Fintech apps are expected to do more than just move money from one place to another. Users want speed, security, personalization, and clarity, while businesses need better risk control, smarter insights, and seamless scalability. Meeting all these expectations at once is challenging, which is why AI features to enhance fintech apps are becoming essential for delivering experiences that feel both intelligent and trustworthy.

AI brings a new layer of decision-making and automation to fintech platforms. From fraud detection and credit scoring to personalized financial insights and conversational support, AI helps apps respond in real time and adapt to user behavior. These capabilities don’t just improve efficiency; they help fintech products feel more intuitive, proactive, and aligned with individual user needs.

In this blog, we’ll explore the top AI features that can elevate fintech applications, explaining how they work and where they create the most impact. Whether you’re building a new fintech product or enhancing an existing one, this guide will help you understand how to use AI strategically to improve performance, security, and user experience.

The Shift from Digital Finance to Intelligent Finance

The evolution from digital finance to intelligent finance is transforming how users interact with financial services. Integrating AI features to enhance fintech apps enables personalized experiences, predictive insights, and smarter workflows that drive engagement and efficiency.

A. From Access to Intelligence

Early fintech innovation focused on digital access such as online banking, mobile payments, and self-service financial tools. Today, these capabilities are expected. Competitive advantage now comes from how intelligently an app responds to user behavior and context.

B. How Intelligent Finance Changes Fintech Apps?

Intelligent finance moves beyond static workflows and rule-based logic. AI enables fintech platforms to learn continuously and adapt in real time.

- AI enables fintech apps to adapt interfaces, navigation, and feature access based on user behavior and usage patterns, creating more relevant and intuitive experiences.

- Financial insights shift from reactive reporting to predictive guidance, helping users anticipate spending risks, savings opportunities, and upcoming financial needs.

- Routine workflows such as onboarding, support, and compliance checks are automated using AI, improving speed, consistency, and operational efficiency.

- Risk assessment and fraud detection become continuous and behavior-driven, allowing platforms to identify anomalies without disrupting legitimate user activity.

C. Why AI Shift Matters for the Fintech Market?

As fintech ecosystems grow more complex, traditional systems struggle to scale personalization, risk management, and operational efficiency simultaneously. AI-driven intelligence allows fintech apps to balance growth, user experience, and compliance without increasing friction.

How AI Is Reshaping User Expectations in Fintech Apps?

User expectations in fintech apps are evolving as AI features to enhance fintech apps enable personalized experiences, predictive insights, and seamless interactions, setting new standards for engagement, convenience, and financial decision-making.

