- What Is Cardano?

- What is ADA?

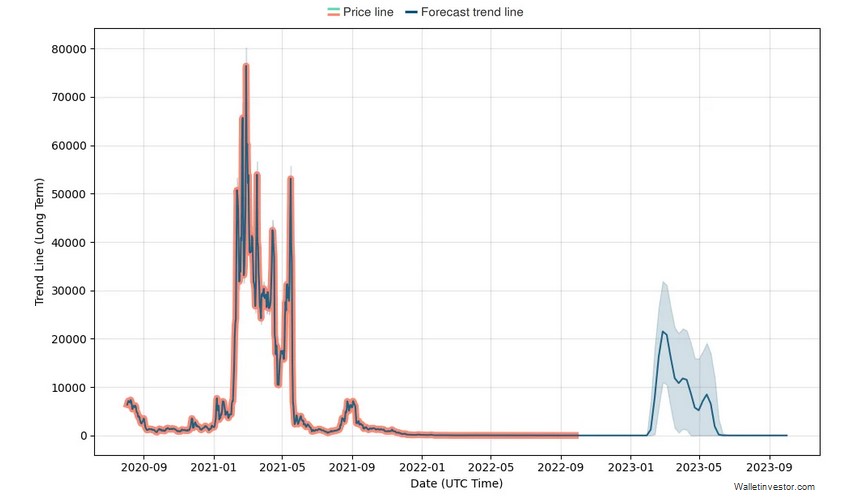

- Cardano Crypto Price Prediction

- Why Is The Cardano Crypto Price Rising?

- Is It Good To Invest In Cardano: Should You Buy Or Sell The Coin?

- Cardano Staking: Maximizing Returns On Your Investment

- Cardano’s Potential Impact On The Future Of Finance

- WrapUp!

- How Idea Usher Can Help?

- FAQ

Cardano might not be able to match Bitcoin’s stratospheric prices, which are presently hovering around $35,000 and may alter in the upcoming months or years. However, but this price still reflects an astounding growth rate. In fact, at one point, this development assisted ADA in regaining third-place standing among cryptocurrencies, giving Cardano a boost.

So now, it’s important to comprehend what Cardano is before we start stating the facts about it. Established in 2015 by Charles Hoskinson, a co-founder of Ethereum, Cardano is a public blockchain platform. With the help of its proprietary cryptocurrency, ADA, it is able to facilitate peer-to-peer transactions.

Cardano is one of the newest platforms in the cryptocurrency industry, having defeated rivals like Litecoin and Ripple XRP.

But what will the value of Cardano be in 2024 and beyond? Is Cardano a good investment?

Let’s read a quick introduction to Cardano and ADA before getting into the details of the ADA Cardano price prediction.

- What Is Cardano?

- What is ADA?

- Cardano Crypto Price Prediction

- Why Is The Cardano Crypto Price Rising?

- Is It Good To Invest In Cardano: Should You Buy Or Sell The Coin?

- Cardano Staking: Maximizing Returns On Your Investment

- Cardano’s Potential Impact On The Future Of Finance

- WrapUp!

- How Idea Usher Can Help?

- FAQ

What Is Cardano?

With the goal to become an environmentally-friendly and scalable blockchain network by reducing the need for energy-intensive bitcoin miners, Cardano was established in 2015 and later released in 2017 by Charles Hoskinson. It is a public blockchain platform, and here the consensus is reached using proof of stake, and it is open-source and decentralized.

With evidence-based approaches, Cardano is developed, including a novel blend of formal methods—typically used in critical, high-stake applications—and an agile system, which allows flexibility and responsiveness to new demands and developments. Recently, Cardano moved to the Goguen mainnet, a blockchain platform with token lock network characteristics.

What Is The Purpose Of Cardano?

It integrates cutting-edge technology to give decentralized apps, networks, and communities “unparalleled security and sustainability,” according to Cardano’s website.

Similar to Ripple and XRP, Ethereum and Ether, Cardano operates the native cryptocurrency ADA. It is divided into two components – Cardano Settlement Layer (CSL) and (CCL) Cardano Computational Layer.

1. Cardano Settlement Layer (CSL)

Also known as Byron Age, Cardano Settlement Layer (CSL) enables the immutable recording of transactions and allows users to send other blockchain participants the native Cardano (ADA) token.

2. Cardano Computational Layer (CCL)

CCL or Cardano Computational Layer combines a number of components that were published throughout the Shelley and Goguen eras to facilitate tokenization, smart contracts, and decentralized apps (dApps).

