Buy now, and pay later (BNPL) apps are gaining traction as large retail chains are tying up with apps like PayPal Credit (formerly Bill Me Later), Affirm, Klarna, and Afterpay. The buy now, pay later concept is great if you understand it. Let’s understand how does buy now pay later work.

Companies like Amazon and Walmart have partnered with the BNPL app Affirm. The omnichannel pact between Walmart and Affirm was finalized in 2019. Subsequently, Walmart introduced the payment mode all across its 4000 stores nationwide. You can also use Affirm to pay for your purchases on Walmart.com.

How Does Buy Now Pay Later Work?

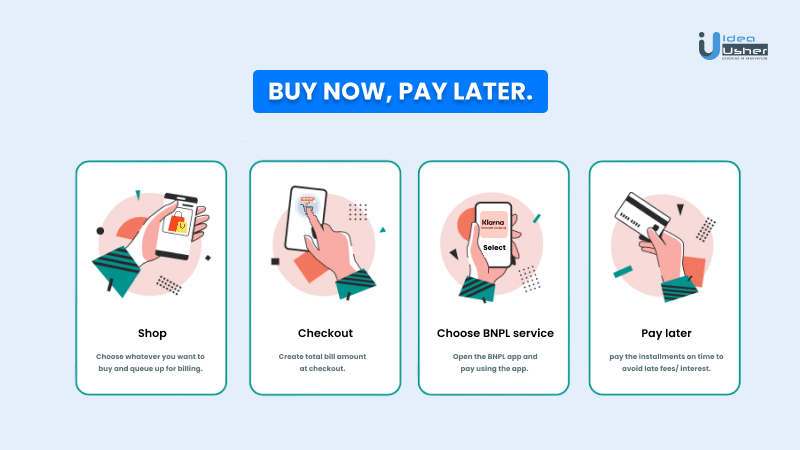

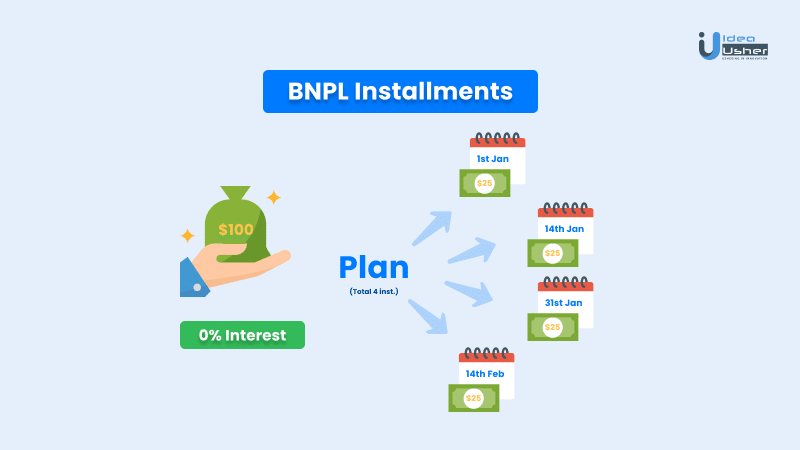

BNPL means buy now, pay later. The BNPL system is used to spread out the payments of generally small ticket items over a short tenure, generally 2 to 4 months. These installments are interest-free over the short term. But, if you do opt for a longer tenure it might carry interest.

So say, your bill was $100, you can pay in installments of $25 for the next four months completely interest-free. This system has disrupted the traditional credit card market.

There are no additional interests added to the bill but, if you fail a payment you attract a hefty late fee.

There is mass adoption of BNPL services across the world due to more and more merchants joining hands with the BNPL service apps. According to Worldpay, BNPL accounted for $97B of total e-commerce sales this year.

Users are finding that BNPL is helping them manage their finances. In the UK alone, BNPL apps accounted for £103M in credit card debt savings, which is equivalent to $139M.

BNPL apps also approve users who will lower credit scores to use their services as they use their own set of algorithms to determine the purchasing power of an individual and not just the conventional credit score.

