- Smart Contracts For Efficient Payments - Overview

- Market Overview Of Smart Contract

- How Do Smart Contracts Work For Payment Solutions?

- Advantages Of Utilizing Smart Contracts For Payment Solutions

- 10 Key Considerations Before Integrating Smart Contracts Into Payment Solutions

- How To Integrate Smart Contracts In Crypto Payment Gateway?

- Steps For Creating A Smart Contract To Receive Payments

- Tech Stack For Smart Contracts-Based Payment Solutions

- Benefits Of Smart Contracts In Real-Time Settlement Of Cross-Border Payments

- Challenges Of Smart Contracts-Based Payment Solutions

- Are Smart Contracts Secure For Payment Solutions?

- Top 5 Companies Using Smart Contract-Based Payments Solutions

- Conclusion

- How Can Idea Usher Help You Implement Smart Contracts In Finance?

- FAQ

Smart contracts are rapidly transforming modern finance. These self-executing agreements, built on the secure and transparent foundation of blockchain technology, are revolutionizing payment processing. By eliminating intermediaries like banks, smart contracts enable direct, frictionless transactions using cryptocurrencies.

These automated programs operate on predefined rules, ensuring swift and secure execution of payments. But how can you utilize this technology to optimize your business’s payment solutions? This blog delves into the technical considerations, security best practices, and the vast potential of integrating smart contracts for streamlined and efficient transactions. So, before you make any move, here is everything you need to know!

- Smart Contracts For Efficient Payments – Overview

- Market Overview Of Smart Contract

- How Do Smart Contracts Work For Payment Solutions?

- Advantages Of Utilizing Smart Contracts For Payment Solutions

- 10 Key Considerations Before Integrating Smart Contracts Into Payment Solutions

- How To Integrate Smart Contracts In Crypto Payment Gateway?

- Steps For Creating A Smart Contract To Receive Payments

- Tech Stack For Smart Contracts-Based Payment Solutions

- Benefits Of Smart Contracts In Real-Time Settlement Of Cross-Border Payments

- Challenges Of Smart Contracts-Based Payment Solutions

- Are Smart Contracts Secure For Payment Solutions?

- Top 5 Companies Using Smart Contract-Based Payments Solutions

- Conclusion

- How Can Idea Usher Help You Implement Smart Contracts In Finance?

- FAQ

Smart Contracts For Efficient Payments – Overview

Smart contracts are self-executing agreements that thrive on a blockchain, a secure and decentralized digital ledger. By automating key aspects of payments, smart contracts have the potential to improve efficiency and security significantly.

For a better understanding, consider a freelance marketplace. Clients post projects, freelancers submit proposals, and a smart contract securely holds the payment until project completion and client approval. The contract is programmed with specific completion criteria, like delivering a final product or achieving milestones. Upon client confirmation, the smart contract automatically releases the payment to the freelancer. This eliminates the need to chase unpaid invoices and ensures the client receives the agreed-upon work before releasing funds, building trust and security within the freelance ecosystem while streamlining the payment process.

There are numerous benefits of smart contracts for payments –

- Increased efficiency by automation of manual tasks.

- The elimination of the need for human verification.

- Faster settlements and reduced paperwork burdens.

- Highly secure environment.

- Tamper-proof transactions.

- Minimum risk of fraud.

- Transparency and accessibility.

Smart contracts are not limited to simple transactions. They can be programmed for a variety of unique applications within the payments ecosystem. For example:

- They can act as secure escrow services, holding funds until both parties fulfill their obligations.

- They can also facilitate micropayments, enabling seamless and automated payments for small transactions like online content or streaming services.

- Within supply chains, they can automate payments upon delivery confirmation.

- They can streamline the flow of goods and finances between suppliers and distributors.

As smart contract technology continues to evolve and regulations are established, we can expect them to play an increasingly prominent role in shaping the future of payments. Their potential to streamline transactions, enhance security, and reduce costs positions them to revolutionize how we exchange value for goods and services across various industries.