Cardano brings a new standard in technology – open and inclusive – to challenge the old and activate a new age of sustainable, globally-distributed innovation.

cardano.org

What is ADA?

The cryptocurrency that utilizes the Cardano blockchain is called ADA. ADA tokens are used by users to pay platform transaction costs and for premium network services. The first third-generation cryptocurrency, ADA, claims to address scaling and infrastructure issues that originally surfaced in first-generation cryptocurrencies like bitcoin and ethereum, a second-generation cryptocurrency.

We must now consider the possibility of investment and the Ada Cardano price prediction for 2022 and beyond since we have a brief understanding of what Cardano and ADA are.

Cardano Crypto Price Prediction

The value of Cardano is anticipated to increase by 2.93% and reach $ 0.408919 by November 21, 2023, according to the most recent price prediction. As of November 2023, the price of ADA is around $0.37.

a. Cardano Price Predictions Based On Tech Growth

| Method | Signal | 2024 | 2025 |

| Internet Growth | Buy | $ 0.852482 | $ 1.100554 |

| Mobile Growth | Buy | $ 0.838147 | $ 1.072912 |

| Facebook Growth | Strong Buy | $ 2.52 | $ 5.58 |

| Google Growth | Strong Buy | $ 1.246026 | $ 1.944797 |

b. As Of in November 2023

- The Cardano price prediction is estimated to be around $0.37, and ADA currently holds the 8th position in the overall cryptocurrency ecosystem. The circulating supply of Cardano is valued at $12,968,029,178.47, accompanied by a market capitalization of 35,274,731,048 ADA.

- The 14-Day, 50-Day, and 100-Day relative strength index (RSI) is recorded as 76.94%, 62.85%, and 52.96%, respectively.

- The 20-Day, 50-Day, 100-Day, and 200-Day simple moving average (SMA) is recorded as 0.325106, 0.280035, 0.283724, and 0.320948, respectively.

c. Cardano Price Prediction 2024 And Beyond

Source – Digitalcoinprice.com

As we gaze into the future of Cardano (ADA), 2024 holds intriguing possibilities. Drawing insights from historical data, it is envisioned that ADA’s price may fluctuate between a minimum of approximately $0.261 and a maximum of around $0.452. The average trading price is forecasted to hover at $0.642, painting a dynamic picture for ADA enthusiasts.

Moving ahead to 2025, the landscape appears even more promising. Technical analyses from crypto experts suggest that ADA could witness a price spectrum spanning from about $0.91 to $1.09, with anticipated average trading costs settling around $0.93. The year unfolds as a potential turning point for ADA, presenting investors with a spectrum of opportunities. As per an alternative forecast for Cardano’s price, it is anticipated that the value of Cardano will experience a surge of 208.64%, reaching $1.42 by the conclusion of 2025.

As we project into 2026, the cryptocurrency landscape remains dynamic. Analysts anticipate ADA to showcase a trading range from a projected minimum of $1.37 to a potential maximum of $1.58. Averaging at approximately $1.41, ADA’s trajectory hints at both stability and growth on the horizon.

Fast-forwarding to 2027, the crypto community anticipates ADA’s price to navigate between $1.94 and $2.42, with an average trading value poised at $2.01. The continued analysis by experts underscores the evolving nature of Cardano, revealing potential scenarios that investors need to consider.

In 2028, the crypto space will witness ADA’s potential average price settling at around $2.98. While it might experience fluctuations, ranging from a minimum of $2.88 to a potential maximum of $3.39, the overall trend indicates a resilient trajectory for Cardano.

As we peek into 2029, the forecasts project ADA trading between $4.13 and $5.02, with an estimated average cost of approximately $4.25. The year showcases a potential rise in ADA’s value, offering a glimpse into the evolving dynamics of the cryptocurrency market.