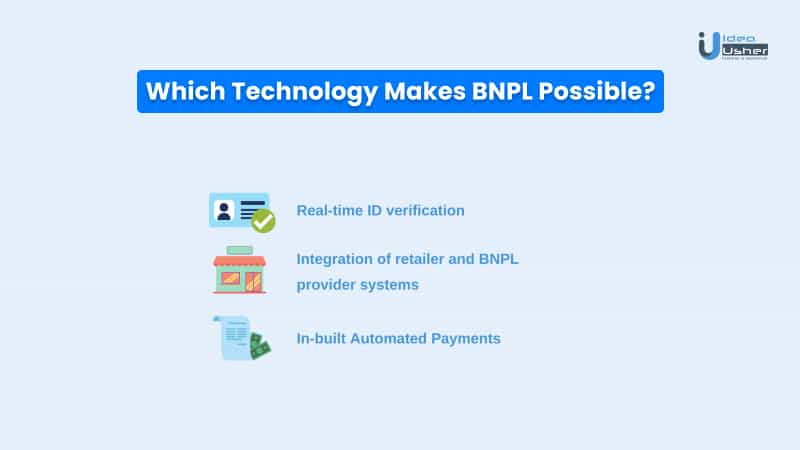

Which Technology Makes BNPL Possible?

To answer the question, we need to inspect closely the technologies involved in its success. Let’s look at some of the most common technologies that are used in BNPL apps:

1. Real-time ID verification:

Apps like Affirm, Afterpay, etc. all include ID verification as the first or second step to signing up for their service. A reliable Know Your Client or KYC process is a technology that needs to be here in a BNPL app.

In case an instant credit report is not available for an individual, a proper KYC with a linked bank account is needed. It can help the BNPL app to scan through the applicant’s bank account statement. This will provide valuable information on whether the applicant can afford an item or not. This process is called open-banking.

2. Integration of Retailer and BNPL Provider Systems:

The pace at which payments can be made using BNPL apps is crucial to its success. If the merchant/ retailer’s systems and billing process aren’t in sync with the BNPL provider, the process will take a lot more time.

So it is very important to integrate the different systems in order to give a seamless experience to all parties involved, i.e, the consumer, the seller, and the BNPL provider.

3. In-built Automated Payments:

Payment systems should be in-built in the app. Plus, they should be automated, secured, and fast. Ideally, they should also include account-to-account (A2A) processing.

How Does Buy Now Pay Later Apps Make Money?

BNPL apps make money in multiple ways.

- They tend to charge both the sellers and the consumers.

- BNPL apps charge a transaction fee to the merchants as well as take a late fine,

- or interest from consumers if the payment is not made on time.

The late fees charged to the consumers are often hefty and make up a good section of the revenue earned by BNPL companies.

These are the main sources of revenue for buy now, pay later companies. This is the bill me later business model.

The Most Popular BNPL Apps in UK, USA And How They Work

There are multiple BNPL service apps that have come into the picture over the past 3 to 4 years. Apps like PayPal Credit, Affirm, Klarna, and Afterpay all provide the same service and have tied up with different merchants too.

Let’s look at how they work:

1. PayPal Credit:

PayPal credit is a BNPL service provided by PayPal itself. You can use the service with any seller/ merchant who accepts PayPal, making it widely available worldwide.

PayPal credit has a pretty high annual percentage rate of almost 24%. However, purchases of $99 or over that are completely interest-free if they are paid in full within a 6-month tenure.

It should also be noted that PayPal credit uses deferred interest. What is PayPal Credit deferred interest? Say you make a purchase of $99, and you plan to pay it in 6 installments of $16.5 each. Now say you paid all five installments on time but defaulted on the last one, you will still be charged interest on the entire ticket value of $99.

2. Afterpay

Afterpay allows you to break down the bill into payments in 3 or 4 payments. These payments are interest-free. An up-front deposit is also taken and the future installments are paid every two weeks.