Market Overview Of Smart Contract

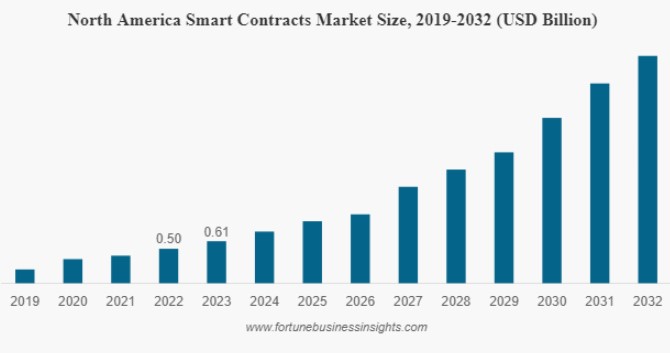

The global smart contracts market, valued at $1.71 billion in 2023, is projected to reach $2.14 billion in 2024 and a substantial $12.55 billion by 2032. This translates to a compound annual growth rate (CAGR) of 24.7% over the next eight years. Smart contracts are essentially self-executing computer programs that manage agreements on blockchain technology, eliminating the need for intermediaries.

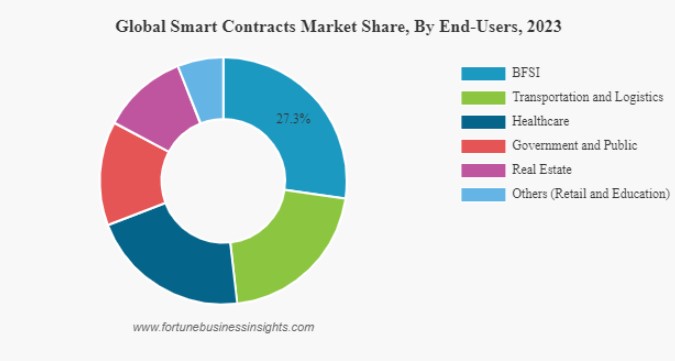

The market segmentation reveals a strong presence in various sectors. The Banking, Financial Services and Insurance (BFSI) industry currently leads the pack. This is driven by the numerous advantages smart contracts offer in this domain, including facilitating direct peer-to-peer transactions, streamlining error-free insurance claim processing, and enabling transparent and auditable audits. Additionally, smart contracts can automate Know Your Customer (KYC) processes, further improving efficiency.

The adoption of smart contracts within the BFSI industry goes beyond just streamlining tasks. By leveraging the decentralized nature of blockchain networks, these contracts allow for easy claim processing and automatic authentication. Traditionally, financial audits relied on extensive documentation and meticulous record-keeping. Smart contracts, however, connect to the immutable code of a blockchain, offering a more advanced and secure bookkeeping solution for the BFSI sector.

How Do Smart Contracts Work For Payment Solutions?

Smart contracts work for payment solutions by utilizing blockchain technology to automate and secure transactions. These contracts operate on a cryptographic framework, employing various technical elements to ensure efficiency, security, and transparency throughout the payment process. Here’s a comprehensive overview of how smart contracts work for payment solutions:

1. Agreement On Terms And Conditions

The process begins with parties agreeing on the terms and conditions of the transaction that govern the smart contract. This includes specifying details such as the nature of the transaction, the parties involved, and the conditions under which the contract will be executed.

2. Cryptographic Keys And Multi-Signature Wallets

Smart contracts utilize cryptographic keys and multi-signature wallets to enhance security and control over funds. Each party involved in the transaction holds a private key, and the smart contract requires a specific combination of signatures (from multiple keys) to authorize the release of funds. This adds an extra layer of security, ensuring that funds are only released when all parties cooperate.

3. Creation And Deployment Of Smart Contracts

Once the terms are agreed upon, the smart contract is created and deployed onto a blockchain network. This involves writing the code that defines the contract’s logic and deploying it onto the blockchain, where it becomes immutable and publicly accessible.

