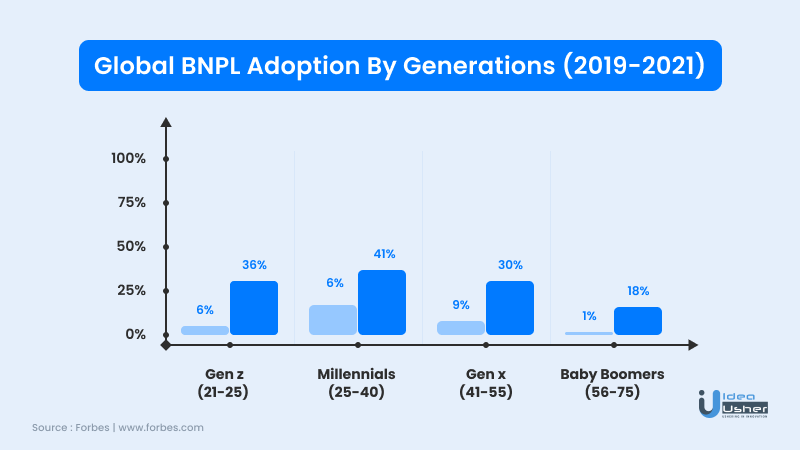

Till 2021, more than 170 startups were estimated to compete in the “Buy now pay later” app space, making the market crowded.

Today, Buy Now Pay Later apps have become the hottest trend in the online market. The BNPL techs are making headlines about the surge in their online shopping sales. According to a C+R Research report, 60% of users have used BNPL apps, with 46% making purchases through this service. With a projected growth of over 200%, the BNPL service will reach an estimated US $ 52,827 million by 2028.

One such app that saw incredible growth is Tabby. Entered the market in 2020, the app continues to offer customers and retailers an interest-free payment solution.

Tabby, the top buy now pay later (BNPL) provider in the UAE, raised $50m in a new equity round, taking the company’s value at $300m, states Techcrunch.

Hosam Arab, Tabby’s co-founder, and CEO, attested that the company grew 8x in transaction volume from August 2021 and 50x between the previous year and 2020.

This growth cannot be ignored, but the question is: how to create such apps?

Taking the heap off the shoulders, the experts at Idea Usher have helped you understand the BNPL app like Tabby and then get it developed in the most economical way. Before that, let’s dig a little deeper about the app, its services, features, and how you can create an app similar to Tabby.

Let’s get started!

Buy Now Pay Later: How it Works?

Since the name suggests, the buy now pay later service allows the customers to purchase a product but pay for it later. Similar to getting soft loans or using a credit card, BNPL enables the users to pay back in installments in a certain determined period that could be months.

This type of payment service has existed in the market but saw huge audiences during the pandemic. As more people drifted towards online shopping, this payment mode became a convenient method. The buying journey is simplified as the customer can easily checkout without paying the bill.

During check out, the customers come across the break-up total purchase option. They are entitled to the benefit of paying a small amount at the time of checkout instead of paying the full balance. The BNPL provider can perform a credit check of the user once he provides the payment method.

The customer’s credit score, bad or no credit score, still makes him eligible for buying at the app. The payment plans offered vary from company to company. However, the Pay in 4″ model, which divides the purchase into four equal installments, is a very common method.

In simple terms, it is like providing a loan in the quickest and fastest way possible. However, the service providers ensure that the loan gets paid back by inducing certain terms and conditions in the platform. If the user fails to pay back, there may be a late fee or interest that is charged.

Also Read: How does Buy Now Pay Later work?

What is Tabby?

Tabby is a Dubai-based buy now, pay later (BNPL) service provider in Saudi Arabia and UAE. The platform allows the users to shop anytime but pay later. Tabby integrates with several well-known retailers like H&M, IKEA, Shein, Ali Express, Namshi, and many more. With more than 400,000 active shoppers and 3000 daily downloads, Tabby has become the leading BNPL service provider in the UAE.

Customers can get their desired things delivered to their homes using Tabby without having to pay the total price right away. The app allows the customers to shop at online and physical stores with the benefit of paying interest-free installments. Customers can pay for their products in installments or in whole according to a predetermined timetable.

