In the rapidly evolving landscape of financial technology, one notable innovation that has garnered significant attention is the Robo-Advisor platform. This transformative technology has not only reshaped investment approaches but is poised to revolutionize the entire financial industry.

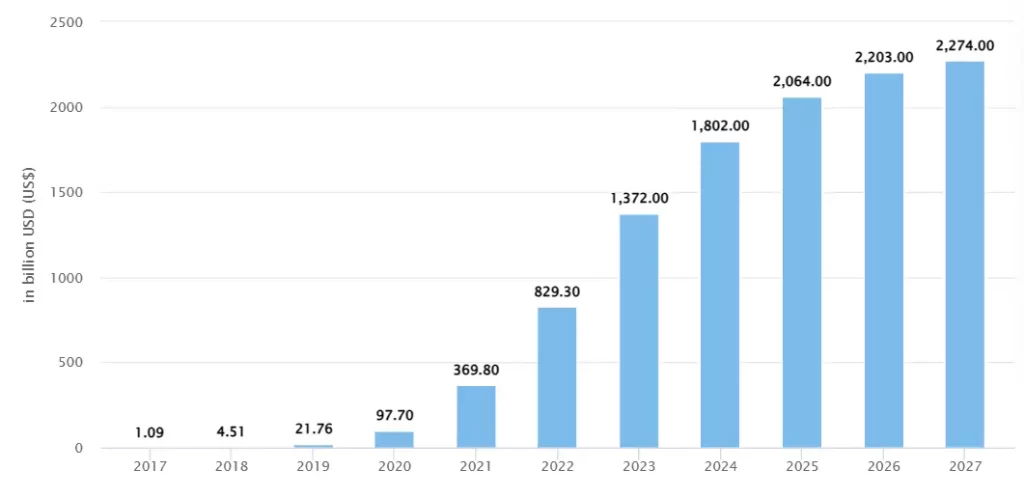

Source: Statista

From the above figure, it is evident that the popularity of this cutting-edge investment approach is on the rise, where adaptation to innovative solutions is crucial for staying competitive, investing in robo-advisor platform development has become not only an option but a strategic requirement.

The benefits of a robo-advisor platform extend beyond enhancing operational efficiency to automating financial decision-making and optimizing wealth management strategies.

This blog aims to serve as a comprehensive guide, offering insights into the complexities of developing a robo-advisor platform and understanding the associated cost dynamics.

- What Is A Robo-Advisor?

- How Robo-Advisor Work?

- Business Benefits Of Robo-Advisor Platform Development For An Investment Firm

- Must-Have Features In A Robo-Advisor Platform

- Robo-Advisor Essential Components

- How To Develop A Robo-Advisor Platform?

- Top 5 Financial Robo-Advisors In The Market Right Now

- Cost Affecting Factors To Develop A Robo Advisor Platform

- Tech Stack To Consider To Develop A Robo Advisor Platform

- Conclusion

What Is A Robo-Advisor?

A robo-advisor is a digital platform that provides automated, algorithm-driven financial planning services with minimal human intervention. These platforms use advanced algorithms to analyze an investor’s financial situation, goals, and risk tolerance to offer personalized investment advice. Robo-advisors have gained popularity for their ability to make investing more accessible to a broader range of individuals by eliminating the need for traditional face-to-face interactions with human financial advisors.

The first key aspect of robo-advisors is their accessibility. These platforms are typically user-friendly, allowing investors to sign up and create an account easily. An intuitive interface lets Investors input their financial information, investment goals, and risk preferences. The automated nature of robo-advisors streamlines the investment process, making it more convenient for individuals who may need more time or expertise to actively manage their investments.

Another important feature of robo-advisors is their use of algorithms and data analysis to generate investment recommendations. These algorithms consider various factors, such as market trends, economic indicators, and individual risk profiles, to create diversified portfolios. The goal is to optimize returns based on the investor’s objectives while managing risk appropriately. This data-driven approach allows robo-advisors to make informed investment decisions in real time.

Diversification is a fundamental principle of investing, and robo-advisors excel in implementing it. By spreading investments across various asset classes, industries, and geographic regions, robo-advisors aim to reduce the impact of poor performance in any single investment. This diversification strategy helps manage risk and provides investors a well-rounded portfolio tailored to their financial goals.

How Robo-Advisor Work?

Robo-advisors operate through a systematic and algorithm-driven process to provide automated financial advice and investment management. Here’s an overview of how a typical robo-advisor works:

1. User Input and Profiling

During the onboarding process, users provide information about their financial goals, risk tolerance, investment knowledge, and any specific preferences they may have. Some robo-advisors use detailed questionnaires to gather this data, while others may employ more interactive interfaces to make the process user-friendly. The information collected is crucial for creating a comprehensive investor profile. Robo-advisors consider factors like age, income, investment time horizon, and the level of comfort with risk. This step is essential in tailoring the investment strategy to meet the individual needs and objectives of the investor.