4. State Channels For Faster Transactions

To overcome potential delays caused by network congestion, smart contracts can utilize state channels. These channels are temporary off-chain communication channels between participants that allow for faster and more efficient transactions. Only the final outcome is recorded on the main blockchain, reducing overall processing time.

5. Execution Of Predefined Conditions

The smart contract is programmed to execute automatically when predefined conditions are met. These conditions could include specific dates, payment amounts, or other criteria agreed upon by the parties involved. This ensures swift and accurate execution of transactions.

6. Decentralized Oracles For Real-world Data

Smart contracts interact with real-world data through decentralized oracles. These blockchain-based services (oracles) retrieve and verify external data, such as market prices or weather conditions, enabling the contract to trigger actions based on real-world events.

7. Completion Of The Transaction And Record On The Blockchain

Upon fulfillment of the predefined conditions, the transaction is completed, and agreed-upon payments are made. A record of the transaction is permanently stored on the blockchain, providing an immutable and auditable trail of the tamper-proof transactions.

8. Security Through Formal Verification

Formal verification is a mathematical process used to prove the absence of bugs or vulnerabilities within the smart contract code. By undergoing formal verification, smart contracts can enhance their security and minimize the risk of unintended consequences or exploits.

9. Integration With Traditional Finance

Hybrid solutions are emerging that combine smart contracts with traditional financial systems. This integration allows smart contracts to trigger automated payments through legacy payment networks upon fulfillment of specific conditions, bridging the gap between decentralized and traditional finance systems. This potentially enables wider adoption of smart contracts for mainstream payment solutions.

Advantages Of Utilizing Smart Contracts For Payment Solutions

Smart contracts offer numerous advantages, pushing businesses towards streamlined transactions and fortified security measures. Here are the detailed benefits of integrating smart contracts into payment solutions:

1. Automated Precision

Smart contracts provide efficiency by executing transactions automatically based on predefined criteria. This precision ensures that agreements are upheld without the risk of human error or manipulation, promoting reliability in every exchange.

2. Decentralized Transactions

Utilizing smart contracts decentralizes payment processes, eliminating the dependency on intermediaries such as banks. This decentralization not only expedites transaction settlements but also minimizes associated costs, empowering businesses to optimize their financial resources.

3. Security Protocols

Embedded within blockchain technology, smart contracts boast unparalleled security features. Transactions are encrypted and immutable, shielding sensitive data from unauthorized access and manipulation. This robust security framework instills trust among parties, mitigating the risk of fraudulent activities.

4. Transparency And Accountability

By transparently documenting transactional details on a public ledger, smart contracts promote an environment of accountability and transparency. Parties involved can confidently navigate agreements as this visibility cultivates accountability, ensuring that agreements are upheld with clarity and integrity.

5. Precision And Reliability

The code-driven nature of smart contracts ensures the precise execution of transactions, minimizing discrepancies and errors commonly associated with manual processing. This unwavering reliability establishes a foundation for seamless business operations and enduring partnerships.

6. Efficiency

Smart contracts streamline payment processes by automating transactions based on predefined conditions, reducing the need for manual intervention. This automation eliminates delays and reduces the time and resources required for settlements. By removing intermediaries, smart contracts expedite the flow of funds between parties, enhancing overall operational efficiency.

7. Real-Time Transaction Processing

One of the standout features of smart contracts is their ability to facilitate real-time fund transfers. Unlike traditional payment methods that may involve delays due to bank processing times or intermediary involvement, smart contracts enable instantaneous transfer of funds upon meeting predetermined conditions. This real-time functionality optimizes liquidity management for businesses and enhances the agility of financial transactions, particularly in fast-paced environments.

10 Key Considerations Before Integrating Smart Contracts Into Payment Solutions

Smart contracts represent a transformative tool for secure and automated payment solutions. However, successful integration requires careful planning and consideration of various technical and practical aspects. Here’s a comprehensive breakdown of key factors to evaluate:

1. Purpose Definition

Clearly define the purpose and objectives of integrating smart contracts into your payment solution. Identify specific use cases and desired outcomes to ensure alignment with business goals.

