Digital identity is changing dramatically across Europe. The launch of the EUDI Wallet under the eIDAS 2.0 regulation is more than just a requirement; it is changing how we view cross-border authentication, data privacy, and user control. For innovative businesses, creating a strong EUDI Wallet app has become necessary to remain competitive in this new digital environment.

Beyond meeting compliance needs, a well-crafted EUDI Wallet can improve customer relationships, provide new service options, and establish your organization as a leader in digital identity.

We’ve seen firsthand how critical digital identity solutions, like the EUDI Wallet, are for success in today’s marketplace. IdeaUsher has helped several clients build secure platforms that not only manage verified credentials but also enhance user trust. This blog serves as our means of imparting knowledge on how you can start building your own EUDI Wallet app, tailored to the evolving needs of the digital world.

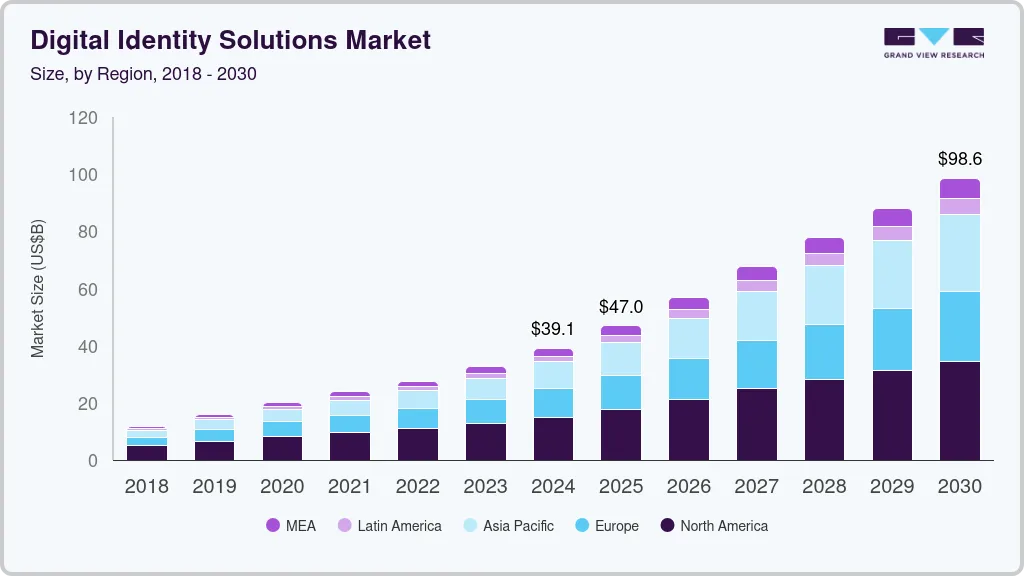

Key Market Takeaways for EUDI Wallet Apps

According to GrandViewResearch, the global market for digital identity solutions is growing rapidly, expected to increase from USD 39.07 billion in 2024 to USD 98.64 billion by 2030, driven by a 16% CAGR. This growth is largely fueled by regulatory changes in the European Union and the rise of EUDI (European Digital Identity) Wallet Apps, which are becoming essential for secure authentication and cross-border digital services.

Source: GrandViewResearch

With the EU mandating that all member states offer a standardized digital identity wallet by 2026, adoption is accelerating. By the end of 2025, over 83 million EUDI wallets are expected to be in use, with the number projected to double to 169 million by 2026. The wallets are designed to offer secure access to services like government portals, financial onboarding, digital licenses, and prescription management, all while ensuring privacy and cross-border interoperability.

Large-scale pilot programs, such as the NOBID consortium, are playing a key role in validating the use of EUDI Wallets for payments, digital signatures, and identification. The consortium, which includes six countries and over 30 public and private partners, is helping to demonstrate the wallet’s potential in real-world applications and accelerate its widespread adoption.

What is an EUDI Wallet App?

An EUDI Wallet App is a digital wallet designed to securely store and manage identity information and official documents, referred to as Verifiable Credentials. It serves as a digital version of your physical identity documents but with added legal weight. Under the eIDAS 2.0 regulation, these credentials will hold the same legal value across all European Union member states as physical documents like passports or driver’s licenses.

How Does an EUDI Wallet App Work?

The EUDI Wallet operates based on a decentralized architecture and involves three key roles, with interoperability as the backbone for cross-border functionality.

