How do dApps make money and benefit firms? These are some central questions in today’s times? Unlike revenue models for the traditional applications, dApps offer initial coin offerings, token launch activities, transaction fees, and donations as unique money-generating ideas.

There are already some dApps having a large user base and earning a massive chunk of profits like Augur, Basic Attention Token, Cryptokitties, MakerDAO, Compound, Finance, Gods Unchained, and Kyber.

These apps follow various monetization models like Native Utility Token, NFTs, earning through Transactional Fee, Asset Management, and Advertising. Since there are multiple sources of revenue, dApps have come out to be a very viable business model for companies.

However, before explaining the monetization models of dApps, let us first delve into the overview of dApps and how they are approaching the world.

What is a dApp?

A decentralization application (dApp) is an open-source application. dApps are more transparent and accountable than existing applications. The goal of decentralized application design is to avoid even a single point of failure.

Blockchain is the critical tech behind the dApps. dApps vocalize their longevity. Unlike centralized functionalities, blockchain allows data blocks to be available and completely open to anyone.

Decentralized applications implement multiple blockchain features that include:

- No user can manipulate the data. Hence, no fraud activities can happen.

- Hashing (mapping a block with a unique address) concept makes it impossible to tamper with the blockchain data.

- Peer-to-peer network security makes it impossible to breach the network.

These features provide several benefits of using dApps. They ultimately enhance the earnings:

1. No downtime

dApps provide zero downtimes because the smart contracts will be available on every node in the blockchain.

2. Data integrity

All data and records are on a public, immutable blockchain. Any malicious attempt cannot forge the data that has already been public.

3. Privacy

Smart contracts help the users not to provide any real-world identity.

dApps market potential and growth – Facts and figures

In recent years, the Decentralized Application (dApp) market has witnessed enormous growth at a Compound Annual Growth Rate (CAGR) of 56.1%. It is believable that the dApp market size will reach USD 368.25 billion by 2027.

Multiple benefits support such estimates. These include fast transactions and flexible and reliable technology usage. dApps uses blockchain technology which reduces the chances of fraud activities.

Multiple reasons and statistics showing the growth of dApps are as follows:

1. Data decentralization

The user data is not centralized. Hence, dApps do not require KYC verification because the data gets stored at the node (user side) itself.

2. Minimal transaction failure risk

The E-commerce industry is showing annual growth of 56.5 % (As analyzed in 2019 in the US). There is a minute risk involvement of transaction failures for traditional applications. However, dApps reduce this risk which can induce market growth.

3. Market share

dApps market share in North America is around 36.8% (as per the survey conducted in 2019). This outcome tells us about the dApps growth capabilities around the globe.

| Current dApp market size | $5.52 Billion (As of 2019) |

| Expected CGAR till 2027 | 56.1% |

| Revenue estimation for coming years | $368.25 Billion |

| Region-wise scope potential | Asia Pacific, North America, and Europe. |

| Countries adapting to dApps | Brazil, South Korea, India, Turkey, etc. |

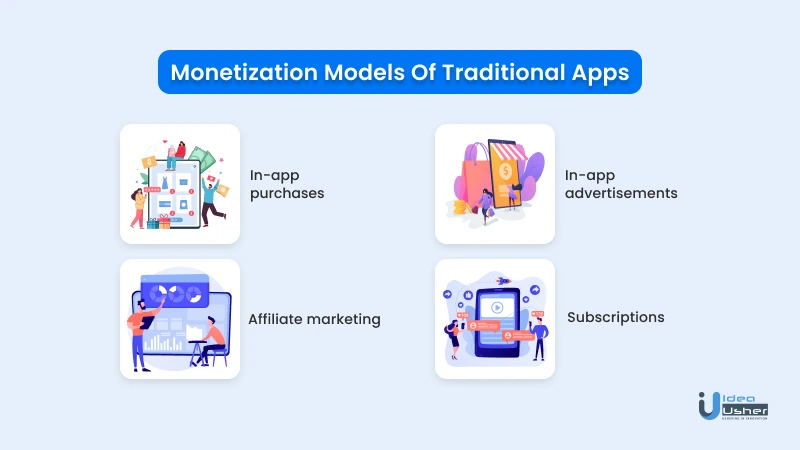

Monetization models of traditional apps

There are multiple business models for traditional apps. These models help companies to monetize their applications.