2. Blockchain Platform Selection

Evaluate different blockchain platforms based on functionality, scalability, and regulatory compliance. Consider factors such as transaction speed, privacy features, and legal guidelines relevant to your target market.

3. Smart Contract Design And Security

Prioritize code clarity, efficiency, and security in smart contract development. Conduct thorough security audits to identify and mitigate potential vulnerabilities. Consider options for formal verification to enhance code reliability.

4. Integration With Existing Infrastructure

Ensure compatibility with existing payment gateways and systems. Implement event-driven architecture for efficient communication between smart contracts and payment gateways. Choose decentralized oracles for reliable access to off-chain data if necessary.

5. Flexibility And Future-Proofing

Implement standardized smart contract protocols like ERC-20 for tokens to promote interoperability and simplify integration. Incorporate upgradability mechanisms to adapt to future changes and regulatory requirements.

6. Gas Fee Analysis

Analyze the cost implications of executing smart contracts on the blockchain. Consider factors such as gas fees and transaction costs to optimize efficiency and minimize expenses.

7. Legal And Regulatory Compliance

Understand the legal implications and regulatory requirements associated with smart contract integration. Stay informed about evolving regulations to ensure compliance and mitigate legal risks.

8. Functional And Economic Considerations

Assess functional aspects such as automation, security, privacy, and functionality to meet user requirements and business objectives. Conduct a cost-benefit analysis to evaluate the economic viability of integrating smart contracts into your payment solution.

9. Code Testing And Deployment

Thoroughly test smart contract functionality to ensure it performs as expected and meets quality standards. Plan for a seamless deployment process into the live environment, with measures in place to handle potential issues or disruptions.

10. Technological Restrictions

Be aware of any technological limitations or constraints that may impact the integration of smart contracts into your payment solution. Consider scalability, interoperability, and compatibility with existing infrastructure.

How To Integrate Smart Contracts In Crypto Payment Gateway?

Here are the steps to integrate smart contracts into payment solutions. It is a crucial move towards embracing efficiency, security, and innovation in digital transactions.

1. Plan For Seamless Integration

Begin by defining your business needs and transaction requirements. Determine the types of crypto payments you aim to accept, whether it’s one-time purchases, subscriptions, diverse payment methods, or any specific features or functionalities required.

2. Select The Ideal Crypto Payment Gateway

You can evaluate payment gateways based on technical capabilities, such as supported currencies, security protocols, and developer resources. Assessing factors like transaction fees and scalability options is vital for ensuring compatibility with the smart contract infrastructure and a seamless integration experience.

3. Develop And Deploy Your Smart Contract

Begin the development phase by translating your payment terms and conditions into robust smart contract code. This involves using programming languages like Solidity for Ethereum-based contracts or languages compatible with other blockchain platforms. You can utilize self-executing smart contracts deployed on blockchain networks to facilitate decentralized automation of transactions, eliminating intermediaries and ensuring trustless execution. Once the code is written and thoroughly tested, deploy it onto the chosen blockchain network, ensuring proper execution and adherence to security best practices.

4. Connectivity To Your Payment Gateway

Integrate the smart contract with the chosen crypto payment gateway through its API. This involves writing code to facilitate communication between the smart contract and the gateway. This integration empowers your platform to embrace omnichannel payment capabilities, offering seamless interaction for processing payments, updating transaction statuses, and a payment experience beyond blockchain transactions.

5. Streamline Transactions With Automated Execution

Implement logic within the smart contract to automate payment processes based on predefined conditions. Define triggers, such as confirmation of product delivery or fulfillment of contractual obligations, to initiate payment execution autonomously. Ensure that the smart contract executes transactions accurately and efficiently, minimizing the need for manual intervention.

6. Take Security Measures

Prioritize security in smart contract development by adhering to best practices and industry standards. Implement cryptographic encryption mechanisms to protect sensitive data and assets within the contract. Utilize decentralized validation mechanisms to ensure the integrity and authenticity of transactions, mitigating risks associated with fraud and unauthorized access.