Issuers: Entities that provide the digital credentials. They could be:

- Governments (e.g., issuing national IDs, driver’s licenses).

- Universities (e.g., issuing diplomas).

- Banks (e.g., issuing proof of financial standing).

Holder: This is the individual who owns the EUDI Wallet. The holder downloads the app and either requests or receives Verifiable Credentials from Issuers. They store these credentials securely on their device and control when and how the data is shared.

Relying Parties: These are businesses or organizations that require identity verification from the holder. Examples include:

- Banks: For Know Your Customer (KYC) processes.

- Online Platforms: For age verification.

- Car Rental Services: For verifying a driver’s license.

- Employers: For checking professional qualifications.

Typical Interaction Flow

| Step | Description |

| 1. User Requests Service | The holder (user) wants to access a service from a relying party (e.g., opening a bank account). |

| 2. Relying Party Requests Data | The bank (relying party) requests specific credentials from the user (e.g., proof of being over 18, proof of residency in Germany). |

| 3. User Reviews and Consents | The user reviews the request in their EUDI Wallet app, consents to share only the requested data (no more), and the wallet securely shares the necessary credentials. |

| 4. Bank Verifies Credentials | The bank verifies the credentials by checking the digital signature against trusted public keys from the issuer (e.g., the German government). |

| 5. Fast, Legal, and Secure Process | The entire process is completed quickly, legally, and with minimal exposure of personal data, ensuring a secure and compliant interaction. |

Interoperability: The system works across borders due to common technical standards. For example, a wallet from Italy can be used seamlessly for verification in Sweden.

Types of Credentials Supported

The EUDI Wallet is a versatile digital container that can store a wide range of official credentials. Initially focusing on basic identity documents, the wallet will expand to include various types of data for everyday use.

- National eIDs: The primary identity verification credential.

- Driver’s Licenses: For car rentals, police checks, and age verification.

- Educational Diplomas & Certificates: To simplify job applications or university admissions.

- Professional Qualifications: For certifying the right to practice certain professions across the EU.

- Health Records: Such as vaccination certificates, prescriptions, or access to medical histories (with strict user consent).

- Financial Identity: Proof of account ownership or other financial attributes, often issued by banks.

This makes the EUDI Wallet more than just an identity card; it becomes a comprehensive, secure, and legal tool for everyday life, allowing users to manage all essential documents digitally and safely.

Key Benefits of EUDI Wallet Apps for Businesses

The EUDI Wallet app offers businesses a secure, efficient way to verify customer identities with cryptographic trust, reducing fraud and compliance costs. It simplifies customer onboarding, turning complex processes into seamless, fast transactions.

Technical Advantages:

The EUDI Wallet’s innovative technical architecture provides the foundation for transformative business advantages. With robust cryptography and interoperability at its core, the wallet creates a secure, cross-border solution that businesses can rely on to enhance trust, security, and operational efficiency.

1. Strong Cryptographic Foundations

At the heart of the EUDI Wallet is Public Key Infrastructure (PKI), which ensures that an authoritative issuer cryptographically signs every Verifiable Credential. This creates an unforgeable chain of trust, ensuring your business can rely on verified sources instead of trusting documents themselves.

2. Selective Disclosure with ZKPs

Zero-Knowledge Proofs (ZKPs) allow users to prove claims (e.g., age, residency) without revealing sensitive underlying data. This privacy-by-design feature minimizes your data storage and compliance costs, making it easier to meet regulations like GDPR while enhancing customer trust.

3. Cross-Border Interoperability

The EUDI Wallet is built on a standardized architecture, ensuring cross-border compatibility. With this system, your business can verify identities from across the EU without needing to navigate complex national systems, dramatically easing cross-border operations.

Business Advantages

The EUDI Wallet’s technical features directly translate into powerful business benefits that can help you save time, reduce costs, and innovate your offerings.

1. Lightning-Fast KYC & Onboarding

With the EUDI Wallet, customer onboarding becomes lightning-fast. Users simply approve requests from their wallet, with cryptographic verification occurring instantly. This significantly boosts conversion rates and enhances user experience by reducing waiting times and friction.

2. Fraud Prevention

The EUDI Wallet’s cryptographic security makes fraud and identity theft much harder to execute. Automating verification reduces manual processes, cutting down operational costs and improving profit margins by reducing fraud-related financial losses.

