Blockchain technology has created a new economic system, and that is tokenomics, which is the key to making it work. Simply put, tokenomics is the study of the economic aspect of blockchain projects. It includes the design of the token ecosystem that defines the distribution, utility, and creation of a token or cryptocurrency within a specific blockchain project.

The tokenomics design is important for businesses like yours because a well-designed tokenomic model can serve as the source that drives user adoption, incentivizes desired behavior, and ultimately encourages a sustainable and thriving ecosystem. This can help you to establish a clear path towards long-term value creation from your investment.

In this blog, we’ll explore the fundamental principles, key considerations, and a lot more to identify the crucial aspects required to design a winning token model for your blockchain project.

- What Is Tokenomics? – Definition And Scope

- Market Overview Of Blockchain

- Top 10 Key Elements Of Tokenomics

- Why Is Tokenomics Design Critical?

- How Can You Detect A Poor Tokenomic Design?

- Essential Guidelines For Effective Tokenomics

- Anatomy Of A Perfect Tokenomics Design

- Mistakes To Avoid In Your Token Design Process

- Step-By-Step Guide To Designing Token Economics Model

- Tools And Frameworks For Tokenomics Design

- Challenges With Tokenomics Design

- Top 5 Real-World Examples Of Great Tokenomics Design

- Why Tokenomics Matters For Choosing Crypto Investments?

- Your Roadmap To Crypto Project Funding: Where To Start?

- What To Include In Tokenomics Design File?

- Conclusion

- How Can Idea Usher Help?

- FAQ

What Is Tokenomics? – Definition And Scope

Tokenomics is the combination of “token” and “economics,” which refers to the economic principles and mechanisms that govern a digital token or cryptocurrency within a blockchain project. It covers various aspects of the token’s distribution, functionality, governance, and overall value proposition. Here are the key aspects of tokenomics:

- Tokenomics broadly encapsulates the demand and supply characteristics of a cryptocurrency. It includes the token’s supply, the mechanics of how the cryptocurrency operates, and the behavioral and psychological forces that may impact its long-term value.

- Tokenomics outlines the distribution of tokens and their utility in relation to supply and demand within a crypto economy.

- A well-structured tokenomics model encourages investors to purchase and retain tokens for an extended period.

- A well-developed platform often translates into increased demand over time as new investors are attracted to the project, which in turn boosts prices.

- In blockchains such as Ethereum 1.0 and Bitcoin, tokenomics enables mining, which is the main way a decentralized network confirms transactions and staking that rewards users who do a similar job by locking up coins in a smart contract instead.

- Tokenomics enables some blockchains or protocols to “burn” tokens in order to reduce the supply of coins in circulation, as it may help support its price as the remaining tokens in circulation become more scarce.

Projects with well-designed tokenomics are more likely to succeed in the long term since investors can be incentivized by buying and holding the coins. That is why, when developing a crypto project, it is crucial that the founding members and developers carefully consider the tokenomics of the native coin, as it can make or break the project.

– Blockchain Expert, Idea Usher

Different Types Of Tokens

There are different types of tokens, and each serves unique purposes within their respective ecosystems:

1. Security Tokens:

It represents ownership of underlying assets, such as shares in a company or real estate properties. These tokens are tradable on secondary markets, and their value often correlates with the performance of the asset they represent. Security tokens are subject to regulatory frameworks governing securities.

2. Utility Tokens:

They provide access to specific products or services within a blockchain ecosystem. It is also known as Dapp tokens or protocol tokens, and they enable users to utilize functionalities within decentralized applications (DApps) or protocols. Utility tokens do not confer ownership rights and are not considered securities.

3. Transactional Tokens:

Transactional tokens, such as cryptocurrencies, are primarily used as a medium of exchange within blockchain networks. They serve as native currencies for facilitating economic transactions that include payment of gas fees for executing smart contracts and transactions on the network.

4. Commodity Tokens:

They represent ownership of physical assets like gold, fiat currencies, or other commodities. These tokens are attached to the value of the underlying asset, providing digital representations of real-world commodities that can be traded on blockchain platforms.