7. Promote Transparency And Traceability

Utilize the transparency and immutability of blockchain technology to enhance accountability in payment processes. Design the smart contract to record transaction details on the blockchain, providing a transparent and auditable trail of payment history. Enable stakeholders to access and verify transaction data, promoting confidence in the payment system.

8. Maximize Cost Efficiency Through Disintermediation

Capitalize on the cost-saving benefits of smart contracts by eliminating intermediaries and associated fees. Design the smart contract to facilitate direct peer-to-peer transactions, bypassing traditional payment gateways and reducing overhead costs. Optimize gas fees and transaction parameters to minimize expenses while maintaining efficiency and reliability.

9. Additional Technical Considerations

- Implement an event-driven architecture for the payment gateway, allowing it to listen for specific events emitted by smart contracts.

- Choose decentralized oracles carefully, considering factors like reputation, security measures, and support for relevant data feeds.

- Mitigate risks of Oracle manipulation by potentially utilizing a decentralized Oracle network for data verification.

- Explore atomic cross-chain transactions to deal with multiple cryptocurrencies across different blockchains.

- Consider interoperable smart contract standards like ERC-20 and RC-777 for tokens on the Ethereum blockchain, simplifying integration with payment gateways supporting these standards.

- Conduct thorough security audits of smart contract code before deployment, employing secure coding practices and static analysis tools to identify vulnerabilities early in the development process.

- Implement robust key management strategies for interacting with smart contracts and managing funds within the payment gateway, including secure storage mechanisms and multi-signature wallets for enhanced security and control.

Steps For Creating A Smart Contract To Receive Payments

Here’s a breakdown of the steps involved in creating a smart contract to receive payments, along with some security considerations:

1. Define Contract Requirements

Begin by selecting the cryptocurrency your contract will accept. Whether it’s Ether for Ethereum-based contracts or ERC-20 tokens, choose the appropriate token for your payment solution, considering factors like transaction speed and ecosystem support. Moving forward, clearly define the purpose for which payments will be received. Whether it’s for product purchases, service fees, or donations, ensure that the contract logic aligns with the intended use case.

Furthermore, identify the Ethereum address where received funds will be accumulated. This address, integrated into the smart contract, serves as the destination for incoming payments.

2. Choose a Development Environment

Evaluate different blockchain platforms based on factors like functionality, scalability, and regulatory compliance. Popular choices include Ethereum for its robust smart contract capabilities, but consider newer platforms offering improved features suited to your project’s requirements.

Utilize Solidity, a popular language for writing smart contracts on the Ethereum blockchain. Familiarize yourself with Solidity’s syntax and features to effectively implement contract logic. Consider working with development frameworks like Truffle or Hardhat to streamline the development, testing, and deployment process. These frameworks offer tools for automated testing and deployment pipelines, enhancing development efficiency.

3. Smart Contract Structure

Once you’ve chosen a development environment and programming language, define the logic of your smart contract. This includes specifying variables, functions, and conditional statements to govern payment receipt and processing.

Begin coding your smart contract by creating a ‘.sol’ file (solidity extension) and define state variables to track the contract’s state, including the total amount received and relevant metadata. Ensure clarity and efficiency in variable naming and usage to enhance code readability and maintainability. Use a constructor function to initialize the contract, set standards for its operation and implement a receive function that allows the contract to accept incoming payments. Define the contract owner and specify that the contract is payable to enable the reception of cryptocurrency transfers and incorporate logic to update state variables accordingly.

If you want, you can consider implementing a fallback function (completely optional) to handle transactions sent to the contract that don’t match any defined function. However, be cautious with fallback functions to prevent unexpected behavior and potential security vulnerabilities.

4. Security Considerations

Mitigate the risk of reentrancy attacks by following best practices such as the checks-effects-interactions pattern. Ensure that state changes occur before interacting with external contracts or sending Ether to minimize vulnerabilities. Guard against arithmetic overflow and underflow vulnerabilities by implementing checks and using safe arithmetic libraries.

