Investment apps that make you money: why is it a good business idea?

How to create an investing app? If you are looking for answers to this question, you’re on the right page. Are you fascinated by the idea of investment apps? The app niche is an ever-growing market with lots of opportunities.

This is the perfect time to develop an investment app. Head over to the finance section on App Annie, and you will straightaway know how popular they are. Trading and investment apps account for about 30% of the total finance app niche market profits.

Even traditional banks such as Wells Fargo and Chase are working on making their own mobile apps. In addition, Investopedia reports that millennials are willing to invest more than ever.

Investing and stock-related app searches, such as “penny stock trading app,” “home advisor app,” and “investments app,” have grown 115% YoY. – Google Data, U.S., Mobile, Jan.–Sept. 2016 vs. Jan.–Sept. 2017.

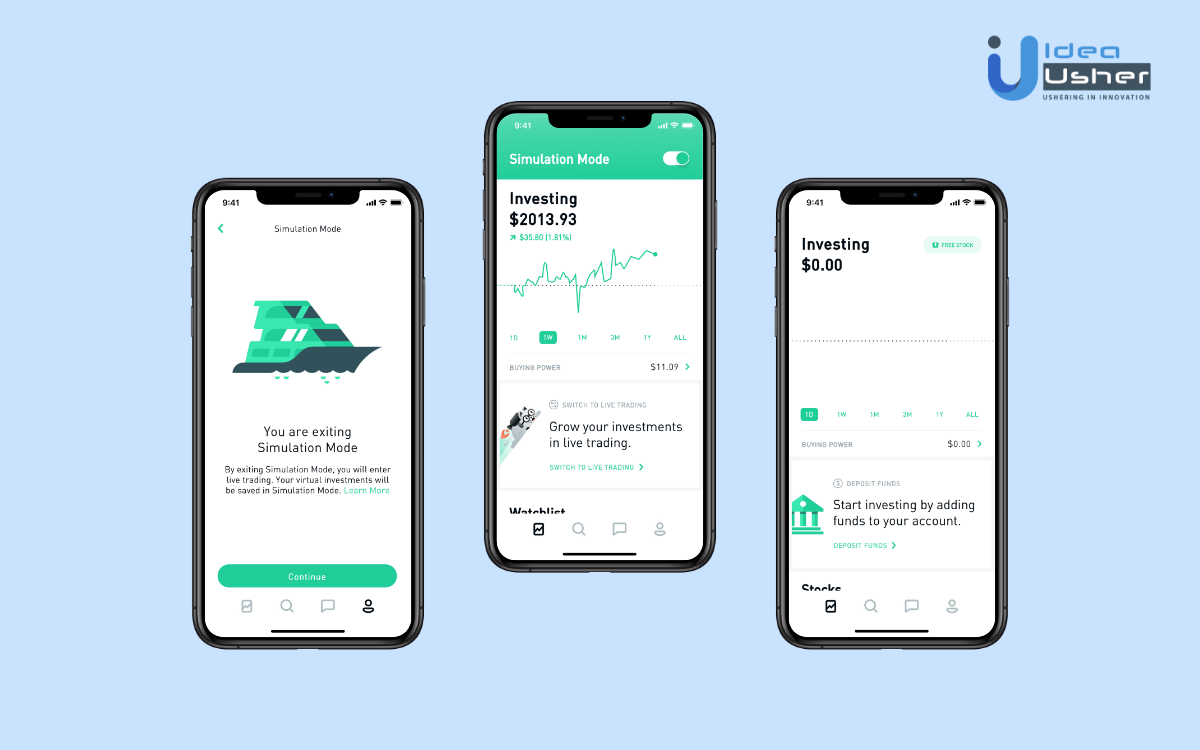

In the last few years, apps like Robinhood have revolutionized the way trading is done. This guide will help you understand how to create an app like Robinhood; and what you need if you are wondering how to create an investing app.

Also Read: The best real estate investment apps

The three types of investment apps

There are different types of investment phone apps available on the market. And they drastically differ based on the features they offer.

1. Banking apps

These are the traditional banking apps. Banking apps offer ease of access to your bank account and help you manage your funds

Some famous examples of banking apps include Bank of America and Capital One.

2. Investing apps

Investing apps build a platform where brokers and customers can interact with each other. Most of them specialize in providing advisory services.

Their main motive is to simplify the process of investing your money. Some examples of investing apps include apps like Betterment, Invstr, and Acorns.

3. Stock trading apps

As the name suggests, stock trading apps allow you to trade stocks. Mobile apps like these eliminate the process of buying stocks via brokers.

Some examples of popular stock trading apps are E-TRADE, Vanguard, and Robinhood.

If you are confused about which type to opt for, contact Idea Usher, and our team will help you decide!