2. Algorithmic Analysis

Robo-advisors utilize advanced algorithms that incorporate financial theories and models, such as Modern Portfolio Theory (MPT). MPT emphasizes diversification to optimize returns for a given level of risk. These algorithms process vast amounts of historical and real-time financial data to assess the potential risk and return of different asset classes. Some robo-advisors may also factor in economic indicators, market trends, and geopolitical events to enhance the algorithmic analysis. The goal is to generate an asset allocation strategy that aligns with the investor’s risk tolerance and financial goals.

3. Portfolio Construction

Once the algorithmic analysis is complete, the robo-advisor constructs a diversified investment portfolio. This diversification is aimed at spreading risk across different asset classes to mitigate the impact of poor performance in any one area. Portfolios may include a mix of stocks, bonds, exchange-traded funds (ETFs), and other securities. The allocation of assets is determined by the investor’s risk profile, and the robo-advisor seeks to strike a balance between potential returns and risk management.

4. Automated Rebalancing

To maintain the desired asset allocation over time, robo-advisors employ automated rebalancing. This process involves periodically reviewing the portfolio and making adjustments if necessary. When market conditions cause certain assets to deviate from their target percentages, the robo-advisor triggers trades to bring the portfolio back in line with the original allocation. This automated approach ensures that the portfolio remains in line with the investor’s risk tolerance and financial objectives.

5. Continuous Monitoring and Reporting

Robo-advisors provide investors with continuous monitoring of their portfolios. Users typically have access to real-time performance data and can view how their investments are performing. Regular performance reports are generated, detailing the overall performance of the portfolio and any actions taken by the robo-advisor. Transparency is a key feature, allowing investors to stay informed and make decisions based on up-to-date information about their financial assets.

6. User Interaction and Support

While robo-advisors automate many aspects of investing, they often offer user interaction and customer support. Users may have access to customer service representatives via chat, email, or phone for assistance with any queries or concerns. Some robo-advisors also provide educational resources, such as articles, videos, and tutorials, to help users better understand investment principles and financial markets. This educational support enhances the user experience and empowers investors to make informed financial decisions.

Business Benefits Of Robo-Advisor Platform Development For An Investment Firm

The integration of a Robo-Advisor platform can revolutionize investment firms by combining advanced technology with financial expertise. Here are benefits in detail

1. Cost-Effectiveness of Robo-Advisors

Robo-advisors revolutionize the financial landscape by providing cost-effective solutions that redefine the economics of wealth management. With annual fees typically ranging from 0.2-0.4% of the client’s balance, these digital advisors offer a compelling alternative to the high costs associated with traditional finance managers. This affordability makes robo-advisors an attractive choice for individuals seeking financial guidance without the burden of exorbitant fees, democratizing access to professional investment advice.

Moreover, the cost-effectiveness of robo-advisors is not only about lower fees but also about operational efficiency. Automated processes reduce the need for extensive human resources, leading to lower overhead costs. This efficiency allows investment firms to pass on the cost savings to clients, making financial advice more accessible to a broader spectrum of investors.

2. Emotion-Free Decision-Making with Robo-Advisors

Emotions have long been recognized as a factor that can negatively impact financial decisions. Robo-advisors address this challenge by providing investment recommendations free from emotional influence. Their decision-making processes rely on data-driven, goal-oriented analysis, ensuring that each investor receives guidance grounded in rational examination rather than subjective biases. This emotion-free approach contributes to more objective and consistent investment strategies. Investors can rely on the fact that their portfolios are managed based on a systematic analysis of market trends and financial indicators, reducing the likelihood of impulsive decisions influenced by market volatility or emotional reactions to short-term fluctuations.

3. Streamlined Documentation for Financial Guidance:

Effective management of investment advice requires a streamlined and organized approach. Robo-advisors excel in this aspect by providing comprehensive documentation through user-friendly interfaces. Unlike traditional finance managers who may require clients to record advice across various channels, robo-advisors consolidate all recommendations in a centralized manner within their mobile apps.

This streamlined documentation not only simplifies access and tracking for clients but also contributes to transparency and accountability. Investors can easily review their financial guidance history, track the performance of their portfolios, and make informed decisions based on a well-documented record of recommendations, enhancing their overall experience with robo-advisory services.

4. Inclusivity without Minimum Balances

A key advantage of robo-advisors lies in their inclusivity, eliminating the traditional barrier of minimum account balances. Unlike human wealth managers who often set high minimums, robo-advisors leverage digital scalability to profitably serve clients across all asset levels. This inclusivity is particularly beneficial for novice investors with limited capital, providing them with the opportunity to enter the investment market without the financial constraints imposed by traditional wealth management firms. The absence of minimum account balances reflects a shift towards democratizing wealth management, aligning with the broader trend of financial inclusivity. Robo-advisors empower a more diverse range of individuals to engage in strategic investment planning, fostering financial literacy and independence.

