Insurance companies have long struggled to accurately assess risk, leading to premiums that don’t always reflect individual driving behavior. Safe drivers, who consistently adhere to traffic rules, often find themselves paying the same premiums as those who engage in high-risk driving. This mismatch not only feels unfair but also discourages safe driving, as drivers see no direct benefit from their caution. Additionally, the process of filing claims and determining fault in accidents is often slow and unclear, resulting in delays, disputes, and dissatisfaction among policyholders. Insurers face the added challenge of fraudulent claims, which drive up operational costs and, consequently, premiums for all customers. These inefficiencies in risk assessment and claims management have created a pressing need for more precise, transparent, and user-friendly solutions.

Telematics technology offers a way to address these issues by using devices to collect data on driving habits. This real-time data enables insurers to adjust premiums based on actual driving behavior rather than relying on broad demographic factors. The result is fairer pricing and incentives for safer driving. The adoption of telematics is on the rise, with projections indicating that the global market could reach $170.35 billion by 2032. In the U.S., more than 100 million insurance policies already use telematics, showing its significant impact on the industry.

As the connectivity of vehicles increases and smartphones become more widespread, telematics use continues to grow. This blog will discuss the benefits and applications of telematics in insurance, showing how it’s changing the way insurers assess risk and set premiums.

What Is Telematic Insurance?

Telematic insurance is a modern approach to vehicle insurance that customizes premiums based on the driver’s real-time behavior and vehicle usage. Utilizing telematics technology, this insurance model involves placing a device in the vehicle or employing a smartphone app to monitor various driving metrics. These metrics typically include speed, acceleration, braking intensity, distance traveled, time of day, and driving routes.

By analyzing this data, insurance companies can create a risk profile customized to the individual driver, leading to more accurate premium calculations. Safe drivers who maintain consistent speeds, avoid harsh braking, and drive during less risky times are often rewarded with reduced premiums. Conversely, those who frequently engage in high-risk driving behaviors might face higher insurance costs.

This approach not only offers a fairer pricing model but also encourages safer driving habits, making telematic insurance a growing trend in the automotive insurance industry.

Key Features Of Telematics Insurance

Telematics insurance utilizes advanced technology to provide a detailed assessment of driving behaviors, influencing insurance premiums based on individual driving patterns. Here are the essential features of this insurance type:

- GPS Tracking: Utilizes GPS to monitor vehicle location, speed, and route choices. This data helps insurers assess driving patterns and adjust premiums accordingly.

- Acceleration and Braking Monitoring: Tracks how smoothly or aggressively a driver accelerates and brakes, offering insights into safe or risky driving habits.

- Mileage Tracking: Records the total distance driven, allowing insurers to adjust premiums based on vehicle usage. Lower mileage can lead to lower insurance costs.

- Time-of-Day Tracking: Monitors when the vehicle is driven. Driving during high-risk times, such as late at night or during rush hours, can impact the premium.

- Cornering and Steering Analysis: Evaluates how turns and steering are handled. This feature reflects driving style and overall vehicle control.

- Phone Usage Monitoring: Some telematics devices can track phone use while driving, helping to reduce distractions and encourage safer driving practices.

- Eco-Driving Analysis: Assesses driving habits to promote fuel efficiency and reduce emissions, which can be beneficial for both the driver and the environment.

- Real-Time Feedback: Provides insights into driving habits through a mobile app or online portal and helps drivers improve their driving behavior.

Telematics insurance is gaining popularity for its personalized approach to car insurance. By tracking driving habits through GPS and monitoring acceleration, braking, and phone use, it customizes premiums based on actual driving behavior. Drivers appreciate the real-time feedback provided through apps, which not only helps improve driving skills but can also lead to cost savings. Additionally, telematics insurance promotes eco-friendly driving practices. Basically, its ability to offer customized premiums and encourage safer, more efficient driving makes it an attractive option for many.

How Does Telematic Insurance Work?

Telematic insurance operates through a series of steps designed to customize your auto insurance premium based on your driving behavior. Here’s how the process unfolds:

- Program Enrollment: To begin, you enroll in a telematics-based insurance plan with your provider, consenting to the collection and use of your driving data.

