Are you planning to build your own fintech app?

Fintech apps have simplified the banking experience more than ever with the help of mobile and internet technology.

“In 2020, over 64% of people worldwide used at least one fintech app, and 90% of the Gen X population used mobile banking and fintech apps.

By looking at the online trend of mobile banking, many investors and entrepreneurs have started their fintech platforms to profit from the fintech app industry.

If you also want to start your fintech platform and want to know how much it costs to build a fintech app, let’s understand in detail.

What are fintech apps?

Fintech combines the terms “finance” and “technology.”

Fintech refers to any business that provides a digital solution to online finance in different services such as online banking, investments, and analysis of users’ spending habits, etc.

Most fintech apps use advanced features and technologies such as AI, big data, blockchain, etc., to simplify financial services.

The fintech apps have been categorized into different parts based on their services, such as banking, investment, consumer finance, lending, insurance, etc.

How fintech app works?

Check the working steps of fintech apps

- Users download their preferable fintech app on their mobile devices.

- The user follows KYC and the registration process to make their account on a specific fintech platform.

- After successfully registering with particular fintech apps, users can access various fintech services such as checking bank balances, using online money transfers, investing in stocks and commodities, etc.

- The fintech platforms make profits by taking service charges or commissions from each transaction whenever users access fintech services.

Is it the right time to invest in building a fintech app?

The use of fintech apps has been growing over the last four to five years. Also, the research suggests that this growth will remain steady during the next four years.

According to Statistica, the revenue of the Fintech market was worth around 92 billion euros in 2018, which is expected to reach 188 billion euros by 2024.

Also, many other fintech market stats show that it is the right time to invest in building fintech apps such as:

- In 2022, 65% of Americans will use mobile banking

- 67% of bank executives believe fintech apps play a major role in money transfer

- 38% of financial loans in the USA has been granted by big fintech giants

- Around 4.6 million new accounts were created in 2021 in the impact of digital banking

After looking at all these trends, we can conclude that it is the right time to invest in building fintech. Now, let’s understand some important factors you must check while building your fintech app.

Important factors to look out for developing fintech apps

Make sure to take care of the following things while developing your fintech app:

1. Legality

All the fintech apps in the US market come under some regularity bodies throughout which, some of which have been discussed below:

- Contact and discuss with regularity specialists in your region to cross-check every legal requirement your business will need to get started

- Always do partnerships with license startups for your fintech apps

- Do follow all the regulations such as Gramm-Leach Bliley Act, the Fair Credit Reporting Act, US Anti-money Laundering Regulations, JOBS Act, etc.

- Hire an HR specialist that is familiar with labor laws

2. Marketing budget

Prioritizing your marketing budget is essential to scale your fintech app in the market. With your marketing budget, you can attract new customers to your platform by promoting your app on different social media platforms.

Talk over your ideal marketing budget. It should be 2 to 3 times more than your app development budget.

3. Clear-defined plans

Having clear app objectives for your financial app is essential to help you understand your target audience and ways to profit from your business.

But what makes an app idea clear?

Doing extensive research in your targeted industry can help clarify your business objective regarding financial app development.

Also, you can do the following things:

- Explore different app ideas in the financial market

- Integrate advanced technologies into your apps, such as chatbot, biometric authentication, multiple payment systems, etc.

- Study your app competitors and find areas of improvement you can benefit from by improving them.

4. Compliance policies

Complices determine the legality and regulations of your fintech platform in the market. You must check multiple compliance policies while developing your fintech platform, such as

I. AML Compliance

AML stands for Anti Money Laundering. Compliance involves monitoring their customers’ transactions to ensure none of them are involved in illegal activities such as terrorism, piracy, etc.

II. Payment Card Industry Data Security Standard

The security standards ensure that businesses can protect their customer data by complying with rules and regulations related to data security. These security standards are mainly related to payment card systems.

III. KYC Compliance

Know your customer (KYC) refers to laws and regulations that require businesses to identify their customers before creating their accounts on their platforms. KYC policies help businesses to avoid fraud-related activities to ensure they provide a safer environment to their customers.

IV. Digital signature compliance

The compliance helps businesses to get signs of their customers without needing a pen, paper, or fax machine. Digital signature complies serve as proof for businesses that their customers have agreed to their terms and conditions before registering with their platform.