Core features of an investment app

The investment app market is growing day by day at an unprecedented pace. Surprisingly, more people are looking forward to financial planning. Any guide will emphasize core features when you search on how to create an investing app.

If you are wondering how to create an investing app, keep the user’s convenience in mind. Here are some ways to make an investment process easier. Here are some MVP features you can work on:

1. Regulatory requirements

Since you will be trading on the market, you first need to comply with regulatory requirements. Depending on geographical location, these rules may vary.

Assuming you are creating an investing app for the U.S market, you will need to take the permission of the U.S Securities and Exchange Commission.

2. Military-grade encryption

The most important feature of the app is security. You should enable some encryption, preferably 256-bit AES. Also, it should have the highest level of SSL certification (A+ category.)

3. High level of security and privacy

Make sure the highest level of security backs your investing app. Ensure the entire platform uses HTTPS. Make sure to enforce Two-factor authentication (2FA).

You can also add biometric authentication for extra security.

4. Portfolio management

The app should allow users to manage their portfolio and see the profits and losses in one place. They should also be able to sell and buy stocks easily.

5. Top investment recommendations

A good investment app curates a list of recommendations based on user data. For example, an app like Robinhood helps users based on their personal investments to increase their profits. You can leverage artificial intelligence to automate these suggestions.

6. Clean, user-friendly UI

If you want to create an investment app, make sure the user interface remains clean and minimal. Also, make sure all the important buttons in the app are clearly visible.

7. Support all platforms

Make sure the investment app is compatible with various platforms such as Android and iOS. This will help you increase your user base and reach out to more people.

8. Daily notifications

Another useful feature you can add is daily notifications. For example, the investment app can post push notifications daily or when the user reaches their desired goals.

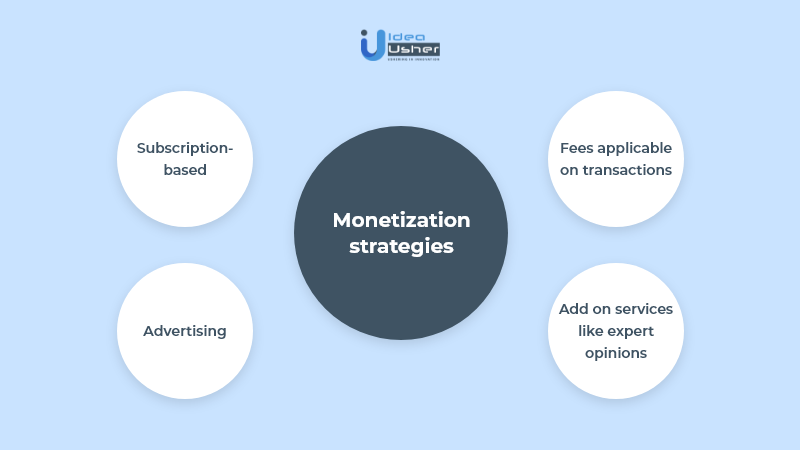

Monetization strategies

Before you create an investment app, you should decide what monetization model your app should use. When it comes to investment apps, you can follow one or a combination of these models:

1. Subscription-based

An investment app can generate some revenue using a premium subscription model. This can be a lucrative source of income generation for your business.

2. Advertising

You can opt to make the app free for users by showing some advertisements within the app. They can either be banners at the bottom of the screen, brand promotions, or full-screen ads.

3. Fees applicable on transactions

Apps like Wealthfront earn money by charging a transaction fee on every purchase or sale you make. These typically amount to 0.25% according to the current industry standards.

4. Add on services

In addition to providing stock trading and investment services, an investment app can also offer add-on services like expert’s picks, suggest which stocks to trade in, predictions, etc.

Best online investment apps: Our list of top 5 investment apps for Android

Let us look at some of the top investment apps that have changed the stock market and trading works.

1. Acorns

Acorns is a unique offering that aims at millennials who do not have the money to make an how to invest in the market. It incentivizes users to invest in small amounts, taking one step at a time.

Here is how does acorns app work:

- It works by keeping track of all your purchases from your credit and debit cards and rounds off everything to a round sum.

- The remaining money is then invested in a portfolio.

Acorns app tutorial videos are also accessible on YouTube. It is one of the best micro investing apps currently available in the market. It makes the learning curve easy for its users.

2. Stash

Stash is a low-cost investment advisor that lets users learn how to invest with a hands-on approach. Apart from investing in stocks, users can also trade in ETFs (Exchange Traded Funds).

What sets it apart from the competition is that they do not charge any trading fees or commissions. However, users with $5,000 or more in their account have to pay a fee of 0.25%, which is a common practice throughout the industry.