- Technology Integration: Depending on the insurer, you’ll either install a telematics device in your vehicle, download a dedicated smartphone app, or utilize existing in-car telematics systems. These tools are responsible for monitoring your driving habits.

- Data Monitoring: The installed technology continuously captures detailed driving data, including your speed, acceleration, braking patterns, total distance driven, and the times of day you typically drive. In some cases, it also records phone usage while the vehicle is in motion.

- Data Transmission: The captured data is securely transmitted to your insurance provider, either in real-time or at specified intervals.

- Behavioral Analysis: The insurance company analyzes the data to evaluate your driving risk profile. Safe driving habits—such as smooth acceleration and braking, consistent speeds, and driving during low-risk times—can result in a lower risk assessment.

- Premium Calculation: Based on the analysis, your insurance premium is dynamically adjusted. This adjustment can occur on a monthly, quarterly, or yearly basis, reflecting your actual driving behavior.

- Driving Insights: Many insurers offer personalized feedback through an app or online portal, allowing you to review your driving patterns and receive tips for improvement. Consistent, safe driving can lead to further discounts and incentives.

Key Market Takeaway For Telematics Insurance

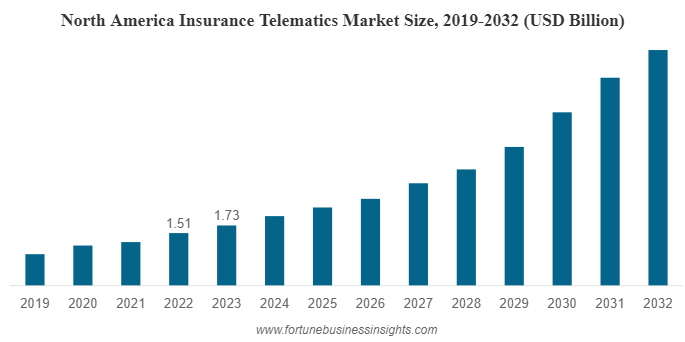

The global insurance telematics market was valued at $4.33 billion in 2023. It is anticipated to grow from $5.03 billion in 2024 to $19.23 billion by 2032. This represents a compound annual growth rate (CAGR) of 18.2% throughout the forecast period.

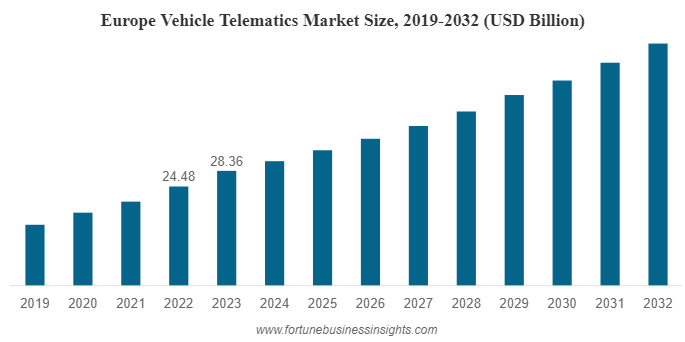

Similarly, the vehicle telematics market had a valuation of $79.17 billion in 2023. Projections indicate it will rise from $85.95 billion in 2024 to $170.35 billion by 2032, with a CAGR of 8.9%. This growth is driven by the increasing adoption of telematics systems by automotive manufacturers for both passenger and commercial vehicles. Additionally, heightened consumer awareness about the benefits of telematics—such as improved vehicle performance insights and driver behavior analysis—is encouraging fleet operators and vehicle managers to implement these systems. The broader adoption of telematics products by original equipment manufacturers (OEMs) and aftermarket providers is also contributing to market growth.

In the telematics-based auto insurance sector, revenue is expected to reach $2,513.9 million in 2023. This market is projected to expand significantly, with a CAGR of 18.7%, potentially reaching $13,998.3 million by 2033. The increasing demand for telematics-based insurance solutions is driven by the rise of connected cars, technological advancements in telematics, and the growing need for personalized insurance options.