The horizon of 2030 unfolds with cryptocurrency analysts envisioning ADA’s maximum price reaching $6.93, while the potential minimum might dip to around $5.90. The expected average trading price in 2030 is projected to be $6.11, highlighting the maturation and potential ascendancy of Cardano in the cryptocurrency realm.

| Year | Minimum Price | Maximum Price | Average Trading Price |

| 2024 | $0.261 | $0.452 | $0.642 |

| 2025 | $0.91 | $1.09 | $0.93 |

| 2026 | $1.37 | $1.58 | $1.41 |

| 2027 | $1.94 | $2.42 | $2.01 |

| 2028 | $2.88 | $3.39 | $2.98 |

| 2029 | $4.13 | $5.02 | $4.25 |

| 2030 | $5.90 | $6.93 | $6.11 |

It’s crucial to note that these projections are speculative and subject to the dynamic nature of the cryptocurrency market. As with any investment, thorough research, consideration of risk tolerance, and staying updated with the latest market trends are key components for informed decision-making.

d. Cardano’s Price Evolution Over Time

Source – Coinemarketgap.com

Cardano (ADA) emerged onto the crypto scene in 2017, propelled by the vision of its co-founder, Charles Hoskinson, a key figure in Ethereum’s early days. Priced at a modest $0.02461 initially, Cardano swiftly gained traction within the crypto community, leveraging a robust technical foundation and the credibility associated with its founder.

In the rollercoaster journey of ADA’s valuation, the 2018 bull run saw its price skyrocket to an all-time high (ATH) of $0.997. However, the post-bull run period saw a prolonged dip, with ADA trading below $0.10 for much of 2019.

A pivotal resurgence occurred in 2021, mirroring the broader crypto market uptrend. ADA reached a new ATH of $3.10 in September 2021. Yet, the subsequent decline was stark, witnessing a 91% drop from its peak. Notably, this descent surpassed Ethereum’s 66% fall from its ATH.

The 2021 Alonzo hard fork, criticized for falling short of expectations, contributed to ADA’s decline. However, the September 2022 Vasil upgrade aimed to counterbalance this setback, enhancing Cardano’s scalability and reducing network transaction fees.

Adding complexity to ADA’s narrative, recent legal actions by the SEC against major exchanges, including Binance and Coinbase, implicated Cardano as a security. This development triggered a substantial 31% drop in ADA’s price since the lawsuit’s initiation on June 5.

Here are the fundamental highlights in the pricing journey of Cardano:

- Cardano was introduced in 2017 with an initial value of $0.024612.

- Following its introduction, Cardano’s value surged to $0.997 before experiencing a downturn in 2019.

- ADA achieved a new all-time high (ATH) of $3.10 in 2021.

- The present value hovers around $0.373, marking a significant decrease from its ATH.

- Following the SEC’s classification of Cardano as a security, it has experienced a 31% decline.

Why Is The Cardano Crypto Price Rising?

Wondering why Cardano’s (ADA) value is on the upswing? Let’s break it down in straightforward terms.

1. Market Sentiment

ADA’s valuation is influenced by market optimism. The collective sentiment in the crypto space significantly impacts Cardano’s price. Investor confidence and positive outlooks on the future of cryptocurrencies can act as driving forces, propelling ADA to higher valuations.

2. Technical Sophistication

As a third-generation blockchain platform, Cardano has evolved into a robust ecosystem over time. Its technical maturity, coupled with the ambitious endeavors of its development team, has positioned ADA among the top cryptocurrencies globally. This technical prowess contributes to ADA’s appeal and, consequently, its increasing market value.

3. Regulatory Dynamics

The regulatory dynamics influence Cardano’s pricing narrative. Developments such as legal victories, as witnessed when Ripple won a lawsuit against the SEC, have demonstrated the potential for regulatory events to sway ADA’s market valuation.

4. Network Enhancements

Cardano’s price is closely linked to upgrades in its network. Notably, the September 2022 Vasil upgrade showcased the platform’s commitment to scalability and reduced transaction fees, factors that directly impact ADA’s perceived value.

5. Market Trends and Corrections

Broader market trends exert a gravitational pull on Cardano’s price. During periods of market undervaluation, ADA may experience an uptick in value as the overall crypto market corrects itself.

Beyond these known factors, several catalysts hint at future rises in Cardano’s price:

a. Blockchain Advancements

Ongoing improvements in Cardano’s blockchain performance enhance its appeal to developers and users, potentially increasing demand for ADA.

b. Analyst Predictions

Analysts speculate on ADA’s future, with projections reaching $1234. While such forecasts are speculative, they can contribute to market sentiment and influence price movements.

c. Native Asset Surge

The increasing supply of native assets on the Cardano network emerges as a fundamental driver for ADA’s price escalation. A burgeoning array of assets minted on the Cardano network may heighten the demand for ADA.

d. Continuous Network Upgrades

The Vasil network upgrade, focused on scaling capabilities, underscores Cardano’s commitment to staying at the forefront of blockchain technology. These upgrades enhance the platform’s attractiveness to users and developers alike.

