For years, traditional insurance has tried to keep up with the speed of a digital world, but it has not quite succeeded. Long claim cycles and hidden processes have made people lose patience with it. The whole system feels like it is stuck in another time. As more sectors move toward decentralization, the idea of an on-chain insurance platform is becoming a clear solution.

Over the years, we’ve worked with numerous fintech startups and developed several decentralized insurance and DeFi protection solutions that use technologies such as smart contract automation and blockchain-based risk modeling. In this blog, we’ll explore how to build an on-chain insurance platform like Nexus Mutual. We’ll dive into how the right technology and architecture can truly make these platforms secure, scalable, and genuinely user-focused.

Key Market Takeaways for On-Chain Insurance Platforms

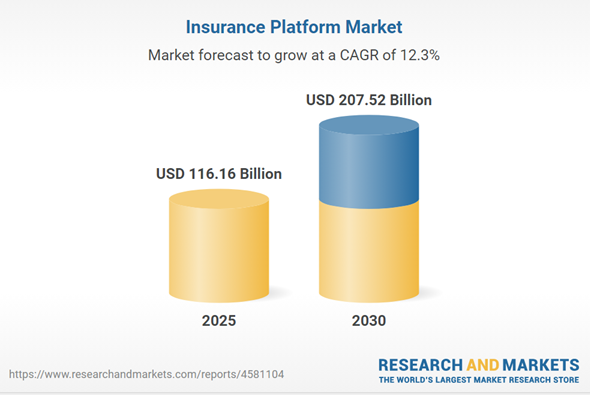

According to ResearchandMarkets, the insurance platform market is growing fast, moving from USD 116.16 billion in 2025 to an estimated USD 207.52 billion by 2030. This growth comes from the global push toward digital transformation and the rising need for flexible, data-driven insurance solutions. Companies are adopting automation and blockchain to streamline operations and deliver better customer experiences, even as they face tighter regulations and cybersecurity challenges.

Source: ResearchandMarkets

On-chain insurance platforms are changing how people think about protection and trust. By using blockchain, these platforms make claims automatic, transactions transparent, and risk-sharing fairer for everyone involved.

Nexus Mutual is a leading example, offering decentralized coverage for smart contract bugs and exchange failures through its community-based model. InsurAce has also made its mark with multi-chain support, affordable premiums, and coverage across smart contracts, stablecoins, and centralized exchanges.

Partnerships are becoming a major growth driver in this space. Projects like Ensuro, which operates on Polygon, are teaming up with traditional insurers and DeFi players to bring on-chain efficiency to real-world insurance use cases. These collaborations are helping decentralized insurance platforms expand their reach, build credibility, and move closer to mainstream acceptance.

What is the Nexus Mutual Platform?

Nexus Mutual is a decentralized insurance platform built on the Ethereum blockchain. It reimagines traditional insurance by allowing members to pool their capital and share risks collectively without relying on centralized insurers. The platform operates as a discretionary mutual fund, governed entirely by its members through a decentralized autonomous organization.

Members hold NXM tokens, which give them the ability to participate in governance, evaluate claims, and help manage the platform’s overall risk strategy. Nexus Mutual primarily focuses on protecting users from smart contract vulnerabilities, DeFi protocol exploits, and other crypto-specific risks.

Here are some of its standout features,

1. Decentralized Risk Sharing

Instead of a traditional insurance company model, Nexus Mutual enables members to contribute to a shared capital pool, distributing risk across participants. This approach fosters a community-led, transparent method of managing collective exposure.

2. Smart Contract Cover

The platform’s flagship product provides protection against losses resulting from smart contract bugs or failures across popular DeFi protocols, safeguarding users from some of the most common blockchain risks.

3. Member-Led Governance

Every major decision, including protocol upgrades, claims approvals, and new coverage types, is guided by members who vote using NXM tokens. This ensures that control remains decentralized and transparent.

4. Community-Based Claims Assessment

Claims are evaluated and approved by members through a decentralized voting system. This process replaces traditional claims adjusters with a transparent, incentive-aligned method that rewards fairness and accuracy.

5. Full On-Chain Transparency

All Nexus Mutual operations, from fund management to claims data, are visible and verifiable on the blockchain, providing real-time accountability and insight into how funds are used.

6. Customized Crypto Risk Coverage

Beyond standard smart contract protection, the mutual offers bespoke insurance options for niche crypto risks, including custody failures, staking slasher events, exchange hacks, and stablecoin depegs.

7. Quick and Fair Claim Settlements

Approved claims are typically paid out within days, ensuring that affected members receive compensation promptly without lengthy bureaucracy.

8. Strong Community and DAO Ecosystem

The Nexus Mutual ecosystem includes community-driven teams and a foundation that help expand adoption, fund innovation, and maintain protocol resilience.