3. Unlocking New Revenue Streams

The EUDI Wallet supports a wide range of credentials, unlocking new business models. By integrating verified attributes, your business can offer personalized promotions, develop premium services, and even build super-apps, opening the door to innovative revenue opportunities and enhancing customer engagement.

How to Develop an EUDI Wallet App?

We specialize in developing secure, compliant, and user-friendly digital identity solutions. Our EUDI Wallet app is built to meet the European Digital Identity framework requirements, ensuring privacy, security, and seamless cross-border interoperability. Here’s how we develop the EUDI Wallet app for our clients:

1. Align eIDAS 2.0 & EUDI ARF

We start by understanding the legal obligations under eIDAS 2.0 and mapping your app features to the European Digital Identity Architecture and Reference Framework (ARF). This ensures full compliance with current regulations and prepares the app for future updates, guaranteeing long-term legal alignment.

2. Secure Identity Infrastructure

Our team uses Secure Elements or Trusted Execution Environments to build a secure identity infrastructure. We establish robust cryptographic key management systems and ensure tamper-resistant architecture to protect against malware and cloning attacks, safeguarding user data at every stage.

3. Integrate Verifiable Credentials & DIDs

We integrate Verifiable Credentials and Decentralized Identifiers to enable self-sovereign identity management. The app facilitates the secure issuance, storage, and verification of credentials, ensuring trust between issuers, wallets, and relying parties while giving users full control over their personal information.

4. Selective Disclosure & Proofs

To enhance privacy, we implement ZKPs, enabling selective data disclosure. Users can prove specific attributes, like age, without revealing unnecessary information. This privacy-first approach ensures minimal data sharing, building trust with users and promoting adoption.

5. Cross-Border Interoperability

We ensure cross-border interoperability by integrating OpenID for Verifiable Credentials and aligning with European trust frameworks. Cross-border testing ensures a seamless experience for users interacting with relying parties across EU member states, providing wide accessibility.

6. UX with Transparency & Consent

We prioritize clear, human-first consent flows, making privacy management intuitive for users. The app supports offline verification in environments like airports and events, and includes multi-language support for a smooth EU-wide rollout, ensuring transparency and ease of use.

Common Challenges for EUDI Wallet App Development

Developing an EUDI Wallet can be a tough journey, with plenty of technical, regulatory, and operational hurdles along the way. At Idea Usher, we’ve been there, and we know that understanding and addressing these challenges early on is key to success. Let’s dive into the most common obstacles and how we tackle them head-on.

1. The Labyrinth of Compliance Complexity

The eIDAS 2.0 regulation and its Architecture and Reference Framework can feel like a maze. Compliance isn’t just about features, it’s about passing rigorous audits and obtaining certifications that prove your wallet is secure and reliable. One small misstep could result in a non-compliant product that can’t be used across the EU.

Our Solution: Partner with Certification-Focused Experts

Compliance is built into our development process from the very start. We proactively conduct internal audits against the latest standards, staying ahead of regulatory changes.

Our established network of legal and regulatory experts ensures that you pass all necessary certifications efficiently, avoiding costly delays.

2. Uncompromising High-Security Requirements

Security is the backbone of the EUDI Wallet. With the highest “Level of Assurance” (LoA High) required, the wallet must withstand sophisticated cyberattacks. A breach would result in catastrophic loss of user trust and legal repercussions.

Our Solution: Multi-Layered Defense with Secure Elements

- We approach security as a layered defense strategy, using tamper-resistant hardware such as Secure Elements and Trusted Execution Environments to protect critical data on the device.

- For backend functions, we use Hardware Security Modules to securely manage cryptographic keys and prevent unauthorized access.

3. The Cross-Border Interoperability Puzzle

The promise of a borderless digital identity is key, but each EU member state may implement the wallet slightly differently. Ensuring seamless communication and verification across all 27+ countries is no small feat.

Our Solution: Early and Continuous Real-World Interoperability Testing

- We don’t wait for official releases to start testing. We proactively create testing sandboxes that simulate the technical environments of different EU member states.

- By engaging with the community through Large-Scale Pilots and interoperability events, we identify and resolve edge cases before they can affect users.