Types Of Telematics Insurance

Telematics insurance comes in two primary forms, each leveraging different technologies to monitor driving behavior and adjust premiums accordingly. Here’s a detailed overview:

1. Pay-As-You-Drive (PAYD)

This type of telematics insurance adjusts your premium based on the total miles you drive. The less you drive, the lower your insurance cost. PAYD is ideal for individuals who use their vehicles infrequently, offering significant savings by aligning costs with actual usage.

2. Pay-Per-Mile (PPM)

Similar to PAYD, Pay-Per-Mile insurance includes a base rate plus a fee for each mile driven. This model is particularly beneficial for low-mileage drivers, as it directly ties the premium to the distance traveled, making it a flexible option for those with variable driving patterns.

3. Behavior-Based Insurance

This model focuses on how you drive rather than how much you drive. By monitoring driving behaviors such as acceleration, braking, speed, and even phone usage while driving, insurers can adjust premiums based on the level of risk associated with your habits. Safe driving behaviors can lead to significant discounts, while riskier behaviors may increase costs.

4. Black Box Insurance

Also known as telematics box insurance, this type involves installing a small device (black box) in your vehicle. The black box monitors various aspects of your driving, including speed, mileage, and driving times. This detailed data allows insurers to tailor your premium based on real-time driving conditions and habits.

5. Green Insurance

Green insurance rewards drivers who adopt eco-friendly driving habits, such as avoiding rapid acceleration and harsh braking. These behaviors not only reduce fuel consumption but also lower emissions, and insurers may offer discounts for environmentally conscious driving.

Traditional vs. Telematics Insurance: A Comparison

When choosing auto insurance, understanding the differences between traditional and telematics insurance is essential for finding the best fit for your needs.

1. Premium Calculation

Traditional Insurance bases its premiums on general factors like the driver’s age, gender, location, vehicle type, driving history, and credit score. These elements are combined with statistical models to estimate the overall risk, resulting in a fixed premium that typically remains constant throughout the policy period.

Telematics Insurance, on the other hand, uses real-time data to calculate premiums. It closely monitors specific driving behaviors such as speed, acceleration, braking, mileage, and driving times. This approach allows for a more personalized premium that can fluctuate depending on how safely you drive, potentially offering significant savings for cautious drivers.

2. Risk Assessment

Traditional Insurance relies heavily on demographic data and historical trends to assess risk. While this method provides a broad view of potential risks, it may not accurately reflect an individual’s current driving habits. Consequently, two drivers with similar demographic profiles might receive the same premium, even if one drives more safely than the other.

Telematics Insurance provides a more precise risk assessment by focusing on real-time driving behaviors. By tracking and analyzing how you drive, it adjusts your premium according to your actual risk level. This method rewards safe driving practices and can result in lower premiums for those who consistently demonstrate low-risk behaviors.

3. Premium Flexibility

With Traditional Insurance, premiums are typically fixed for the duration of the policy. Changes in premiums generally occur only at renewal, based on updated information or changes in the insured’s circumstances.

In contrast, Telematics Insurance offers greater flexibility. Since premiums are adjusted based on ongoing monitoring of driving behavior, safe driving can lead to lower premiums over time. Conversely, risky behaviors may result in higher costs, providing continuous incentives for safe driving.

4. Discounts And Rewards

Traditional Insurance offers discounts based on broad criteria, such as maintaining a clean driving record, bundling multiple policies, or having safety features in the vehicle. These discounts are predetermined and apply to a wide range of drivers.

Telematics Insurance takes discounts a step further by offering rewards based on real-time driving data. Safe drivers receive immediate feedback through apps or online portals, which can help them improve their driving habits. Over time, these improvements can lead to more substantial discounts and a more customized insurance experience.

5. Technology And Monitoring

Traditional Insurance does not involve active monitoring of driving behavior. The premium remains unaffected by how the insured drives during the policy period.