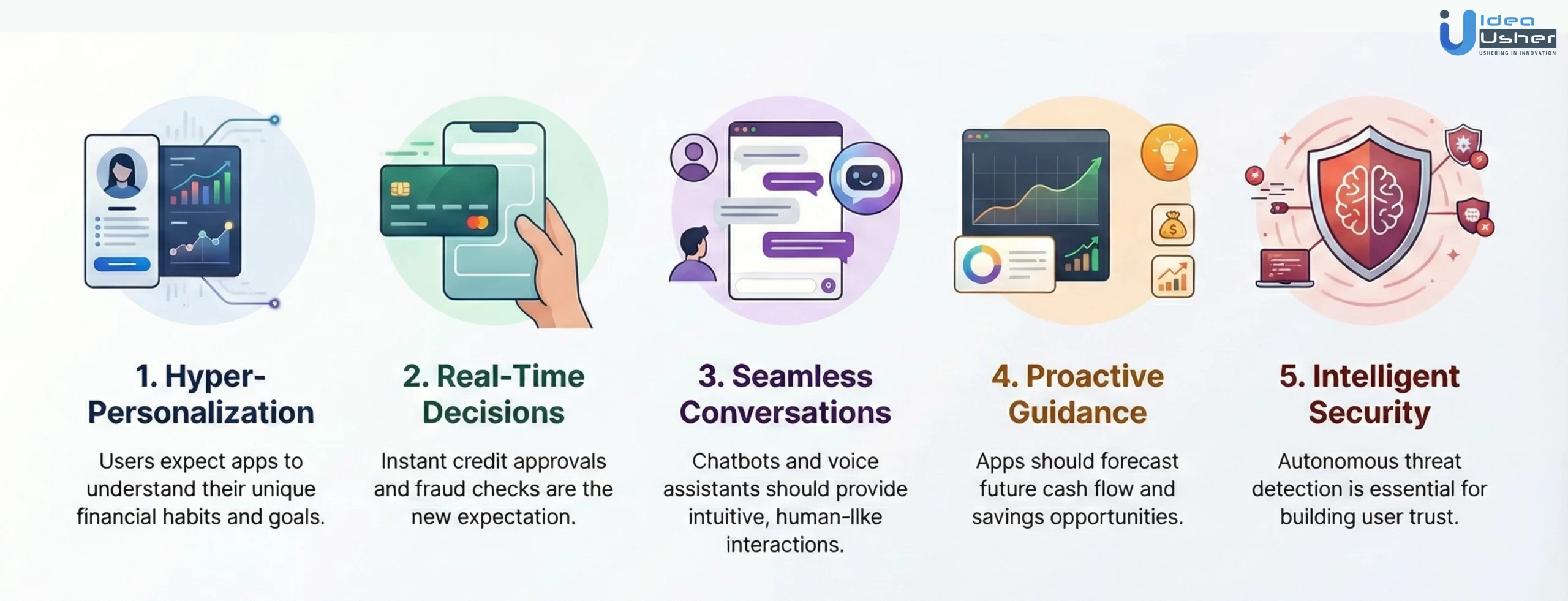

1. Hyper Personalized Financial Experience

Users expect fintech apps to understand their spending habits, goals, and risk tolerance via a behavioral intelligence model. AI provides personalized insights, dynamic budgets, and tailored advice, creating proactive, personalized financial experiences.

2. Real-Time Intelligence Decision

Financial users increasingly expect instant credit approvals, fraud checks and risk evaluations. AI enables millisecond-level decisioning by analyzing transaction streams, identity signals and risk profiles simultaneously, reshaping expectations around speed, accuracy and the elimination of manual review delays.

3. Seamless Conversational Interactions

AI-driven conversational layers such as context-aware chatbots and voice assistants make financial interactions feel intuitive and human-like. Users now expect frictionless navigation, natural language support and automated task completion without navigating menus or waiting for human agents.

4. Predictive & Proactive Financial Guidance

Fintech users no longer want static statements or historical summaries. AI empowers apps to deliver future-focused insights, forecasting cash flow, upcoming expenses and savings opportunities using time-series analysis, shifting user expectations toward proactive financial coaching.

5. Intelligent Security to Build Trust

Users increasingly expect fintech apps to detect threats autonomously through continuous anomaly detection, device context assessment and behavioral biometrics. AI-driven security creates a perception of always-on protection, setting a new baseline for trust and safety in digital finance platforms.

Why 59% of Financial Institutions Are Adopting AI at Scale by 2025?