5. Governance Tokens:

These tokens empower holders to participate in decision-making processes within decentralized networks. If a user owns governance tokens, they can gain voting rights to influence changes to the network’s protocol, allocation of funds, or other governance-related matters.

Market Overview Of Blockchain

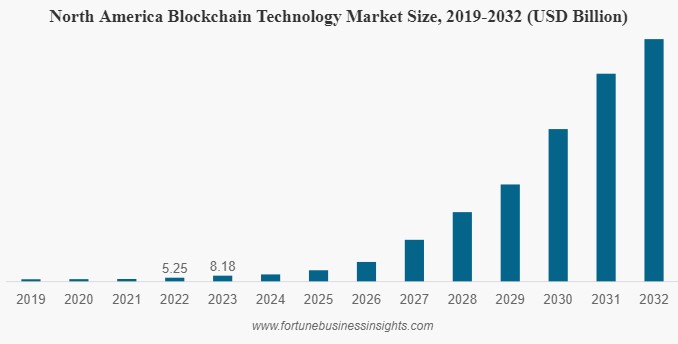

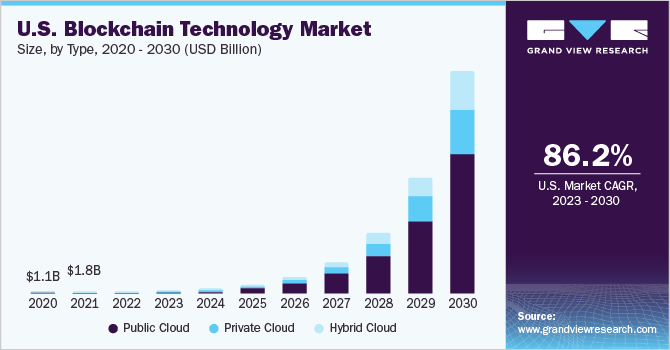

The worldwide market size for blockchain technology is anticipated to witness substantial growth, with projections estimating it to rise to USD 27.84 billion in 2024 and skyrocket to an impressive USD 825.93 billion by 2032. This forecast period, spanning from 2024 to 2032, is expected to showcase a remarkable compound annual growth rate (CAGR) of 52.8%.

According to another report, the global market for blockchain technology reached a significant value of USD 17.46 billion in 2023. Analysts predict continued strong growth, with an annual increase expected to average 87.7% between 2023 and 2030.

As per the same report, this growth is driven by the increasing need for secure and transparent transactions across various industries. The strength of blockchain lies in its decentralized and unchangeable record-keeping system, which makes it particularly appealing to sectors like finance, healthcare, and supply chain management, where trust and the ability to track information are crucial. Consequently, businesses in these fields are increasingly adopting blockchain solutions to strengthen security and transparency within their operations.

Top 10 Key Elements Of Tokenomics

Tokenomics defines the value and economic structure of digital assets, and here are the 12 main elements that are important in the crypto world:

1. Token Utility & Use Cases:

The true worth of a token lies in its utility within the blockchain ecosystem. A token with clear and valuable use cases, like powering transactions or granting voting rights, drives adoption and bolsters its long-term value proposition.

2. Total Supply & Circulating Supply:

Understanding the interplay between these is crucial. Total supply dictates token scarcity while circulating supply reflects readily available tokens, impacting market capitalization and potential price appreciation.

3. Token Allocation And Emission Rate:

Equitable distribution of tokens among stakeholders, such as project developers, early investors, and the community, lays the foundation for fair participation and encourages community engagement. Moreover, balancing token creation (emission) and burning mechanisms is essential. A well-managed emission rate helps maintain price stability and mitigate inflationary pressures, protecting the value of existing tokens.

4. Governance & Voting Rights:

Decentralized governance empowers token holders to participate in crucial decision-making processes. This builds a sense of community ownership and drives project development in a direction aligned with the interests of token holders.

5. Inflation/Deflation Model:

Choosing an inflationary or deflationary tokenomic model influences long-term price trends and investor sentiment. Inflationary models might introduce new tokens for ongoing development, while deflationary models utilize burning mechanisms to decrease supply, potentially increasing token value.