5. Real-Time Analytics and Dynamic Advice

The real-time capabilities of robo-advisors position them as dynamic players in the financial advisory space. Traditional human managers face limitations in monitoring markets continuously, but robo-advisors operate 24/7, swiftly responding to market fluctuations. This real-time analytics and dynamic advice ensure that clients receive recommendations based on the most current market conditions, allowing for proactive adjustments to investment strategies.

The ability to adapt quickly to changing market dynamics enhances the overall effectiveness of robo-advisors, making them well-suited for navigating today’s fast-paced and interconnected financial markets. Clients benefit from timely insights and recommendations that align with the ever-evolving nature of global economies.

Must-Have Features In A Robo-Advisor Platform

From advanced algorithms to personalized portfolio management, explore the essentials shaping the future of financial decision-making.

1. Strategic Asset Allocation

Robo-advisors leverage mean-variance analysis to strategically allocate assets and build diversified portfolios. This sophisticated methodology aims to find the optimal balance between risk and return by considering the past performance of assets and their correlations. The result is a well-constructed portfolio that aligns with the client’s financial goals while mitigating risk through diversification.

Asset allocation is a fundamental aspect of investment strategy, and robo-advisor platforms excel at employing data-driven approaches to optimize the allocation of assets. This feature contributes to the creation of resilient and well-balanced portfolios that stand up to the complexities of the financial markets.

2. Portfolio Management

Robo-advisor platforms go beyond initial portfolio creation, providing comprehensive portfolio management services. This includes the continuous monitoring of portfolios and automatic rebalancing to ensure alignment with clients’ objectives. The proactive approach to portfolio management aims to optimize returns while minimizing risk, offering investors a well-rounded and efficient solution for their investment needs.

The seamless integration of portfolio management features into the robo-advisor platform streamlines the investment process for clients. It empowers them with a dynamic and responsive portfolio that adapts to market conditions, ultimately contributing to a more robust and goal-oriented investment strategy.

3. Client-Centric Risk Assessment

During the onboarding process, robo-advisors conduct a comprehensive questionnaire to assess the client’s risk tolerance and financial aims. This essential step ensures that the investment plan devised by the platform aligns with the client’s comfort level regarding potential market changes and losses. The data gathered from this assessment forms the foundation for constructing a personalized investment strategy that meets the client’s unique financial objectives and risk preferences.

By incorporating a risk tolerance assessment into the onboarding process, robo-advisors enhance the suitability of the investment recommendations provided, fostering a more customized and client-centric approach to automated investing.

4. Empowering Investor Education

Robo-advisors place a strong emphasis on investor education, offering a wide range of resources and tools for setting goals. These valuable tools empower investors with the necessary knowledge to make well-informed decisions about their financial future, thereby enhancing their financial literacy and encouraging a more proactive role in the investment process.

Investor education features on robo-advisor platforms may include informative articles, tutorials, and interactive tools that help clients understand investment concepts, risk management strategies, and the potential long-term benefits of disciplined investing. This emphasis on education aligns with the goal of fostering a more informed and engaged investor community.

5. Strategies for Tax Optimization

Robo-advisors offer sophisticated tax optimization strategies, with tax-loss harvesting being a standout feature. These platforms identify opportunities to sell investments at a loss strategically, offsetting capital gains and reducing investor tax liability. Additionally, robo-advisors minimize capital gains by carefully weighing the tax implications of each trade, preserving more returns.

Tax-efficient asset allocation ensures assets with higher tax implications reside in tax-advantaged accounts. Moreover, robo-advisors provide automated tax-advantaged investing, optimizing tax outcomes without constant manual oversight. This comprehensive tax optimization approach aligns with robo-advisors’ commitment to maximize returns while maintaining portfolio tax efficiency. It reflects a proactive stance toward minimizing tax burdens and enhancing overall portfolio performance.

6. Data-Driven Investment Analytics

The use of investment analytics sets robo-advisor platforms apart, enabling continuous monitoring and rebalancing of portfolios. By processing and interpreting large datasets, automation facilitates informed decisions to adjust the portfolio, maintaining the desired asset allocation to achieve client financial goals. Investment analytics ensure that the robo-advisor remains vigilant in responding to market changes and evolving economic conditions.

This feature reflects the commitment of robo-advisors to data-driven decision-making, providing clients with the benefit of timely adjustments to their investment portfolios. The utilization of investment analytics enhances the overall effectiveness of the robo-advisor platform in delivering optimal and informed investment strategies.