Afterpay is completely interest-free, however, if you miss a payment you will incur a hefty late fine. This may even affect your credit history. The full payment can also be charged to your

3. Affirm

Affirm has an APR of 15% although it can range upto 30% depending on your credit history and purchase power determined by Affirm. It spreads out online purchase bills into equal installments of six, twelve, or eighteen payments.

Affirm payments will also have an impact on your credit score. If you make payments on time you will see a positive impact on your credit score, whereas if you default on the payment it will decrease your credit score.

4. Klarna

Klarna breaks up the payment into 4 equal installments paid every two weeks. It does not charge it’s user any interest or fees if the payments are made on time.

It works on the same principle as Afterpay. If you default on the payment you might have to pay a late fee, or it might charge the full amount to your linked card and shut your account. Your credit history will take a huge hit in that case.

5. FuturePay

FuturePay allows you to finance your online purchases. You can add the products to your “tab” and pay the bill off at the end of the month.

You can even carry a part of the bill forward to the next month. If you do that you will be charged a flat rate of $1.50 for every $50 balance that you carry. If you default on that payment you will be charged a late fee like every other BNPL app.

Idea Usher has a team of experienced designers, front-end developers, back-end developers, mobile app developers. The team has access to all the necessary tools and resources that your project might require.

With a reasonable budget of $8k to $80k, you can develop the best BNPL application. You can contact us if you want to build a BNPL app like Affirm.

Build Better Solutions With Idea Usher

Professionals

Projects

BNPL And Its Relation With Customer’s Credit Score

Buying now to pay later might not be as formal as a traditional credit card but it surely affects your credit history. If you keep paying your installments on time you will increase your credit score by quite a lot and that too interest-free.

The different apps like Afterpay, Affirm, etc. even let you use their services with a low or absent credit score. This gives you a tremendous opportunity to increase your credit score slowly over the long term.

But, Why should you care about your credit score?

BNPL apps often have their own way of determining a person’s debt pay-back capacity. But obviously, the credit score also plays a crucial role in doing the same.

A credit score allows creditors to analyze the risk in lending individual money. It shows them how likely it is that they are going to get back the amount that they have paid.

Say you purchase a $100 product at Walmart. You at that moment are only going to pay $25 as your first installment but Affirm is going to pay the rest of $75 from its pocket to Walmart right there. So, if you default on the bill, Walmart has no stake in it.

This is how risky it gets when companies are lending people money. So they need to be very aware of whether the person they are going to lend to, i.e, the user, can handle their finances well.

If a person’s credit score drops below a certain threshold, the BNPL companies might even shut off your account. This will make it harder for the person to get all kinds of loans from banks, creditors or other BNPL providers and he/she will be marked as “too risky”.

So what’s a good credit score?

This infographic shows you that a score of 720 to 850 is considered excellent, 690 – 719 is considered good, 630-689 is considered moderate, and below that is a bad credit score.

Maintaining a good credit score has its benefits. You can get a loan easily if you have a great credit score. And if you don’t, most financiers will give you a hard time.

This is where BNPL comes into the picture since BNPL is used to purchase low ticket items, i.e, products that are cheaper. It is assumed to some extent that you will be able to pay it off on time.

So if you have a bad credit score, you can use BNPL to buy cheap items and pay them off on time or before time to improve your credit score. This essentially gives you a second chance.

While the record of on-time payments can boost your credit, you could see a blow to your score from using the (BNPL) service, says Leslie Tayne, founder and managing director at Tayne Law Group. Share on XSource: cnbc.com

Should You Use BNPL?

Yes! You should definitely try it out if you think that it can help you manage your finances better and make your life easier. But, make sure you pay the installments on time and are never late at it.

When done right, BNPL can change your life, but if done wrong it WILL ruin it. So be careful and participate. It’s an opportunity worth grabbing.