3. Robinhood

It is one of the most famous investment apps on the planet. Robinhood completely revolutionized the investment sector by offering commission-free trading. The user interface is clean and minimalistic. Also, the learning curve is small, and it comes with a personalized news feed.

Many people wonder, “Is the Robinhood app secure?“. While people were skeptical of using in the initial days, Robinhood now has more than 13 million users. Their primary source of revenue generation is Robinhood Gold and a method called “payment for order flow.”

4. Wealthfront

It is one of the well-known investment solutions that will help you manage your money for a fee (0.25%). When you register with the app, you can manage up to $5,000 for free.

5. Invstr

If you are just getting started, then this app is for you. It takes a dig at beginners by indulging them in fantasy stock games. Invstr also has an in-built social network and a news feed to let the creativity flow.

Also Read: Build music apps like Pandora

How to create an investing app like Robinhood: Phases of development

1. Market research

The first step of creating an investment app is market research. However, before you take any step, analyze the market trends and decide the customers you want to target. You will be able to identify trusted investment apps; and what makes them popular. It would help you incorporate related features in the app.

2. Regulatory compliance

Before developing an investing app, you need to pay attention to every minute detail. In addition, since you will be storing sensitive user data, your app should comply with General Data Protection Regulation.

You might want to create a Robinhood app clone. However, the regulations vary from region to region, so make sure to adhere to the rules in that particular country. If you are creating an app in the UK, apply to the Financial Conduct Authority.

Investment apps for the US need to follow:

- The rules of the Federal Trade Commission (FTC)

- The laws of the Consumer Financial Protection Bureau (CFTB)

3. Hiring app developers

The core step of the process is app development. If you want to make the best investment app, make sure you choose highly experienced coders. Outsourcing is your best way if you’re going to create an investment app from scratch.

4. MVP features

Make sure your investment app has MVP features. If you are unsure what you will need, start with an app offering minimal features and add on the go.

5. Focus on UI/UX

Within 50 milliseconds of launching an app, most users decide subconsciously if they will use the app or not. Share on X

Users love apps that provide a clean and straightforward UI. The UX should help users perform actions quickly. Idea Usher has various UI/UX experts who can help you develop a visually attractive app.

6. Coding

The app development or the coding process is the most important part of the development phase. The development process may be divided into several parts called sprints. The developers, along with the app testers, ensure your app runs the way it should.

7. App deployment

Deployment is the last stage of app development. A good mobile development company will ensure that your app is bug-free and tests every function and button thoroughly to squash any possible bugs.

You can now launch your app on whatever platform you aim for, be it Google Play Store or Apple App Store.

How to create an investing app with the ideal tech stack

Why is an experienced development team important?

Before you make a financial investment app, make sure the developers are experienced and that the team knows what they are doing. Then, if you invest in app developers, you’ll save a lot of maintenance in the future compared to hiring freelancers.

Since you will be having a lot of sensitive data to handle, make sure they comply with all the industry-wide security standards.

The majority of users will most likely not use your mobile investment app if they encounter a bug or some error. To ensure the success of your app, make sure you hire a team like Idea Usher, who has years of experience and a vast portfolio of developing mobile applications.

Cost for developing an investment app

If you choose to outsource the app development process, the cost of creating an investment app will reduce drastically. If you want to develop a trading app, it will cost you somewhere between $130,000 to $200,000.

However, if you choose to work with us, Idea Usher offers you economical packages to help you create your investment app.

Why choose Idea Usher for investment wallet app development?

We at Idea Usher have an expert team of developers and researchers who can easily adhere to your requirements. So you can focus on your business aspect and leave the development to us. We can help you build the best micro investing platform, mutual funds investing apps or an investment app MVP.

Contact Idea Usher today and get a free quote!

FAQs on how to create an investing app

-

Which is the best investment app?

Robinhood is currently one of the best investment app available on the market. Commission-free trading allows you to invest as much as you want without incurring any overhead charges.

1. How to invest on your phone?

Users can download apps like Robinhood or Acorns to begin investment via mobile devices.

2. Why develop an investment app now?

This is the best time to create an investment app. The market is currently experiencing rapid growth, with more people trying their hands on the stock and trading market.

3. How long will it take to create an investment app?

Creating a complex app like Robinhood takes some time. Keeping in mind the research and market analysis, it will take somewhere around 8-10 weeks to develop an investment app.

4. How secure is the Acorn app?

The 256-bit encryption makes the Acorn investment application a user’s choice.

5. Is the Stash app safe?

The Stash Application is safe to use. Also, it’s one of the best app to start investing for beginners.

6. What’s better: Acorns or Robinhood?

Honestly, there is no definitive answer to this question. Acorn and Robinhood target entirely different types of audiences. While Robinhood helps you get started in stock trading, Acorns is aimed at people who have hands-on experience with trading.