Now, let’s understand the app-building steps to build your fintech app.

Steps to build fintech apps

Follow these steps to develop your fintech app:

Step 1: Choose your fintech niche

Choosing the right niche for your fintech product is one of the most critical steps you need to take. To better increase the chances of succeeding in your fintech platform, try to solve complex fintech-based challenges through your fintech platform.

Step 2: Legalize your fintech app

Multiple financial protection systems exist, such as KYC, GDPR, CCPA, and others. Ensure your fintech platform complies with all these laws to improve the trustability among your app users.

Each country has its own rules and regulations regarding fintech platforms. So do proper research in the countries of your targeted market where you will launch your fintech platform.

Step 3: Do market research in the fintech industry

The stage consists of doing research in the fintech app industry to know your audience and competitors in a better way.

Doing market research will help you understand the areas of improvement in the fintech app industry so you can improve them by implementing them in your fintech app.

Also, the discovery phase includes the following aspects that we have discussed in detail.

| Aspect | Description |

| Market Analysis | As per the report, 42% of businesses fail due to poor market analysis. To ensure your fintech business will not fail, doing extensive market research in the fintech industry is a must for your business. You should carry out market research to know whether your business idea will perform well or not |

| Competitor Analysis | Doing competitor research will help you understand what works well for the fintech business. You can study popular fintech apps to know their audience and how they promote their products and services in the market. |

| Target audience | Your target audience is the customers through which you will profit from your fintech app. Research your target audience to know their pain points and challenges, so you can let them improve your fintech app. You can better create MVP of your fintech apps where the app will contain only the required features to operate fintech apps. Later you can improve your app by adding new features based on the feedback of your targeted audience. |

| Business goals | According to CB Insights, 13% of businesses failed due to losing their focus on their goals. Therefore, a clear, well-defined plan is necessary to run your fintech business in the long run. So sticking to your business goal is another important aspect you must take care of. |

| Cost Analysis | The recent Fortunly survey states that around 29% of businesses failed due to poor cost analysis. Collaborate properly with your investors to analyze the cost of running your fintech business smoothly. Doing cost analysis will help you understand how much does it cost to build a fintech app |

In the discovery phase, make sure you have gone through the following process:

- Overall cost reduction

- Better risk management

- Idea validation

- Hire a reliable and professional team

- A clear goal in mind

Step 4: Create user-friendly UI/UX

A clean user interface of your fintech platform will help your app users easily access your platform features such as money transfer services, checking bank balances, etc.

Implement simple app UI by choosing a minimalistic fintech app design and properly putting app buttons in your app’s home screen, etc.

Step 5: Create your fintech app’s MVP

Instead of directly jumping into full-scale fintech platform development. Try to build an MVP of your fintech platform that will only contain the necessary features to operate your fintech platform, such as money transfer services, social media signup, checking bank balances, etc.

Step 6: Launch beta testing

Launch the beta version of your fintech platform and allow beta testers to test your fintech app features. Performing beta testing of your fintech app will help you better decide on features you will need in your fintech app.

Step 7: Make all the required changes

After getting feedback from your beta testing community, you can modify your fintech app by including all the necessary features and excluding all the unnecessary features from your fintech platform.

Your app development includes building the decided features for your fintech app, such as mobile banking, online money transfer, tracking spending, and so on.

You will need skilled app developers to build your fintech app features; you can best contact app development companies to develop your fintech app starting from scratch.

The cost of outsourcing your app will depend on different factors, such as the app development company’s location, their app development charges, and so on.

Step 8: Test your fintech app

Protecting your user data is essential to build trustability for your fintech platform among your app users. Moreover, you must ensure that your platform is lag-free and performs smoothly.

For that, you can perform app testing of your fintech platform to find out every possible bug and drawback and improve them on each update.

You can do app testing multiple times and should only proceed with your app ready to launch once satisfied with its quality and functionality.

Step 9: Launch and market your fintech platform

Once your app fulfills all the development criteria, you can launch your app on your preferred platform to make profits by targeting your app users.

Also, you can perform different marketing practices to scale your fintech business and attract your targeted audience on your platform.

By practicing different marketing strategies, you can target your app users from other social media sites and search engines.

