized ecosystems.

1. Instant Claims with Smart Contracts

Smart contracts handle every step of insurance, from setting up policies to paying out claims. When something happens, the contract checks the details and pays out right away, making claims faster, fair, and less likely to have mistakes or fraud.

2. Fast Payouts via Liquidity Pools

DeFi insurance uses community-funded liquidity pools instead of centralized reserves. Capital remains available in smart contracts, enabling immediate claim settlements when triggers are met. This model ensures solvency, real-time liquidity, and greater user confidence.

3. Oracle-Based Event Verification

DeFi insurers use oracles like Chainlink and API3 to provide verified data to smart contracts. Oracles confirm events such as exploits or price depegs, preventing false claims. Multi-source verification ensures payouts occur only with authentic data, making the process trustless and reliable.

4. On-Chain Transparency

Every transaction, including payments, claims, and payouts, is recorded on the blockchain where anyone can check it at any time. This openness helps build trust because all actions are easy to see and verify.

5. Governance-Driven Claim Validation

DeFi insurance protocols use community governance for claim assessment. Token holders vote on claims and platform changes, ensuring decentralized, fair decisions. This approach reduces fraud, aligns incentives, and sustains a trustless ecosystem.

6. Multi-Chain & Real-Time Coverage

DeFi Insurance Protocol provides multi-chain protection across Ethereum, BNB Chain, Polygon, and more. Their smart contracts enable real-time coverage and payouts, making DeFi insurance accessible and efficient for users on different networks.