It is essential to understand the final goal of the application. Its ultimate goal might be to focus on gaining users or earning revenue.

Depending on that goal, the organization selects an application monetization strategy. Below mentioned are some of the popular tactics for monetization of traditional applications:

1. In-app advertisements

This business model is the most vivid strategy. The main aim of in-app advertising applications is to allow their users a free download. In other words, it prohibits users from paying to use the application.

Users see the advertisements. The data collected by the application helps in shortlisting which advertisement is best for a particular user. After that, the organization stores and presents the data to many advertising companies.

2. In-app purchases

This business model is almost similar to an in-app advertising strategy. However, certain features cost money to unlock and get used by the user. In simple words, there is a charge for using proprietary components of the application.

A good example that perfectly fits this strategy is “Canva’’ (a photo editing app). Canva is a free version application. It keeps a collection of features hidden from free version users. Once the user pays upfront, the features unlock themselves, providing value for money.

3. Affiliate marketing

The affiliate marketing monetization model involves the user onboarding an application platform with the help of a referral link. The referral link provider gets a reward for each user joining the application.

The reward depends on the traffic or clicks sent by a referral link to the promoter’s website. In some dApps, the prize is in the form of a digital token.

“Amazon pay” is a prime example. The referral link user gets a certain predefined reward amount.

4. Subscriptions

Under this business model, all application features are available for usage for free. This liability is for a limited pre-defined tenure.

Once that tenure finishes, the application prompts the user to buy/pay for the subscription to continue using application features.

This model helps applications earn a handful of revenue regularly. “Amazon prime” and “Netflix” are the best examples of the subscription models. These streaming platforms allow the viewers a free streaming service for 30 days on a trial basis. After that, the application prompts the users to pay for the services.

Monetization opportunities in the dApp

Just like traditional applications, dApps also focus on earning a handsome revenue. There are multiple methods that dApps entrepreneurs use to make money for their dApp.

The following part of the article explains those models.

1. Crowdsale and launching token

The term crowd sale means issuing tokens (electronics records) that the trader can store on their device. In general terms, a token is similar to a share of a transactional stock (Sell, Buy).

Crowd sale offers new cryptocurrency or new tokens as an investment for capital gains. This new cryptocurrency then launches a token for blockchain businesses to earn massive capital flow.

2. Transaction fee

Another model is charging a transaction fee for crypto trading purposes. Under this model, multiple dApp platforms charge users to avail of their services.

It is one of the most popular methods to monetize a dApp. For instance, a user purchases something from another user. Suppose 2% is the transaction fee amount to the service provider. Then, (100-2%) is the actual purchase value of the user.

3. Premium versions

Centralized applications help in implementing this idea. Many decentralized gaming platforms allow in-app purchases.

A gaming dApp grants premium version holders a chance to skip the initial gaming level with the help of digital currency. It helps users to move ahead in-game progress.

4. Subscription model

Do you know the best answer for how do dApps make money? Subscription models are the most fitting replies to that question. A basic functionality code helps in implementing this model in dApps. It offers certain application features for use only by the subscription or premium membership holders.

For example, a dApp will only allow users to download a song if they are subscription holders. But listening to online songs in the same dApp is an option available for all the users. It provides solutions to how we can make money with smart contracts.

This subscription is on the following two bases:

- Usage

- Time

5. Advertisement

Earning money through sponsored content like video advertisements and banners is an excellent option to monetize a dApp.

Multiple blockchain businesses follow this monetization approach. Pi network (cryptocurrency application), developed by Stanford University, is an example of this monetization model.