Step 10: Improve your fintech app

Even after launching your fintech app on your preferred platform, you need to constantly update and improve your finance platform by adding new features to your fintech app.

Continually upgrading your fintech app will help retain your customers and make your fintech app business profitable in the long run.

You must be familiar with some features of fintech apps. For that, you can check some essential features you can add to your fintech application to help you to improve the product experience of your fintech app users.

Features of fintech applications

These are some of the most common features you can implement in your fintech apps:

1. Money transfer services

Offering a money transfer service is one of the most common features of fintech apps. Allow your app users to send and receive money anywhere around the world.

Moreover, offering this service can help you earn additionally by charging a transaction fee on each transaction from your app users.

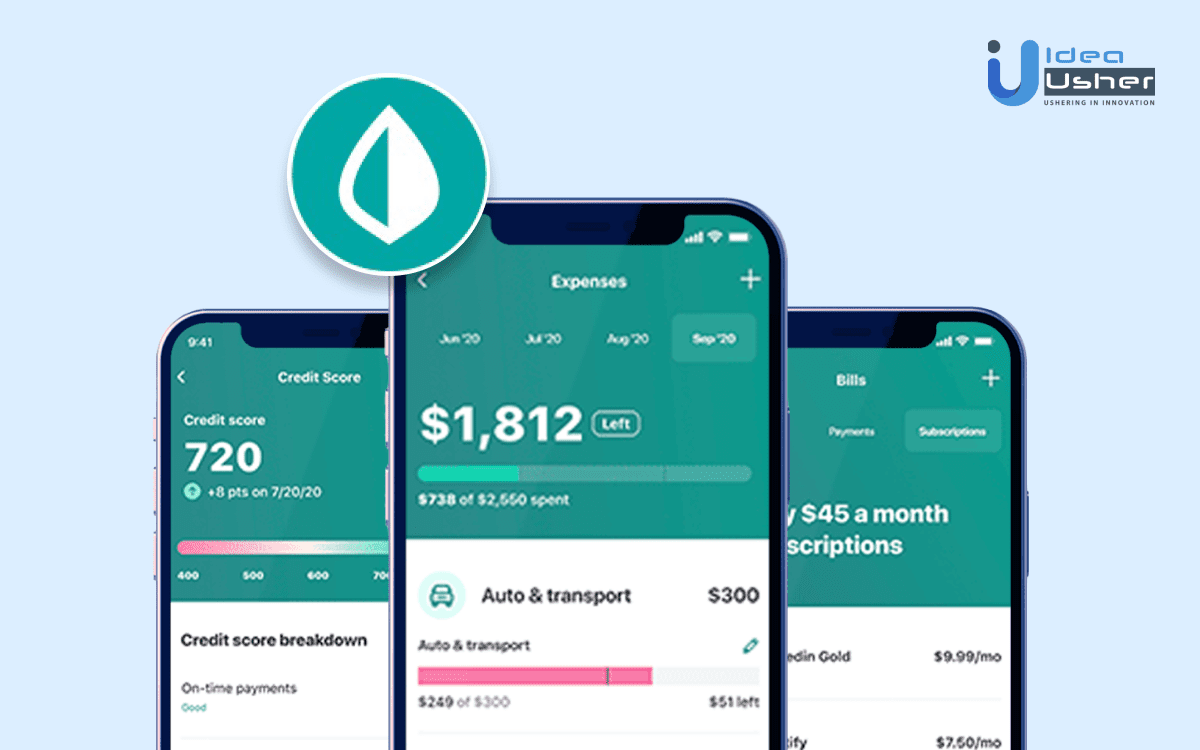

2. Expense tracking

You can integrate this feature to allow users to track their expenses, such as home loans, electricity bills, internet bills, and so on.

Users can integrate their banking account details into your fintech apps, such as debit cards and credit cards, to track spending by checking transactions made through their banking accounts.

3. Payroll services

This service will help businesses to pay their employees on time. Moreover, payroll services will help businesses to automate their payment process to pay their business partners and employees a fixed amount of money regularly.

4. Mobile banking

Mobile banking is another best feature you can offer through your fintech app. You can allow multiple mobile banking features such as checking bank balances, depositing cheques, paying online bills, etc.

5. Credit score and monitoring service

Users can calculate their credit score and keep track of spending habits with the help of credit score and monitoring services. This feature will help users improve their spending habits and encourage them to save money through your fintech app.