Tabby allows you to pay in four interest-free installments or pay after 14 days. Customers can benefit from the convenience and flexibility of these payment methods without incurring any additional costs. Additionally, Tabby accepts all major credit cards and debit cards.

Many businesses and individuals have started to utilize the app since it allows for safer payment methods without the inconveniences of transaction delays and fund processing.

How does the Tabby App Work?

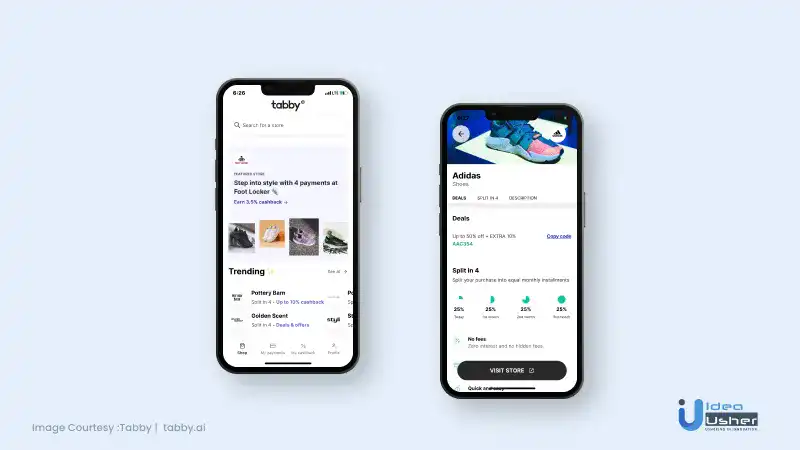

Customers can shop from their favorite brands and pay later – with no interest or fees. The app empowers the users with flexibility and freedom to shop what they want.

Shopping journey can be outlined as follows:

Shop from favorite brands

From Adidas to IKEA, Tabby showcases the products of more than a hundred brands. Customers discover new brands every now and then and make the most out of shopping.

Shop now pay later

The best part is the payment method that allows users to split the purchase into four interest-free payments.

Get the exclusive deals

The app brings several exclusive deals and discounts for customers from their favorite brands.

Manage the payments

Customers can track all their shopping in one place, from upcoming bills to changing payment methods. Also, they get alerts for the next payment.

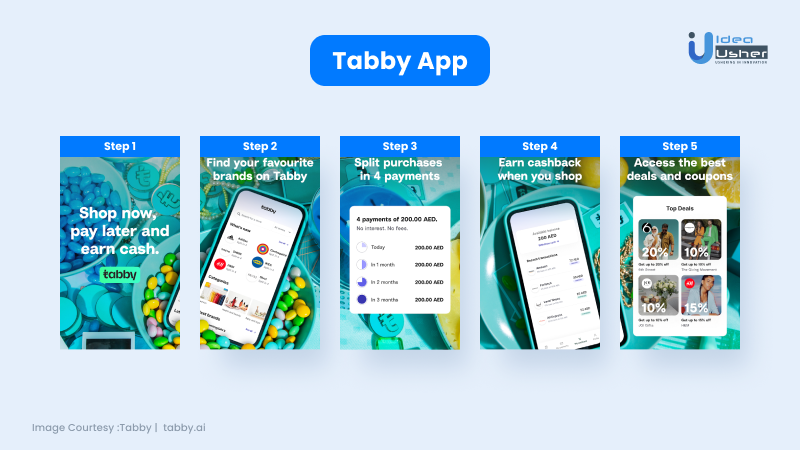

Customers may shop with Tabby after initially downloading the app. The entire procedure is outlined below:

- The customer creates an account in the app and verifies their identification by presenting their Emirates ID.

- Following the approval process, the client can purchase an item and select Tabby as the recipient during the checkout process.

- The consumer must then pick between two payment options: 14-day payment or four payments.

- After charging the merchant a commission, Tabby pays the merchant the whole amount immediately away.

- Once all of the procedures have been completed, the customer will begin paying Tabby the agreed-upon amount on a monthly basis.

