Blockchain development firms have an advantage in the current financial climate, where fintech is altering the sector. The pace and scale of this shift will be significantly influenced by the degree to which users accept the new economic model.

Blockchain technology uses digital ledgers (or “blocks”) to record and verify business-related transactions and to maintain track of assets across a network of businesses. Using blockchain technology, business may record information in a very secure manner, making it very impossible to alter or breach a system. Security, transparency, and efficiency are only some of the benefits of this technology’s decentralized ownership, often known as democratizing processes.

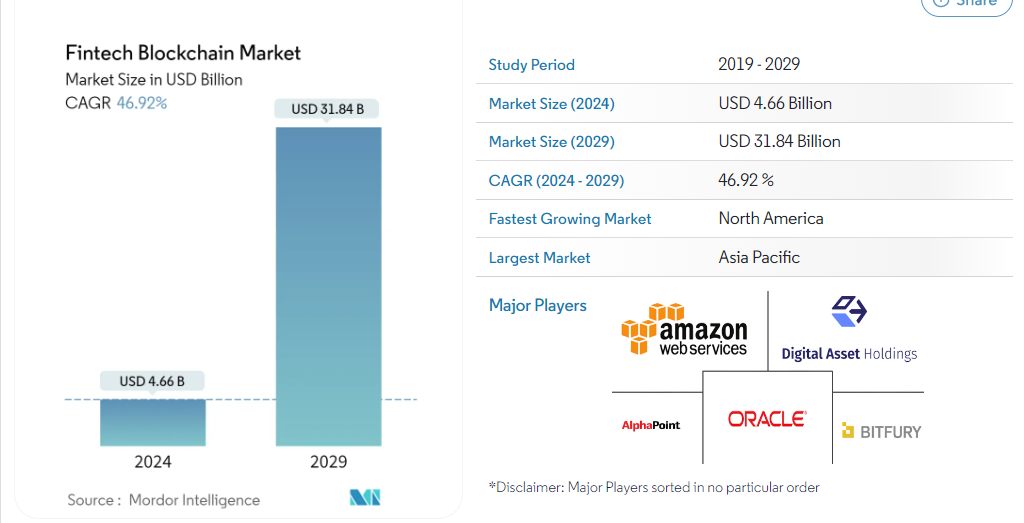

There’s an apparent reason why the financial technology sector dominates the blockchain industry. By 2028’s end, the value of the global financial technology blockchain industry is projected to rise to $36.04 billion.

What Is FinTech Blockchain?

Fintech blockchain is a term that describes the implementation of blockchain technology in the finance industry. In the financial industry, blockchain comprises hybrid and private networks that are especially designed to support hundreds of transactions per second.

2022 usher in the fintech age. While several fintech companies have been doing well since the early 2000s, the sector has seen tremendous growth in recent years. Businesses have succeeded by employing cutting-edge technologies and customer-centric approaches to addressing problems in the established financial industry.

The next phase in this progression is DeFi, or decentralized finance, which uses decentralized smart contracts. Several large financial institutions have also invested in blockchain in finance R&D.

Fintech and blockchain are brought together in DeFi. Although the two are distinct, they share many typical applications within the financial sector. Blockchain is a distributed, irreversible, and transparent digital record that may be used in the financial industry to provide a new level of safety and autonomy. Using blockchain technology, DeFi firms offer a transparent replacement for traditional banking services. Because of this, users may now use stablecoins without going via a third party.

How Blockchain Can Improve The Financial Sector?

Blockchain technology has expanded the scope of the fintech environment, which is itself a product of the ongoing technological change in the financial services industry. It has brought about changes to corporate structures and operational methods, offering immense promise to the fintech industry. As a result, businesses throughout the fintech ecosystem, from startups to established players, are beginning to investigate the potential benefits of blockchain technology.

Blockchain’s Solutions To Fintech’s Problems

Failure to meet goals, protracted fund-raising cycles and mounting losses are all symptoms of poor management, which is all too frequent in the fintech sector. Among the problems that blockchain technology can solve for the financial technology sector are the following:

1. Dependency On A Centralized System

Despite the apparent ease of fintech technologies, the control over financial transactions has remained with unelected third parties. All transactions still await approval from higher authorities before being released to users.

With the introduction of blockchain technology, this problem has been overcome for the first time in the financial sector.

2. Having No Credibility

In fintech apps, users are mostly unaware of the consequences of their actions. This leads to skepticism and doubt in the system as a whole and generates a lot of unnecessary hassle and anxiety over identity theft.

Blockchain’s inherent transparency and immutability make it an ideal solution to this type of finance problem.