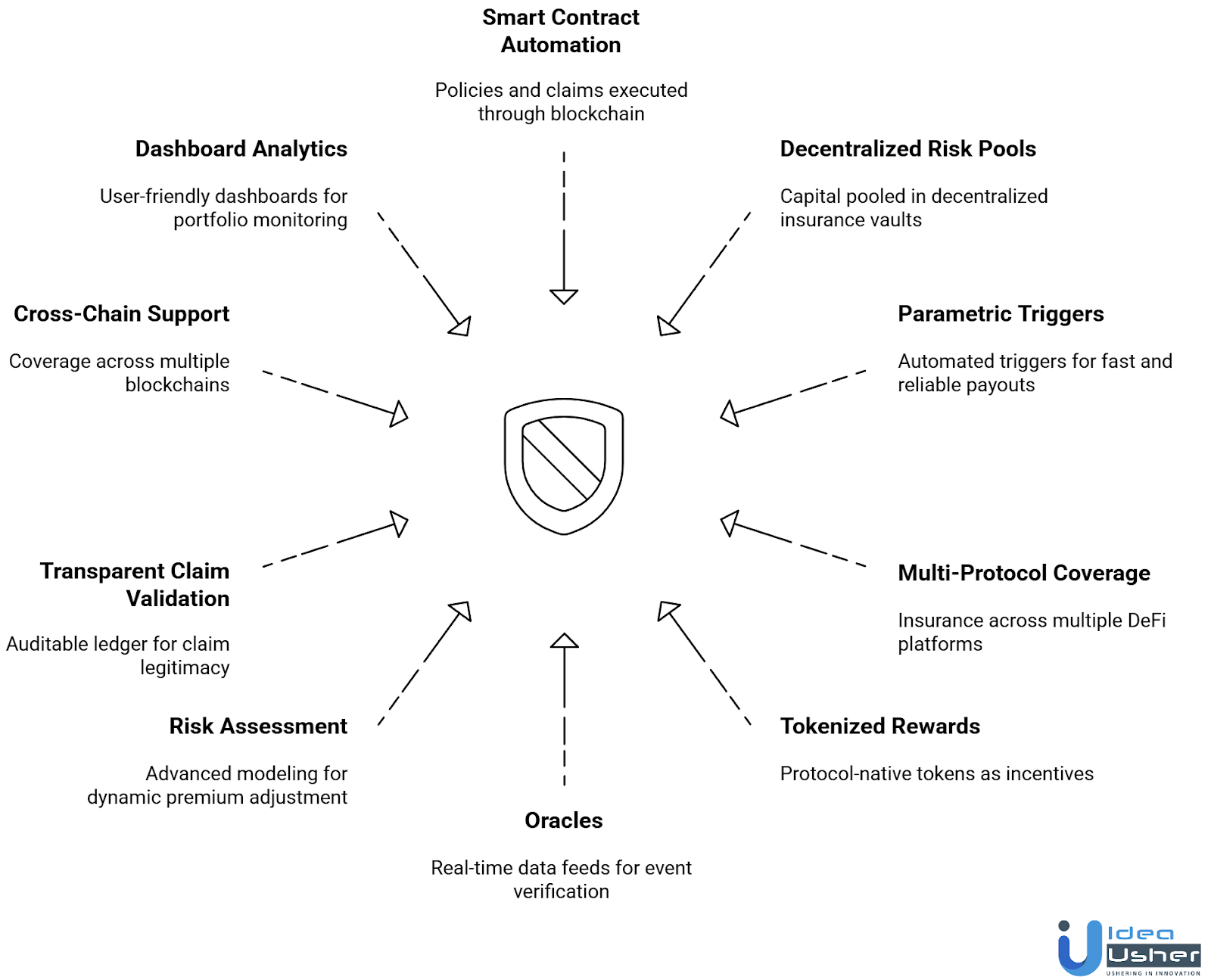

Key Features of DeFi Insurance Protocol like InsurAce

DeFi insurance protocols like InsurAce offer decentralized coverage for crypto assets, protecting against smart contract failures, hacks, and depegging. They use blockchain transparency and automated claims for secure risk management.

1. Smart Contract Automation

Policies and claims are executed through blockchain-based smart contracts, ensuring trustless, tamper-proof, and transparent automation. Premium collection, claim validation, and payouts happen without intermediaries, reducing operational overhead.

2. Decentralized Risk Pools

Capital from liquidity providers is pooled in decentralized insurance vaults, which underwrite risks. This allows community-driven liquidity provisioning, transparent fund allocation, and distributed exposure to different insurance products.

3. Parametric & On-Chain Triggers

InsurAce supports parametric triggers (e.g., DeFi protocol hacks, smart contract failures) verified on-chain. Automated triggers ensure fast, reliable, and precise payouts without manual intervention.

4. Multi-Protocol Coverage

Users can purchase insurance across multiple DeFi platforms, including lending, staking, and AMM protocols. Coverage is modular, allowing investors to protect assets on different chains and smart contracts simultaneously.

5. Tokenized Rewards & Governance

Liquidity providers and policyholders earn protocol-native tokens as incentives. These tokens often carry voting rights, enabling community governance of coverage parameters, claim approvals, and platform upgrades.

6. Oracles & Real-Time Data Feeds

Reliable on-chain and off-chain oracles provide real-time data for event verification. Multi-source data integration ensures accurate claim validation and reduces reliance on a single data source.

7. Risk Assessment & Pricing Engine

Advanced actuarial modeling and AI/ML algorithms assess protocol risks, dynamically adjust premiums, and calculate potential payouts. This ensures sustainable pool management and fair pricing for users.

8. Transparent Claim Validation

All events, policy terms, and claim settlements are recorded on-chain, providing a fully auditable, immutable ledger. Users and regulators can independently verify claim legitimacy.

9. Cross-Chain & Multi-Asset Support

Supports coverage for assets across multiple blockchains and DeFi ecosystems, enabling users to insure diversified portfolios without switching protocols manually.

10. Dashboard & Analytics

User-friendly dashboards provide portfolio monitoring, coverage status, claim history, and liquidity stats. Advanced analytics help both users and liquidity providers make informed decisions.