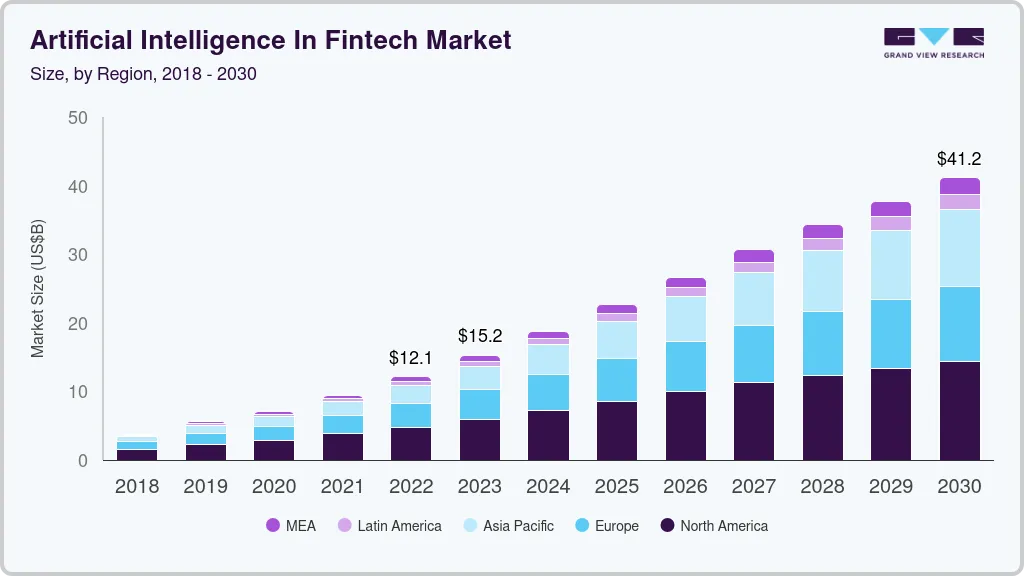

The global artificial intelligence in fintech market was valued at USD 9.45 billion in 2021 and is projected to reach USD 41.16 billion by 2030, growing at a CAGR of 16.5% from 2022 to 2030. This reflects rapidly increasing demand for intelligent automation, predictive analytics, and personalized customer experiences in financial services.

According to Gartner, 59% of financial institutions will use AI at scale by 2025, up from 37% in 2023. This rapid growth shows that AI has become essential for operations and competitiveness. Financial leaders now view AI adoption as a strategic imperative, not an optional enhancement.

A. AI Personalization Drives Engagement & Retention

AI-powered personalization has become a core feature in fintech apps, influencing user engagement and loyalty.

- 78% of fintech companies implement AI in UX/UI, with 76% using AI for personalized interfaces.

- Firms implementing AI-assisted design reported 37% improvement in user retention, 53% better feature discovery, and 42% increase in time spent in-app

- Personalized rewards and recommendations enhance satisfaction, with 80% of brands offering AI-personalized rewards and 73% of customers actively seeking personalization.

- AI reduces friction in transactions and onboarding, enabling targeted upsells and smarter financial guidance.

B. AI-Powered Efficiency & Impact

Beyond user engagement, AI adoption directly improves operational efficiency and generates measurable financial benefits.

- 58% of financial institutions attribute revenue growth directly to AI, highlighting top-line impact.

- AI-driven process automation provides 60% efficiency gains and 40% cost reductions in areas such as onboarding, compliance, and settlements.

- Robotic Process Automation (RPA) adoption has reached 80% in banking, improving compliance for 73% of users.

- Generative AI agents deployment jumped to 72% of firms, enabling conversational AI for customer service, robo-advisors, and intelligent assistants

- AI features support predictive risk management, fraud detection, and trading optimization, ensuring both compliance and profitability

The rapid growth of the fintech AI market and the widespread adoption of AI at scale confirm a clear shift in how financial institutions compete and operate. AI-driven features now shape customer experiences, improve efficiency, and drive measurable revenue impact, making them foundational to modern fintech success.

Top AI Features To Enhance Fintech Apps

AI is transforming fintech apps by boosting efficiency, security, and customer experience through intelligent automation, predictive analytics, and personalized insights. These are the key AI features to enhance fintech apps.

1. Personalized Financial Recommendations

AI analyzes spending, transactions, and goals to offer personalized budgeting, savings, and investment advice. This intelligence helps users make better decisions, improve financial wellness and increase app engagement with behavior-driven suggestions.

Example: Mint employs machine learning to categorize transactions, learn from corrections, and create spending profiles. The AI analyzes patterns, suggests budgets, alerts nearing limits, and recommends financial products.

2. AI-Powered Fraud Detection & Security

Machine learning models assess transaction speed, device fingerprints and anomaly scores to detect fraud in real time. This reduces fraud, boosts platform integrity, and builds user trust by automating threat detection before financial loss.

Example: Revolut uses anomaly detection to establish “normal” user behavior and monitors transactions, flagging deviations like unusual locations, amounts, or rapid purchases. It can instantly freeze cards and notify users for verification.

3. Smart Credit Scoring & Risk Assessment

AI creates multi-dimensional credit profiles using behavioral data, alternative info, and repayment history. This improves risk assessment, broadens credit access for underserved users, and lowers defaults with data-driven loan evaluation.

Example: Affirm makes instant lending decisions at the point of sale by analyzing thousands of data points in real-time, including purchase history, device data, and behavioral signals. The AI assesses risk for each transaction and purchase amount, rather than issuing a blanket credit limit.