7. Automated Portfolio Balancing

Automatic rebalancing is a cornerstone feature of robo-advisor platforms, providing continuous monitoring and adjustment of investment portfolios. This crucial function reassesses the asset allocation regularly, aligning it with the client’s financial goals. By doing so, it effectively reduces volatility and manages risk. The automated nature of this process guarantees that the portfolio maintains its desired risk-return profile over time, offering investors a hands-off yet disciplined approach to portfolio management.

This feature ensures that clients’ investment strategies remain on track, responding dynamically to market changes without requiring constant manual intervention. The result is a well-maintained and optimized portfolio that aligns with the client’s evolving financial objectives.

8. Tax-Efficient Investing

Robo-advisors employ tax-loss harvesting as an effective tax strategy to maximize after-tax returns for investors. This approach involves strategically selling underperforming investments to realize losses, offsetting capital gains and thereby reducing the overall tax burden on an investment portfolio. Tax-loss harvesting is a proactive and systematic method employed by robo-advisors to enhance tax efficiency and preserve more returns for investors.

By integrating tax-loss harvesting into their platforms, robo-advisors demonstrate a commitment to optimizing the after-tax performance of client portfolios. This feature aligns with the broader goal of providing investors with a comprehensive and efficient investment solution that goes beyond traditional wealth management strategies.

9. Diversification Strategies

Diversification is a fundamental principle in the world of investing, and robo-advisor platforms excel at providing access to a wide array of asset classes. This exceptional feature ensures that investors can distribute their investments across different sectors, industries, and geographic regions, thereby mitigating the impact of underperformance in any one area. Robo-advisors systematically employ diversification strategies to enhance portfolio resilience and minimize risk.

The diverse range of investment options offered by robo-advisor platforms enables clients to build well-rounded portfolios that are less susceptible to the volatility of individual market segments. Diversification is a key component of risk management, and robo-advisors integrate this principle into their automated investment strategies.

10. Dynamic Portfolio Rebalancing

Robo-advisors offer a unique value through constant monitoring and automated rebalancing of investment portfolios. These platforms use complex algorithms to closely track market conditions, asset performance, and the overall makeup of the portfolio. The automatic adjustment ability ensures the portfolio sticks to its planned asset allocation.

The robo-advisor makes real-time decisions to buy or sell assets, maintaining this balance. This disciplined and objective rebalancing approach manages risk by keeping the portfolio aligned with the investor’s risk tolerance. Investors benefit from a hands-off yet responsive strategy that reacts quickly to market shifts, offering risk management tailored to their financial goals.

Robo-Advisor Essential Components

Explore the essential robo-advisor components driving the future of personalized and accessible wealth management:

1. Client-Facing Interface

The front end of a robo-advisor is the face of the platform for customers. It plays a crucial role in creating a positive user experience and facilitating client interaction. The design should be intuitive, responsive, and accessible, allowing clients to seamlessly navigate through the onboarding process, including Know Your Customer (KYC) procedures and profiling. The user interface should also provide tools for clients to easily monitor and manage their investments. Features like interactive charts, performance tracking, and goal-setting functionalities enhance the user engagement. Personalization is key here, ensuring that clients feel a sense of control and understanding of their financial journey.

2. Strategic Employer Access

For enterprises seeking to integrate robo-advisory platforms into employee benefit programs, a dedicated portal for partners becomes indispensable. This portal offers employers a comprehensive overview of their employees’ participation in the robo-advisory framework. It includes features such as tracking payroll contributions, monitoring balances, analyzing earnings, and accessing other relevant metrics. This ensures that employers have the necessary tools to effectively manage retirement plans and financial well-being initiatives for their workforce. The partner portal acts as a centralized hub for employers to stay informed and engaged in the financial wellness of their employees, fostering a collaborative approach to employee benefits through robo-advisory services.

3. Connectivity

Financial Application Programming Interfaces (APIs) serve as the vital connectors that enable the seamless functioning of robo-advisory platforms. These APIs link the platform to clients’ bank accounts, automating long-term investments, and offering guidance on optimal money management strategies. They play a pivotal role in executing trades, balancing portfolios, and integrating with supplementary financial systems. The security and reliability of these APIs are paramount, as they handle sensitive financial operations. With the right financial APIs, robo-advisors can deliver a holistic and automated approach to portfolio management and financial planning, enhancing the overall efficiency and effectiveness of the platform.

4. Efficient Backend System Management

The backend of a robo-advisory system serves as the operational powerhouse, providing a robust foundation for efficient and accurate functionality. This space is where financial advisors work to refine and validate portfolio balancing strategies, ensuring that the algorithms align with market trends and client expectations. It also facilitates the ongoing development and oversight of investing algorithms, allowing for continuous improvements. Monitoring overall financial performance, the backend verifies that the robo-advisor adheres to rigorous reliability and efficacy standards. It’s the engine room where the technological aspects and the human touch converge to deliver a reliable and effective financial advisory service.