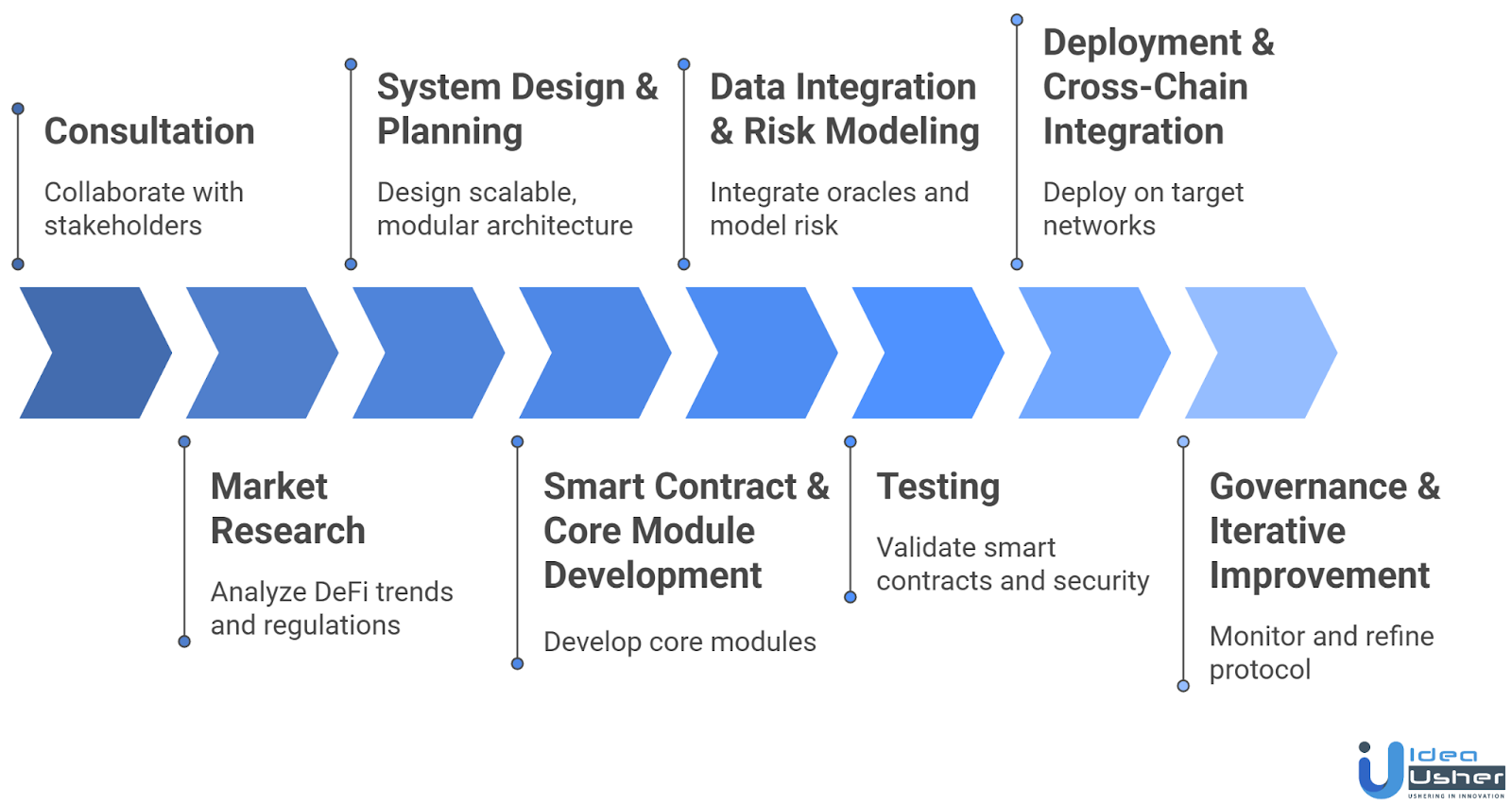

Development Process of a DeFi Insurance Protocol Platform

Developing a DeFi insurance protocol requires combining blockchain technology, decentralized finance mechanisms, smart contracts, and risk modeling. A structured end-to-end process ensures reliability, transparency, and scalability.

1. Consultation

We consult with you to understand business objectives, target assets, and coverage needs. This step defines insurance products, parametric triggers, payout rules, and regulatory considerations.

2. Market Research

Thorough research on DeFi trends, competitor protocols, and user expectations helps identify opportunities for differentiation. Compliance with local regulations, KYC/AML standards, and blockchain governance rules is analyzed to ensure legal viability.

3. System Design & Planning

We design a scalable, modular architecture for decentralized insurance pools, cross-chain asset coverage, and smart contract execution. System planning ensures smooth integration of on-chain oracles, tokenomics, and governance mechanisms.

4. Smart Contract & Core Module Development

Core modules include:

- Smart contracts for automated premium collection, claims, and payouts

- Decentralized risk pools for liquidity management

- Parametric triggers linked to reliable oracles

- Governance & tokenomics modules for community-driven decisions

These modules ensure trustless, transparent, and automated operations for users and liquidity providers.

5. Data Integration & Risk Modeling

Integration with on-chain and off-chain oracles ensures accurate event verification. Actuarial modeling and AI/ML algorithms assess risk, optimize premiums, and simulate potential payouts, reducing exposure for pools and users.