9. NXM Token Utility

The NXM token powers the platform. It represents membership, voting rights, and a claim on the capital pool. It also aligns incentives between participants, ensuring that governance and risk management remain community-oriented.

How Does the Nexus Mutual Platform Work?

Nexus Mutual works like a digital safety net where members pool their crypto to protect each other from losses. You can join by buying NXM tokens and then use them to get cover, assess risks, or vote on claims. When something goes wrong, members will review the claim and quickly decide whether to make a payout, keeping the process fair and transparent.

Step 1: Becoming a Member

To participate in Nexus Mutual, you first become a member by purchasing the native NXM token. This step is more than just a financial transaction. It grants you access to several core functions within the ecosystem:

- Buy insurance cover for your digital assets.

- Stake NXM as a Risk Assessor to earn fees.

- Vote on claims and help govern the mutual’s operations.

Owning NXM tokens essentially makes you part of the mutual, giving you both responsibility and decision-making power.

Step 2: How Coverage Is Priced and Purchased

When you buy coverage for a DeFi protocol (for example, to protect funds on Aave or Uniswap), pricing is determined by market dynamics rather than a centralized authority.

Risk Assessment Staking

Members who act as Risk Assessors stake NXM tokens on protocols they believe are safe. The more tokens staked on a protocol, the lower the cost of coverage. This creates a decentralized pricing mechanism that reflects the community’s confidence in each platform.

Dynamic Pricing

Premiums are also influenced by the Minimum Capital Requirement, which measures the mutual’s solvency. If capital levels drop too low compared to liabilities, cover prices increase to attract new funds and limit exposure.

To purchase cover, you simply connect your wallet, choose the protocol and duration, and pay the premium in ETH, DAI, or other accepted tokens.

Step 3: The Claims Process

This stage represents the heart of Nexus Mutual’s innovation. When a loss occurs due to a covered event, claims are not handled by an insurance company but by the community itself.

- Filing a Claim: The affected member submits a claim with evidence showing that a covered event, such as a smart contract exploit, caused financial loss.

- Community Assessment: Claims are reviewed by members who have staked NXM to become Claims Assessors.

- Skin in the Game: Assessors stake their NXM on the outcome they believe is correct, either “Valid” or “Invalid.”

- Voting and Incentives: Assessors who vote with the majority are rewarded with part of the claimant’s fee and a share of the slashed tokens from those who voted incorrectly. Those who vote against the consensus lose a portion of their stake.

- Outcome: If the claim is approved, the payout is made directly from the shared capital pool. If it is rejected, the cover expires without payment.

This system aligns incentives and encourages careful, honest assessments using the wisdom of the crowd.

Step 4: Capital Efficiency and Governance

The capital within Nexus Mutual’s pool is not left idle. A portion is strategically deployed into yield-generating protocols such as Aave and Compound to earn additional returns for the mutual.

All members can also participate in governance by voting with their NXM tokens on key decisions such as investment strategies, risk parameters, or new cover products. This ensures that the platform evolves according to the collective interests of its community.

What is the Business Model of the Nexus Mutual Platform?

Nexus Mutual operates as a decentralized insurance protocol designed for crypto assets, built on the Ethereum blockchain. Its business model centers on a member-driven mutual structure, where participants collectively manage capital, assess risk, and process claims through transparent on-chain governance. The platform protects a wide range of crypto-native risks such as smart contract exploits, custody failures, validator slashing, and stablecoin depegs.

By replacing traditional insurers with a community of token holders, Nexus Mutual aligns incentives between members while maintaining full transparency over how capital is used, distributed, and invested.

Revenue Streams

Nexus Mutual earns its primary revenue from insurance premiums paid by policyholders who purchase various types of risk cover. These premiums are collected into a shared capital pool, which serves as the foundation for claims and future cover growth.

- To enhance sustainability, the platform also invests a portion of the capital pool, typically around 20%, into low-risk yield opportunities, generating additional income that supports operations and reserves.

- The NXM token underpins the incentive model. Members use it to participate in governance, vote on claims, and receive rewards or fee benefits, ensuring active engagement and alignment within the ecosystem.

Claims and Payouts

Since its launch in 2019, Nexus Mutual has paid out more than $18.5 million in claims, covering major incidents such as the Rari Capital, FTX, and Yearn Finance losses.

- Claims are processed through a community-driven voting mechanism, where members assess the validity of each submission. Approved claims are usually settled within two to six days, offering a faster, fairer alternative to traditional insurance.

- Although some risk pools have seen loss ratios exceeding 100% during periods of high exposure, the overall claim approval rate remains above 80%, reflecting consistent trust and fair governance across the mutual.