5. Algorithmic Financial Management

At the heart of a robo-advisor lies the sophisticated machinery of money management algorithms powered by artificial intelligence and machine learning. These algorithms are responsible for crafting personalized portfolio options tailored to individual client needs and preferences. They analyze intricate details such as financial goals, risk tolerance, and investing ability to construct and manage optimal portfolios. Beyond the basics, these algorithms can incorporate advanced strategies such as tax loss harvesting or student loan management, providing clients with added value. Continuous refinement and adaptation are critical to ensure that the algorithms stay aligned with market dynamics and client objectives.

How To Develop A Robo-Advisor Platform?

The development of a robust robo-advisor platform involves a strategic blend of finance, technology, and user experience. In this section, we’ll break down the key steps and considerations essential for developing a cutting-edge robo-advisor

1. Initiating Development

The inception of a robo-advisor platform starts with the crucial Discovery Phase, where strategic planning and goal-setting take center stage. Establishing Return on Investment (ROI) goals and making informed technology approximations are pivotal. A pre-flight workshop becomes an invaluable tool during this phase, acting as a collaborative platform to identify priority features, align business goals, and define the technical architecture necessary for the optimal solution. The insights gained during this phase set the foundation for a smooth transition into subsequent development stages.

2. Validate Algorithms

To validate the efficiency of machine learning algorithms within the context of a robo-advisor, the Proof of Concept (PoC) phase comes into play. This involves the creation and assessment of machine learning algorithms capable of analyzing customer data and generating portfolios tailored to individual client preferences. Multiple portfolio models are formulated and rigorously evaluated using historical stock market data. The PoC phase serves as a critical checkpoint to ensure that the envisioned algorithms align with the platform’s objectives and can effectively deliver personalized financial solutions.

3. Craft User Experiences

The Design phase is where the front ends of consumer-facing mobile and web applications are crafted. This encompasses the development of user flows, creation of low-fidelity UI wireframes, and advancement to high-fidelity UI screens. An interactive prototype is developed, tested with users, and refined based on their feedback. Importantly, developers are actively involved in the design process to ensure practicality and feasibility. This collaborative approach between designers and developers is crucial for creating a seamless and user-friendly interface that aligns with both aesthetic and functional considerations.

4. Coding and Iterating

With the Proof of Concept validated and the design solidified, the development phase takes center stage. Writing code and performing rigorous automated and manual tests are key activities in this phase to identify and rectify any glitches or issues. Following an agile development approach allows for regular releases, typically every two weeks, enhancing the product-market fit incrementally. Coordination among diverse development team members, including front-end developers, mobile engineers, back-end coders, testers, and UX/UI engineers, is facilitated by having dedicated product and project managers overseeing the process.

5. Deployment and Continuous Enhancement

The deployment phase marks the transition of the robo-advisor platform to the production environment, making it accessible to the public. If applicable, mobile apps are uploaded to the App Store and Google Play. Ongoing maintenance is critical, involving the monitoring of system performance, addressing issues promptly, and evaluating user engagement patterns. This iterative process informs the next development cycle, ensuring that updates not only introduce new features but also address any unnoticed user concerns, thereby maintaining the platform’s efficiency and relevance in a dynamic financial landscape.

Top 5 Financial Robo-Advisors In The Market Right Now

Explore the cutting-edge world of financial management with our roundup of the top 5 robo-advisors currently dominating the market. These automated investment platforms offer a seamless blend of technology and financial expertise to help you navigate the complexities of wealth management effortlessly.