6. Distribution Mechanism:

The method of token dispersal, from initial coin offerings (ICOs) to ongoing rewards programs, profoundly impacts investor sentiment and project growth. A well-designed distribution strategy encourages community participation and incentivizes long-term holding.

7. Interoperability & Market Dynamics:

Seamless interoperability with other blockchains supports ecosystem integration. This expands the reach and utility of the project by enabling interaction with a wider network of users and applications. Additionally, ensuring sufficient token liquidity and implementing effective marketing strategies are essential for driving exchange adoption and community engagement. A liquid market allows for easy buying and selling of tokens, while a strong marketing strategy attracts new users and fuels project growth.

8. Security Measures:

Robust cybersecurity protocols are the bedrock of a secure tokenomic ecosystem. Implementing strong security measures protects user assets, safeguards against evolving threats, and maintains the integrity of the underlying blockchain protocol.

9. Economic & Financial Models:

Scarcity, utility, and user demand are the primary drivers of token value. However, a project’s long-term viability and growth depend on its ability to generate revenue. Effective economic and financial models ensure sustainable token value by outlining mechanisms for revenue generation and project growth.

10. Regulatory Compliance:

Navigating the ever-evolving regulatory landscape surrounding cryptocurrencies is crucial. Adherence to regulatory standards ensures legal compliance, safeguards against potential risks, and enhances investor trust and project credibility.

Why Is Tokenomics Design Critical?

Tokenomics design includes building a robust and sustainable economic framework for a cryptocurrency or token. Here’s why tokenomics design holds utmost importance:

1. Sustainability:

Establishing a tokenomic model is indispensable for any blockchain or DLT-based project. It helps create a self-sustaining ecosystem where tokens accurately reflect the underlying economic activities.

2. Preventing Imbalances:

Decentralized economies are prone to imbalances resulting from flawed design choices. A deficient reward system can lead to distorted incentives, undermining the viability of an otherwise promising tokenomics model.

3. Incentivizing Participation:

A well-designed tokenomics model empowers the network to incentivize active participation and recognize contributors’ contributions. This dynamic drives adoption and usage and cultivates a robust community around the project.

4. Alignment Of Interests:

Tokenomics design is crucial in aligning the interests of diverse stakeholders, including developers, investors, and end-users. It helps create systems with competitive advantages over conventional centralized models.

How Can You Detect A Poor Tokenomic Design?

Identifying a potentially poor tokenomic design involves recognizing specific facts:

1. Unsustainable Reward Structures:

When rewards for basic actions like transactions or staking are excessively high, they can rapidly consume the token supply, which causes inflation and devaluation. On the other hand, when the rewards are inadequate, they may fail to incentivize user participation while hampering network growth.

2. Unbalanced Token Distribution:

A large allocation of tokens to the development team, founders, or early investors raises concerns about long-term commitment and potential manipulation. Another thing to look at is the limited distribution of the token to the public or lack of transparency in the allocation of the token, as it can discourage user participation.

3. Unclear Token Utility:

Tokens with limited or poorly defined use cases within the project’s ecosystem provide less incentive for users to hold or use them. On the other hand, a token solely designed for speculation without a clear purpose is also a warning sign.

4. Static Or Inflexible Supply:

A completely fixed token supply limits the project’s ability to incentivize users or raise funds in the long run. Conversely, the absence of mechanisms to control token creation, such as burning mechanisms, could lead to excessive inflation.

5. Lack Of Security Measures:

Poorly designed tokenomics can leave the project vulnerable to hacking or manipulation. Thus, projects should prioritize security audits, secure token storage solutions, and measures to prevent pump-and-dump schemes.

6. Ignoring Regulations:

Tokenomic models that disregard potential regulations or legal considerations pose risks for investors and project development. Thus, projects that demonstrate a commitment to compliance and adaptability within the regulatory limit are mostly preferable.