Financial Performance

As of October 2025, Nexus Mutual manages approximately $400 million in ETH and other assets within its capital pool. This reserve supports an equivalent level of insured coverage, providing strong backing for the platform’s risk exposure.

- Cumulative cover sales have surpassed $425 million, marking significant adoption and utility within the DeFi ecosystem.

- Annual revenues average around $10.4 million from premiums and an additional $4 million from investment returns, delivering an estimated 2.5% return on assets.

- The NXM token currently holds a market capitalization of about $176.99 million, signaling steady growth and market confidence in the platform’s long-term viability.

Funding and Investment Rounds

Nexus Mutual has raised approximately $2.94 million through three funding rounds, combining private investments and a token launch. The most notable raise occurred in February 2021, when the project secured $2.7 million in early-stage venture funding.

Key backers include Version One Ventures and several other blockchain-focused investment firms. This funding has supported Nexus Mutual’s protocol development, product expansion, and community growth initiatives.

Other Business Models for an On-Chain Insurance Platform

While Nexus Mutual’s discretionary mutual model has proven successful, the on-chain insurance ecosystem is still in its early stages. There is significant room for innovation through niche specialization, automation, and creative risk management structures. By exploring alternative models, entrepreneurs and investors can identify new opportunities for growth and profitability.

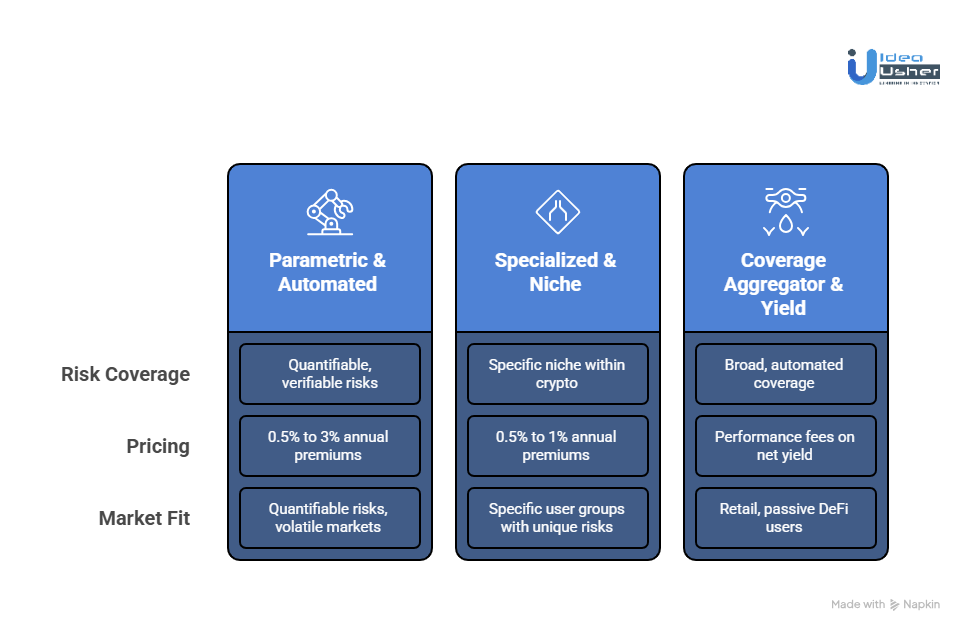

1. The Parametric and Automated Payout Model

In this model, subjective claims assessment is replaced by objective, data-driven payouts. Instead of relying on human evaluators, smart contracts automatically issue payments when a predefined condition is met.

These conditions are verified by decentralized oracle networks that provide real-world data. In essence, the insurance operates like a financial derivative that triggers a payout when measurable events occur.

For instance, Neptune Mutual uses this structure to protect against crypto-related events such as exchange hacks or stablecoin depegs.

Pricing and Revenue

Parametric products typically carry 0.5% to 3% annual premiums, depending on the risk volatility of the underlying asset. Because these systems require little manual intervention, they retain a higher profit margin.

If Neptune Mutual manages a $20 million capital pool and collects 5% in annual premiums, it would earn $1 million in yearly revenue from premiums alone, with minimal operational costs.

Market Fit

This model fits best for quantifiable and verifiable risks, such as stablecoin depegs, halted withdrawals on centralized exchanges, or defined on-chain events. Its transparency and near-instant settlement create strong user trust, particularly in volatile markets.

2. The Specialized and Niche Risk Model

Instead of offering broad-based coverage, this model focuses on a specific niche within the crypto ecosystem. By specializing in a single area, such as Ethereum validator slashing, cross-chain bridge insurance, or NFT lending protection, the platform builds deep expertise and trust.

