Among countless ways in which smartphones have made our life easier, one of the biggest eases and comforts it brought are transforming our old leather wallets into digital ones with the concept of mobile banking , bringing numerous advantages and functionality such as seamless transactions and various instant services, which used to be a pain to even think about before.

Thinking of creating a banking app but have confusions on how to create a mobile banking app and what is the cost of developing a banking app? Then, this blog is just for you !

Well, the cost of developing a banking app depends on its features:

| Features | Time required | Cost/Hour |

| Simple, Safe, and Fast Payments | 96 hours | $1440 – $5760 |

| Managing accounts | 42 hours | $630 – $2520 |

| Tracking and Budgeting | 42 hours | $630 – $2520 |

| Banking securely | 72 hours | $1080 – $4320 |

| Simple, seamless, and innovative design | 42 hours | $630 – $2520 |

| Peer-to-Peer Payments | 96 hours | $1440 – $5760 |

| Alerts and Push Notifications | 48 hours | $720 – $2880 |

| Cardless Transactions | 96 hours | $1440 – $5760 |

| Multilingual banking apps | 84 hours | $1260 – $5040 |

| Chatbot and Customer support | 96 hours | $1440 – $5760 |

| Scheduled bills and payments | 42 hours | $630 – $2520 |

| Cashback Features | 32 hours | $480 – $1920 |

| Quick Glances | 48 hours | $720 – $2880 |

| Biometrics | 64 hours | $960 – $3840 |

| Instantaneous Account Opening | 96 hours | $1440 – $5760 |

| Applications for Loans | 96 hours | $1440 – $5760 |

| Fraud Alerts | 32 hours | $480 – $1920 |

| Investment | 85 hours | $1325 – $5100 |

| Online shopping | 48 hours | $720 – $2880 |

| Voice assistance | 64 hours | $960 – $3840 |

The cost of developing a banking app depends majorly on it’s features so its important to understand each feature in depth to understand why it is important;

1.Simple, Safe, and Fast Payments

Transferring and receiving funds are one of the essential features, and banking apps need to be absolutely flawless in their payment services for people to trust digitally made payments ranging from the lowest to the highest of amounts

2. Managing accounts

Banking apps should have a very flexible system so that people can easily monitor activities in their accounts and manage their performance, such as checking balances, reviewing previous transactions that occurred, view statements, etc.

3.Tracking and Budgeting

Innovative apps provide customers with insights helping them track their spending and saving habits and suggest ways by which they can estimate their timely budgets and take advantage of various schemes and plans proposed by the banking app.

4.Banking securely

Security and authorization form the top feature that must be up to date to maintain the highest form of customer satisfaction. Safe and secure sign-in, locking/unlocking cards, updating passcodes, multiple ways of authorization before payments, etcetera are some of the vital security features.