Tools & APIs for Building a Secure EUDI Wallet App

Building an EUDI Wallet app needs tools like OpenID Connect for identity, Zero-Knowledge Proofs for privacy, and secure hardware for data protection. You’ll also integrate KYC APIs, payment gateways, and document verification for smooth operation. It’s about security, privacy, and compliance.

1. Identity & Standards

To establish a secure and universally recognized digital identity for users, adherence to open standards is crucial.

- OpenID Connect: A standard for secure, user-friendly authentication, OpenID Connect ensures privacy and facilitates user authentication and authorization in EUDI Wallet apps.

- OpenID for Verifiable Credentials (OID4VC): OID4VC extends OpenID Connect for managing tamper-proof verifiable credentials, allowing EUDI Wallets to securely issue, store, and manage identities, qualifications, or certifications.

2. Cryptography

To maintain the security and privacy of the wallet’s data, advanced cryptographic techniques are essential.

- Zero-Knowledge Proof Libraries: ZKPs allow users to prove they know a value without revealing it, enabling privacy-preserving identity verification. Libraries like zk-SNARKs and zk-STARKs are commonly used for this purpose.

- W3C VC Libraries: W3C’s Verifiable Credentials specification helps create and manage tamper-proof credentials. Libraries like VC-JS and DIDComm make it easy for developers to work with decentralized identifiers (DIDs) and VCs.

3. Secure Hardware

For the highest level of security, integrating hardware-based protection mechanisms is crucial.

| Component | Description |

| Secure Elements (SE) | Dedicated chips that store sensitive information like private keys in a secure, isolated environment, protecting data from hacking and tampering. |

| Trusted Execution Environments (TEEs) | Isolated processor environments that protect sensitive operations (e.g., cryptographic key generation) from malware and other security threats. |

| Hardware Security Modules (HSMs) | Physical devices that generate, store, and manage cryptographic keys securely, ensuring they are never exposed outside the hardware. |

4. EUDI-Specific Resources

To meet EU regulations, integrating EUDI-specific resources is key. The EUDI ARF specifications provide the technical standards for security, privacy, and interoperability, ensuring compliance. Plus, Large Scale Pilots testbeds let developers validate their EUDI Wallet app in real-world scenarios, making sure it works smoothly within the EU’s framework.

5. Integration APIs: Connecting with Third-Party Services

To provide a fully functional EUDI Wallet app, you’ll need to integrate with various external services for identity verification, payments, and document validation.

- KYC APIs: Essential for verifying user identities during registration or sensitive transactions, ensuring compliance with AML regulations and preventing fraud.

- Payment Gateways: APIs like Stripe, PayPal, or SEPA enable secure transactions via the EUDI Wallet, ensuring EU regulatory compliance for safe payments.

- Document Verification Services: APIs like Jumio, Onfido, or Veriff use AI to validate documents such as IDs, passports, or driver’s licenses, confirming user identity.

Use Case: Transforming Onboarding for a Bank

A leading European bank came to us with a critical problem: their outdated and slow onboarding process was causing potential customers to abandon account applications. In a world where speed is key, their digital account opening took days instead of minutes, hindering customer acquisition and leading to frustration. The bank needed a fast, seamless solution to meet the expectations of today’s consumer.

The issues they faced were clear:

- Cumbersome Document Uploads: Customers had to dig out physical documents like passports, utility bills, and take low-quality photos to submit online.

- Manual Verification Bottlenecks: Each application required a compliance team to manually check documents, resulting in delays and high costs.

- High Drop-off Rates: The complicated and slow process led to customers abandoning their applications midway.

- Fraud Risk: Verifying the authenticity of digital document copies was a constant challenge.

- Scalability Issues: As the bank expanded into new European markets, they faced challenges with navigating 27 different national ID systems.

What they needed was a solution that was not only secure and compliant but also fast, seamless, and scalable across Europe. They needed to turn this point of friction into a competitive advantage.

Our Solution

Rather than just offering a technical solution, Idea Usher saw an opportunity to completely redefine the bank’s customer onboarding experience. With a team of experts who had previously worked at MAANG/FAANG companies, we designed a future-proof, scalable, and secure system that would revolutionize the onboarding process.