For example, Ethereum validators risk losing part of their stake if they act maliciously or experience technical errors. Given that over 32 million ETH are currently staked (worth roughly $120 billion), the total addressable market is substantial.

Pricing and Revenue

If a platform offers validator slashing coverage at an annual premium of 0.5% to 1% and captures 1% of the market, yearly potential revenue could range from $6 million to $12 million.

($120B × 1% × 0.5–1.0% = $6M–$12M).

Market Fit

This model attracts specific user groups, such as Ethereum validators, NFT lenders, or liquidity providers, who seek protection for unique risks not covered by generalist platforms. By specializing, the platform simplifies underwriting, builds community loyalty, and achieves predictable risk management outcomes.

3. The Coverage Aggregator & Yield-Bearing Vault Model

This model removes the friction of purchasing individual policies. Instead of manually buying coverage, users deposit their assets into a vault, which automatically allocates a portion of the yield it generates to buy insurance from other on-chain providers. The user benefits passively from protection and yield optimization.

The platform Ease (formerly Armor.fi) pioneered this model by automating protection purchasing for DeFi users.

Pricing and Revenue

Revenue comes from performance fees charged on the vault’s net yield after coverage costs are deducted.

Assume a vault manages $50 million in total assets and generates an annual yield of 5% ($2.5 million). If 1% ($500,000) is allocated to insurance premiums, the remaining 4% ($2 million) serves as the basis for fee calculation. With a 10% performance fee, the platform earns $200,000 annually.

Market Fit

This model is ideal for retail and passive DeFi users who prefer simplicity and automation. It removes the complexity of active policy management and embeds insurance into familiar DeFi products such as yield vaults and liquidity pools.

How to Develop an On-Chain Insurance Platform Like Nexus Mutual?

We have been building on-chain insurance platforms like Nexus Mutual for our clients for over a decade. Our team truly understands how to merge blockchain transparency with DAO governance to create systems that actually work in the real world. Each platform is designed carefully so it stays compliant, community-driven, and genuinely decentralized.

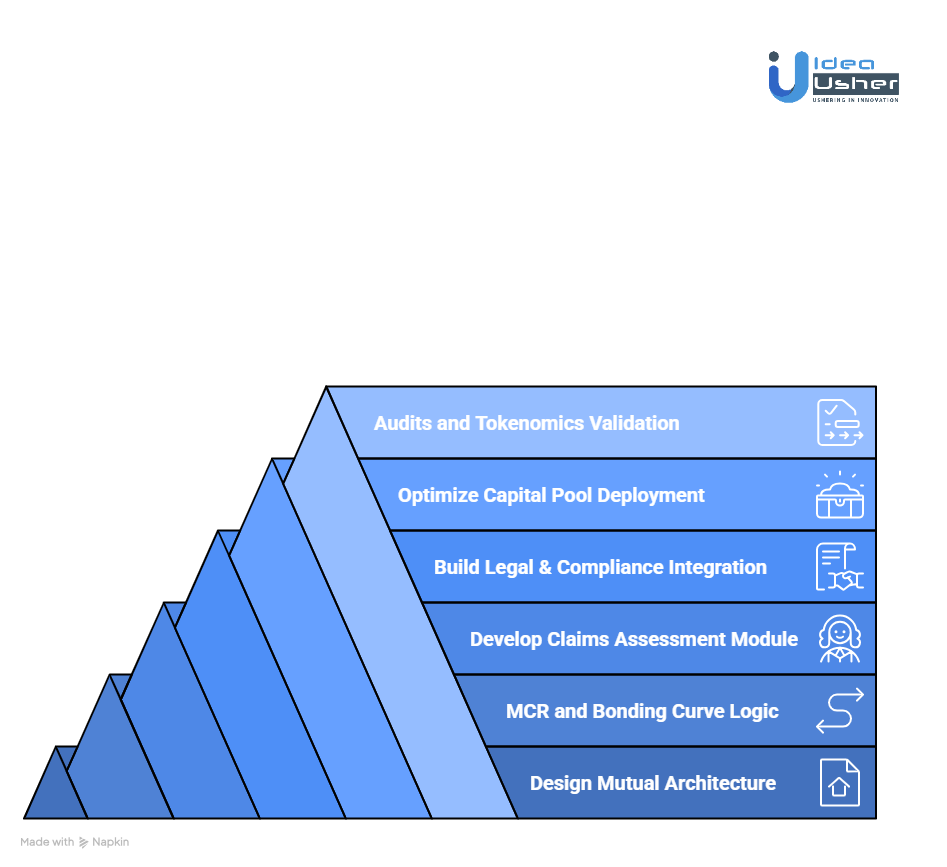

1. Design Mutual Architecture

We begin by defining the mutual structure like the capital pool, members, and governance DAO. Depending on client needs, we choose between discretionary or parametric cover models and map smart contract flows from the capital pool to the claims module for full transparency.