4. Real-Time Transaction Monitoring

Streaming AI systems analyze transaction flows instantly, flagging deviations from normal spending. This enables quick detection of unauthorized activities, supporting dynamic risk scoring and providing users protection without delays.

Example: Chime monitors transactions as they occur and uses predictive analytics to warn users about potential overdrafts before they happen, analyzing upcoming bills and typical spending patterns.

5. Chatbots & Virtual Assistants

Natural language AI automates customer support by responding to queries, guiding transactions, and resolving issues instantly. These context-aware assistants reduce workload, improve satisfaction, and ensure 24/7 availability for smooth financial interactions.

Example: Erica (Bank of America) uses natural language processing to understand customer queries conversationally. Handling over 2 million daily interactions, it answers questions, proactively sends insights on duplicate charges, unusual spending, or upcoming bills, executes transactions, searches purchases, and provides personalized financial guidance based on account analysis.

6. Automated Compliance & AML Checks

AI monitors user activity and transactions against AML patterns, risk rules, and databases, spotting suspicious entities and reporting needs. This automation cuts compliance costs, speeds up reviews, and boosts regulatory alignment in fintech.

Example: Chainalysis monitors cryptocurrency transactions, using graph analysis and machine learning to find addresses linked to illegal activities, money laundering, and sanctions violations. The AI traces funds through mixing services and connects seemingly unrelated addresses.

7. Predictive Analytics for Financial Forecasting

Machine learning predicts spending, cash flow, and market trends by analyzing historical data and real-time signals. This supports smarter budgeting, investment, and business decisions for users and fintech providers.

Example: Dave analyzes income patterns, recurring bills, spending behavior, and scheduled payments to predict low account balances. The AI uses time-series forecasting and pattern recognition to identify potential overdrafts 1-3 days in advance. When detecting shortfalls, it automatically offers advances up to $500.

8. Robo Advisory & Portfolio Optimization

AI wealth engines assess risk, horizons, and market indicators to automatically create and rebalance portfolios. This democratizes wealth management, providing institution-grade financial planning to everyday users via low-cost, automated advisory systems.

Example: Acorns uses AI to determine optimal portfolio allocations across five risk levels, automatically investing spare change from linked debit cards, and gradually shifting allocations as users age or their goals change.

9. User Behavior Analytics & Retention Insights

Behavioral AI studies interaction paths, feature usage, and engagement to generate personalized nudges, content, and UX improvements. This boosts user retention, product stickiness, and conversion by understanding individual financial behaviors.

Example: Robinhood monitors trading patterns, feature use, and engagement to spot users at risk of churning. It detects declining activity and initiates re-engagement campaigns with personalized content, like investment education for confused users or new feature highlights for power users.

10. Voice, Facial & Biometric Authentication

AI-powered biometric verification evaluates facial signatures, voiceprints or fingerprint data to secure access and authorize transactions. This eliminates password friction, boosts security and protects accounts against impersonation or credential theft.

Example: Nubank introduced facial recognition for account access and high-value transactions. Users enroll via a selfie, and AI verifies identity by matching real-time images to stored biometric data, ensuring liveness to prevent spoofing.

11. Real-Time Personal Financial Insights

AI identifies spending anomalies, upcoming financial risks and recurring pattern trends, providing instant alerts and proactive insights. This helps users avoid overdrafts, manage bills and stay financially aware through continuous, personalized monitoring.

Example: Yolt uses machine learning to categorize transactions across multiple accounts, predict upcoming bills, identify money-saving opportunities and provide personalized budgeting recommendations. The AI learns from user behavior to improve accuracy and relevance.

12. Explainable AI for Transparent Decisions

Explainable AI shows how credit assessments, recommendations, or risk scores are made, revealing feature contributions and decision pathways. This transparency boosts user confidence, supports regulation, and prevents distrust in AI fintech processes.

Example: Zest AI builds ML models that predict credit risk and explain each decision using SHAP values. The system shows which factors contributed most, such as consistent income history (30%), low debt-to-income ratio (25%), and strong payment history (20%).

The Role of AI in Building Trust & Confidence in Digital Finance

Digital finance is becoming more secure and user-friendly as AI features to enhance fintech apps improve transparency, personalization, and risk management, helping users build trust and confidence in their financial decisions.