6. Testing

Comprehensive testing validates:

- Smart contract execution

- Risk pool liquidity management

- Parametric trigger accuracy

- Security against hacks and exploits

- Compliance with blockchain and DeFi standards

Simulations of extreme events ensure reliability and payout accuracy.

7. Deployment & Cross-Chain Integration

The protocol is deployed on Ethereum, Binance Smart Chain, or other target networks. Cross-chain bridges allow multi-asset coverage, while secure cloud and node infrastructure ensure uptime, performance, and scalability.

8. Governance & Iterative Improvement

Post-launch, we monitor claim events, pool utilization, and smart contract performance. Community governance allows updates to coverage rules, tokenomics, and risk parameters. Iterative improvements refine payout accuracy, security, and user experience.

Cost to Build a DeFi Insurance Protocol like InsurAce

Building a DeFi insurance protocol involves blockchain expertise, smart contract automation, and risk modeling. Costs vary depending on security, cross-chain integration, and compliance requirements. Below is a detailed breakdown to plan your investment efficiently.

| Development Phase | Description | Estimated Cost |

| Consultation | Understanding business objectives, defining coverage models, and planning protocol incentives and tokenomics. | $5,000 – $8,000 |

| Market Research | Analyzing DeFi insurance demand, competitor protocols, risk factors, and regulatory landscapes. | $8,000 – $12,000 |

| System Design & Planning | Designing blockchain architecture, protocol modules, token economics, and cross-chain interoperability. | $14,000 – $23,000 |

| Smart Contract Development | Coding insurance policies, automated premium collection, claims processing, and staking mechanisms on smart contracts. | $18,000 – $35,000 |

| Data Integration & Risk Modeling | Integrating on-chain/off-chain data feeds, risk scoring models, oracle services, and analytics for automated payouts. | $12,000 – $26,500 |

| Testing | Functional, security, and penetration testing of smart contracts and protocol modules to prevent exploits. | $5,000 – $10,000 |

| Deployment | Deploying on mainnet, enabling multi-chain support, and configuring cloud infrastructure and nodes. | $8,000 – $15,000 |

| Governance & Iterative Improvement | Implementing DAO governance, platform upgrades, feature iteration, and risk strategy adjustments. | $6,000 – $11,000 |

Total Estimated Cost: $65,000 – $138,000

Note: This budget ensures a secure, automated, and scalable DeFi insurance protocol with robust smart contracts, risk analytics, and cross-chain support.

Consult with IdeaUsher to build and launch your DeFi insurance platform.

Recommended Tech Stack for DeFi Insurance Protocol Development

Developing a DeFi insurance protocol requires a secure, scalable, and transparent technology stack. The stack combines blockchain, smart contracts, oracles, backend infrastructure, and frontend frameworks to deliver trustless insurance products on-chain.

1. Blockchain Layer

These blockchains run smart contracts and dApps. Ethereum leads DeFi with a mature ecosystem and Solidity support. Polygon reduces gas fees and improves scalability. Avalanche and Binance Smart Chain offer fast finality and EVM compatibility.

2. Smart Contract Development

Smart contracts handle insurance logic and claims. Solidity is key for Ethereum and EVM chains, supporting complex workflows. Vyper is a secure, simple Pythonic alternative for safety-critical contracts.

3. Oracles and Data Feeds

Oracles provide real-world data to smart contracts. Chainlink gives decentralized feeds for prices and insurance triggers. Band Protocol offers scalable, fast, multi-chain data for DeFi insurance.

4. Backend Infrastructure

Node.js and Python are used for server logic, smart contract connections, and databases. The Graph supports efficient blockchain data queries for analytics and policy tracking.

5. Frontend Development

Frontend frameworks build user interfaces for the protocol. React and Next.js power responsive web apps. Ethers.js and Web3.js enable wallet connections via MetaMask or WalletConnect.

6. Security and Auditing Tools

Security is vital in DeFi. OpenZeppelin provides trusted smart contract libraries. MythX and Slither automate vulnerability scans and aid contract audits before deployment.

Challenges & How to Overcome Those?

Building a DeFi insurance protocol offers decentralized risk coverage, automates claims, and improves liquidity. Yet, integrating smart contracts, governance, and cross-chain features presents operational and technical challenges.

1. Smart Contract Vulnerabilities

Challenge: Smart contracts automate DeFi insurance payouts, but bugs, exploits, or coding errors can compromise funds or block claims, posing financial and reputational risks for the platform.