2. MCR and Bonding Curve Logic

Our team develops dynamic solvency and pricing models using MCR logic and bonding curves. With integrated oracles, the system constantly updates capital and coverage data, keeping the native token value accurate and responsive to market conditions.

3. Develop Claims Assessment Module

We build staking-based voting contracts for decentralized claims assessment. Honest participation is encouraged through staking rewards, while slashing mechanisms deter manipulation. A clear, DAO-driven claims UI ensures every member can transparently view and participate in decisions.

4. Build Legal & Compliance Integration

We help clients set up a suitable legal entity and compliance framework that aligns with decentralized principles. KYM or Know Your Member processes are embedded for accountability, while DAO-to-legal bridge contracts ensure on-chain governance translates into legally enforceable outcomes.

5. Optimize Capital Pool Deployment

To maximize returns, we integrate idle funds with DeFi protocols like Aave or Compound. Governance controls the investment strategy through on-chain proposals, while custom dashboards track capital pool health, liquidity levels, and overall solvency in real time.

6. Audits and Tokenomics Validation

Before mainnet deployment, we carry out smart contract audits, risk backtesting, and tokenomics validation. We also simulate governance and claims scenarios to ensure the system performs seamlessly in real-world conditions before going live.

Revenue Potential of an On-Chain Insurance Platform

The DeFi sector, with a Total Value Locked ranging between $40 billion and $80 billion, represents one of the largest untapped markets for on-chain risk management. Insurance protocols operating within this ecosystem are uniquely positioned to capture a portion of this market’s risk premium, the cost participants are willing to pay to protect their digital assets.

Although the industry is still in its early stages, its revenue potential is substantial. By analyzing the financial performance and operating models of leading protocols such as Nexus Mutual, InsurAce, and Neptune Mutual, we can build a realistic view of how revenue is generated and how it scales as adoption grows.

Primary Revenue Streams

An on-chain insurance platform typically earns revenue from two key sources:

- Insurance Premiums: The fees collected from users who purchase coverage for their crypto assets.

- Investment Income: The yield generated from deploying the platform’s collateralized capital pool into low-risk DeFi lending or staking markets.

These two income streams form the foundation of a sustainable business model. Premiums drive immediate cash flow, while yield-based income strengthens long-term solvency and growth capacity.

Revenue Stream 1: Insurance Premiums

The core business of any insurance protocol is collecting premiums in exchange for assuming risk. Three main variables determine premium revenue:

- Total Addressable Market: The overall value of assets seeking protection.

- Market Penetration Rate: The proportion of the market currently purchasing coverage.

- Average Premium Rate: The average percentage charged annually for coverage.

Step 1: Estimating the Total Addressable Market

The Total Addressable Market for on-chain insurance closely mirrors the TVL of the DeFi ecosystem. As of late 2023 and early 2024, major DeFi protocols consistently maintained over 50 billion dollars in locked assets, even during bearish market conditions.

This figure represents a conservative baseline. With the growing adoption of tokenized real-world assets, institutional staking, and regulated DeFi platforms, the TAM could easily surpass 100 billion dollars within the next few years.

Step 2: Estimating Market Penetration Rate

The penetration rate remains low, underscoring the scale of future opportunity. Based on data from industry leaders:

- Nexus Mutual has written over 6 billion dollars in historical coverage, with active cover between 150 and 250 million dollars.

- InsurAce Protocol maintains 50 to 100 million dollars in active coverage capacity across multiple chains.

Combining these gives a total active coverage of approximately 200 to 350 million dollars.

Penetration Rate = Active Cover ÷ TAM

275 million ÷ 50,000 million = 0.55 percent

This shows that less than one percent of the total DeFi value is currently insured, highlighting enormous headroom for growth as the sector matures.

Step 3: Applying an Average Premium Rate

Premium rates vary depending on the risk profile of covered assets.

- Nexus Mutual charges between 1.5 and 4.0 percent annually for smart contract cover.

- InsurAce Protocol offers competitive pricing between 2.0 and 3.5 percent.

A weighted average of 2.5 percent provides a balanced basis for revenue modeling.

Premium Revenue Formula: Annual Premium Revenue = TAM × Penetration Rate × Premium Rate

Conservative Scenario: 50,000,000,000 × 0.55% × 2.5% = 6,875,000 dollars

Optimistic Scenario: If the TAM rises to 80 billion and penetration doubles to 1.1 percent,

80,000,000,000 × 1.1% × 2.5% = 22,000,000 dollars

Real-World Validation: Nexus Mutual’s 200 million dollars in active cover at an average 2.5 percent premium generates roughly 5 million dollars annually, which aligns closely with the conservative model.