7. Limited Community Engagement:

A closed or inactive community around a token may indicate a lack of user interest or potential flaws in tokenomics design. This is why strong community engagement and clear communication strategies are considered signs of well-designed tokenomics.

8. Unrealistic Projections:

Projects promising unreasonable returns or unrealistic token value appreciation should be approached with caution; on the other hand, projects with clear roadmaps, defined value propositions, and realistic tokenomics are often considered more trustworthy.

Essential Guidelines For Effective Tokenomics

Here are the key principles to ensure sustainability and equilibrium in tokenomics:

1. Strategic Ecosystem Design:

Tokenomics should complement the project’s ecosystem design. It can be done by prioritizing value creation for users because that also incentivizes user engagement and participation. This, in turn, strengthens the ecosystem and enhances the token’s utility while creating a self-reinforcing cycle of growth.

2. Continuous Value Generation:

Effective tokenomics functions as a sustainable value engine, driving continuous value generation for the project and its users. This is achieved through well-designed reward systems that offer meaningful incentives for user participation and contributions. Consistent value creation maintains user interest and drives long-term token demand.

3. Mitigation Of Negative Behavior:

The crypto space is innovative but also attracts negative behavior like fraud and manipulation. However, well-planned tokenomics consider these risks and implement measures to prevent such activities. This might involve high-quality smart contract design with multi-layered security protocols and thorough testing to identify and mitigate potential vulnerabilities before they can be exploited.

4. Balanced Supply And Demand Dynamics:

A well-balanced tokenomic design relies on a balanced interplay between supply and demand. Thus, establishing clear utility parameters and diverse use cases for the token encourages sustained user demand. This, in turn, helps maintain the token’s value and stability over the long term, ensuring the project’s financial viability and growth.

5. Goal-Oriented Token Design:

The most effective tokenomics models are not one-size-fits-all solutions. Instead, they are carefully customized to align seamlessly with the project’s specific goals and objectives. For example, different token categories, such as stablecoins that are designed for price stability or volatile assets that are used for speculation, require distinct design approaches to optimize their utility and effectiveness within their intended use cases. This ensures the token’s utility and effectiveness are optimized to achieve the project’s unique vision.

Anatomy Of A Perfect Tokenomics Design

While building a strong tokenomics model for your blockchain project, you must have a keen eye for the connections between its core elements. These elements act as the building blocks of a dynamic and impactful token ecosystem. Here are the essential components that build a flawless tokenomics design:

1. Fair Token Distribution:

Develop a transparent strategy for distributing tokens across stakeholders. A fair and balanced allocation builds trust and engagement within the community and lays the foundation for a healthy and collaborative ecosystem.

2. Clear Token Utility:

Clearly define the role and value proposition of your token within the project’s ecosystem. A token with demonstrably valuable use cases encourages user adoption, motivates active participation from token holders, and leads to the project’s growth and success.

3. Limited Supply:

Establish clear limitations on the total token supply. This creates scarcity that potentially drives up the value of the token and protects against inflation that can decrease its worth over time.

4. Stable Price Strategies:

Implement mechanisms like token buybacks (project repurchasing tokens from the market) and burning (permanently removing tokens from circulation) to keep token prices stable. This boosts investor confidence and promotes a healthy trading environment that benefits everyone in the ecosystem.

5. Empowering Governance Framework:

Design a strong governance model that empowers community members to actively participate in decision-making processes. This promotes a sense of ownership, decentralization, and inclusivity within the project that aligns the interests of the community with the project’s long-term vision.

6. Aligned Economic Interests:

Ensure the interests of all stakeholders, including developers, users, and investors – are well-balanced within the tokenomics model. This well-rounded approach builds a sustainable and long-lasting ecosystem where everyone benefits from the project’s success.

Mistakes To Avoid In Your Token Design Process

Here are some prevalent missteps you should avoid while designing your token:

1. Ambiguity In Purpose:

Ensure that your token serves a clearly defined purpose or use case within your project or community. This clarity helps users understand the value proposition of the token and encourages adoption. Without a distinct purpose, users may question the token’s relevance and legitimacy, leading to skepticism and hesitation to participate.