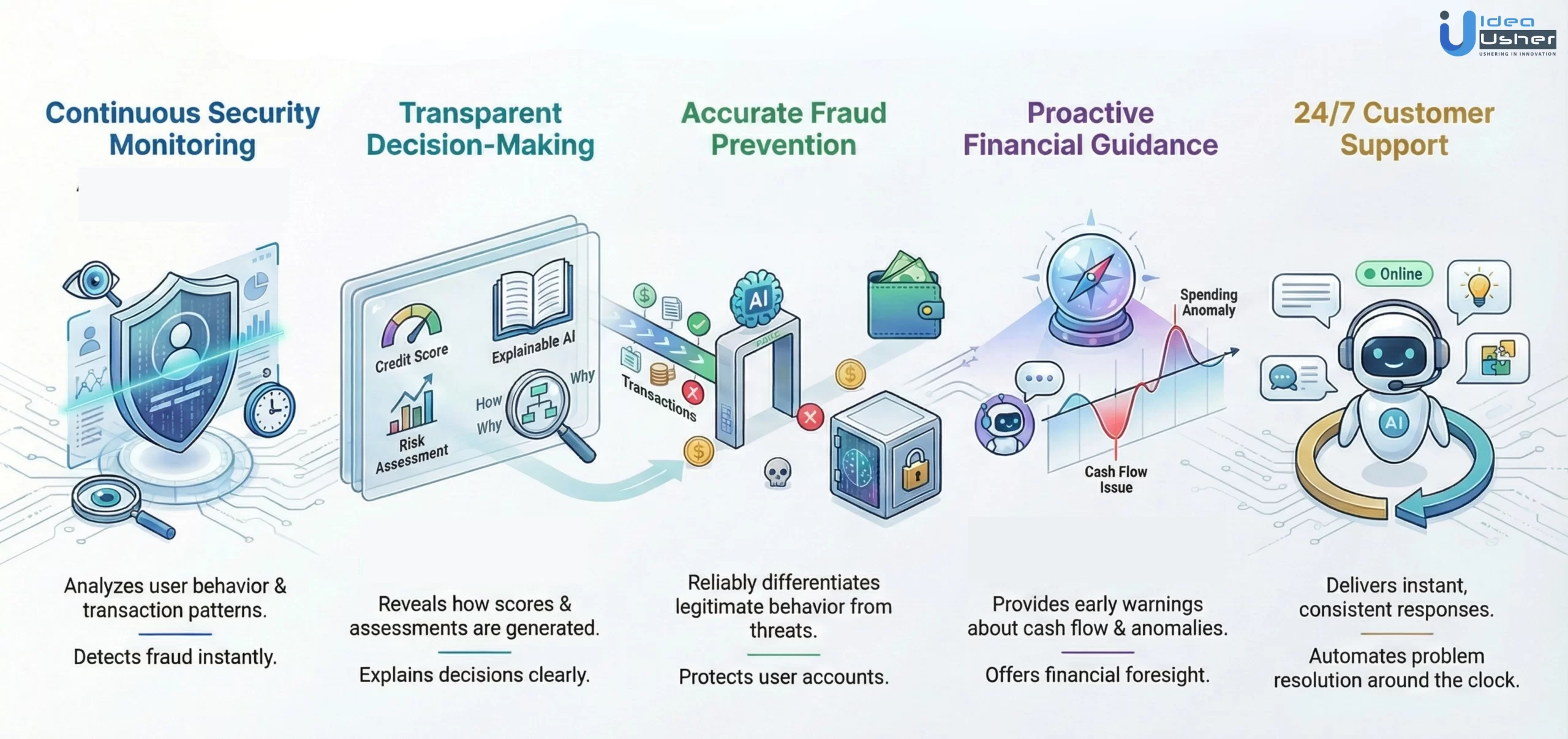

1. Security Through Continuous Behavioral Monitoring

AI enhances trust by monitoring behavioral biometrics, transaction velocity and device patterns to detect anomalies instantly. Users feel safer when security adapts continuously, reducing fraud risk and creating confidence that the platform protects their financial activity autonomously.