Revenue Stream 2: Investment Income on the Capital Pool

Insurance platforms must maintain a collateralized capital pool to ensure solvency and cover potential claims. This pool is not static; it can be deployed in conservative DeFi strategies to generate yield, creating an additional and often substantial revenue stream.

Step 1: Estimating the Capital Pool Size

Capital pool requirements depend on the protocol’s solvency model and underwriting exposure.

- Nexus Mutual maintains a capital pool between 120 and 150 million dollars.

- Bridge Mutual and Tidal Finance manage smaller pools ranging from 10 to 30 million dollars.

For a competitive mid-sized entrant, a 150 million dollar capital pool represents a realistic target within two years of operation.

Step 2: Estimating a Sustainable Yield

In the current DeFi environment, stablecoin lending and staking on platforms like Aave, Compound, and Spark yield 3 to 5 percent APY with relatively low risk.

Nexus Mutual’s financial reports for 2022–2023 confirm that such strategies are already being used to fund operations and enhance treasury resilience.

Assuming a 4 percent net annual yield provides a conservative yet realistic estimate.

- Investment Income Formula: Annual Investment Income = Capital Pool × Yield Rate

- Conservative Estimate: 150,000,000 × 4% = 6,000,000 dollars

- Optimistic Estimate: 250,000,000 × 4% = 10,000,000 dollars

Historical Benchmark: In 2021–2022, Nexus Mutual reported over 10.4 million dollars in investment income, surpassing its premium revenue and demonstrating that treasury yield can rival or exceed underwriting income in a well-structured insurance protocol.

Total Annual Revenue Potential

| Scenario | Premium Income | Investment Yield | Total Revenue |

| Conservative | 6.9M | 6.0M | 12.9M (~13M) |

| Optimistic | 22.0M | 10.0M | 32.0M (~32M) |

A mature on-chain insurance protocol can therefore expect annual revenues between 13 and 32 million dollars, driven by premiums and yield returns. The ability to scale both revenue sources simultaneously gives these platforms strong financial leverage as adoption increases.

To achieve meaningful market share, new platforms should focus on:

- Transparency and Trust: Establish on-chain solvency metrics and conduct third-party audits.

- Liquidity Growth: Larger capital pools directly increase underwriting capacity and yield potential.

- Product Diversification: Introduce coverage for new risks such as validator slashing, bridge failures, depegging events, and centralized exchange insolvencies.

Even capturing 10 percent of Nexus Mutual’s current market could yield 1.5 to 2 million dollars in annual revenue, providing a strong foundation for compounding growth as DeFi insurance penetration moves from 0.55 percent toward the 10 to 20 percent seen in traditional finance.

Comparative Market Insights

- InsurAce Protocol: With an estimated 75 million dollars in active cover at a 2.5 percent premium, it likely generates around 1.9 million dollars in annual premium revenue. Adding investment yield from its smaller pool brings total annual revenue to roughly 3 to 5 million dollars.

- Parametric Protocols (Neptune Mutual): These operate with lower premiums but greater automation and scalability. Automated payouts reduce administrative costs, enabling faster market expansion and higher transaction volume.

- Emerging Mutuals: New entrants leveraging cross-chain coverage and reinsurance models could raise total market penetration above 2 percent within the next three years.

Key Challenges for an Insurance Platform Like Nexus Mutual

Building an on-chain insurance platform can be thrilling yet demanding because it brings together blockchain, finance, and regulation in one space. At Idea Usher, we have worked closely with clients to design and launch such systems, and we have often noticed similar challenges appear. Here are the key hurdles you might face and how you could practically overcome them.

1. Balancing Decentralization and Compliance

Decentralized systems exist in a world still governed by centralized laws. Without a legal structure, your DAO risks being viewed as an unregulated insurer, which can expose members and developers to significant liability.

Our Solution

- We help clients establish a foundation-plus-DAO structure where a non-profit foundation (typically in jurisdictions like Switzerland or the Cayman Islands) serves as the legal representative of the ecosystem.

- This foundation holds any required licenses, interacts with traditional financial systems, and provides a legal interface, while the DAO retains full control of the on-chain protocol, treasury, and governance.

2. Building Reliable Risk Models

Pricing coverage for a new DeFi protocol can be tricky because there is no past data to rely on. You might need to blend expert judgment with live on-chain insights so the pricing can adjust naturally as risks evolve.

Our Solution

Our approach combines human expertise and real-time data:

- Collaborate with Actuaries: We partner with progressive actuaries to develop early-stage DeFi risk models based on measurable indicators like TVL, audit quality, and protocol maturity.