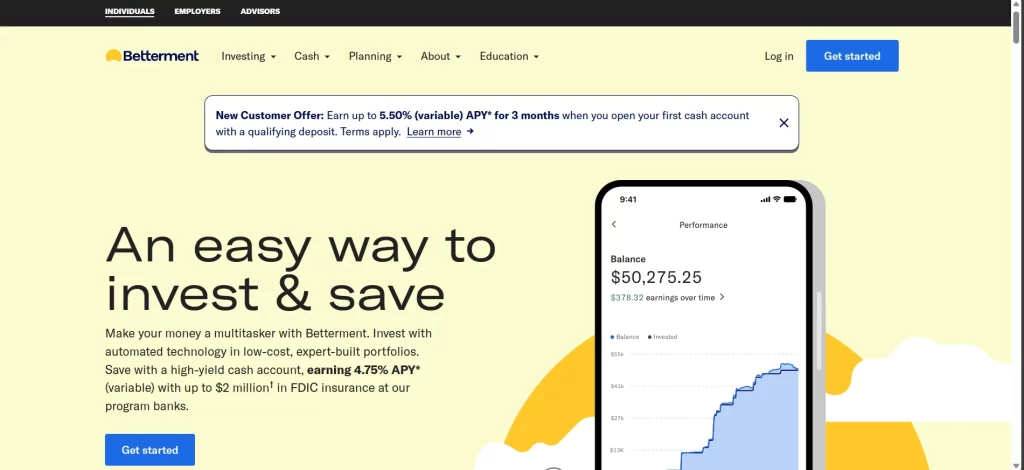

1. Betterment

Betterment stands out as a top-tier robo-advisor, setting industry standards with its comprehensive suite of services. The platform offers automatic portfolio rebalancing, tax-loss harvesting, and a personalized retirement plan. Notably, Betterment allows fractional shares in funds, ensuring that all invested money is actively working in the market. A distinctive feature is the availability of impact investing portfolios, allowing users to align their investments with their values. Betterment also supports external account synchronization, providing holistic financial advice. Customer support is available seven days a week, enhancing the overall user experience. For those seeking a more hands-on approach, Betterment’s premium plan provides access to human advisors.

Additionally, Betterment has a zero-dollar account minimum, making it accessible to a wide range of investors, including beginners. The platform’s commitment to customer service, diverse portfolio options, and innovative features solidify its position as a top financial robo-advisor.

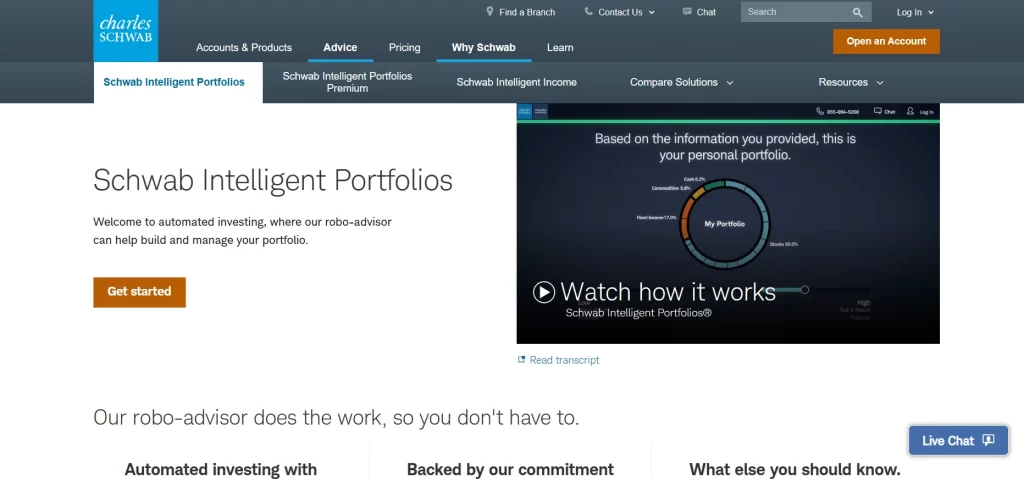

2. Schwab Intelligent Portfolios

Charles Schwab’s Intelligent Portfolios offers a robust robo-advisor solution, backed by the company’s investor-friendly reputation. The platform provides essential features such as automatic rebalancing, tax-loss harvesting, and 24/7 access to U.S.-based customer service. Notably, Schwab charges no management fees, making it an attractive option for cost-conscious investors. While there is a higher account minimum, the platform offers unlimited access to human advisors for accounts exceeding a certain threshold, coupled with a reasonable monthly fee.

Schwab’s commitment to customer service, coupled with its no-fee structure, positions Intelligent Portfolios as a compelling choice for investors looking for a reliable and cost-effective robo-advisor. The inclusion of human advisor access further enhances the overall value proposition.