Keynote: In case a customer misses making a payment, a late fee of 15 AED is levied the day after it is due. If the customers fail to pay within two weeks, they will be charged a late fee of 30 AED.

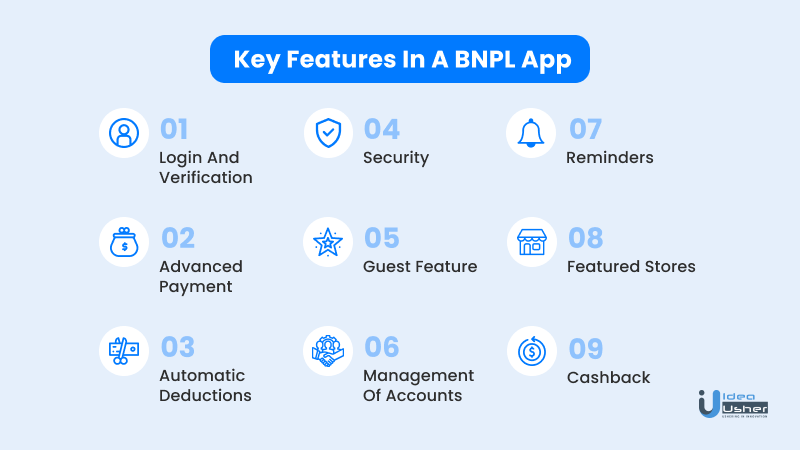

Key features of a buy now pay later app like Tabby

To develop an app like Tabby, one must be familiar with all its features ranging from basic to advanced.

Here’s the list of features that helped the app to experience record-breaking growth:

Login and verification

To begin with, the most critical but basic feature is safe and secure signup. The app must allow users to integrate with their phone numbers and get themselves registered. Keeping security in mind, ask users their national identification number. Once they provide it, only then the app must complete the verification process.

Advanced payment

The app allows the customers to pay the bill in installments even when the due date is not yet reached. The feature plays an imperative role in making the app highly user-friendly.

Automatic deductions

Another feature that helped the app unleash its maximum potential is automatic deduction. The app allows the clients to manually enable automatic deductions’ functionality, which eventually allows the app to deduce costs from the selected card automatically. The customers can also add multiple cards and switch them when needed.

Security

An increase of 30% was observed in e-commerce fraudulent activities, whereas e-commerce sales saw 16% growth. These numbers signify the importance of inducing security parameters in e-Commerce platforms, especially for secure transactions.

Embedding robust and effective security systems in the app is the key to keeping the app protected against cyber-attacks and data loss. Incorporating security solutions like data encryption, two-factor authentication, and other regulations results in the development of a secure and reliable buy now pay later app.

Guest feature

Tabby gained a huge population because of its user-friendly features. One such is the Guest feature. The feature allows the customers to use the app without an account, and they can perform the signup process later while making payments.

Management of Accounts

Customers tend to forget their purchase history and related information. The platform resolved this problem by displaying account information of the customer that includes purchase history, payment dates, and other relevant information of the customer. As a result, the app gained huge popularity for having a user-interface design.

Reminders

The next key feature in a BNPL app is reminders. Reminders are just like push notifications. The feature effectively clues the customers about their pending bill payments and due dates, allowing them to make timely payments and prevent overdrafts. The feature sets show rightly by helping the app build trust among the customers.

Featured stores

Another key feature to embed in the BNPL app is the addition of separate sections or featured stores sections. This inbuilt feature highlights all the best brands with which the app has collaborations. The feature simplifies the navigation process as they don’t have to dig around to find their preferred companies to shop from.

Cashback

Research by Mozo revealed that 30% of BNPL app users purchase multiple products from the platform with the motive to get returns like cashback or rewards. Thus, incorporating the cashback feature is another factor for a seamless user experience.

Factors affecting the Development Cost of a BNPL App Like Tabby

App Platform

To begin with, the app platform plays a critical role in deciding the cost of the development of an app. Different platforms have varying degrees of complexity. Some will need more written codes, while others may simply need a few. As a result, the type of app development platform employed has an impact on the development cost.