6. Bill reminders

The feature will allow your app users to remind them of upcoming bills, such as rent or car payments. Moreover, the user can set up recurring bills such as student loan payments and subscriptions.

7. Bookkeeping software

The feature will help businesses and app users track their finances in one place. The bookkeeping software will help users track their business expenses and performance over time with the help of generated reports from your fintech app.

8. Investment portfolio management

Allow users to track their portfolios straight from your fintech app. With investment portfolio management, the user can manage their portfolio to determine their risk tolerance over different assets such as stocks, bonds, ETFs, etc.

9. Security features

Integrating multiple security features, such as two-factor and biometric authentication, can help protect your user data from hackers and malicious attacks.

Offering security features through your fintech app can help you build trust among your targeted audience.

Each type of fintech app has its own app development cost. Let’s understand how much it costs to build a fintech app.

Fintech Trends

Fintech, the intersection of technology and finance, has witnessed remarkable growth and transformation in recent years. As of 2023, the fintech space has surged in value, reaching an impressive $179 billion. This substantial figure reflects the thriving market and the increasing significance of fintech in the global economy.

One of the most notable fintech trends is the steady expansion of its user base. Over the past few years, the adoption of fintech solutions has seen a significant rise, attracting a growing number of individuals and businesses. This surge in users can be attributed to the convenience, accessibility, and enhanced user experience offered by fintech platforms.

Furthermore, the exponential growth in fintech industry revenue demonstrates the increasing demand for innovative financial technology solutions. With revenue nearly doubling since 2017, the fintech sector has proven its potential to generate substantial returns on investment.

In line with the impressive revenue growth, fintech industry investment has also experienced a significant boost. Since 2015, investments in fintech have surged 3.5 times, indicating the increasing confidence of investors in the sector.

Monetisation Model – Fintech App Development

When it comes to monetizing fintech app development, there are several strategies that can be employed to generate revenue. Fintech apps have the advantage of offering innovative financial services and convenience, making them attractive to both users and potential monetization partners. Here are five common monetization models for fintech apps:

1. Selling Data

Fintech apps generate vast amounts of data on user behavior, spending patterns, and financial insights. Aggregating and anonymizing this data can create opportunities to sell it to financial institutions, market research firms, or other entities that can leverage the data for analytics and decision-making.

This monetization strategy capitalises on the value of data and can provide a significant revenue stream for fintech app developers.

2. Paid Access to APIs

Many fintech apps provide Application Programming Interfaces (APIs) that allow other developers and businesses to integrate their services or access their financial data. Fintech apps can monetize these APIs by charging developers or businesses for access, creating a revenue stream based on licensing and usage fees.

3. Transactional Fees

Fintech apps can charge transactional fees for facilitating financial transactions or providing services such as peer-to-peer payments, money transfers, or foreign currency exchanges. By charging a percentage or fixed fee per transaction, fintech apps can generate revenue directly from the transactions conducted through their platforms.

It’s worth noting that fintech app developers can employ a combination of these monetization models to diversify their revenue streams and adapt to the specific needs of their target audience. By considering the unique features and value propositions of their app, developers can select the most appropriate monetization strategies to ensure sustainability and growth in the competitive fintech landscape.

These are the following monetization models that help Fintech apps to make money.

4. Robo advisors

These money management platforms help users take trades on assets such as stocks, commodities, and others. Users can use these apps to manage their money in an automated way by taking the apps’ investment advice.

These kinds of apps make money by taking a fractional percentage of commission from the investment amount of each user.

Also, According to Statista, the market of Robo Advisors are apps made around US$980,541m in 2019, which shows the profitability of the Robo advisors market.

5. P2P lending

Lending money is another way fintech apps make money from their app users. In P2P lending, the individual can get loans from other individuals or financial institutions with the help of P2P lending apps.

Moreover, the platform owner can also lend money to their app user to generate a better interest in each lending provided to their app users.

6. Subscriptions

Many fintech apps charge subscription fees from their app users monthly or annually to allow them to use their fintech services.

However, a subscription-based monetization model can be an easy way to make money from your app users.

You don’t need to integrate third-party services or additional features to charge commissions on each transaction made on your fintech platform.