3. Reduced Efficiency

The necessity for blockchain in the financial industry stems partly from the fact that the participation of several parties in a given procedure might significantly lengthen its duration. As a result, consumer confidence dwindles, and business disruptions increase.

4. More Expensive Operations

A moment’s delay may cost a lot of cash in the financial technology industry. Thus, blockchain technology has again proven to be one of the fintech innovations that may lower the cost by over 50% by removing the dependence on numerous individuals, making the process public to everybody, and reducing the time required.

How Blockchain Is Changing The Financial Technology Industry?

Examining the influence of blockchain technology in fintech on the most important parts of the economy is the best method to comprehend and assess the topic. Now let’s move on to the subsections.

1. Banks And Peer-to-peer Payment Systems

The clearing and settlement areas of banks are particularly vulnerable to the problems of wasteful bureaucracy and nebulous incompetence that plague most financial systems.

Blockchain technology has entered the financial services industry to help bridge the gaps caused by the slowness of traditional banking and the various layers of hierarchy involved in processing transactions.

According to Accenture, the most significant investment bank could save about $10 billion if the clearing and settlement sections of banking implements the blockchain technology. In addition, the Australian Securities Exchange has completed a project to migrate its post-trade clearing and settlement operations to a blockchain platform.

The actual advantages of blockchain in finance (using digital currencies) over the old ones, such as cheaper transaction costs, quicker transactions, etc., are already well-known by banks. Because of this, the world’s financial institutions are considering adopting digital currencies and looking at blockchain fintech solutions. Also, innovative payment methods like cryptocurrency are the need because of the inefficiencies of the current financial system.

Payments made over the internet (with a credit card, for example), international money transfers, and banking services for the financially excluded are three of the most important financial services accessible today.

Three Of The Most Important Financial Services:

- To begin, we overlook the fact that credit card were developed long before the internet and, as such, are better suited to in-person transactions than online ones. Thus, the three main problems with credit card payments made over the internet are high processing costs, fraud, and security. Adopting blockchain technology in banking and associated financial services is a great way to eliminate these problems.

- Second, the structure of international monetary exchange is still in its infancy, self-contained, and separated into several parts. Because your funds must pass through many separate financial systems, each with its own procedures, international payments typically take more than a day to process and can only be made during the payment agency’s business hours. Incorporating these different procedures significantly increases the time spent on data verification. As a solution, cryptocurrency must be considered.

- Lastly, decentralized ledger technology will allow those who cannot create bank accounts to still access financial services via mobile devices. According to a survey by McKinsey, over half of the world’s adult population does not have access to financial services. This amounts to around 2.5 billion people. However, a sizable percentage of these populations now have access to cell phones. And cellphones can provide individuals with immediate access to microcredit and the ability to send and receive payments.

2. Financial And Commercial Exchange

Documents are still being mailed or faxed worldwide to confirm the information in the trade financing industry. The cumbersome steps of brokerage, exchanges, clearing, and settlement are still a requirement for stock and share purchases. Since every trader needs to keep their own databases for all the transaction-based documents and constantly verify this database against each other for improved accuracy, settlement can take up to three days and sometimes even longer on the weekends.

By incorporating blockchain technology into financial services in this space, dealers may avoid the time-consuming verification of counterparties and improve efficiency across the board. Because of this, there are fewer potential adverse outcomes, faster settlement, and more actual trading.

3. Crypto Lending

Crypto lending ushers in a new era of transparent and efficient financing in the financial industry. Borrowers retain ownership of their crypto holdings while using them as collateral for a loan denominated in fiat currency or a stable coin; lenders provide the loan proceeds in exchange for interest payments on the borrowed funds. You may also use this to your advantage when going backward. When borrowing crypto assets, borrowers occasionally use stable coins or fiat cash as security.

4. Conformity With Rules And Regulations

Once again, this is a perfect example of a use case for blockchain technology in the financial industry. As the need for regulatory services might increases worldwide in the future years, fintech firms are embracing blockchain technology to improve their regulatory compliance procedures. It is the expectation that by using this technology, regulators won’t need to verify the legitimacy of the record, and they’ll be able to keep track of every validated transaction and the related people’s behaviors. Moreover, the technology allows authorities to examine the original records rather than a plethora of duplicates.

Additionally, the blockchain’s potential immutability is assisting in reducing the chance of mistakes and assuring the integrity of records for financial reporting and audits, all while cutting down on the time and expense usually associated with such processes.