Depending on the business model, the building platform can be either Android, iOS, or both. However, to scale the business, having both native and hybrid apps is a thoughtful process. Thus, the cost varies on the type of business model implemented.

App Design

Next factor that determines the cost of app development is based on the design and functionalities of the app. Said that, the addition of advanced functions to provide seamless performance and a better user experience explains the cost of an app. An app should be designed in such a way that users find it simple in terms of navigation and usage, with no bugs or problems. The development cost increases higher as the investment in modern technology to create high-end designs increases.

App Development Team

The next factor that adds to the app budget is employing a highly trained, experienced team of mobile app developers to create an app like Tabby. To develop a rich-featured, designed, and functioning app, having proficient development. Thus, when developing such complicated mobile apps, inexperienced developers are more likely to make mistakes. Naturally, hiring a professional developer with extensive experience will increase the cost of producing a mobile app. If you’re looking for competent mobile app developers, Idea Usher can help you out a lot.

App feature and functionality

The app has an array of useful features. Select only the functionalities that are absolutely important, then invest money in making them more user-friendly. The more features are incorporated, the more expensive an app like Tabby becomes to develop. We recommend focusing on fewer features initially. After you’ve built up the following, then one can start adding new features and functions.

What do users like the most about the Tabby app?

Customers are highly overwhelmed with the shopping experience that the app offers, especially the payment method. As discussed above, the multiple store feature also aids in generating a large audience for the app. Customers gave great reviews about the cashback and fast response of the app.

However, the app can enhance its sales by making the platform available in other regions than UAE. Also, it can work on making the interface more user-friendly. However, learning about the app’s drawbacks and benefits helps you develop an app that is unique in itself. Idea Usher can definitely help you in developing an app that overcomes the challenges of the app.

Develop a BNPL app like Tabby with Idea Usher

BNPL has a large market, and more and more entrepreneurs are interested in getting involved. We are pleased to assist you if you are interested in entering this disruptive sector but lack the necessary resources to do so. Every day, we add more feathers to our hats. Our primary goal is to supply our clients with high-quality mobile apps.

For additional assurance, please visit Idea Usher’s website and review our portfolio. Our passionate and motivated employees work tirelessly to maintain the reputation we’ve built over the last few years. You can trust us with the task of turning your dreams into a reality. Let us know what you want from the buy now pay later app(BNPL app), and we’ll take care of the rest.

Final Words

Consumers’ interest in online buying has evolved as the e-commerce wave sweeps the globe, thanks to the rise of smartphones and digitalization. Slowly but steadily, the future of business is starting to depend on models based on mobile solutions and experiences.

Thus, we believe that BNPL apps will revolutionize the shopping experiences resulting in profitable results in the future. To be the owner of such Buy now pay later apps, you can contact Idea Usher for your buy now pay later app(BNPL app) development project.

Attesting to this, the global BNPL market is predicted to reach the milestone of $20.4 billion by 2028 and, by 2025 reach over $1 trillion in annual gross merchandise volume (GMV).

For more information and a detailed understanding of the application development process, you can contact them at.

E-mail: [email protected]

Phone Numbers : (+91)9463407140, (+91)8591407140, and (+1)7329624560

Build Better Solutions With Idea Usher

Professionals

Projects

FAQ

Here are some interesting FAQs related to BNPL apps

How does the BNPL model benefit the retailers?

Several online shops experienced an increase of 130% in AOV after implementing the buy now pay later(BNPL)system. Buy now pay later app has been very fortunate for the e-Commerce niche and help them grow year-over-year.

Here are some common benefits for retailers:

- Higher sales

- Better customer experience

- Build strong customer loyalty

- High lifetime value for the customers

How much time will it take to develop a buy now pay later app?

Depending on the business model, design, and development requirements, the development time can vary from company to company. It could take months, depending on the functionality and design features of the app. With the fast turnaround time, Idea Usher can get you your app in the fastest time possible. Connect today!

How customizable are BNPL apps?

Anything and everything can be added or removed from the app, depending on the requirement. Connect with Idea Usher and get your vision developed with the most economical solutions.