7. Advertising

With advertising, the Fintech apps can promote the products and services of other businesses on their platform. Also, other companies can approach fintech platforms to promote their product and services.

Fintech apps can use third-party ad networks to showcase ads to their users. There are different ways by which fintech platforms can implement ads on their platforms, such as

I. Banner ads

Banner ads are small-size ads placed on the home screen of the Fintech app, either at the top or bottom, covering only a fraction of the screen.

The fintech apps can make money whenever the user clicks on that ad. There are many different criteria that the advertiser pays to the fintech owner, such as cost per click, cost per mile, etc.

II. Rich media ads

These ads come in multiple formats, such as audio, video, text, images, or even mini-games. Rich media ads provide greater revenue than banner ads as they cover the whole screen while displaying the ad.

Selecting the right Fintech app development team is necessary to successfully build and launch your fintech platform. Let’s check the best way to help you select the right app development team for your fintech project.

Tech Stack for Fintech App Development

When developing a fintech app, choosing the right technology stack is crucial to ensure security, scalability, and performance. Here are some key components that form a typical tech stack for fintech app development:

1. Front-end Development:

– Programming Languages: JavaScript (with frameworks like React, Angular, or Vue.js) for web applications, and Swift (for iOS) or Kotlin (for Android) for mobile applications.

– UI/UX Frameworks: Bootstrap, Material UI, or Foundation for responsive and user-friendly interfaces.

– State Management: Redux or MobX for managing application state.

2. Back-end Development:

– Programming Languages: Java, Python, Ruby, or Node.js for server-side development.

– Frameworks: Spring Boot (Java), Django (Python), Ruby on Rails (Ruby), or Express.js (Node.js) for rapid development and MVC architecture.

– Databases: Relational databases like MySQL or PostgreSQL for structured data, and NoSQL databases like MongoDB or Cassandra for flexible and scalable data storage.

– APIs: RESTful APIs or GraphQL for integrating with external services and data retrieval.

3. Security:

– Encryption: SSL/TLS for secure communication and data encryption.

– Tokenization: To protect sensitive information, tokenization can be implemented to replace card or user data with unique identifiers.

– Two-Factor Authentication (2FA): Implementing additional layers of security by integrating SMS or email-based 2FA.

4. Cloud Infrastructure:

– Cloud Service Providers: Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP) for scalable infrastructure, storage, and serverless computing.

– Content Delivery Networks (CDNs): CDNs like Cloudflare or Akamai for improving app performance and global content delivery.

5. Data Analytics and AI:

– Analytics Platforms: Tools like Google Analytics, Mixpanel, or Amplitude for tracking user behavior and app performance.

– Machine Learning (ML) and Artificial Intelligence (AI): Libraries and frameworks like TensorFlow or PyTorch for implementing ML models and predictive analytics.

6. Compliance and Regulations:

– KYC/AML Verification: Integration with third-party services like Jumio or Onfido for identity verification and compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

– Regulatory Compliance: Adhering to data protection regulations such as GDPR or financial regulations specific to the region of operation.

It’s important to note that the specific tech stack may vary depending on the app’s requirements, scalability needs, and the development team’s expertise. Additionally, staying updated with the latest security patches and conducting regular security audits is essential to ensure the app’s integrity and protect user data in the fintech domain.

Key functional domains to make a fintech app

In the fintech industry, several key functional domains encompass a wide range of financial services. Here are the key functional domains commonly found in fintech:

1. Payments Transfers

This domain focuses on providing secure and convenient payment solutions, including peer-to-peer transfers, online payments, mobile wallets, and remittance services. Fintech companies in this domain often leverage technology to streamline payment processes, enhance transaction security, and offer seamless cross-border payment capabilities.

2. Stock Trading

Fintech platforms within this domain enable individuals and institutional investors to trade stocks, bonds, and other financial instruments online. They often provide user-friendly interfaces, real-time market data, investment analysis tools, and access to a variety of investment products. Fintech stock trading platforms may also incorporate features such as algorithmic trading, social trading, and automated portfolio management.

3. Digital Banking

Digital banking fintech solutions offer online and mobile-based banking services, providing users with the ability to manage their accounts, make payments, deposit checks, and access various banking functionalities remotely.

These platforms often focus on delivering a seamless user experience, personalized financial insights, and innovative features like budgeting tools and virtual cards.