2. Lack Of Scalability Planning:

Anticipate future growth and increased usage of your token by designing it with scalability in mind. Failure to plan for scalability can result in network congestion, slower transaction times, and increased costs as the demand for the token grows. By considering scalability during the design phase, you can implement solutions that accommodate future expansion without compromising performance.

3. Neglecting Community Engagement:

Your community plays a crucial role in the success of your token. Neglecting to engage with your community can disturb the adoption and limit the potential for growth. So, it is advisable to actively involve your community in discussions, gather feedback, and address concerns to build a sense of ownership and loyalty.

4. Insufficient Testing:

Rushing to launch your token without thorough testing can be a step towards disaster. Bugs, vulnerabilities, and security issues discovered post-launch can damage the reputation of your token and user trust. This prioritizes comprehensive testing to identify and address any issues before releasing your token to the public. This includes testing for functionality, security, and compatibility to ensure a smooth and secure user experience.

5. Excessive Token Supply:

Be cautious about flooding the market with too many tokens, as this can lead to inflation and devaluation of your token’s value. An oversupply of tokens dilutes ownership and reduces scarcity, diminishing the token’s perceived value.

6. Complexity Overload:

Keep your token mechanics and usage simple and intuitive to avoid overwhelming users with unnecessary complexity. Complex tokenomics or usage instructions can confuse and deter users. Thus, strive for simplicity in design by making it easy for users to understand how to interact with your token and derive value from it.

7. Lack Of Transparency:

Transparency is essential for building trust and credibility with stakeholders. Provide clear and accurate information about token distribution, project team members, development progress, and governance processes.

8. Disregarding Regulations:

Compliance with legal and regulatory requirements is crucial for the long-term viability of your token project. Ignoring regulations can result in legal consequences, fines, and reputational damage. Thus, it is important to stay informed about relevant laws and guidelines, which include considerations such as know-your-customer (KYC) and anti-money laundering (AML) regulations, tax laws, and securities regulations.

9. Weak Security Measures:

Security breaches can have devastating consequences for your token project and its users, which is why it is important to prioritize robust security measures to protect against hacking, fraud, and data breaches. For this, you can implement secure smart contracts, encryption protocols, and multi-factor authentication to safeguard user assets and data.

10. Ignoring Market Trends:

Stay informed about market trends and developments in the cryptocurrency and blockchain space to remain competitive and relevant. Ignoring market trends can result in missed opportunities or outdated token designs that fail to resonate with users.

Step-By-Step Guide To Designing Token Economics Model

Below is a comprehensive guide to guide you through the intricate process of tokenomics designing:

Step 1: Define Token Purpose And Functionality

The first step involves clearly defining the role your token will play within your blockchain ecosystem. This includes a deep understanding of how the token will function to achieve your project’s goals. A thorough analysis of your target audience, project objectives, and the specific challenges you aim to address is crucial. Ultimately, you need to specify the value proposition the token offers to users. Will it facilitate transactions within your platform? Provide access to exclusive services? Or incentivize user participation through rewards?

Step 2: Establish Total Token Supply

Determining the total number of tokens to be created (total token supply) requires careful consideration. You’ll need to factor in potential future token generation mechanisms like mining or staking. Additionally, it’s vital to implement mechanisms that maintain a healthy balance between the supply of tokens and user demand. This can involve strategies like token burning to manage inflation and ensure the long-term value of your token.

Step 3: Design A Token Distribution Strategy

Formulating a plan for token distribution is essential. This plan should outline the methods you’ll use to distribute tokens, the timing of the distribution, and who will receive them. Explore various channels for distribution, such as Initial Coin Offerings (ICOs), Initial Token Offerings (ITOs), or Initial DEX Offerings (IDOs). You can also consider alternative methods like mining, staking, airdrops, or bounty programs to incentivize early participation and community building. Implementing token lockup periods further encourages long-term commitment from participants and helps prevent market manipulation.