Validate input parameters and ensure that arithmetic operations are conducted securely to prevent unintended behavior. Moreover, it is advisable to prioritize security audits of your smart contract code to identify and address potential vulnerabilities. Engage reputable firms specializing in smart contract security to conduct comprehensive audits and ensure the robustness of your codebase.

5. Testing and Deployment

Develop unit tests to verify the functionality of individual components and integration tests to validate the interaction between your smart contract and external systems, APIs, or contracts. Utilize testing frameworks provided by development frameworks like Truffle or Hardhat to automate testing, ensure code reliability, and test various scenarios to verify seamless communication and interoperability.

Moreover, deploy your smart contract to a test network, such as Rinkeby for Ethereum, to conduct thorough testing and debugging. Once validated, deploy the contract to the mainnet for production use, ensuring a smooth transition to live deployment.

Additional Considerations

- Upgradability: Explore mechanisms for contract upgradability to accommodate future updates and enhancements without disrupting existing functionality. Implement upgradeable patterns or proxy contracts to facilitate seamless upgrades and maintain compatibility with evolving requirements.

- Access Control (Optional): Consider incorporating access control mechanisms to restrict access to sensitive functions or features within your smart contract. Implement role-based access control (RBAC) or permissioned systems to manage user privileges and enhance security.

By following these comprehensive steps and considering insights from both datasets, you can effectively create a robust and secure smart contract to receive payments, leveraging the power of blockchain technology for real-world applications.

Tech Stack For Smart Contracts-Based Payment Solutions

Selecting the perfect combination of technologies is essential for creating powerful and effective software solutions.

| Category | Technology |

| Blockchain Platform | Ethereum, Hyperledger Fabric, Binance Smart Chain |

| Smart Contract Development | Solidity (for Ethereum), Chaincode (for Hyperledger Fabric) |

| Development Frameworks | Truffle, Hardhat, Embark |

| Testing Frameworks | Truffle, Hardhat, Ganache |

| IDEs | Remix, Visual Studio Code (with Solidity extensions) |

| Oracles | Chainlink, Band Protocol |

| Frontend Development | HTML, CSS, JavaScript (for web interfaces) |

| Backend Development | Node.js, Express.js |

| Database | MongoDB, PostgreSQL (for storing off-chain data) |

| Security Tools | MythX, Securify, Slither |

Benefits Of Smart Contracts In Real-Time Settlement Of Cross-Border Payments

Cross-border transactions have long struggled with inefficiencies, including delays, exorbitant fees, and opacity. However, smart contracts offer a solution to these challenges, enabling instantaneous settlement as mentioned below:

1. Removal Of Intermediaries

Conventional cross-border payments involve numerous intermediaries, complicating and slowing down the process. Smart contracts automate transactions, eliminating these middlemen and drastically reducing settlement times to near-instantaneous levels.

2. 24/7 Accessibility

Unlike traditional banking systems with restricted operating hours, blockchain networks operate round the clock. This enables seamless processing of cross-border payments regardless of time zones or holidays.

3. Elimination Of Intermediary Charges

By bypassing correspondent banks and other intermediaries, smart contracts eliminate associated fees, resulting in substantial savings for both senders and recipients.

4. Enhanced Transparency

All transaction details are permanently recorded on the blockchain, offering transparent insight into applied fees and exchange rates. This builds trust and diminishes the risk of concealed charges.

5. Immutable Record-Keeping

Transactions on the blockchain are immutable and resistant to tampering, ensuring a secure and trustworthy environment for cross-border payments.

6. Robust Cryptographic Measures

Smart contracts employ advanced cryptographic techniques to safeguard transactions, mitigating the risk of unauthorized access or fund theft during the transfer process.

7. Automated Compliance Checks

Smart contracts can be programmed to autonomously verify compliance with applicable regulations governing cross-border payments. This minimizes the likelihood of non-compliance and simplifies the overall procedure.