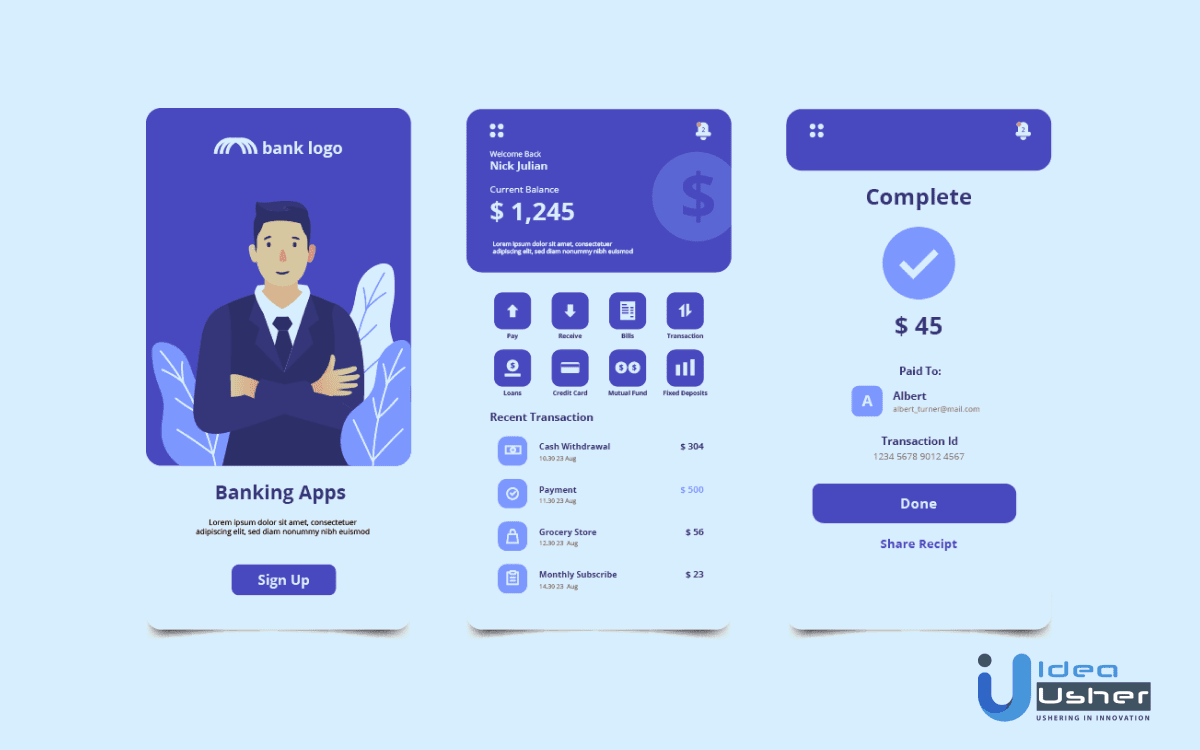

5.Simple, seamless, and innovative design

User experience is all that matters when using apps, and making apps that are easy on the eyes and our thumbs is crucial. Ease of access and comfortable yet outstanding and unique design language forms the base of this essential feature.

6.Peer-to-Peer Payments

This feature allows users to pay peers directly from their credit cards or bank accounts to one another personally, thus saving a lot of time and opening many possibilities for banks to expand their business.

7.Cardless Transactions

With increasing trends of apps such as Paytm, Google Pay, etcetera. Banking apps must provide cardless transfer of funds instantly with the help of push codes, scanning QR codes, etc.

8.Alerts and Push Notifications

Push notifications, unlike text messages, are sent by banking apps without requiring the person to be active in the banking app. These can be very effective for a wholesome round-the-clock customer experience. Sending regular alerts regarding all major and minor activities in the user’s account helps them keep track and take instant action regarding all activities.

9.Multilingual banking apps

To target a large section of the audience and various market segments, it’s essential for banking apps to be multilingual because it makes people more comfortable with a familiar language.

10.Chatbot and Customer support

A 24/7 customer support feature providing users with a personalized and professional consultation increases their retention, and AI chatbots are a huge helping hand. Intelligent chatbots can answer hundreds of questions very fast.

11.Scheduled bills and payments

Scheduling payments to individuals and businesses is one feature that makes things easy for both parties involved. These payments can be set with thresholds and can be assigned according to frequency, for example, weekly, monthly, yearly, etc.

12.Cashback Features

Cashback features are among the most growing trends giving rise to commercial sales by billions of dollars. Cashback plans and various similar schemes are significant to be included in the application.

13.Quick Glances

Many Banking apps have started to incorporate this feature where people can glance into certain basic information without logging In without crossing thresholds.

14.Biometrics

Biometrics such as fingerprint readers, facial recognition, etcetera makes use of banking apps faster and much easier to remember one more passcode, among several others.

15.Instantaneous Account Opening

Nowadays, banking apps are revolutionizing the game by allowing customers to open their bank accounts in the app itself, making things hassle-free and more accessible for the customer.

16.Applications for Loans

Applying for loans such as home equity loans, etc., has also been made available on the banking apps, making it easier for verification, speeding up the process by miles.

17.Fraud Alerts

Scams and frauds seem to be inevitable but for sure are controllable. Although online banking has given rise to new forms of fraud, they are also effective in protecting and taking action as soon as possible.

18.Investment

With the growing trend of investments, mobile banking apps also provide various investment opportunities such as term deposits, mutual funds, Demat accounts, etc.

19.Online shopping

Various banking apps also assist with online shopping in comparing prices, providing eccentric deals, cashback, discounts, etcetera as well.

2O.Voice assistance

With the help of powerful Artificial Intelligence, mobile banking apps now allow customers to talk and interact with digit assistants rather than calling and talking to customer care executives. This makes things quicker and provides immediate assistance to customers seeking help.

Factors affecting the banking app development cost

1. Wireframing

The wireframing stage is crucial in mobile app design. Wireframes provide the architectural design or map of the app’s layout, which is usually created with tools like Figma or PhotoShop. The cost of wireframing typically ranges from $8,000 to $10,000 and involves multiple testing procedures to finalize the design.

2. App Platform

The underlying platform of the mobile banking app impacts its overall cost. While choosing between an iOS or Android platform usually has a negligible effect on the app’s budget, it is generally preferred to start with Android considering its extensive user base.

3. UI/UX Design

The user interface (UI) and user experience (UX) design of a mobile banking app play a vital role in its success. A minimalistic design that ensures smoother navigation while retaining the audience’s attention is highly appreciated. The cost of UI/UX design varies depending on the complexity of the design.