Telematics Insurance integrates technology into the driving experience, using devices like plug-in modules, mobile apps, or built-in car systems to monitor driving habits continuously. This technology-driven approach not only provides insurers with accurate data but also empowers drivers with actionable insights into their driving patterns.

| Aspect | Traditional Insurance | Telematics Insurance |

| Premium Calculation | Fixed, based on demographics and vehicle factors. | Variable, based on real-time driving behavior. |

| Risk Assessment | General, based on statistical data and demographics. | Detailed, based on actual driving data. |

| Premium Flexibility | Fixed for the policy period, adjusted only at renewal. | Adjusted regularly based on driving habits. |

| Discounts and Rewards | General discounts for safe driving, bundling, or features. | Personalized discounts for specific driving behaviors. |

| Technology and Monitoring | No real-time monitoring. | Continuous monitoring via devices or apps. |

Benefits Of Telematics Insurance

Telematics insurance presents several significant advantages for both drivers and insurance companies. Here’s a detailed look at its benefits:

Advantages For Policyholders

- Potential for Lower Premiums: Drivers who exhibit safe and efficient driving behaviors can enjoy substantial savings on their insurance premiums. Discounts of up to 40% are possible for those who consistently demonstrate responsible driving.

- Customized Premiums: Unlike traditional policies, telematics insurance bases premiums on actual driving habits. This personalization ensures that the cost of insurance more accurately reflects individual driving behavior.

- Enhanced Driving Insights: Policyholders receive detailed feedback on their driving patterns. This real-time information helps individuals identify areas for improvement, which can lead to further premium reductions.

- Environmental Benefits: The system promotes eco-friendly driving by rewarding behaviors that reduce fuel consumption and lower emissions, contributing to a greener environment.

Advantages For Insurers

- Precise Risk Evaluation: Insurers benefit from detailed, real-time data that enhances the accuracy of risk assessments. This allows for a more precise and fair premium setting.

- Fraud Prevention: By analyzing comprehensive driving data, insurers can detect patterns indicative of fraudulent claims, thereby reducing fraud and associated costs.

- Enhanced Customer Interaction: The technology provides a platform for continuous customer engagement through personalized feedback and educational resources, improving overall customer satisfaction.

- Reduction In Claims Frequency: Encouraging safe driving habits through telematics can lead to a decrease in accidents and claims, which benefits insurers by reducing overall claim expenses.

Applications Of Telematics In The Insurance Industry

Telematics technology is reshaping the insurance industry by enhancing risk assessment and customer engagement. Here are several impactful applications:

1. Usage-Based Insurance (UBI):

Insurers like Progressive and Allstate utilize telematics to monitor driving behavior in real time. Programs such as Snapshot and Drivewise adjust premiums based on individual driving patterns, offering cost savings for safe drivers.

A real-world example of this application: Progressive’s Snapshot tracks your driving through a plug-in device or mobile app, rewarding safe drivers with discounts.

2. Fleet Management:

For commercial fleets, telematics systems track vehicle performance and driver behavior. This technology helps optimize routes, improve fuel efficiency, and enforce safe driving practices, leading to cost savings and operational efficiency.

A real-world example of this application: Geotab helps companies like UPS manage their vehicle fleets by tracking location, driver behavior, and fuel use, which improves safety and cuts costs.

3. Real-Time Roadside Assistance:

Telematics enables insurers to provide immediate roadside assistance. By accessing real-time vehicle data, insurers can quickly dispatch help in emergencies, such as breakdowns or accidents, improving response times and customer satisfaction.

A real-world example of this application: OnStar offers real-time tracking and emergency help by detecting accidents and sending the vehicle’s location to emergency services.

4. Theft Recovery:

GPS tracking integrated with telematics assists in locating stolen vehicles. This capability enhances the likelihood of vehicle recovery and reduces the financial impact of theft on both insurers and policyholders.

A real-world example of this application: Teltonika’s GPS trackers help recover stolen vehicles by detecting tampering and allowing the vehicle’s engine to be disabled if needed.

5. Accident Analysis:

Telematics data aids in accident reconstruction by providing detailed information about the incident. This data is invaluable for processing claims accurately and identifying fraudulent activities.

A real-world example of this application: Geotab’s system uses driving data to analyze accidents, helping understand what happened and improve safety measures.

6. Eco-Driving Incentives:

Telematics promotes environmentally friendly driving by tracking fuel consumption and emissions. Insurers can offer incentives and discounts to drivers who adopt eco-friendly practices, supporting both cost savings and sustainability.