Step 4: Construct Token Use Mechanics

The core rules and incentives that govern how users interact with your token within the ecosystem need to be established. This involves defining parameters for token circulation, the protocols for transactions, and the economic policies that will be in place. Designing robust incentive structures is key to promoting active user participation and establishing liquidity within your ecosystem. Ultimately, your tokenomics model should be customized to optimize the user experience and ensure seamless integration with your project’s overall goals.

Step 5: Implement The Tokenomics Model

Now, it’s time to translate your blueprint for tokenomics into operational smart contracts. These smart contracts, which are secure and reliable pieces of code, will flawlessly align with your token design. Executing your distribution plan with precision is critical, which includes listing your tokens on relevant exchanges and organizing a successful token launch. Careful attention to detail is crucial throughout this process to ensure accessibility for potential investors while mitigating any potential risks.

Step 6: Continuously Monitor And Adapt

The field of token economics is constantly evolving, necessitating a commitment to continuous monitoring and adaptation. Remain vigilant by keeping yourself informed of market trends and industry developments. This allows you to adjust your tokenomics model as needed. Regularly evaluate the performance of your token in the market and iterate accordingly. This may involve adjusting the total token supply, optimizing distribution strategies, or refining your economic incentives to enhance the long-term sustainability of your project.

Tools And Frameworks For Tokenomics Design

Designing a successful token economy requires a blend of frameworks and tools. These elements guide the creation of a sustainable and functional system within your blockchain project. Here are the various categories that can empower your tokenomics design process:

1. Core Frameworks For Foundation

- Problem Definition Framework: This structured approach helps pinpoint the exact problem your tokenized ecosystem aims to solve. By clearly defining the issue, you ensure your token has a distinct purpose and addresses a genuine need within the market.

- Stakeholder Analysis Framework: Understanding the motivations and needs of key stakeholders within your ecosystem is crucial. Stakeholders can encompass users, investors, developers, and platform operators. This framework helps identify these groups and tailor your tokenomics model to incentivize them for aligned participation.

- Incentive Design Framework: This framework focuses on crafting incentives that drive desired behaviors within your ecosystem. By leveraging principles from game theory and mechanism design, you can design effective incentives that encourage user participation and propel your project toward its goals.

2. Tools For Planning And Modeling

- Brainstorming and Mind Mapping Tools: Tools like Miro or Lucidchart can be helpful in brainstorming sessions. They provide a visual space to organize your ideas related to token utility, distribution strategies, and incentive structures.

- Spreadsheets and Data Analysis Tools: Spreadsheets or tools like Python with libraries such as NumPy and SciPy can be used for data analysis and modeling. This allows you to simulate token supply, distribution structures, and economic scenarios within your tokenomics design.

3. Tools For Simulation And Optimization

Once you have a foundational tokenomics design, simulation tools like Machinations or CadCAD can be valuable assets. These tools allow you to visualize and test the behavior of your token model under various market conditions. This helps identify potential issues and optimize your tokenomics for long-term stability.

4. Design Thinking Tools

- Platform Design Toolkit: While initially designed for Web2 platforms, this design method can be adapted for Web3 projects. It helps develop multi-sided platform strategies that create shared value within your tokenized ecosystem.

- Token Utility Canvas: Developed by Outlier Ventures, this framework helps identify and define the utility of your token. It emphasizes ensuring your token offers value through incentives, meaningful integration within your platform, and effective distribution.

The choice of specific tools and frameworks depends on the complexity of your project. However, by considering the resources, you can develop a well-rounded tokenomics model that strengthens your project’s foundation.

– Blockchain Expert, Idea Usher

Challenges With Tokenomics Design

Here are some of the key challenges associated with tokenomics design:

1. Inflation Threat:

Uncontrolled token minting risks collapsing value, deterring investors. Rigorous supply management and compelling token utilities are essential to combat inflation and inspire confidence

2. Shared Governance:

Centralized control poses risks. Open governance with inclusive participation builds trust. Distributing decision-making power and ensuring transparency minimizes governance issues.

3. Liquidity Lag:

Low liquidity stalls growth. Partnering with key exchanges and rewarding market makers ignites trading activity, and building a healthy, liquid market is essential for smooth transactions.