4. Insurance

Fintech companies in the insurance domain leverage technology to offer improved insurance services. This may include online policy management, digital claims processing, personalized insurance recommendations, and innovative insurance products such as usage-based or on-demand coverage.

Insurtech platforms aim to enhance customer experience, simplify insurance processes, and leverage data analytics for risk assessment and pricing.

5. Financial Planning

Fintech platforms focused on financial planning provide users with tools and services to manage their personal finances, budgeting, investment planning, retirement planning, and goal tracking.

These platforms often utilize automation, artificial intelligence, and data analysis to provide personalized financial recommendations, insights, and automated investment solutions.

6. Lending and Financing

Fintech lending platforms offer alternative lending options to individuals and businesses. They often employ innovative underwriting models, data analytics, and digital processes to streamline loan applications, approvals, and disbursements.

These platforms may cater to various types of loans, such as personal loans, small business loans, peer-to-peer lending, or invoice financing.

These key functional domains represent the core areas of fintech innovation, where technology is harnessed to revolutionize traditional financial services. Each domain addresses specific financial needs and challenges, aiming to improve efficiency, accessibility, and user experience in the respective areas of payments, trading, banking, insurance, financial planning, and lending.

How much does it cost to build a fintech app?

These factors can determine the development budget of your fintech app:

1. Cost based on the app type

Multiple types of apps fall under the fintech market, each requiring a specific set of features and functionality that can affect your app development budget.

First, decide which type of app you want to develop for your fintech app business. Even better, you can explore the given options for your fintech app.

I. Digital payments

Users can perform online transactions to purchase goods and services from different platforms with the help of digital payments. Many digital platforms, such as PayPal, Apple Pay, Venmo, etc., allow users to make digital payments on different shopping platforms.

II. Digital banking app

Banking apps allow users to manage their accounts from their smartphones and computers. These kinds of apps come with all the required features for banking, such as money transfers, billing reminders, checking account balances, etc.

III. Digital lending

You can create your lending app to allow investors to lend their money to your app users. The interest rates are pretty higher than traditional loans in lending apps.

You can attract large audiences of those who are not qualified to get loans from banks or credit unions due to their low credit scores or other factors.

IV. Digital investment

The app includes brokerage facilities allowing users to trade and invest in stocks, commodities, derivatives, mutual funds, etc. You can implement advanced charting features to help users track each asset’s prices quickly and precisely.

V. Insurtech

With your insurance app, you can allow other companies to sell their insurance policy on your platform to your app users and get a profitable commission on each sale.

There are multiple niches where insurance is performing well, such as health insurance, automobile insurance, term insurance, etc.

VI. Regtech

Businesses can comply with the regulations with the help of Regtech. Many financial regulators use tech to understand the financial industry in detail and take multiple advantages, such as enabling automation, data analysis, management, and reporting.

VII. Consumer Finance

Consumer finance apps mainly intend to offer money management services such as credit card storage, managing digital payments, consumer data, analytics, etc.

There is plenty of improvement available for consumer financial apps by adding various features such as buy now pay later, advanced analytics of spending behavior, etc.

2. Type of app development team

There are multiple options you can choose to outsource your fintech app project:

I. In-house

The option includes hiring app developers in your team along with other required professionals such as project managers, UX designers, etc. Hiring professionals can help speed up your fintech project development as you can get total control over your development team.

| Pros | Cons |

| All the professionals in your team can be familiar with the fintech project. | You may pay more money and taxes to hire exclusive app developers for your fintech project. |

| Hiring in-house app developers can help secure your business infrastructure by avoiding transmitting essential details on the internet. | You may need to invest extra time in recruitment to hire the best app developers for your project. |

| All their source code will be exclusive to your project, which can give you 100% ownership of your Fintech platform. |

II. Local agency

These are the app development companies situated in your city. Hiring a regional agency can help you interact with them non-virtually, which can help you build an excellent level of trust with your app developers.

| Pros | Cons |

| Hiring local developers can enable you to interact with them more engagingly. | The cost of building the MVP of your intake project can be really expensive. |

| Interacting locally can help you better represent your app idea in front of developers. | Working with local companies requires a high budget compared to other outsourcing options. |

| High trustability, as you can easily reach them whenever you face troubles in your fintech business. |

III. Freelancers

These are independent individuals that work based on contracts. There are many freelancing websites where you can hire app developers for your fintech project.