2. Decision Making With Explainable AI

Explainable AI reveals how credit scores, risk assessments and recommendations are generated by surfacing feature contributions, model reasoning and decision pathways. This transparency builds user confidence, reduces perceived bias and aligns with regulatory expectations for responsible fintech automation.

3. Fraud Prevention Accuracy Improvement

Users trust fintech apps that reliably identify threats. AI-driven models analyze multi-channel identity signals, anomaly clusters and trust scores to differentiate legitimate behavior from fraud attempts. Higher detection accuracy reassures users that their accounts and funds are consistently protected.

4. Predictive Financial Insights

Predictive AI provides users with early warnings about cash flow issues, spending anomalies or upcoming obligations, helping them avoid mistakes and financial stress. This proactive guidance positions the platform as a dependable companion, strengthening long-term trust and user commitment.

5. Consistent, High-Quality Customer Support

AI-driven assistants deliver 24/7 instant responses, contextual recommendations and automated problem resolution, reducing frustration and uncertainty. Consistent support performance builds confidence in the platform, ensuring users feel supported at every stage of their financial journey.

AI Features That Directly Influence Revenue, Not Just Engagement

AI-driven insights and automation not only boost engagement but also drive revenue, with AI features to enhance fintech apps, enabling smarter decisions and measurable financial growth.

1. AI-Driven Dynamic Pricing

AI models analyze risk scores, market conditions and borrower behavior to set personalized pricing or interest rates in real time. This increases approval accuracy, reduces default probability and maximizes revenue by aligning pricing with true customer risk and intent.

2. Smart Upsell & Cross-Sell Engines

AI identifies intent signals, purchase likelihood and financial patterns to recommend relevant financial products such as insurance, credit lines or investment plans. These precision-driven recommendations significantly increase conversion rates and customer lifetime value, generating measurable revenue uplift.

3. Automated Risk Scoring to Reduce Losses

Machine learning models evaluate hundreds of structured and unstructured data points to improve credit assessments. By reducing default rates and enabling safe lending to underserved segments, fintech apps unlock new revenue channels without increasing risk exposure.

3. Predictive Churn Modeling For Recurring Revenue

AI detects early indicators of churn by analyzing engagement drops, spending shifts and lifecycle behaviors. This enables targeted retention campaigns, personalized incentives and intervention strategies that directly protect subscription revenue and maintain long-term user monetization.

4. Fraud Prevention Systems to Reduce Financial Leakage

Advanced AI models conduct real-time anomaly detection, device intelligence checks and transaction scoring to minimize fraud losses. Lower fraud leakage improves net revenue retention, reduces insurance costs and strengthens financial performance across payment and lending ecosystems.

5. AI-Optimized Collections & Recovery Workflows

AI predicts repayment probability, identifies optimal outreach channels and schedules engagement based on behavioral patterns and risk tiers. This improves recovery rates, reduces manual collection costs and strengthens revenue retention across lending and BNPL ecosystems through targeted, data-driven intervention.

Common Misconceptions About AI Features in Fintech Apps

Despite growing adoption, misconceptions persist around AI features in fintech apps, often overstating complexity or risks. Understanding their true capabilities helps businesses and users make informed, practical decisions.

1. Personalization Isn’t Just Cosmetic

Many assume personalization only improves interface experience, but advanced systems influence creditworthiness insights, saving behavior, spending control and risk scoring. These deeper financial impacts directly shape user trust, revenue growth and long-term product value far beyond UI customization.

2. High-Quality Data Is Key for Accurate Predictions

A common misconception is that machine learning can perform well despite messy financial data. In fintech, reliable results require clean transaction histories, structured behavioral patterns and labeled fraud indicators, otherwise prediction drift, bias and inaccurate risk evaluations quickly emerge.

3. Automation Still Needs Human Oversight

Teams often believe automation replaces analysts, when it actually provides decision augmentation. Algorithms surface anomalies, patterns and risk indicators, while humans handle interpretation, escalation and compliance. This hybrid intelligence improves accuracy, reduces blind spots and protects against misuse.

4. Models Run Themselves After Deployment

Many expect predictive systems to be plug-and-play. In reality, fintech models require continuous retraining, drift detection and compliance tuning as fraud tactics evolve, user behavior shifts and regulatory rules change, making ongoing maintenance essential for long-term reliability.