5. Digital Identity

The total number of fake profiles continues to grow. Banks perform extensive Know Your Customer and Anti-Money Laundering inspections, but these measures could be more successful. They are much more secure because there is no uniform procedure for customers to follow to authenticate their identities.

A digital identification system that utilizes blockchain technology will be beneficial. Clients must go through the verification process once before using them for transactions anywhere in the world. Likewise, blockchain can aid the banking sector in this respect:

- Managing personal information

- Share data without safety risks

- Using a digital signature when signing contracts or making claims.

6. Auditing

An audit is a method of checking records and identifying discrepancies. The procedure is not only problematic in execution but also time-consuming. Blockchain technology, however, simplifies the process. If you want a quick and easy approach to updating your data, you can ask your blockchain application development business to add the record straight to the distributed ledger.

7. Innovative Crowdfunding Platforms

Crowdfunding is a method of acquiring money by many individuals contributing a modest amount each, typically via the Internet. Fundraising via the blockchain, whether through an initial coin offering (ICO) or an initial exchange offering (IEO), is more open and quicker than conventional methods. This is why ICOs have become more popular than the traditional venture capital funding strategy.

Advantages Of Blockchain In Finance

To provide digital security quickly, cheaply, and with a high degree of personalization, blockchain has made possible inclusive, open, and secure corporate networks. Fintech’s use of blockchain has progressed over the past several years, and it’s become clear that the following advantages may be realized:

1. Enhanced Security

Blockchain operates on a distributed ledger system, meaning a tamper-proof record of transactions is replicated across a network of computers. This eliminates the risk of a single point of failure and makes altering data nearly impossible. Traditional financial systems can be vulnerable to cyberattacks, but blockchain’s cryptography and decentralized nature significantly bolster security.

2. Streamlined Transactions

Blockchain facilitates peer-to-peer transactions, bypassing the need for intermediaries like banks. This reduces processing time and associated fees. Imagine sending money internationally – currently, it can take days due to intermediaries and various clearances. Blockchain can potentially expedite this process to minutes.

3. Increased Transparency

All transactions on a blockchain are visible to authorized participants, providing a clear audit trail. This fosters trust and accountability within the financial system. Regulators and auditors can easily track the movement of assets, reducing the chances of fraud or errors.

4. Smart Contracts

Blockchain allows for the creation of self-executing contracts, known as smart contracts. These automate pre-defined agreements, eliminating the need for manual intervention and reducing the risk of human error. Imagine a loan agreement – with a smart contract, upon fulfilling the loan terms, the funds are automatically released, streamlining the process.

5. Reduced Costs

By eliminating intermediaries and streamlining processes, blockchain has the potential to significantly reduce operational costs within the financial sector. Fewer manual tasks, faster transactions, and lower administrative burdens can lead to substantial financial savings.

6. Improved Efficiency

Transactions processed on a blockchain can be settled almost instantly compared to traditional systems that can take days or even weeks. This efficiency can improve cash flow management and expedite business operations.

7. Fractional Ownership

Blockchain enables the division of assets into smaller units, facilitating fractional ownership. This opens up investment opportunities to a wider range of participants, making previously inaccessible assets like real estate or artwork more approachable.

8. Greater Financial Inclusion

Blockchain can potentially bring financial services to the underbanked population. By creating secure and transparent systems, individuals without access to traditional banking channels can participate in the financial ecosystem.

9. Reduced Settlement Times

Traditional trade finance involves complex paperwork and multiple intermediaries, leading to lengthy settlement times. Blockchain can streamline this process by providing a secure and transparent platform for exchanging goods and services, significantly reducing settlement times.

10. Enhanced Traceability

Every transaction on a blockchain is permanently recorded, providing a clear audit trail for the movement of assets. This allows for better tracking of goods throughout the supply chain, ensuring authenticity and origin. This can be crucial for industries like pharmaceuticals or luxury goods.

These are just a few of the many advantages that blockchain technology presents for the financial sector. As the technology continues to evolve, we can expect even more innovative applications to emerge, transforming the way we conduct financial transactions.