4. Value Distribution Complexity:

Fairly distributing project value is tricky. Clear rules for sharing value build trust and get people involved. Designing fair distribution mechanisms incentivizes long-term participation and investor confidence.

5. Investor Engagement:

Communicating project value and returns is key to attracting investors. Compelling stories showcasing unique benefits can spark investor interest. Open communication and participation opportunities build a strong investor community.

6. User-Friendly Tokens:

Simple tokens with a great user experience drive adoption. Prioritize intuitive interfaces and practical utilities that cater to user needs. Seamless integration fosters user adoption and retention for long-term success.

Top 5 Real-World Examples Of Great Tokenomics Design

Here are some real-world examples of successful tokenomics design:

1. Ethereum (ETH):

The tokenomics of Ethereum revolve around its native currency, Ether (ETH). Ether is utilized to cover transaction fees, known as gas, on the Ethereum network. Unlike some other cryptocurrencies, Ethereum does not have a predetermined maximum supply; instead, new Ether tokens are generated through the process of mining. The initial allocation of Ethereum (ETH) was distributed as follows: 83.33% was designated for the Ethereum Crowdsale, while 16.68% was assigned to the Ethereum Foundation, Early Contributors, and Others.

2. MakerDAO (MKR):

MakerDAO’s tokenomics center on its MKR token. MKR serves as a governance token, granting holders voting rights concerning the Maker Protocol’s development. Additionally, MKR tokens play a crucial role in maintaining the stability of DAI, the stablecoin created by MakerDAO. The Maker Core issues a total of 60,000 MKR annually, with allocations benefiting its subDAOs.

3. BNB (Binance Coin):

BNB functions as the native token on both the Binance Chain and Binance Smart Chain. Its utility spans various functions, including covering transaction fees, staking, asset transfers, and executing smart contracts. All BNB tokens (200 million) were pre-mined before being made available for public sale.

4. Flow:

Flow’s tokenomics framework aims to provide incentives for the different participants in its network, including validators, developers, and users. Flow operates as a proof of stake layer 1 blockchain, with the FLOW token serving as its native currency. FLOW tokens are utilized to reward participants who stake their tokens, facilitate exchanges within the Flow ecosystem, and cover transaction and storage fees within the network.

5. Solana (SOL):

Solana’s tokenomics are centered on its native token, SOL. SOL tokens are employed for staking, earning rewards, paying transaction fees, and participating in protocol governance. Solana has set a maximum total supply of 489 million SOL tokens.

Why Tokenomics Matters For Choosing Crypto Investments?

Understanding tokenomics is crucial for making informed decisions in the crypto investment arena. Here’s why:

1. Understanding Value And Functionality:

Tokenomics unveils the true worth of tokens by examining their utility and distribution dynamics. These factors shed light on a token’s long-term viability. Elements like total supply, circulation, and distribution strategies significantly influence a token’s price stability and demand within the blockchain ecosystem.

2. Incentives And Rewards:

A well-designed tokenomics model lays out a roadmap for intelligent incentives. Tokens that offer compelling reasons to buy and hold for the long term tend to outshine projects lacking a robust ecosystem around their token. By aligning incentives with user behaviors, tokenomics can drive sustained growth and investor confidence.

3. Mitigating Risks:

Tokenomics empowers investors to assess and manage risks associated with various cryptocurrencies. Factors such as token supply, issuance mechanisms, and utility play pivotal roles in determining investment risks and potential rewards. Armed with this knowledge, investors can make more informed decisions to safeguard their portfolios.

4. Informing Project Evaluation:

Tokenomics serves as a base for evaluating the potential trajectory of a token’s value. While it provides a foundational framework, investors must also consider external factors like market sentiment, regulatory changes, and technological advancements. By integrating tokenomics insights with broader market trends, investors can gain a comprehensive understanding of a project’s growth potential.

Your Roadmap To Crypto Project Funding: Where To Start?

Before diving into the world of crypto fundraising, it’s crucial to plan strategically. Here’s your roadmap:

- Ensure legal compliance with your jurisdiction’s framework.