In the world of crypto, things change fast. While ADA’s price goes on a ride, it’s smart to take your time, do some research, and think about your money before jumping in

Is It Good To Invest In Cardano: Should You Buy Or Sell The Coin?

For those pondering the question, “Should I invest in Cardano?” The answer hinges on individual risk tolerance and investment horizon. Cardano, positioned as a third-generation blockchain, offers smart contract support, staking opportunities, and scalability. The team envisions it as a self-evolving universal financial protocol with potential benefits for the unbanked.

While the journey to Cardano’s ambitious goals might take decades, the platform has already made strides, notably in Ethiopia, where it addresses digital identity and educational certification challenges. With a recent price change from its peak at $3.10 in 2021 to around $0.387, some might view this as a compelling opportunity, signaling a significant discount from all-time highs.

a. Key Considerations

Key considerations for potential investors revolve around Cardano’s unique attributes. It distinguishes itself by anchoring on peer-reviewed academic research, and translating papers into code after thorough analysis. However, Cardano faces competition from established players like Ethereum and emerging platforms like Solana.

b. Critical Factors

Critical factors impacting Cardano’s future include market sentiment, real-world adoption, ecosystem growth, and regulatory developments. The upcoming Voltaire upgrade aims to enhance decentralization, mitigating regulatory concerns. Predictions for ADA’s future value vary, with analysts suggesting potential breakouts, especially if macroeconomic conditions and interest rates favor riskier assets.

c. Short-Term vs. Long-Term Investment

Investors weighing short-term versus long-term commitments should factor in ADA’s price volatility and inherent risks. While short-term gains may be subject to market whims, long-term prospects align with Cardano’s evolving utility, encompassing digital currency.

ADA, Cardano’s native coin, facilitates transactions and enables staking, offering a way to earn additional ADA coins by validating transactions and securing the network.

- NFTs on Cardano: Despite flying under the radar compared to Ethereum, Cardano boasts a robust NFT ecosystem with over $600 million in all-time trading volume.

- Web3 Games: Cardano’s foray into Web3 gaming introduces play-to-earn models, where in-game assets are NFTs that players can earn and trade.

- Document Certification with Atala PRISM: Atala PRISM, Cardano’s self-sovereign identity platform, addresses document certification and verification, providing a tamper-proof system for academic credentials and other documents.

- Supply Chain and Anti-Counterfeiting Measures: Initiatives like Atala SCAN aim to enhance supply chain transparency, fighting counterfeit goods, especially in healthcare, by authenticating and verifying the origin of products on the blockchain.

The decision to invest in Cardano rests on a careful evaluation of its unique features, ongoing developments, and alignment with individual investment goals. While risks persist, ADA’s current price levels and promising utility make it an intriguing option for investors eyeing the long game. As always, conduct thorough research and consider individual circumstances before diving into the world of Cardano investment.

Cardano Staking: Maximizing Returns On Your Investment

Embarking on Cardano (ADA) staking opens doors to a passive income stream through active participation in the network’s proof-of-stake consensus mechanism. To maximize returns, strategic considerations come into play.

Firstly, the cardinal rule is to stake a substantial amount of ADA, as your stake weight directly influences your chances of being selected to validate a block and reap the rewards. Carefully selecting the right staking pool is equally pivotal in this journey. While larger pools distribute rewards more frequently, their individual rewards are smaller. On the flip side, smaller pools offer larger rewards at less frequent intervals, allowing stakeholders to tailor their strategy based on their preferences and risk tolerance.

Navigating the details of Cardano staking also involves steering clear of saturated pools, as those exceeding 94M ADA can result in penalties for stakeholders. Moreover, prudent consideration of pool fees is essential, as small pools with high fixed fees may penalize stakeholders more than their larger counterparts with similar fees. Diversification emerges as a key tactic – spreading your stake across multiple pools mitigates risk, safeguarding against potential pitfalls in individual pools and events. Regularly monitoring your stake within the cyclical framework of Cardano staking ensures a proactive approach to optimizing returns, with rewards disbursed every “epoch” or every five days.

It’s imperative for stakeholders to grasp that while Cardano staking can yield annual returns of up to 11.23%, the actual passive income is subject to variations based on crypto exchange dynamics and lockup periods. As with any financial decision, conducting thorough research and considering individual financial circumstances is paramount before engaging in ADA staking.