4. Location of the Agency

The location of the mobile banking application development company you choose can affect the development costs. The average hourly rate of app developers in the US is higher than that of app developers in Asian or African countries.

5. Team Size

Hiring a dedicated app development team is the next phase of the project that can ultimately affect the overall development costs. The team size can vary depending on the complexity of the project, but a standard team usually includes a project manager, backend developers, iOS/Android developers, designers, and quality analysts.

Hiring freelancers may help decrease the app budget, but a full-fledged banking app development service company can ensure quality services and greater return in the long run.

6. App Maintenance

App maintenance is an essential factor affecting the app development budget. It is crucial to not only deploy the app but also keep it up and running constantly. App maintenance becomes even more important for the mobile banking industry, considering the criticality of user data and activities involved.

7. Technology Integration

Incorporating new technologies like AI or Blockchain to future-proof your banking application can considerably affect the overall app budget.

In summary, mobile banking app development involves several factors that can impact the development cost. Understanding these factors can help you determine your overall app budget and ensure the success of your app.

How to build a mobile banking app ? (DEVELOPMENT PROCESS)

Wondering how to build a mobile banking app ? Don’t worry,I’ll help you out.

Knowing just the cost of developing a banking app is not enough . If you’re investing your money, it is important to know how the process is going to take place and how your money is going to be utilised.

Let us now understand the mobile banking app development process . This process involves a few simple steps :

1. Decide the features you want to include

For any other app, I would have suggested you do some market research, but I would like you to think like a customer for a banking app. What services would you have expected from a banking app for your ease?

This simple step can make your app user-friendly and make it stand out from the rest.

This simple step can make your app user-friendly and make it stand out from the rest.

As of now, you also know the cost of all the features, so here there’s the time when you will communicate your PRD ( Product Requirement Document ) with your app developer.

2. Select the UI/UX of the app

Decide how you want your app to look and communicate it with the developers and ask them to send you a copy of the design before finalizing it for the app. If you have confusion about how you want your app to look, ask the developers or UI/UX designers to help you. There’sThere’s no harm in asking for help from the experts!

3. Select the platform for the app

You can choose a platform like a google play store or Ios app store to launch your app. But since this is a banking app, I would highly suggest you go for hybrid apps available on both platforms so that all your customers ( Android and Iphone users) have access to the app.

4. Develop and test

Once everything is decided, it’s time to get into action and develop the app. The development of the app goes through three stages :

- Alpha phase: All the bugs in the apps will be identified here, and the developers will try to fix them. ( Some bugs are fixed, some remains)

- Beta phase: A few more bugs are identified here, and the developers try to debug them. It’sIt’s essential to make your app bug-free before the launch to don’t require many updates and corrections after the launch.

- Test launch: Once the app is developed, it is launched only for a few users who can use and review it. According to the reviews received from the users, you can make the changes in your app before the final launch.

5. Launch

Once everything is done, it’s finally time to launch the app on the selected platforms. It is necessary to read all the terms and conditions of the platforms before launch.

But hey! You launched an app, but how are people going to know about it?

You need to bring all your existing customers online and some new customers too. Thus, it is essential to do some post-launch activities like marketing and advertising.

Contact Idea Usher to know more about it, and it can be your one-stop destination for guidance, app development, and marketing.

Top 5 banks with mobile banking solutions

You can also go through these banking apps that rank and get hands-on experience on how the app works.

#Ally

| Pros | Cons |

|

|

#Bank of America

| Pros | Cons |

|

|

#Chase

| Pros | Cons |

|

|

#Discover

| Pros | Cons |

|

|

#Capital one

| Pros | Cons |

|

|

Why choose Idea Usher for your banking app?

Idea Usher is your one-stop solution for pre-launch development and post-launch activities for your upcoming revolutionary application.

We not only explain the cost of developing a banking app, but we can also develop a banking app at a feasible budget for you.With our unbeatable prices, which makes our competitors sweat and customers never regret, complete your project before all the deadlines. Our team of dependable developers would make you reach for the stars with their genuine creativity and professional capabilities.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

Q. How much does mobile banking development cost?

A. A mobile banking app development can cost you more than 250,000 USD as it is a complex application with a lot of features , however contact Idea Usher to get the app developed for 4000-40,000 USD.

Q. What is the online banking software price ?

A. Online banking software price would be around 10,000 USD on an average

Q. How to start a banking app?

A. The best way to begin would be to hire experienced app developers. They will help you from start to finish in the app development process. It’s good to outsource, and save time. Only then, you can utilise your saved time on other activities that require your attention. (eg marketing, funding activities).

Q. Which is the best banking app ?

A. Some of the best banking apps are Discover ,Chase and Ally.

Q. How much time does it take to develop a banking app ?

A. It can take upto 160 days to develop a banking app, however you can contact Idea Usher and get the app made faster.