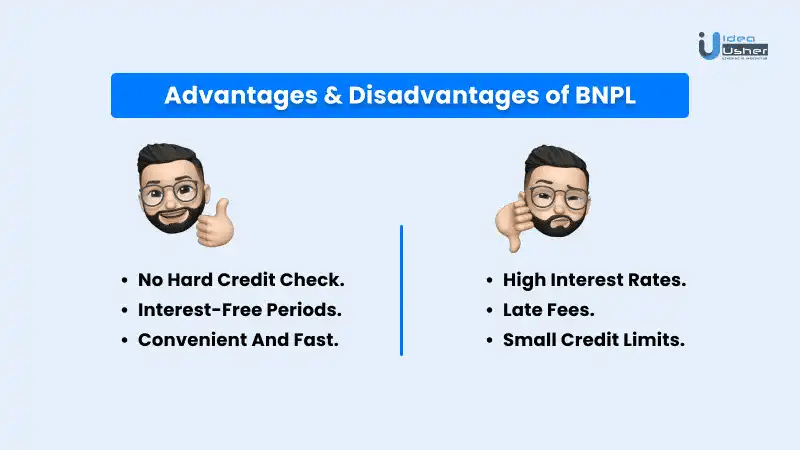

Also before you join a BNPL app there are a few advantages and disadvantages that you should look at:

Advantages

1. No Hard Credit Check

BNPL apps usually do not perform a hard credit check. So, you can join a BNPL app even if you have a low or absent credit score. Getting approved for a BNPL service app is easier than a traditional credit card.

2. Interest-Free Periods

The bill is generally split into 3 to 6 equal installments which are payable every two weeks. These payments if done on time are completely interest-free and have a positive effect on your credit score.

3. Convenient And Fast

It is very easy to pay using a BNPL app to a retailer which accepts that mode of payment, as the system is built-in within the retailer’s business model and logistics. So it is as easy as swiping your credit card and getting the payment processed.

Disadvantages

1. Late Fees

If you pay your installments on time you don’t even have to consider this disadvantage because it is only meant for missed payments. If you are late you might incur hefty late fees.

So even if you are a day late, you will have to pay the due amount along with a late fine which might be a flat rate or in a percentage form.

2. High-Interest Rates

BNPL service agreements come with interest-free plans but only if you make the payments on time. If you miss the payment or are late you might attract a deferred interest which can go upto or even over 30% depending on which app you are using.

Some of these interest rates can even be higher than credit cards like PayPal credit which has an APR of 23.99% or Affirm whose APR ranges from 15% to 30% depending on your creditworthiness.

3. Small Credit Limits

This is the only disadvantage on this list that is not dependent on whether you make the payments on time. BNPL apps are designed to buy low-ticket items and spread the bill over a short tenure.

This means that your credit limit is very small compared to credit cards which generally have a higher credit limit based on your credit score. Apps like AfterPay have a maximum purchase limit of $1500. And, you can have a maximum outstanding balance of $2000.

Although apps like Affirm are trying to enter the bigger ticket items space they are now offering a maximum limit of $17,500. But, most BNPL apps have a smaller credit limit.

Closing Thoughts

In this blog, we have explored the question “How does buy now pay later work?”. BNPL service apps are convenient to use and can be really helpful when it comes to buying relatively small-ticket items. Especially things like electronics which are at the higher end of the small ticket spectrum.

Idea Usher has a team of experienced designers, front-end developers, back-end developers, mobile app developers. The team has access to all the necessary tools and resources that your project might require.

With a reasonable budget of $8k to $80k, you can develop the best BNPL application. You can contact us if you want to build a BNPL app like Affirm.

Build Better Solutions With Idea Usher

Professionals

Projects

FAQs:

Q. Does After Pay pay automatically?

A. Yes! Afterpay takes out the installment on the due date from your linked card. Making the process easy and seamless.

Q. What is the catch of apps like Afterpay?

A. There is no catch. It is a genuinely free service. Just pay the installments on time and you are good.

Q. Does BNPL affect your credit?

A. If you are late at your payments regularly it will impact your credit. But, otherwise, if you pay your bills regularly, it has no effect on your credit, or might even have a positive effect on the score.