- Evaluate the necessity of creating a new token for your project.

- Clearly define the goals and use cases of your token.

- Anticipate and mitigate potential challenges and risks associated with your token.

- Develop strategies to drive user adoption of your token.

- Define the role of token economy participants in your project’s growth.

- Identify key factors influencing the demand for your token.

- Establish transparent systems for token distribution and unlocking.

- Develop protocols for token movement and governance within your ecosystem.

What To Include In Tokenomics Design File?

A comprehensive tokenomics design file should include the following key elements:

- General Ecosystem Design: Outline the architecture of the blockchain project and its integration with the token.

- Reward Structure Alignment: Design rewards that match the value created within the ecosystem.

- Token Demand-Supply Balance: Define the total and circulating token supply and strategies to maintain balance with demand.

- Token Utility Definition: Specify the purpose and use cases of the token within the ecosystem.

- Token Distribution Mechanism: Detail how tokens will be distributed among stakeholders.

- Economic and Financial Models: Design tokenomics aspects, including supply, distribution, and inflation/deflation models.

- Governance and Voting: Define the token’s role in project governance and voting rights.

- Security Measures: Identify and address potential risks with mitigation strategies.

- Regulatory Compliance: Ensure adherence to legal and regulatory requirements.

- Interoperability Consideration: Assess how the token will interact with other tokens and blockchains.

- Market Dynamics Analysis: Understand market dynamics influencing the token’s value.

Conclusion

Cryptocurrency projects have a plan for their tokens, and that plan is called tokenomics. It explains how the tokens are shared (distribution), what they’re good for (utility), and how they gain value. Knowing tokenomics helps you understand a token’s real worth, any rewards you might get for using it, and potential risks. This knowledge makes navigating the crypto market easier. A well-designed tokenomics plan attracts users, keeps the project growing, and shows it’s built to last. In the fast-paced world of crypto, where people want clear information, tokenomics acts as a guide. It helps both crypto enthusiasts and investors make smart decisions about funding and investing in projects.

How Can Idea Usher Help?

At Idea Usher, we have crypto and blockchain experts who can propel your business forward with their expertise. We leverage our expertise and custom solutions to craft robust tokenomic models that attract and retain users and promote business growth. Our expertise spans tokenomics, blockchain tech, legal compliance, token distribution, security, market analysis, and much more. So you can partner with us to navigate the complexities of crypto and gain access to skilled professionals who share your vision. Connect with us today and empower your success in the dynamic world of blockchain and cryptocurrency.

FAQ

Who is a tokenomics designer?

A tokenomics designer is a specialist who crafts the economic framework for a cryptocurrency project. They determine how tokens are distributed (allocation), their use cases within the ecosystem (utility), and the mechanisms that influence their value (economics). This role requires expertise in blockchain technology, economics, and game theory.

How to design crypto tokenomics?

Designing crypto tokenomics involves a multi-step process. First, you define the project’s goals and target audience. Then, you determine the token’s utility and design a distribution strategy that incentivizes user participation. Next, you establish economic models to manage token supply, inflation, and value creation. Finally, you ensure legal compliance and develop a plan for long-term sustainability.

What is the concept of tokenomics?

Tokenomics refers to the economic blueprint of a cryptocurrency project. It encompasses the creation, distribution, and utility of tokens within a specific ecosystem. Understanding tokenomics helps assess a token’s true value, potential rewards for users, and inherent risks. A well-designed tokenomics model fosters user adoption, promotes sustainable growth, and signifies a project’s long-term viability.

What is the formula for tokenomics?

There’s no single formula for tokenomics, as it’s a strategic framework tailored to each project’s unique goals. However, key elements include:

- Total Token Supply: The fixed number of tokens created.

- Distribution Model: How tokens are allocated (e.g., fundraising, team allocation, community rewards).

- Token Utility: What users can do with the tokens within the ecosystem.

- Economic Incentives: Mechanisms to encourage desired user behavior and manage inflation.

These elements work together to create a functional and sustainable token economy.

Rebecca Lal