5. Instant Results Are Possible Without Explainability

Some believe advanced features generate value immediately, ignoring transparency requirements. Fintech products must provide clear reasoning trails, feature contributions and decision logic to satisfy regulators and build user trust, making explainability a foundational part of responsible product design.

6. AI Features Are Too Expensive

Many founders assume intelligent features require massive investment, but modular models, pre-trained engines and incremental deployment make scalable intelligence affordable. When applied strategically, intelligent automation reduces fraud losses, boosts conversions and accelerates revenue, often offsetting development costs quickly.

Real-World AI Fintech Products We’ve Helped Launch

Many misconceptions about AI in fintech apps stem from uncertainty about their real-world use. In fact, intelligent fintech platforms are already active, operating at scale, and delivering measurable value. Based on our experience building production-ready fintech apps that address user and business needs, here is an example.

CHIMAD – Intelligent Cashless Payments and Engagement

CHIMAD is a fintech platform built to support cashless transactions while enabling merchants and administrators to manage rewards, promotions, and user engagement programs. The application supports secure payments, vendor onboarding, coupon management, and loyalty initiatives within a single ecosystem.

- Intelligent chatbot-based assistance supports users during transactions and common queries, helping reduce friction without interrupting core payment flows

- Analytics-driven dashboards provide real-time visibility into transactions, campaigns, and user behavior, allowing administrators to make informed decisions efficiently.

- Reward and promotion workflows are designed to adapt to user engagement patterns, subtly tailoring offers based on usage trends and interaction history.

- Vendor onboarding and management processes are optimized with intelligent checks to ensure smooth operations while maintaining compliance and security standards.

- Smart support mechanisms are designed to enhance usability while maintaining strong security controls and transaction integrity.

Conclusion

Exploring AI features to enhance fintech apps reveals how intelligence, personalization, and automation are transforming user experiences and operational efficiency. From predictive insights to adaptive interfaces and intelligent workflows, these features empower financial institutions to anticipate user needs, reduce friction, and deliver more value. By integrating AI thoughtfully, fintech platforms can drive engagement, retention, and measurable business outcomes while maintaining security and compliance. Understanding and leveraging these capabilities ensures that apps remain competitive, relevant, and capable of meeting evolving expectations in a rapidly changing financial landscape.

Why Choose IdeaUsher for AI-Driven Fintech App Development?

At IdeaUsher, we specialize in designing and building fintech applications that integrate advanced AI features to enhance personalization, security, and operational efficiency. Our experience spans digital banking, payments, wealth management, and engagement-driven fintech platforms.

Why Work with Us?

- Fintech AI Expertise: Our developers implement machine learning, predictive analytics, and intelligent automation to deliver smarter, user-focused applications.

- Custom Solutions: From ideation to deployment, we tailor AI features to your business goals and regulatory requirements.

- Proven Experience: With apps like JabaPay and CHIMAD, we’ve demonstrated the ability to create fintech platforms that balance innovation, usability, and compliance.

- Scalable and Secure: Our solutions are designed for rapid adoption and long-term growth, ensuring apps remain reliable and compliant across all financial operations.

Explore our portfolio to see how we help fintech companies implement AI features that drive engagement, retention, and measurable revenue growth.

Work with Ex-MAANG developers to build next-gen apps schedule your consultation now

FAQs

When building a fintech app, integrating AI features like personalized interfaces, predictive analytics, intelligent chatbots, fraud detection, and automated workflows enhances user engagement and operational efficiency, ensuring the app delivers value while remaining secure and scalable.

AI-driven personalization, adaptive recommendations, and behavior-based notifications keep users engaged by anticipating their financial needs. These features reduce churn, promote feature discovery, and create a seamless experience that encourages regular app usage and long-term loyalty.

Machine learning for predictive insights, natural language processing for chatbots, anomaly detection for fraud prevention, and analytics engines for real-time data processing are essential AI technologies that enhance fintech apps’ functionality, security, and user satisfaction.

AI features streamline operations, reduce manual intervention, and optimize user experiences, resulting in higher retention, increased transactions, and improved revenue. Organizations adopting AI in fintech apps can achieve measurable gains in engagement, efficiency, and profitability.