- Integrate Data-Driven Oracles: By connecting to on-chain oracles and using tools like The Graph, we track real-time metrics such as transaction volume, protocol dependencies, and exploit frequency.

3. Defending Against Governance Attacks

If voting power depends solely on token ownership, a bad actor can accumulate enough tokens to pass malicious proposals, drain funds, or approve fraudulent claims.

Our Solution

We design governance frameworks where credibility and participation matter as much as capital:

- Reputation-Based Voting: Voting influence grows with a participant’s history of constructive engagement, such as correct claim assessments or consistent participation.

- Staking and Slashing: Users stake tokens when voting on critical proposals. Voting dishonestly or against consensus can trigger token slashing, creating a direct economic disincentive for malicious behavior.

4. Maintaining Liquidity and Stability

Mass claim events can drain liquidity and threaten solvency. However, holding excess idle capital reduces returns and discourages staking.

Our Solution

We build automated financial resilience into the protocol:

- Dynamic Reinsurance: When risk exposure exceeds predefined limits, the protocol automatically purchases reinsurance from other DeFi insurers or traditional providers to spread the risk.

- Minimum Capital Requirement: Smart contracts continuously monitor the ratio between capital and cover. If liquidity falls below a safe level, the system can pause new cover, adjust premiums, or rebalance from yield-bearing positions to ensure payouts remain fully backed.

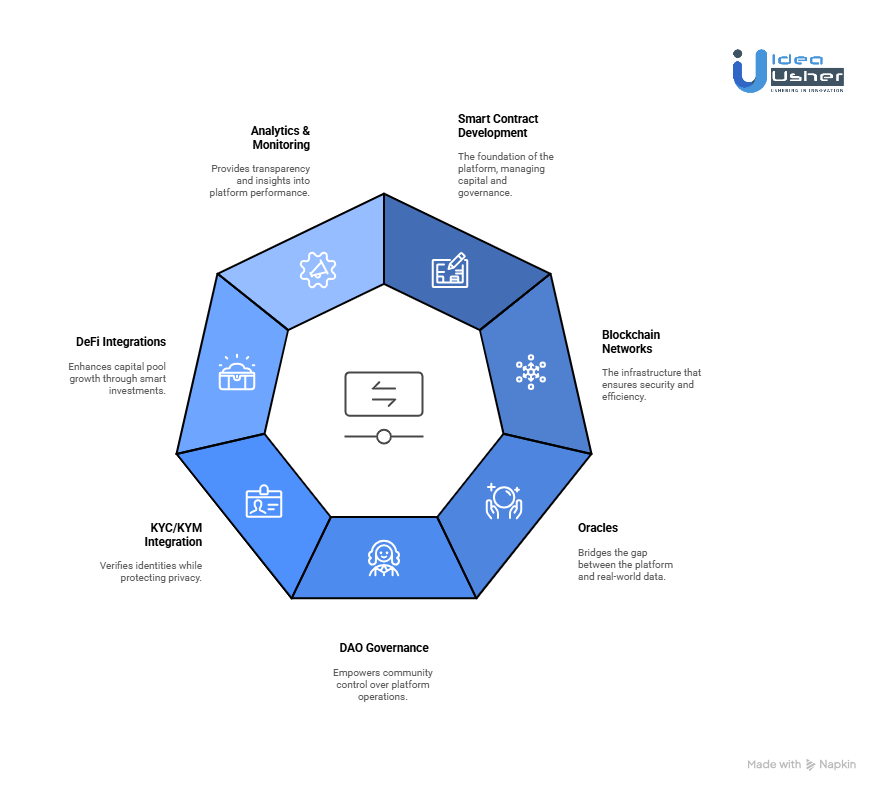

Tools & APIs for an On-Chain Insurance Platform Like Nexus Mutual

Creating an on-chain insurance platform is not just about writing smart contracts; it is about designing a secure, transparent, and scalable ecosystem. Each layer of the stack plays a critical role in balancing trust, usability, and compliance. Below is a curated breakdown of the essential technologies you will need and why they matter.

1. Smart Contract Development

Smart contracts form the backbone of your platform, managing everything from capital pooling to claims assessment and member governance.

Solidity

The standard language for Ethereum and other EVM-compatible chains such as Polygon or Arbitrum. It is used to build your core modules, including capital pools, cover policies, staking mechanisms, and DAO logic. Solidity expertise is essential.

Hardhat / Truffle

Full-featured development frameworks that handle compiling, testing, debugging, and deployment. Hardhat’s local testing environment and console logging make it especially valuable for modeling complex interactions like multi-contract calls or claims voting.

2. Blockchain Networks

Selecting the right chain involves balancing decentralization, cost, and user experience.