Use Cases Of Blockchain

| Asian Bank | The platform offers a custodial cryptocurrency wallet along with plastic cards that helps users to add crypto funds and transact through the application or the application-issued plastic card. The blockchain technology led to over 50K crypto transactions for the bank. |

| J.P. Morgan | On April 12, 2021, J.P. Morgan said that they were using blockchain technology to enhance money transactions. In order to expedite the verification process for large payments, they are employing blockchain technology. |

| Swedish Central Bank | Sweden’s Central Bank has been testing the market with its own digital money, the e-krona, built on the distributed ledger technology of R3’s Corda platform. The Swedish Central Bank has made a significant step toward the creation of a cryptocurrency that may be used throughout the country. |

| HSBC | HSBC is using the R3 blockchain platform for enabling Digital Vault – a custody blockchain platform for storing digital assets. The technology helps with lowering the cost of their custodial service to a huge extent. |

| Goldman Sachs | Goldman Sachs is one of the leading investors behind the strong stablecoin USDC by startup Circle. A stablecoin is a digital asset pegged against the U.S. Dollar. |

Other Use Cases Of Blockchain In Financial Services Include:

- International payments

- Lending and banking (credit prediction and credit scoring, loan syndication, underwriting and disbursement, asset collateralization)

- Solution for billing and invoice management

- Capital market (issuance, sales and trading, clearing and settlement, post-trade services and infrastructure, asset servicing, custody)

- Governmental expenses

- Political donations

- Keeping of financial records (financial history, Money on Money Multiple (MoM), profits earned, dividend distribution)

- Stock market

- Initial offering to the public (IPO)

Blockchain in financial services can provide a number of advantages that could help alter the financial sector. KPMG claims that blockchain technology may boost efficiency by 40%, decrease capital consumption by up to 75%, and minimize errors by up to 95%. Blockchain in banking is a fascinating idea that has the potential to revolutionize the financial sector.

Why Is Blockchain Important In Fintech?

Blockchain is a platform that enables the incredibly secure recording of data, making it nearly difficult to change or compromise the system. It is a digital ledger of data, blocks, that records transaction and tracks asset in a corporate network. Blockchain contributed to the democratization of processes by assuring security, transparency, and efficiency. One of this technology’s most alluring features is decentralized ownership. In the financial sector, blockchain technology provides a trustworthy record of every transaction, preventing the possibility of changing previous transactions.

Future Of Blockchain In Finance Industry

When discussing the future of blockchain in fintech, it is essential to note that both the acceptance of technology and the application of blockchain in fintech are on the rise. By 2023, the blockchain-based fintech market is anticipated to be worth USD 6700.63 Mn, growing at a CAGR of 75.2% between 2018 and 2023. Along with this, there will be a lot of room for expansion in the blockchain fintech sector, as revenue from business blockchain applications is projected to hit $19.9 billion by 2025.

The blockchain’s potential for use in the financial sector will cause a revolution. Soon, this platform’s advantages will be seen in banking and non-banking financial services like asset and wealth management.

There is a need for financial institutions of all sizes to seek guidance on how to best integrate and leverage this cutting-edge technology into their business model. And how to achieve their unique benchmarks of enhanced productivity, decreased costs, and satisfied customers throughout the entire value chain.

WrapUp!

Blockchain is secure and promises transparency and blockchain in fintech is everything the financial industry needs. It promises privacy, transparency, security, efficiency, and reliability. With the highest degree of need for blockchain technology in fintech, there is an opportunity of huge growth in the near future.

So if you are willing to dive in the opportunity and create your finance application with blockchain technology, Idea Usher is your solution. With a team of skilled blockchain professionals, Idea Usher guarantees in-depth market analysis, satisfactory product and functionality based on your requirements.

FAQ

Q. To what extent is blockchain technology altering the financial technology industry?

A. Blockchain technology is revolutionizing the financial sector by lowering reliance on middlemen, shortening transaction times, cutting down on expenses, etc. These features, along with the many others, facilitates the digital transformation of the financial services industry.

Q. Which blockchain platform is most suitable for the banking sector?

A. Some blockchain technologies that can modernize the financial sector include Ethereum, Hyperledger Fabric, Quorum, Corda, and Ripple.

Q. How do you use blockchain technology in a banking app?

A. Many different approaches exist for using blockchain technology in a financial app, but they are intricate and complicated. Therefore, it is advisable to seek assistance from top blockchain and fintech app development firms. As their team mostly have a deep understanding of blockchain technology.

Q. How does blockchain technology vary from financial technology?

A. Cryptocurrency applications, like Bitcoin, are blockchain’s primary focus. It’s a copied and widely dispersed digital ledger of transactions over the internet and other computer networks. While fintech, short for “financial technology,” is an invention that allows for digital tools in the financial sector.

Q. What are the four broad types of financial technology?

A. Here are the four main subfields within financial technology:

- Making a loan

- Global monetary transactions

- Remittances

- Equity Investments

Q. To what extent does Bitcoin fit the definition of financial technology?

A. Bitcoin and other cryptocurrencies are a novel kind of fintech. It might revolutionize the whole industry, from investing and trading to payments and loans.

Rebecca Lal