Solution: We mitigate vulnerabilities through rigorous testing, formal verification, independent audits, and upgradeable contracts with timelock governance, ensuring secure DeFi insurance operations while allowing safe patching of potential issues.

2. Liquidity Management & Risk Pool Optimization

Challenge: Insufficient liquidity in decentralized risk pools can delay claims, reduce coverage capacity, and undermine trust in the DeFi insurance protocol.

Solution: Our approach includes dynamic pool sizing, staking incentives, reinsurance strategies, and predictive fund allocation models, maintaining optimal liquidity across risk categories to ensure timely and reliable payouts.

3. Event Verification & Oracle Dependence

Challenge: DeFi insurance relies on external oracles for event verification such as protocol hacks or contract failures, and inaccurate or delayed data can trigger false claims.

Solution: We enhance accuracy using multi-source oracles, redundancy checks, and cross-verification mechanisms, providing reliable event validation for DeFi insurance protocols and minimizing false positives or missed claims.

4. Regulatory Uncertainty

Challenge: DeFi insurance operates in a fragmented legal landscape with unclear regulations for tokenized coverage, automated payouts, and cross-jurisdiction compliance.

Solution: We embed KYC/AML modules, maintain audit-ready transaction records to navigate regulations, ensuring our DeFi insurance protocol operates securely and within legal frameworks.

5. Risk Pricing & Premium Optimization

Challenge: Setting accurate premiums is difficult due to volatile yields, protocol risks, and liquidity fluctuations, impacting sustainability and fair coverage for users.

Solution: We leverage AI/ML risk models, historical DeFi event analysis, and actuarial techniques to calculate fair premiums, ensuring pool sustainability and balanced DeFi insurance coverage across varying protocols.

6. Cross-Chain & Multi-Asset Support

Challenge: Users demand coverage across multiple blockchains and assets, creating integration complexity and potential security risks in DeFi insurance platforms.

Solution: Our platform supports cross-chain bridges, multi-asset vaults, and modular smart contracts, enabling secure, flexible, and scalable DeFi insurance coverage for diverse blockchain ecosystems and user assets.

Conclusion

Creating a DeFi Insurance Protocol requires blending blockchain technology, smart contracts, and decentralized risk management to offer transparent and efficient coverage solutions. By prioritizing security, automation, and community governance, such protocols enable users to access insurance without intermediaries while maintaining trust and reliability. Understanding the essential features, regulatory considerations, and integration strategies is crucial for building a scalable and resilient platform. A well-executed DeFi insurance protocol can transform the way coverage is offered, fostering innovation, transparency, and user confidence in the decentralized finance ecosystem.

Why Choose IdeaUsher for Your DeFi Insurance Protocol Development?

IdeaUsher builds decentralized insurance solutions that combine blockchain, smart contracts, and community governance to deliver secure, transparent, and automated risk coverage for crypto and DeFi users.

Why Work with Us?

- DeFi & Blockchain Expertise: Our team ensures your protocol operates transparently and efficiently, automating claims while securing user funds.

- Customizable Protocols: We provide fully tailored solutions, from smart contract architecture to liquidity pool management and staking incentives.

- Proven Track Record: We have launched multiple blockchain products, helping platforms maximize user trust and engagement.

- Scalable & Secure: Our protocols are designed to handle growing user bases and high transaction volumes without compromising security.

Check out our portfolio to explore how we’ve helped projects launch successful decentralized solutions.

Contact us today for a consultation to start building your DeFi insurance protocol.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A DeFi insurance protocol is a decentralized platform that offers coverage for blockchain and crypto-related risks using smart contracts. It eliminates intermediaries, automates claims, and allows users to participate in risk pooling and governance.

Core components include decentralized risk pools, automated smart contracts, governance tokens, secure wallets, and real-time monitoring systems. Together, they enable transparent, user-driven coverage and streamline claims processing in the decentralized ecosystem.

Blockchain platforms like Ethereum, smart contract frameworks, oracles for real-world data, and secure cryptography form the backbone. These technologies ensure automation, transparency, and security while supporting decentralized decision-making and claim execution.

Offering competitive yields, transparent governance, user-friendly interfaces, and reliable coverage options helps attract participants. Incentivizing liquidity providers with rewards and token staking encourages active engagement and ensures sufficient capital for risk coverage.