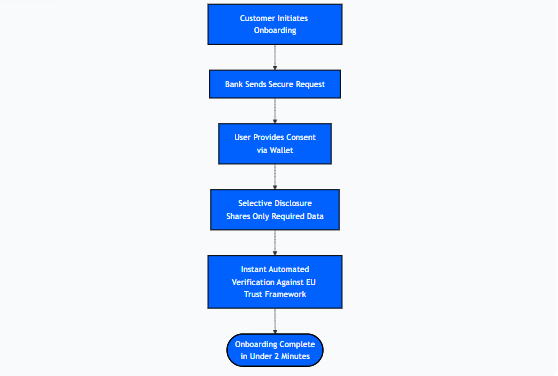

Our solution involved seamlessly integrating the EU Digital Identity Wallet into the bank’s web and mobile application flows. Here’s how it worked:

Initiating the Onboarding Process

When a potential customer wants to open an account, they simply click “Open an Account” and select the option to “Use my EU Digital Identity Wallet.” It’s an easy, straightforward choice that kicks off the process with a few taps. From there, everything happens quickly and securely, making the experience smooth and hassle-free.

Secure Request for Credentials

The bank’s system sends a secure request to the user’s wallet, asking for two key credentials: Proof of Identity to confirm their name and age, and Proof of Residency to verify their address. It’s all automated, ensuring that the process stays quick and secure. The user simply approves the request, and it’s done.

User Consent & Selective Disclosure:

The customer opens their wallet, sees the bank’s request, and simply approves it with a tap or biometric scan. Thanks to Selective Disclosure, they only share the necessary details, like “Over 18” and “Country of Residency,” not their whole ID. It’s quick, secure, and respects their privacy.

Instant, Automated Verification

Once the customer approves, the bank gets cryptographically signed, government-verified credentials. Our system automatically checks these against the EU’s trust framework, so there’s no need for manual verification. It’s all done in the background, making the process faster and more efficient.

The Outcome: A Transformation Measured in Minutes and Millions

The results of this transformation were remarkable and measurable:

- Onboarding Time Reduced: Cut customer onboarding from days to under 2 minutes, boosting conversion rates as more customers completed applications.

- Operational Costs Slashed: KYC costs dropped over 70%, freeing up the compliance team for higher-value tasks.

- Fraud Nearly Eliminated: Government-issued, tamper-proof credentials reduced fraud to near zero, enhancing security.

- Pan-European Scalability: One integration allowed onboarding from all 27 EU countries, unlocking major growth opportunities.

- Improved Customer Trust: A sleek, privacy-first process boosted customer experience and positioned the bank as a leader in innovation.

Conclusion

EUDI Wallets go beyond merely meeting compliance requirements; they are powerful tools for driving business growth. By adopting these wallets early, enterprises can not only ensure regulatory compliance but also build greater trust with users, giving them a competitive advantage. Idea Usher is ready to partner with businesses to design, develop, and integrate secure, scalable, and compliant EUDI Wallet applications, helping them stay ahead in an evolving digital landscape.

Looking to Develop an EUDI Wallet App?

At Idea Usher, we don’t just code, we design the future. With over 500,000 hours of development experience and a team of ex-MAANG/FAANG developers, we have the technical expertise to turn complex regulations into a competitive advantage for your business.

- Built on proven expertise

- Insights from top-tier tech talent

- Navigating eIDAS 2.0 with confidence

Ready to build the next big thing? Take a look at our latest projects, and let’s start the conversation.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

A1: EUDI Wallets are legally recognized as equivalent to physical IDs across the EU, providing a higher level of trust and security compared to private digital ID apps. Unlike regular wallets, they are governed by strict regulations under eIDAS 2.0, ensuring interoperability and legal validity throughout the EU.

A2: Yes, private businesses can develop their own EUDI Wallet apps, but they must adhere to the eIDAS 2.0 regulations and meet rigorous certification requirements to ensure compliance with EU standards. This guarantees that the wallets are secure, trustworthy, and legally recognized.

A3: EUDI Wallets leverage advanced security technologies such as Secure Elements, cryptographic keys, Verifiable Credentials, and Zero-Knowledge Proofs (ZKPs). These technologies work together to protect sensitive data, ensuring that the wallet is both secure and tamper-proof.

A4: Businesses can monetize EUDI Wallet apps by offering value-added services like identity verification, enterprise integrations, and fraud prevention tools. Additionally, they can introduce premium offerings that provide enhanced features, creating new revenue streams while maintaining user trust and security.