A real-world example of this application: Some insurers offer discounts for drivers of electric or hybrid cars and support eco-friendly driving practices.

7. Programs For Young Drivers:

Specific programs for young or inexperienced drivers use telematics to monitor and guide their driving habits. These initiatives offer feedback and incentives for safe driving, helping to reduce accident rates among new drivers.

A real-world example of this application: GM’s Teen Driver system helps parents monitor their teen drivers by providing alerts and reports on their driving habits.

Steps To Build A Mobile Telematics Program

Creating a successful mobile telematics program involves a strategic blend of technology and user-centric design. To achieve this, follow these detailed steps:

1. Integrate Advanced Technological Solutions

Start by incorporating cutting-edge technologies to ensure data accuracy and functionality. Artificial Intelligence (AI) is instrumental in analyzing driving patterns and identifying risky behaviors through advanced algorithms. This technology allows for deep insights and predictive analytics. Alongside AI, utilize Internet of Things (IoT) devices to collect comprehensive data from a variety of sources, such as in-vehicle sensors and environmental conditions. This approach provides a holistic view of driving dynamics. Additionally, exploring blockchain technology can further enhance data security. Blockchain offers a transparent and immutable record of data, ensuring its integrity and protection against tampering.

2. Prioritize An Intuitive User Interface

Next, focus on designing an intuitive user interface that caters to all technical skill levels. A well-designed interface should be easy to navigate and understand, promoting user engagement. Implement personalized features that adapt to individual driving habits and preferences to make the app more relevant and useful. To further increase engagement, incorporate gamification elements. These can turn safe driving practices into enjoyable challenges, motivating users to improve their driving behaviors while keeping the experience fun.

3. Ensure Robust Data Privacy And Security

Data privacy and security are important for user trust and compliance. Clearly communicate how user data is collected, stored, and used to build transparency. Use data anonymization techniques to protect individual privacy and prevent unauthorized access. Conduct regular security audits to identify and mitigate potential vulnerabilities, ensuring that the app remains secure against cyber threats. Implement encryption and secure storage solutions to safeguard sensitive information.

4. Guarantee Comprehensive Device Compatibility

Ensuring that your telematics app works smoothly across various devices is essential. Design the app to be compatible with a wide range of smartphones and operating systems. Address network connectivity issues by providing offline functionality, allowing the app to perform effectively even in areas with poor network coverage. This ensures that users can rely on the app regardless of their location.

5. Integrate With External Services

Enhance the app’s functionality by integrating it with popular external services. Partner with navigation apps to offer real-time traffic updates and turn-by-turn directions. Collaborate with music streaming services to provide in-car entertainment options, making the app more versatile and appealing. These integrations add significant value and convenience, improving the overall user experience.

6. Provide Value-Added Features

Differentiate your telematics program by offering additional, valuable services. Develop personalized driver coaching programs that use telematics data to help users refine their driving skills. Incorporate emergency assistance services such as roadside help and stolen vehicle recovery. Additionally, monitor vehicle health metrics like tire pressure and engine performance to preemptively address maintenance needs. These features not only enhance user satisfaction but also contribute to overall safety and vehicle longevity.

7. Stay Aware Of Industry Developments

Finally, keep up with industry trends and regulatory changes to maintain relevance and compliance. Regularly review emerging technologies and industry standards that could improve your telematics solution. Staying informed about the latest advancements ensures that your program remains competitive and aligned with current best practices.

Technology That Can Enhance Telematics Solutions

As telematics technology advances, several emerging technologies have the potential to significantly improve its capabilities. Here is a detailed look at how these innovations can enhance telematics solutions:

1. Natural Language Processing (NLP)

Natural Language Processing (NLP) offers a more intuitive way to interact with telematics systems. By enabling voice commands, NLP allows drivers to use the system hands-free, which enhances safety and convenience. Beyond voice interaction, NLP can analyze driving data to provide personalized recommendations. For example, it can suggest the most efficient routes based on real-time traffic conditions or alert drivers to potential hazards. This ability to interpret and respond to natural language makes the system more user-friendly and effective.