8. Enhanced Audit Trail

The transparent nature of blockchain transactions facilitates seamless auditing and regulatory oversight, instilling confidence and facilitating adherence to evolving regulatory frameworks.

9. Automated Operations

Smart contracts streamline manual tasks like reconciliation and verification, optimizing the entire cross-border payment workflow and reducing administrative burdens.

10. Seamless Integration

Smart contracts are adaptable to existing financial systems, enabling a smooth transition to real-time cross-border payments without necessitating a complete infrastructure overhaul.

Challenges Of Smart Contracts-Based Payment Solutions

Smart contract-based payment solutions offer a glimpse into a future of efficient and secure transactions. However, there are still challenges to overcome before widespread adoption:

1. Scalability Challenges

As the popularity of blockchain-based payment systems grows, scalability becomes a pressing issue. With more users and transactions, blockchain networks can experience congestion, resulting in slower transaction speeds and increased costs. This can hamper the scalability of smart contract-based payment solutions, impacting their ability to handle large transaction volumes efficiently.

2. Security Risks And Vulnerabilities

Smart contracts are susceptible to bugs and vulnerabilities, which can be exploited by malicious elements to manipulate transactions or steal funds. These security risks pose significant challenges to the widespread adoption of smart contract-based payment solutions. It’s crucial to conduct thorough security audits and implement security measures to mitigate these risks and protect users’ assets.

3. Legal And Regulatory Ambiguities

The legal and regulatory framework surrounding smart contracts and blockchain technology is still evolving. This uncertainty creates challenges for businesses and users navigating compliance requirements. Without clear guidelines and regulations, businesses may face legal challenges or regulatory investigations, hampering the adoption of smart contract-based payment solutions.

4. Privacy Concerns

While blockchain transactions offer security through encryption and decentralization, they also provide transparency, which can raise privacy concerns. Users may be hesitant to conduct sensitive transactions on a public ledger where transaction details are visible to anyone. Balancing the transparency and privacy aspects of blockchain technology is essential for addressing these concerns and fostering trust in smart contract-based payment solutions.

5. Complexity And Technical Expertise

Developing and managing smart contracts requires a high level of technical expertise in blockchain technology and programming languages like Solidity. This complexity can be a barrier for many users, especially those with limited technical knowledge. Simplifying the development process and providing user-friendly tools and resources can help overcome this challenge and make smart contract-based payment solutions more accessible to a wider audience.

6. Prolonged Payment Processes And Inefficiencies

In industries like construction, where projects involve multiple stakeholders and complex payment structures, smart contract-based payment solutions can face challenges related to prolonged payment cycles and inefficiencies. Addressing these challenges requires streamlining payment processes, improving communication between parties, and ensuring transparency and accountability throughout the payment lifecycle.

7. Compliance Challenges

Smart contracts must comply with various legal and regulatory standards, which can be complex and subject to change. Ensuring compliance requires ongoing monitoring and adjustments to adapt to evolving regulatory requirements. Businesses operating in regulated industries must navigate these compliance challenges effectively to avoid legal consequences and maintain the integrity of their smart contract-based payment solutions.

Are Smart Contracts Secure For Payment Solutions?

Smart contracts hold immense promise for revolutionizing payment solutions. Their inherent security features offer distinct advantages:

- Immutable Record-Keeping: Transactions are stored permanently on the blockchain, eliminating the risk of tampering or revision. This cultivates trust and transparency in financial interactions.

- Cryptographic Safeguards: Robust encryption techniques secure transactions within smart contracts. Unauthorized access or manipulation becomes exceptionally difficult, minimizing the likelihood of fraud.

- Decentralized Power: By eliminating central authorities, smart contracts reduce the vulnerability of the system to cyberattacks. This distributed model enhances overall resilience.

However, achieving bulletproof security requires a vigilant approach:

- Flawed Code, Fatal Flaws: Code vulnerabilities within the smart contract itself can be exploited by malicious actors. Rigorous audits and secure coding practices are paramount to minimize these risks.