However, there are risks associated with hiring freelancers, as they can leave your project in the middle if they cannot handle them properly.

| Pros | Cons |

| You can easily find great talented freelancers by checking their reviews and ratings from their past clients. | Freelancers might leave your project in the middle if they find a better deal from other clients. |

| Working with freelancers can be economical as they only charge based on their working hours or separate tasks. | It is hard to monitor freelancers efficiently to know whether they working dedicatedly on your fintech project or not |

IV. Outsource agency

Contacting the outsourcing agency can be your best decision as most outsourced agencies are already experienced in developing different kinds of apps.

You can consider an outsourcing agency as a remote team hired at a distant location. Their team Includes all the professionals required to build and launch your fintech business.

| Pros | Cons |

| They are economical compared to hiring in-house developers or contacting local agencies. | You may need to constantly contact their project managers to make any changes to your fintech project. |

| Outsourced agencies have more excellent app development experience for fintech projects, as they already run many projects in parallel for their clients. |

3. Location of app developers

Development costs are relatively high in Western countries, which can eventually reduce when you consider outsourcing your project to Asian countries like India.

You can best check the app development budget by outsourcing your project to countries such as the US, Ukraine, India, etc., to get an estimate on how much it costs to build a fintech app.

4. Choosing a platform to launch your fintech app.

Multiple platforms are available to launch your fintech apps, such as mobile devices, websites, desktops, etc.

However, many business owners target mobile devices and websites due to having a large audience space compared to other platforms.

Selecting a platform for your fintech business will determine the fintech app development cost as each platform needs a specific amount of budget to build fintech apps that includes their development tools, app hosting charges, and so on.

5. List of fintech app features

Your app development budget will also depend on the list of features you will add to your fintech app. The more you add features, the higher your app development cost.

So, in the beginning, it is advisable to go with only the list of essential features such as online money transfer, checking account balance, and others required to run the fintech platform.

Now let’s understand the challenges you may face while building your fintech app.

Challenges in building fintech apps

Just like building apps in other industries, the development process of fintech apps also involves some common challenges that we have discussed below.

Challenge 1. Cybersecurity

Securing your user data is one of the most important part you should consider while building your fintech app. One data breach where the leak of your users’ banking details can easily disturb your fintech business’s reputation.

These are the most common reasons that cause cyber security issues throughout the fintech apps.

- Not testing the fintech apps.

- Scalability issues and fintech business.

- Poor use of data encryption.

- Not following the proper coding practices in terms of security

Challenge 2. Use of big data and AI integration

Undoubtedly, big data and AI integration can give advanced features to your fintech apps. However, integrating these technologies is complex and needs experienced app developers to simplify adding the latest technologies to your fintech apps.

With big data and AI, you can effectively manage your user data and offer personalized services such as chatbots, offering different banking offers such as loans, EMIs, and FDs (offering services based on users’ browsing history).

Challenge 3. User retention issues

Retaining your customers on your platform is equally as challenging as acquiring new customers in the era of the high-paced competitive market of the fintech app industry.

However, offering the best product experience with your fintech app can help you maintain user retention on your platform to make your business profitable in the long run.

You can improve the product experience of your fintech by testing your app and working on different aspects of your app, such as app features, user interface, app stability, constantly adding new features, and so on.

Challenge 4. Selecting the right platform to launch your fintech app

Choosing the right platform also determines the cost of building your fintech app. It becomes challenging for fintech app owners to select the best platform to scale their fintech business among their targeted audience.

There are multiple options, such as Android, iOS, website, etc., where you can launch your fintech app. However, it is recommended to choose only a single of the few platforms at the start to minimize your app development budget for your fintech platform.

However, contacting the best IT companies can help you simplify your decision to choose the best platform to build and launch your Fintech platform.

Challenge 5. Providing simplified UX for your fintech app

Even after offering many fintech features, there is a high risk of losing your customers if you cannot provide a simplified user experience on your Fintech platform.

When designing your fintech platform, it is essential to focus on your customer demands and banking requirements and provide a well-engaging user interface to help them quickly access all the features available on your Fintech platform.