2. Biometric Authentication

Biometric authentication introduces a higher level of security to telematics systems. By using unique biological traits, such as fingerprints or facial recognition, this technology ensures that only authorized users can access the system. Implementing biometric authentication helps to protect sensitive information and prevents unauthorized use. This added layer of security not only safeguards user data but also builds trust in the telematics system.

3. Cognitive Computing

Cognitive computing enhances telematics systems by predicting maintenance needs before they arise. By analyzing vehicle data, cognitive computing can identify patterns that suggest potential issues. This proactive approach allows drivers to address maintenance concerns early, reducing the risk of unexpected breakdowns and costly repairs. The capability to forecast vehicle needs based on historical and current data improves both the reliability and longevity of the vehicle.

4. Neuromorphic Computing

Neuromorphic computing improves the speed and accuracy of data processing. This technology simulates the way the human brain processes information, enabling real-time analysis with greater efficiency. Neuromorphic computing can lead to faster response times and more precise predictions in telematics systems. For example, it can quickly adjust driving recommendations based on immediate conditions, making the system more responsive and effective.

5. Quantum Computing

Quantum computing offers powerful data analysis capabilities that surpass traditional computing methods. It can handle complex and large-scale data sets with remarkable speed. This advanced processing power allows for a more detailed analysis of driving behaviors and patterns. Quantum computing can identify subtle trends and correlations that might be missed with conventional techniques, leading to more accurate insights and improved system performance.

Costs To Build A Mobile Telematics Solution

Here’s the estimate based on various components and stages of development:

| Component | Description | Cost Range (Min) | Cost Range (Max) |

| Research and Planning | Market Research | $500 | $3,000 |

| Frontend Development | UI/UX Design | $1,000 | $15,500 |

| Front-End Coding | $3,000 | $20,000 | |

| Backend Development | Server Setup | $500 | $7,000 |

| Database Development | $500 | $6,500 | |

| API Integration | $1,000 | $6,500 | |

| App Features | GPS Tracking | $500 | $6,000 |

| Driving Behavior Analysis | $500 | $8,000 | |

| Notifications and Alerts | $500 | $5,000 | |

| User Authentication | $500 | $3,000 | |

| Testing | Quality Assurance | $500 | $6,500 |

| User Testing | $500 | $3,000 | |

| Additional | Ongoing Maintenance and Updates | $500 | $10,000 |

| Total Cost Range | $10,000 | $100,000 |

Challenges Of Insurance-Based Telematics

Telematics-based insurance solutions offer numerous benefits, but they also come with specific challenges. Here’s a clear overview of these issues:

1. Data Privacy And Security

Protecting customer data is a fundamental concern. Insurance companies must comply with regulations like GDPR to ensure data privacy. This involves using strong encryption and secure storage methods to prevent unauthorized access and breaches. Without these measures, sensitive information could be at risk.

2. Technological Compatibility

Telematics systems must operate across various devices and operating systems. Developing solutions that work seamlessly on different platforms can be complex. Additionally, analyzing large volumes of data requires advanced computational tools. Ensuring that data from multiple sources is standardized and accurate is also vital for reliable analysis.

3. Network Coverage and Connectivity

Stable network connections are essential for real-time data transmission. However, poor network coverage or unstable connections can disrupt this process, affecting the accuracy and timeliness of the data collected. To mitigate this, investing in technologies that enhance connectivity or using systems designed for low-connectivity areas can be beneficial.

4. Cost And Return on Investment (ROI)

The initial investment in telematics technology can be substantial, including costs for devices, software, and infrastructure. Demonstrating a clear return on investment can be challenging, particularly in the early stages. Insurance companies need to evaluate how telematics improves risk management and customer retention to justify these costs.

5. Data Quality And Accuracy

Ensuring accurate data is essential for assessing risk and setting prices correctly. Issues such as incorrect readings or anomalies must be addressed through effective data processing techniques. Implementing data verification and cleansing processes helps maintain data integrity.

6. Scalability

As the user base for telematics solutions grows, so does the volume of data and the need for processing power. It’s important for insurers to ensure that their systems can handle increased demands without sacrificing performance. Investing in scalable infrastructure and optimizing data workflows is key to managing this growth effectively.