Cardano’s Potential Impact On The Future Of Finance

Cardano (ADA) is a third-generation blockchain platform that stands out in the competitive and crowded world of cryptocurrencies. It’s designed to be more secure, scalable, and sustainable. Here are some ways Cardano could impact the future of finance:

1. Enabling Financial Inclusion and Streamlined Efficiency

At its core, Cardano aims to promote financial inclusion by providing a secure and efficient financial ecosystem. It seeks to enhance economic productivity by ensuring cross-chain interoperability, regulatory compliance, and the foundations for sustainable development.

2. Embracing Sustainability

One notable aspect of Cardano is its energy efficiency, consuming only 6 GW hours annually, a stark contrast to Bitcoin’s energy-intensive 100 TW hours-plus per year. This commitment to sustainability positions Cardano as a responsible choice in the changing landscape of finance, aligning with global efforts for eco-friendly blockchain solutions.

3. Transforming Decentralized Finance (DeFi)

The introduction of Hydra, a revolutionary enhancement for speed and scalability, propels Cardano into the decentralized finance arena. Prepared to challenge the dominance of Ethereum and Solana, Cardano presents itself as a strong contender, disrupting norms and paving the way for a new era in DeFi.

4. Continuous Growth and Adoption

Despite facing challenges like regulatory oversight, Cardano’s strategic focus on education, innovative infrastructure (including stablecoins), user-friendly programming languages, and wallets, alongside the evolution of multi-chain solutions, underscores its ambitious roadmap. This commitment to ongoing development positions Cardano as a dynamic force, driving advancements that could reshape the financial landscape.

However, it’s essential to recognize that the extent of Cardano’s future impact depends on its evolution and widespread adoption within the broader financial community. As investors navigate Cardano, conducting thorough research tailored to individual financial situations becomes crucial. Cardano’s journey unfolds as a promising narrative, intertwining innovation, sustainability, and the potential to redefine the very foundations of finance.

WrapUp!

There is a lot of guesswork involved in predicting Cardano or other cryptocurrency prices, as well as the pricing movement of the larger cryptocurrency market. Doing your own research is always advised if you’re thinking about investing in Cardano. Before making any trading decisions, consider the most recent Cardano cryptocurrency news, market trends, technical and fundamental analysis, and expert opinion. Never invest money you cannot afford to lose because past performance does not guarantee future results.

How Idea Usher Can Help?

If you’re looking to delve into the world of cryptocurrency, Idea Usher, a leading app development company, is your go-to partner. Specializing in cutting-edge technologies such as cryptocurrency, AI-ML, Blockchain, and more, Idea Usher boasts a team of in-house professionals ready to cater to your specific needs. When it comes to custom applications for Cardano trading, Idea Usher stands out as the optimal choice. Our commitment to meeting deadlines and ensuring a seamless development process ensures that your project is in capable hands. Don’t miss out on the opportunity to elevate your cryptocurrency endeavors – get in touch with us now!

Contact Idea Usher at [email protected]

FAQ

Q. Is Cardano a good investment?

A. If you want to know if a coin or token is a good fit for your investment portfolio in the volatile, high-risk cryptocurrency markets, you need to conduct your own study on it. Never put money into an investment that you cannot afford to lose.

Q. How many Cardano coins are there?

A. As of 2023, the upper limit for the supply of Cardano (ADA) stands at 45 billion coins. The current circulating supply, based on the latest accessible data, is 35,268,531,003 ADA coins. It’s important to note that the circulating supply is subject to change. For the most up-to-date information, kindly refer to a trustworthy financial news source or cryptocurrency exchange.

Q. How do you predict cryptocurrency prices?

A. By taking into account on-chain and off-chain measures as well as technical indicators that account for Cardano’s historical price performance, you can forecast cryptocurrency prices. To determine if investors are bullish or bearish about Cardano, you may also assess market sentiment.

Q. Is Cardano correlated to other assets?

A. The coins that have the most positive correlations with Cardano are Enjin Coin (ENJ), TRON (TRX), Basic Attention Token (BAT), Stacks (STX), and Flow (FLOW), all of which frequently trend in the same direction at the same time. The price of Cardano often fluctuates in the opposite way from that of Ethereum Name Service (ENS), IOTA (MIOTA), Fei USD (FEI), Terra Classic (LUNC), and Quant (QNT), whereas it is most negatively associated with these coins.

Rebecca Lal