6. Donations

The craze and research involved in developing decentralized applications are increasing day by day.

Several dApps are focusing on resolving everyday issues. Some of those are working towards a better goal. dApp development authorities directly ask users for donations on their official website/ dApp, which allows them to continue their research work.

7. Creating digital goods

Selling, supplying, and transferring goods in a dApp is possible. Digital good is a term related to such online transactional activities of goods.

Media files, such as music files, video files comprising movies or television programming, branded multimedia files, and other similar items, are some of the most prevalent instances of digital goods. Creating and selling these goods digitally is the functionality of a dApp.

8. Marketing through referral

The referral marketing approach favors a plethora of blockchain-powered platforms

on the internet. It allows users to refer more than one dApp to other users. Depending on the referral consumption, the referral link generator gets a reward in digital currency.

dApplications and their money-generating models

The examples and instances of dApps generating high revenue in different sectors are as follows

1. Gaming applications – My crypto heroes and Dark Forest

Gaming dApps makes players play against each other. As a money-making firm (that invested in a dApp), the firm can earn a handful of revenue by sponsoring or promoting the content of multiple other organizations.

In addition, the game company owner provides investors with a small share of every luxury item purchased by the user in the game.

2. Decentralized exchanges– Uniswap and 1-inch

Stock exchanges provide the facility to the users for trading a market share. The investors get a predefined amount for every transaction fee involved in a single stock transaction. This idea eventually returns investors and businesses tremendous revenue.

3. Marketplaces- OpenSea, Ocean Market, and Decentralization Marketplace.

NFTs are pretty popular these days. Marketplaces like Opensea allow users to sell, buy or even create a new NFT. Similar to other platforms, transaction fees add to the overall revenue earned by the investor companies and the marketplace owner.

4. Payments dApps– Sablier and Tornado Cash

These apps facilitate money streaming in real-time and enable sending anonymous transactions on Ethereum. The transaction fee involved in every transfer depends on the location of the receiver and the subscription (dApp subscription) held by the sender.

The investor company earns revenue based on these factors and the percentage of fee share of the investor.

Summing up

To sum- up, dApps are apps or programs that run on a peer-to-peer network or blockchain. There is no central managing authority for the dApps. However, various online industries are implementing such approaches because of the vast money-generating opportunities.

dApp’s low development cost, high security, and reliability make it an irreplaceable option for future dApp developments. Having answers to questions like how do dApps make money, work, benefit, and future potential facilitate securely and profitably putting vision into reality.

Combining more than two monetization opportunities enhances the sApp’s functionality, attractiveness to users, and revenue.

For a deeper understanding, you can contact the experts of Idea Usher at the following contact information

- (+91) 946 340 7140

- (+91) 859 140 7140

- (+1) 732 962 4560

- [email protected]

FAQ’s

Why should the dApp app get considered over traditional applications?

The development under dApps has increased drastically since 2017. It covers aspects like security and transparency better than a traditional application. Hence, these are preferred.

Which are the popular dApps in cryptocurrency today?

PancakeSwap (2.98 Million users) is the most popular and most prominent dApp in today’s cryptocurrency. It is followed by Splinterlands (592.57 Thousand Users) and Alien Worlds (501.26 Thousand Users) cryptocurrencies.

Which frameworks can help develop dApp?

There are multiple frameworks available in the market for building dApps. Some of the most common and popular ones are- Truffle, Brownie, Hardhat, and Embark.

Is it hard to implement a dApp?

Unlike regular applications, decentralized applications require a cryptocurrency. Thus, after successfully deploying a dApp, it is tough to update them as they are already on a decentralized network. It makes them challenging to manage and hard to implement.

What factors determine the capital investment for developing a decentralized application?

There are multiple sectors for which a dApp gets developed. Numerous factors like the number of users, targeted industry, and the complexity of the application determine the cost of the dApp development.

Kamalpreet Kaur