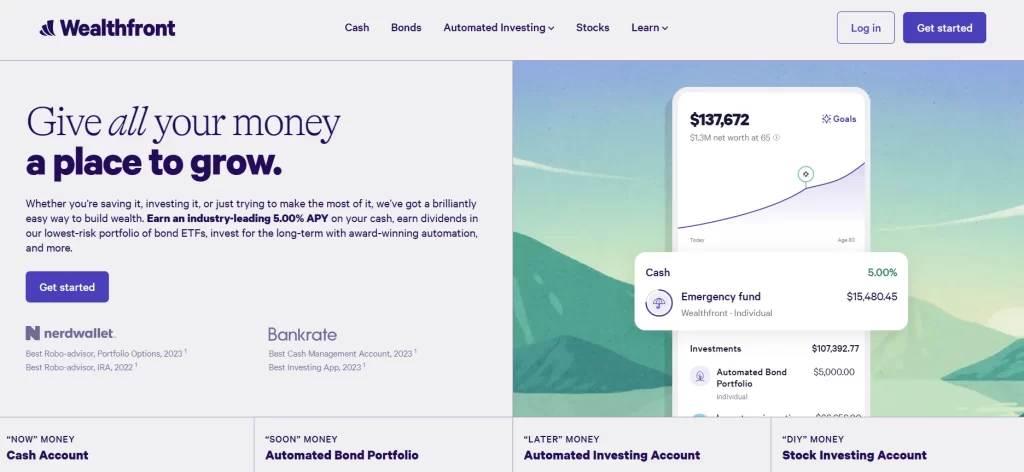

3. Wealthfront

As one of the largest robo-advisors, Wealthfront stands out for its goal-based investing approach. The platform goes beyond basic investment management, helping users understand the long-term implications of their financial decisions. Wealthfront offers tax-loss harvesting, and its extensive selection of ETFs allows for a highly customizable portfolio. A notable feature is the competitive interest rate on the FDIC-insured cash management account, without any associated fees. Additionally, Wealthfront provides the option to borrow against the account at attractive interest rates.

The platform’s focus on goal-oriented investing, coupled with a user-friendly interface and a diverse range of investment options, positions Wealthfront as a leading choice among robo-advisors. The absence of fees for certain services adds to its appeal for investors looking to optimize their financial strategies.

4. Fidelity Go

Fidelity Go, offered by Fidelity Investments, is a well-regarded robo-advisor that leverages the company’s extensive experience in the brokerage industry. The platform provides core functions such as portfolio management and rebalancing, making it an excellent choice for beginners. Fidelity Go stands out by charging no fees for assets under $25,000, offering a cost-effective entry point for new investors. Beyond this threshold, users pay a competitive all-in price of 0.35 percent of their assets.

Fidelity Go is particularly beneficial for existing Fidelity customers, providing a seamless experience by consolidating all accounts on one dashboard. This integration extends to the ability to open a cash management account easily. The platform’s commitment to customer support further enhances the overall user experience, making it a compelling choice for investors seeking a reliable and user-friendly robo-advisor.

5. SoFi Automated Investing

SoFi Automated Investing stands out in the competitive robo-advisor market with its investor-friendly approach. One of the most attractive features is the absence of a management fee, setting it apart from many other robo-advisor platforms. Investors benefit from an average fund fee of less than 0.10 percent, making it an appealing choice for those looking to minimize costs. The low entry requirement of just $1 makes it accessible for investors with various budget levels.

In addition to cost-effectiveness, SoFi offers automatic rebalancing and goal-based planning. These features help investors align their portfolios with their life objectives and maintain a diversified and well-structured investment strategy. Beyond the robo-advisor services, SoFi provides users with career services, access to financial advisors, and discounts on other SoFi products at no extra cost. This comprehensive approach enhances the overall value proposition for investors seeking not only wealth management but also additional financial resources and support.

Cost Affecting Factors To Develop A Robo Advisor Platform

The development of a Robo Advisor platform is a strategic move that demands careful consideration of various cost factors. From technological infrastructure to regulatory compliance, explore key elements influencing the financial investment required to bring a robust and efficient Robo Advisor to market

1. Choosing Between White-Label Components and Custom Development

Determining whether to opt for white-label components or custom development significantly impacts the cost of building a robo-advisor platform. White-label solutions leverage existing technology, potentially offering cost savings. On the other hand, custom development involves building the platform from the ground up, incurring higher initial expenses. While white-label solutions might seem more budget-friendly initially, a custom-built platform provides greater flexibility and room for customization in the long term. Deciding between the two approaches requires careful consideration of short-term budget constraints versus long-term scalability and adaptability needs.

2. Navigating the Integration with Existing Banking Infrastructure

The integration of a robo-advisor with existing banking infrastructure plays a pivotal role in cost considerations. Seamless integration with current financial systems, APIs, and data sources can pose challenges based on the complexity and compatibility of the existing infrastructure. The need for in-depth integration may lead to additional expenses. It’s crucial to assess the intricacies of the current banking infrastructure and budget accordingly to ensure a smooth and cohesive integration process, minimizing disruptions and potential cost overruns.

3. Legal and Security Measures

Compliance with regulatory standards and financial industry regulations is a crucial factor affecting the cost of developing a robo-advisor. Meeting the necessary legal requirements and ensuring data security and privacy can incur additional expenses. Engaging legal and compliance experts to navigate the regulatory landscape and implement robust security measures is essential. The level of compliance complexity in different regions and jurisdictions should be thoroughly assessed to anticipate and budget for compliance-related costs throughout the development process.

4. Mobile and Web Interfaces

The development cost of a robo-advisor is influenced by the number and types of front ends created. Building both mobile and web interfaces adds to the overall development expenses. The level of sophistication in the design of these interfaces also contributes to the cost. Creating responsive, user-friendly front ends that cater to both mobile and web users is essential for the success of the robo-advisor. The choice between focusing on one type of interface or offering a seamless experience across multiple platforms can impact the overall budget for development.