- Guarding the Keys: The private keys controlling access to funds are critical. Secure storage and management strategies like hardware wallets and multi-signature approvals are essential to prevent unauthorized use.

- Beyond Technology: While the technology offers strong safeguards, social engineering scams still pose a threat. Educating users about phishing attacks and promoting responsible interaction with smart contracts is crucial.

The future of smart contract security is bright. Advancements in standardized protocols, self-healing contracts, and quantum-resistant cryptography offer exciting possibilities for even greater security. By acknowledging potential pitfalls and implementing robust security measures, smart contracts can evolve into a trusted pillar of secure and efficient payment solutions in the years to come.

Top 5 Companies Using Smart Contract-Based Payments Solutions

While smart contract technology for payments is still evolving, there are several real-world brands and companies pioneering its use:

1. Lemonade

Lemonade, an InsurTech firm, employs smart contracts to enhance the efficiency of insurance claims processing. Through the implementation of blockchain technology, Lemonade utilizes smart contracts for parametric insurance. This innovative solution automates various processes, including weather risk assessment, premium calculations, damage evaluation, and claim settlements.

2. Flexa

Flexa operates a decentralized payments network utilizing a network of smart contracts for secure and instant transactions. Their Flexa Payments feature provides merchants with tools to accept over 99 different digital currencies from any app or wallet across twelve popular blockchain networks.

3. MakerDAO

MakerDAO operates a decentralized lending platform powered by smart contracts. Their protocol allows individuals with ETH and a Metamask wallet to borrow DAI stablecoin by locking up ETH in MakerDAO’s smart contracts.

4. OpenSea

OpenSea, a leading NFT marketplace, utilizes smart contracts to facilitate the buying and selling of digital assets. These contracts securely handle funds and transfer ownership upon completion of transactions.

5. RippleNet

RippleNet utilizes blockchain technology and smart contracts to facilitate faster and more cost-effective cross-border payments for financial institutions. By eliminating intermediaries and offering real-time settlement, RippleNet aims to streamline international transactions.

Conclusion

The integration of smart contracts into payment solutions is no longer a futuristic vision; it’s a reality reshaping modern finance. These self-executing agreements, powered by blockchain technology, offer a compelling proposition: automated transactions, enhanced security, and unparalleled transparency. Businesses seeking to streamline payment processes can leverage this transformative technology to unlock a new era of efficiency.

However, the path to a smart contract-powered future isn’t without its challenges. Scalability issues and potential security vulnerabilities demand careful consideration. Yet, the potential benefits far outweigh these hurdles. As technology continues to evolve and regulations mature, staying informed and adapting to smart contracts becomes crucial. By embracing this transformative technology, you can unlock a future of secure, frictionless payments and pave the way for innovation in your business transactions.

How Can Idea Usher Help You Implement Smart Contracts In Finance?

Our expertise lies in creating streamlined processes through smart contract technology. With a deep understanding of blockchain and smart contract mechanisms, we transform your financial operations, ensuring efficiency and security. We develop smart contract solutions to fit your specific business needs and strategic objectives. Get in touch today for a complimentary consultation and discover how smart contracts can revolutionize your financial services.

FAQ

Q. What are the key benefits of using smart contracts for payment solutions?

Smart contracts offer increased efficiency by automating manual tasks, eliminating the need for intermediaries, ensuring faster settlements, providing high security, and offering transparency and accessibility.

Q. How secure are smart contracts for payments, and what measures can be taken to enhance security?

Smart contracts are highly secure due to their immutable nature and cryptographic safeguards. To enhance security, measures such as thorough code audits, secure key management, and adherence to best practices are essential.

Q. What types of payments can be processed and automated using smart contracts?

Smart contracts can process and automate various types of payments, including peer-to-peer transfers, escrow services, micropayments, and supply chain transactions.

Q. What does the future hold for smart contracts in the realm of payment solutions?

The future of smart contracts in payment solutions looks promising, with advancements in scalability, security, and interoperability expected to drive wider adoption and integration across industries, leading to more efficient and secure payment processes.

Rebecca Lal