- Ethereum Mainnet: The gold standard for security and decentralization, ideal for protocols managing significant capital. The downside is higher gas fees for frequent transactions.

- Layer-2s (Polygon, Arbitrum, Optimism): Offer the same security guarantees as Ethereum but with lower transaction costs and faster throughput, making cover purchases, claims, and votes more affordable for users.

3. Oracles

Oracles help your platform stay connected to real-world events and price data securely and reliably. Tools like Chainlink and API3 can truly make a difference because they provide trusted data feeds your system can depend on. They might fetch live asset prices or even trigger payouts automatically when conditions such as a stablecoin depeg occur.

4. DAO Governance

An on-chain insurance platform is inherently a community-owned mutual. Governance tools give your members direct control over operations.

Aragon: A framework for setting up DAOs with modular governance, voting, and treasury management. It is ideal for structuring the legal and technical foundations of your mutual.

Snapshot & Tally:

- Snapshot: Enables off-chain, gasless voting, perfect for gauging community sentiment efficiently.

- Tally: Provides a clean interface for on-chain governance, allowing members to view proposals, delegate votes, and participate transparently.

5. KYC/KYM Integration

If your insurance protocol interacts with real-world regulations, you will need a way to verify identities without compromising privacy. Tools like Civic, Fractal ID, and Polygon ID can easily help users prove their identity through secure verification. This method can fully protect personal data while still meeting KYC or KYM standards.

6. DeFi Integrations

Your capital pool should not just sit idle because it can steadily grow through smart DeFi integrations. Platforms like Aave, Compound, and Yearn Finance can help it earn returns by lending stablecoins or ETH safely. The extra yield could then support rewards for stakers or lower member costs while keeping the system secure.

7. Analytics & Monitoring

Transparency is not just a feature; it is the promise that builds trust. Analytics tools make your platform’s performance visible to members, auditors, and the public.

- The Graph: Index and expose your platform’s on-chain data through a custom subgraph. This enables real-time querying of covers, claims, and pool balances for dashboards and third-party integrations.

- Dune Analytics: Build public dashboards to track metrics like Total Value Locked, claims processed, and premium income. These become powerful tools for community insight and investor trust.

- Tenderly: A must-have for smart contract devops. It provides real-time monitoring, simulations, and alerting to catch anomalies or bugs before they escalate.

Conclusion

On-chain insurance is quietly transforming how we think about risk in the DeFi world. Platforms like Nexus Mutual have already shown that decentralized and community-driven coverage can truly work when built on trust and transparency. With the right mix of solid architecture, a clear legal framework, and thoughtful tokenomics, any business can build its own sustainable on-chain mutual that actually lasts.

At Idea Usher, we work side by side with you to design and develop full-stack on-chain insurance platforms that are legally sound, technically strong, and economically balanced so you can move forward with confidence and build something that really makes a difference.

Looking to Develop an On-Chain Insurance Platform Like Nexus Mutual?

Our team of seasoned ex-MAANG developers, with over 500,000 hours of combined engineering experience, specializes in solving the technical, economic, and regulatory challenges of decentralized insurance systems.

Here’s how we do it:

- Core Mechanics Mastery: We design stake-weighted claims systems and dynamic pricing engines built on bonding curves.

- Economic Security: Our engineers implement robust solvency (MCR) models and incentive mechanisms grounded in sound game theory.

- Legal-Tech Integration: We help bridge the gap between decentralized governance and compliant legal structures for discretionary cover.

Let’s build a member-owned mutual that is transparent, trustless, and ready to protect the next generation of crypto innovations.

Your vision. Our execution. Proven results.

Explore our latest projects to see what we can create together.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: An on-chain insurance platform runs on blockchain, where smart contracts replace the middlemen and community members govern decisions. Instead of trusting a single company, users rely on transparent code and collective voting, which can feel more democratic and secure. It is appealing because it lets members truly own and control the system rather than depending on a corporate promise.

A2: To build something like Nexus Mutual, developers mainly use Ethereum smart contracts that can automatically manage policies and claims. DAO frameworks help set up community voting, while bonding curves handle token pricing and liquidity. Risk oracles play a vital role because they feed real-world data into the blockchain, making sure the system can respond accurately to events.

A3: The claims process is designed to stay fair by letting only staked members vote on outcomes. These assessors must think carefully before voting since dishonest decisions can cost them part of their stake. Because everything happens on-chain, anyone can review the process, which makes it almost impossible to manipulate quietly.

A4: Companies can earn in several ways, such as collecting premiums and taking governance fees from the platform’s activity. They might also gain staking rewards or generate yield by investing the capital pool strategically. This model allows sustainable revenue without depending on traditional insurers and encourages active participation in the ecosystem.