5. Evaluating Specific Functionalities

The complexity and cost of robo-advisor development can increase significantly based on the inclusion of specific features. Incorporating advanced functionalities, such as voice capabilities or personalized chatbots, may raise development expenses. The decision to add specific features should align with the target audience and the unique value proposition of the robo-advisor. While additional features can enhance the user experience and competitiveness of the platform, careful consideration of their impact on development costs is essential to maintain a balanced budget.

Tech Stack To Consider To Develop A Robo Advisor Platform

Developing a Robo Advisor platform involves integrating various technologies to create a seamless and efficient system for automated financial advice. Here is a tech stack you may consider for building a Robo Advisor:

1. Programming Languages

- Backend: Python (Django, Flask), Java (Spring), Node.js (Express)

- Frontend: JavaScript (React, Angular)

2. Web Framework

- Flask (Python)

- Spring (Java)

- Express (Node.js)

3. Database

- PostgreSQL

- MySQL

4. Cloud Services

- AWS

- Azure

- Google Cloud

5. APIs

- Alpha Vantage

- IEX Cloud

- Yahoo Finance API

6. Security

- HTTPS

- Encryption (SSL/TLS)

7. Authentication and Authorization

- OAuth

- JWT (JSON Web Tokens)

8. Robo Advisor Algorithms

- Scikit-learn (Python)

- TensorFlow

- PyTorch

9. Financial Calculations

- Quantlib

- financial functions in Python

10. User Interface (UI)

- React

- Angular

13. Testing

- Unit testing frameworks (e.g., pytest, JUnit)

- Integration testing

- End-to-end testing

14. Monitoring and Analytics

- Prometheus

- ELK stack (Elasticsearch, Logstash, Kibana)

15. Mobile App (Optional)

- React Native

- Flutter

Conclusion

The development of a customized robo-advisor platform represents a pivotal step towards the future of the financial industry. The transformative potential of such platforms extends across various sectors, providing tangible benefits to banks, startups, and financial institutions alike.

The expedited returns facilitated by robo-advisors cannot be overstated. With real-time data analysis and algorithm-driven decision-making, these platforms enable faster and more accurate investment strategies. This not only benefits clients by maximizing their returns but also enhances the overall reputation and competitiveness of the financial institution utilizing the robo-advisor.

Moreover, the improved data analysis capabilities of robo-advisors contribute to better-informed investment decisions. By processing vast amounts of financial data quickly and accurately, these platforms can identify trends, assess risks, and make strategic recommendations which positions financial institutions to adapt swiftly to market changes and regulatory requirements.

How Can Idea Usher Transform Your Business With A Robo-Advisor Platform Development?

To harness the full advantages of robo-advisor application development, consider relying on the experienced team at Idea Usher. Our FinTech software development services not only align with your specific needs and objectives but also guarantee a smooth integration of cutting-edge technologies, ensuring a robust and future-ready solution.

Idea Usher stands as a proven catalyst for business transformation, leveraging its extensive experience with a diverse clientele, including Fortune 500 giants like Gold’s Gym and Honda, as well as emerging indie brands.

With a track record of developing hybrid apps, mobile apps, and custom websites, Idea Usher is well-equipped to usher in a new era of success for your business through the implementation of a robust Robo-Advisor platform.

You can read case study about the “EQL Trading & Investing” platform to gain an understanding of our development expertise in fintech industry.

Partner with us, and let your business thrive in the age of automation and innovation.

FAQ

Q. What is a robo-advising platform?

A. A robo-advising platform constitutes a software or application employing AI algorithms and automation to deliver financial guidance to FinTech businesses and manage their investment portfolios digitally. Its primary goal is to simplify and automate the investment process, ensuring users benefit from enhanced accessibility and cost efficiency.

Q. What is the cost for developing a robo-advisor app?

A. Various factors influence the overall development cost, including the location of the chosen app development firm, the complexity of the app, the development timeframe, and the integrated features. To obtain accurate pricing tailored to your specific business requirements, it is recommended to consult with a dedicated app development company for custom quotes.

Q. How do robo-advisors generate revenue?

A. Robo-advisors commonly generate revenue through management fees, often calculated as a percentage (ranging from 0.25% to 0.75%) of the assets under management (AUM). These fees are generally lower compared to traditional financial advisors, making robo-advisors an appealing and cost-effective choice for investors.

Q. What is the typical timeline for developing a robo-advisor app?

A. The time required for the development of a robo-advisor platform can vary based on factors such as desired features, complexity, and the technology involved. On average, it typically takes anywhere from 6 to 12 months to create a fully functional and user-friendly robo-advisor FinTech application.

Gaurav Patil