First, you can create a prototype of your fintech app where you can test the usability of your app’s UI and make the required changes to improve the usability of your fintech app.

Now let’s check the latest tech trends you can benefit from by including them in your Fintech platform.

Latest tech trend in the fintech app market

To enhance the experience of your fintech platform, you can integrate the latest tools and technologies that we have discussed below:

1. Blockchain

Enabling blockchain in your fintech platform can help you attract users interested in cryptocurrencies-related domains.

Integrating blockchain technology can provide multiple benefits to your business, such as enhanced security and a high level of ownership, and attracting a different user base that is crypto enthusiasts.

You can get many benefits from implementing blockchain technology in your fintech business.

2. Artificial Intelligence

You can enhance the product experience of your fintech platform by bringing automation with the help of artificial intelligence, such as chatbots, predictive models, data analysis, etc.

With AI technology, you can prevent fraud detection by performing compliance checks to Identify any scammers on your fintech platform.

3. Big Data

With Big data, you can benefit your fintech business by analyzing customer trends and improving their experience by integrating new features relevant to fintech services.

Big Data uses advanced technologies and algorithms to identify consumer behavior and suggest more relevant Fintech services. For example, anyone interested in cryptocurrency will get a recommendation for crypto wallets, crypto trading, crypto staking, etc.

4. Cybersecurity

Protecting your user data should be your topmost priority to maintain the trustability of your Fintech platform. You can enable multiple cybersecurity features, such as two-factor and biometric authentication.

Adding numerous cyber security features will help you avoid cyber attacks from hackers and scammers. So you can add encryption-based features to protect your user’s data and their privacy on your fintech platform.

5. Microservices

Microservices has enabled app developers to build fintech app features independently, which can later be assembled to make a fully functional fintech app.

Tips for selecting the right fintech app development team

Follow the given tips to ensure you have chosen the right app development team for building your fintech app:

1. Do study the portfolio of the fintech app of your partner IT company, such as the user interface and features of their launched fintech platforms

2. Ensure their app development team is skilled in integrating advanced features into your platforms, such as AI, Big data, artificial intelligence, blockchain technology, etc.

3. Make sure the team you have selected has the list of the following skilled professionals:

- Project manager

- Business analyst

- CTO

- Backend developer

- Frontend developer

- Mobile developer

- UI/UX designer

- Markup developer

- Quality assurance tester

4. Check whether the team is experienced in working with the below popular technologies required to build your fintech app.

| Purpose | Tools |

| Server | AWS or Vultr |

| Backend | Laravel or Node.js |

| Frontend | Vue.js or Node.js |

| Mobile | Swift, Java or React Native |

| 3rd party integrations | Yodlee, Trulioo, Firebase, Paypal, or Stripe, and others based on your requirements. |

Contact Idea Usher to build your fintech app

Providing a secure environment for fintech app users is one of the top priorities you must take care of while developing your fintech app.

Moreover, fintech apps need advanced features and technology integrations such as authentication, blockchain, AI, Big Data, etc.

You can best contact the best app development companies, such as Idea Usher. Their team is already experienced in building fintech apps with advanced features and functionalities.

Their team will guide you to build your fintech platform starting from scratch, such as selecting the right tech stack, creating fintech app design and features, and properly launching them to your target market.

Also, you can check the latest fintech app they recently made: Jaba Pay – Idea Usher

Contact Idea Usher

Email:

Phone:

FAQ

Q. What is the cost of developing a financial app?

A. The cost of building a financial app depends on different factors, such as

- Building a specific type of financial app

- Choosing the type of app development team,

- Locality of the app development team

- Platform where you are going to launch your Fintech app.

- Tools that you will use to build your Fintech app.

- List of features that you are going to add in your fintech platform.

Q. How do you make a fintech app?

A. You can make your fintech app by following the development steps:

- Start with market research in the fintech industry

- Select the app design for your fintech platform.

- Decide what features you want to include in your fintech app

- Start the backend development process to build the decided features for your friend

- Test your fintech app to identify any drawbacks and glitches

- Launch your fintech platform in the market

- Improve your fintech app by constantly adding new features on each update.

Q. How does the fintech app work?

A. Fintech apps offer different features relevant to banking and investments, such as money transfer services, checking bank balances, allowing users to invest in stocks, etc.