Impact Of Telematics On The Insurance Sector

Telematics technology is transforming various insurance sectors by providing detailed, real-time data that enhances risk assessment and policy customization. Here are its specific impacts:

1. Home Insurance

Telematics sensors installed in homes monitor conditions such as temperature, humidity, and security. This real-time data helps insurers assess risks more accurately and create personalized insurance policies. Early detection of problems like water leaks or fire hazards allows for prompt action, reducing the likelihood of claims and associated costs.

2. Health Insurance

Wearable devices and health apps track physical activity, heart rate, and sleep patterns. Insurers use this data to design personalized health plans and offer incentives for healthy behaviors. Continuous monitoring helps in managing chronic conditions more effectively, lowering hospital visits and healthcare costs.

3. Life Insurance

Telematics provides data on lifestyle choices, including exercise and diet. This information allows insurers to assess life expectancy with greater accuracy and offer more precise life insurance policies. Real-time updates enable flexible underwriting, adjusting premiums based on ongoing health and lifestyle changes.

4. Commercial Insurance

For businesses with vehicle fleets, telematics offers insights into driver behavior and vehicle usage. This information helps reduce operational costs and improve safety. Additionally, tracking the condition and location of valuable assets, such as machinery, mitigates risks related to theft and damage.

5. Agricultural Insurance

Telematics devices monitor soil conditions, weather patterns, and crop health. This information enables insurers to better evaluate agricultural risks and provide accurate coverage. Additionally, tracking livestock health and location helps manage risks related to disease and theft.

6. Marine Insurance

Telematics tracks vessel movements and monitors environmental conditions such as water temperature and pollution levels. This data assists in preventing theft and managing risks, improving the accuracy of marine insurance claims.

7. Travel Insurance

Telematics can track the location of travelers, offering support in emergencies. It also helps insurers assess risks associated with different travel destinations, allowing for more customized coverage options.

Conclusion

Telematics technology is changing the insurance industry by offering a more accurate and fair way to assess risk and set premiums. By using real-time data on driving habits, telematics allows insurers to adjust premiums based on individual driving patterns. This approach rewards safe drivers with lower costs and promotes better driving habits. As telematics adoption grows, driven by advances in connectivity and data analysis, it is addressing many inefficiencies found in older insurance models. The continued development of telematics is set to improve customer satisfaction and operational efficiency, leading to more personalized and fair insurance options.

Build Your Telematic Insurance Solution With Idea Usher

Build your telematics insurance solution with Idea Usher. We specialize in creating precise telematics systems that offer clear insights into driving behaviors and vehicle use. Our solutions enable insurance companies to improve risk assessment, adjust premiums accurately, and reward safe driving. With our support, you can enhance customer satisfaction and operational efficiency. Idea Usher provides solutions designed to meet your unique needs and help you stay competitive in the insurance industry. Partner with us to integrate effective data-driven solutions into your insurance services.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQ

What is telematics in insurance?

Telematics in insurance involves using technology to monitor and collect data on driving behaviors and vehicle usage. This data helps insurers assess risk more accurately and set premiums based on individual driving patterns. Telematics enables personalized pricing, rewarding safe drivers with lower premiums and encouraging improved driving habits.

Does Progressive use telematics?

Yes, Progressive uses telematics through its Snapshot program. This program tracks driving behavior, such as speed, braking, and mileage, to determine discounts on insurance premiums. By analyzing this data, Progressive offers personalized rates based on individual driving habits, promoting safer driving and potentially lowering costs for responsible drivers.

How many insurance companies use telematics?

Many insurance companies have adopted telematics to enhance their offerings. While the exact number varies, it is estimated that over 30% of insurers globally use telematics in some capacity. This trend is growing as more companies recognize the benefits of precise risk assessment and personalized premium pricing.

How much does telematics cost?

The cost of implementing telematics varies based on the provider and the complexity of the system. For insurance companies, initial setup costs can range from a few thousand to several million dollars. These costs cover hardware, software, and data analytics. However, the long-term benefits often outweigh the initial investment, leading to improved risk management and customer satisfaction.